Asia Pacific Microscopy Market Size, Share, Trends & Growth Forecast Report By Product, Type, Application, End User and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) - Industry Analysis From (2025 to 2033)

Asia Pacific Microscopy Market Size

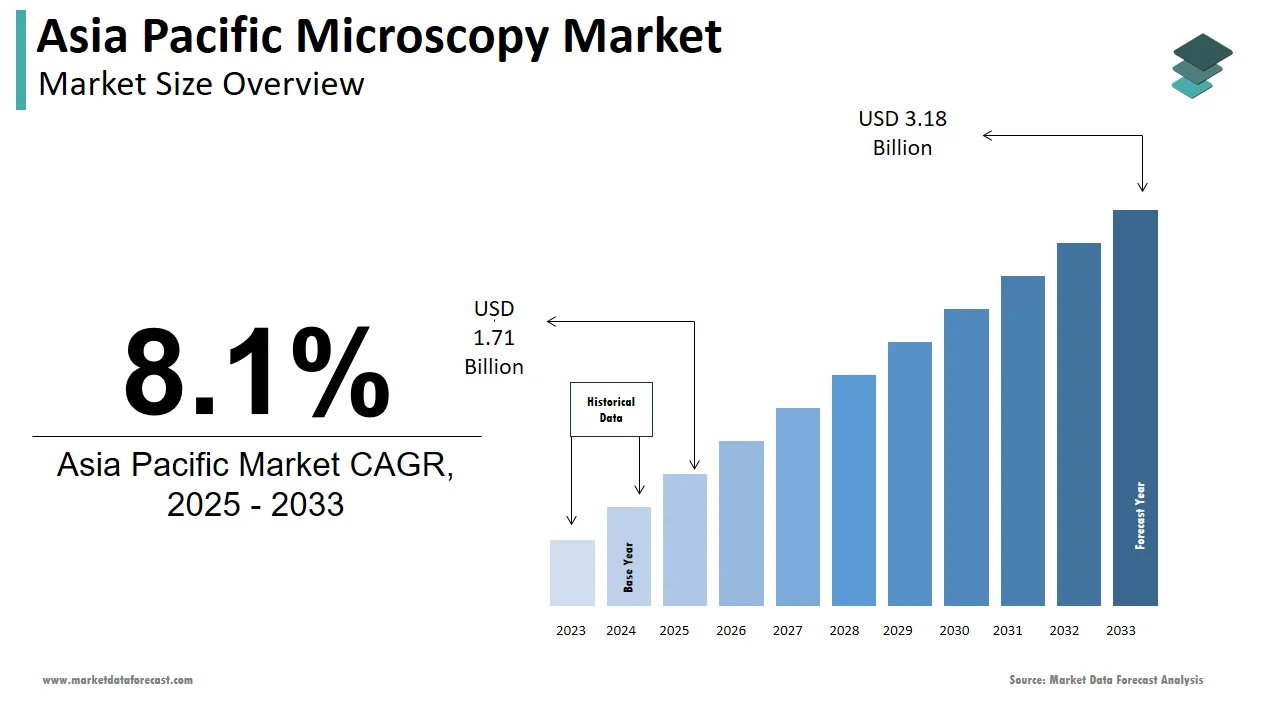

The size of the Asia Pacific microscopy market was worth USD 1.58 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 8.1% from 2025 to 2033 and be worth USD 3.18 billion by 2033 from USD 1.71 billion in 2025.

MARKET DRIVERS

Microscopy Market Growth Fueled by R&D and Nanotechnology Focus

Some factors, such as growing funds and investments in Microscopy R&D, technological advancements, and rising concentration on nanotechnology and regenerative medicine are majorly propelling the microscopy market in the APAC region. In addition, increasing applications in nanotechnology which is one of the existing technology and widely used for an extensive range of applications like electronics, IT applications, healthcare, medical, energy, and other utilities, is also adding fuel to the market growth. Moreover, the low cost of the raw materials, the availability of low-cost experienced labor in this region, and the introduction of artificial intelligence in microscopy are further expected to accelerate the growth in the market in the upcoming years.

MARKET RESTRAINTS

High Costs and Low Awareness Hinder Microscopy Market Growth

The high costs associated with the advanced microscopes and increasing excise tax may hamper the market growth. Besides this, a lack of awareness regarding the microscopy market hinders the growth in this region. Lack of consciousness among the key players is expected to obstruct the growth in this region.

COUNTRY LEVEL ANALYSIS

Regionally, the Asia Pacific is expected to showcase a high CAGR during the forecast period due to swelling research activities in countries like Japan and China. Asia-Pacific is esteemed to have the highest CAGR over the analysis period due to increasing research activities such as China and Japan. Growing research and development funds and investment activities for microscopy, augmenting applications for correlative microscopy towards life sciences and nanotechnology research. In countries like China and India, factors like increasing proficiency and academic excellence in existing APAC countries.

The Japanese microscopy market is projected to showcase the highest CAGR growth rate during the forecast period and is majorly driven by advancements in microscopes. Furthermore, the appearance of enormous key players incorporated with the growing number of local manufacturers is considered to surge the microscopy market in the APAC region.

The Chinese microscopy market is expected to be the largest market in the APAC microscopy market. This is because it has increased demand, low cost, new product developments, and growing applications for microscopy.

The microscopy market in India is predicted to have considerable growth in the historical period as of rising healthcare domain together with growing applications with existing economies which provides various advantages with which causes to the development of microscopy in the market of this region.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC microscopy market profiled in this report are Carl Zeiss, Danaher, Thermo Fisher, Nikon, Bruker Corporation, Olympus, Oxford Instruments, JEOL Hitachi High-Technologies, Keyence, Vision Engineering, and Helmut Hund.

MARKET SEGMENTATION

This Asia Pacific microscopy market research report is segmented and sub-segmented into the following categories.

By Product

- Microscopes

- Accessories

By Type

- Optical Microscope

- Electron Microscope

- AFM

- STM

- NSOM

By Application

- Semiconductor

- Nanotechnology

- Electronics

By End User

- Industrial

- Research Institutes

- Blood Bank

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com