Asia Pacific Automation Testing Market Size, Share, Trends & Growth Forecast Report By Offering [Testing Type (Static Testing, Dynamic Testing – Functional, Non-functional), Services (Advisory, Planning, Support, Documentation, Implementation, Managed)], Endpoint Interface (Mobile, Web, Desktop, Embedded Software), Vertical (BFSI, Automotive, Aerospace and Defense, Healthcare, Retail, IT and ITES, Telecom, Manufacturing, Transportation, Energy and Utilities, Media and Entertainment), and Country (India, China, Japan, South Korea, Australia, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific Automation Testing Market Size

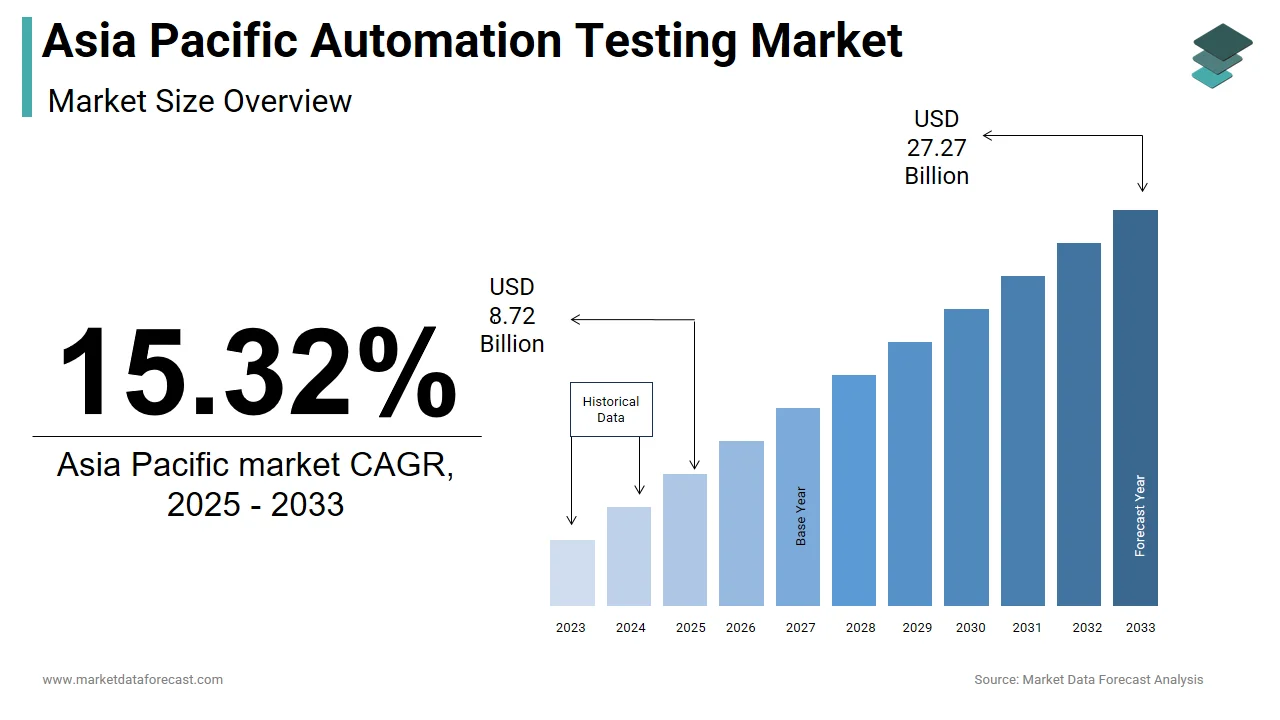

The size of the Asia Pacific automation testing market was valued at USD 7.56 billion in 2024. This market is expected to grow at a CAGR of 15.32% from 2025 to 2033 and be worth USD 27.27 billion by 2033 from USD 8.72 billion in 2025.

MARKET DRIVERS

Increasing Adoption of Agile and DevOps Methodologies

The surge in agile and DevOps practices across industries is a significant driver propelling the Asia Pacific automation testing market. Enterprises are shifting from traditional waterfall models to agile frameworks to enhance software delivery speed and efficiency. Automation testing reduces manual intervention, enabling faster feedback loops and ensuring consistent software quality. Additionally, the growing complexity of applications, coupled with the need for frequent updates, has intensified the demand for automation tools. This trend underscores the critical role of automation testing in enabling businesses to stay competitive in a dynamic market landscape.

Rising Demand for High-Quality Software Solutions

Another key driver is the escalating demand for high-quality software solutions amidst the proliferation of digital platforms. The Asia Pacific region witnessed a notable increase in mobile app downloads in in recent years, creating a pressing need for rigorous testing protocols. Automation testing ensures comprehensive coverage, identifying defects early in the development lifecycle and minimizing post-release issues. Furthermore, the rise of IoT devices and cloud-based applications has expanded the scope of testing requirements. Gartner predicts that by 2028, over 75% of enterprise applications in the region will integrate cloud technologies, necessitating robust automation frameworks. Industries like retail and telecommunications are investing heavily in automation testing to meet customer expectations for seamless user experiences.

MARKET RESTRAINTS

High Initial Costs of Implementation

One of the primary restraints hindering the growth of the Asia Pacific automation testing market is the substantial upfront investment required for implementation. Automation testing tools often come with licensing fees, infrastructure setup costs, and expenses related to training personnel. This financial burden is particularly pronounced in developing economies like Indonesia and Vietnam, where SMEs constitute a large portion of the business ecosystem. Additionally, the return on investment (ROI) for automation testing may not be immediately visible, deterring organizations from adopting these solutions. While larger corporations can absorb these costs, smaller players often struggle to justify the expenditure, limiting market penetration.

Shortage of Skilled Professionals

Another critical restraint is the scarcity of skilled professionals proficient in automation testing tools and methodologies. The rapid evolution of technologies such as artificial intelligence (AI) and machine learning (ML) has created a skills gap, leaving many organizations ill-equipped to implement automation testing effectively. The situation is exacerbated by the limited availability of formal training programs focused on advanced testing frameworks like Selenium, JUnit, and TestNG. Furthermore, a study by LinkedIn revealed that job postings for automation testing roles in the region increased in the past few years, reflecting the growing demand for expertise in this domain. Countries like India and the Philippines, despite having a large talent pool, still face challenges in aligning workforce capabilities with industry requirements. This shortage not only delays project timelines but also increases reliance on external consultants, further inflating operational costs.

MARKET OPPORTUNITIES

Emergence of AI-Driven Testing Solutions

The integration of artificial intelligence (AI) into automation testing presents a transformative opportunity for the Asia Pacific market. AI-driven testing tools enable predictive analytics, self-healing test scripts, and intelligent test case generation, significantly enhancing testing efficiency. Like, AI-powered automation testing can reduce testing efforts notably, while improving accuracy and coverage. The region’s burgeoning AI ecosystem, supported by government initiatives like China’s New Generation Artificial Intelligence Development Plan, provides a fertile ground for innovation in this space. Moreover, the increasing complexity of applications, such as those incorporating natural language processing (NLP) and computer vision, demands advanced testing capabilities that AI can deliver. Enterprises in sectors like healthcare and automotive are already leveraging AI-driven testing to validate complex systems, such as autonomous vehicles and telemedicine platforms.

Growing Focus on Cloud-Based Testing Platforms

Another promising opportunity lies in the adoption of cloud-based testing platforms, which offer scalability, flexibility, and cost-effectiveness. The Asia Pacific region is witnessing a surge in cloud adoption. Cloud-based automation testing allows organizations to execute tests on diverse environments without the need for extensive physical infrastructure, making it ideal for geographically dispersed teams. A significant percentage of enterprises in the region are prioritizing cloud migration strategies, driving demand for compatible testing solutions. Platforms like BrowserStack and Sauce Labs are gaining traction, enabling real-time testing across multiple devices and browsers. For example, Flipkart, a leading e-commerce player in India, reduced its testing cycle time notably after transitioning to a cloud-based automation framework. Additionally, the pay-as-you-go pricing model of cloud platforms appeals to SMEs, democratizing access to advanced testing tools.

MARKET CHALLENGES

Integration with Legacy Systems

A significant challenge facing the Asia Pacific automation testing market is the difficulty of integrating modern testing tools with legacy systems. Many enterprises, especially in traditional industries like banking and manufacturing, rely on outdated software architectures that are incompatible with contemporary automation frameworks. For instance, a report by EY revealed that a major Indian bank faced an increase in testing failures after attempting to automate workflows on a 20-year-old core banking platform. The lack of standardized APIs and documentation for legacy systems further complicates the integration process, requiring custom solutions that inflate costs and extend timelines. Also, the risk of disrupting critical operations during integration discourages organizations from pursuing automation initiatives. This challenge highlights the need for hybrid approaches that combine manual and automated testing to bridge the gap between old and new systems.

Ensuring Cross-Platform Compatibility

Another pressing challenge is ensuring cross-platform compatibility in an increasingly fragmented digital ecosystem. The Asia Pacific region boasts a diverse range of devices, operating systems, and network conditions, making it difficult to achieve consistent testing outcomes. According to a study by Gartner, over 60% of enterprises in the region reported challenges in validating applications across multiple platforms, particularly in mobile environments. The proliferation of IoT devices further exacerbates this issue, as testing must account for variations in hardware specifications and connectivity protocols. Traditional automation tools often fall short in addressing these challenges, necessitating the development of specialized frameworks capable of simulating real-world usage scenarios. Without effective solutions, businesses risk delivering subpar user experiences, undermining customer satisfaction and brand reputation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Offering, Endpoint Interface, Vertical, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

IBM (US), Accenture (Ireland), Broadcom (US), OpenText (Canada), Capgemini (France), Microsoft (US), Keysight Technologies (US), Cigniti Technologies (India), Tricentis (US), Cygnet Infotech (India), Invensis Technologies Pvt Ltd (India), QualityKiosk Technologies Pvt. Ltd. (India), Apexon (US), Idera, Inc. (US), QA Source (US), Astegic (US), Worksoft (US), ACCELQ (US), Sauce Labs (US), SmartBear (US), Parasoft (US), Applitools (US), AFour Technologies (India), QA mentor (US), Mobisoft Infotech (US), ThinkSys (US), Qt Group (Finland), Codoid (India), and others. |

SEGMENTAL ANALYSIS

By Offering Insights

The dynamic testing segment dominated the Asia Pacific automation testing market by accounting for a 65.1% of the total share in 2024. This segment’s prominence is driven by its ability to validate software behavior under real-time conditions, ensuring higher accuracy and reliability. The demand for dynamic testing is particularly strong in industries like BFSI and e-commerce, where system performance and user experience are critical. For instance, Flipkart reported a reduction in post-deployment issues after adopting dynamic testing frameworks. The proliferation of mobile and web applications further amplifies the need for dynamic testing. Besides, the growing complexity of cloud-based applications has expanded the scope of dynamic testing.

The static testing segment is the fastest-growing segment within the Asia Pacific automation testing market, with a projected CAGR of 18.5% from 2025 to 2033. This rapid growth is fueled by the increasing emphasis on early defect detection during the software development lifecycle. Static testing tools analyze source code without executing it, enabling developers to identify vulnerabilities and inefficiencies at an early stage. As per Number Analytics, organizations implementing static testing experienced a 35% reduction in defect resolution costs compared to traditional methods. The rise of DevSecOps practices is another key driver propelling the adoption of static testing. Enterprises are integrating security into the development pipeline, with static application security testing (SAST) tools playing a crucial role. A large number of IT firms in the region have adopted DevSecOps methodologies, driving demand for static testing solutions. Furthermore, regulatory compliance requirements, such as GDPR and APPI, mandate rigorous code reviews, further boosting the segment’s growth.

By Endpoint Interface Insights

The segment of web-based testing held the largest share of the Asia Pacific automation testing market i.e. 45% of the total share in 2024. This segment’s dominance is attributed to the widespread adoption of web applications across industries, particularly in e-commerce, education, and healthcare. Like, the number of active web users in the region increased in recent years, creating a robust demand for testing tools that ensure cross-browser compatibility and optimal performance. For instance, Alibaba Group reported a 25% increase in customer satisfaction after implementing automated web testing frameworks to validate its platforms. The growing complexity of web applications, coupled with the need for seamless user experiences, further drives the segment’s growth. Additionally, the shift toward remote work and digital transformation has intensified the reliance on web applications, making testing indispensable. For example, Zoom’s rapid expansion in the region was supported by rigorous web-based testing to ensure uninterrupted video conferencing services.

By Vertical Insights

The automotive vertical is the quickest expanding segment in the Asia Pacific automation testing market, with a projected CAGR of 20.3%. This rise is driven by the increasing integration of advanced technologies such as autonomous driving systems, connected cars, and electric vehicles. For instance, Hyundai reported a 40% improvement in software reliability after deploying automation testing tools for its autonomous vehicle projects. The push for regulatory compliance also fuels the segment’s expansion. Governments in the region are enforcing stringent safety and emission standards, necessitating rigorous testing protocols. Furthermore, the rise of smart factories and Industry 4.0 initiatives has created new opportunities for automation testing in manufacturing processes. For example, Toyota leveraged automation testing to streamline production workflows, achieving a reduction in downtime.

COUNTRY-LEVEL ANALYSIS

China continued to be the top performer in the Asia Pacific automation testing market by contributing a 40.6% of the total revenue in 2024. The country’s dominance is fueled by its robust manufacturing sector and emphasis on smart factories. The government’s Made in China 2025 initiative has accelerated investments in automation technologies, with a focus on sectors like automotive and electronics. For instance, Huawei reported an improvement in software deployment efficiency after implementing advanced automation testing frameworks.

India is moving ahead with a notable market share. The country’s IT services industry plays a pivotal role, with automation testing being integral to delivering high-quality software solutions. For example, TCS achieved a reduction in testing cycle times for its clients using AI-driven automation tools.

Japan holds a significant share of the market. The country’s focus on precision and quality aligns perfectly with automation testing. Government initiatives like Society 5.0 further bolster the adoption of advanced testing frameworks.

South Korea accounts for decent portion of the market which is driven by its leadership in technology innovation. The country’s emphasis on 5G and IoT has increased demand for automation testing. For instance, LG Electronics reduced post-deployment issues through automation testing.

Australia and New Zealand collectively are key players of the market. The region’s strong regulatory framework and focus on digital transformation drive adoption.

KEY MARKET PLAYERS

Companies dominating the Asia-Pacific automation testing market profiled in this report are IBM (US), Accenture (Ireland), Broadcom (US), OpenText (Canada), Capgemini (France), Microsoft (US), Keysight Technologies (US), Cigniti Technologies (India), Tricentis (US), Cygnet Infotech (India), Invensis Technologies Pvt Ltd (India), QualityKiosk Technologies Pvt. Ltd. (India), Apexon (US), Idera, Inc. (US), QA Source (US), Astegic (US), Worksoft (US), ACCELQ (US), Sauce Labs (US), SmartBear (US), Parasoft (US), Applitools (US), AFour Technologies (India), QA mentor (US), Mobisoft Infotech (US), ThinkSys (US), Qt Group (Finland), Codoid (India), and others.

TOP LEADING PLAYERS IN THE MARKET

Accenture

Accenture has emerged as a leader in the Asia Pacific automation testing market, leveraging its expertise in digital transformation and AI-driven solutions. The company focuses on delivering end-to-end automation testing services tailored to industries like BFSI, healthcare, and retail.

Capgemini

Capgemini plays a pivotal role in driving innovation within the Asia Pacific automation testing landscape. The company emphasizes cloud-based testing platforms, catering to enterprises transitioning to hybrid IT environments. In early 2024, Capgemini partnered with AWS to develop a self-healing automation framework, enhancing testing efficiency for clients in Australia and Japan. Its focus on upskilling professionals in automation tools has strengthened its position as a trusted partner for large-scale digital transformation projects across the region.

Cognizant

Cognizant has established itself as a key player by offering specialized automation testing solutions for mobile and web applications. The company’s recent initiatives include the deployment of machine learning algorithms to optimize test case generation and execution. By investing in R&D and expanding its delivery centers in Southeast Asia, Cognizant continues to address the evolving needs of the regional market.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the Asia Pacific automation testing market employ a mix of organic and inorganic strategies to strengthen their positions. Partnerships with cloud providers like AWS and Microsoft Azure enable companies to offer scalable and flexible testing solutions. Acquisitions of niche automation tool vendors help expand service portfolios and enhance technological capabilities. For instance, investments in AI and machine learning are prioritized to develop intelligent testing frameworks. Additionally, firms focus on upskilling their workforce through training programs, ensuring alignment with industry trends. Collaborations with regional governments and enterprises also play a crucial role in driving adoption across sectors like BFSI and automotive. These strategies collectively enhance competitiveness and foster innovation in the market.

COMPETITION OVERVIEW

The Asia Pacific automation testing market is characterized by intense competition, driven by the presence of global IT services firms, regional players, and niche solution providers. Companies like Accenture, Capgemini, and Cognizant dominate the landscape, leveraging their expertise in AI, cloud, and DevOps to deliver innovative testing solutions. Regional players, such as Infosys and TCS, compete by offering cost-effective and customized frameworks tailored to local market needs. The market also witnesses the entry of startups specializing in AI-driven testing tools, intensifying rivalry. Strategic collaborations with technology providers and investments in R&D are critical differentiators. Furthermore, government initiatives promoting digital transformation have created opportunities for market participants to expand their footprints. This competitive environment fosters innovation, driving advancements in automation testing technologies and methodologies tailored to the region’s diverse industries.

RECENT MARKET DEVELOPMENTS

- In April 2023, Accenture launched an AI-powered testing platform to integrate with agile and DevOps workflows, enhancing defect detection for clients in India and Southeast Asia.

- In June 2023, Capgemini partnered with AWS to develop a cloud-based self-healing automation framework, improving testing efficiency for enterprises in Japan and Australia.

- In August 2023, Cognizant collaborated with Indian e-commerce leaders to deploy dynamic testing frameworks, ensuring seamless performance during peak shopping seasons.

- In November 2023, Infosys acquired a niche automation tool provider to expand its portfolio of intelligent testing solutions, targeting BFSI and healthcare sectors.

- In February 2024, TCS introduced a machine learning-based testing tool designed to optimize test case generation, reducing testing cycle times for clients in South Korea and Vietnam.

MARKET SEGMENTATION

This Asia Pacific automation testing market research report is segmented and sub-segmented into the following categories.

By offering

- Testing Type

- Static Testing

- Dynamic Testing

- Functional Testing

- Non-functional Testing

- Services

- Advisory and Consulting Services

- Planning and Development Services

- Support and Maintenance Services

- Documentation and Training Services

- Implementation Services

- Managed Services

- Other Services

By Endpoint Interface

- Mobile

- Web

- Desktop

- Embedded Software

By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Automotive

- Aerospace and Defense

- Healthcare and Life Sciences

- Retail

- IT and ITES

- Telecom

- Manufacturing

- Transportation and Logistics

- Energy and Utilities

- Media and Entertainment

- Other Verticals

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific automation testing market?

The Asia Pacific automation testing market is driven by agile and DevOps adoption, rising digital platforms, and demand for high-quality software and rapid releases

2. What challenges affect the Asia Pacific automation testing market?

High upfront costs, shortage of skilled professionals, integration with legacy systems, and ensuring cross-platform compatibility are major challenges for the Asia Pacific automation testing market

3. What opportunities exist in the Asia Pacific automation testing market?

AI-powered testing, cloud-based platforms, and demand for advanced solutions in sectors like automotive and healthcare create strong opportunities in the Asia Pacific automation testing market

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com