Asia Pacific Cardiac Marker Testing Market Size, Share, Trends & Growth Forecast Report By Type, Product, Disease, Testing and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) - Industry Analysis From (2025 to 2033)

Asia Pacific Cardiac Marker Testing Market Size

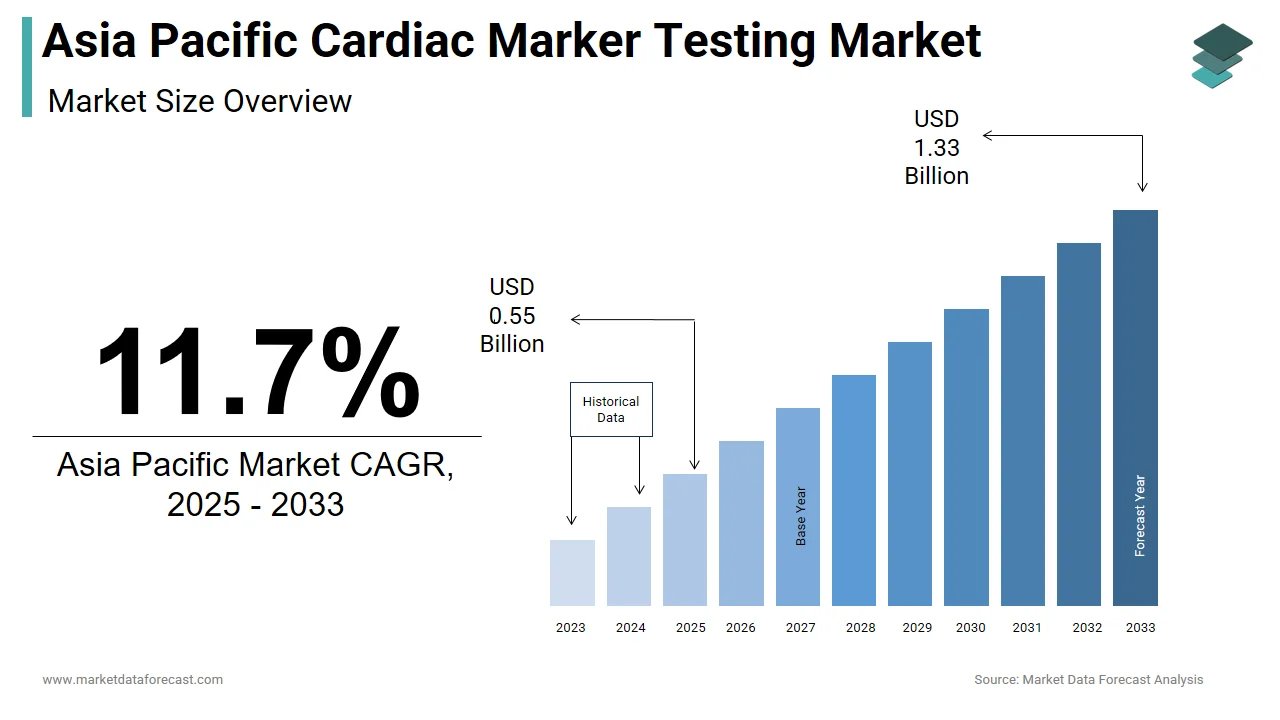

The size of the Asia Pacific cardiac marker testing market was worth USD 0.49 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 11.7% from 2025 to 2033 and be worth USD 1.33 billion by 2033 from USD 0.55 billion in 2025.

MARKET DRIVERS

Rising Awareness and Research Advancements Driving Cardiac Marker Testing Market Growth

An increasing number of clinical studies for cardiac biomarker detection and public-private collaborations for cardiac biomarker research are driving the market for cardiac marker testing. An increase in heart-related diseases and substantial product research and development projects are driving market demand. Consumers are more aware of early detection and the growing need to avoid cardiovascular illnesses such as heart failure, heart attacks, and Acute Coronary Syndrome (ACS). Several Asian Pacific organizations are increasing financing for clinical investigations and research on cardiac marker identification.

Growth in point-of-care testing and rising demand for the most up-to-date treatment processes propel the market forward. In addition, the market is also growing as people become more aware of the benefits of early detection and prevention of heart disorders, including heart attacks.

MARKET RESTRAINTS

Reimbursement Challenges and Regulatory Barriers Limiting Market Growth

BNP, hs-TNI, - HBDH, CK-MB, and LDH operate as predictive biomarkers in COVID-19 individuals with or without pre-existing coronary artery disease. With all of these factors in mind, the Asia Pacific Cardiac Marker Testing Market has had moderate growth during the pandemic and is anticipated to increase in the following years. Therefore, these factors will drive the Asia Pacific Cardiac Marker Testing market.

Unfavorable reimbursement policies and strict government rules and regulations are limiting the growth of the Asia Pacific cardiac marker testing market. The cardiac markers aren't employed to diagnose the heart's myocardial blood supply or the tissue location where death occurs. Factors that limit expansion include issues with sample storage and preservation, and the amount paid in compensation for suffering. Correct and early outcomes and cardiac POC testing drive the market.

MARKET CHALLENGES

COVID-19 Impacted Market Growth with Decline in Cardiovascular Patients

The cardiac marker testing market witnessed short-term negative growth during COVID-19, which might be attributed to more than a 50% decline in patients with cardiovascular disorders and those diagnosed with myocardial infarction.

GEOGRAPHICAL ANALYSIS

Geographically, the market for cardiac marker testing in the Asia Pacific is expected to develop at the quickest rate. Higher healthcare spending by a more extensive population base, modernization of healthcare infrastructure, and increased penetration of cutting-edge clinical laboratory technologies (mainly in rural regions) are driving the Asia Pacific market.

The India Cardiac Marker Testing Market is predicted to expand at significant growth among all regions of the globe due to variables such as Y-O-Y growth in CVD incidence and a rapid rise in the aging population throughout the forecast period.

The China Cardiac Marker Testing Market is predicted to dominate market share due to the growing understanding of sophisticated technologies among lab workers and cardiologists because of frequent conferences and seminars.

The market growth in APAC is accelerating due to public and private sector initiatives to raise awareness about early disease diagnosis. As a result, according to estimates, annual cardiovascular incidents in China are expected to increase by more than 50% between 2010 and 2030.

As a result, the cardiac marker testing market is booming in APAC, especially in Japan and India. Improving healthcare infrastructure, a significant patient population, and increasing funding and investments for cardiac analyzer upgrades propels the APAC region's market expansion.

KEY MARKET PLAYERS

Notable companies leading the Asia Pacific Cardiac Marker Testing Market Profiled in the report are Getinge Group, Medtronic plc, LivaNova PLC, XENIOS Roche Diagnostics Ltd., Siemens AG, Danaher Corporation, Alere Inc., Guangzhou Wondfo Biotech Co. Ltd, LSI Medience Corporation, Ortho Clinical Diagnostics, Randox Laboratories Ltd, bioMérieux SA, Abbott Laboratories.

MARKET SEGMENTATION

This Asia Pacific cardiac marker testing market research report is segmented and sub-segmented into the following categories.

By Type

- Troponin I & T

- CK-MB

- Myoglobin

- BNP

- hs-CRP

By Product

- Reagent

- Instrument

- Chemiluminescence

- Immunofluorescence

- Immunochromatography

- ELISA

By Disease

- Acute Coronary Syndrome

- Myocardial Infarction

- Congestive Heart Failure

By Testing

- Lab

- POC

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com