Asia Pacific Aerostat Systems Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Product, Propulsion Systems, Class, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Aerostat Systems Market Size

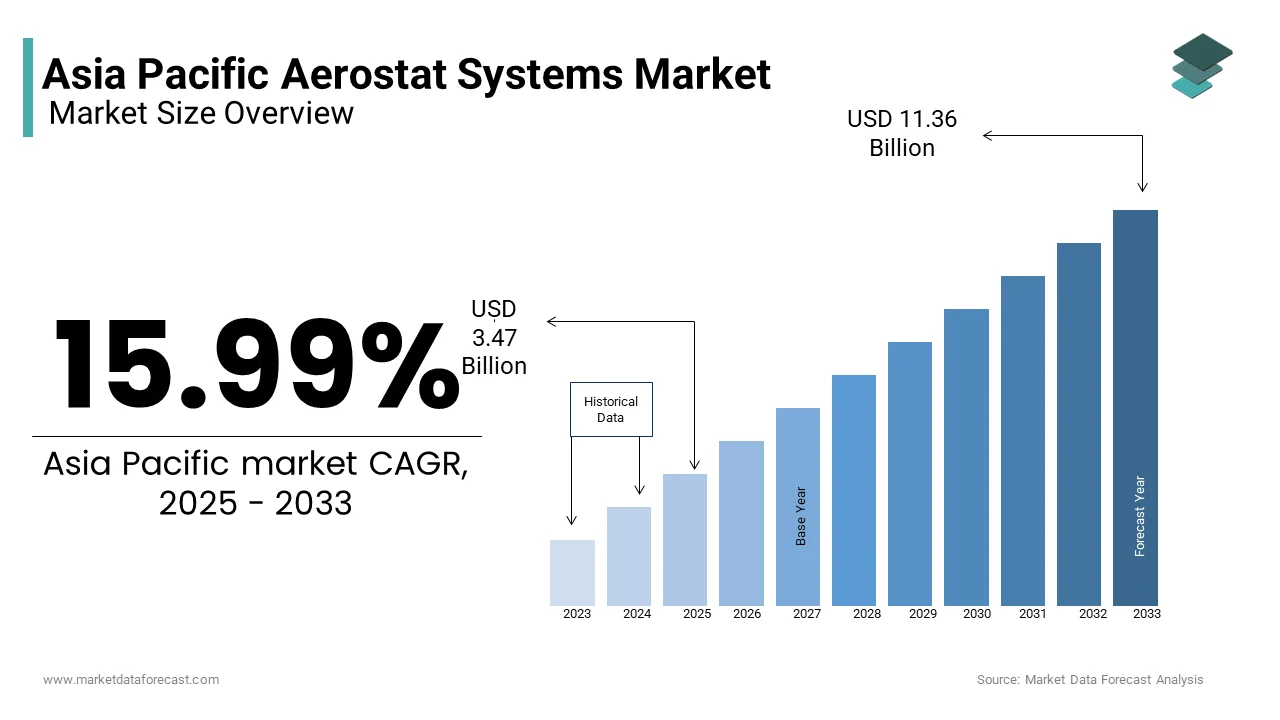

The Asia Pacific aerostat systems market size was valued at USD 2.99 billion in 2024 and is anticipated to reach USD 3.47 billion in 2025 from USD 11.36 billion by 2033, growing at a CAGR of 15.99% during the forecast period from 2025 to 2033.

Current Scenario of the Asia Pacific Aerostat Systems Market

Aerostat systems, buoyant airborne platforms tethered to the ground, have emerged as vital assets in surveillance, communication, and environmental monitoring across the Asia Pacific region. These systems are characterized by their ability to remain airborne for extended durations, providing persistent aerial coverage at a fraction of the cost of traditional aircraft or satellites.

The aerostat systems market in this region benefits from its strategic geopolitical significance. These platforms also play a pivotal role in supporting rural connectivity.

MARKET DRIVERS

Escalating Border Security Concerns Across the Region

The Asia Pacific region is home to some of the world's most contentious borders, including those between India and China, and North Korea and South Korea. Like, the region experienced an increase in militarized disputes in 2022, reflecting growing tensions. Aerostat systems are uniquely suited to address these challenges due to their ability to provide continuous aerial surveillance over vast and often inaccessible terrains. The increasing frequency of cross-border skirmishes and illegal infiltrations further amplifies the demand for aerostat systems, making border security a primary driver of market growth.

Growing Adoption in Maritime Surveillance Applications

Maritime security remains a critical concern for the Asia Pacific, given the region's extensive coastlines and strategic waterways such as the South China Sea and the Strait of Malacca. Aerostat systems are increasingly being deployed to monitor illegal fishing, piracy, and smuggling activities. For example, Australia's Border Force has integrated aerostats into its maritime surveillance operations, enabling the detection of unauthorized vessels within its exclusive economic zone. These systems can operate at altitudes of up to 4,500 meters, providing a wide field of view and long-range detection capabilities. Also, according to the International Maritime Organization, incidents of piracy in Southeast Asia increased in 2022, further driving the adoption of aerostat systems. Their ability to integrate with existing radar and communication networks enhances their effectiveness, making them indispensable for safeguarding maritime interests in the region.

MARKET RESTRAINTS

High Initial Deployment Costs

One of the most significant barriers to the widespread adoption of aerostat systems in the Asia Pacific is the substantial initial investment required for deployment. Aerostat systems involve complex technologies, including high-altitude tethering mechanisms, sensor integration, and ground control stations, which contribute to their elevated costs. For instance, a fully equipped aerostat system with surveillance capabilities can cost a substantial amount, excluding maintenance expenses. This financial burden is particularly challenging for smaller economies with constrained budgets. Moreover, public spending on infrastructure development in the region is prioritized over defense expenditures, further reducing the allocation for advanced security solutions.

Vulnerability to Adverse Weather Conditions

Another critical restraint impacting the adoption of aerostat systems in the Asia Pacific is their susceptibility to extreme weather conditions. The region is prone to typhoons, monsoons, and cyclones, which can severely disrupt aerostat operations. For example, the Asia Pacific experiences an average of 26 tropical cyclones annually, with countries like the Philippines and Bangladesh being particularly vulnerable. Aerostats, despite their durability, are limited by wind speeds exceeding 100 kilometers per hour, beyond which they must be grounded to prevent structural damage. Furthermore, according to the Intergovernmental Panel on Climate Change, the frequency and intensity of extreme weather events are expected to rise in the coming decades, exacerbating this challenge. Such vulnerabilities undermine the reliability of aerostat systems in critical applications, deterring potential adopters who require consistent operational performance regardless of environmental conditions.

MARKET OPPORTUNITIES

Integration with Emerging Technologies

The Asia Pacific aerostat systems market stands to benefit significantly from advancements in emerging technologies such as artificial intelligence (AI) and the Internet of Things (IoT). Aerostats equipped with AI-driven analytics can enhance their surveillance capabilities by processing large volumes of data in real-time, identifying patterns, and predicting potential threats. For instance, integrating machine learning algorithms into aerostat systems allows for automated object detection and classification, reducing the need for human intervention and improving operational efficiency. IoT-enabled sensors further augment these capabilities by facilitating seamless communication between aerostats and ground-based infrastructure.

Rising Demand for Rural Connectivity Solutions

The Asia Pacific region faces a significant digital divide, with rural areas often lacking access to reliable internet services. Aerostat systems present a viable alternative to traditional infrastructure, offering cost-effective and scalable broadband coverage for remote communities. For example, Google's Project Loon, which utilized high-altitude balloons to provide internet access, demonstrated the feasibility of airborne platforms in bridging connectivity gaps. Aerostats, with their ability to hover at fixed altitudes for extended periods, can serve as aerial base stations, delivering high-speed internet to underserved regions. A study by McKinsey & Company estimates that closing the digital divide in the Asia Pacific could add USD 1 trillion to the region's GDP by 2030. Governments and private enterprises are increasingly recognizing the potential of aerostats in achieving universal connectivity, creating lucrative opportunities for market players to innovate and expand their offerings.

MARKET CHALLENGES

Regulatory Hurdles and Airspace Restrictions

The deployment of aerostat systems in the Asia Pacific is often hindered by stringent regulatory frameworks and airspace restrictions. According to the International Civil Aviation Organization, airspace regulations vary significantly across the region, with some countries imposing strict limits on the operation of unmanned aerial systems, including aerostats. For instance, in densely populated areas such as urban centers in Japan and South Korea, obtaining clearance for aerostat deployment involves navigating complex bureaucratic processes, often delaying project timelines. In addition, as per the Centre for Aviation, overlapping jurisdictions between civil aviation authorities and defense agencies create further complications, requiring operators to secure multiple approvals before launching operations. These regulatory barriers not only increase compliance costs but also limit the flexibility of aerostat systems in addressing urgent security or humanitarian needs. Furthermore, airspace congestion in metropolitan regions poses additional challenges, as aerostats must coexist with commercial air traffic, necessitating advanced coordination and risk mitigation measures.

Limited Awareness and Technical Expertise

Another pressing challenge for the Asia Pacific aerostat systems market is the limited awareness and technical expertise among potential adopters. Many organizations, particularly in developing nations, lack a comprehensive understanding of the capabilities and benefits of aerostat systems. This gap in awareness is compounded by a shortage of skilled personnel capable of operating and maintaining these systems. For example, training programs for aerostat operators are scarce, with only a handful of institutions offering specialized courses in the region. As per the World Economic Forum, the Asia Pacific region faces a skills gap in emerging technologies, with an estimated shortfall of 47 million workers by 2030. This lack of technical expertise not only impedes the effective deployment of aerostat systems but also raises concerns about long-term sustainability and operational efficiency, deterring organizations from investing in these solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.99% |

|

Segments Covered |

By Product, Propulsion Systems, Class, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

Lockheed Martin Corporation (U.S.), Raytheon Company (U.S.), TCOM L.P. (U.S.), Raven Industries (U.S.), Augur Rosaerosystems (Russia), ILC Dover (U.S.), Exelis (U.S.), RT LTA Systems Ltd. (Israel), Lindstrand Technologies (U.K.), Aeroscraft Corporation (U.S.), Rafael Advanced Systems (Israel), Allsopp Helikites (U.K.), Hybrid Air Vehicles (U.K.), Near Space Systems (U.S.). |

SEGMENTAL ANALYSIS

By Product Type Insights

The balloon segment dominated the Asia Pacific aerostat systems market by commanding a market share of 55% in 2024. This influence is caused by its cost-effectiveness and versatility in applications such as surveillance, communication, and environmental monitoring. According to the Aerospace Industries Association, balloons are preferred for their lower operational costs compared to airships and hybrid systems, with deployment expenses being considerably less. For instance, the Indian government has deployed balloon-based aerostats along its northern borders, citing their affordability and ease of maintenance. Besides, balloons are highly effective in disaster-prone areas, where rapid deployment is critical. The United Nations Office for Disaster Risk Reduction estimates that the Asia Pacific region experiences over 40% of global natural disasters annually, making balloons an ideal choice for emergency response operations. Their ability to remain airborne for extended periods at altitudes of up to 4,500 meters enhances their appeal. Moreover, advancements in material technology have improved the durability of balloon aerostats, allowing them to withstand harsh weather conditions. Another factor driving the dominance of the balloon segment is its compatibility with existing infrastructure. Balloons can be integrated seamlessly with radar and communication systems, reducing the need for extensive modifications.

The hybrid aerostat segment is estimated to grow at the highest CAGR of 12.8% during the forecast period, driven by its ability to combine the advantages of balloons and airships. Hybrids offer enhanced payload capacity, longer endurance, and greater flexibility, making them suitable for complex missions requiring multifunctional capabilities. Like, the demand for hybrid systems is fueled by their application in maritime surveillance, where they can cover vast oceanic regions while integrating advanced sensors and communication equipment. Another key driver of the hybrid segment’s rapid growth is the increasing investment in dual-use technologies. Governments in the Asia Pacific are prioritizing systems that serve both military and civilian purposes, such as disaster management and rural connectivity. Also, public-private partnerships in the region are expected to invest a substantial amount in hybrid aerostat projects by 2025, further accelerating adoption. Furthermore, the integration of artificial intelligence and IoT into hybrid systems enhances their operational efficiency.

By Propulsion System Insights

The unpowered propulsion system segment held the largest market share by accounting for 65% of the Asia Pacific aerostat systems market in 2024. This dominance is attributed to the simplicity and cost-effectiveness of unpowered systems, which rely on wind currents and tethering mechanisms for stability. For instance, Vietnam has deployed unpowered aerostats along its coastlines to monitor illegal fishing activities, citing their affordability and reliability. A different aspect driving the popularity of unpowered systems is their suitability for stationary applications. Unpowered aerostats excel in scenarios requiring persistent aerial coverage, such as border surveillance and disaster monitoring. Like, the Asia Pacific accounts for nearly 40% of global natural disasters, making unpowered systems indispensable for early warning and response efforts. Their ability to operate without fuel also reduces logistical complexities, particularly in remote areas. According to the International Energy Agency, fossil fuel consumption in the region is projected to decline by 5% by 2030, incentivizing governments to adopt energy-efficient solutions like unpowered aerostats. Also, unpowered systems are easier to deploy and maintain, requiring minimal technical expertise.

The powered propulsion system segment is expected to advance at the fastest CAGR of 14.2% during the forecast period. This sudden rise is supported by advancements in energy-efficient propulsion technologies. One more key factor adding to the rapid growth of powered systems is their enhanced mobility and payload capacity. Powered aerostats are increasingly being deployed for dynamic missions, such as search-and-rescue operations and large-scale surveillance. As per the Stockholm International Peace Research Institute, military expenditure in the Asia Pacific increased by 3.5% in 2022, reflecting growing demand for versatile and high-performance systems. Apart from these, the integration of hybrid propulsion technologies has improved the efficiency of powered aerostats, reducing fuel consumption. Furthermore, powered systems are gaining traction in urban environments, where their maneuverability and precision are critical. According to the United Nations, over 50% of the Asia Pacific population resides in urban areas, creating opportunities for powered aerostats to support smart city initiatives.

By Class Insights

The mid-sized aerostat segment accounted for 45.6% of the Asia Pacific market in 2024. This segment is driven by its balance of performance, cost, and versatility. Like, mid-sized aerostats are favored for their ability to carry payloads weighing between 50 and 200 kilograms, making them suitable for a wide range of applications, including border security and disaster monitoring.

A further factor contributing to the dominance of mid-sized systems is their operational flexibility. These aerostats can operate at altitudes ranging from 1,000 to 3,000 meters, providing comprehensive coverage without the complexity associated with larger systems. As per the United Nations Office for Disaster Risk Reduction, the Asia Pacific region experiences over 40% of global natural disasters annually, necessitating versatile solutions like mid-sized aerostats. Their ability to integrate with existing radar and communication networks further enhances their appeal. Besides, mid-sized systems are cost-effective to deploy and maintain, requiring fewer resources than large-sized aerostats.

The compact-sized aerostat segment is projected to grow at the fastest CAGR of 15.6% during the forecast period. It is driven by their portability and ease of deployment. Also, the demand for compact systems is fueled by their application in urban environments, where space constraints and operational requirements necessitate smaller platforms. Another key factor driving the rapid growth of compact-sized systems is their affordability. Compact aerostats require significantly lower investment compared to mid-sized and large-sized systems, making them accessible to smaller organizations and municipalities. Apart from these, advancements in sensor miniaturization have enhanced the capabilities of compact systems, enabling them to perform tasks traditionally reserved for larger platforms. Also, the integration of IoT-enabled sensors has improved the functionality of compact aerostats, allowing them to deliver real-time data with greater accuracy. Furthermore, compact systems are increasingly being used for humanitarian missions, such as disaster relief and search-and-rescue operations. According to the United Nations Office for Disaster Risk Reduction, the frequency of extreme weather events in the region is expected to rise by 2030, further driving the adoption of compact aerostats.

COUNTRY ANALYSIS

Top Leading Countries in the Market

India is considered the fastest-growing market in the region the Asia Pacific aerostat systems market. The country’s strategic focus on border security and disaster management has driven significant investments in aerostat technologies. Like, India allocated a substantial amount for border security modernization in 2022, with aerostats playing a pivotal role in enhancing surveillance capabilities along its northern and western borders. Additionally, the Indian Space Research Organisation has collaborated with private firms to develop aerostat-based solutions for environmental monitoring, further boosting adoption.

China holds a large share and is experiencing rapid growth in the regional market, and is driven by its emphasis on maritime security and smart city initiatives. According to the Stockholm International Peace Research Institute, China’s defense budget increased by 7% in 2022, with significant portions allocated to advanced surveillance technologies.

Japan is witnessing a growing demand in the market, with a strong focus on disaster management and environmental monitoring. According to the Japan Meteorological Agency, the country experiences over 1,500 seismic events annually, necessitating robust monitoring systems. Aerostats equipped with advanced sensors are increasingly being used to track atmospheric changes and predict natural disasters.

Australia is experiencing rapid growth in the market, which is driven by its extensive coastline and maritime security needs.

South Korea is a significant player in the market, with a focus on border security and urban surveillance. According to the Ministry of National Defense, aerostats are deployed along the demilitarized zone to enhance real-time monitoring capabilities. Also, the country’s smart city initiatives have driven the adoption of compact aerostats for urban applications.

KEY MARKET PLAYERS

Lockheed Martin Corporation (U.S.), Raytheon Company (U.S.), TCOM L.P. (U.S.), Raven Industries (U.S.), Augur Rosaerosystems (Russia), ILC Dover (U.S.), Exelis (U.S.), RT LTA Systems Ltd. (Israel), Lindstrand Technologies (U.K.), Aeroscraft Corporation (U.S.), Rafael Advanced Systems (Israel), Allsopp Helikites (U.K.), Hybrid Air Vehicles (U.K.), Near Space Systems (U.S.). are the market players that are dominating the Asia Pacific aerostat systems market.

Top Players in the Market

Lockheed Martin is a global leader in aerospace and defense technologies, with a significant presence in the aerostat systems market. The company’s Persistent Threat Detection System (PTDS) has been widely adopted for border security and surveillance applications across the Asia Pacific. Lockheed Martin’s contribution to the global market lies in its ability to integrate advanced sensors and communication systems into aerostats, providing unparalleled operational capabilities.

Raytheon Technologies

Raytheon Technologies specializes in developing cutting-edge defense and aerospace solutions, including aerostat systems tailored for maritime and disaster monitoring. The company’s JLENS (Joint Land Attack Cruise Missile Defense Elevated Netted Sensor) system has been instrumental in enhancing aerial surveillance capabilities in the Asia Pacific. Raytheon’s commitment to research and development ensures that its aerostat systems remain at the forefront of technological advancements, contributing significantly to both regional and global markets.

IAI (Israel Aerospace Industries)

IAI is renowned for its expertise in unmanned systems and aerostat technologies, with a strong foothold in the Asia Pacific market. The company’s Skystar series of aerostats has been deployed for civilian and military applications, including rural connectivity and border security. IAI’s ability to customize aerostat systems to meet specific regional needs has strengthened its reputation as a reliable provider.

Top Strategies Used By Key Market Participants

Strategic Partnerships and Collaborations

Key players in the Asia Pacific aerostat systems market have prioritized forming strategic partnerships with local governments and private entities to expand their reach. These collaborations enable companies to tailor their solutions to regional requirements while leveraging local expertise. For instance, partnering with defense ministries allows firms to integrate aerostats into national security frameworks, ensuring long-term adoption and sustainability.

Investment in Research and Development

Investing in R&D remains a cornerstone strategy for market leaders aiming to enhance the capabilities of aerostat systems. By incorporating emerging technologies such as AI, IoT, and advanced materials, companies are improving the efficiency and functionality of their products.

Expansion of Service Offerings

Key players are diversifying their service portfolios beyond hardware sales. Offering comprehensive solutions, including maintenance, training, and integration services, ensures customer retention and fosters trust. This approach enables companies to address the entire lifecycle of aerostat systems, creating a competitive edge in the market.

COMPETITION OVERVIEW

The Asia Pacific aerostat systems market is characterized by intense competition, driven by the presence of established global players and emerging regional firms. Leading companies such as Lockheed Martin, Raytheon Technologies, and IAI dominate the market through their advanced technologies and extensive experience in defense and surveillance applications. However, smaller players are gaining traction by offering cost-effective and customizable solutions tailored to local needs. The competitive landscape is further shaped by increasing government investments in border security, disaster management, and rural connectivity, which create lucrative opportunities for all participants. To differentiate themselves, companies are focusing on innovation, strategic collaborations, and expanding their service offerings. Besides, the growing demand for dual-use technologies has intensified competition, as firms strive to develop versatile systems capable of addressing both military and civilian applications.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Lockheed Martin Corporation partnered with the Indian Ministry of Defense to deploy its PTDS aerostat systems along the northern borders. This collaboration aimed to enhance real-time surveillance capabilities and strengthen India’s border security infrastructure.

- In June 2023, Raytheon Technologies launched its next-generation JLENS system in Australia, designed to monitor illegal fishing activities in the South China Sea. This initiative reinforced the company’s commitment to addressing regional maritime security challenges.

- In September 2023, IAI (Israel Aerospace Industries) signed a Memorandum of Understanding with the Philippines government to supply Skystar aerostats for disaster monitoring and emergency response operations. This agreement marked a significant step in expanding IAI’s presence in Southeast Asia.

- In November 2023, TCOM LP, a subsidiary of Leonardo DRS, opened a new manufacturing facility in Thailand to produce compact-sized aerostats. This move was aimed at catering to the growing demand for cost-effective surveillance solutions in urban environments.

- In February 2024, Aerostar International, Inc. introduced a hybrid aerostat system in Japan, integrating solar-powered propulsion technology. This innovation positioned Aerostar as a leader in sustainable aerostat solutions, aligning with Japan’s focus on renewable energy initiatives.

MARKET SEGMENTATION

This research report on the Asia Pacific aerostat systems market is segmented and sub-segmented into the following categories.

By Product Type

- Balloon

- Airship

- Hybrid

By Propulsion System

- Powered Aerostats

- Unpowered Aerostats

By Class

- Compact-Sized Aerostats

- Mid-Sized Aerostats

- Large-Sized Aerostats

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What strategic and geographical factors are driving defense and surveillance agencies in Asia Pacific to invest in aerostat systems over other aerial platforms?

Explores how border tensions, maritime disputes, and regional defense priorities are shaping demand for cost-effective, persistent surveillance solutions.

How are domestic R&D capabilities and government procurement policies affecting the development and deployment of aerostat systems in Asia Pacific countries?

Addresses the role of local innovation ecosystems, defense indigenization programs, and technology transfer in shaping market trajectories.

What are the key environmental and operational challenges faced by aerostat systems in the diverse terrains and weather conditions of the Asia Pacific region?

Looks at how tropical storms, high humidity, mountainous areas, and coastal climates influence design, durability, and deployment strategy.

How is the dual-use potential of aerostats (civilian and military) evolving in Asia Pacific, especially for disaster management, border control, and telecom?

Focuses on non-defense applications—like early warning systems, flood monitoring, or extending rural connectivity—gaining traction alongside military uses.

What advancements in tethering, payload integration, and autonomous control are shaping next-gen aerostat systems in Asia Pacific's innovation landscape?

Explores how the region is adopting or contributing to cutting-edge tech like AI-enabled payloads, lightweight composites, and advanced data fusion.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]