Global AI in Oil and Gas Market Research Report – Segmentation By Component (Solution, Services), By Technology (Machine Learning, Natural Language Processing (NLP), and Computer Vision ), By Application (Upstream, Midstream, and Downstream ), and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East - Africa) – Industry Forecast 2024 to 2032.

Global AI in Oil and Gas Market Size (2024-2032):

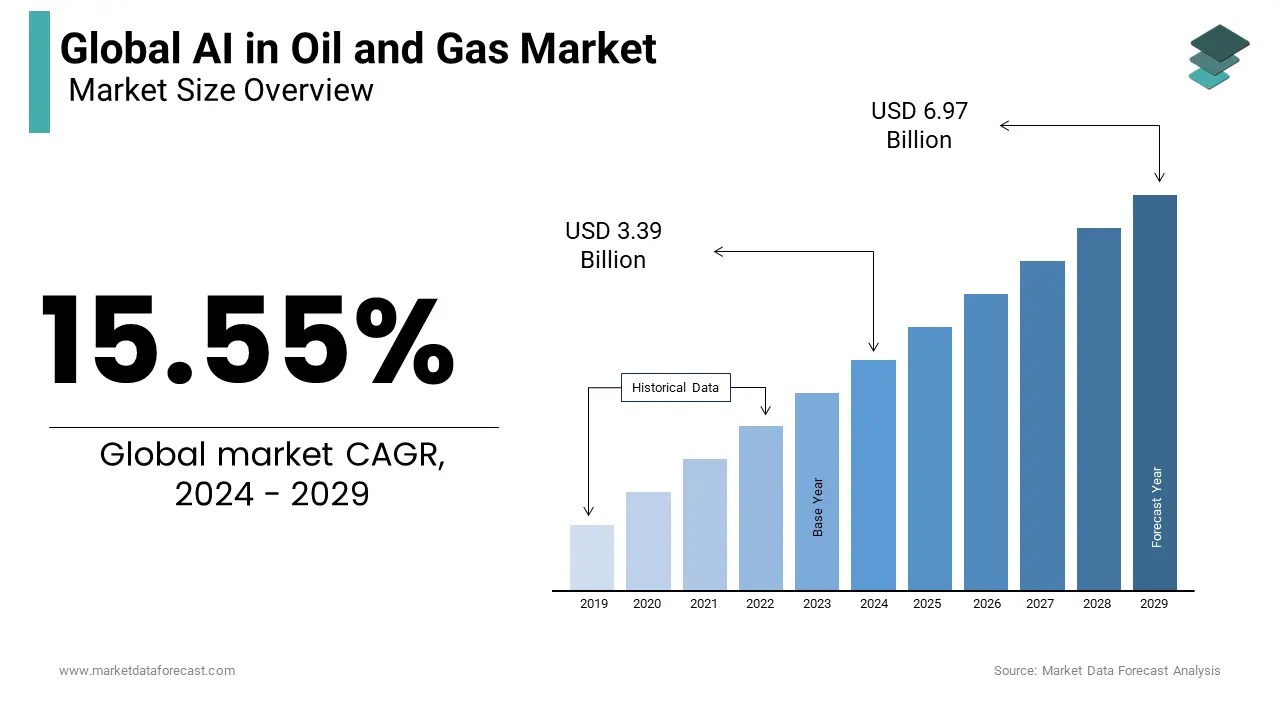

The Global AI in Oil and Gas Market was valued at USD 2.93 billion in 2023 and is expected to reach a valuation of USD 10.76 billion by 2032 from USD 3.39 billion in 2024, registering a CAGR of 15.55% during the forecast period 2024-2032.

MARKET DRIVERS

AI technologies like machine learning and predictive analytics are turbocharging the oil and gas industry by streamlining operations.

These AI systems are experts at analyzing extensive data, predicting equipment failures, refining drilling methods, and optimizing production processes. By using these, the Downtime is reduced, resources are allocated more effectively, and efficiency soars. As a result, Companies in the oil and gas sector are increasingly preferring AI to not only boost their productivity but also ensure the industry's financial health and make it a transformative force in AI in the Oil and Gas market.

AI in the Oil and Gas Market is driving due to data Analysis and Insights. This sector generates a vast amount of data from equipment and exploration activities, which AI and data analytics tools can process and evaluate the data to offer valuable insights. This AI-powered data analysis boosts decision-making, safety, and cost-saving efforts. They also enhance reservoir management and allow companies to extract oil and gas resources more efficiently. As a result, AI in the Oil and Gas Market is all about utilizing the power of artificial intelligence to unlock the industry's full potential, improve operations, and drive market growth.

MARKET RESTRAINTS

AI in the Oil and Gas Market faces significant restraints due to high initial costs.

Implementing AI into the sector requires a substantial investment. This includes the expense of acquiring AI technology, training personnel, and integrating AI systems into existing operations. For some companies, especially smaller ones, this initial investment can be a hurdle to embracing AI, even though it offers long-term advantages. Therefore, while AI offers improved efficiency and insights, the upfront costs can be a barrier, especially for those with limited resources, slowing down its accessibility to a broader range of industry players.

IMPACT OF COVID-19 ON THE GLOBAL AI IN OIL AND GAS MARKET

The COVID-19 pandemic had a notable impact on the AI in Oil and Gas Market. Initially, the industry faced challenges as global economic uncertainties, travel restrictions, and oil price volatility led to reduced capital investments and delayed projects. Many oil and gas companies postponed AI implementation plans due to financial constraints. However, the pandemic also accelerated the adoption of AI in the sector. As companies sought ways to enhance operational efficiency, reduce costs, and maintain operations remotely, AI technologies played a crucial role. AI-driven solutions were deployed for predictive maintenance, optimization of drilling operations, and asset management, contributing to resilience during challenging times.

Overall, the AI in Oil and Gas Market is expected to continue growing. The industry increasingly values AI's ability to enhance safety, efficiency, and environmental sustainability, aligning with the sector's transition towards digital transformation and reduced carbon emissions. AI is becoming a cornerstone of future strategies in the oil and gas industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

15.55% |

|

Segments Covered |

By Type, Application, Function, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

IBM Corporation, Accenture PLC, Baker Hughes (a GE Company), C3.ai, Microsoft Corporation, NVIDIA Corporation, Hewlett Packard Enterprise (HPE), Schlumberger Limited, Halliburton Company, Oracle Corporation, and Others. |

SEGMENTAL ANALYSIS

Global AI in Oil and Gas Market Analysis By Component

Based on component, the solutions segment is the dominant force in the AI in the Oil and Gas market value. They offer a wide array of applications, including predictive maintenance, reservoir optimization, and safety enhancements. These solutions empower the industry by processing and analysing large datasets in real time, leading to better decision-making and operational efficiency. AI plays a pivotal role in exploration and drilling, helping companies uncover new reserves and streamline extraction. With the ever-increasing volume of data generated, AI solutions are crucial for data interpretation and driving efficiency in the sector.

The services segment is estimated to showcase the highest CAGR during the forecast period due to its effective implementation and management of these solutions. AI service providers offer expertise in deploying AI technologies, customizing them to oil and gas companies' specific needs, and ensuring seamless integration with existing systems. Services encompass consulting, maintenance, support, and training. Given the industry's complexity, specialized AI service providers bridge the gap between AI capabilities and practical, industry-specific applications. They help companies configure and fine-tune AI solutions to meet evolving sector demands, extracting maximum value from their AI investments.

Global AI in Oil and Gas Market Analysis By Technology

Based on Technology, Machine Learning holds the largest share of the market during the forecast period. It plays a pivotal role in transforming the industry, enabling predictive analytics, anomaly detection, and optimization of various operational processes. Its ability to analyze vast datasets and discover patterns and correlations is invaluable in areas like predictive maintenance, reservoir management, and equipment optimization. Machine learning models adapt to changing conditions, enhancing productivity, reducing downtime, and aligning well with the oil and gas sector's complex operations. This positions it as the industry's preferred technology.

Natural Language Processing (NLP) AI in the Oil and Gas market is expected to showcase the largest CAGR during the forecast period. It empowers the industry to process and comprehend unstructured data like text and speech, prevalent in documents, reports, and conversations. NLP aids in information extraction, document summarization, and sentiment analysis, enhancing the sector's capacity to interpret and act upon textual data. This is crucial for decision support, compliance, and risk assessment. NLP technology significantly improves communication and knowledge management within the industry.

Global AI in Oil and Gas Market Analysis By Application

Based on Application, Upstream applications are currently dominating the AI in the Oil and Gas market share. The upstream sector, comprising exploration, drilling, and production, has spearheaded the adoption of AI technologies. AI has profoundly impacted upstream operations through predictive maintenance, reservoir management, and exploration optimization. These applications have empowered oil and gas companies to enhance drilling practices, identify new reserves, and maximize production efficiency. Machine learning algorithms analyze seismic data, well logs, and historical information, enabling precise predictions about reservoir behaviour and equipment performance. This reduces downtime and operational costs. Given the complexity and high stakes in upstream activities, AI is a natural fit and thus dominates the market.

The mid-stream applications segment is expected to hit the highest CAGR during the forecast period. Focusing on pipeline and transportation management. AI technologies monitor pipeline integrity, optimize transportation routes, and ensure safe resource flow. They reduce leaks, enhance transportation scheduling, and ensure safety and environmental compliance.

REGIONAL ANALYSIS

North America's AI in the Oil and Gas market share is ruling with the largest share due to its technologically advanced oil and gas industry, well-established infrastructure, high data volume, and supportive regulatory environment. The region prioritizes safety, environmental impact reduction, and resource optimization. Additionally, the presence of AI-focused tech companies and startups contributes to innovation and adoption, particularly in the United States and Canada. These factors collectively make North America a leader in AI integration within the oil and gas sector.

Europe holds a substantial share of the market following North America due to its dedication to sustainability, stringent environmental standards, and the imperative to optimize output from mature oil and gas fields. United Kingdom has led the way in employing AI to enhance operational efficiency, decrease emissions, and extend the lifespan of current assets. Europe's comprehensive adoption of AI and the collaboration between energy firms and tech providers underscore its significance in the market.

Asia-Pacific is witnessing a surge in AI in the Oil and Gas market and is expected to grow the fastest during the forecast period due to its rising energy needs, robust exploration and production endeavors, and digital technology adoption. Nations like China, Australia, and India are making substantial investments in AI solutions to bolster their energy infrastructure. The region's growth is further propelled by the emergence of smart cities and the integration of AI across multiple sectors, with a particular focus on the energy industry.

Latin America is displaying potential growth in AI in the Oil and Gas market; countries in the region are directing investments towards AI-driven solutions for efficient management of their substantial offshore oil reserves. Latin America's emerging energy sector and the necessity for innovative resource management methods contribute to its growing interest in AI adoption.

KEY PLAYERS IN THE GLOBAL AI IN OIL AND GAS MARKET

Companies playing a prominent role in the global AI in oil and gas market include IBM Corporation, Accenture PLC, Baker Hughes (a GE Company), C3.ai, Microsoft Corporation, NVIDIA Corporation, Hewlett Packard Enterprise (HPE), Schlumberger Limited, Halliburton Company, Oracle Corporation, and Others.

RECENT HAPPENINGS IN THE GLOBAL AI IN OIL AND GAS MARKET

- In 2022, Baker Hughes expanded its AI offerings, including the BHC3 AI Suite, to provide predictive maintenance and operational optimization solutions. They collaborated with customers to enhance equipment reliability.

- In 2023, C3.ai partnered with oil and gas companies to deploy AI-based applications for asset management, production optimization, and environmental monitoring.

- In 2023, Microsoft Azure continued to be a leading cloud platform for AI solutions in the oil and gas sector. They developed AI applications for reservoir simulation and predictive analytics.

DETAILED SEGMENTATION OF THE GLOBAL AI IN OIL AND GAS MARKET INCLUDED IN THIS REPORT

This research report on the global AI in oil and gas market has been segmented and sub-segmented based on component, technology, application, and region.

By Component

- Solution

- Services

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Computer Vision

By Application

- Upstream

- Midstream

- Downstream

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the AI in Oil and Gas Market growth rate during the projection period?

The Global AI in Oil and Gas Market is expected to grow with a CAGR of 15.55% between 2024-2032.

2. What can be the total AI in Oil and Gas Market value?

The Global AI in Oil and Gas Market size is expected to reach a revised size of US$ 10.76 billion by 2032.

3. Name any three AI in Oil and Gas Market key players?

IBM Corporation, Accenture PLC, Baker Hughes (a GE Company), are the three AI in Oil and Gas Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com