Global Aliphatic Solvents & Thinners Market Size, Share, Trends, & Growth Forecast Report – Segmented By Type (Varnish Makers’ & Painters’ Naphtha, Mineral Spirits, Hexane, Heptane and Others), Application, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Aliphatic Solvents & Thinners Market Size

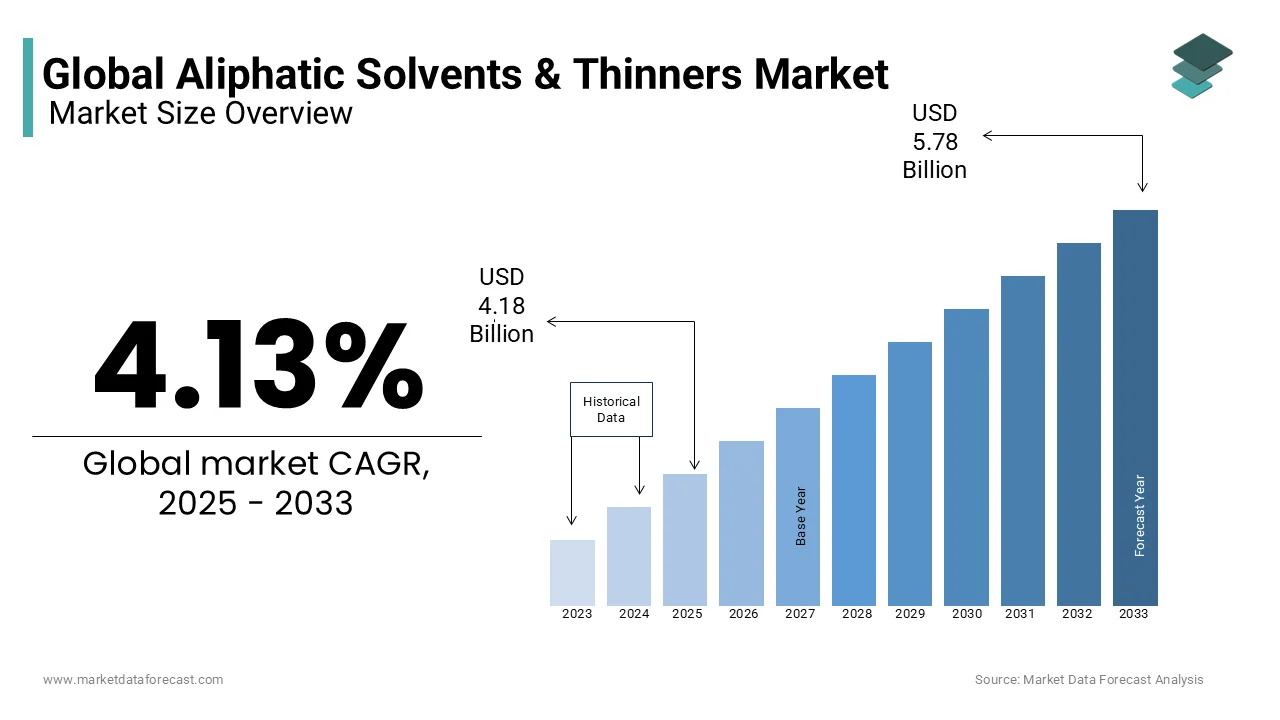

The global Aliphatic Solvents & Thinners market size was calculated to be USD 4.01 billion in 2024 and is anticipated to be worth USD 5.78 billion by 2033 from USD 4.18 billion in 2025, growing at a CAGR of 4.13% during the forecast period.

Aliphatic Solvents & Thinners Market refers to a category of organic solvents derived primarily from petroleum refining, characterized by their straight or branched-chain hydrocarbon structures. These solvents are widely used across industrial applications for their ability to dissolve, dilute, or disperse other substances without chemically altering them. Common uses include paint and coatings formulation, printing inks, adhesives, cleaning agents, and chemical intermediates in manufacturing processes. Their low aromatic content makes them preferable over more toxic alternatives like benzene or toluene, especially where worker safety and environmental compliance are critical.

Also, aliphatic solvents have gained preference in recent years due to regulatory pressure to reduce volatile organic compound (VOC) emissions in urban areas. As these solvents exhibit lower reactivity with atmospheric pollutants compared to their aromatic counterparts, industries are increasingly shifting toward them to meet stringent air quality norms.

Additionally, as per data from the American Chemistry Council, the global demand for low-aromatic solvents has been growing steadily, driven by expansion in construction, automotive refinishes, and consumer goods sectors.

MARKET DRIVERS

A major factor contributing to the Aliphatic Solvents & Thinners Market is the growing demand from the paints and coatings industry, particularly in construction and automotive sectors. Paints, varnishes, and protective coatings rely heavily on aliphatic solvents for their ability to thin formulations, improve application properties, and enhance drying times without compromising finish quality.

According to the research, global coatings production surpassed 60 million metric tons in recent years, with developing regions such as Asia-Pacific and Latin America witnessing rapid expansion due to urbanization and infrastructure development.

This growth is closely tied to rising housing construction activity, which directly influences architectural paint consumption. Similarly, in India and Southeast Asia, government-led infrastructure projects have spurred commercial and industrial painting activities, further boosting solvent usage. The automotive refinish segment also plays a crucial role, with aliphatic solvents preferred for their low odor, reduced toxicity, and compatibility with high-performance coatings. With major paint manufacturers reformulating products to comply with VOC regulations, the shift toward low-aromatic solvents is accelerating, reinforcing market growth.

A parallel driver of the Aliphatic Solvents & Thinners Market is the increasing adoption in the printing inks sector , particularly in flexible packaging and digital printing applications. Printing inks require solvents that offer controlled evaporation rates, color dispersion stability, and minimal residual odor—qualities that aliphatic solvents deliver effectively.

Flexible packaging relies heavily on gravure and flexographic printing technologies, both of which depend on solvent-based ink systems. Aliphatic hydrocarbons are favored in this context due to their ability to maintain consistent viscosity and pigment suspension while ensuring quick drying on high-speed production lines.

Moreover, the rise of e-commerce has fueled demand for branded packaging, further increasing the need for high-quality printed films and laminates. In response, major ink manufacturers such as Sun Chemical and DIC Corporation have been reformulating their products to incorporate low-VOC solvents, aligning with environmental regulations while maintaining performance standards.

MARKET RESTRAINTS

Among the major restraints affecting the Aliphatic Solvents & Thinners Market is the availability of alternative solvent technologies, particularly water-based and bio-derived solvents that are gaining traction due to environmental and health considerations. Governments and regulatory bodies worldwide are pushing for the reduction of solvent emissions across industries, encouraging the use of greener alternatives that pose fewer risks to human health and the environment.

According to the European Environment Agency, solvent emissions account for a significant portion of non-methane volatile organic compounds (NMVOCs), prompting stricter limits on industrial usage.

Water-based formulations have become increasingly popular in coatings and inks, reducing dependency on hydrocarbon solvents. Companies such as BASF and AkzoNobel have invested heavily in aqueous dispersion technologies that eliminate the need for traditional thinners.

In addition, bio-solvents derived from renewable feedstocks like citrus, corn, and soybeans are being integrated into various industrial applications.

As noted by the Biobased and Renewable Products Advocacy Group, the global market for bio-solvents expanded notably between 2018 and 2023, indicating a gradual but impactful shift away from petroleum-based aliphatic solvents.

An additional potential restraint influencing the Aliphatic Solvents & Thinners Market is the high cost of compliance with environmental regulations , which increases operational expenses for manufacturers and end-users alike. Regulatory frameworks such as the U.S. Environmental Protection Agency’s (EPA) National Emission Standards for Hazardous Air Pollutants (NESHAP) and the European Union’s REACH regulation impose strict guidelines on solvent handling, storage, and disposal. These requirements necessitate investment in advanced ventilation systems, emission control equipment, and worker safety protocols, raising overall production costs.

For small and medium-sized enterprises (SMEs), meeting these regulatory demands can be particularly burdensome. Like, many regional paint and ink producers struggle to afford the capital expenditures required for full compliance, limiting their ability to compete with larger firms that have dedicated environmental management divisions.

In addition, fluctuating solvent prices due to crude oil volatility add another layer of financial uncertainty. As governments continue to tighten restrictions on industrial emissions and push for cleaner production methods, companies operating in the aliphatic solvents sector must navigate an increasingly complex regulatory landscape, potentially slowing market expansion in certain regions.

MARKET OPPORTUNITIES

One of the major opportunities in the Aliphatic Solvents & Thinners Market lies in the development of high-purity and customized solvent blends tailored for niche industrial applications, including electronics manufacturing, pharmaceuticals, and precision cleaning. These specialized applications require solvents with ultra-low impurities, controlled volatility, and specific solvency characteristics, creating new avenues for value-added product offerings.

In particular, precision cleaning in semiconductor fabrication requires solvents that leave no residue and do not react with sensitive materials. While traditionally dominated by chlorinated solvents, this segment is seeing a shift toward aliphatic alternatives due to their lower toxicity and better environmental profiles. Companies such as ExxonMobil Chemical and Shell Chemicals have introduced high-purity aliphatic distillates designed specifically for electronic component cleaning and degreasing. Similarly, in the pharmaceutical industry, where solvent purity and traceability are paramount, there is growing interest in refined aliphatic blends that meet Good Manufacturing Practice (GMP) standards. As manufacturers seek safer, more sustainable substitutes for conventional solvents, the opportunity for high-performance aliphatic solutions in specialty applications continues to expand.

Another notable opportunity shaping the Aliphatic Solvents & Thinners Market is the expansion of solvent recovery and closed-loop systems , which enable industries to reuse solvents rather than dispose of them after single-use cycles. This approach not only reduces waste generation and environmental impact but also lowers procurement costs for manufacturers seeking to optimize resource efficiency. According to the U.S. Department of Energy, solvent recovery technologies can reclaim up to 95% of used solvents, depending on the distillation and filtration methods employed.

Industries such as automotive refinishing, aerospace maintenance, and industrial coating operations are increasingly adopting on-site solvent recycling units to comply with environmental mandates while improving cost efficiency. Major solvent suppliers, including Honeywell and Chevron Phillips Chemical, have launched solvent recovery programs that provide technical support and equipment leasing options to facilitate circular usage models.

Apart from these, advancements in vacuum distillation and membrane separation technologies are enhancing the feasibility of recovering high-purity aliphatic solvents from waste streams.

As corporate sustainability goals and regulatory pressures converge, solvent recovery presents a compelling opportunity for both suppliers and end-users to reduce their environmental footprint while maintaining operational effectiveness.

MARKET CHALLENGES

One of the major challenges facing the Aliphatic Solvents & Thinners Market is the fluctuating supply and pricing of raw materials, particularly crude oil derivatives that serve as primary feedstocks. Since aliphatic solvents are petroleum-based products, their production costs are closely linked to global oil prices, which are subject to geopolitical tensions, supply chain disruptions, and macroeconomic fluctuations.

This instability affects both producers and end-users, making it difficult to forecast budget allocations and maintain consistent pricing strategies. Small-scale manufacturers, in particular, face difficulties in securing stable feedstock supplies at predictable costs, limiting their ability to scale operations or invest in product innovation.

Also, refineries producing aliphatic solvents often prioritize higher-margin petrochemical products such as gasoline and diesel, leading to periodic shortages or reduced availability of solvent-grade hydrocarbons.

As a result, companies in the aliphatic solvents market must continuously adapt to changing raw material economics, sometimes passing on increased costs to consumers or exploring alternative sourcing strategies to mitigate price risks.

Another critical challenge confronting the Aliphatic Solvents & Thinners Market is the complexity of transportation and logistics , especially when supplying to remote or underdeveloped regions. Due to their flammable nature, aliphatic solvents are classified as hazardous materials, requiring specialized handling, storage, and transport procedures that increase logistical costs and regulatory compliance burdens. According to the International Air Transport Association (IATA), the movement of hydrocarbon-based solvents via air freight is subject to stringent packaging and documentation requirements, limiting speed and flexibility in global distribution.

Maritime and land transport also present hurdles, particularly in regions with inadequate infrastructure or inconsistent enforcement of chemical transportation laws. In parts of Africa, South America, and Southeast Asia, unreliable road networks and port congestion delay solvent deliveries, disrupting supply chains for manufacturers dependent on just-in-time inventory systems.

Also, customs delays and varying import regulations across countries complicate international trade, increasing lead times and operational inefficiencies. To address these issues, solvent suppliers are investing in localized production facilities and third-party logistics partnerships to enhance supply chain resilience. However, navigating the logistical complexities of hazardous material transport remains a persistent challenge for market participants seeking to expand their geographic reach.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.13% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ExxonMobil Chemical, Inc., SK Global Chemical Co., Ltd., Royal Dutch Shell Plc., Calumet Specialty Products Partners, L.P., Gotham Industries, Gulf Chemicals and Industrial Oils Co., Recochem Inc., HCS Group, W.M. Barr, Ganga Rasayanie Ltd, and others |

SEGMENTAL ANALYSIS

By Application Insights

The Paints & Coatings application segment held the largest share of the global aliphatic solvents & thinners market, accounting for a 38.2% of total demand in 2024. This dominance is primarily due to the extensive use of aliphatic hydrocarbons in industrial and architectural coatings as diluents, viscosity reducers, and drying agents.

One key driver behind this segment's leadership is the expansion of the construction industry, particularly in Asia-Pacific and North America.

In China, government infrastructure projects contributed to an increase in industrial coating applications, further strengthening solvent demand.

Another contributing factor is the automotive refinish sector , where aliphatic solvents are preferred for their low aromatic content, reduced odor, and compatibility with high-performance coatings. The push for eco-friendly alternatives has not yet displaced aliphatic solvents entirely, as they offer a balance between performance and regulatory compliance.

Besides, coatings manufacturers are reformulating products to meet VOC regulations , leading to increased adoption of aliphatic solvents that emit fewer volatile compounds compared to traditional aromatic ones. With major players like PPG Industries and AkzoNobel prioritizing cleaner formulations, the reliance on aliphatic thinners continues to grow, reinforcing the dominance of this application segment.

On the other hand, the Printing Inks segment is expected to grow at the fastest CAGR of 6.9% from 2025 to 2033, driven by rising demand for flexible packaging, digital printing, and branded consumer goods. This expansion reflects broader trends in e-commerce, food packaging, and label printing, which rely heavily on high-quality ink formulations.

A primary growth catalyst is the booming flexible packaging industry, especially in emerging markets such as India, Southeast Asia, and Latin America. Flexible films used in food and pharmaceutical packaging require gravure and flexographic inks that depend on aliphatic solvents for optimal pigment dispersion and fast drying times.

In addition, the rise of digital and wide-format printing has spurred demand for specialized inks compatible with modern print technologies. Companies like HP Indigo and Canon have expanded their industrial digital printing offerings, increasing the need for solvent-based systems that ensure sharp image resolution and durability. While water-based inks are gaining traction, many high-end applications still rely on aliphatic solvents for superior adhesion and color retention.

Moreover, branding and marketing efforts across industries have intensified the need for visually appealing packaging, driving innovation in ink formulation. Major ink producers such as Sun Chemical and DIC Corporation are integrating aliphatic solvents into premium-grade inks to meet evolving aesthetic and functional demands.

REGIONAL ANALYSIS

North America

North America commanded the largest regional share of the global aliphatic solvents & thinners market, accounting for a 28.4% of total demand in 2024, driven by mature industrial sectors, stringent environmental regulations, and strong manufacturing capabilities.

One of the core drivers is the well-established coatings and automotive industries, particularly in the United States. Additionally, the automotive refinish market remains robust.

Another contributing factor is the adoption of low-VOC formulations, aligning with EPA standards aimed at reducing air pollution. ExxonMobil and Chevron Phillips Chemical have introduced high-purity aliphatic distillates tailored for regulated markets, supporting both compliance and performance needs. The printing inks and adhesive sectors also play a role, with major companies such as Sun Chemical and Henkel relying on these solvents for product consistency and efficiency.

Furthermore, the electronics and aerospace industries utilize aliphatic solvents for precision cleaning and degreasing, where safety and purity are paramount. As companies seek safer alternatives to chlorinated solvents, aliphatic blends are increasingly being adopted.

Europe

Europe is maintaining a strong presence due to its emphasis on sustainability, chemical safety, and advanced industrial applications. The region’s regulatory framework, particularly REACH and the EU Ecolabel criteria, has significantly shaped the direction of solvent usage and formulation strategies.

A key driver is the shift away from aromatic solvents in favor of aliphatic alternatives to comply with European Environment Agency guidelines on volatile organic compound emissions. This trend is especially pronounced in Germany, France, and the Netherlands, where coatings and inks manufacturers have proactively adapted to stricter norms.

Besides, the growth of green chemistry initiatives has encouraged the development of bio-based aliphatic solvents and closed-loop recycling systems. Companies such as BASF and Shell Chemicals have launched solvent recovery programs, enhancing resource efficiency while reducing environmental impact. Moreover, the pharmaceutical and electronics sectors in countries like Switzerland and Finland rely on ultra-pure aliphatic solvents for precision cleaning and process applications.

Despite economic headwinds and inflationary pressures, Europe’s commitment to sustainable industrial practices ensures steady demand for aliphatic solvents.

Asia Pacific

Asia Pacific is expanding at the highest growth rate among all regions, driven by rapid industrialization, urbanization, and increasing investments in manufacturing infrastructure.

China remains the largest consumer in the region, with its construction and automotive industries playing pivotal roles. In addition, as per the Chinese Ministry of Housing and Urban-Rural Development, new construction starts exceeded 2 billion square meters in 2023, significantly boosting architectural paint demand.

India is another key growth engine, with the government’s “Make in India” initiative spurring domestic production across electronics, automotive, and packaging sectors. The Indian Printing Ink Manufacturers Association noted that the country’s printing ink output grew by over 12% in 2023, driven by rising flexible packaging demand. Aliphatic solvents are widely used in gravure and flexo inks, making them essential to this expansion.

Meanwhile, Southeast Asian nations such as Vietnam and Indonesia are becoming manufacturing hubs, attracting foreign investment in paint and adhesive production.

Latin America

Latin America holds a notable share of the global aliphatic solvents & thinners market, with Brazil, Mexico, and Argentina leading consumption due to expanding industrial activities, growing automotive production, and rising construction investments.

Brazil is the largest market in the region, supported by its booming construction and automotive sectors. Also, according to the Brazilian Association of the Automotive Industry (ANFAVEA), domestic vehicle production surpassed 2.5 million units in 2023, increasing the need for refinish coatings containing aliphatic thinners.

Mexico plays a crucial role due to its proximity to North America and integration into global supply chains. This industrial strength translates into consistent demand for industrial solvents used in coatings and component manufacturing.

Besides, government initiatives promoting cleaner industrial practices are encouraging the shift from aromatic to aliphatic solvents. Environmental agencies in Chile and Colombia have introduced VOC reduction targets, prompting paint and ink manufacturers to reformulate products accordingly.

Middle East & Africa

The Middle East & Africa is an emerging market, with demand concentrated in GCC countries and South Africa due to industrial diversification and infrastructure development efforts.

The United Arab Emirates and Saudi Arabia are leading consumers, driven by massive construction and infrastructure projects. These activities require substantial volumes of architectural and industrial coatings, many of which incorporate aliphatic solvents for improved application and drying properties.

In addition, the oil and gas sector in Kuwait and Qatar utilizes aliphatic solvents in maintenance and pipeline cleaning applications. Given the prevalence of heavy industrial operations in the region, solvent-based degreasing and surface preparation remain essential processes. Companies such as SABIC and TotalEnergies operate refining and petrochemical complexes that contribute to both local consumption and downstream exports.

South Africa serves as a regional industrial hub, with moderate growth observed in automotive manufacturing and packaging industries. According to the South African Packaging Council, flexible packaging demand rose by nearly 9% in 2023, increasing ink consumption and, consequently, solvent demand.

KEY MARKET PLAYERS

ExxonMobil Chemical, Inc., SK Global Chemical Co., Ltd., Royal Dutch Shell Plc., Calumet Specialty Products Partners, L.P., Gotham Industries, Gulf Chemicals and Industrial Oils Co., Recochem Inc., HCS Group, W.M. Barr, Ganga Rasayanie Ltd, NOCO Energy Corporation, Gadiv Petrochemical Industries Ltd., Hunt Refining Company, Honeywell International Inc., BASF SE, and LyondellBasell Industries Holdings B.V. are the key players in the global aliphatic solvents & thinners market.

MARKET SEGMENTATION

This research report on the global aliphatic solvents & thinners market has been segmented and sub-segmented based on application, product form, distribution channel and region.

By Type

- Varnish Makers’ & Painters’ Naphtha

- Mineral Spirits

- Hexane

- Heptane

- Others (Paraffinic Solvent, Pentane, and Solvent 140)

By Application

- Paints & Coatings

- Cleaning & Degreasing

- Adhesives

- Aerosols

- Rubbers & polymers

- Printing inks

- Others (Agrochemicals, Pharmaceuticals, and Automotive)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current and projected size of the global aliphatic solvents & thinners market?

The market was valued at USD 4.01 billion in 2024 and is expected to reach USD 5.78 billion by 2033, growing at a CAGR of 4.13%.

2. What are the primary growth drivers of the aliphatic solvents & thinners market?

Growth is driven by rising demand from the paints & coatings, automotive, and industrial cleaning sectors.

3. Which industries are creating major demand for aliphatic solvents & thinners?

Key industries include construction, automotive refinishing, and general industrial applications.

4. What are the key market trends influencing the adoption of aliphatic solvents?

A shift toward low-VOC and environmentally compliant solvents is gaining traction globally.

5. How are environmental regulations impacting market growth?

Stringent environmental policies are prompting R&D into safer, greener solvent formulations.

6. Which regions are showing the fastest growth in this market?

Asia Pacific is witnessing the fastest growth due to expanding infrastructure and manufacturing bases.

7. What are the key challenges faced by manufacturers in this market?

Volatile raw material prices and increasing regulatory pressures are significant challenges.

8. Are there any emerging opportunities in the global aliphatic solvents market?

Rising investments in green chemistry and solvent recovery technologies present new growth avenues.

9. What role does innovation play in shaping this market?

Product innovation focused on high-performance, eco-friendly solvents is critical to market competitiveness.

10. How is the competitive landscape shaping the future of the market?

The market is moderately fragmented, with key players focusing on capacity expansion and sustainable solutions.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com