Latin America Animal Feed Market Size, Share, Growth, Trends, And Forecast Report Segmented By Type, Livestock, Raw Material, And By Country (Brazil, Chile, Argentina, Mexico, and Colombia, etc), Industry Analysis From 2025 To 2033

Latin America Animal Feed Market Size

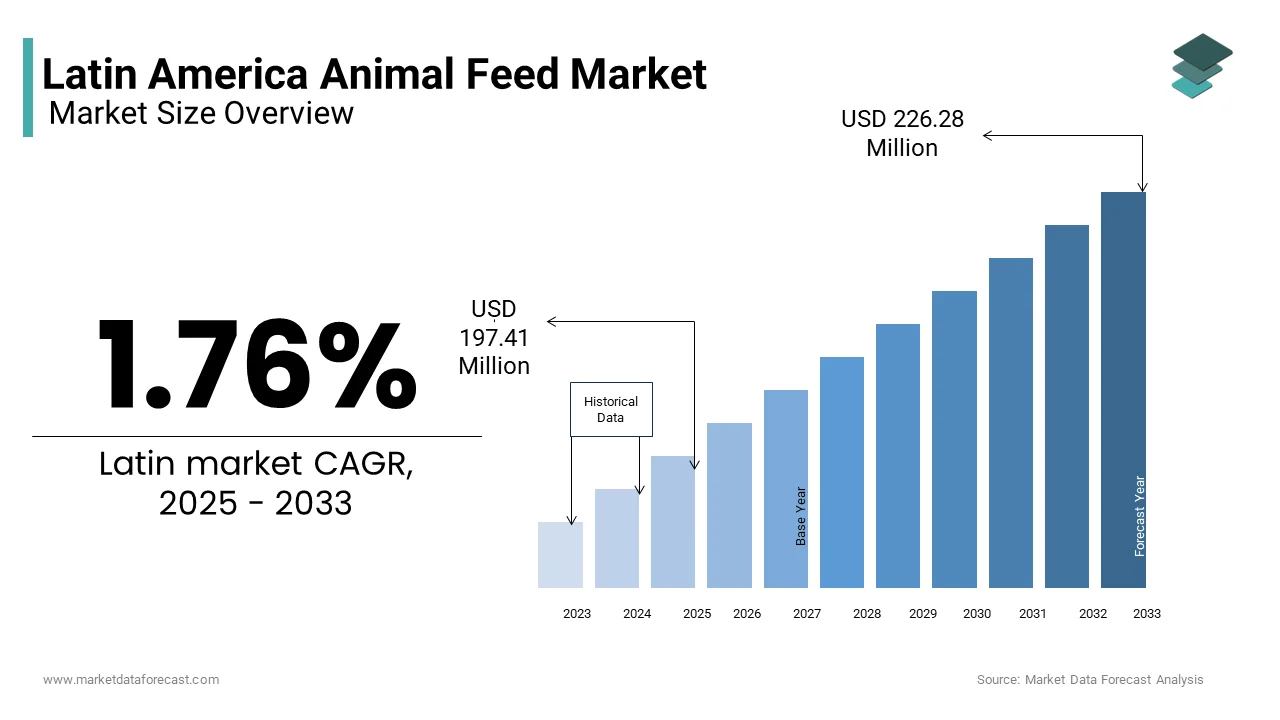

The Latin American animal feed market size was valued at USD 194 million in 2024 and is anticipated to reach USD 197.41 million in 2025 from USD 226.98 million by 2033, growing at a CAGR of 1.76% during the forecast period from 2025 to 2033.

The LatinAmericana animal feed market covers the production, distribution, and consumption of compounded feeds designed for livestock, poultry, aquaculture, and companion animals across the region. This market plays a critical role in supporting the broader agricultural and food supply chain by ensuring optimal nutrition for animals to enhance productivity and health.

The growing demand for animal protein, particularly in urban centers, has spurred increased investment in feed manufacturing infrastructure and ingredient sourcing. Additionally, rising awareness around feed quality and safety has prompted regulatory bodies like Brazil’s MAPA (Ministry of Agriculture, Livestock and Supply) to enforce stricter compliance standards. Moreover, increasing pet ownership rates, especially in Mexico and Brazil, have led to a surge in premium pet food formulations, which further supports feedstock demand.

MARKET DRIVERS

Rising Demand for Animal Protein Consumption

One of the most significant drivers of the Latin American animal feed market is the escalating domestic and international demand for animal-based proteins such as poultry, beef, pork, and seafood.

As per the United States Department of Agriculture (USDA), per capita meat consumption in Latin America has grown steadily over the past decade, with countries like Argentina and Brazil among the top consumers globally. This surge in meat consumption directly translates into higher demand for animal feed, particularly compound feed.

Furthermore, the region's emergence as a major meat exporter has intensified feed production needs.

In addition, shifting consumer preferences toward high-protein diets and processed foods have reinforced this trend. As incomes rise and urbanization expands, the middle-class population increasingly favors convenient and nutritious food options, further stimulating the need for efficient livestock feeding systems.

Expansion of Commercial Livestock Farming and Poultry Operations

Another key driver fueling the Latin American animal feed market is the rapid expansion of commercial livestock and poultry farming, especially in Brazil, Argentina, and Mexico. These nations have witnessed a structural shift from traditional backyard farming to large-scale, vertically integrated operations that rely heavily on industrially produced feed.

A substantial portion of this volume is attributed to the poultry and swine sectors. The consolidation of the livestock sector has been supported by technological advancements, improved breeding techniques, and better farm management practices, all of which increase reliance on standardized, nutrient-rich feed formulations.

Moreover, government initiatives aimed at modernizing agriculture, such as credit programs and technical assistance, have enabled small and medium-sized farmers to transition toward commercial models. With continued investments in agribusiness infrastructure and logistics, Latin American countries are poised to sustain this upward trajectory in commercial livestock production, thereby reinforcing the demand for animal feed.

MARKET RESTRAINTS

Volatility in Raw Material Prices

A major restraint affecting the Latin American animal feed market is the persistent volatility in raw material prices, particularly for essential ingredients such as corn, soybean meal, and wheat. These commodities constitute a significant portion of feed formulation cost, and any fluctuations in their pricing can severely impact profit margins for feed manufacturers.

Brazil, despite being a major producer of soybeans and corn, experienced domestic shortages during the 2021/2022 harvest season due to consecutive droughts, leading to a temporary spike in feed costs. Similarly, Argentina, another key agricultural economy, faced logistical bottlenecks and currency devaluation issues that hampered the import of supplementary feed ingredients, further exacerbating cost instability.

In Mexico, where a considerable amount of soybean meal is imported from the United States, exchange rate fluctuations have also contributed to price unpredictability. As a result, smaller feed mills often struggle to maintain consistent pricing strategies or ensure product availability, limiting their ability to compete with larger firms.

Regulatory and Environmental Compliance Challenges

Another significant constraint on the Latin American animal feed market is the evolving landscape of regulatory and environmental compliance requirements. Governments across the region have been increasingly focused on enforcing stricter regulations related to feed safety, antibiotic usage, and sustainable sourcing of raw materials. While these measures aim to protect public health and promote responsible agricultural practices, they also impose additional operational and financial burdens on feed producers.

For instance, Brazil’s Ministry of Agriculture, Livestock and Supply (MAPA) has introduced stringent guidelines on the use of antimicrobial growth promoters in animal feed, aligning with global trends to combat antibiotic resistance.

In addition, environmental concerns surrounding deforestation linked to soy and corn cultivation have prompted international buyers to demand certified sustainable sourcing, adding complexity to the supply chain. Smaller feed producers, lacking the resources for certification and compliance monitoring, face barriers to entry in both domestic and export markets. Consequently, while regulatory advancements are beneficial in the long run, they currently pose short-to-medium-term challenges that hinder the scalability and profitability of the Latin American animal feed industry.

MARKET OPPORTUNITY

Growth of Organic and Specialty Feed Segments

A promising opportunity within the Latin American animal feed market lies in the expanding demand for organic and specialty feed products tailored to niche markets such as free-range poultry, grass-fed cattle, and premium pet food. Consumers across the region are becoming more conscious of food safety, animal welfare, and environmental sustainability, driving a shift toward cleaner and more transparent feed solutions. This trend has encouraged feed manufacturers to develop organic-certified feed blends that exclude synthetic additives, genetically modified organisms (GMOs), and chemical preservatives.

In Brazil, companies like JBS and BRF have launched dedicated lines of organic poultry and pork, backed by corresponding changes in feed sourcing and formulation. Similarly, in Mexico, the rise of premium pet ownership has fueled demand for natural and grain-free pet food variants, prompting local feed producers to invest in specialized extrusion technologies and high-protein formulations.

Technological Advancements in Precision Feeding and Nutritional Analytics

Another emerging opportunity in the Latin American animal feed market is the adoption of precision feeding technologies and advanced nutritional analytics to optimize feed efficiency and reduce waste. With increasing pressure to improve productivity while minimizing environmental impact, livestock producers are turning to digital tools that enable real-time monitoring and customized feed formulation. Companies in Brazil, for example, have begun integrating artificial intelligence (AI) and Internet of Things (IoT)-based systems to track animal performance and adjust feed composition accordingly.

According to a report by Embrapa (Brazilian Agricultural Research Corporation), precision feeding systems have helped reduce feed conversion ratios in commercial poultry farms, enhancing both economic returns and sustainability.

Additionally, biotechnology firms are developing enzyme supplements and probiotics that improve digestion and nutrient absorption in livestock, allowing for lower inclusion rates of expensive grains without compromising growth rates. Argentina has seen a notable uptake in genomic testing for cattle, enabling ranchers to tailor feed rations based on genetic predispositions to weight gain and disease resistance. These innovations signal a transformative shift in how feed is formulated and administered, offering Latin American producers a competitive edge in the global market.

Climate Change and Weather-Induced Crop Failures

One of the foremost challenges facing the Latin American animal feed market is the increasing frequency of climate-related disruptions that affect the availability and quality of key feed crops such as corn and soybeans. The region has experienced prolonged droughts, unseasonal rainfall, and extreme temperatures that have significantly impacted agricultural yields.

For instance, Brazil, one of the world’s largest soybean producers, suffered a severe drought in 2021–2022, leading to a 12% drop in soybean production compared to the previous year, as reported by Conab (Brazilian Company of Agricultural Research). This reduction in supply had a cascading effect on feed production, forcing manufacturers to either raise prices or seek alternative sources of raw materials. Similarly, Argentina, another major grain exporter, encountered excessive rainfall in parts of the Pampas region during the 2022–2023 planting season, delaying sowing cycles and reducing expected yields. Moreover, the reliance on rain-fed agriculture in many parts of the region makes the feed supply chain highly vulnerable to future climate shocks.

Limited Access to Financing and Credit for Small-Scale Feed Producers

Access to adequate financing remains a persistent challenge for small-scale feed producers across Latin America, hindering their ability to scale operations, adopt new technologies, and compete with larger players in the market. Unlike multinational corporations that benefit from established credit lines and vertical integration, independent feed mills often struggle to secure loans or investment capital due to weak financial histories, lack of collateral, and limited creditworthiness.

According to the Inter-American Development Bank (IDB), less than 30% of small and medium-sized enterprises (SMEs) in the Latin American agribusiness sector have access to formal banking services, restricting their capacity to modernize facilities or expand production capacities. In countries like Peru and Bolivia, where rural financial infrastructure is underdeveloped, feed producers frequently rely on informal lending channels that charge exorbitant interest rates, further straining profitability.

Also, fluctuating commodity prices and seasonal demand patterns make lenders cautious about extending credit to feed businesses, which are perceived as high-risk. The Mexican National Institute for Forestry, Agriculture and Livestock Research (INIFAP) noted that many regional feed mills operate below capacity due to insufficient working capital, preventing them from taking advantage of economies of scale.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

1.76% |

|

Segments Covered |

By Type, Livestock, Raw Material, and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

Brazil, Chile, Argentina, Mexico, and Colombia etc |

|

Market Leaders Profiled |

Agrosuper S.A., BRF S.A., Cooperativa Central Aurora Alimentos, JBS S.A, Goncalves Tortola S.A., Grupo Pilar S.A., Industrias Bachoco S.A.B. de C.V. and Italcol S.A. |

SEGMENTAL ANALYSIS

By Type Insights

The compound feed segment held the largest share in the Latin American animal feed market, accounting for approximately 68% of total consumption in 2024. This dominance is primarily attributed to the region’s growing commercial livestock and poultry industries, which rely heavily on nutritionally balanced, industrially manufactured feeds to optimize productivity.

According to data from the International Feed Industry Federation (IFIF), Brazil alone produced over 75 million metric tons of compound feed in 2023, driven largely by its position as one of the world's top exporters of poultry and pork. The integration of large agribusiness firms such as BRF and JBS has further consolidated the use of standardized compound feeds across supply chains.

Also, increasing awareness regarding feed efficiency and disease prevention among livestock producers has led to a shift away from traditional feeding practices toward scientifically formulated compound feed blends. Moreover, rising urbanization and per capita income growth have fueled demand for meat and dairy products, reinforcing the need for reliable feed supply systems that only compound feed can effectively support.

Among the different types in the Latin American animal feed market, forage is projected to grow at the fastest compound annual growth rate (CAGR) of 5.4%. This growth is primarily driven by the expansion of pasture-based cattle farming systems, particularly in countries like Argentina, Uruguay, and Paraguay, where grass-fed beef production remains a dominant model.

As consumer preferences in international markets increasingly favor sustainably produced, hormone-free meat, local ranchers are investing in improved forage varieties and rotational grazing techniques to enhance productivity without compromising quality. Furthermore, government initiatives promoting sustainable land use and biodiversity conservation have encouraged the adoption of forage-based feeding strategies.

In Brazil, Embrapa (Brazilian Agricultural Research Corporation) launched several programs aimed at developing drought-resistant forage species, enabling farmers to maintain feed availability even under adverse climatic conditions.

By Livestock Insights

The poultry sector accounted for the maximum share of 34.1% of the LatinAmericana animal feed market in 2024, driven primarily by the region's robust chicken meat production and export infrastructure. Countries like Brazil and Mexico have emerged as major global suppliers of poultry products, necessitating a consistent and high-volume supply of specialized feed formulations. This export-driven model has created a strong dependency on high-efficiency, nutrient-dense poultry feed to ensure rapid growth cycles and cost-effective production.

In addition, domestic consumption trends in Latin America are also contributing to this demand. Technological advancements in feed formulation, including the incorporation of enzymes and amino acids to improve digestibility, have further reinforced the poultry feed segment’s dominance. Moreover, vertical integration in the poultry industry allows for streamlined control over feed sourcing and quality assurance, ensuring consistent performance across production units.

The aquatic animals segment is anticipated to register the highest growth in the Latin American animal feed market, expanding at a CAGR of 6.2% during the forecast period. This rapid growth is primarily fueled by the expansion of aquaculture operations, especially in Chile and Ecuador, where salmon and shrimp farming have become key contributors to agricultural exports.

Similarly, Ecuador solidified its position as the world’s largest exporter of farmed whiteleg shrimp, exporting more than 1 million metric tons in 2023, as reported by Camara Nacional de Acuacultura (CNA). These developments have directly stimulated demand for specialized aquafeed products tailored to meet the nutritional needs of various fish and crustacean species. Also, rising health consciousness among consumers has increased seafood consumption, prompting greater investment in aquaculture feed innovation. Companies like Biomar and Skretting have expanded their presence in the region, offering high-protein, low-waste feed solutions that enhance yield while minimizing environmental impact. Government-led initiatives promoting sustainable aquaculture practices, along with improvements in hatchery technology and water management, are further accelerating the uptake of premium aquafeeds.

By Raw Material Insights

Soya constituted the prominent raw material segment in the Latin American animal feed market, capturing approximately 54% of total ingredient usage in 2024. This dominance is due to soya’s high protein content, making it an essential component in poultry, swine, and aquaculture feed formulations. Brazil and Argentina, two of the world’s top three soybean producers, supply a significant portion of the region’s feedstock requirements.

These volumes underscore the critical role of soya in supporting the region’s livestock and aquaculture sectors. Moreover, ongoing investments in biotechnology have led to the development of genetically modified soybean varieties with enhanced resistance to pests and drought, improving yield stability and reducing reliance on chemical inputs. Despite concerns around deforestation-linked sourcing, certification schemes such as RTRS (Round Table on Responsible Soy) are gaining traction, promoting more sustainable procurement practices.

Rendered meal is emerging as the fastest-growing raw material in the Latin American animal feed market, registering a projected CAGR of 5.9% over the next decade. This growth is being driven by increasing emphasis on circular economy principles and resource efficiency within the livestock and pet food sectors. Rendered meal—derived from animal by-products such as bone, fat, and offal—is widely used as a high-protein supplement in poultry, swine, and aquaculture feed, offering a sustainable alternative to plant-based proteins.

The country’s expanding poultry and pig farming industries have been key adopters of rendered meal due to its cost-effectiveness and ability to reduce dependence on imported feed ingredients. Moreover, regulatory bodies such as Brazil’s MAPA (Ministry of Agriculture, Livestock and Supply) have implemented stringent guidelines to ensure the safety and traceability of rendered products, enhancing consumer confidence. As sustainability becomes a central focus in global agriculture, rendered meal is gaining traction as a viable solution for optimizing feed resource utilization across Latin America.

COUNTRY-LEVEL ANALYSIS

Brazil stood as the biggest contributor to the Latin American animal feed market, holding a market share of 42.1% in 2024. This lead position is underpinned by its status as a global powerhouse in poultry and pork production, alongside a well-established feed manufacturing infrastructure.

The country's feed industry benefits from abundant arable land, favorable climatic conditions, and high domestic demand for meat products.

Apart from these, Brazil is one of the top three producers of soybeans and corn globally, providing a stable supply of key raw materials for compound feed production. Moreover, Brazil's growing pet ownership rates, as highlighted by Euromonitor International, have spurred demand for premium pet food, further diversifying the feed market.

Mexico is a key player in the market. The country's strong livestock sector, particularly in poultry and swine production, drives a steady demand for industrial feed. Moreover, the country serves as a key supplier to the U.S. market, benefiting from trade agreements such as USMCA, which facilitate the cross-border movement of animal protein products. The rise in domestic meat consumption, fueled by urbanization and disposable income growth, has also contributed to the expansion of commercial feed production. Beyond livestock, Mexico has seen a surge in pet ownership. The country’s proximity to North American grain suppliers ensures a relatively stable supply of corn and soybean meal, mitigating some of the volatility faced by other regional players.

Argentina held a notable share of the Latin American animal feed market, driven by its export-oriented livestock industry and strong domestic demand for meat products.

This growth has necessitated a parallel expansion in feed production, particularly for poultry and swine segments. A significant portion of this output is utilized domestically in feed manufacturing, supporting both large-scale and smallholder livestock operations. The country’s agricultural policy framework, including subsidies and credit lines for agribusinesses, has facilitated the modernization of feed production facilities. However, economic instability and currency fluctuations pose challenges to long-term investment.

Chile is distinguished by its prominence in aquaculture feed production. The country is the second-largest producer of farmed salmon globally, trailing only Norway. This robust aquaculture industry has spurred demand for high-protein, nutrient-dense aquafeed, positioning Chile as a leader in specialty feed formulation. Local and international companies, including Biomar and AquaChile, have invested significantly in advanced feed technologies that enhance fish health and minimize environmental impact.

In addition, Chile’s commitment to sustainable aquaculture practices has attracted global buyers, strengthening its export-oriented feed industry. While livestock and poultry feed production remains modest compared to larger economies, the country’s focus on innovation and quality has enabled niche market differentiation.

The remaining Latin American countries are characterized by diverse growth patterns across Colombia, Peru, Ecuador, and Central American nations. Colombia, for instance, has experienced a resurgence in poultry production. The country’s expanding middle class and government-backed rural development programs have supported this growth.

Meanwhile, Central American countries such as Guatemala and Honduras have strengthened their poultry sectors, leveraging regional trade agreements to boost exports to the Caribbean and North America. Smaller yet dynamic markets like Bolivia and Paraguay are witnessing the gradual modernization of feed production through public-private partnerships and foreign investment. Although fragmented, the Rest of Latin America presents substantial untapped potential, particularly in organic feed, pet food, and climate-resilient livestock systems.

Top Players in the Market

Cargill Incorporated

Cargill is a dominant force in the Latin American animal feed market, offering a comprehensive range of feed ingredients and customized feed solutions for poultry, swine, cattle, and aquaculture. The company leverages its global expertise and regional supply chain infrastructure to maintain a strong presence across key markets like Brazil, Argentina, and Mexico. Cargill integrates sustainable sourcing practices into its operations, supporting both large-scale agribusinesses and local farmers. Its commitment to innovation, nutritional research, and vertical integration enables it to influence not only regional production but also global trade flows of feed commodities.

Bunge Limited

Bunge plays a pivotal role in the Latin American animal feed sector by supplying essential raw materials such as soybean meal and corn, which are critical components in compound feed formulations. With deep roots in Brazil and Argentina, Bunge operates integrated crushing and processing facilities that directly support livestock producers. The company’s extensive logistics network ensures efficient grain movement to feed mills, enhancing operational efficiency across the value chain. Bunge's investment in sustainability initiatives and traceability programs aligns with evolving consumer demands, reinforcing its position as a trusted supplier in both domestic and international markets.

JBS S.A.

JBS is a leading player in the Latin American animal feed market due to its vertically integrated business model that spans livestock production, meat processing, and feed manufacturing. Through its subsidiary Seara in Brazil and other regional brands, JBS controls a significant portion of the poultry and swine feed supply chain. This integration allows the company to ensure feed quality, optimize costs, and enhance product consistency. JBS invests heavily in technology-driven feed formulation and biosecurity protocols, contributing to improved productivity and food safety standards across the region’s livestock industry.

Top Strategies Used by Key Market Participants

One major strategy adopted by key players in the Latin American animal feed market is vertical integration, where companies control multiple stages of their supply chain—from raw material sourcing to feed production and livestock farming. This approach enhances cost efficiency, ensures consistent feed quality, and reduces dependency on external suppliers. Another key strategy is investment in sustainable and innovative feed solutions, including organic feed, alternative protein sources, and precision nutrition technologies. These innovations help companies meet evolving regulatory standards and consumer preferences while improving environmental performance. A third crucial strategy is strategic partnerships and acquisitions, through which firms expand their regional footprint, access new distribution channels, and integrate complementary capabilities. By consolidating smaller feed mills or forming joint ventures with biotech firms, leading players strengthen their market dominance and adapt more effectively to changing industry dynamics.

COMPETITION OVERVIEW

The competition in the Latin American animal feed market is characterized by a mix of multinational corporations, regional agribusinesses, and numerous local feed mills, creating a dynamic and fragmented landscape. While large players dominate due to their vertical integration and economies of scale, mid-sized enterprises continue to carve out niche positions through specialized products and localized strategies. Innovation is a key battleground, with companies investing heavily in feed formulation technologies, digital monitoring systems, and sustainable sourcing practices to differentiate themselves. Additionally, the market sees intense rivalry in pricing and service offerings, particularly in countries with high livestock density, such as Brazil and Mexico. Regulatory compliance, raw material availability, and fluctuating input costs further shape competitive dynamics. As demand for animal protein continues to rise, companies are increasingly focusing on strategic expansion, brand positioning, and technological differentiation to secure long-term growth in this evolving market.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Cargill expanded its soybean processing facility in Mato Grosso, Brazil, aiming to increase meal production capacity to better serve the growing poultry and swine sectors.

- In May 2023, Bunge launched a new line of certified sustainable soybean meal tailored for premium livestock feed manufacturers in Argentina, enhancing its reputation in eco-conscious markets.

- In September 2023, JBS introduced an advanced feed analytics platform across its Brazilian feed mills to optimize formulation and improve livestock performance tracking.

- In March 2024, Nutreco acquired a controlling stake in a Peruvian aquafeed producer to strengthen its presence in South America’s expanding aquaculture segment.

- In July 2023, De Heus opened a state-of-the-art feed mill in Mexico, targeting small and medium-scale poultry producers with customized feed solutions to capture underserved market segments.

MARKET SEGMENTATION

This research report on the Latin American animal feed market is segmented and sub-segmented into the following categories.

By Type

- Fodder

- Forage

- Compound Feed

By Livestock

- Swine

- Aquatic Animals

- Cattle

- Poultry

- Others

By Raw Material

- Soya

- Canola

- Rendered Meal

- Others

By Production System

- Integrated

- Commercial Mills

By Country

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Others

Frequently Asked Questions

What is the projected CAGR of the Latin America Animal Feed Market from 2025 to 2033?

The Latin America animal feed market is expected to grow at a CAGR of 1.76% from 2025 to 2033 , driven by rising demand for poultry, cattle, and swine feed due to expanding export markets and domestic meat consumption.

Which country leads in animal feed production in Latin America?

Brazil dominates the region, accounting for over 40% of total feed output, supported by its status as the world's largest exporter of poultry meat and one of the top beef exporters globally.

How many metric tons of animal feed were produced in Latin America in 2023?

In 2023, the region produced approximately 220 million metric tons of compound animal feed , with poultry feed representing nearly 50% of total production, according to the Latin American Feed Industry Association (ALUIA).

Which type of livestock feed is growing fastest in Latin America?

Aquafeed is the fastest-growing segment, with a CAGR of 8.1% , particularly in Chile, Ecuador, and Brazil, where salmon and shrimp farming are expanding rapidly to meet global seafood demand.

What percentage of dairy farms in Argentina use specialized feed supplements?

Over 65% of commercial dairy farms in Argentina now use specialized feed additives and nutritional enhancers, especially in the Pampas region, to improve milk yield and composition under pasture-based systems

How has soybean availability impacted feed formulation strategies in Brazil?

With Brazil producing over 150 million tons of soybeans annually , the country has shifted toward local sourcing of protein-rich feed ingredients , reducing dependency on imported feed additives and improving cost efficiency for poultry and pig producers.

Which countries in Latin America have implemented regulations on antibiotic use in animal feed?

Brazil, Colombia, and Mexico have introduced partial restrictions on growth-promoting antibiotics in animal feed, encouraging adoption of alternatives like probiotics, organic acids, and phytogenics since 2022.

What role does climate change play in feed ingredient sourcing across Latin America?

Unpredictable rainfall patterns and prolonged droughts in parts of northern Mexico, Central America, and northeastern Brazil have increased reliance on drought-tolerant feed crops and alternative protein sources like insect meal and algae-based additives.

How much do smallholder farmers contribute to overall animal feed demand in the region?

Small-scale livestock operations account for nearly 38% of total animal feed usage , particularly in countries like Peru, Bolivia, and Guatemala, where government programs are promoting improved feeding practices.

How is digital agriculture influencing feed management in Latin America?

Digital platforms offering feed formulation apps, livestock monitoring tools, and e-commerce for feed ingredients have gained traction, with over 20% of medium-sized farms in Brazil and Chile using mobile apps for real-time feed planning and inventory control.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com