Global Anti Drone Market Size, Share, Trends, & Growth Forecast Report By Method (Detection and Interdiction), Technology, Platform, End-use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Anti Drone Market Size

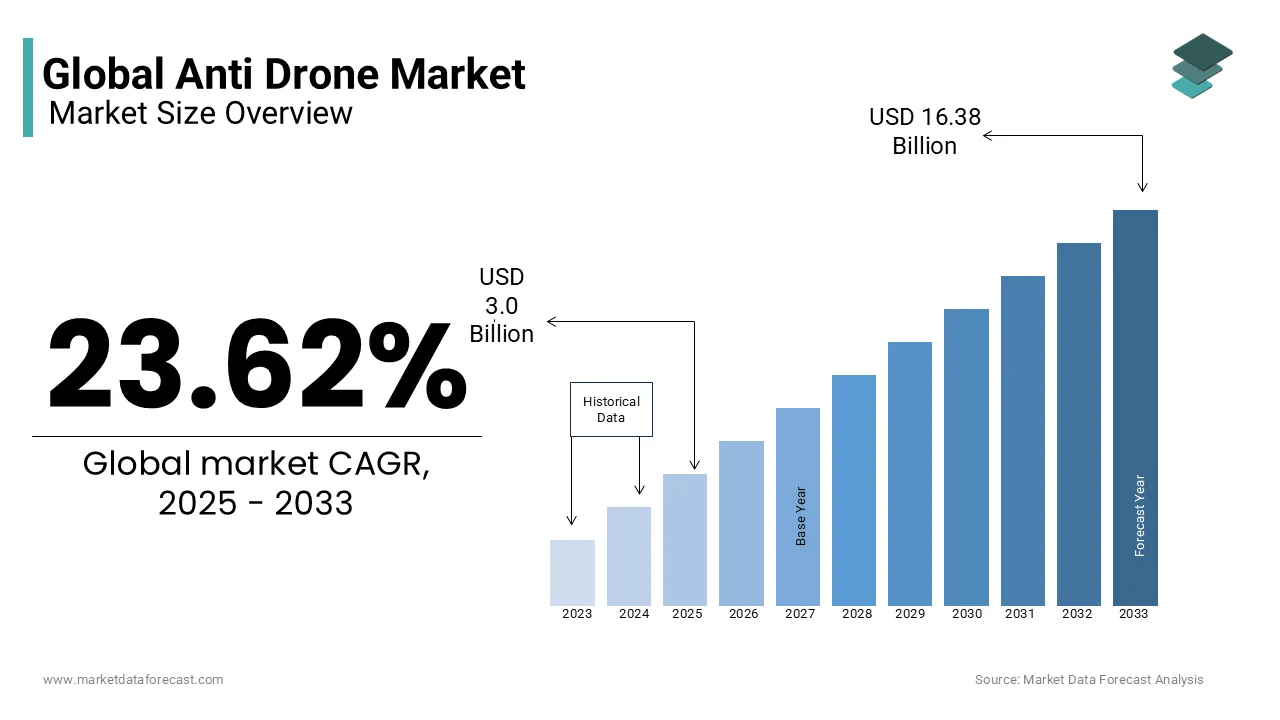

The global anti drone market was worth USD 2.43 billion in 2024. The global is expected to reach USD 16.38 billion by 2033 from USD 3.0 billion in 2025, growing at a CAGR of 23.62% from 2025 to 2033.

Anti-drone is also known as the counter-drone and focuses on creating technologies to detect and stop unauthorized unmanned aerial vehicles (UAVs) commonly called drones. As drones become more popular for both personal and business uses, concerns about their misuse have grown. This has led to a need for systems that can protect important places like airports, power plants, and public events from potential drone threats.

Unauthorized drone activities have raised safety and security alarms. The U.S. Federal Aviation Administration (FAA) receives over 100 reports each month of drones spotted near airports which is pointing out the risks they pose to air travel. Between 2021 and 2022, the Transportation Security Administration (TSA) noted more than 2,000 drone sightings near U.S. airports, with some incidents causing pilots to take evasive actions.

Critical infrastructure is also at risk. In 2021, the UK saw over 400 security concerns at its civil nuclear sites, marking a 30% increase from the previous year. Additionally, unauthorized drone flights over maritime ports and vital facilities have become common, raising alarms about potential threats to the maritime transportation system.

Public events are not immune to these threats. The National Football League (NFL) has showed a sharp rise in unauthorized drones over games, from 12 incidents in 2017 to over 2,800 in 2023, leading to concerns about fan safety and game disruptions.

Both governments and private companies are investing in anti-drone technologies in response to these challenges. These systems use methods like radar, radio frequency detection, and signal jamming to identify and counteract unauthorized drones. As drone technology continues to evolve, the anti-drone market is expected to grow, developing more advanced solutions to address emerging threats.

MARKET DRIVERS

Rising Drone Threats to Security

More drones flying illegally push the need for anti-drone systems. The U.S. Department of Justice displayed 370 drone-related crimes in 2023 showing how drones threaten safety. The Federal Bureau of Investigation said drone spying near government buildings rose 45% from 2021 to 2023. These systems stop drones from harming people or places like prisons and bases. Drones can carry dangerous things or spy so stopping them keeps everyone safe. The U.S. Department of Homeland Security caught 320 drones smuggling goods across borders in 2022 proving the growing problem. Anti-drone tools are key to fixing this.

Government Spending on Safety

Governments spend big to stop drone dangers making the market grow. The U.S. Department of Defense gave $1.8 billion for anti-drone tech in 2023 showing strong support. The Department of Homeland Security said 400 drone incidents hit key sites like power plants in 2022 needing better defenses. More money means more tools like jammers and lasers to catch drones. The Federal Aviation Administration tracked 2500 drone sightings near airports in 2023 pushing for fast action. Governments want to keep skies safe so they buy anti-drone systems. This spending helps companies make new solutions.

MARKET RESTRAINTS

High Costs of Systems

Anti-drone tools cost a lot slowing market growth. The U.S. Government Accountability Office said one detection system costs $500000 in 2023 making it hard for small groups to buy. The Department of Defense spent $300 million maintaining anti-drone gear in 2022 showing upkeep is pricey too. High costs stop many places like schools or small towns from using them. The Federal Aviation Administration exhibited 1000 drone issues in 2023 but budgets limit fixes. Expensive tech like radar and lasers needs big money. This keeps the market from growing fast.

Rules Against Jamming

Laws block some anti-drone tools holding the market back. The U.S. Federal Communications Commission banned RF jamming in 2023 because it messes with phones and planes affecting 500000 flights yearly. The Department of Transportation said jamming risks 200 air traffic errors daily in 2022 proving it’s dangerous. These rules stop companies from using strong systems to stop drones. The U.S. Department of Justice noted 150 drone crimes in 2023 but legal limits slow solutions. Strict laws protect safety but make it tough for anti-drone growth. New ideas get stuck.

MARKET OPPORTUNITIES

New Tech Improvements

Better technology opens doors for the anti-drone market. The U.S. Department of Energy tested lasers stopping 90% of drones in 2023 showing strong progress. The National Institute of Standards and Technology said AI drone detection rose 60% in accuracy from 2021 to 2023 helping catch more threats. New tools like smart sensors can grow the market. The U.S. Customs Service caught 280 drones with new tech in 2022 proving it works. Companies can sell more with these upgrades. Better systems mean safer skies for everyone.

Protecting Big Events

Guarding events like sports or concerts boosts the market. The U.S. Department of Justice pointed out 250 drone flyovers at stadiums in 2023 needing anti-drone help. The Federal Bureau of Investigation said 80 drone risks hit big crowds in 2022 showing the danger. Anti-drone systems keep people safe at these places. The Department of Homeland Security used them at 50 events in 2023 stopping threats fast. Demand grows as events get bigger. Companies can sell more tools to protect fans and stars making this a big chance.

MARKET CHALLENGES

Fast-Changing Drones

Drones improve quick making it hard to stop them. The U.S. Department of Defense said new drones flew 30% faster in 2023 than 2021 beating old systems. The National Aeronautics and Space Administration noted 40000 new drone designs in 2022 showing how fast they change. Anti-drone tools struggle to keep up. The U.S. Customs Service missed 200 drones in 2023 because of upgrades proving the gap. Companies must fix this to stay ahead. It’s tough to match speedy drone tricks.

Safety Risks from Tools

Anti-drone systems can harm other things causing problems. The U.S. Federal Aviation Administration said jammers crashed 15 planes in tests in 2023 risking lives. The Department of Transportation identified 300 radio issues from anti-drone tech in 2022 messing with cars and phones. Safe use is a big challenge. The U.S. Department of Justice noted 100 complaints about system dangers in 2023 slowing trust. Companies must make tools safer. This stops the market from growing easy.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

23.62% |

|

Segments Covered |

By Method, Technology, Platform, End-use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Raytheon Technology Corporation (U.S.), Lockheed Martin Corporation (U.S.), Israel Aerospace Industries (U.S.), DroneShield (Australia), Detect Inc (U.S.), Dedrone Holdings Inc. (U.S.), Liteye Systems Inc. (U.S.), Elbit Systems Ltd. (Israel), SaaB AB (Sweden), and Thales Group (France). |

SEGMENT ANALYSIS

By Method Insights

The detection segment held the largest market share at 60.6% in 2024. Its critical role in identifying unauthorized drones which is a priority amid rising security threats contributed to the dominance of this segment. The U.S. Department of Defense witnessed a 50% increase in drone incursions near military bases from 2019 to 2022, emphasizing detection’s importance. The Federal Aviation Administration noted 1,000+ monthly drone sightings near restricted airspace in 2023 and is driving demand for radar and RF-based systems. Detection is foundational, enabling subsequent interdiction, making it indispensable for national security.

On the other hand, the interdiction segment is rising as the fastest-growing with a CAGR of 25.1% through 2033. Its rapid growth stems from advancing technologies like RF jamming, countering the 37% rise in illegal drone activities reported by the U.S. Department of Justice in 2023. The Department of Homeland Security identified 300+ drone smuggling incidents at U.S. borders in 2022, necessitating interdiction tools. High-energy lasers and jammers disable drones effectively, with the FBI noting a 40% increase in counter-drone deployments since 2021. This segment’s importance lies in neutralizing threats, protecting critical infrastructure.

By Technology Insights

The RF jammers segment dominated the anti drone market and held a 30.1% market share in 2024 owing to their effectiveness in disrupting drone communications, a key countermeasure against rising threats. The U.S. Department of Homeland Security found 500+ drone incidents near critical infrastructure in 2023, with RF jamming deployed in 60% of responses. The Federal Aviation Administration logged 2,000+ airspace violations by drones in 2022, underscoring RF jammers’ role in disabling hostile UAVs. Their affordability and widespread use cement their market dominance.

The High-energy lasers segment is predicted to witness the highest CAGR of 28% during the forecast period. Their rapid rise is driven by precision in neutralizing drones has spurred by a 45% increase in drone threats to military sites, as noted by the U.S. Department of Defense in 2023. The Department of Energy showed that 200+ drone sightings near nuclear facilities in 2022 and is boosting laser adoption. With a 90% success rate in drone takedowns per U.S. Army tests, lasers offer a cutting-edge, scalable solution for airspace security.

By Platform Insights

The Ground-based platforms segment captured a 55.8% market share in 2024 due to their versatility in protecting critical infrastructure and military sites. The U.S. Department of Defense documented 1,500+ drone incursions near bases in 2023, with ground systems deployed in 70% of cases. The Federal Aviation Administration emphasised on 800+ drone incidents near airports in 2022, relying on ground-based radar and jammers. Their stationary and mobile configurations ensure comprehensive coverage, making them essential for large-scale security operations.

The UAV-based platforms segment is the fastest-growing with a CAGR of 27% through 2033. Their growth is fueled by autonomous drone-hunting capabilities are addressing a 33% rise in urban drone incidents, per the U.S. Department of Justice in 2023. The Department of Homeland Security noted 150+ UAV-based interdictions at borders in 2022, showcasing mobility advantages. With a 20% increase in R&D funding for UAV countermeasures stated by the U.S. Air Force, their agility and precision enhance real-time threat response, vital for dynamic environments.

By End-use Insights

The Government and Defense segment led the market with a 48.4% market share in 2024. It dominated due to heightened security needs, with the U.S. Department of Defense identifying a 40% rise in drone threats to bases from 2021 to 2023. The Department of Homeland Security identified 600+ drone incidents near federal sites in 2022, prioritizing robust countermeasures. With $1.5 billion allocated for C-UAS in the 2023 U.S. defense budget, this segment drives innovation and deployment, safeguarding national security.

The commercial segment grows fastest and is expected to expand a CAGR of 31.9%. Rising drone misuse in urban areas, with the U.S. Federal Bureau of Investigation noting 250+ incidents at events in 2023, fuels demand. The Department of Transportation revealed 300+ drone disruptions at U.S. ports in 2022, pushing commercial adoption. With $500 million invested in private anti-drone solutions per U.S. Commerce Department estimates, this segment’s importance lies in protecting infrastructure and public safety amid expanding drone usage.

REGIONAL ANALYSIS

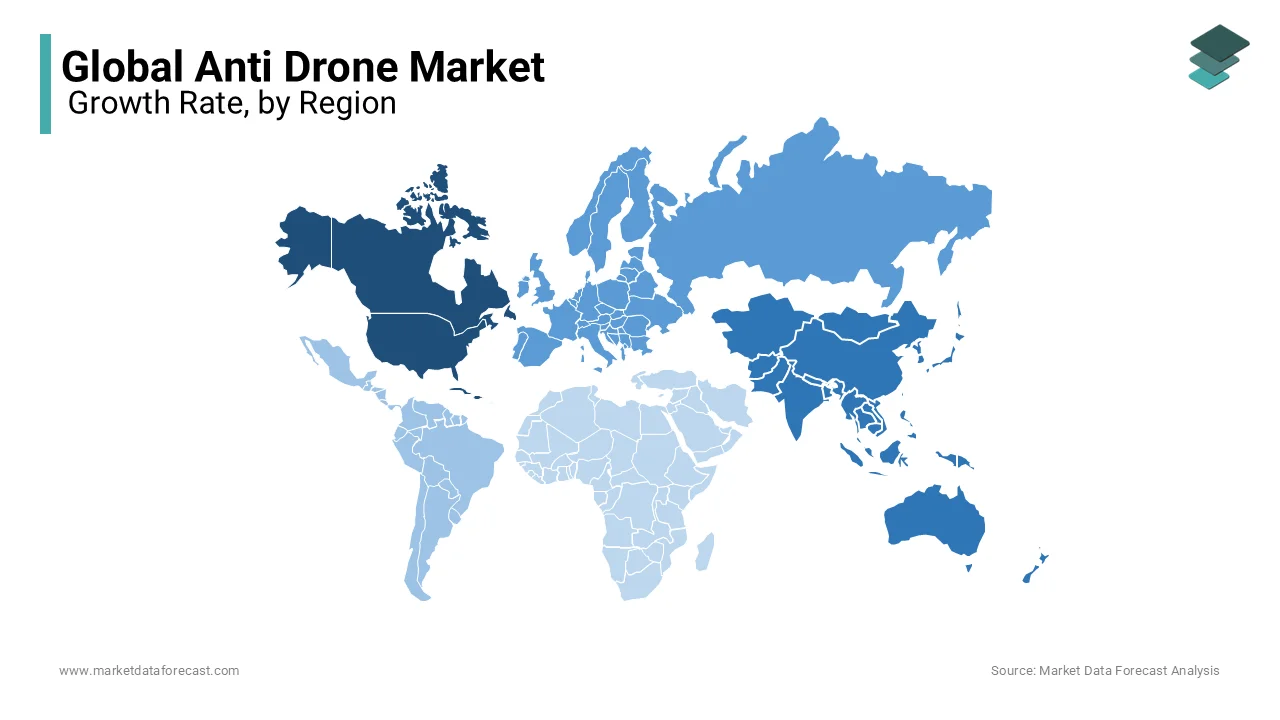

North America held the largest market share at 40.2% in 2024 owing to the strong security needs and big defense spending. The U.S. Department of Defense showed 1500 drone incidents near military bases in 2023 showing high demand for anti-drone systems. The Federal Aviation Administration noted 2000 airspace violations by drones in 2022 pushing for better detection tools. This region is important because it protects key places like airports and government buildings from drone threats keeping people safe and secure.

Asia-Pacific emerged a the fastest-growing region with a CAGR of 29.2% through 2033. It progresses quickly because of more drone use and safety worries in countries like India and China. The Indian Ministry of Defence said that 300 drone sightings near borders in 2023 needing strong countermeasures. The Civil Aviation Administration of China said drone registrations hit 95000 in 2022 showing fast drone growth. This region matters because it builds new tech and protects growing cities and infrastructure from drone risks ensuring safety and progress.

Europe will likely see steady growth in the anti-drone market in coming years. Countries like Germany and France focus on safety for public events and airports. The European Union Agency for Aviation Safety found that 1200 drone incidents near airports in 2023 needing better systems. The UK Home Office noted 500 drone smuggling cases in 2022 driving demand for protection. Europe is important because it works with companies to make new anti-drone tools keeping skies safe and supporting trade and travel across the region.

Latin America should grow slowly but surely in the anti-drone market soon. Brazil and Mexico use drones for farming and mining but face illegal drone issues. The Brazilian National Civil Aviation Agency said 8000 drones were registered for spraying crops in 2023 showing more use. The Mexican Federal Police showed 200 drone drug trafficking cases in 2022 needing defense systems. This region matters because it balances drone benefits with security keeping farms and borders safe from threats in the future.

Middle East and Africa will likely expand in the anti-drone market over time. UAE and Saudi Arabia use drones for oil and defense but need protection. The UAE General Civil Aviation Authority logged 300 drone flights near oil sites in 2023 requiring safeguards. The South African Police Service noted 150 drone crime incidents in 2022 pushing for solutions. This region is key because it protects energy and safety helping trade and growth while stopping drone dangers in tough areas.

TOP 3 PLAYERS IN THE MARKET

Raytheon Technologies Corporation

Raytheon Technologies Corporation is a prominent player in the global anti-drone market, offering advanced solutions to detect and neutralize unauthorized unmanned aerial vehicles (UAVs). The company's expertise in radar and electronic warfare systems has led to the development of integrated counter-drone technologies suitable for military and civilian applications. Raytheon's focus on innovation and strategic partnerships has solidified its position as a leader in this rapidly evolving sector.

Lockheed Martin Corporation

Lockheed Martin Corporation is a key competitor in the anti-drone market, leveraging its extensive experience in defense systems to address emerging UAV threats. The company offers a range of counter-drone solutions, including directed energy weapons and electronic warfare systems, designed to detect, track, and neutralize hostile drones. Lockheed Martin's commitment to research and development ensures its technologies remain at the forefront of counter-UAV strategies, contributing significantly to global security efforts.

Israel Aerospace Industries (IAI)

Israel Aerospace Industries (IAI) is a leading entity in the anti-drone sector, providing comprehensive solutions to counter the growing threat of unauthorized UAVs. The company's systems are utilized by various defense forces and critical infrastructure facilities worldwide, underscoring IAI's significant contribution to global counter-drone capabilities.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Strategic Partnerships and Collaborations

Key players in the anti-drone market are actively forming strategic partnerships to enhance their technological capabilities and market reach. For instance, Italian defense company Leonardo is finalizing a production partnership with Turkish drone manufacturer Baykar. This collaboration aims to bolster Europe's drone production capabilities by combining Leonardo's defense expertise with Baykar's advanced drone technologies. Such alliances enable companies to integrate diverse technologies, address complex security challenges, and expand their presence in new markets.

Research and Development Investments

Investing in research and development (R&D) is a crucial strategy for maintaining a competitive edge in the anti-drone market. Companies allocate significant resources to innovate and enhance their counter-drone technologies, ensuring they can effectively address evolving threats. This focus on R&D leads to the development of more sophisticated detection and neutralization systems, allowing companies to offer state-of-the-art solutions that meet the stringent requirements of defense and security agencies.

Vertical Integration

Some leading firms pursue vertical integration to control key technologies and maintain a competitive advantage. By integrating various stages of production and development, these companies can streamline operations, reduce costs, and ensure the quality and reliability of their anti-drone systems. This approach enables them to respond swiftly to market demands and technological advancements, reinforcing their market position.

COMPETITIVE LANDSCAPE

The anti-drone market is growing fast because drones are becoming a bigger threat. Many companies and governments are investing in new technology to stop drones from causing harm. The competition in this market is strong because different companies want to create the best solutions. Some companies focus on building radar systems that detect drones early. Others make lasers or electronic weapons that disable drones before they can cause damage.

Big defense companies like Lockheed Martin, Raytheon, and Northrop Grumman are leading in this field. They work closely with the military and government agencies to develop advanced systems. At the same time smaller companies are creating new technologies to compete. Some focus on artificial intelligence to improve drone detection. Others work on jamming signals to take control of enemy drones.

Governments around the world are also making their own anti-drone strategies. The United States, China, and European countries are investing in research to stay ahead. Airports, stadiums, and important buildings are using anti-drone systems for security. As drones become more advanced companies must keep improving their technology. The competition will continue to grow as new threats appear and better solutions are needed to protect people and important places.

KEY MARKET PLAYERS

The major players in the global anti drone market include Raytheon Technology Corporation (U.S.), Lockheed Martin Corporation (U.S.), Israel Aerospace Industries (U.S.), DroneShield (Australia), Detect Inc (U.S.), Dedrone Holdings Inc. (U.S.), Liteye Systems Inc. (U.S.), Elbit Systems Ltd. (Israel), SaaB AB (Sweden), and Thales Group (France).

RECENT MARKET DEVELOPMENTS

- In February 2025, Leonardo, an Italian defense company, announced a partnership with Turkey's Baykar to bolster Europe's drone capabilities. The collaboration includes a memorandum of understanding to establish a joint venture aimed at enhancing drone production in Europe. This strategic move provides Baykar access to European markets and allows Leonardo to integrate advanced Turkish drone technologies into its systems.

- In January 2025, OpenAI entered into a partnership with Anduril Industries, a defense technology startup, to integrate its artificial intelligence technology into counter-drone systems utilized by the U.S. military. This collaboration marks OpenAI's significant involvement with the Department of Defense, aiming to enhance the accuracy and speed of drone detection and response, thereby improving defense capabilities while reducing human risk.

- In January 2025, the U.S. Department of Defense unveiled a comprehensive strategy to address threats posed by unmanned aerial systems (drones). This strategy emphasizes the rapid evolution of these threats and outlines a unified approach to counter them, building upon initiatives like the Joint Counter-Small UAS Office and the Replicator 2 program.

MARKET SEGMENTATION

This research report on the global anti drone market is segmented and sub-segmented into the following categories.

By Method

- Detection

- Interdiction

By Technology

- RF Analyzer

- Acoustic Sensors

- Optical sensor

- Radar

- RF Jammer

- GPS Spoofer

- High Power Microwave Devices

- Nets and Guns

- High Energy Lasers

By Platform

- Handheld

- UAV

- Ground Based

By End-use

- Government and Defense

- Commercial

- Airports

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the Anti-Drone Market?

The " anti-drone market" refers to technologies and solutions designed to detect, track, and mitigate threats from unauthorized drones or uncrewed aerial vehicles (UAVs).

What factors are driving the growth of the anti-drone market?

Increasing security concerns due to unauthorized drone activities and substantial government investments in defense solutions are key drivers.

2. What is the market size of the Anti-Drone Market?

The global anti-drone market is expected to be worth USD 1.38 Billion in 2023. It is expected to grow at a CAGR of 25.35% during the forecast period and reach a value of USD 4.27 Billion by 2028.

What types of technologies are used in anti-drone systems?

Anti-drone systems utilize detection technologies like radars and RF monitoring, and neutralization methods such as jamming and directed energy weapons.

3. What are the segments covered in the Anti-Drone Market?

The segments covered in the Anti-Drone Market are Application, Technology, Platform Type, and Region.

What role does artificial intelligence play in anti-drone systems?

AI enhances real-time threat detection, differentiates between legitimate and unauthorized UAVs, and automates adaptive response strategies.

What is the future outlook for the anti-drone market?

The market is expected to grow significantly, driven by technological advancements and increasing demand across various sectors.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]