Global Artificial Pancreas Device Systems Market Size, Share, Trends & Growth Forecast Report By Type, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Artificial Pancreas Device Systems Market Size

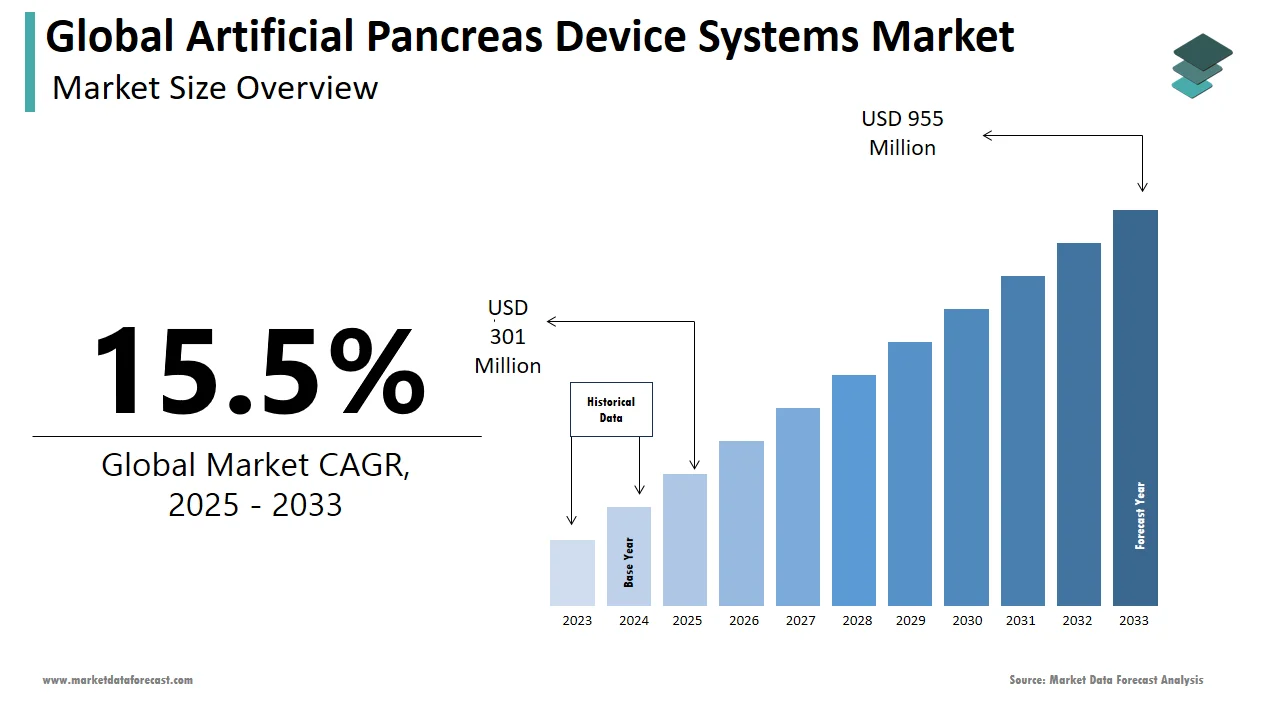

The size of the global artificial pancreas device systems market was worth USD 261 million in 2024. The global market is anticipated to grow at a CAGR of 15.5% from 2025 to 2033 and be worth USD 955 million by 2033 from USD 301 million in 2025.

MARKET DRIVERS

The growing diabetic population and the increasing prevalence of diabetes are the main reasons for the increasing demand for an artificial pancreas device system (APDS) during the forecast period.

According to the International Diabetes Federation (IDF), in 2021, more than 537 million adults (20-79 years old) worldwide will be living with diabetes globally. The total number of people living with diabetes is estimated to reach 643 million by 2030 and 783 million by 2045. Low- and middle-income countries are the most affected, particularly in Asia, Africa, and Latin America. The rising prevalence of pancreatic cancer, pancreatitis, and other chronic conditions also drives the market. In addition, the increasing incidence of obesity due to age-related factors, physical inactivity, and unhealthy eating habits are also contributing to the widespread adoption of APDS in the world.

APDS automatically monitors glucose levels and delivers insulin doses throughout the day in controlled amounts. Almost 1 in 2 adults (240 million) live with diabetes and are undiagnosed. In 2021, approximately 6.7 million deaths were due to diabetes. Hence, the use of APDS will decrease the death rate and complications in diabetic patients across the globe. There is a massive requirement for an effective and long-lasting alternative drug that can substitute insulin. However, type 2 diabetes can be well controlled in most patients with oral medications, but people with type 1 diabetes should use insulin first. Various technological innovations, including the development of software-based wireless systems that integrate with automated controls, further contribute to the market's growth. At least US$966 billion in healthcare spending was spent on diabetes in 2021, including 9% of total spending for adults.

More than 10% of the diabetic population is affected by type 1 diabetes. People with type 1 diabetes need to inject insulin daily to control their blood sugar and symptoms. In addition, worldwide, more than 1.2 million children and adolescents (0-19 years old) live with type-1 diabetes. Thus, it increases the demand for APDS and further drives the market's growth. Growing demand for effective minimally invasive (MI) diabetes monitoring and drug delivery systems is also driving market growth. Local governments in many countries are investing heavily in research and development (R&D) to improve healthcare infrastructure worldwide.

MARKET RESTRAINTS

However, certain restraints and difficulties encountered may hinder the growth of the artificial pancreas device system market, such as the lack of trained professionals in underdeveloped regions like Africa and South America and limited resources for research and development.

Impact Of COVID-19 on The Global Artificial Pancreas Device Systems Market

The artificial pancreas device systems market is analyzed to witness substantial growth post-pandemic. However, COVID-19 has affected global economies and various industries due to lockdowns, travel bans, and shutting down of manufacturing units. As the COVID-19 pandemic progresses, the healthcare sector is expected to experience a decline in market growth due to a decrease in sales from a decline in the number of surgeries performed and delayed or prolonged equipment supplies. Additionally, the halt in clinical trials and subsequent delay in drug launches are also estimated to pave the way for virtual trials in the future. New technologies such as mRNA intend to emerge and change the pharmaceutical sector, and the market is also expected to experience more joint ventures in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.5% |

|

Segments Covered |

By Type, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Medtronic Plc, Johnson & Johnson, Insulet Corp, Tandem Diabetes Care, F. Hoffmann-La Roche Ltd, Beta Bionics, Bigfoot Biomedical Inc., Inreda Diabetic B.V., Dexcom, Inc., and Cellnovo., and Others. |

SEGMENTAL ANALYSIS

By Type Insights

Based on type, the control-to-target system segment held the largest share of the worldwide market in 2024 and is expected to grow with the highest CAGR during the forecast period. The CTT system is anticipated to witness the fastest growth with a healthy CAGR. CTT system is a fully automated system that minimizes patient intervention, and this factor will contribute to the market growth rate.

By End User Insights

Based on end-user, the hospital segment held the leading share of the global market in 2024 and is anticipated to grow at a notable share of the global market during the forecast period. The growth of this segment can be attributed to the growing number of hospitals with the latest adoption of APDS and the presence of skilled labor.

REGIONAL ANALYSIS

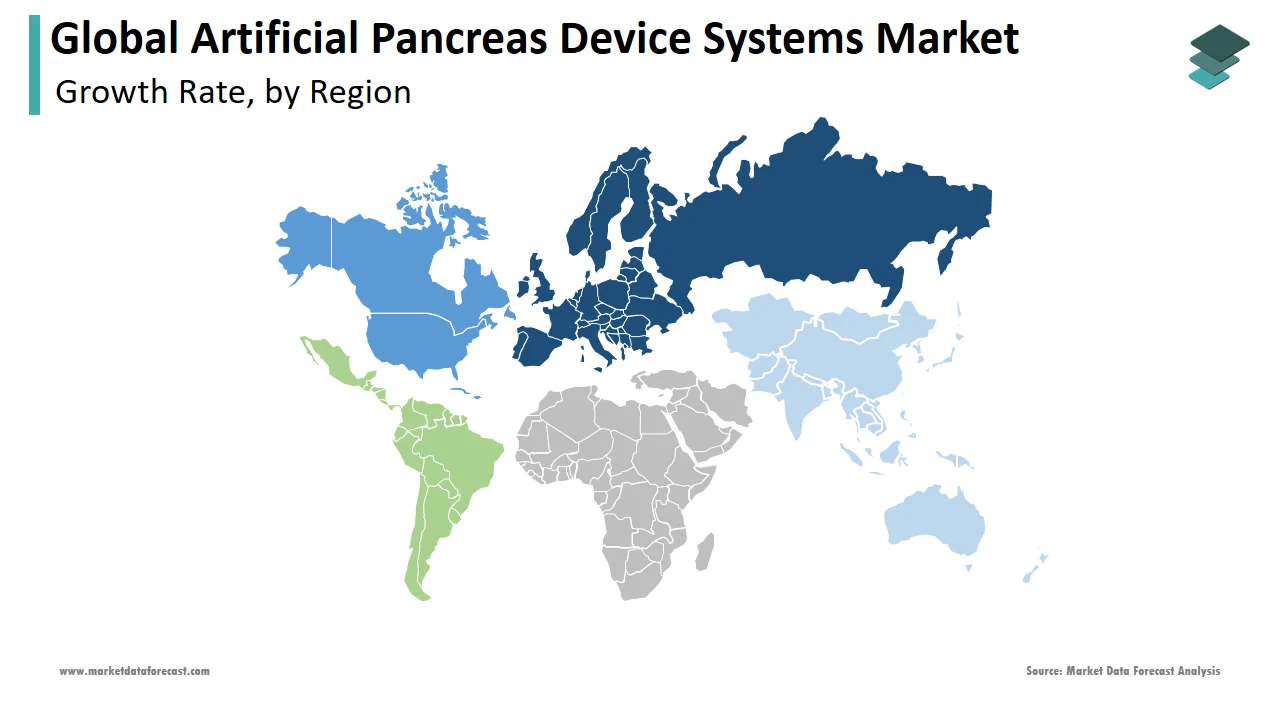

Europe dominated the artificial pancreas device system market, and it is likely to continue the same trend during the forecast period. According to Beyond Type 1, approximately 1.64 million people have type 1 diabetes. In addition, 5 million people are estimated to be diagnosed with type 1 diabetes by 2050. A higher incidence of diabetes will be the primary driver leading the market in this region. According to the Administration of Food and Drug Administration, using an artificial pancreas is associated with better blood sugar control in people with type 1 diabetes than the normal methods. Hence, owing to this factor, major players are increasing funding to develop better and more innovative devices to cater to the growing market demand across European countries.

During the forecast period, North America is estimated to be a significant market shareholder, owing to various factors such as the rising geriatric population, the high incidence rate of diabetes and its complications, well-developed medical facilities, and technological advancements. According to the Centers for Disease Control and Prevention (CDC) National Diabetes Statistics 2020 report, approximately 34.24 million people of all ages had diabetes in the United States in 2018. The percentage of adults with diabetes has increased with age to reach 26.8% among those over 65. Additionally, nearly 88 million American adults were estimated to have prediabetes in 2018. According to the Institute for Health Metrics and Evaluation, the prevalence rate of diabetes mellitus in 2019 was estimated at 11,847 per 100,000 and 11,366 per 100,000 in 2018 in the U.S. The elderly population is more susceptible to acquiring diabetes with age and a preference for a sedentary lifestyle in the region. Based on the Bureau of Population Reference's Aging in America population bulletin, the number of Americans age 65 and older is expected to nearly double, from 52 million in 2018 to 95 million by 2060.

However, the APAC region is projected to witness the fastest growth in the studied market. The development of this regional market is due to factors such as growing demand for APDS in developing countries, increasing healthcare expenditure, and the availability of a large population base. According to an article published by NCBI, Asian countries account for more than 60% of the global diabetic population, driving the growth of the APDS market in the region.

KEY MARKET PARTICIPANTS

Some of the noteworthy companies that dominate the global artificial pancreas device systems market in this report are Medtronic Plc, Johnson & Johnson, Insulet Corp, Tandem Diabetes Care, F. Hoffmann-La Roche Ltd, Beta Bionics, Bigfoot Biomedical Inc., Inreda Diabetic B.V., Dexcom, Inc., and Cellnovo.The aforementioned market is highly competitive, with significant players dominating the market. Many small and medium-sized enterprises are also stepping into the artificial pancreas device systems market, leading to impressive growth over the analysis period.

MARKET SEGMENTATION

This research report on the global artificial pancreas device systems market has been segmented and sub-segmented based on type, end-user, and region.

By Type

- Control to Range

- Control to Target Systems

By End User

- Hospital

- Medical Centers

- Others

By Region

- North America

- The U.S.

- Canada

- Rest of North America

- Europe

- UK

- France

- Spain

- Germany

- Italy

- Rest of EU

- Asia-Pacific

- India

- China

- Japan

- South Korea

- Australia & New Zealand

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

- Middle East

- Africa

Frequently Asked Questions

What was the size of the artificial pancreas devices systems market in 2024?

The global artificial pancreas devices systems market size was valued at USD 261 million in 2024.

What factors are driving the growth of the artificial pancreas devices systems market?

The growth of the artificial pancreas devices systems market is primarily driven by the increasing prevalence of type 1 diabetes, rising adoption of APDS for diabetes management, and technological advancements in the field of diabetes management devices.

Who are the key players in the artificial pancreas devices systems market?

Some of the key players operating in the artificial pancreas devices systems market include Medtronic, Insulet Corporation, Tandem Diabetes Care, Beta Bionics, Cellnovo, Bigfoot Biomedical, and Diabeloop.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com