Asia Pacific Artificial Intelligence In Retail Market Size, Share, Trends & Growth Forecast Report By Solution (Personalized Product Recommendation, Visual Search), Type, End-User, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Artificial Intelligence in Retail Market Size

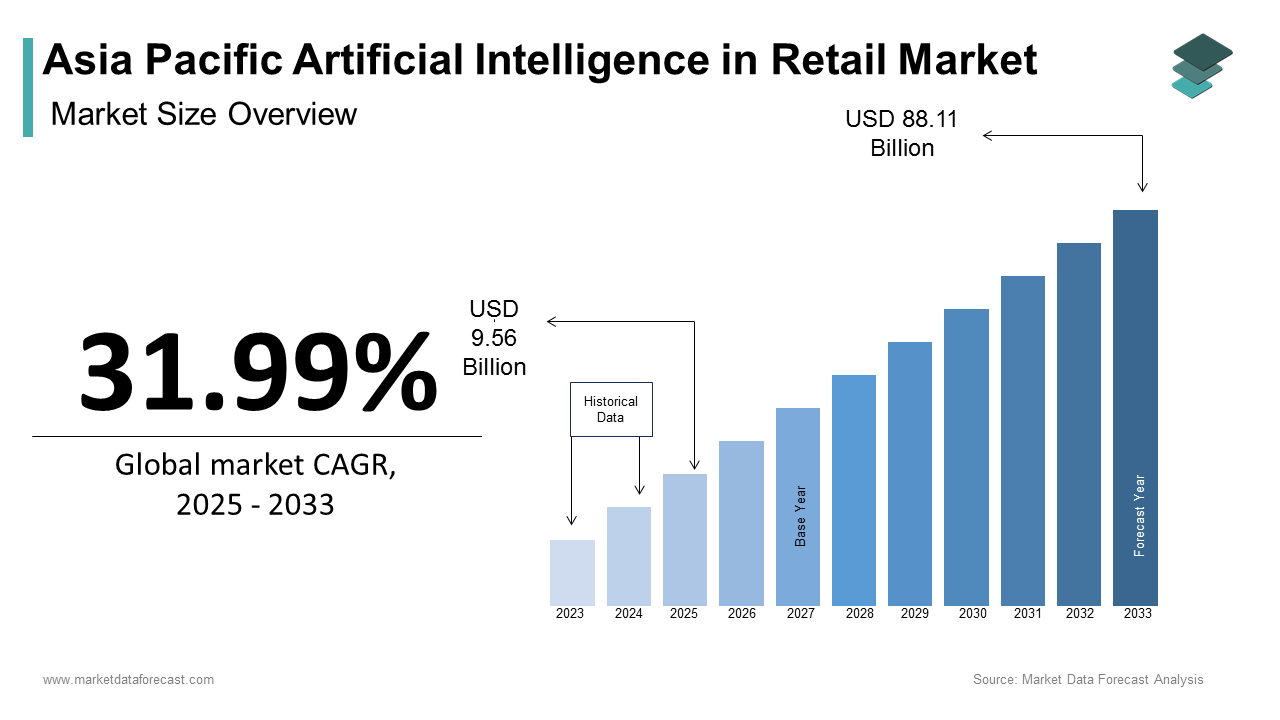

The Asia Pacific artificial intelligence in retail market size was calculated to be USD 7.24 billion in 2024 and is anticipated to be worth USD 88.11 billion by 2033, from USD 9.56 billion in 2025, growing at a CAGR of 31.99% during the forecast period.

The Asia Pacific artificial intelligence (AI) in the retail market represents a transformative shift in how retailers engage with consumers, optimize operations, and enhance profitability. AI technologies, including machine learning, natural language processing, and computer vision, are being deployed across various retail functions such as inventory management, personalized marketing, and customer service automation. This demographic advantage is further amplified by the region’s rapid digital transformation, with countries like China and India leading the charge in e-commerce and smart retail initiatives.

MARKET DRIVERS

Surge in E-Commerce Adoption

The exponential growth of e-commerce in the Asia Pacific region serves as a significant driver for the adoption of artificial intelligence in retail. This surge in online shopping has necessitated the use of AI technologies to enhance customer experience and operational efficiency. For example, AI-powered recommendation engines can analyze customer browsing patterns and purchase history to suggest personalized product offerings, increasing conversion rates notably. Moreover, AI-driven chatbots have become indispensable for handling customer queries in real time, particularly during peak shopping seasons.

Rising Demand for Personalized Shopping Experiences

Another key driver is the growing consumer expectation for personalized shopping experiences, which AI technologies are uniquely positioned to deliver. According to Accenture, 91% of consumers in the Asia Pacific region are more likely to shop with brands that provide relevant offers and recommendations. AI systems leverage data analytics and machine learning to create hyper-personalized marketing campaigns, enhancing customer engagement and loyalty. For instance, JD.com, a leading Chinese e-commerce platform, uses AI algorithms to analyze user behavior and deliver tailored product suggestions, increasing repeat purchases.

Apart from these, AI-powered virtual try-on tools and augmented reality applications are gaining traction, particularly in the fashion and beauty sectors. These innovations allow customers to visualize products before purchasing, reducing return rates.

MARKET RESTRAINTS

High Implementation Costs

One of the primary restraints in the adoption of AI in the Asia Pacific retail market is the high cost associated with implementation and integration. AI systems require significant investments in hardware, software, and skilled personnel to deploy and maintain. Similarly, small and medium-sized enterprises (SMEs) in the region allocate less share of their annual revenue to digital transformation initiatives, limiting their ability to adopt advanced AI solutions. In addition, the financial burden extends beyond the initial setup to include ongoing maintenance and upgrades. Regular updates to AI algorithms and cybersecurity measures add to the overall expenditure, making these technologies inaccessible to smaller players. This financial strain discourages widespread adoption, especially among retailers operating on thin profit margins.

Data Privacy and Security Concerns

Another restraint stems from data privacy and security concerns, which pose significant challenges to AI adoption in the retail sector. According to the International Association of Privacy Professionals, a majority of consumers in the Asia Pacific region are hesitant to share personal data due to fears of misuse or breaches. Retailers leveraging AI systems often rely on extensive customer data to power personalized recommendations and predictive analytics, raising ethical and regulatory questions. For example, Australia’s Privacy Act mandates strict compliance with data protection standards, imposing penalties of up to $2.1 million for non-compliance. Furthermore, high-profile data breaches in the region, such as the 2021 incident involving a major e-commerce platform in Singapore, have heightened consumer skepticism.

MARKET OPPORTUNITIES

Integration of AI in Omnichannel Retailing

The integration of AI in omnichannel retailing presents a significant opportunity for the Asia Pacific market. As retailers strive to provide seamless shopping experiences across online and offline channels, AI technologies play a pivotal role in bridging the gap. Also, AI-powered tools like computer vision and IoT sensors enhance in-store experiences by enabling cashier-less checkouts and automated shelf monitoring.

Expansion of AI in Supply Chain Optimization

Another promising opportunity lies in the application of AI for supply chain optimization, addressing inefficiencies and reducing costs. In the Asia Pacific region, where logistics networks are often complex and fragmented, AI technologies offer significant value. Moreover, AI systems enable demand forecasting and route optimization, minimizing wastage and enhancing resource allocation. These capabilities are particularly beneficial for perishable goods industries, such as food and pharmaceuticals, where timely deliveries are critical.

MARKET CHALLENGES

Limited Availability of Skilled Workforce

A significant challenge facing the adoption of AI in the Asia Pacific retail market is the limited availability of skilled professionals capable of implementing and managing these technologies. A significant share of companies in the region struggle to find talent with expertise in AI and machine learning, hindering their ability to fully leverage these solutions. In addition, the complexity of AI systems requires continuous training and upskilling, which many organizations cannot afford. This skills gap is exacerbated by the rapid pace of technological advancements, leaving retailers unable to keep up with evolving requirements.

Resistance to Change Among Traditional Retailers

Another challenge is the resistance to change among traditional retailers, particularly in rural and semi-urban areas. These retailers often perceive AI technologies as unnecessary expenses that disrupt established workflows. Moreover, cultural and generational factors contribute to this resistance, with older business owners preferring face-to-face interactions over automated systems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

31.99% |

|

Segments Covered |

By Solution, Type, End-user, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

Alibaba, JD.com, Baidu, Tencent, SenseTime, NEC Corporation, Fujitsu, Toshiba, LG CNS, Samsung SDS, SAP, IBM, Microsoft, and Google |

SEGMENTAL ANALYSIS

By Solution Insights

The personalized product recommendation systems segment dominated the Asia Pacific AI retail market by commanding 35.8% of the total share in 2024. This leading position is propelled by the region’s booming e-commerce sector, where retailers rely on AI to enhance customer engagement and drive sales. According to Accenture, over 91% of consumers in the Asia Pacific region are more likely to shop with brands that provide relevant offers and recommendations, underscoring the importance of personalized experiences. Another key factor is the integration of machine learning models that analyze vast datasets to predict consumer preferences. Also, the proliferation of mobile commerce, which accounts for a significant share of e-commerce sales in Southeast Asia, further amplifies the demand for personalized solutions tailored to mobile users.

The segment of visual search represented the fastest-growing segment in the Asia Pacific AI in retail market by exhibiting a CAGR of 28.9%. This progress is linked to the increasing adoption of smartphones and advancements in computer vision technologies. For example, South Korea’s Naver Shopping integrates AI-powered visual search tools, allowing users to upload images and find similar products, as highlighted by the Korea Internet & Security Agency.

Another driving factor is the growing demand for seamless shopping experiences. A large share of consumers in the region prefer visual search over text-based queries, particularly in the fashion and home decor sectors. In addition, the rise of augmented reality (AR) applications, which enable virtual try-ons and product visualization, creates synergies with visual search technologies.

By Type Insights

The generative AI segment was at the forefront of the Asia Pacific AI retail market by holding 60.5% of the total share in 2024. This is due to its versatility in creating content, optimizing processes, and enhancing customer interactions. According to Gartner, generative AI applications, such as chatbots and dynamic pricing models, are expected to account for over 30% of all AI-driven interactions in retail by 2025. Another key factor is the ability of generative AI to automate repetitive tasks, such as inventory management and supply chain optimization. The World Economic Forum highlights that AI-driven automation can reduce operational costs, making it an attractive solution for retailers. In addition, the integration of natural language processing (NLP) enables retailers to offer multilingual support, catering to the region’s diverse linguistic landscape.

The “Other AI” segment, encompassing niche applications like predictive analytics and robotics, is the fastest-growing, with a projected CAGR of 32%. This development is propelled by the increasing focus on operational efficiency and cost reduction. Like, the adoption of predictive analytics in supply chain management can reduce logistics costs. Another driving factor is the integration of AI-powered robotics in warehouses and fulfillment centers. A report by DHL Supply Chain notes that robotic systems equipped with AI can increase order processing speeds notably, addressing the growing demand for faster deliveries.

By End-User Insights

The segment of online retail spearheaded in the Asia Pacific AI in retail market. This is because of the region’s exponential growth in e-commerce, with countries like China and India leading the way. For instance, Flipkart uses AI algorithms to analyze customer data and optimize product placements, resulting in an increase in sales.

Another key factor is the proliferation of mobile commerce, which accounts for a significant share of e-commerce sales in Southeast Asia. AI-powered solutions, such as virtual assistants and personalized marketing campaigns, cater to the unique needs of mobile users, enhancing customer satisfaction and retention.

The offline retail segment exhibits the swiftest advancing category, with a calculated CAGR of 22%. This is associated with the integration of AI technologies in physical stores to enhance customer experiences and streamline operations. Like, retailers adopting AI-driven tools like cashier-less checkouts and automated shelf monitoring can reduce operational inefficiencies. For example, South Korea’s Lotte Department Store implemented AI-powered systems to track stock levels in real-time, reducing out-of-stock instances by 25%. Apart from these, the rise of omnichannel strategies, which blend online and offline experiences, amplifies the demand for AI solutions in brick-and-mortar stores.

REGIONAL ANALYSIS

China led the Asia Pacific AI in the retail market by contributing 45.5% to the regional share in 2024. This dominance is underpinned by the country’s status as the world’s largest e-commerce hub, with platforms like Alibaba and JD.com driving innovation. Another factor is the government’s push for digital transformation, as outlined in the "Made in China 2025" initiative. Investments in AI research and development have enabled retailers to deploy advanced solutions like facial recognition and automated warehouses.

India is adding greatly to the regional market share. The country’s rapid digitalization and rising internet penetration drive demand for AI solutions. Also, government initiatives like "Digital India" promote AI adoption across industries. For instance, Reliance Retail has integrated AI-powered chatbots to enhance customer service.

Japan holds a significant position. The country’s advanced technological infrastructure and aging population drive demand for AI solutions. Another factor is the focus on sustainability. AI-driven systems help retailers optimize energy consumption and reduce waste, aligning with Japan’s carbon neutrality goals.

South Korea is advancing in this market and is driven by its emphasis on smart retail and technological innovation. Besides, government policies promoting AI adoption further amplify demand.

Australia and New Zealand together a ma, driven by their focus on customer-centric solutions. One more aspect is the emphasis on data privacy, ensuring ethical AI adoption. These efforts position the region as a leader in responsible AI practices.

LEADING PLAYERS IN THE ASIA PACIFIC ARTIFICIAL INTELLIGENCE IN RETAIL MARKET

Alibaba Group

Alibaba Group is a global leader in AI-driven retail solutions, with a significant presence in the Asia Pacific region. The company leverages its cutting-edge AI technologies to enhance e-commerce platforms like Taobao and Tmall, offering personalized recommendations, visual search, and virtual assistants. Alibaba’s contribution to the global market lies in its ability to integrate AI into every aspect of the retail value chain, from supply chain optimization to customer engagement. Its focus on innovation and scalability ensures that retailers can adopt advanced tools without compromising efficiency. Also, Alibaba’s cloud computing division, Alibaba Cloud, provides robust AI infrastructure, enabling seamless integration for businesses worldwide.

JD.com

JD.com is a key player in the Asia Pacific AI retail market, renowned for its data-driven approach and technological prowess. The company utilizes AI to optimize inventory management, automate logistics, and deliver hyper-personalized shopping experiences. JD.com’s commitment to sustainability is evident in its AI-powered initiatives to reduce carbon footprints across its operations. Globally, JD.com plays a pivotal role in shaping the future of retail by introducing innovations such as cashier-less stores and drone deliveries.

Flipkart

Flipkart, a leading e-commerce platform in India, has emerged as a major contributor to AI in the retail market. The company employs AI to enhance customer experience through personalized product recommendations, chatbots, and dynamic pricing models. Flipkart’s focus on democratizing AI tools for small and medium-sized retailers underscores its commitment to inclusivity and innovation. Its contributions to the global market include pioneering localized AI solutions tailored to emerging markets, ensuring accessibility and affordability. Flipkart’s strategic partnerships with tech firms further amplify its impact on the retail landscape.

TOP STRATEGIES USED BY KEY PLAYERS IN THE ASIA PACIFIC AI IN THE RETAIL MARKET

Strategic Partnerships and Collaborations

Key players in the Asia Pacific AI retail market have prioritized forming strategic partnerships to expand their technological capabilities and market reach. By collaborating with local governments, startups, and technology providers, companies aim to co-develop innovative solutions tailored to regional needs. These alliances enable firms to access new markets, share resources, and accelerate product development cycles. For instance, partnerships with smart city initiatives allow companies to integrate AI-driven tools like facial recognition and predictive analytics into retail ecosystems, ensuring alignment with urbanization trends.

Focus on Hyper-Personalization

Hyper-personalization remains a cornerstone of competitive strategies adopted by leading players. Companies are investing heavily in AI-driven recommendation engines, visual search tools, and virtual assistants to create tailored shopping experiences. This strategy not only enhances customer engagement but also fosters brand loyalty. By leveraging machine learning and big data analytics, retailers can predict consumer preferences and deliver relevant offers, ensuring a seamless and intuitive shopping journey.

Expansion of AI-Driven Logistics Solutions

To cater to the growing demand in the Asia Pacific region, key players are expanding their AI-driven logistics and supply chain solutions. Implementing predictive analytics, robotics, and automated systems allows companies to optimize inventory management, reduce delivery times, and minimize operational costs. This approach not only enhances efficiency but also addresses the challenges posed by fragmented logistics networks in the region.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the Asia Pacific AI in the retail market include Alibaba, JD.com, Baidu, Tencent, SenseTime, NEC Corporation, Fujitsu, Toshiba, LG CNS, Samsung SDS, SAP, IBM, Microsoft, and Google.

The Asia Pacific AI retail market is characterized by intense competition, driven by the presence of both global giants and regional innovators vying for dominance. Global leaders like Alibaba, JD.com, and Amazon leverage their extensive technological expertise, vast datasets, and robust ecosystems to maintain leadership positions. Meanwhile, regional players focus on niche markets, offering localized AI solutions tailored to specific cultural and regulatory frameworks.

The competitive landscape is further shaped by rapid advancements in AI technologies and shifting consumer expectations. Players must continuously innovate to keep pace with trends such as omnichannel integration, real-time personalization, and sustainable practices. Additionally, stringent data privacy regulations compel companies to adopt ethical AI practices while ensuring transparency.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Alibaba partnered with a leading Chinese retailer to deploy AI-driven inventory management systems across 500 stores. This initiative aimed to streamline stock monitoring and reduce discrepancies, enhancing operational efficiency.

- In June 2023, JD.com launched an AI-powered recommendation engine designed specifically for small and medium-sized retailers. This move aimed to democratize access to advanced personalization tools, fostering inclusivity in the market.

- In August 2023, Flipkart expanded its AI-driven chatbot services to rural areas in India. This initiative focused on enhancing customer support accessibility, particularly for first-time internet users, ensuring broader adoption of AI tools.

- In November 2023, the Lotte Department Store implemented AI-powered shelf-monitoring systems in its Seoul outlets. These systems aimed to track stock levels in real-time, reducing out-of-stock instances and improving customer satisfaction.

- In January 2024, Reliance Retail acquired a Singapore-based AI startup specializing in visual search technologies. This acquisition allowed the company to integrate advanced tools into its e-commerce platform, enhancing user experience and driving innovation.

MARKET SEGMENTATION

This research report on the Asia Pacific Artificial Intelligence in Retail Market has been segmented and sub-segmented based on solution, type, end-user, and region.

By Solution

- Personalized Product Recommendation

- Visual Search

By Type

- Generative AI

- Other AI

By End User

- Online Retail

- Offline Retail

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What factors are driving the growth of AI in the retail sector in Asia Pacific?

Key drivers include the rise of e-commerce, increasing adoption of cloud computing, growing internet and smartphone penetration, and demand for improved customer experience.

2. Which countries are leading in AI adoption in retail across Asia Pacific?

China, Japan, South Korea, and India are the leading countries in terms of AI adoption in retail, due to strong tech ecosystems and large consumer markets.

3. Who are the major players in the Asia Pacific AI in Retail Market?

Key players include Alibaba, JD.com, Baidu, Tencent, SenseTime, NEC Corporation, Fujitsu, Toshiba, LG CNS, and Samsung SDS.

4. How are small and medium retailers using AI in Asia Pacific?

SMEs are using AI-based tools for customer support (chatbots), demand forecasting, and automated marketing, often via affordable SaaS platforms.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com