Global Air Compressor Market Size, Share, Trends, & Growth Forecast Report By Type (Portable and Stationary), Technology (Centrifugal, Rotary and Reciprocating), Lubrication method (Oil-free and Oiled), End-User Industry (Manufacturing, Oil and Gas, Food and Beverage, Medical, Power Generation and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Air Compressor Market Size

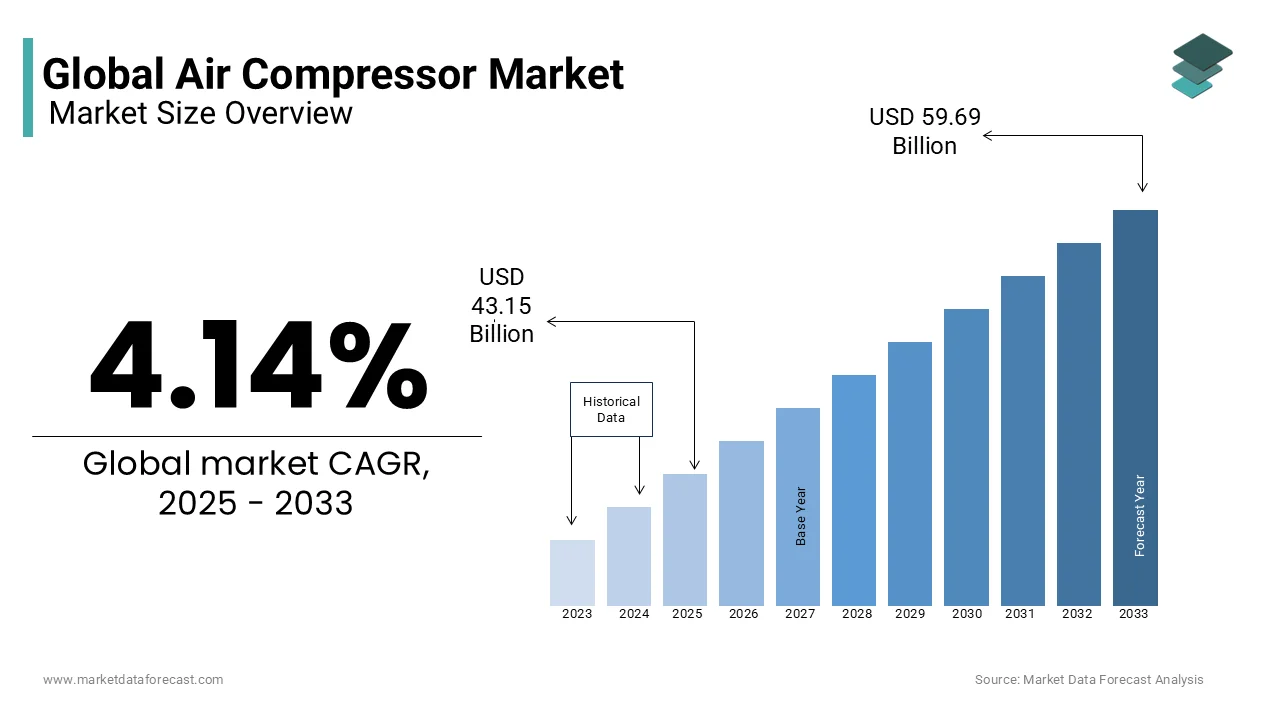

The global air compressor market was worth USD 41.43 billion in 2024. the global market size is expected to be worth USD 59.69 billion by 2033 from USD 43.15 billion in 2025, growing at a CAGR of 4.14% from 2025 to 2033.

Air compressors are machines that convert power into potential energy stored in compressed air. This compressed air is then used to power tools machinery and various industrial processes. The global market has been experiencing significant growth in recent years.

Air compressors are widely used in industries such as manufacturing automotive construction and healthcare. In the automotive industry air compressors are essential for vehicle painting tire inflation and operating pneumatic tools. According to the International Organization of Motor Vehicle Manufacturers, over 85 million motor vehicles were produced worldwide in 2023 increasing the demand for efficient air compressors in the sector.

It plays a vital role in construction industry in operating heavy machinery and power tools. The Global Construction Review reported that worldwide construction output reached USD 13.6 trillion in 2023 driven by rapid urbanization and infrastructure development. This has led to an increasing need for reliable and energy-efficient air compressors.

Healthcare is another sector where air compressors are important. Medical air compressors are used for respiratory devices and hospital air systems. According to the World Health Organization, more than 339 million people worldwide suffer from asthma requiring medical air solutions in hospitals and healthcare facilities.

The air compressor market is also witnessing technological advancements with companies focusing on developing energy-efficient and oil-free compressors to meet the evolving needs of end-users. The adoption of Industry 4.0 and automation in manufacturing processes is further increasing the demand for advanced air compressor systems. As industries continue to prioritize operational efficiency and sustainability, the air compressor market is expected to grow in the coming years.

MARKET DRIVERS

Growing Industrial Automation

Industrial automation is a big reason why the air compressors market is growing. Factories use air compressors to power machines and tools which makes work faster and easier. The U.S. Bureau of Labor Statistics says manufacturing jobs grew by 1.4 million from 2010 to 2020 showing more factories are opening. Air compressors help these factories run smoothly by providing steady air pressure. For example, a single compressor can power tools worth over $50000 in a factory. The International Energy Agency reports global energy use in industriesrose by 2% yearly since 2010 pushing the need for efficient tools like air compressors.

Rising Demand from Construction

The construction industry needs air compressors for tasks like drilling and painting. As cities grow more buildings and roads are needed. The U.S. Census Bureau says construction spending in the United States hit $1.8 trillion in 2023 up by 7% from 2022. Air compressors are key for portable power tools used on sites. A typical compressor can run equipment costing $10000 or more. The World Bank states that global urban population grew to 57% in 2022 from 50% in 2010 meaning more construction projects worldwide which boosts the air compressors market.

MARKET RESTRAINTS

High Energy Costs

Air compressors use a lot of electricity which makes them expensive to run. This can stop companies from buying them. The U.S. Energy Information Administration says industrial electricity prices rose to 7.5 cents per kilowatt-hour in 2023 up 10% from 2020. A large compressor might use $20000 of power yearly. With energy costs going up businesses think twice before investing. The International Energy Agency notes global energy demand increased by 6% in 2021 after the pandemic adding pressure on costs which hurts the air compressors market growth.

Strict Environmental Rules

Governments make tough rules to protect the environment and this affects air compressors. Oil-based compressors can pollute air and water if not handled right. The U.S. Environmental Protection Agency says industrial air pollution dropped by 15% from 2010 to 2020 due to strict laws. Companies may need to spend $5000 extra per unit for cleaner models. The World Health Organization reports 7 million people die yearly from air pollution pushing for tighter rules. These laws make it harder and costlier to sell traditional compressors slowing market growth.

MARKET OPPORTUNITIES

Push for Energy-Saving Technology

People want machines that use less energy and air compressors can improve with new tech. Energy-efficient models can cut costs and help the planet. The U.S. Department of Energy says industries could save 15% on energy bills with better equipment. A modern compressor might save $3000 yearly in power. The International Energy Agency states global renewable energy use grew by 3% in 2022 supporting green tech. Companies that make energy-saving compressors can grow fast as businesses look for ways to lower expenses and meet eco-friendly goals.

Growth in Healthcare Needs

Hospitals use air compressors for things like ventilators and clean air systems. As healthcare grows so does this market. The U.S. Centers for Disease Control and Prevention says hospital visits rose to 140 million in 2022 up 5% from 2019. A medical-grade compressor can cost $10000 but is vital for patient care. The World Health Organization reports global health spending reached $8.5 trillion in 2021 showing more investment. This rise in healthcare demand creates a big chance for air compressor makers to sell more.

MARKET CHALLENGES

Noise Pollution Issues

Air compressors can be very loud which causes problems in cities and factories. Too much noise bothers workers and nearby people. The U.S. National Institute for Occupational Safety and Health says noise above 85 decibels harms hearing and many compressors hit 90 decibels. Fixing this might cost $2000 per unit for soundproofing. The World Health Organization states 1.1 billion young people risk hearing loss from noise yearly. This challenge makes it tough for companies to sell noisy models in strict areas slowing market growth.

Lack of Skilled Workers

Running and fixing air compressors needs trained people but there aren’t enough. This slows down sales and use. The U.S. Bureau of Labor Statistics says skilled trade jobs like mechanics dropped by 3% from 2015 to 2020. Training one worker can cost $4000 and take months. The International Labour Organization reports a global shortage of 10 million skilled workers in 2022. Companies without enough experts struggle to maintain compressors which hurts the market as businesses delay buying new units due to support issues.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.14% |

|

Segments Covered |

By Type, Technology, Lubrication Method, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Atlas Copco AB, Kobe Steel Ltd., Elgi Equipments Limited, Ingersoll-Rand PLC, Kirloskar Pneumatic Company Limited, Mitsubishi Heavy Industries Ltd., and Sulzer Ltd. |

SEGMENTAL ANALYSIS

By Type Insights

The Stationary air compressors segment was the top performing category and held a 58.4% market share in 2024. They progressed due to their extensive application in industrial settings like manufacturing and oil refineries needing steady air supply. Their importance lies in powering heavy machinery efficiently. The U.S. Bureau of Labor Statistics reports manufacturing employed 12.9 million people in 2022 showing a strong industrial base. A stationary compressor can support tools worth over $50,000 showcasing its value. The U.S. Energy Information Administration notes industrial energy use rose 3% in 2022 is driving demand for reliable stationary units.

The Portable air compressors segment is growing at a CAGR of 5.35% from 2025 to 2033. Their fast growth comes from flexibility in construction and mining where mobility is key. The U.S. Census Bureau says construction spending reached $1.8 trillion in 2023 up 7% from 2022 boosting portable use. A unit can power tools costing $10000 on-site. The U.S. Department of Labor reports construction jobs grew by 200000 in 2022 showing rising demand. Their importance lies in supporting remote projects efficiently where stationary units can’t reach.

By Technology Insights

The Rotary air compressors dominated the market by having a 63.2% market share in 2024. They lead due to high efficiency and low maintenance ideal for continuous industrial use. Their importance is in supporting manufacturing and power generation. The U.S. Energy Information Administration states industrial electricity use hit 1000 terawatt-hours in 2022 emphasizing efficient tools. A rotary unit can save $3000 yearly in energy costs. The U.S. Bureau of Labor Statistics notes 8.1 million manufacturing jobs in 2023 rely on such technology for production reliability.

The Centrifugal air compressor segment is predicted to grow at a highest CAGR of 6.3% during the forecast period. Their rapid rise is due to demand in high-purity sectors like electronics and petrochemicals. The U.S. Environmental Protection Agency says industrial emissions fell 5% in 2022 pushing cleaner tech. A unit can process air for plants worth $100000. The U.S. Department of Energy reports energy-efficient equipment saved 15% power in 2022. Their importance is in providing oil-free air critical for sensitive applications driving adoption in advanced industries.

By Lubrication Method Insights

The Petroleum-based air compressors segment led with a 65.1% market share in 2024. They dominated because of durability and cost-effectiveness in heavy-duty tasks like construction. Their importance is in reliable performance for industrial tools. The U.S. Energy Information Administration reports industrial energy costs rose to 7.5 cents per kilowatt-hour in 2023 up 10% from 2020 favoring affordable options. A unit can run equipment worth $20,000 annually. The U.S. Bureau of Labor Statistics notes 1.4 million construction jobs in 2022 depend on such compressors.

The Oil-free air compressor segment is expected to develop at the fastest CAGR of 5.1% from 2025 to 2033. Their fast growth is caused by the demand in healthcare and food sectors needing clean air. The U.S. Centers for Disease Control and Prevention says hospital visits hit 140 million in 2022 up 5% from 2019 increasing medical needs. A unit costs $10000 but ensures purity. The U.S. Environmental Protection Agency reports air quality rules cut pollution by 15% since 2010. Their importance is in meeting strict hygiene standards driving sales in sensitive industries.

By End-User Industry Insights

The Manufacturing segment captured a 28.7% market share in 2024. The reliance on air compressors for tools and assembly lines contributed to the growth of this segment. Its importance is in supporting mass production. The U.S. Bureau of Labor Statistics reports manufacturing output grew 2.5% in 2022 with 12.9 million workers. A compressor can power systems worth $50000. The U.S. Energy Information Administration notes industrial energy use rose 3% in 2022 showing robust activity. This segment drives economic growth through efficient production processes.

The Energy production segment is growing at a CAGR of 5% from 2025 to 2033. Its rapid rise is due to power generation needs like gas turbines. The U.S. Department of Energy says renewable energy grew 3% in 2022 pushing compressor use. A unit can support plants costing $100,000. The U.S. Energy Information Administration reports energy demand rose 6% in 2021 post-pandemic. Its importance lies in enabling clean energy shifts meeting global sustainability goals and supporting infrastructure growth.

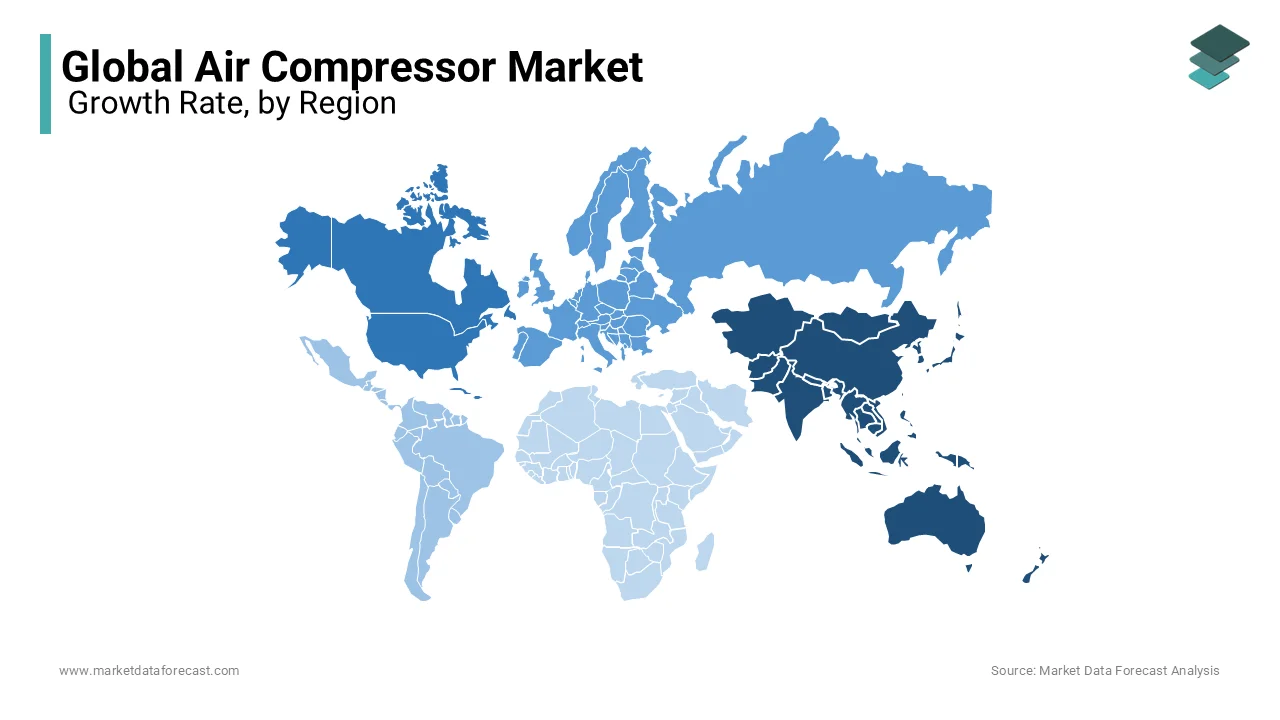

REGIONAL ANALYSIS

The Asia-Pacific region spearheaded the biggest share of the air compressors market and accounted for 46.3% in 2024. This prominence is attributed to swift industrialization and urbanization in countries like China and India. For instance, China's manufacturing sector contributed about 27% to its GDP in 2022, exhibiting extensive industrial activity. Additionally, the United Nations projects that urban areas in Asia will house 2.75 billion people by 2030, increasing the need for infrastructure and construction projects that utilize air compressors. These factors underscore the region's leading position in the market.

North America is experiencing steady growth in the air compressors market, driven by advancements in manufacturing and the oil and gas industry. The U.S. Energy Information Administration notes that the United States produced an average of 11 million barrels of crude oil per day in 2021, requiring extensive use of air compressors in extraction and processing. Furthermore, the National Association of Manufacturers states that manufacturing accounted for 11.4% of the U.S. economy's GDP in 2021, indicating a robust industrial base that supports market growth.

Europe's air compressor market is expected to grow due to the region's focus on renewable energy and sustainability. The European Environment Agency reports that renewable energy sources accounted for 22.1% of the EU's energy consumption in 2020, leading to increased demand for air compressors in wind and solar energy projects. Additionally, the European Commission's emphasis on reducing carbon emissions has led industries to adopt energy-efficient air compressors, further boosting the market.

In Latin America, the air compressor market is anticipated to expand, driven by growth in the mining and automotive sectors. The International Trade Administration states that Mexico produced over 3 million vehicles in 2021, making it one of the largest automotive producers globally and increasing the demand for air compressors in manufacturing processes. Additionally, the region's rich mineral resources and mining activities require air compressors for extraction and processing, contributing to market growth.

The Middle East and Africa are expected to see growth in the air compressor market, primarily due to investments in oil and gas exploration. According to OPEC's Annual Statistical Bulletin, the Middle East accounted for nearly 31.5% of global oil production in 2020, necessitating the use of air compressors in various stages of oil extraction and processing. Moreover, infrastructure development projects in countries like the United Arab Emirates and Saudi Arabia are increasing the demand for air compressors in construction activities

TOP 3 PLAYERS IN THE MARKET

Atlas Copco

Atlas Copco, established in 1873 and headquartered in Nacka, Sweden, is a leading provider of industrial solutions, including air compressors. The company operates in over 180 countries, offering a comprehensive range of air compressors such as rotary screw, reciprocating, and centrifugal models. Atlas Copco's commitment to innovation and sustainability is evident in its development of energy-efficient products that cater to industries like manufacturing, mining, and oil and gas. Their global presence and extensive product portfolio have strengthened their position as a top player in the air compressor market.

Ingersoll Rand

Ingersoll Rand, founded in 1859 and based in Davidson, North Carolina, USA, is a prominent manufacturer of industrial equipment, including air compressors. The company's product line features rotary screw compressors, reciprocating compressors, and centrifugal compressors, serving sectors such as automotive, construction, and food and beverage. Ingersoll Rand's dedication to innovation and efficiency is reflected in its development of oil-free compressors, addressing the growing demand for clean compressed air. Strategic acquisitions and a focus on energy-efficient solutions have reinforced its strong position in the global air compressor market.

Hitachi

Hitachi Ltd., established in 1910 and headquartered in Tokyo, Japan, is a diversified conglomerate with a great presence in the air compressor market through its subsidiary, Hitachi Industrial Equipment Systems. The company offers a broad range of air compressors, including oil-free screw compressors, oil-flooded screw compressors, and scroll compressors, catering to industries such as electronics, pharmaceuticals, and automotive. Hitachi's commitment to sustainability and technological advancement is evident in its development of energy-efficient and environmentally friendly air compressors. The company's focus on integrating IoT technologies into its products enhances operational efficiency and predictive maintenance capabilities, strengthening its position in the global air compressor market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Technological Advancement

Leading companies in the air compressor market prioritize product innovation and technological advancement to maintain a competitive edge. By investing in research and development, these companies create energy-efficient and reliable compressors that meet diverse industrial needs. For instance, Atlas Copco has developed a range of compressors known for their high efficiency and durability, catering to various applications. Similarly, Ingersoll Rand focuses on producing compressors that offer enhanced performance and reduced energy consumption. This commitment to innovation not only addresses evolving customer requirements but also reinforces their positions as market leaders.

Strategic Partnerships and Acquisitions

Key players in the air compressor market engage in strategic partnerships and acquisitions to expand their market presence and diversify product offerings. For example, Ingersoll Rand has undertaken initiatives to strengthen its position in the market. Such strategic moves enable companies to integrate new technologies, access broader customer bases, and enhance their global footprint and thereby consolidating their market positions.

Focus on Aftermarket Services and Customer Support

Recognizing the importance of comprehensive customer support, leading air compressor manufacturers invest substantially in aftermarket services. By expanding service centers, offering training programs for technicians, and developing online support platforms, companies like Atlas Copco and Ingersoll Rand ensure optimal performance and longevity of their products. This focus on customer satisfaction fosters brand loyalty and differentiates them from competitors, thereby strengthening their market positions.

COMPETITIVE LANDSCAPE

The air compressors market is very competitive. Some of the top companies in this space are Atlas Copco, Ingersoll Rand, and Hitachi. These companies make different types of air compressors such as rotary screw, reciprocating, and centrifugal compressors for many industries like manufacturing, healthcare, construction, and oil & gas.

Companies focus on new technology, energy efficiency, and strong customer service to stay ahead in the market. They invest in research to create better compressors that use less energy and last longer. Many companies also buy smaller businesses or partner with other companies to expand their reach and improve their products.

Another way companies in this market compete is by offering good after-sales services like maintenance and repairs to keep customers happy. Few players also use digital tools to help customers monitor and control their compressors remotely.

New companies are also entering the market and especially in Asia, Europe, and North America which is making competition even stronger. So, because of this big companies are compelled to continue to improve their products and services to stay ahead. In the future, air compressors will likely become smarter and more energy-efficient, turning the market even more competitive.

KEY MARKET PLAYERS

The major players in the global air compressors market include Atlas Copco AB, Kobe Steel Ltd., Elgi Equipments Limited, Ingersoll-Rand PLC, Kirloskar Pneumatic Company Limited, Mitsubishi Heavy Industries Ltd., and Sulzer Ltd.

RECENT MARKET DEVELOPMENTS

- In February 2025, the California Governor's Office of Business and Economic Development announced over $245 million in investments to support various industries, including energy infrastructure and efficiency. While specific allocations for air compressor technologies were not mentioned, companies in this sector may benefit from funding aimed at energy efficiency improvements.

- In February 2025, the U.S. Department of Energy extended the deadline for a $25 million funding opportunity targeting tribal energy projects. This initiative aims to enhance energy infrastructure, potentially involving the deployment of advanced technologies like energy-efficient air compressors to improve grid resiliency and efficiency.

MARKET SEGMENTATION

This research report on the global air compressors market is segmented and sub-segmented into the following categories.

By Type

- Portable

- Stationary

By Technology

- Reciprocal

- Rotary

- Centrifugal

By Lubrication Method

- Petroleum

- Oil-free

By End-User Industry

- Food and drinks

- Petroleum gas

- Manufacturing

- Doctor

- Energy production

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key drivers of growth in the global air compressor market?

The key drivers include the rising demand for energy-efficient compressors, technological advancements such as the development of oil-free compressors, and the increasing application of air compressors in diverse sectors like food and beverage, pharmaceuticals, and healthcare. Additionally, the growth of the construction and mining industries in emerging economies is fueling market expansion.

How is the adoption of energy-efficient air compressors impacting the market?

Energy-efficient air compressors are gaining traction due to rising energy costs and the global emphasis on reducing carbon footprints. Governments and organizations are increasingly adopting stringent energy regulations, which is driving the demand for compressors that consume less power and offer higher efficiency, leading to a shift towards energy-efficient models.

How is technological innovation influencing the air compressor market?

Technological advancements, such as the development of oil-free compressors, smart and connected air compressors, and variable speed drive (VSD) technology, are revolutionizing the market. These innovations are enhancing the efficiency, reliability, and lifespan of air compressors, making them more attractive to a broader range of industries.

What is the future outlook for the global air compressor market?

The future outlook for the global air compressor market is positive, with steady growth expected over the next decade. The ongoing industrialization in emerging markets, coupled with the rising demand for energy-efficient solutions, is likely to drive market expansion. However, manufacturers will need to navigate challenges such as cost pressures and evolving regulatory requirements to sustain growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com