Global Agricultural Disinfectants Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report - Segmented By Type (Oxidizing Agents & Aldehydes, hypochlorite & Halogens, Quaternary Ammonium Compounds & Phenols, Others), Application (Water Sanitizing, Aerial, Surface), Form (Powder, Liquid, Others), End-Use (Livestock farms, Agricultural farms), Region (North America, Europe, Asia-Pacific, Middle East & Africa, Latin America) – Industry Analysis From 2025 To 2033

Global Agricultural Disinfectants Market Size

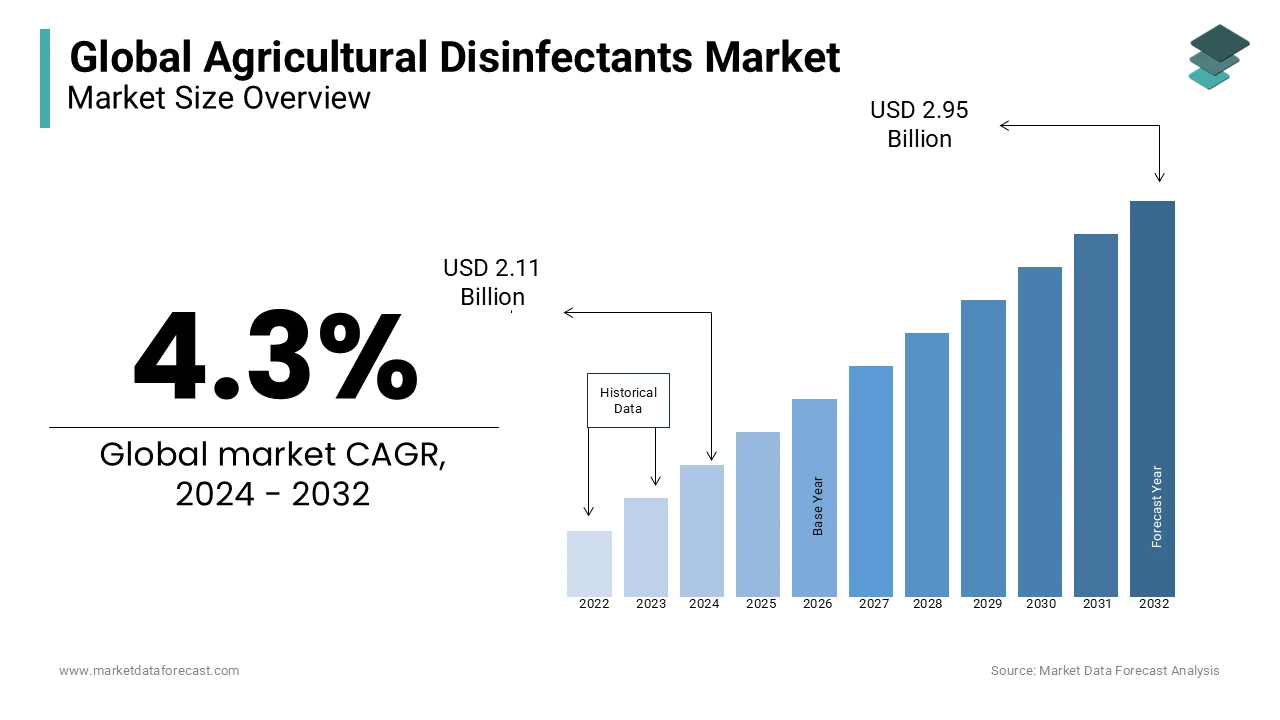

The global agricultural disinfectants market was valued at USD 2.11 billion in 2024 and is anticipated to reach USD 2.20 billion in 2025 from USD 3.08 billion by 2033, growing at a CAGR of 4.3% during the forecast period from 2025 to 2033.

Agricultural disinfectants are fatal substances used for crops and livestock to protect against bacteria, fungi, viruses, and other microorganisms. The requirement for agricultural productivity is growing to fulfill the global demand due to the increasing population. The increased adoption of vertical farming and greenhouse vegetable production techniques has powered the growth of the global agricultural disinfectant market. However, there has been a recent slowdown in the industry due to the negative impact of these products on crops and livestock. Thus, the current trend is to use eco-friendly agricultural disinfectants. Along with this liquid formulation, the market is estimated to grow at a higher rate during 2022-2028 due to its ease of use and low cost.

Market Drivers

WHO has banned the use of antibiotics for animal products to reduce the ill effects and antibiotic resistance in humans. This leads to growth in the demand for agricultural disinfectants because they are an excellent substitute for antibiotics. In addition, the growing importance and research on improving the quality of disinfectants is also a driver to the growth of the agricultural disinfectants market. Due to poor water quality and environmental concerns, the demand for farming disinfectants is growing. In addition, the increasing population and requirements to remove hazardous substances to maintain food quality also contribute to agricultural disinfectant demand.

Market Restraints

Farmers are also not very well educated and aware of the use of agricultural disinfectants. Although agricultural disinfectants are essential for food security and livestock, they adversely impact health if not used properly. This has created a restraint in the usage of disinfectants. Due to the preconceived mindset that disinfectants will negatively impact crops, health, and livestock, the adoption rate of the product is less.

Market Opportunities

In emerging economies like India and China, the opportunity for a disinfectant market is rising because of the growing demand for meat products. Furthermore, research on the use of eco-friendly disinfectants is growing in developing countries, which creates an extension in the disinfectants market. In addition, the growing population has led to more consumption which in turn requires quantity and quality of crops and livestock. Due to this, the market growth opportunity is rising.

COVID-19 Impact on the Agricultural Disinfectant Market

COVID-19 harmed the global agricultural disinfectants market. COVID-19 led to disruption in the supply chain due to transportation bans by different countries, and the export-import also got affected. The industry faced a downturn during this time as many manufacturing plants were closed to lockdown and regulation of commutation. The demand for disinfectants had decreased as the dependent industries were also adversely impacted. But currently, the sector has revived again and is expected to grow positively.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.3% |

|

Segments Covered |

By Type, Application, Form, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Stepan Company, Zoetis Services LLC, Thymox Technology, Bayer CropScience AG, Neogen Corporation, Bayer CropScience AG, Lanxess AG, Shandong Daming Disinfection Technology Co. Ltd. |

SEGMENTAL ANALYSIS

Global Agricultural Disinfectants Market By Type

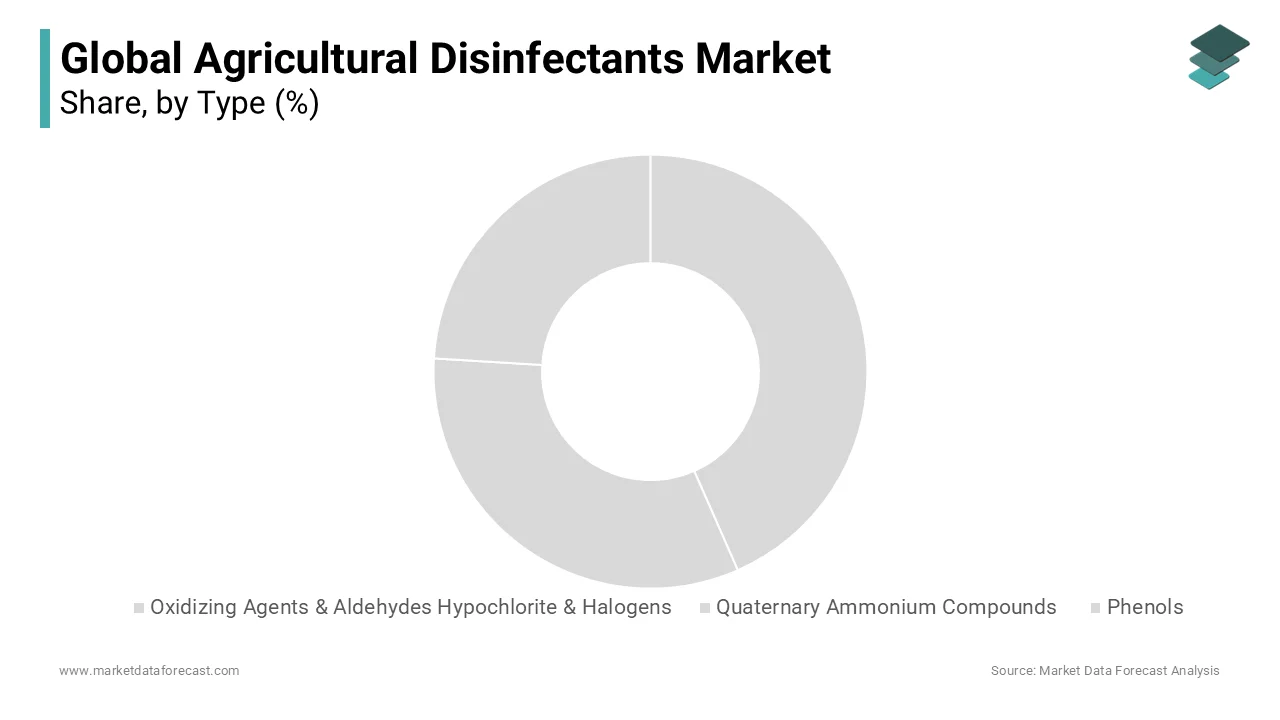

Based on Segmentation by type, Phenols and Quaternary Ammonium Compounds are expected to have the highest growth rate. Quaternary Ammonium Compounds are used in different products and processes like water purification, textiles, etc. Due to their cationic properties, they become powerful cleaners and help kill most bacteria, fungi, and viruses. In addition, they are readily available at a lower price.

Global Agricultural Disinfectants Market By Application

Based on Segmentation by application, the water sanitizing segment is leading with the highest shares of the market. Agricultural disinfectants are mainly used for water sanitizing and aerial and surface cleaning. Due to deteriorating water quality, agricultural disinfectants are used to improve their quality. It is used in Aerial disinfection to reduce microbes and dust. In addition, it disinfects the surface by removing any organic matter or microbes.

Global Agricultural Disinfectants Market By Form

Based on Segmentation by form, liquid disinfectant is expected to grow at a greater rate because of its convenience, availability, low price, and ease of use. The primary benefit of liquid disinfectant is improving crop quality and productivity. Along with being used in crops, it's also effective in enhancing the disease problems in livestock.

Global Agricultural Disinfectants Market By End-Use

Disinfectants for livestock are used to prevent the spread of cattle diseases by eliminating microorganisms such as viruses, bacteria, and fungi. Due to conditions like ringworms, lysine sickness, etc., the usage and demand to disinfect livestock have increased, and the livestock disinfectant market is expected to grow significantly. Disinfectants for Agricultural farms are also primarily used to remove microorganisms from crops and improve product quality.

REGIONAL ANALYSIS

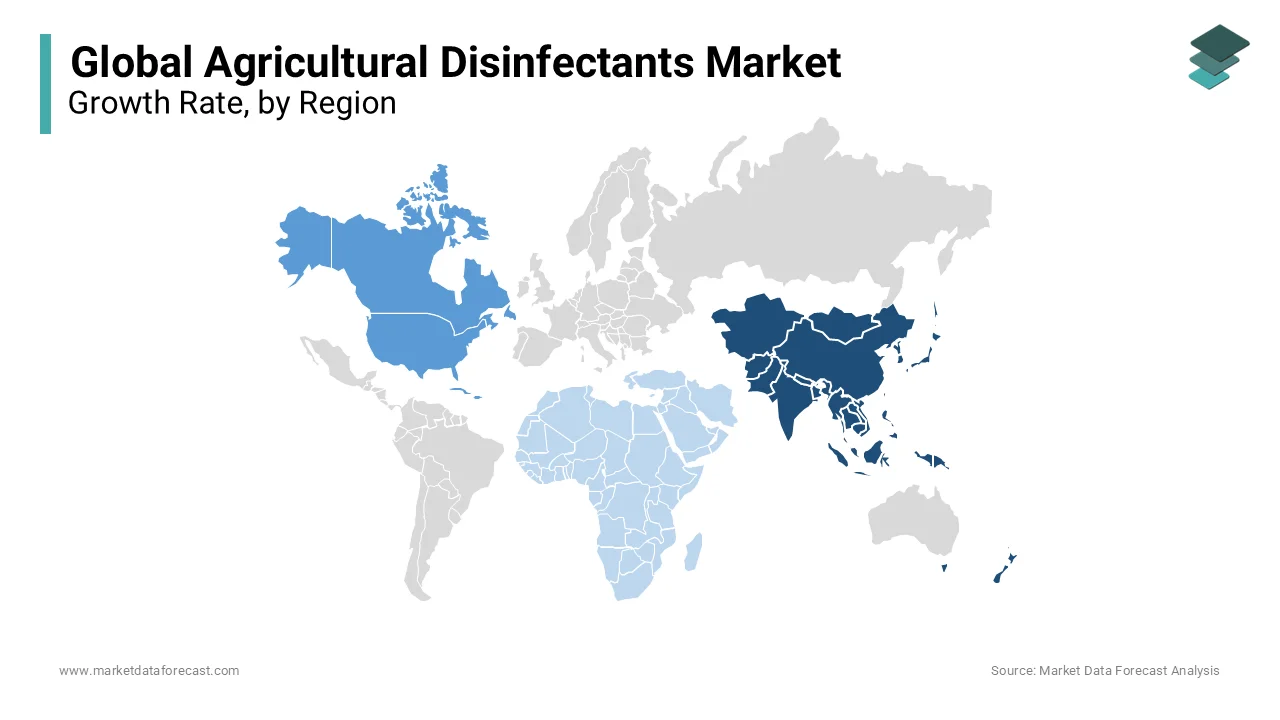

The Asia-Pacific agricultural disinfectant industry is predicted to rise at a CAGR of 5.4% between 2022-2027. This is one of the most potential markets based on growth and market opportunity. Due to the increasing population and growing awareness of farmers, the demand for agricultural disinfectants is growing. The market also gives opportunities like mergers, acquisitions, and joint ventures to penetrate the market strategically. The North American industry is assumed to rise at a CAGR of 4.3% between 2020-2025. The Europe disinfectant industry is assumed to grow at a 3.62% CAGR between 2020-2925. Companies here are inventing more in R&D due to increased competition. Middle East and Africa have the highest growth rates of 6.2% CAGR. The reason for such growth is rising demand after COVID-19, healthcare facilities, and due to more aware and environmentally friendly consumers.

KEY MARKET PLAYERS

Stepan Company, Zoetis Services LLC, Thymox Technology, Bayer CropScience AG, Neogen Corporation, Bayer CropScience AG, Lanxess AG, Shandong Daming Disinfection Technology Co. Ltd. Some of the market players dominate the global agriculture disinfectants maket.

RECENT DEVELOPMENTS IN THIS MARKET

- In 2021, LANXESS, to expand its consumer protection business, acquired the These group, a French company that manufactures disinfection and hygiene solution products. Through this acquisition, LANXESS aims to grow its animal hygiene product market.

- In 2021, the CEO of INRAE & Ceva collaborated and signed a framework agreement regarding COVID-19 and avian influenza in France.

- In 2022, Holland & Knight acquired Clarion Corp to enter the residential and commercial pool spa and water treatment market.

MARKET SEGMENTATION

This research report on the global agriculture disinfectants market has been segmented and sub-segmented into the following categories.

By Type

- Oxidizing Agents & Aldehydes Hypochlorite & Halogens

- Quaternary Ammonium Compounds

- Phenols

- Others

By Application

- Water Sanitizing

- Aerial

- Surface

By Form

- Powder

- Liquid

- Others

By End-Use

- Livestock farms

- Agricultural farms

By Region

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

Frequently Asked Questions

How big is the global Agricultural Disinfectants Market?

The global agricultural disinfectants market was valued at USD 2.11 billion in 2024 and is anticipated to reach USD 2.20 billion in 2025 from USD 3.08 billion by 2033, growing at a CAGR of 4.3% during the forecast period from 2025 to 2033.

Who are the major players in Agricultural Disinfectants Market?

The major players are Stepan Company, Zoetis Services LLC, Thymox Technology, Bayer Cropscience AG, Neogen Corporation, Bayer Cropscience AG, Lanxess AG, Shandong Daming Disinfection Technology Co. Ltd.

Which is the leading segment based on market share in the Agricultural Disinfectants Market?

Asia Pacific has the highest market share in Agricultural Disinfectants Market

What is the Agricultural Disinfectants Market segmentation by identity Type?

Oxidizing Agents & Aldehydes, Hypochlorite & Halogens, Quaternary Ammonium Compounds, Phenols, and Others.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com