Asia Pacific Hospital Beds Market Size, Share, Trends & Growth Analysis Report By Usage, Power, End-Users and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) – Industry Forecast (2025 to 2033)

Asia Pacific Hospital Beds Market Size

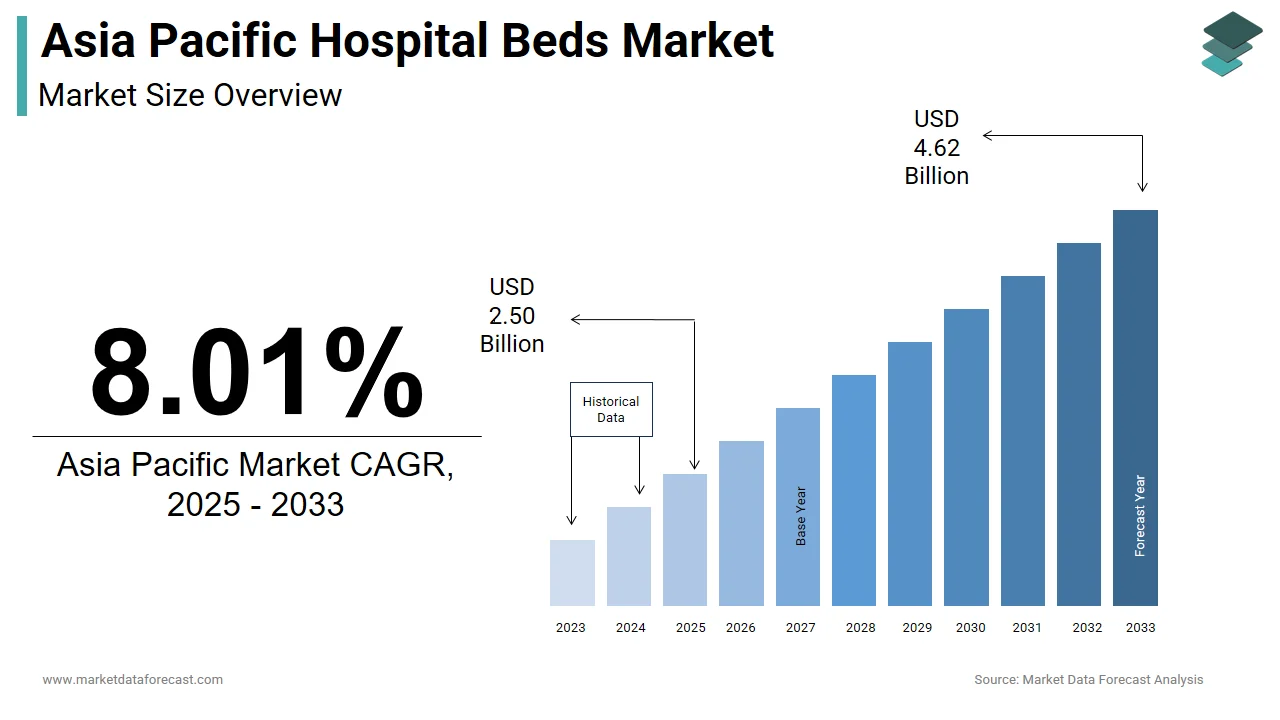

The size of the Asia Pacific hospital beds market was worth USD 2.31 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 8.01% from 2025 to 2033 and be worth USD 4.62 billion by 2033 from USD 2.50 billion in 2025.

The Asia Pacific hospital bed market growth is driven by a wide range of medical equipment used in hospitals, clinics, and long-term care facilities to support patient comfort, mobility and clinical monitoring. These beds come in various configurations, including manual, semi-electric, fully electric, ICU-specific, bariatric and therapeutic models tailored for critical and chronic care settings. With rising healthcare investments along with growing geriatric populations and increasing prevalence of chronic diseases demand for hospital beds is expanding across both developed and emerging economies in the region. The number of people aged 65 years or older in the Asia Pacific is projected to more than double by 2050 thereby significantly increasing the need for acute and post-acute care infrastructure. In countries like Japan and South Korea where aging demographics are already pronounced and public health systems have prioritized hospital expansion and modernization efforts. In developing nations such as India and Indonesi,a government initiatives aimed at improving healthcare access are contributing to increased procurement of hospital beds. In India, hospital infrastructure projects under the Ayushman Bharat scheme added over 70,000 new hospital beds between 2018 and 2023 thereby enhancing capacity in rural and underserved areas.

MARKET DRIVERS

Rapid Aging of Population in Developed APAC Countries

Rapid aging of the population particularly in developed economies such as Japan, South Korea and Australia is one of the most significant drivers of the Asia Pacific hospital bed market. Japan’s dependency ratio defined as the number of elderly persons per 100 working-age adults has surpassed 50% thereby necessitating greater healthcare infrastructure to accommodate their needs. This demographic shift directly translates into higher demand for hospital beds especially in geriatric wards, rehabilitation centers and intensive care units. In South Korea, the number of individuals aged above 65 years reached 9.6 million in 2023 and accounted for nearly 19.71% of the total population. This surge has prompted hospitals to expand their bed capacities and upgrade existing facilities with advanced and electronically adjustable beds that cater to elderly patients. Moreover, in Australia more than 40.91% of hospitalizations occur among individuals aged 65 and above thereby emphasizing the impact of aging on healthcare utilization.

Expansion of Healthcare Infrastructure in Emerging Economies

Expansion of healthcare infrastructure in emerging economies such as India, Indonesia and Vietnam is another key driver fueling growth in the Asia Pacific hospital bed market. Governments in these countries are making substantial investments to improve hospital networks, increase bed availability and enhance overall healthcare delivery especially in rural and semi-urban regions. Public healthcare expenditure in Southeast Asia grew at an average annual rate of 6.5% between 2015 and 2022, thereby supporting large-scale hospital construction and renovation projects. In India, as a part of Pradhan Mantri Swasthya Suraksha Yojana (PMSSY) over 50,000 additional hospital beds were added across 24 states between 2020 and 2023.These infrastructure development programs are directly boosting the procurement of hospital beds particularly those designed for general wards and emergency departments. The demand for hospital beds in emerging APAC countries is expected to remain strong as urbanization continues and healthcare spending rises.

MARKET RESTRAINTS

High Cost of Advanced Electric and Smart Beds in Low-Income Markets

The high cost associated with advanced electric and smart beds particularly in lower-income countries is a major restraint hindering the growth of the Asia Pacific hospital bed market. While developed economies such as Japan and Australia can absorb the expenses of technologically enhanced beds equipped with features like weight monitoring, automatic pressure adjustment and remote control functionality many middle- and low-income countries struggle to justify such expenditures. A single ICU-grade electric bed can cost upwards of USD 10,000 which is beyond the budget of many public hospitals in countries like Cambodia, Myanmar and Papua New Guinea. In several parts of Southeast Asia public sector hospitals operate with limited capital budgets and rely heavily on donated or second-hand medical equipment thereby limiting the adoption of newer and high-end hospital beds. Additionally, maintenance and repair costs for complex electronic beds pose another financial challenge especially in rural healthcare settings where technical expertise is scarce. In Bangladesh, over 40.91% of electric hospital beds in district-level hospitals remain non-functional due to lack of spare parts and trained technicians.

Regulatory Complexity and Approval Delays Across APAC Countries

Another significant barrier affecting the Asia Pacific hospital bed market is the regulatory complexity and varying approval processes across different countries. In Europe or North America harmonized regulatory frameworks streamline product approvals but the APAC region consists of diverse regulatory landscapes that often slow down market entry and increase compliance costs for manufacturers. In China, the National Medical Products Administration requires extensive documentation and clinical evaluations before approving hospital beds classified as medical devices thereby leading to delays of up to 12 months. In Malaysia, the Medical Device Authority enforces stringent guidelines that require foreign manufacturers to obtain multiple certifications before launching products domestically. The average time required to secure market authorization for a mid-range hospital bed in Southeast Asia is nearly 18 months compared to 8 months in Australia. Furthermore, inconsistent classification standards create confusion among stakeholders. For instance, while Japan categorizes certain electric beds as Class II medical devices requiring full registration whereas neighboring Thailand may classify them differently thereby leading to discrepancies in import regulations.

MARKET OPPORTUNITIES

Growing Demand for Bariatric Hospital Beds Due to Rising Obesity Rates

An emerging opportunity within the Asia Pacific hospital bed market is the increasing demand for bariatric hospital beds which is driven by rising obesity rates and associated comorbidities such as diabetes, hypertension and cardiovascular diseases. Obesity rates in Southeast Asia have nearly doubled over the past decade with Malaysia reporting an adult obesity prevalence exceeding 15.62% in 2023. In response, hospitals in Kuala Lumpur and Jakarta have begun upgrading their ICU and surgical wards with bariatric beds featuring wider frames, reinforced bases and enhanced weight capacities of up to 1,000 pounds. The bariatric segment of the hospital bed market in Asia Pacific is expected to grow at a CAGR of over 12.77% through 2030 thereby indicating strong future potential. Additionally, governments in countries like Singapore and Thailand are initiating campaigns to address metabolic disorders thereby indirectly boosting demand for specialized hospital infrastructure. Public hospitals in these nations are incorporating bariatric beds into their standard equipment planning to improve patient safety and reduce complications related to improper bed use.

Integration of Smart and IoT-Enabled Hospital Beds in Telehealth Applications

The integration of smart and IoT-enabled hospital beds presents a transformative opportunity for the Asia Pacific hospital bed market particularly in light of the accelerated adoption of telehealth services following the pandemic. These advanced beds feature embedded sensors, real-time monitoring capabilities and remote connectivity allowing healthcare providers to track patient vitals as well as movement and risk of pressure ulcers without direct physical contact. In South Korea, the Ministry of Health and Welfare collaborated with Medtech firms to pilot IoT-integrated hospital beds in homecare settings for elderly patients suffering from chronic conditions. Early trials demonstrated a 25.09% reduction in readmission rates due to improved early detection of complications thereby encouraging broader rollout plans. In Singapore, Khoo Teck Puat Hospital deployed smart beds equipped with AI-based fall detection systems thereby reducing patient falls by 18.53% within the first year of implementation. India has also seen growing interest in connected hospital beds especially in private nursing homes and urban clinics. Startups like Tricog and Niramai are partnering with hospital bed manufacturers to integrate digital diagnostics and remote alerts into standard bed models.

MARKET CHALLENGES

Shortage of Skilled Technicians for Maintenance and Operation of Advanced Beds

One of the primary challenges confronting the Asia Pacific hospital bed market is the shortage of skilled technicians and healthcare staff trained in the operation and maintenance of advanced hospital beds. While electric and smart beds offer enhanced functionalities, they also require specialized knowledge for setup, calibration and troubleshooting which is an area where many public and rural healthcare facilities in the region face deficiencies. A similar situation exists in rural India, where healthcare facilities often rely on external vendors for repairs thereby causing delays that compromise patient care. Nearly 45.79% of electric hospital beds in tier-2 and tier-3 cities remained out of service for extended periods due to lack of local repair support in 2023. Moreover, training programs for hospital staff on advanced bed usage are limited thereby resulting in underutilization of available features. In the Philippines, the Professional Regulation Commission acknowledged a gap in formal certification courses for biomedical equipment handling and prompted calls for revised curriculum reforms.

Increasing Preference for Home-Based Care Reducing Hospital Admissions

Another notable challenge affecting the Asia Pacific hospital bed market is the growing preference for home-based care and ambulatory treatment models which is gradually reducing the need for traditional inpatient hospital admissions. As telemedicine, mobile health services and portable medical equipment become more accessible to patients and insurers so they are increasingly opting for outpatient and home-based recovery setups especially for post-surgical and chronic care management. Home healthcare adoption in the APAC region grew by 18.09% annually between 2020 and 2023 supported by advancements in remote monitoring technology and insurance coverage expansion. Similarly, in Japan, the Ministry of Health, Labour and Welfare introduced policies encouraging elderly patients.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Bed Type, Usage, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Invacare Corporation, Paramount Bed Holdings Co. Ltd., Gendron Inc., Medline Industries Inc., and LINET spol. S r.o., Savaria Corporation, Savion Industries, Hill-Rom Holdings Inc., Stryker Corporation, and Getinge Group. |

SEGMENTAL ANALYSIS

By Technology Insights

The manual hospital beds segment dominated the Asia Pacific hospital bed market by capturing 45.09% of the total market share in 2023. This dominance is primarily attributed to their affordability and widespread use in low-income and rural healthcare settings where budget constraints limit the adoption of electric or semi-electric alternatives. In countries like India and Indonesia public hospitals and primary healthcare centers rely heavily on manual beds due to limited capital budgets and infrastructure limitations. Over 60.03% of district-level hospitals in India operate with manual beds as they require minimal maintenance and do not depend on electricity which can be unreliable in remote locations. In Bangladesh, manual beds constituted more than 70.87% of total hospital bed procurements in 2022, thereby reflecting their continued relevance despite technological advancements. These beds are often used in general wards, maternity units and post-operative rehabilitation setups where high mobility and advanced positioning features are not always necessary. Moreover, manufacturers in China and Vietnam have scaled up cost-effective production capabilities thereby supporting large-scale distribution across developing economies.

The electric hospital beds segment is projected to witness a CAGR of 13.5% from 2025 to 2033. This growth is driven by increasing demand for patient-centric care, automation in ICU and surgical departments along with rising adoption in private hospitals aiming to enhance clinical efficiency. In Japan electric bed installations in acute care hospitals increased by over 20.99% between 2020 and 2023 thereby reducing the burden on caregivers. In South Korea, major medical device firms such as Mediplus and Corevic developed IoT-enabled electric beds that integrate with hospital management systems which allow real-time monitoring of patient vitals and posture adjustments. The integration of AI-based analytics into these beds resulted in a 15.65% improvement in pressure ulcer prevention, thereby further driving adoption. In Australia, public health authorities included electric beds in modernization grants for regional hospitals under the National Digital Health Strategy thereby ensuring broader access.

By Bed Type Insights

The regular hospital beds segment was the largest in the Asia Pacific hospital bed market by capturing 38.4% of the total market share in 2024. The widespread use of regular beds is particularly pronounced in emerging economies such as India and Indonesia, where government health policies prioritize expanding hospital infrastructure over immediate adoption of high-end specialty beds.Beds installed in new rural hospitals between 2020 and 2023 were standard non-adjustable models, thereby emphasizing their importance in large-scale healthcare projects. In China, newly constructed county-level hospitals maintain at least 80.97% of their beds as regular models to ensure affordability and operational simplicity. Regular beds remained the most frequently utilized type in internal medicine and general surgery departments which accounted for nearly half of all patient admissions.

The Intensive Care Unit (ICU) segment is estimated to register the fastest CAGR of 14.2% during the forecast period. Critical care admissions in Southeast Asia increased by 25.66% between 2020 and 2023 and is driven by respiratory diseases, sepsis and trauma-related conditions. Governments in Thailand and Malaysia responded by allocating substantial funds to upgrade ICU capacities. In South Korea, over 20.28% increase in ICU bed utilization following the introduction of mandatory insurance coverage for intensive care procedures thereby encouraging both public and private hospitals to invest in high-quality equipment. Additionally, Australian hospitals expanded ICU bed availability after the Royal Australasian College of Surgeons recommended upgrades to emergency preparedness infrastructure.

By Usage Insights

The acute care usage segment held the leading share of 52.99% of the Asia Pacific hospital bed market in 2023. This includes hospitals specializing in short-term and intensive treatment for severe injuries, infections, surgical procedures, and sudden illnesses. The dominance of this segment is largely due to the high patient turnover in acute care facilities especially in urban areas where public and private hospitals manage large volumes of surgical and medical admissions daily. Acute care hospitals in Tokyo alone admitted over 2 million patients annually thereby necessitating continuous investment in hospital beds to meet demand. In China,acute care hospitalizations grew by 9% between 2019 and 2023 and supported by expanded insurance coverage and improved access to diagnostic services. Private hospital chains such as Apollo Hospitals and Fortis Healthcare also contributed to this trend by launching multi-specialty acute care centers in tier-2 and tier-3 cities.

The Long-term care (LTC) usage segment is anticipated to witness the fastest CAGR of 15.1% from 2025 to 2033. This growth is primarily driven by the rising elderly population, increasing prevalence of chronic diseases and supportive government initiatives aimed at strengthening senior care infrastructure. In Japan, there were over 8 million individuals aged above 75 years in 2023 many of whom required extended care for stroke, dementia and mobility issues. The government introduced subsidies for LTC facility operators thereby resulting in a 22.09% increase in specialized beds deployed in nursing homes and geriatric care centers between 2020 and 2023. South Korea and Singapore followed similar trajectories with national policies promoting home-based and assisted-living models backed by appropriate hospital bed integration. In addition, India’s National Programme for the Elderly is incentivizing the development of senior care infrastructure thereby prompting private investors to enter the sector.

By End User Insights

The hospitals and clinics segment dominated the hospital bed market by capturing 83.33% of total market share in 2024. This is driven by the vast number of inpatient care facilities across the region ranging from small community hospitals to large multi-specialty institutions. Public healthcare systems in countries like India and Indonesia have significantly expanded their hospital networks under national infrastructure programs. Private healthcare providers have also played a pivotal role in driving demand. In China, hospital groups such as United Family Healthcare and KingMed Diagnostics have invested heavily in upgrading facilities with modern beds equipped with adjustable positions and integrated monitoring capabilities. In Australia, health authorities allocated funding under the National Hospital Infrastructure Plan to replace outdated beds in metropolitan and regional hospitals. Additionally, regulatory mandates in several APAC countries require minimum bed-to-population ratios in registered hospitals thereby reinforcing steady procurement cycles.

The Ambulatory Surgery Centers (ASCs) segment is likely to experience the fastest CAGR of 16.4% from 2025 to 2033. These centers specialize in outpatient procedures thereby offering shorter recovery times, reduced costs and enhanced patient convenience compared to traditional hospital stays.In South Korea, the Ministry of Health and Welfare recognized ASCs as a viable solution to reduce hospital overcrowding and improve surgical accessibility. The number of licensed ASCs doubled between 2020 and 2023 with many installing specialized recovery beds designed for rapid turnover. In Australia, the Private Hospitals Association reported a 28.87% increase in same-day surgical procedures conducted in ASCs and supported by favorable reimbursement policies. India has witnessed a surge in private ASC development particularly in urban centers where patients seek efficient and cost-effective alternatives to hospital-based surgeries. In addition, government initiatives in Japan and Singapore encourage elective surgeries to be performed in ASCs rather than acute care hospitals thereby freeing up hospital beds for emergency cases.

COUNTRY-LEVEL ANALYSIS

China was the top performer in the Asia Pacific hospital bed market and accounted for 27.8% of the total market share in 2023. The country's massive population coupled with rapid healthcare infrastructure expansion, has driven significant demand for hospital beds across public and private sectors. China added over 300,000 hospital beds between 2020 and 2023 thereby reflecting a strategic push to improve healthcare accessibility and service delivery. A key factor behind China’s market growth is its robust domestic manufacturing industry. Companies like Funtech, Mindray and Jiangsu Yuyue have emerged as leading producers of manual and electric hospital beds thereby supplying both domestic hospitals and international markets. China remains a front-runner in shaping the future of the APAC hospital bed landscape with ongoing investments in digital health infrastructure and policy support for modernized hospital facilities.

Japan was positioned second in holding the dominant share of the Asia Pacific hospital bed market in 2023. The country’s well-developed healthcare system, high per capita healthcare expenditure and rapidly aging population contribute to its strong position. Japanese hospitals extensively utilize electric and smart beds equipped with features such as automatic repositioning, weight sensing and fall detection technologies. Japan serves as a testbed for cutting-edge hospital bed innovations with companies like Panasonic and Sanyo collaborating with medical institutions to develop next-generation solutions. The government has also facilitated hospital bed modernization through subsidy programs under the Long-Term Care Insurance System.

India’s hospital bed market growth is primarily driven by expanding public and private healthcare infrastructure, increasing health insurance penetration and rising demand for improved inpatient care. Under the Ayushman Bharat scheme, the Indian government has prioritized hospital bed expansion to address the gap in healthcare access. Over 70,000 new hospital beds were added in government-run facilities between 2018 and 2023 particularly in rural and semi-urban districts. Manufacturers are introducing cost-effective yet durable models tailored for Indian hospitals where budget constraints and high patient turnover dictate purchasing decisions. India is positioned as a key growth engine in the APAC hospital bed market with ongoing investments in medical infrastructure and insurance coverage.

Australia's hospital bed market growth is likely to be driven by a well-funded public healthcare system, stringent quality standards and a strong emphasis on patient comfort and safety. More than 70,000 hospital beds nationwide in 2023, with a significant portion being electric or smart models designed for enhanced caregiving. Government initiatives such as the National Digital Health Strategy have encouraged the integration of intelligent hospital beds capable of real-time data transmission and remote monitoring. Private healthcare providers have also embraced technological advancements along with investing in beds equipped with pressure ulcer prevention systems and voice-controlled adjustment features. Moreover, Australia serves as a regional hub for clinical trials and product testing with multinational hospital bed manufacturers using the country as a gateway for APAC expansion.

South Korea’s hospital bed market growth is driven by rapid technological advancements, government-led healthcare reforms and a strong domestic MedTech industry. The South Korean government has actively supported the adoption of smart hospital infrastructure through policies such as the Smart Healthcare Innovation Roadmap which encourages hospitals to integrate IoT-based devices including hospital beds into their operations. Domestic manufacturers like Corevic and Mediplus have gained recognition for producing technologically advanced beds that cater to both local and export markets. Additionally, rising demand for elderly care beds in nursing homes and rehabilitation centers has created new avenues for growth.

KEY MARKET PARTICIPANTS

Some of the notable companies dominating the APAC hospital beds market profiled in this report are Invacare Corporation, Paramount Bed Holdings Co. Ltd., Gendron Inc., Medline Industries Inc., and LINET spol. S r.o., Savaria Corporation, Savion Industries, Hill-Rom Holdings Inc., Stryker Corporation, and Getinge Group.

TOP LEADING PLAYERS IN THE MARKET

Hill-Rom Holdings, Inc.

Hill-Rom is a globally recognized leader in medical technology and hospital bed manufacturing with a strong presence in the Asia Pacific region. The company offers a comprehensive range of acute care, ICU, surgical and long-term care beds equipped with advanced features such as integrated therapy systems and fall prevention technologies. In the APAC market, Hill-Rom has built strategic partnerships with major healthcare providers and distributors to ensure widespread product availability. Its emphasis on patient safety, caregiver ergonomics and digital integration has made it a preferred choice for hospitals across Japan, Australia and South Korea.

Stryker Corporation

Stryker is a key player in the Asia Pacific hospital bed market known for its high-performance and technologically advanced beds that cater to diverse clinical settings including critical care, rehabilitation and homecare environments. The company leverages its strong R&D capabilities to develop smart beds that enhance patient mobility as well as reduce pressure ulcers and improve nursing efficiency. Stryker has expanded its footprint in APAC through localized manufacturing strategies, collaborative agreements with regional healthcare institutions and participation in government health infrastructure programs.

Funtech Medical Equipment Co., Ltd.

Funtech is a leading Chinese manufacturer that has gained prominence in the Asia Pacific hospital bed market due to its cost-effective yet durable products tailored for both public and private healthcare facilities. The company produces a wide array of manual, semi-electric and fully electric beds suited for general wards, ICUs and elderly care centers. Funtech’s competitive edge lies in its ability to scale production efficiently while maintaining compliance with international safety and quality standards. Funtech supports large-scale hospital expansion projects in China and exports to neighboring Southeast Asian countries.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Enhancing product portfolios through innovation and customization is one of the primary strategies employed by key players in the Asia Pacific hospital bed market. Companies are investing heavily in research and development to introduce beds with advanced functionalities such as automated positioning, remote monitoring and AI-assisted diagnostics. These innovations are tailored to meet specific clinical demands from ICU precision to homecare comfort, thereby allowing firms to differentiate themselves in a competitive environment.

Another crucial approach is expanding distribution networks through strategic partnerships and local collaborations. Major manufacturers are forging alliances with regional distributors, hospital chains and government agencies to ensure seamless market access and after-sales service support. These collaborations enable companies to navigate regulatory complexities and better understand regional healthcare needs thereby facilitating more effective product placement and customer engagement.

Many firms are focusing on digital integration and smart healthcare compatibility to future-proof their offerings. By incorporating IoT-enabled features and integrating hospital beds into broader hospital management systems many manufacturers are aligning their products with the ongoing shift toward connected healthcare ecosystems. This strategy enhances clinical efficiency and positions hospital beds as integral components of modern patient care infrastructure.

COMPETITION OVERVIEW

The competition in the Asia Pacific hospital bed market is marked by a blend of global MedTech giants and emerging regional manufacturers striving to capture market share through differentiation, pricing strategies and technological advancements. Multinational corporations leverage their brand reputation, extensive R&D resources and established distribution channels to maintain dominance in higher-income markets such as Japan, Australia and South Korea. At the same time, domestic producers in China, India and Southeast Asia are gaining traction by offering cost-competitive alternatives without compromising on essential functionalities.Market participants face intense rivalry not only in product performance but also in after-sales services, installation support and training programs for healthcare staff. Pricing pressures are particularly pronounced in public procurement tenders where governments prioritize affordability without sacrificing quality. Additionally, regulatory variations across countries create operational complexities that impact market entry speed and scalability.

RECENT MARKET DEVELOPMENTS

- In February 2024, Hill-Rom partnered with a Japanese healthcare technology firm to co-develop AI-integrated ICU beds capable of real-time patient monitoring and posture adjustments.

- In July 2023, Stryker launched a new line of lightweight portable bariatric beds specifically designed for the Indian market.

- In November 2024, Funtech Medical announced the establishment of a new regional distribution center in Vietnam to streamline logistics and accelerate product delivery across Southeast Asia.

- In March 2023, Getinge AB collaborated with an Australian hospital group to pilot smart beds equipped with pressure ulcer prevention systems in select public hospitals.

- In September 2024, Paramount Bed Holdings entered into a joint venture with a South Korean tech startup to integrate AI-powered sleep monitoring features into its hospital beds.

MARKET SEGMENTATION

This Asia Pacific hospital beds market research report is segmented and sub-segmented into the following categories.

By Technology

- Electric Beds

- Semi-Electric Beds

- Manual Beds

By Bed Type

- Regular Beds

- Pediatrics Bed

- Respiratory Beds

- ICU Beds

- Bariatric Beds

- Birthing Beds

- Pressure Relief Beds

- Others

By Usage

- Critical Care

- Acute Care

- Long-Term Care

By End User

- Hospitals and Clinics

- Ambulatory Surgery Centers (ASCs)

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com