Global Ambulatory Services Market Size, Share, Trends & Growth Forecast Report By Type (Primary Care Offices, Emergency Departments and Surgical Specialty) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Ambulatory Services Market Size

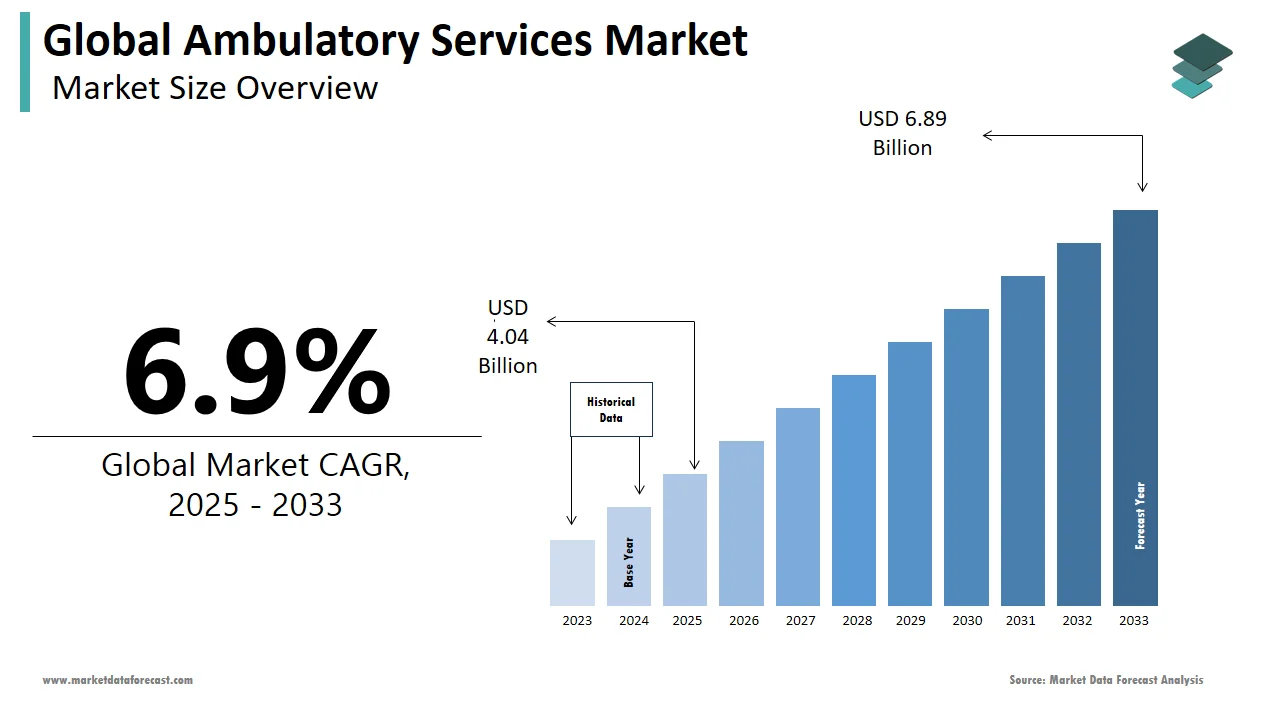

The global ambulatory services market was worth US$ 3.78 billion in 2024 and is anticipated to reach a valuation of US$ 6.89 billion by 2033 from US$ 4.04 billion in 2025, and it is predicted to register a CAGR of 6.9% during the forecast period 2033-2033.

MARKET DRIVERS

Increasing patient pool is the key factor that drives the global ambulatory services market.

Chronic illnesses are becoming more common as the population ages and life expectancy rises, resulting in a huge patient pool each year. In addition, the prevalence of various illnesses in the same person is increasing as a result of sedentary lifestyles. According to the WHO, chronic illnesses kill 41 million people each year, accounting for 71% of all deaths worldwide. Between 30 and 69, more than 15 million individuals die each year from chronic diseases. The rising number of instances has become a serious cause of concern for healthcare practitioners. As a result, ambulatory services have become the hubs of effective healthcare organizations for hospitals. These ambulatory care centers aid in the management of this patient group. Ambulatory services, for example, include wellness services like yearly check-ups and post-hospital discharge care, while retail clinics might give preventative treatments such as flu vaccines. In addition, patients might be referred to primary care clinics for follow-up care from urgent care centers that handle minor injuries. As a result, the number of outpatient care services has grown. In 2018, hospitals delivered 879.6 million outpatient visits, according to the American Hospital Association's 2020 hospital statistics report. According to Medicare, the ambulatory surgery centers in North America, which has the largest market share, spent about 4.9 billion dollars in 2018.

Technological advancements are further promoting the ambulatory services market growth.

Ambulatory services are becoming more widespread as technological advances make operations easier. Because of modern, minimally invasive surgery procedures, ENT, heart, kidney, and orthopedic operations may now be performed in outpatient clinics. In addition, hybrid operating rooms in ambulatory facilities are built up in such a way that patients can endure two distinct procedures under one round of anesthesia. Doctors may conduct open surgery and minimally invasive treatments simultaneously in these expanding operating rooms, resulting in fewer labor demands, lower costs, better outcomes, and shorter recovery time. Telehealth technologies, in particular, are crucial in the outpatient scenario. Beyond that, telemedicine will be especially beneficial in rural regions, enabling access to specialists who may not be available locally. EHR systems assist clinicians in ensuring data flow between inpatient and outpatient settings while also keeping the patient record current. Patients can also use mobile health applications and devices to keep track of their health. The worldwide ambulatory healthcare service market has grown as a result of these advances.

MARKET RESTRAINTS

Missed or delayed diagnosis restraining the global ambulatory services market. One of the most common claims in malpractice cases is that the doctor "failed to diagnose" a serious illness (e.g., cancer). Multiple malfunctions and individual and system variables are usually the cause of diagnostic mistakes that damage patients. A diagnostic mistake in the ambulatory context can cause significant damage and death to patients. According to a recent study published in BMJ Quality & Safety, approximately 12 million individuals seeking outpatient medical treatment in the United States get a misdiagnosis each year.

Impact Of COVID-19 on The Global Ambulatory Services Market

The COVID-19 epidemic has had a significant impact on how outpatient treatment is given in hospitals and clinics. Providers are postponing elective and preventative appointments, like yearly physicals, to reduce the risk of spreading the virus to patients or health care employees inside their practice. They are also turning in-person appointments to telemedicine visits wherever possible. On the other hand, many patients are avoiding visits because they do not want to leave their houses and risk being exposed. State and local regulations that reduce travel and non-essential services can also affect the behavior of providers and patients.

Furthermore, the coronavirus disease (COVID)-19 pandemic has significantly influenced global healthcare provision. Face-to-face meetings (FTF) in primary and secondary regions due to interruption in the provision of medical services were canceled or limited when the first UK national lockdown began on March 23, 2020. From December 2018 to October 2020, data from the Digital Hospital Episode Statistics (HES) reveals that overall appointments fell by 58 percent during the lockdown, first attendances fell by 43 %, follow-ups fell by 51 %, and day cases fell by 37 %.

On the other hand, the epidemic has fuelled a rising desire among physicians and even medical technology companies to purchase or enter the ambulatory surgical center sector. As a result, many institutions have focused on the growth of ambulatory care solutions and technology and health systems' growing emphasis on extending care throughout the continuum. Stryker, for example, established its own ambulatory surgical center business in July 2020, indicating that it can save more than $55 billion in healthcare costs each year.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2033 to 2033 |

|

CAGR |

6.9% |

|

Segments Covered |

By Type, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Envision Healthcare Corporation, Surgery Partners, IntegraMed America, Inc., NueHealth (Nueterra Healthcare), Terveystalo Healthcare, Hospital Corporation of America (HCA) Management Services, L.P., Aspen Healthcare, Healthway Medical Group, Medical Facilities Corporation., and Others. |

SEGMENTAL ANALYSIS

By Type Insights

Based on the type, the primary care offices segment is expected to dominate the ambulatory services market during the forecast period. This segment receives support from the advanced quality of care and novel technology accomplishments like computerized prescription systems and Electronic Health Records (EHRs). In March 2015, Tenet HealthCare Corporation and United Surgical Partners announced that they enter into a joint venture regarding ownership interests in 244 Ambulatory Surgery Centers (ASCs), 20 imaging centers, and 16 short-stay surgical hospitals United States. Moreover, partnerships amid high government and other private organizations offering fewer cost permissions for different treatment types are considered to bolster the ambulatory services market growth globally.

Besides primary care offices, the Surgical Specialty is expected to schedule the quickest CAGR growth rate in the global ambulatory services market during the analysis period. Effortless reimbursement schemes, insistence for minimal invasive processes, and surging M&A activities amid the key industries are factors adding fuel to the segment growth in the market globally. For instance, in 2016, Surgical Care Affiliates, Inc. (SCA) has made a partnership with the Midwest Center for Day Surgery. This combination supported the expansion of SCA’s product portfolio in Chicago. Moreover, the Surgical Specialty segment has gained popularity globally because of advanced technologies of same-day surgeries for cataracts and orthopedic surgeries.

REGIONAL ANALYSIS

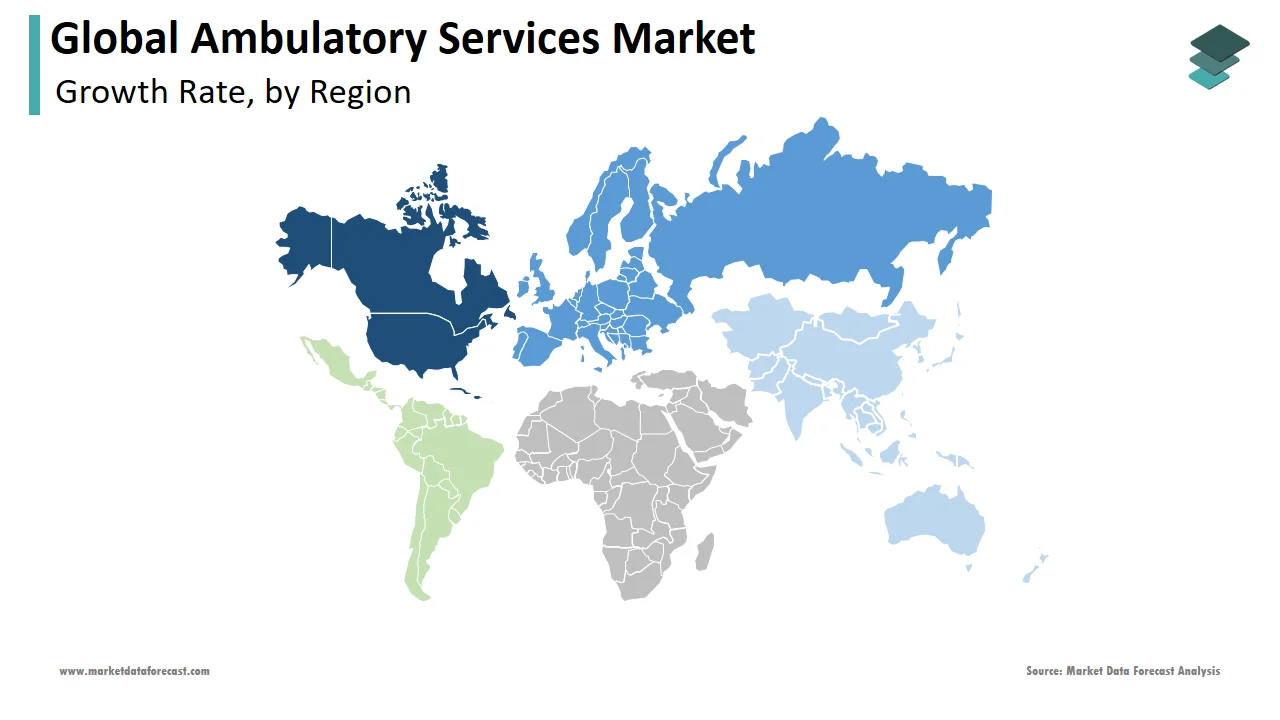

Regionally, the North America region held the largest share in the global market in 2024 due to the rise in healthcare expenditure; the cost-saving offers given by the hospital stay, alter of the aging population to outpatient care, increasing network with physicians and healthcare providers, and the presence of leading players in the market.

The European ambulatory services market is expected to account for the second-largest share globally during the forecast period. In this region, the factors driving the market in this region are a rise in investment in research and development, well-developed healthcare infrastructure, and increased healthcare funds. Further, the demand for ambulatory service is expected to grow in Europe by creating awareness amongst patients and improved surgery quality, said to the British Association of Day Surgery and Healthcare Conferences UK.

India, China, Japan, Australia & NZ, South Korea, ASEAN countries (Indonesia, Thailand, Singapore, Vietnam, Myanmar, and Others), and the Rest of APAC are considered under the Asia Pacific region. Asia-Pacific is expected to grow radically in the forecast period due to the increasing health care issues with the rising incidence of chronic diseases. The government is also taking the initiative to introduce outpatient strategies. For this case, the applications launched by China and Japan are easy to use and book outpatient appointments; they are also providing knowledge about the ambulatory service. Latin America region is segmented into Mexico, Brazil, Argentina, Chile, and the Rest of LATAM.

The Middle East & Africa market sees a fixed growth due to increased investments in research and developments and the rapid adoption of technological advancements in the medical sector.

KEY MARKET PARTICIPANTS

A few of the major companies operating in the global ambulatory services market profiled in this report are Envision Healthcare Corporation, Surgery Partners, IntegraMed America, Inc., NueHealth (Nueterra Healthcare), Terveystalo Healthcare, Hospital Corporation of America (HCA) Management Services, L.P., Aspen Healthcare, Healthway Medical Group, and Medical Facilities Corporation.

RECENT MARKET HAPPENINGS

- In January 2021, Medical West Hospital, a University of Alabama Medicine Health System (UAB) member, has announced its retail ambulatory-based pharmacy opening, which has had a successful start. The pharmacy was founded as part of a joint venture with ShiftRx, which also handled the pharmacy's purchase, upgrades, and operations.

- In June 2021, Alliance HealthCare Services, Inc. (“Alliance”), a nationwide supplier of radiology and oncology solutions to hospitals, health systems, and physician groups, said today that it has agreed to be purchased by Akumin Inc. for $820 million.

MARKET SEGMENTATION

This research report on the global ambulatory services market has been segmented and sub-segmented based on the type and region.

By Type

- Primary Care Offices

- Emergency Departments

- Surgical Specialty

- Ophthalmology

- Orthopedics

- Gastroenterology

- Spinal Injection/Pain Management

- Plastic Surgery

- Others

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- The United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Australia

- South Korea

- Rest of the Asia-Pacific

- Latin America

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

- Middle East

- Africa

Frequently Asked Questions

Who are the leading players in the ambulatory services market?

Yes, we have studied and included the COVID-19 impact on the global ambulatory services market in this report.

What was the size of the ambulatory services market worldwide in 2024?

The global ambulatory services market size was worth USD 3.78 Billion in 2024.

Which region will lead the ambulatory services market in the future?

Envision Healthcare Corporation, Surgery Partners, IntegraMed America, Inc., NueHealth (Nueterra Healthcare), Terveystalo Healthcare, Hospital Corporation of America (HCA) Management Services, L.P., Aspen Healthcare, Healthway Medical Group, and Medical Facilities Corporation are some of the notable companies in the ambulatory services market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com