Flat Steel Market Research Report - Segmentation By Product (Sheets & Strips, Plates ), By Material (Carbon, Alloy, Stainless Steel, Tool), By Application (Building, Infrastructure, Mechanical Equipment, Automotive, Transport, Mechanical Equipment) & By Region (North America, Latin America, Europe, Asia Pacific, Middle East & Africa)-Industry Analysis on Size, Share, Trends, Growth, Opportunities & Forecast 2024 to 2029

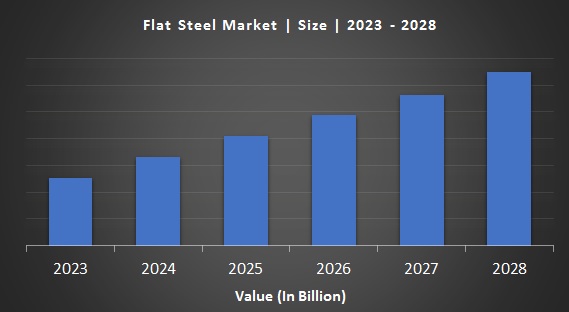

Flat Steel Market Size (2023-2028):

The Global Flat Steel Market was worth US$ 556.9 billion in 2022 and is anticipated to reach a valuation of US$ 897.9 billion by 2028 and is predicted to register a CAGR of 5.9% during 2023-2028.

Market Drivers:

Flat steel is utilized in the production of automotive components, reinforced bars, cladding, appliances, pipes, power transmission towers, railway tracks, and many more. It is a kind of processed steel that is used by manufacturers to produce different types of steel sheets and plates.

The increasing urbanization and industrialization are surging the flat steel market share. Rising urbanization in towns and cities and the growing manufacturing industry in developing countries are prompting the demand for flat steel. For instance, the consumption of steel in the building, construction, and infrastructure sectors has experienced a growth of more than 4 per cent over the last four years, and when compared to other nations, the steel-to-cement ratio in India is 0.35. Also, the utilization of steel-framed construction stands at only 10%, contrasting with figures exceeding 40% and even reaching 80% in other nations. Thus, there is huge potential for the market growth rate to increase in the coming years.

Rising disposable income in developing countries is enhancing the market share. As per a report, there will be around a 38% surge in global wealth within the next five years, reaching a total of USD 629 trillion by the year 2027. Middle-income nations are anticipated to shape global trends, with the wealth per adult projected to attain more than $110k by 2027. This period is expected to see the emergence of over 85 million millionaires and 372k ultra-high-net-worth individuals; therefore, growth in disposable income will drive the demand for the flat steel market during the forecast period.

The global expansion of the flat steel market is driven by the heightened utilization of lightweight materials across various sectors, including automotive, construction, aerospace, and packaging. Governments are prioritizing these materials to tackle environmental issues, enhance energy efficiency, and comply with emission standards. Flat steel plays a crucial role in crafting sustainable structures and components, contributing to the creation of eco-friendly products and infrastructure.

The growing demands for advanced telecommunication networks are fuelling the expansion of the flat steel industry, driven by infrastructure needs. The construction of towers and antennas necessitates extensive steel networks, and flat steel is the preferred choice for cable trays and conduits. This choice ensures robust and secure installation and protection of cables. For instance, SAIL-Bokaro Steel Plant has partnered with TCIL to prospect the use of 5G, IT, and telecom technologies in its facilities, including mines, collieries, and the Jharkhand Refractory Unit.

Market Restraints:

Increasing energy costs pose a constraint on the flat steel market, attributed to the energy-intensive nature of its manufacturing process. Carbon pricing mechanisms and environmental regulations have the potential to elevate energy-related expenditures for manufacturers in the steel industry. Overcapacity in the flat steel market share arises when production capabilities surpass market demand, leading to challenges and limitations within the industry. This is ascribed to limit the growth of the flat steel market.

In February 2023, Prices of carbon hot-rolled, cold-rolled, and coated steel products were increased by $100 per net ton by the Cleveland-Cliffs Inc.

Market Opportunities:

Technological progress in the flat steel market presents abundant growth prospects. Innovative alloys cater to various industries, and the implementation of smart manufacturing and Industry 4.0 principles optimizes production processes. Additive manufacturing provides design flexibility, while advancements in coatings enhance the protective features of flat steel. Embracing sustainable practices contributes to environmental well-being.

Market Challenges:

Global flat steel market dynamics can be influenced by trade disputes and tariffs, causing disruptions in pricing, trade patterns, and overall competitiveness. Elevated import duties may restrict market access for producers, impeding the exploration of new opportunities and the expansion of customer bases.

FLAT STEEL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 – 2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2028 |

|

CAGR |

5.9% |

|

Segments Covered |

By Product, Material, Application, and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ArcelorMittal, Create Materials Inc., HBIS, Ohara, Mineral Technologies, American Elements, Innovilt, and Others. |

Segmentation Analysis:

Flat Steel Market- By-Product:

- Sheets & Strips

- Plates

The sheets & strips segment is leading with the largest market share in 2022 and is estimated to grow further during the forecast period. Hot Rolled wide Strip and Quarto Plate were the two most produced flat steel products in the last decade (2013-2022). In 2022, real steel consumption was more than the steel supplied to the market. The European market is heavily dominated by domestically produced flat steel products, including hot and cold rolled sheets, coated sheets, and quarto plates. In 2022, over 28 million tonnes of finished steel products were imported. Plates, generally exceeding 6 mm in thickness, are frequently employed in structural uses such as constructing buildings bridges, and manufacturing heavy machinery, emphasizing their strength and resilience.

Flat Steel Market-By Material:

- Carbon

- Alloy

- Stainless Steel

- Tool

The carbon segment dominates the flat steel market and is expected to drive the growth rate forward during the forecast period. Carbon steel non-alloy is the most produced crude steel in the European Union in the decade. This substance finds widespread application in the construction, automotive, and oil sectors owing to its strength and cost-efficiency, playing a crucial role in the production of pipelines, structural elements, and automotive manufacturing. The Alloy is favourably chosen in the manufacturing of automotive, aerospace, and machinery components owing to its exceptional mechanical characteristics, rendering it appropriate for parts exposed to substantial loads, wear, and demanding environments.

Flat Steel Market-By Application:

- Building

- Infrastructure

- Automotive

- Transport

- Mechanical Equipment

The infrastructure segment is ruling with the largest shares of the market. The construction sector accounts for more than 35% of steel consumption in 2021-22. Followed by the automotive segment at around 17%, then by mechanical engineering at 15%. Global initiatives in infrastructure development funded by governments are escalating the requirement for flat steel. Projects focused on modernization and rehabilitation further contribute to the sustained demand in the infrastructure sector.

Market Regional Analysis:

The North American flat steel market holds a significant market share owing to the exponential growth of the automotive industry. The US and Canada are major countries contributing the highest shares of the market because of their wide scope of investments. The increased sturdiness and resistance to temperature exhibited by cold-rolled coil are anticipated to create substantial prospects in North America's electronic and engineering sectors. The Stainless-Steel Market witnessed significant growth in the past year, with construction projects contributing to half of the market. The USA and Canada experienced growth driven by the investment potential in North America.

Asia Pacific's flat steel market is next in leading the dominant shares. China dominates the steel industry market share, propelled by increasing industrialization, technological advancements, and growth in the construction sector, supported by ongoing research and development efforts. The growth of the regional market will be facilitated by the convenient availability of raw materials.

The European baby care products market is growing at a faster rate during the forecast period. The utilization of flat steel is anticipated to increase in Europe, propelled by technological advancements and expansion in the automotive sector. In North America, the robust strength and temperature-resistant characteristics will enhance the demand for cold-rolled coils in the electronics and engineering sectors. According to a report, the European Union steel sector contributes around 143 billion euros in Gross Value Added.

Latin America and the Middle East & Africa are expected to experience significant growth opportunities in the coming years. Mexico and Brazil play pivotal roles in Latin America's construction sector, propelled by the rising adoption of consumer goods, metal products, and mechanical equipment. The construction industry in the Middle East and Africa is also expanding, driven by various companies enhancing their industrial facilities and manufacturing capacities. This contributes to the overall growth of construction activities in the region.

COVID-19 Impact on the Flat Steel Market:

The flat steel market witnessed substantial effects from the COVID-19 pandemic, marked by reduced demand and an excess supply of steel. The escalation in the costs of essential raw materials, such as iron ore and coal, played a role in this downturn. Governments globally are actively engaging in infrastructure initiatives as part of economic recovery efforts, with a focus on stimulating steel production. The rebound in steel demand is anticipated to be more robust in developing economies compared to developed ones, with a projection to return to pre-pandemic levels by 2021, although the recovery may take longer for developed economies.

Market Key Players:

- ArcelorMittal

- Create Materials Inc.

- HBIS

- Ohara

- Mineral Technologies

- American elements

- Innovilt

Market Key Developments:

- In January 2023, ArcelorMittal Nippon Steel India announced the construction of a steel plant worth 4 billion dollars in the Odisha state of India with a production capacity of 7 million tonnes.

- In February 2023, an Italian company announced that it would raise the production of crude steel to 4 million metric tons and 5 million MT in 2024.

-

In March 2021, ArcelorMittal launched XCarb with the aim of cutting CO2 emissions in steel manufacturing and transitioning to carbon-neutral steel. The company is making strategic investments in blast furnace technologies to minimize greenhouse gas emissions.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1800

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]