Global Agrochemical And Pesticide Market Size, Share, Trends & Growth Forecast Report, Segmented By Applications (Agricultural, Garden And Other), Type (Insecticides, Antiseptics, Herbicides And Others) And By Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Agrochemical and Pesticide Market Size

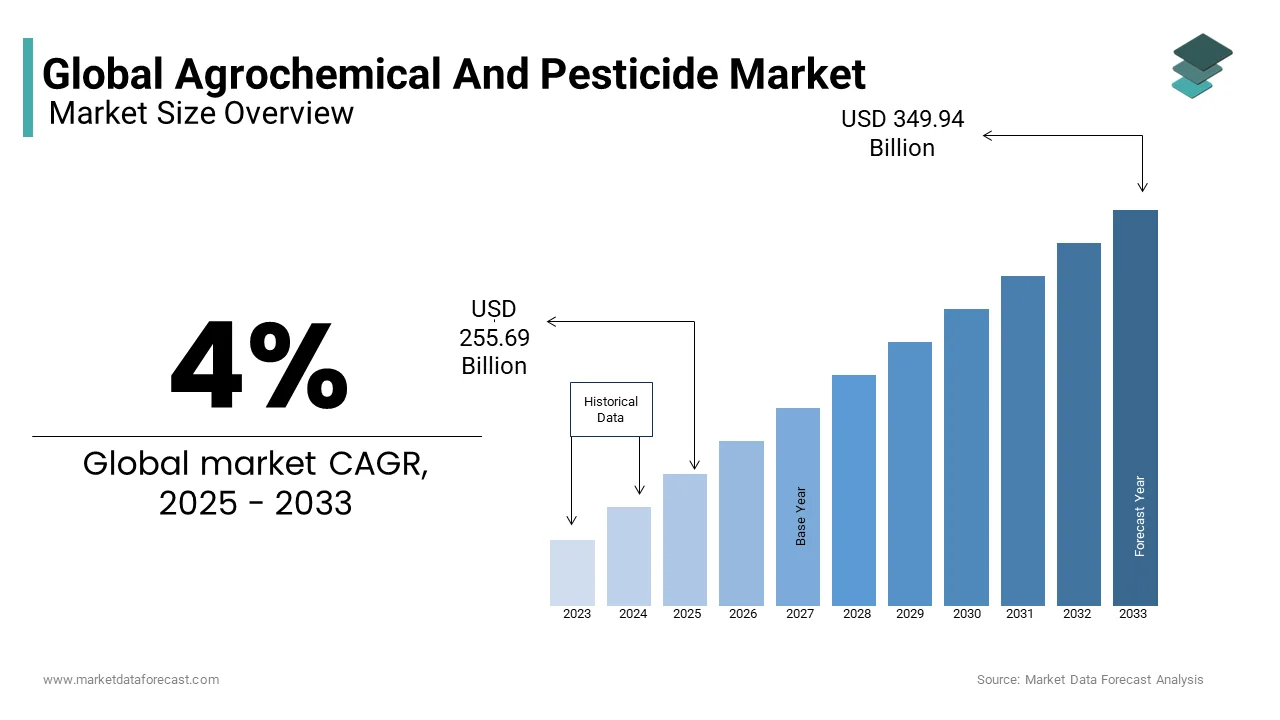

The agrochemical and pesticide market was valued at USD 245.86 billion in 2024 and is anticipated to reach USD 255.69 billion in 2025 from USD 349.94 billion by 2033, growing at a CAGR of 4% during the forecast period from 2025 to 2033.

An agrochemical or agrichemical, a varied nomenclature for agricultural chemical, is, as the name suggests, a chemical substance used to aid in cultivation or its related activities. The range of products may vary from herbicides and insecticides to fungicides and nematicides. Other substances that also fall under it include hormones, antiseptics, and other chemical growth-enhancing or inhibiting agents.

A pesticide is, in general, any substance that kills or adversely affects the life cycle of organisms that are considered to hurt crop cultivation. The potential list of target pests can include insects, plant pathogens, weeds, mollusks, birds, mammals, fish, nematodes, and microbes that destroy property, cause nuisance, or spread disease, or are disease vectors. The management of such pests and the manufacture of chemicals used for the same purpose have turned out to be a multi-million-dollar industry.

MARKET DRIVERS

The growth of the agrochemical and pesticide market is mainly driven by increasing health awareness among consumers and the increased demand for food production. Consumers are also demanding different varieties of organic and eco-friendly agrochemicals. Other drivers of the market include the lack of arable land, favorable government policies towards agriculture, and the technological advancements and research done in the field. Despite the numerous advantages, the market continues to be hampered by the lack of unified standards for safety as well as pricing.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4% |

|

Segments Covered |

By Application, Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bayer, Dow AgroSciences, Monsanto, BASF, Adama, Nufarm, Syngenta, DuPont, Qingdao Kyx Chemical, Jiangsu Huangma Agrochemicals, Jiangsu Changqing Agrochemical, Albaugh, Gharda, Jiangsu Yangnong Chemical Group, Nanjing Red Sun, Jiangsu Changlong Agrochemical, Yancheng Limin Chemical, KWIN Joint-stock, Jiangsu Pesticide Research Institute Company, Hubei Sanonda, Zhejiang Hisun Chemical, Bailing Agrochemical, Hailir Pesticides and Chemicals, Jiangsu Fengshan Group, Hebei Yetian Agrochemicals, Xinyi Zhongkai Agro-chemical Industry, Shandong Qilin Agrochemical and Others. |

REGIONAL ANALYSIS

The Agrochemical and Pesticide Market was dominated by North America in 2016, with the region accounting for 36% of the overall market share. North America was followed next in line by Europe and Asia-Pacific. Asia-Pacific is expected to grow rapidly in the coming years, as is evident from the high CAGR value for the region. Another promising region for the market is Latin America, which is expected to show high growth rates in the coming years.

KEY MARKET PLAYERS

Bayer, Dow AgroSciences, Monsanto, BASF, Adama, Nufarm, Syngenta, DuPont, Qingdao Kyx Chemical, Jiangsu Huangma Agrochemicals, Jiangsu Changqing Agrochemical, Albaugh, Gharda, Jiangsu Yangnong Chemical Group, Nanjing Red Sun, Jiangsu Changlong Agrochemical, Yancheng Limin Chemical, KWIN Joint-stock, Jiangsu Pesticide Research Institute Company, Hubei Sanonda, Zhejiang Hisun Chemical, Bailing Agrochemical, Hailir Pesticides and Chemicals, Jiangsu Fengshan Group, Hebei Yetian Agrochemicals, Xinyi Zhongkai Agro-chemical Industry, Shandong Qilin Agrochemical

MARKET SEGMENTATION

This research report on the global agrochemical and pesticide market is segmented and sub-segmented into the following categories.

By Application

- Agricultural

- Garden

- Other

By Type

- Insecticides

- Antiseptics

- Herbicides

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]