Global Agricultural Films Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (LLDPE, LDPE, Reclaim, EVA, HDPE), Application (Greenhouse Film, Mulch Film, And Silage Film), And By Region (North America, Europe, Asia Pacific, Latin America, and Middle East - Africa) – Industry Forecast From 2025 to 2033

Global Agricultural Films Market Size

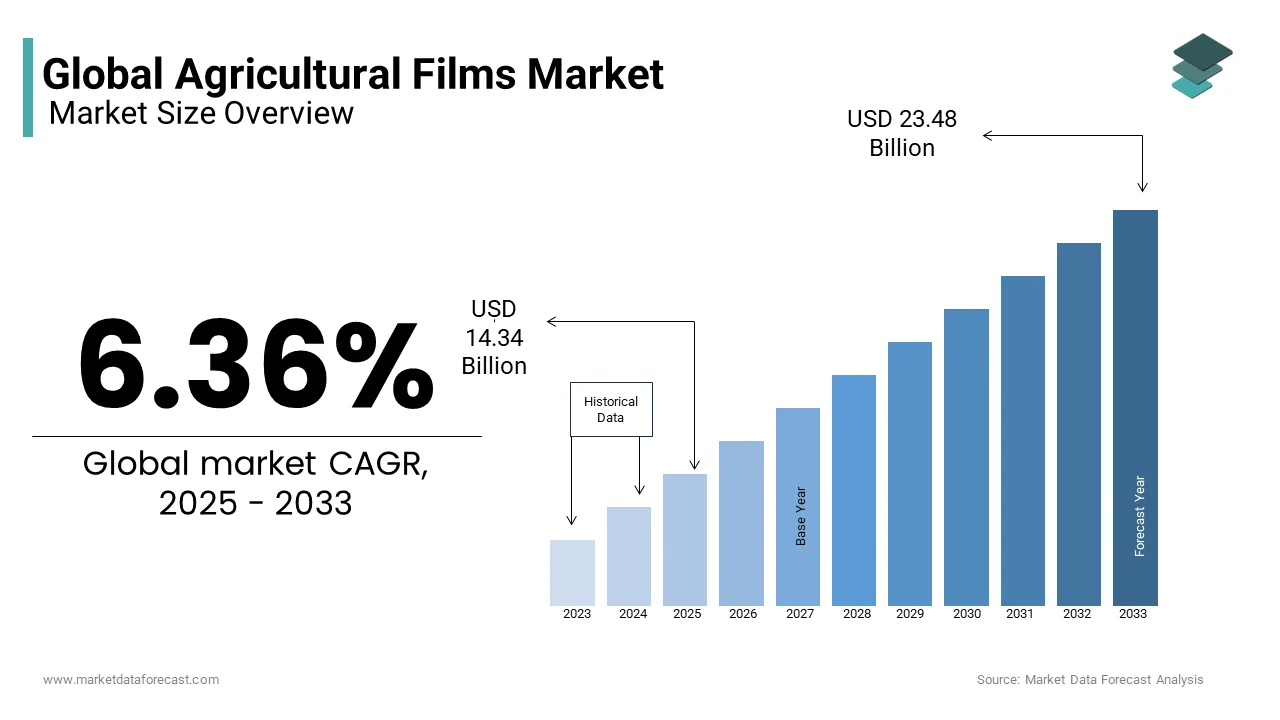

The global agricultural films market was valued at USD 13.48 billion in 2024 and is anticipated to reach USD 14.34 billion in 2025 from USD 23.48 billion by 2033, growing at a CAGR of 6.36% during the forecast period from 2025 to 2033.

Agricultural films are used to cover greenhouses and cover over soil or wrap around fodder. They help in improving crop quality and increasing overall productivity. The rising need to increase agricultural productivity to fulfill the daily demand of the population has led to the commercialization of these specialty coverings. Growing demand for food owing to the increase in population coupled with the rising requirement for optimum agricultural productivity is expected to drive market growth. The rise in demand for high-quality crops and the decline in arable land are projected to raise product demand over the coming years. Various innovations in the industry, including Ultra Violet (UV) blocking, fluorescent, NIR blocking, and ultra-thermic films, are expected to impact product demand positively over the next few years.

However, environmental concerns regarding product disposal and stringent government regulations regarding plastics and polythene are anticipated to hinder growth in the near future and affect agricultural film market growth. Be that as it may, the introduction of biodegradable and bio-based polymer films is expected to create lucrative opportunities for industry participants over the next few years. Biodegradable agricultural films are getting popular in eco-friendly regions. Technological advancements in horticulture coupled with the development of particle, multi-layer, and UV protection films to improve agricultural productivity are anticipated to raise product demand over the foreseeable future.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.36% |

|

Segments Covered |

By Type, By Application, By Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Dow Chemical Company, BASF SE, ExxonMobil Corporation, RKW SE, Berry Plastic Group Inc., Grupo Armando Alvarez, British Polythene Industries Plc., and Barbier Group. |

SEGMENTAL ANALYSIS

Global Agricultural Films Market By Type

LLDPE has the largest market share in this segment and is anticipated to witness the fastest growth. Factors such as high durability, the extended shelf life of finished products with high tensile strength, and improved thermal properties are expected to increase market growth. Meanwhile, LLDPE and LDPE are expected to witness high demand in the Asia Pacific, especially in China due to their applications being highly beneficial in areas with a limited water supply and harsh climatic conditions.

HDPE and EVA/EBA films are used in agricultural applications where rigidity is desired. PVC and EVOH have low market penetration owing to non-competitive prices and low durability of finished products coupled with the non-biodegradable nature of the products.

Global Agricultural Films Market By Application

Mulch film emerged as the leading application segment and accounted for the largest share of the market. Factors such as an increase in demand for high-quality crops and a rise in disposable incomes are expected to drive the industry. The greenhouse is projected to witness the fastest growth. Growing greenhouse agriculture in Asia, the Middle East, and Western Europe is expected to have a positive impact on market growth. Growing demand for floriculture & horticulture and uncertain climatic conditions are expected to increase market penetration. Greenhouse films also help in improving productivity and plant cultivation.

REGIONAL ANALYSIS

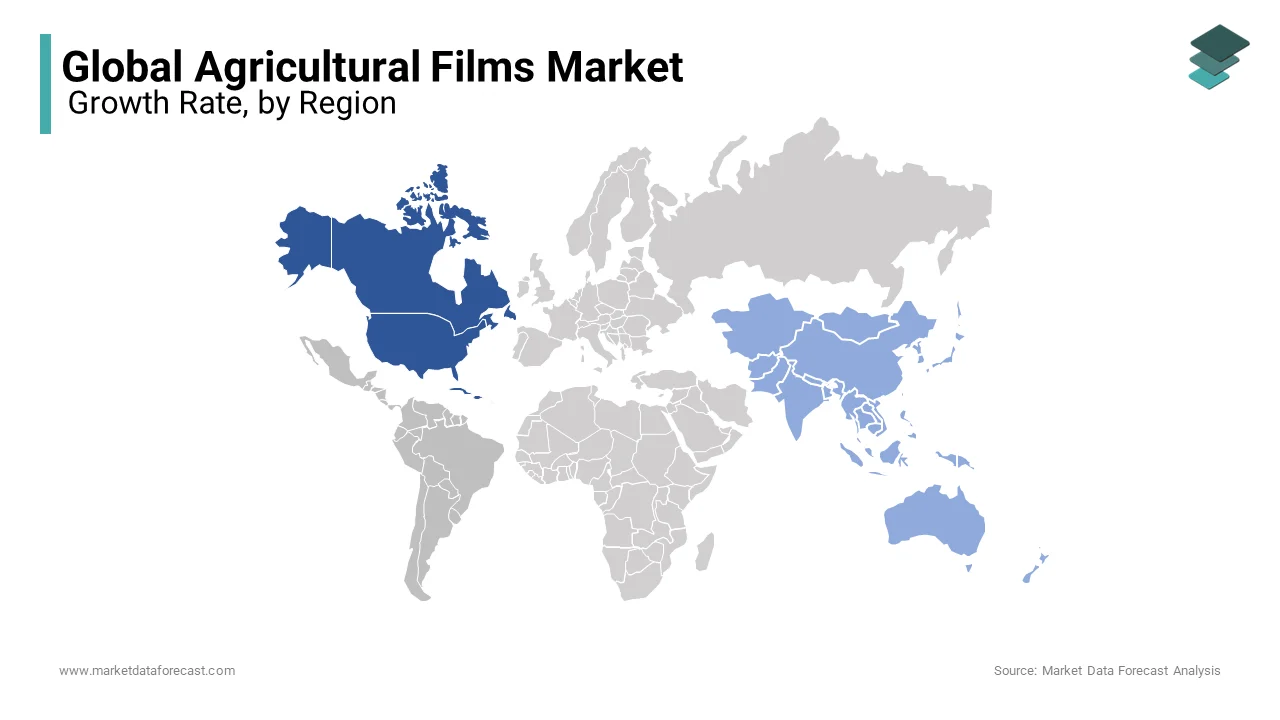

North America holds the largest share of the market, owing to its technological advancements in the agricultural sector and heavy investment in research and development of protected Agricultural practices. Asia-Pacific is expected to grow the most in the coming years. Europe is expected to witness stagnant growth in the near future owing to stringent environmental regulations regarding film disposal and manufacturing.

KEY MARKET PLAYERS

Some of the major companies dominating the market are The Dow Chemical Company, BASF SE, ExxonMobil Corporation, RKW SE, Berry Plastic Group Inc., Grupo Armando Alvarez, British Polythene Industries Plc., and Barbier Group.

MARKET SEGMENTATION

This research report on the global agricultural films market is segmented and sub-segmented into the following categories.

By Type

- LLDPE

- LDPE

- Reclaim

- EVA

- HDPE

By Application

- Greenhouse Film

- Mulch Film

- Silage Film

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global agricultural films market?

The current market size of the global agricultural films market is 14.34 billion in 2025

What segments ae added and which segment is most dominating in the global agricultural films market?

The segments that are added to the global agriculture films market are type, application, and region. The LLDPE has the largest market share in this segment and is anticipated to witness the fastest growth.

Who are the market players that are dominating the agricultural films market?

Some of the major companies dominating the market are The Dow Chemical Company, BASF SE, ExxonMobil Corporation, RKW SE, Berry Plastic Group Inc., Grupo Armando Alvarez, British Polythene Industries Plc., and Barbier Group.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]