Asia Pacific Apheresis Equipment Market Research Report – Segmented By Application (renal diseases, neurology application )Procedure and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis from 2025 to 2033

Asia Pacific Apheresis Equipment Market Size

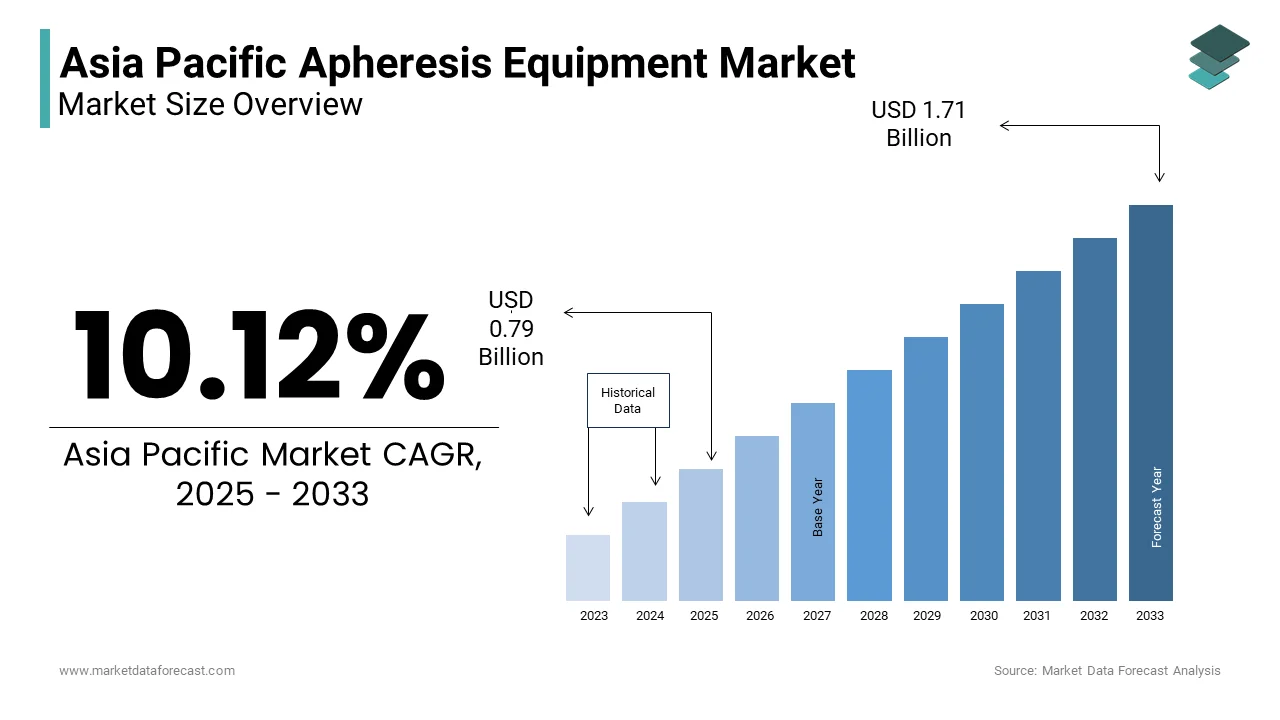

The Asia Pacific Apheresis Equipment Market Size was valued at USD 0.72 billion in 2024. The Asia Pacific Apheresis Equipment Market Size is expected to have 10.12 % CAGR from 2025 to 2033 and be worth USD 1.71 billion by 2033 from USD 0.79 billion in 2025.

The Asia Pacific apheresis equipment market growth is driven by the demand for advanced medical devices that can separate, collect and process specific blood components during therapeutic and donation procedures. Apheresis technology is widely employed in treating autoimmune disorders, plasma collection, stem cell harvesting and critical care interventions such as sepsis management and renal failure support. The equipment includes automated systems capable of performing plasmapheresis, leukapheresis, erythrocytapheresis and other specialized extracorporeal therapies.

An increasing number of patients across the region suffer from chronic diseases that require periodic apheresis interventions including multiple sclerosis, sickle cell disease and severe hypercholesterolemia. The utilization of apheresis therapy has grown steadily due to rising awareness among clinicians and enhanced hospital infrastructure supporting dedicated apheresis units. Moreover, the volume of plasma donations in countries like Japan, South Korea and Australia has surged significantly and driven by national demand for fractionated biopharmaceuticals such as immunoglobulins and clotting factors. This trend is encouraging governments and private healthcare providers to invest in modern apheresis centers equipped with high-efficiency separation technologies. In tandem, educational initiatives led by professional associations and regulatory bodies are fostering greater training and standardization of apheresis practices.

MARKET DRIVERS

Rising Incidence of Autoimmune and Chronic Diseases

Rising incidence of autoimmune and chronic diseases is one of the most significant drivers fueling the growth of the Asia Pacific apheresis equipment market. Conditions such as systemic lupus erythematosus, Guillain-Barré syndrome, myasthenia gravis and thrombotic thrombocytopenic purpura have seen a notable increase across the region in aging populations. Autoimmune disorders now affect over 10.92% of the population in urban centers across Australia, Japan and China. This surge in disease burden has directly increased the clinical application of apheresis techniques such as therapeutic plasma exchange and immunoadsorption. In India, over 25.85% annual rise in apheresis procedures conducted for autoimmune indications between 2020 and 2023. Similarly, in South Korea, hospitals have integrated apheresis into multidisciplinary treatment plans for severe rheumatological and neurological conditions. Additionally, growing recognition of apheresis as a first-line or adjunct therapy has encouraged its adoption in both public and private healthcare settings. More than 40.77% of tertiary hospitals in Thailand and Malaysia have expanded their apheresis capabilities in response to rising patient demand.

Expansion of Plasma Collection Networks and Biopharma Demand

Expansion of plasma collection infrastructure and the corresponding demand from the biopharmaceutical industry is another pivotal factor propelling the Asia Pacific apheresis equipment market. Plasma-derived products such as intravenous immunoglobulin (IVIG), albumin and coagulation factors play an essential role in managing immune deficiencies, burns, and bleeding disorders. Countries such as Japan, South Korea and Australia have well-established plasma collection frameworks with government-backed programs actively promoting voluntary apheresis donations. In China, the National Health Commission launched an initiative in 2023 to establish 50 new plasma collection centers thereby aiming to reduce dependency on imported plasma-derived therapeutics. Furthermore, emerging markets like India and Indonesia are witnessing increased collaboration between public health authorities and private pharmaceutical firms to enhance domestic plasma production capacity.

MARKET RESTRAINTS

High Cost of Apheresis Equipment and Operational Complexity

A primary constraint affecting the Asia Pacific apheresis equipment market is the substantial capital investment required for acquiring and maintaining automated apheresis systems. Advanced machines equipped with real-time monitoring, closed-loop fluid control and pathogen reduction features often cost several hundred thousand dollars which makes them financially prohibitive for smaller hospitals and regional blood banks. The operational complexity of apheresis equipment presents another barrier. These systems require trained personnel proficient in hematology, anticoagulant management and machine calibration. Additionally, consumables such as single-use disposable kits, filters and anticoagulant solutions contribute to recurring expenses thus discouraging widespread adoption. Public healthcare institutions in low-income economies face further challenges related to reimbursement policies and budget allocation. In Malaysia, government tenders for apheresis equipment procurement have been delayed due to funding shortages. The high cost and technical complexity of apheresis equipment will continue to hinder market penetration across the Asia Pacific until financial accessibility improves and workforce readiness strengthens.

Regulatory Hurdles and Fragmented Reimbursement Policies

Fragmented regulatory environment and inconsistent reimbursement policies across different countries is another significant restraint impeding the growth of the Asia Pacific apheresis equipment market. Each nation maintains its own set of guidelines governing device approval, clinical usage criteria and insurance coverage thereby creating compliance challenges for manufacturers seeking regional expansion. The average time required for product registration in ASEAN countries ranges from 18 to 30 months which is significantly longer than in North America or Europe. Japan enforces one of the strictest regulatory frameworks through the Pharmaceuticals and Medical Devices Agency (PMDA) requiring extensive documentation even for modified versions of existing apheresis systems. Similarly, in India, recent amendments to the Medical Device Rules under the Central Drugs Standard Control Organization (CDSCO) have introduced additional quality assurance protocols thus delaying market entry for some international players.Reimbursement inconsistencies further exacerbate the challenge. In Australia, Medicare covers therapeutic apheresis for select indications whereas in China, coverage remains limited to major urban centers. These regulatory discrepancies and financial barriers collectively slow down the diffusion of advanced apheresis equipment across the Asia Pacific region.

MARKET OPPORTUNITIES

Integration of AI and Automation in Apheresis Systems

Integration of artificial intelligence (AI) and automation into next-generation apheresis platforms is an emerging opportunity for the Asia Pacific apheresis equipment market. Manufacturers are increasingly incorporating smart diagnostics, predictive analytics and real-time monitoring features to enhance procedural precision, safety and efficiency. AI-driven hematology analytics is projected to grow at a CAGR exceeding 20.63% in the Asia Pacific between 2023 and 2030 which directly influences the evolution of apheresis equipment. One key growth driver is the ability of AI-integrated systems to optimize donor and patient outcomes by adjusting parameters in real time based on physiological feedback. Companies such as Terumo BCT and Fresenius Kabi have already initiated pilot programs in Japan and South Korea to test automated apheresis workflows that reduce human error and improve component yield. Moreover, the deployment of cloud-connected apheresis machines enables centralized data tracking and remote diagnostics while facilitating better inventory management and maintenance scheduling. Hospitals in Singapore and Australia have begun adopting such digital solutions to streamline operations and reduce downtime. AI-powered apheresis equipment is poised to redefine therapeutic and collection standards across the Asia Pacific region with ongoing advancements in machine learning and biomedical engineering.

Expansion of Therapeutic Applications Beyond Traditional Indications

An expanding range of therapeutic applications beyond traditional uses presents a compelling growth avenue for the Asia Pacific apheresis equipment market. Apheresis is increasingly being explored for novel indications such as sepsis management, acute respiratory distress syndrome (ARDS) and metabolic detoxification in organ failure cases. Early-phase clinical trials in Australia and South Korea have demonstrated promising results in using apheresis for cytokine removal in critically ill patients suffering from multiorgan dysfunction. In Japan, apheresis therapy is gaining traction in the treatment of metabolic syndromes including refractory hyperlipidemia and amyloidosis. The number of off-label applications for apheresis procedures had increased by over 15.07% year-on-year thus reflecting growing physician confidence in its versatility. Similarly, in India, nephrologists are exploring apheresis-based filtration modalities for end-stage renal disease patients awaiting dialysis compatibility. Pharmaceutical companies are also investing in research to combine apheresis with regenerative medicine approaches such as stem cell mobilization for oncology applications. Partnerships between biotech firms and apheresis equipment manufacturers are accelerating the development of customized protocols tailored for emerging therapeutic domains.

MARKET CHALLENGES

Shortage of Trained Professionals and Standardized Training Programs

Scarcity of adequately trained professionals capable of operating complex apheresis systems with precision and safety is one of the foremost challenges confronting the Asia Pacific apheresis equipment market. Apheresis procedures require specialized knowledge in hemodynamics, anticoagulation management and machine calibration yet many regions lack structured training programs to develop a skilled workforce. Only 30.6% of hospitals in Indonesia and the Philippines have certified apheresis technologists which severely limits the scalability of therapeutic and donation services. This shortage is particularly pronounced in rural and semi-urban healthcare facilities where access to continuing medical education remains limited. In India, fewer than 10.88% receive formal training in apheresis techniques despite having a large pool of general hematologists. The absence of standardized certification processes contributes to inconsistent procedural outcomes and slower adoption of newer apheresis technologies. In China, it still lags behind demand particularly in central and western provinces although the number of apheresis-trained specialists has increased. It takes an average of two to four years for a clinician to become proficient in therapeutic apheresis, slowing down market penetration.

Limited Awareness and Low Patient Uptake in Rural Areas

Limited awareness and low patient uptake of apheresis procedures in rural and underserved regions is a critical challenge impeding the growth of the Asia Pacific apheresis equipment market. A significant portion of the population residing in remote areas lacks adequate information about the benefits of apheresis therapy or plasma donation despite increasing availability of apheresis centers in urban hospitals. This disparity stems from inadequate healthcare outreach programs and insufficient dissemination of medical education in rural settings. The absence of mobile diagnostic units and telemedicine networks in many rural districts exacerbates the problem thus preventing timely diagnosis and intervention.

Even when patients are aware of apheresis procedures, affordability and accessibility remain major barriers. Public health facilities in rural areas often lack the necessary infrastructure to perform apheresis while pushing patients toward expensive private clinics. Nearly 50.7% of rural patients in the Philippines and Bangladesh cannot afford out-of-pocket payments for specialty treatments. Until awareness campaigns, healthcare financing models and last-mile delivery mechanisms improve low patient engagement will continue to constrain the overall growth of the apheresis equipment market in the Asia Pacific.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.12 % |

|

Segments Covered |

By Application, Procedure and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

China, India, Japan, South Korea, Australia, New Zealand, Thailand, Indonesia, Philippines, Vietnam, Singapore, Rest of APAC. |

|

Market Leader Profiled |

Asahi Kasei Corp, Terumo Corp, Fresenius SE |

SEGMENTAL ANALYSIS

By Application Insights

The renal diseases segment dominated the Asia Pacific apheresis equipment market by capturing 41.82% of total market share in 2024, which is primarily attributed to the increasing prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) particularly in countries like India, China, and Indonesia where metabolic disorders and hypertension are widespread. Over 150 million individuals in the Asia Pacific suffer from CKD with a subset requiring apheresis-based interventions such as hemodialysis-related therapeutic pheresis or lipid removal in dialysis-resistant conditions. A key driver for this segment’s dominance is the integration of apheresis into pre and post-transplant care protocols. In Japan, major transplant centers incorporate plasmapheresis to reduce antibody-mediated rejection risks where organ failure remains a pressing public health issue. More than 70.6% of kidney transplant patients in Tokyo hospitals undergo at least one session of preoperative apheresis. Additionally, in South Korea, government-backed initiatives have expanded hospital access to automated apheresis systems for managing uremic toxins and fluid imbalances. The Korean Health Technology R&D Project has funded multiple pilot studies exploring novel indications for apheresis in nephrology.

The neurology application segment is estimated to register a fastest CAGR of 9.8% during the forecast period with an increased focus on treating autoimmune neurological disorders such as Guillain-Barré syndrome, myasthenia gravis and multiple sclerosis through therapeutic plasma exchange and immunoadsorption techniques. One of the primary growth catalysts is the rising number of neurological diagnoses linked to immune dysregulation. Similarly, in South Korea, leading university hospitals have integrated apheresis into treatment guidelines for refractory cases of neuromyelitis optica and CIDP (chronic inflammatory demyelinating polyneuropathy) where advancements in precision medicine are accelerating. Another contributing factor is the inclusion of therapeutic apheresis in national treatment protocols. In China, the Ministry of Health updated its clinical pathways in 2023 to endorse apheresis for selected neuroimmunological conditions.

By Procedure Insights

The LDL-apheresis segment was the largest in the Asia Pacific apheresis equipment market by capturing 39.82% of total market share in 2024. This procedure is widely used to manage severe hypercholesterolemia and familial hyperlipidemia particularly in patients unresponsive to pharmacologic treatments. Countries such as Japan, Australia and South Korea exhibit high adoption rates due to their aging populations and elevated incidence of cardiovascular and metabolic disorders.A core reason for LDL-apheresis’ market dominance is the growing recognition of metabolic syndrome as a precursor to chronic heart and renal disease.Nearly 30.72% of adults in urbanized Asia Pacific societies suffer from dyslipidemia while making them potential candidates for extracorporeal lipid removal. In Japan, over 5,000 LDL-apheresis sessions were performed in 2023 alone, as documented by the Japanese Society of Apheresis. Moreover, insurance coverage in developed markets such as Australia and New Zealand supports procedural affordability. Medicare Australia expanded reimbursement eligibility for long-term dyslipidemia patients in mid-2022. These factors collectively reinforce LDL-apheresis as the most widely adopted apheresis procedure in the Asia Pacific.

Leukapheresis segment is likely to experience a fastest CAGR of 11.2% from 2025 to 2033. This rapid expansion results from its pivotal role in stem cell mobilization for hematopoietic transplants, CAR-T therapy preparation and leukemia treatment support in oncology and regenerative medicine settings. A primary growth enabler is the rise in cancer cases requiring cellular therapies. Over 6 million new blood cancer cases were diagnosed in the region in 2023 with leukapheresis being a critical component in autologous stem cell harvesting. Leukapheresis is increasingly being explored beyond traditional oncology including in rheumatology and dermatology for selective leukocyte removal in psoriasis and lupus. Leukapheresis is set to outpace other apheresis modalities in terms of market uptake across the Asia Pacific with increasing integration into cellular therapy pipelines and broader clinical exploration.

COUNTRY LEVEL ANALYSIS

Japan outperformed other regions in the Asia Pacific apheresis equipment market by accounting for 16.92% of total regional share in 2024. The country benefits from a mature healthcare system, proactive regulatory support and advanced clinical integration of apheresis in both therapeutic and donation settings. The Pharmaceuticals and Medical Devices Agency maintains stringent yet efficient approval pathways thereby facilitating early adoption of innovative apheresis technologies. A major growth driver is the nation’s high prevalence of metabolic and autoimmune diseases that require regular apheresis interventions. Furthermore, academic-medical collaborations drive continuous innovation. Institutions such as the Osaka University Medical Center have partnered with domestic manufacturers to refine automation and pathogen reduction features in ongoing clinical trials.

China was positioned second in holding the dominant share of the Asia Pacific apheresis equipment market in 2024 and is driven by its vast patient base, expanding healthcare infrastructure and increasing government investment in specialized medical technology. China has witnessed a notable surge in chronic disease burden especially in urban areas where lifestyle disorders and autoimmune conditions are on the rise. A prominent strength of the Chinese market lies in its growing network of centralized blood banks and transfusion medicine centers. The Chinese Society of Blood Transfusion reports that plasma donation programs have expanded significantly with several provinces launching state-sponsored collection drives to meet biopharma requirements for IVIG and clotting factor production. These homegrown solutions offer cost advantages while maintaining performance parity with international models.

Australia’s apheresis equipment market is likely to grow with a healthy CAGR in the next coming years and is supported by a well-developed healthcare ecosystem, strong regulatory oversight and significant contributions to clinical research. The country's blood donation and therapeutic apheresis uptake remain robust with plasma-derived therapeutics playing a central role in national pharmaceutical supply chains. The nation's proactive stance on integrating apheresis into tertiary care hospitals enhances its market position. Referral rates for immunomodulatory apheresis procedures have risen steadily in recent years particularly in treating neurological and rheumatological conditions. Moreover, the presence of leading research institutions such as the Australian Apheresis Group and funding initiatives under the National Health and Medical Research Council encourage the adoption of next-generation protocols.

South Korea’s apheresis equipment market is likely to have significant growth opportunities during the forecast period which is reflecting steady growth driven by advanced biomedical research, digital health integration and rising demand for regenerative therapies. The country has embraced apheresis not only for established indications but also for experimental applications in immunotherapy and cell-based treatments. A key element strengthening South Korea’s position is its early adoption of AI-integrated apheresis platforms. Leading hospitals in Seoul and Busan employ smart systems that allow real-time monitoring and remote diagnostics thus enhancing procedural efficiency and patient outcomes. Government-led initiatives promoting plasma donation and therapeutic applications have spurred increased procurement of apheresis equipment.

India’s apheresis equipment market growth is driven by a rapidly expanding population suffering from autoimmune and metabolic disorders. A major growth enabler is the increasing availability of affordable apheresis solutions through both multinational and domestic players. Companies such as Fresenius Kabi India and Gambro BCT have strengthened their distribution networks thereby ensuring equipment accessibility even in semi-urban and tier-two cities. Academic-industry partnerships are improving training and device utilization in teaching hospitals. Plasma donation initiatives have grown substantially particularly in states like Tamil Nadu and Maharashtra. This expansion coupled with rising awareness about apheresis applications in critical care ensures India’s strong and growing contribution to the regional market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Asia Pacific apheresis equipment market are Asahi Kasei Corp, Terumo Corp, Fresenius SE & Co KGaA, Haemonetics Corp, B. Braun, Nikkiso Co Ltd, Mallinckrodt PLC Ordinary Shares.

The competition in the Asia Pacific apheresis equipment market is marked by a dynamic interplay of innovation, regional expansion and strategic positioning by key global and local players. Companies are intensifying their efforts to differentiate themselves through product development and superior service offerings as demand for advanced blood processing and therapeutic apheresis procedures increases. The market sees an active exchange of expertise between multinational corporations and domestic manufacturers with collaboration being a vital tool for navigating diverse regulatory environments and addressing region-specific healthcare challenges. Emerging companies strive to gain traction through cost-effective solutions and niche innovations while established players leverage their brand reputation and extensive distribution networks. This growing competition is driving improvements in system design, automation and operational efficiency which ultimately benefit end-users such as hospitals, blood banks and specialized clinics.

Top Players in the Market

Terumo BCT

Terumo BCT is a leading innovator in blood and cell separation technologies. The company plays a crucial role in advancing apheresis equipment globally particularly in the Asia Pacific region. Terumo BCT delivers high-quality systems for therapeutic and donation-based applications. Their solutions are widely adopted across hospitals and blood centers thus enhancing treatment efficiency and patient safety. The company's commitment to innovation and customer support has strengthened its reputation as a trusted name in the industry.

Fenwal

Fenwal, operating under Fresenius Kabi, is a major contributor to the global apheresis equipment market. Fenwal supports healthcare institutions with reliable and efficient solutions Known for its advanced technologies in blood component collection and therapeutic procedures. Its presence in the Asia Pacific region has expanded through strategic collaborations and localized offerings. Fenwal continues to influence global standards in apheresis practices by emphasizing product innovation and quality.

Haemonetics Corporation

Haemonetics is a global leader in blood management solutions including apheresis technology. The company develops cutting-edge automated systems that streamline blood collection and processing. Haemonetics has established a strong footprint by catering to evolving healthcare demands and improving clinical outcomes. Their focus on digital integration and automation enhances workflow efficiency and data accuracy thereby contributing significantly to modernizing apheresis practices worldwide.

Top Strategies Used by Key Market Participants

One key strategy employed by market leaders is product innovation and technological advancement . Companies continuously invest in R&D to develop next-generation apheresis systems that offer improved efficiency, automation and ease of use. These innovations help attract healthcare providers seeking advanced and reliable solutions.

Another major strategy is strategic partnerships and collaborations. Key players engage with local distributors, research institutions and government bodies to enhance market access and tailor products to regional needs. These alliances also facilitate regulatory approvals and faster adoption in emerging markets across the Asia Pacific region.

Expansion through acquisitions and localization efforts is a common approach. Companies acquire smaller firms or set up regional offices and manufacturing units to strengthen their supply chain and better serve local clients thereby increasing their competitive edge.

RECENT HAPPENINGS IN THE MARKET

In January 2024, Terumo BCT launched a new line of automated apheresis systems tailored for plasma collection centers in Southeast Asia.

In March 2024, Haemonetics announced a partnership with a leading Australian blood services provider to integrate its digital apheresis platform into national blood donation programs.

In June 2024, Fresenius Kabi introduced a localized version of its flagship apheresis device in India which is designed to meet the specific needs of regional blood banks and hospitals.

In September 2024, Asahi Kasei Medical opened a new technical support center in South Korea to enhance service delivery and post-sale maintenance capabilities for its apheresis equipment.

In November 2024, Kawasumi Laboratories entered into a joint venture with a Japanese medical IT firm to develop AI-assisted monitoring systems for therapeutic apheresis applications.

MARKET SEGMENTATION

This research report on the asia pacific apheresis equipment market has been segmented and sub-segmented into the following.

By Application

- renal diseases

- neurology application

By Procedure

- LDL-apheresis

- Leukapheresis

By Country

- China

- India

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Indonesia

- Philippines

- Vietnam

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of the Asia Pacific apheresis equipment market?

Key drivers include increasing demand for blood components, rising incidence of blood-related disorders, expanding healthcare infrastructure, and growth in therapeutic apheresis applications.

Which countries in Asia Pacific are leading in apheresis equipment adoption?

Japan, China, India, South Korea, and Australia are among the leading countries, driven by improved healthcare access and higher awareness of apheresis therapies.

Who are the key players in the Asia Pacific apheresis equipment market?

Major companies include Haemonetics Corporation, Fresenius Kabi, Terumo BCT, Baxter International, and Asahi Kasei Medical Co., Ltd.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com