Global Aerospace Materials Market Size, Share, Trends, & Growth Forecast Report - Segmented By Based On Type, Aircraft Type, Application, & Region - Industry Forecast From 2024 to 2032

Global Aerospace Materials Market Size (2024 to 2032)

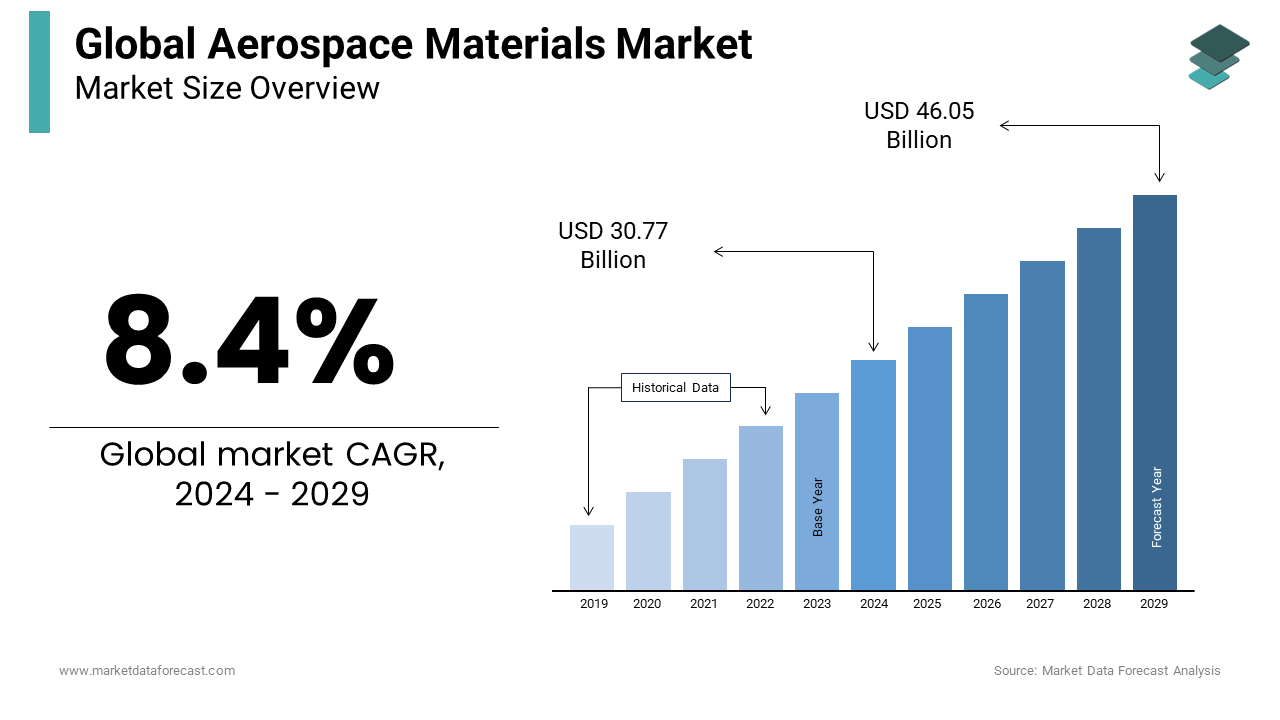

The global aerospace materials market was worth USD 28.39 billion in 2023. The global market is expected to reach USD 58.66 billion by 2032 from USD 30.77 billion in 2024, growing at a compound annual growth rate (CAGR) of 8.4 % during the forecast timeline.

High demand from emerging economies is driving the growth of the global aerospace materials market. Europe accounts for a large share of the aerospace materials market owing to high demand for commercial and business aircraft. The rising demand from emerging economies is expected to drive the aerospace materials market during the forecast period. Post-pandemic, a significant change in travel and operational activities can be seen. The industries started to work full-time, resulting in a rise in people traveling. The global aerospace industry has experienced a rise in passenger numbers. This resulted in the demand for the aviation industry, thereby increasing demand for the aerospace materials market. In the developing economies, there is a high demand for low-cost carriers that provide strong competition in the market. The rising demand will provide an opportunity for aerospace materials-providing companies as they are part of the aircraft manufacturing industry.

The rise in the demand for budget aircraft is anticipated to propel growth in the aerospace materials market. The low-cost operators always have the front position in the market, mostly in the Asia-Pacific and South American countries. The travel frequency is higher between Europe and APAC, like most popular airlines like Qatar Airways and Emirates. The higher frequency of traveling through aircraft will drive the requirement of the new aircraft at a higher rate, resulting in more requirements of the aircraft materials to construct new aircraft.

The decline in the number of product deliveries through aircraft would show a direct impact on the aerospace materials market as the requirement for raw materials will decrease significantly. The consumption of composite materials is seen more in commercial aircraft, and the decline in the demand for them would negatively impact the market. Unforeseen incidents such as accidents, delayed aircraft, and shutdown of operations due to external conditions result in the impact on traveling through aircraft. The high maintenance cost of the aircraft, along with the regulatory requirements, impacts the aerospace material market negatively. The change in the regulatory compliance of the aviation industry impacts the manufacturers and operators. Any sudden change in the material usage in the manufacturing of the aircraft results in an imbalance between the supply and demand for the aircraft. The high cost of manufacturing carbon fibres and the decline in the use of alloys are some other factors expected to restrain the growth of the targeted industry over time.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

8.4% |

|

Segments Covered |

By Type, Aircraft Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Alcoa Corporation, ATI Metals, Doncasters Group Ltd, Kaiser Aluminum, Novelis, Kymera Global, Mitsubishi Chemical Holdings, DuPont de Nemours, Inc, Arconic, Inc, Duncan Aviation, Hexcel Corporation, Rio Tinto Group, Cytec Solvay Group, Toray Composite Materials, Isovolta AG |

SEGMENTAL ANALYSIS

Global Aerospace Materials Market Analysis By Type

Aluminum alloys have a large share in the aerospace materials market. Nowadays, most modern aircraft are made of aluminum alloys. They are used for producing the fuselage, wings, and some other parts of the aircraft. Aluminum alloys are preferred over other alloys due to their high strength, resistance to corrosion and heat, and lightweight. These characteristics help the designers to reduce the weight of the aircraft and increase fuel efficiency. The most used aircraft, like commercial and business aircraft, use aluminum alloys in their manufacturing. The easy availability of aluminum and affordability drive the segment’s growth.

Global Aerospace Materials Market Analysis By Aircraft Type

Commercial aircraft hold a high market share in the aerospace materials market during the forecast timeline in the type of aircraft segment. There is a large-scale use of different materials like aluminum alloys, titanium alloys, and composite materials in the manufacturing of these aircraft. In terms of volume, the commercial aircraft segment has a larger share of material demand. The increase in the demand for aircraft for traveling in emerging countries will create an additional demand for new aircraft. That drives the aircraft material demand.

Global Aerospace Materials Market Analysis By Application

Based on the application, the interior segment is anticipated to hold a large share of the aerospace materials market. The demand for better passenger comfort and increased safety in the aircraft, as well as rising demand in emerging countries, will drive market growth. There is an increasing demand for fuel-efficient aircraft, and rising investments in advanced space technologies propel segmental growth.

REGIONAL ANALYSIS

Europe region is anticipated to hold a high share of the aerospace materials market in terms of revenue. In this region, there is more demand for commercial and business aircraft. Germany holds the first position in delivering the greatest number of commercial aircraft. Europe also has more tourism, resulting in more travellers from other countries. Even though the pandemic impacted the market negatively in this region, post-pandemic, there has been an increase in market growth. Europe also has major players in the aerospace material industry, driving market growth.

The Asia-Pacific region also has a high growth rate in the aerospace materials market. The rise in the demand is driven by the proportionate rise in the demand for commercial aircraft in this region.

The United States has the largest aerospace industry in the world, which drives the aerospace materials market in the North American region. There is an anticipated increase in the commercial fleets in the coming years. The government also plays a key role in the growth of the aerospace material industry by allocating a certain part of the defense budget. A strong presence of market players, advanced technologies, and increasing government investment drive the growth of the market in this region.

KEY PLAYERS IN THE GLOBAL AEROSPACE MATERIALS MARKET

Alcoa Corporation, ATI Metals, Doncasters Group Ltd, Kaiser Aluminum, Novelis, Kymera Global, Mitsubishi Chemical Holdings, DuPont de Nemours, Inc, Arconic, Inc, Duncan Aviation, Hexcel Corporation, Rio Tinto Group, Cytec Solvay Group, Toray Composite Materials, Isovolta AG

RECENT HAPPENINGS IN THE MARKET

- In 2022, a partnership was formed between Toray Advanced Composites, America, and Specialty Materials, U.S. The partnership helps develop advanced next-generation aerospace materials with functional properties. This partnership will strengthen the company’s position in the aerospace materials industry.

- In 2022, Isovolta AG has acquired the Gurit Holding AG’s Aviation and Aerospace business unit. The acquisition will give the company an advantage in expanding the business to produce composite materials, composite manufacturing equipment, and core kitting services for the aerospace industry.

- In 2021, Duncan Aviation announced the obtaining of accreditation from the AWS Infrastructure Welded Code Aluminum for its welding and machining department.

- In 2020, Kymera Global brought a scanning alloy division of AMETEK. Kymera Global is a maker of tiny powder metallurgy. Kymera benefits from this acquisition in the metal sector.

DETAILES SEGMENTATION OF THE GLOBAL AEROSPACE MATERIALS MARKET INCLUDED IN THIS REPORT

This research report on the global aerospace materials market has been segmented and sub-segmented based on type, aircraft type, application and region

By Type

- Aluminium Alloys

- Titanium Alloys

- Steel Alloys

- Super Alloys

- Composites

- Others

By Aircraft Type

- Commercial Aircraft

- Business & General Aviation

- Military Aircraft

- Helicopters

- Others

By Application

- Interior

- Passenger seating

- Gallery

- Interiors

- Panels

- Others

- Propulsion Systems

- Airframe

- Tail & Fin

- Windows & Windshields

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key drivers of the global aerospace materials market?

The key drivers include the growing demand for lightweight and fuel-efficient aircraft, advancements in material science and technology, increasing air travel and defense spending, and the rising production of commercial and military aircraft.

Which materials are most commonly used in the aerospace industry?

The most commonly used materials include aluminum alloys, titanium alloys, high-strength steels, composites (such as carbon fiber-reinforced polymers), and superalloys. Each material is selected based on its properties such as strength, weight, durability, and resistance to environmental factors.

What are the latest technological advancements in aerospace materials?

Recent advancements include the development of next-generation composites, additive manufacturing (3D printing) of aerospace parts, the use of nanomaterials for improved performance, and the integration of smart materials that can respond to environmental changes.

What role do composites play in the aerospace materials market?

Composites play a crucial role due to their high strength-to-weight ratio, corrosion resistance, and ability to be molded into complex shapes. They are extensively used in aircraft structures, including fuselages, wings, and interior components, contributing to weight reduction and improved fuel efficiency.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com