Asia Pacific Ablation Devices Market Size, Share, Trends & Growth Forecast Report By Device Technology (Radiofrequency Devices, Laser/Light Ablation, Ultrasound Devices, Cryoablation Devices, Other Devices), By Application (Cancer, Cardiovascular, Ophthalmologic, Gynecological, Urological, Cosmetic, Others), By End Users (Hospitals, ASCs, Others), and Country (India, China, Japan, South Korea, Australia, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific Ablation Devices Market Size

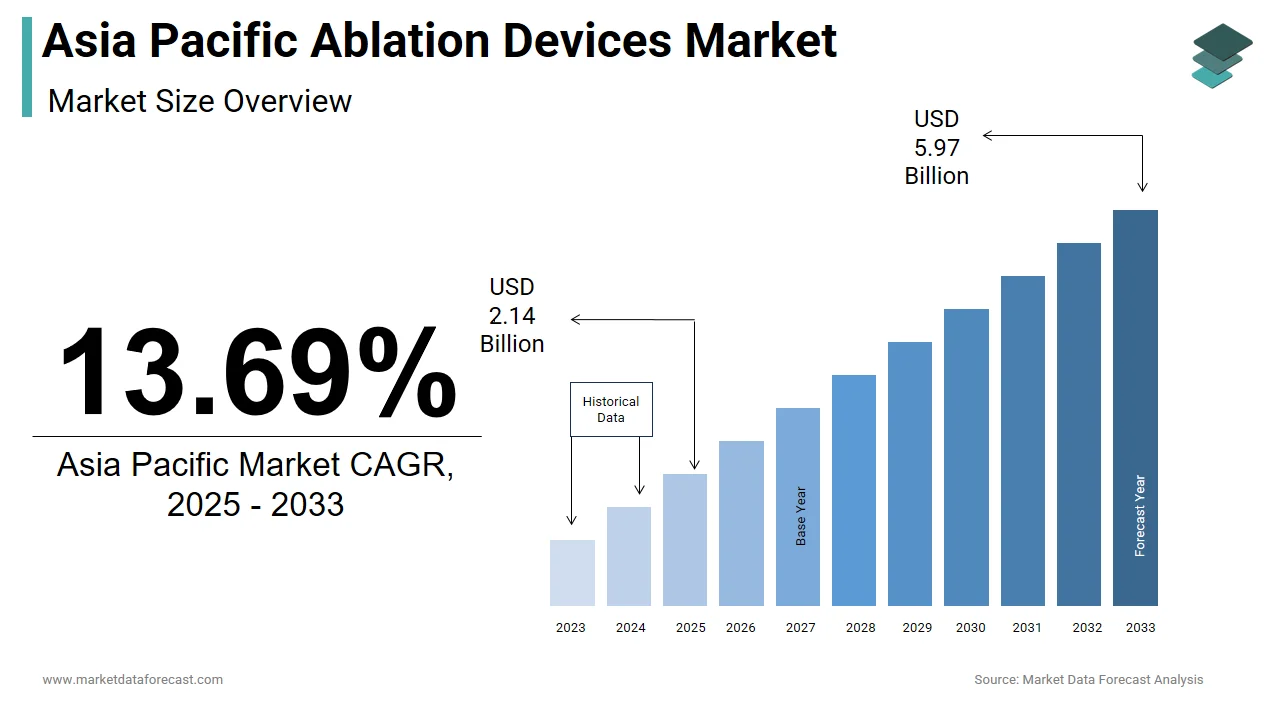

The size of the Asia Pacific ablation devices market was worth USD 1.88 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 13.69% from 2025 to 2033 and be worth USD 5.97 billion by 2033 from USD 2.14 billion in 2025.

The Asia Pacific ablation devices market growth is driven by the growing adoption of minimally invasive procedures that utilize heat, cold, or other energy sources to destroy abnormal tissue. These devices are widely utilized in cardiology, oncology, and pain management to treat conditions such as cardiac arrhythmias, tumors, and chronic nerve pain. The region has witnessed a surge in demand for these devices due to the rising prevalence of lifestyle diseases, thereby improving healthcare infrastructure and growing adoption of advanced therapeutic solutions. Non-communicable diseases account for over 60.97% of total deaths in the Asia Pacific region, significantly driving the need for efficient interventional therapies. Moreover, the increasing geriatric population across countries like Japan and South Korea further amplifies the demand for ablation-based treatments. Growth in electrophysiology labs and investment by major global players in emerging markets like India and China have played a crucial role in shaping the regional landscape. The expansion of private healthcare networks and rising disposable incomes are also contributing to greater patient access to ablation procedures.

MARKET DRIVERS

Rise in Prevalence of Cardiac Arrhythmias

Escalating incidence of cardiac arrhythmias is one of the most significant drivers fueling the Asia Pacific ablation devices market. AFib affects nearly 13 million individuals across the region, with a projected increase of over 20.87% in new cases by 2030. This surge is primarily attributed to aging populations, as well as rising obesity rates and increased diagnosis capabilities. Countries such as Australia, Japan, and South Korea report high hospitalization rates due to rhythm disorders, thereby directly boosting the utilization of catheter ablation procedures. Moreover, technological advancements have enhanced the precision and safety of ablation systems. For instance, the uptake of cryoablation and radiofrequency ablation technologies has grown rapidly in urban hospitals. Additionally, government initiatives aimed at expanding cardiovascular care access, especially in Southeast Asian nations, are accelerating device adoption.

Expansion of Healthcare Infrastructure and Private Medical Facilities

Expansion of healthcare infrastructure and private medical facilities is another pivotal factor driving the Asia Pacific ablation devices market. Substantial investments in countries like Indonesia, Vietnam, and the Philippines are leading to the adoption of advanced diagnostic and therapeutic technologies in modern healthcare settings. The number of private hospital beds in Southeast Asia has experienced steady growth in recent years, thereby fostering a favorable environment for the adoption of ablation technologies. In tandem, rising health insurance penetration and out-of-pocket expenditure in the private sector have improved patient affordability for complex procedures. The Insurance Information Institute reports that private health insurance coverage in Thailand increased by nearly 12.76% in 2022 alone, thereby enabling broader access to ablation therapies. Strategic collaborations between international device manufacturers and local distributors have facilitated easier access to ablation systems. For example, Boston Scientific and Abbott have established regional hubs in Singapore and Malaysia to streamline supply chains and reduce costs.

MARKET RESTRAINTS

High Cost of Advanced Ablation Technologies

The high cost associated with advanced ablation technologies is one of the primary constraints hindering the growth of the Asia Pacific ablation devices market. Sophisticated systems such as robotic-assisted platforms and high-resolution mapping devices often require significant capital investment, thereby making them inaccessible to smaller hospitals and clinics, especially in low- and middle-income countries. The average cost of setting up a fully equipped electrophysiology lab capable of performing complex ablations exceeds USD 2 million. This financial burden is further exacerbated by the recurring expenses related to consumables, maintenance, and physician training. In countries like Nepal and Cambodia where public healthcare spending remains below 5% of GDP. Even in moderately developed markets such as Bangladesh and Lao,s only a handful of tertiary care centers can afford to integrate next-generation ablation systems into their routine practices. Additionally, the lack of standardized reimbursement policies across several Asia Pacific nations limits patient access to these procedures.

Shortage of Trained Professionals and Standardized Training Programs

Scarcity of skilled healthcare professionals trained in advanced ablation techniques is s significant restraint affecting the Asia Pacific ablation devices market. Performing ablation procedures requires specialized knowledge in electrophysiology, imaging, and real-time navigation yet the availability of adequately trained cardiologists and technicians remains uneven across the region. Only 40.77% of hospitals in Indonesia and the Philippines have access to certified electrophysiologists capable of conducting complex ablation surgeries. This shortage is particularly pronounced in rural and semi-urban areas where access to structured education programs in interventional cardiology is limited. In India, fewer than 10.72% of general cardiologists undergo formal training in ablation procedures despite the large size of the overall cardiology workforce. Moreover, the learning curve associated with advanced ablation systems such as contact force sensing catheters and 3D electroanatomical mapping requires prolonged hands-on experience, which is often unavailable in lower-tier medical institutions. Japan and South Korea lead in technology adoption, yet both countries face challenges in scaling up workforce readiness due to stringent regulatory requirements for specialist accreditation. It takes an average of three to five years for a cardiologist in the Asia Pacific region to become proficient in catheter ablation techniques, thereby limiting the speed of market penetration.

MARKET OPPORTUNITIES

Increasing Incidence of Cancer and Growing Adoption of Minimally Invasive Oncological Treatments

One of the most promising opportunities in the Asia Pacific ablation devices market lies in the rising prevalence of cancer and the increasing shift toward minimally invasive tumor ablation techniques. The Asia Pacific region accounts for nearly 50.34% of all new cancer cases globally, with liver, lung and thyroid cancers being particularly prevalent in countries such as China, India, and Japan. Due to the higher risks and extended recovery periods associated with traditional surgical procedures, there is an increasing shift toward image-guided ablation therapies such as radiofrequency ablation (RFA), microwave ablation (MWA,) and cryoablation. The effectiveness of these techniques in treating small-to-moderate-sized tumors is gaining traction among oncologists. Ablation therapies were found to achieve local tumor control rates exceeding 85.6% in hepatocellular carcinoma patients who were not eligible for surgery. Moreover, regulatory approvals and favorable reimbursement policies in countries like Australia and South Korea have accelerated the integration of ablation into standard cancer care protocols.

Technological Advancements and Innovations in Ablation Systems

Technological evolution is emerging as a transformative opportunity in the Asia Pacific ablation devices market and is driven by innovations that enhance procedural accuracy, reduce complications, and expand treatment indications. Manufacturers are increasingly investing in AI-integrated mapping systems, robotic-assisted platforms, and real-time monitoring tools to improve clinical outcomes. The global ablation devices market is expected to grow at a CAGR of over 10% from 2023 to 2030 with the Asia Pacific region contributing significantly due to the rising adoption of next-generation technologies. One notable advancement is the introduction of high-resolution electroanatomical mapping systems, which enable physicians to visualize cardiac structures with greater precision. Companies like Abbott and Biosense Webster have launched AI-powered platforms that facilitate faster lesion creation and better identification of arrhythmogenic substrates. The uptake of such systems in Japanese and South Korean hospitals has increased by more than 20.33% annually, thereby reflecting strong institutional support for digital transformation in cardiology. Additionally, the emergence of pulsed field ablation (PFA), which selectively targets cardiac tissue without damaging surrounding structures, is gaining attention across the region. Clinical trials conducted in Singapore and Australia have demonstrated PFA's potential to reduce procedural time and improve patient recovery rates.

MARKET CHALLENGES

Regulatory Hurdles and Lengthy Approval Processes

One of the foremost challenges confronting the Asia Pacific ablation devices market is the complexity and variability of regulatory frameworks across different countries. Each nation maintains its own set of approval procedures, thereby requiring manufacturers to undergo multiple compliance checks before introducing a product to the market. Japan enforces stringent evaluation standards through the Pharmaceuticals and Medical Devices Agency (PMDA), mandating extensive clinical data even for modified versions of existing devices. In India, the Central Drugs Standard Control Organization (CDSCO) has implemented revised guidelines in 2023 that require additional post-market surveillance and quality documentation,n thereby increasing the regulatory burden on foreign manufacturers. A significant proportion of medical device companies face delays in product launches across the Asia Pacific region due to challenges in navigating complex local regulatory frameworks. Moreover, inconsistent enforcement of quality standards across regions complicates supply chain logistics and increases operational costs. In countries like Thailand and the Philippines frequent policy updates and unclear documentation requirements add further layers of complexity.

Limited Awareness and Low Patient Uptake in Rural Areas

A critical challenge impeding the growth of the Asia Pacific ablation devices market is the limited awareness and low patient uptake of ablation therapies in rural and underserved regions. Although ablation technologies are becoming more available in urban hospitals, a large segment of the population in remote areas remains unaware of minimally invasive treatment options. Rural populations in countries like India, Indonesia and Vietnam constitute over 60.98% of the total population, despite that they exhibit significantly lower rates of specialist consultation and early disease detection. This disparity stems from inadequate healthcare outreach programs and insufficient dissemination of medical education in rural settings. In India, less than 25.64% of rural patients diagnosed with arrhythmias received referrals for electrophysiological evaluation, largely due to misconceptions about treatment options and financial constraints. Furthermore, the absence of mobile diagnostic units and telemedicine networks in many rural districts exacerbates the problem, thereby preventing timely diagnosis and intervention. Even when patients are aware of ablation procedures, affordability and accessibility remain major barriers. Public health facilities in rural areas often lack the necessary infrastructure to perform ablation thereby pushing patients toward expensive private clinics. Nearly 50.62% of rural patients in the Philippines and Bangladesh cannot afford out-of-pocket payments for specialty treatments.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Device Technology, Application, End-uses, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Abbott Laboratories, Boston Scientific Corporation, Medtronic PLC, Conmed Corporation, and Olympus Corporation. |

SEGMENTAL ANALYSIS

By Device Technology Insights

The radiofrequency ablation devices segment was the largest and held 38.6% of the Asia Pacific ablation devices market share in 2024 due to the widespread adoption of RFA across multiple clinical applications such as cardiology, oncology and chronic pain management. RFA remains the most preferred energy modality due to its proven efficacy, cost-effectiveness and availability of skilled professionals trained in RF-based procedures. One key factor driving its growth is the increasing prevalence of cardiac arrhythmias in the region. The Asia Pacific Heart Rhythm Society reported in early 2024 that atrial fibrillation alone affects over 15 million individuals across major countries like China, India and Japan. Hospitals are increasingly investing in RF mapping and ablation systems as RFA catheterization is considered a gold standard for treating complex arrhythmias. Additionally, regulatory approvals are faster for RFA technologies compared to newer modalities thereby enabling quicker integration into clinical workflows. Another contributing element is the robust presence of global manufacturers in the region. Companies such as Abbott and Medtronic have localized their production and distribution networks, especially in China and India thereby leading to lower procurement costs.

The cryoablation devices segment is projected to witness a CAGR of 13.2% between 2025 and 2033. This acceleration is largely driven by technological advancements that enhance procedural safety particularly in cardiac and oncological interventions. A primary driver is the rising preference for cryoablation in treating atrial fibrillation due to its ability to create transmural lesions without charring tissue or causing thromboembolic complications. In Japan, the use of cryo balloons increased by over 25.4% in 2023 as cardiologists rapidly adopt advanced rhythm disorder therapies. In South Korea, reimbursement policies introduced by the National Health Insurance Service now cover cryo-based ablations for selected cardiac conditions which significantly boost adoption. Another key growth enabler is the expanding application of cryoablation in oncology. In Australia, public hospitals have integrated cryoablation for early-stage renal tumors due to its minimal invasiveness and shorter recovery times. Local tumor control rates using cryoablation exceeded 90.72% in patients with small renal masses.

By Application Insights

The cardiovascular disease treatment segment held the leading share of the Asia Pacific ablation devices market share in 2024 with the surging burden of heart rhythm disorders and the critical role ablation plays in managing conditions like atrial fibrillation, ventricular tachycardia and supraventricular tachycardia. Cardiovascular diseases account for more than 35.9% of all deaths in the Asia Pacific with arrhythmias being a significant contributor to hospitalizations and mortality. The rise in atrial fibrillation cases is a key catalyst. Over 15 million individuals in the region suffer from AFib with projections showing a 20.83% increase by 2030. Countries like Japan and South Korea are witnessing high penetration of electrophysiological studies and catheter ablation procedures. In China, the Ministry of Health has sanctioned over 500 new electrophysiology labs since 2019. Private healthcare providers in India are also investing heavily in catheter labs with Apollo Hospitals reporting a 45.63% year-on-year increase in ablation procedures in 2023.

The cancer treatment segment is likely to register a CAGR of 14.1% during the forecast period. This rapid expansion is primarily fueled by the escalating incidence of cancers amenable to minimally invasive ablation techniques such as liver, lung and thyroid malignancies. The Asia Pacific region accounts for nearly half of all new cancer cases globally with China and India bearing the largest shares. Liver cancer is a strong growth driver. In China over 400,000 new cases of hepatocellular carcinoma in 2023, many of which were treated using radiofrequency or microwave ablation due to limited surgical options. The high success rates of these procedures with over 85% local tumor control have bolstered their acceptance among oncologists. Moreover, the expansion of dedicated cancer centers and improved insurance coverage for interventional oncology procedures is further enhancing access.

By End User Insights

The hospitals segment was the largest segment in the Asia Pacific ablation devices market share in 2024 with the extensive use of ablation procedures in tertiary and secondary care hospitals for a range of therapeutic applications including cardiology, oncology and pain management. Hospitals across the region have increasingly invested in infrastructure upgrades particularly in hybrid operating rooms equipped with advanced imaging and navigation tools essential for performing ablation procedures. In Japan, over 200 hospitals had fully operational electrophysiology labs thereby facilitating thousands of cardiac ablation procedures annually. In India state-run health policy frameworks such as Ayushman Bharat have expanded access to ablation therapies in public hospitals. The presence of experienced medical professionals and multidisciplinary teams in hospitals enhances procedural success rates and patient outcomes. Clinical reviews show that complication-free discharge rates after ablation procedures in large hospitals surpass 95.86% thereby reinforcing the central role of hospitals in providing these services.

The Ambulatory Surgical Centers (ASCs) segment is anticipated to witness the fastest CAGR of 11.8% in the coming years. This growth trajectory is primarily driven by a shift toward outpatient procedures, cost efficiencies and enhanced patient convenience offered by ASCs compared to traditional hospital settings. The number of ASCs across Southeast Asia and Australia has grown by over 15.66% annually thereby reflecting increased demand for same-day surgeries and minimally invasive treatments. One major growth driver is the rising preference for non-invasive ablation procedures for chronic pain and minor cardiac dysfunctions. In Australia, Medicare has expanded rebates for certain ablation procedures conducted in ASCs while making them financially viable for both providers and patients. Another contributing factor is the development of compact and portable ablation devices tailored for smaller facilities. Companies such as Boston Scientific and Bovie Medical have launched user-friendly systems that require minimal setup and training. The installation costs of ablation equipment in certain healthcare settings are significantly lower than in hospitals thereby providing an additional incentive for adoption.

COUNTRY-LEVEL ANALYSIS

China was the top performer in the Asia Pacific ablation devices landscape market and accounted for 25.8% of the share in 2024. This is driven by a combination of a large patient pool suffering from cardiovascular diseases as well as aggressive domestic manufacturing expansion and increasing government support for modernizing healthcare infrastructure. The number of diagnosed atrial fibrillation cases surpassed 12 million in 2023, thereby creating sustained demand for catheter ablation procedures. Along with rising disease prevalence the proliferation of private hospitals and the expansion of urban healthcare networks have facilitated greater access to ablation therapies. Over 800 new electrophysiology labs were established in Tier-1 and Tier-2 cities over the past five years thereby significantly boosting procedural volumes. Moreover, multinational companies such as Abbott and Medtronic have intensified their presence through joint ventures and localized R&D thereby catering to the growing demand for advanced ablation systems

Japan was positioned second in holding the dominant share of the Asia Pacific ablation devices market. The country's mature healthcare system coupled with an aging population and high prevalence of chronic conditions supports a thriving demand for ablation technologies. More than 1.5 million people in Japan suffer from atrial fibrillation with over 80.13% of electrophysiology labs utilizing either radiofrequency or cryoablation techniques. A major factor underpinning Japan's strong market position is its early adoption of innovative ablation technologies. Japanese hospitals are known for integrating AI-powered mapping systems and robotic-assisted platforms at a faster pace than many other regional counterparts. The Pharmaceuticals and Medical Devices Agency (PMDA) has been proactive in approving novel ablation solutions thereby allowing quicker access to cutting-edge devices. Japan was among the first countries in the region to approve pulsed field ablation technology for cardiac rhythm disorders. Furthermore, favorable reimbursement policies by the Ministry of Health, Labour and Welfare encourage widespread utilization of ablation therapies.

India’s ablation devices market is driven by a rapidly expanding middle class along with rising burden of lifestyle-related diseases and increasing investments in private healthcare infrastructure. The number of ablation procedures performed annually in India has more than tripled over the last decade. One of the major growth drivers is the surge in cardiovascular ailments particularly in urban centers. Over 10 million Indians suffer from atrial fibrillation which leads to heightened demand for catheter ablation. The localization of ablation device manufacturing and distribution is helping reduce costs and improve availability. Domestic players such as Transmedics and Meril Life Sciences are gaining traction by offering affordable alternatives to imported products. The average cost of ablation in India is nearly 40.52% lower than in neighboring countries thereby making it a competitive hub for medical tourism and domestic consumption alike.

Australia's ablation devices market share is likely to grow with the adoption of well-developed healthcare ecosystem along with high healthcare expenditure per capita and strong regulatory support for medical innovation. Cardiovascular diseases remain one of the leading causes of death affecting over 4.2 million Australians which fuels consistent demand for ablation-based interventions. The high adoption rate of advanced ablation technologies is another distinguishing factor. Australian hospitals have widely integrated AI-driven mapping systems and robotic-assisted platforms thereby ensuring superior procedural accuracy. The country's healthcare facilities have some of the highest utilization rates of cryoablation and pulsed field ablation in the Asia Pacific. Moreover, Australia's robust reimbursement framework facilitates broad access to ablation procedures. The Medical Services Advisory Committee (MSAC) revised its coverage policies in 2023 to include additional indications for thermal ablation in oncology thereby expanding applicability beyond cardiology.

South Korea’s ablation devices market is driven by a technologically advanced healthcare system and rising prevalence of chronic diseases. The country recorded over 1.2 million diagnosed cases of arrhythmias in 2023 with a significant portion undergoing ablation therapy. This has led to a surge in demand for advanced ablation systems particularly in Seoul and Busan-based hospitals known for adopting cutting-edge medical technologies. A core driver of growth is South Korea’s emphasis on digital healthcare and medical innovation. Cardiovascular procedures in tertiary hospitals now incorporate ablation-based interventions. Additionally, South Korea benefits from a highly integrated supply chain for medical devices supported by partnerships between domestic firms and international players. Companies such as Samsung Medison and Sejong Healthcare have developed indigenous ablation solutions tailored for local and export markets.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC ablation devices market profiled in this report are Abbott Laboratories, Boston Scientific Corporation, Medtronic PLC, Conmed Corporation, and Olympus Corporation.

TOP LEADING PLAYERS IN THE MARKET

Abbott Laboratories

Abbott is a leading global player in the ablation devices market and maintains a strong presence across the Asia Pacific region. The company offers a wide portfolio of ablation technologies which include advanced catheters and mapping systems that cater to cardiac and oncological applications. Abbott’s strategic partnerships with regional healthcare providers have enabled it to enhance distribution and improve access to its products. Its emphasis on innovation and continuous R&D has strengthened its reputation as a trusted partner in minimally invasive therapies.

Boston Scientific Corporation

Boston Scientific is a dominant force in the Asia Pacific ablation devices landscape due to its comprehensive product offerings and strong local partnerships. The company focuses on expanding its footprint through localized manufacturing and tailored solutions for diverse patient populations. Boston Scientific also invests heavily in clinical education programs thereby ensuring physician readiness and procedural adoption of its ablation technologies. Its commitment to technological advancement and market expansion makes it a key contributor to the global industry.

Medtronic plc

Medtronic plays a pivotal role in shaping the Asia Pacific ablation devices market by offering cutting-edge ablation platforms aimed at treating cardiac arrhythmias and chronic pain. The company’s robust distribution network and collaborations with healthcare institutions support widespread adoption of its technologies. Medtronic emphasizes patient-centric innovation and works closely with regulatory bodies to expedite product approvals in the region. Its long-standing market presence and focus on digital integration further strengthen its top position.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Product innovation and technology development is one major strategy employed by leading players in the Asia Pacific ablation devices market. Companies are continuously enhancing their portfolios with next-generation ablation systems that offer improved precision, shorter procedure times and better patient outcomes. This includes integrating AI, robotics and real-time imaging into existing platforms to meet evolving clinical demands.

Another key approach is strategic collaborations and partnerships particularly with regional distributors, hospitals and research institutions. These alliances enable companies to expand their reach along with navigating complex regulatory landscapes and accelerate market entry while maintaining compliance and localization standards. Market localization and tailored business models are being leveraged to adapt to the diverse economic and healthcare environments within the Asia Pacific.

COMPETITION OVERVIEW

The Asia Pacific ablation devices market is characterized by intense competition driven by the presence of established global players and an increasing number of regional manufacturers entering the space. Multinational corporations such as Abbott, Boston Scientific and Medtronic maintain a dominant position due to their extensive product portfolios, advanced technologies and strong distribution networks. However, domestic firms in countries like China and India are rapidly gaining traction by offering cost-effective alternatives that cater to price-sensitive segments. The level of innovation and differentiation among products plays a crucial role in shaping competitive advantage with companies striving to introduce novel platforms that integrate artificial intelligence along with enhanced imaging and robotic assistance. Additionally, regulatory variations across countries present both opportunities and challenges for new entrants as well as established players seeking to expand their regional footprint. Strategic mergers, acquisitions and collaborative ventures are increasingly used as tools to consolidate market presence and respond to evolving clinical and commercial demands.

RECENT MARKET DEVELOPMENTS

- In February 2024, Abbott launched a new regional innovation center in Singapore focused on advancing ablation technologies tailored for the Asia Pacific population.

- In June 2023, Boston Scientific expanded its manufacturing facility in Malaysia to increase production capacity for radiofrequency ablation devices and streamline supply chain efficiency across Southeast Asia.

- In November 2023, Medtronic partnered with a leading Indian hospital chain to establish dedicated electrophysiology training centers.

- In March 2024, Biotronik entered into a distribution agreement with a South Korean medtech firm to broaden its reach in the cardiology segment through enhanced local sales and service capabilities.

- In September 2023, Edwards Lifesciences announced a collaboration with a Japanese diagnostics company to develop integrated imaging systems for use in conjunction with ablation procedures.

MARKET SEGMENTATION

This Asia Pacific ablation devices market research report is segmented and sub-segmented into the following categories.

By Device Technology

- Radiofrequency Devices

- Laser/Light Ablation

- Ultrasound Devices

- Cryoablation Devices

- Other Devices

By Application

- Cancer Treatment

- Cardiovascular Disease Treatment

- Ophthalmologic Treatment

- Gynecological Treatment

- Urological Treatment

- Cosmetic Surgery

- Other Applications

By End Users

- Hospitals

- Ambulatory Surgical Centers

- Other End Users

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What factors are driving the Asia Pacific ablation devices market?

The Asia Pacific ablation devices market is driven by rising incidences of cancer and cardiac arrhythmias, a rapidly aging population, increasing demand for minimally invasive procedures, and ongoing technological advancements

2. What challenges does the Asia Pacific ablation devices market face?

The Asia Pacific ablation devices market faces challenges such as high costs of advanced ablation technologies, shortage of skilled professionals, regulatory complexities, and initial disruptions from events like the COVID-19 pandemic

3. What opportunities exist in the Asia Pacific ablation devices market?

Opportunities in the Asia Pacific ablation devices market include growing adoption of ablation for cancer and cardiac treatments, product innovations, expanding healthcare infrastructure, and rising awareness of minimally invasive options

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com