Asia Pacific Automotive Camera Market Report – Segmented By Technology (Digital Cameras, Infrared Cameras),ICE and EV Application, Vehicle Type, View, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Automotive Camera Market Size

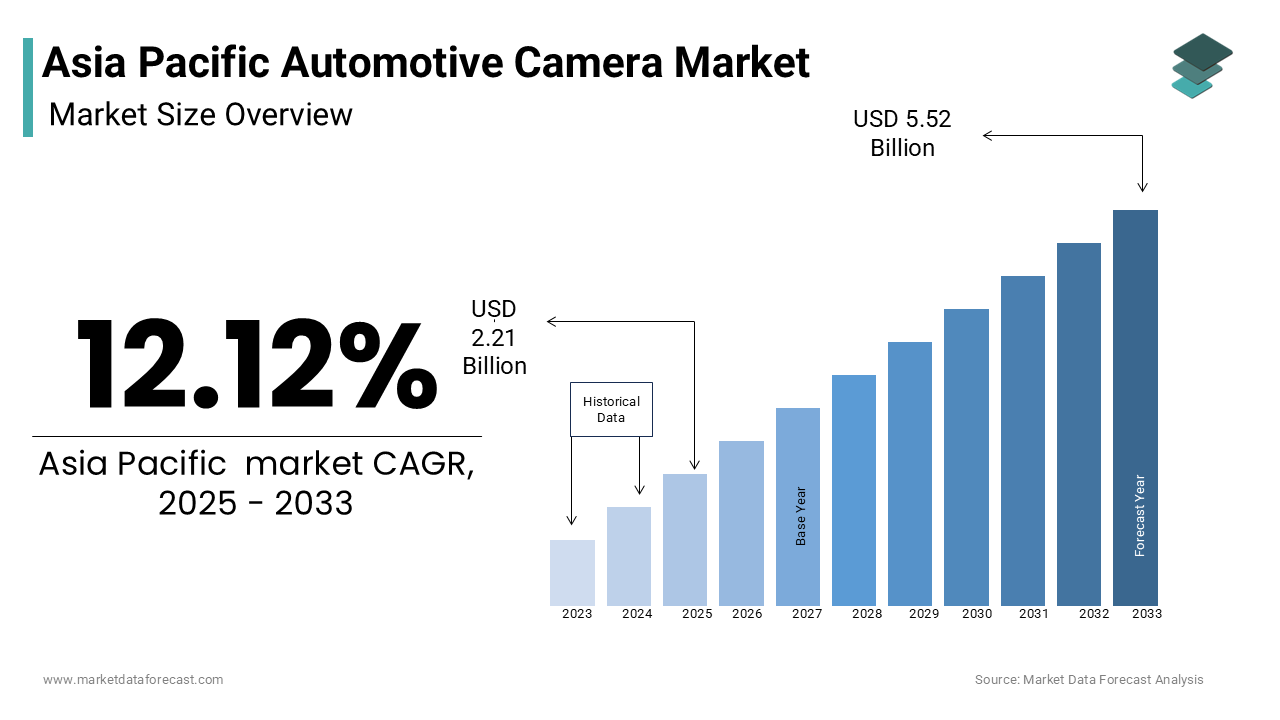

The Asia Pacific Automotive Camera Market was worth USD 1.97 billion in 2024. The Asia Pacific market is expected to reach USD 5.52 billion by 2033 from USD 2.21 billion in 2025, rising at a CAGR of 12.12% from 2025 to 2033.

Automotive cameras are integral components of advanced driver assistance systems (ADAS), enabling functionalities such as lane departure warnings, adaptive cruise control, and parking assistance.

MARKET DRIVERS

Rising Demand for Advanced Driver Assistance Systems (ADAS)

The growing adoption of advanced driver assistance systems (ADAS) is a significant driver propelling the Asia Pacific automotive camera market. Also, the shift toward semi-autonomous and autonomous vehicles has intensified demand for 360-degree surround-view cameras, which provide real-time imaging for navigation and parking assistance. Also, automakers adopting high-resolution cameras achieve an improvement in system accuracy, enhancing user experience and safety.

Increasing Penetration of Electric Vehicles (EVs)

The exponential growth of the electric vehicle (EV) market in the Asia Pacific serves as another major driver for automotive cameras. Automotive cameras are indispensable in EVs, particularly for autonomous driving features and energy-efficient systems. Besides, the integration of artificial intelligence (AI) with camera systems enhances object detection and decision-making capabilities, aligning with the transition to autonomous mobility. In addition, vehicles incorporating AI-enabled cameras achieve a reduction in operational costs over their lifespan, making them a preferred choice for manufacturers.

MARKET RESTRAINTS

High Costs of Implementation and Maintenance

A significant restraint impacting the Asia Pacific automotive camera market is the high cost associated with implementation and maintenance. Like, the integration of high-resolution cameras and AI-based processing systems can increase vehicle manufacturing costs deterring price-sensitive consumers in developing countries like India and Vietnam. This financial barrier is particularly challenging for small-scale automakers, who struggle to balance affordability with technological innovation. For instance, limited number of local manufacturers were capable of adopting advanced camera systems due to limited financial resources. Apart from these, the lack of standardized repair networks for camera-equipped vehicles creates challenges for end-users, leading to higher maintenance expenses. Governments across the region are attempting to address these issues through subsidies and policy reforms, but progress remains slow due to entrenched practices and limited outreach.

Limited Awareness Among End-Users

Another critical restraint is the limited awareness among end-users about the benefits of automotive cameras compared to traditional safety systems. Also, a significant portion of small-scale vehicle owners in rural areas rely on conventional safety mechanisms, unaware of the superior performance and reliability offered by modern camera systems. This knowledge gap is exacerbated by inadequate marketing and educational campaigns, leaving consumers hesitant to invest in advanced technologies. For example, only a small number of first-time vehicle buyers in the country were familiar with ADAS features, citing concerns about complexity and compatibility with existing systems. In addition, misconceptions about higher operational costs and limited availability further deter adoption, despite advancements in technology addressing these issues. Regulatory bodies in countries like Thailand and the Philippines are attempting to address these challenges through awareness programs, but progress remains slow due to limited funding and outreach.

MARKET OPPORTUNITIES

Adoption of AI-Integrated Camera Systems

A burgeoning opportunity in the Asia Pacific automotive camera market lies in the increasing adoption of artificial intelligence (AI)-integrated camera systems, driven by the global push for autonomous mobility. Like, AI-enabled cameras enhance object detection and decision-making capabilities, making them indispensable for Level 3 and above autonomous driving systems. For instance, vehicles incorporating AI-based cameras achieve an improvement in obstacle recognition accuracy, reducing the risk of accidents in urban environments. Further, the integration of deep learning algorithms enables real-time image processing, addressing challenges posed by adverse weather conditions and low visibility. Governments across the region are incentivizing the development of these technologies through research grants and policy reforms, providing additional impetus for their adoption.

Expansion into Emerging Applications

Another significant opportunity stems from the expansion into emerging applications, such as fleet management, logistics, and public transportation. According to the Global Fleet Management Market Report, the Asia Pacific accounts for a significant portion of global fleet operations, driving demand for advanced camera systems that enhance safety and operational efficiency. For example, a study reveals that logistics companies using dashcams achieve a reduction in insurance premiums, addressing concerns about liability and compliance. Also, the growing emphasis on smart cities has propelled the use of cameras in public transportation systems, where they monitor passenger safety and optimize route planning. Governments across the region are incentivizing the adoption of these technologies through subsidies and infrastructure investments, further amplifying demand.

MARKET CHALLENGES

Cybersecurity Vulnerabilities

A significant challenge facing the Asia Pacific automotive camera market is the heightened risk of cybersecurity vulnerabilities, particularly as camera systems become increasingly integrated with AI and connected technologies. Also, the lack of standardized cybersecurity protocols creates inconsistencies in protection measures, leaving stakeholders vulnerable to emerging threats. Governments in countries like Japan and South Korea are attempting to address these issues through policy reforms, but progress remains slow due to limited technological expertise and fragmented regulatory frameworks. These factors, combined with consumer concerns about data privacy, create a pressing need for robust security solutions to ensure widespread adoption.

Technological Limitations in Adverse Conditions

Another pressing challenge is the technological limitations of automotive cameras in adverse weather conditions, such as heavy rain, fog, or snow. Similarly, a notable percentage of road accidents in the Asia Pacific region occur during inclement weather, highlighting the need for reliable imaging systems. Additionally, the integration of thermal imaging and infrared technologies, while promising, faces challenges related to high costs and limited scalability. Governments across the region are incentivizing the development of these technologies through subsidies and research grants, but progress remains slow due to technical complexities and resource constraints.

SEGMENTAL ANALYSIS

By Technology Insights

The digital cameras segment dominated the Asia Pacific automotive camera market by commanding a market share of 65.6% in 2024. This leading position is primarily driven by their versatility, affordability, and compatibility with advanced driver assistance systems (ADAS). According to the study, digital cameras are widely used in functionalities such as lane departure warnings and adaptive cruise control, which enhance vehicle safety and user experience. Also, advancements in image processing technologies have enabled real-time object detection and decision-making capabilities, aligning with the transition to autonomous mobility.

Infrared cameras are projected to grow at a CAGR of 12.5%. This rapid expansion is fueled by their ability to enhance visibility under low-light conditions, making them indispensable for applications like night vision systems (NVS) and pedestrian detection. Like, infrared cameras exhibit a considerable improvement in obstacle recognition accuracy during nighttime driving, reducing the risk of accidents in urban environments. For example, a study reveals that vehicles equipped with infrared cameras achieve reduction in collision rates during adverse lighting conditions. In addition, the growing emphasis on smart cities has propelled the adoption of infrared cameras in public transportation systems, where they monitor passenger safety and optimize route planning. Governments across the region are incentivizing the development of these technologies through subsidies and research grants, providing additional impetus for their adoption.

By ICE and EV Application

The Adaptive cruise control (ACC) represented the largest application segment in the Asia Pacific automotive camera market by accounting for 35.7% of total demand in 2024. This prominence is driven by the widespread use of ACC systems in both internal combustion engine (ICE) and electric vehicles (EVs), where their ability to maintain safe distances enhances driver convenience and safety. Like, a significant portion of new vehicles in Japan are equipped with ACC systems, necessitating high-performance cameras for object detection and distance measurement. For instance, a study notes that vehicles using ACC systems achieve an improvement in fuel efficiency, addressing consumer concerns about mileage limitations. Also, the integration of AI-based image processing enhances decision-making capabilities, aligning with the transition to autonomous mobility.

The driver monitoring systems (DMS) segment is emerging as the fastest-growing application, with a projected CAGR of 15.2%. This rise is propelled by the increasing focus on driver safety and fatigue detection, particularly in long-haul commercial vehicles. Also, DMS-equipped vehicles exhibit a reduction in accidents caused by driver fatigue, addressing critical safety concerns. For example, logistics companies using DMS achieve a reduction in insurance premiums, enhancing cost efficiency. In addition, the growing emphasis on shared mobility and autonomous taxis has intensified demand for DMS, where they ensure continuous monitoring of driver attentiveness and compliance with safety protocols. Governments across the region are incentivizing the adoption of these technologies through policy reforms and infrastructure investments, further amplifying demand.

By Vehicle Type Insights

Passenger cars (PC) were the biggest vehicle type segment in the Asia Pacific automotive camera market. This control is driven by the widespread adoption of advanced driver assistance systems (ADAS) in passenger vehicles, where cameras enhance safety, convenience, and user experience. Additionally, the proliferation of electric vehicles (EVs) has amplified demand for high-resolution cameras, which are essential for autonomous driving features and energy-efficient systems.

The light commercial vehicles (LCVs) are moving ahead quickly in the market, with a calculated CAGR of 13.8%. This progress is influenced by the increasing adoption of fleet management systems, where cameras enhance safety and operational efficiency. Further, the growing emphasis on e-commerce and last-mile delivery has intensified demand for advanced camera systems, where they monitor driver behavior and ensure timely deliveries. Governments across the region are incentivizing the adoption of these technologies through subsidies and infrastructure investments, further amplifying demand.

By View Insights

The segment of rear view cameras segment commanded the Asia Pacific automotive camera market by commanding a market share of 45.6%. This leading position is primarily driven by stringent regulatory mandates requiring the inclusion of rearview cameras in all new vehicles. Apart from these, the integration of wide-angle lenses and AI-based image processing enhances object detection capabilities, aligning with the transition to autonomous mobility.

The surround view cameras segment is predicted to advance at a CAGR of 14.5%. This rapid expansion is fueled by their ability to provide a 360-degree view of the vehicle’s surroundings, making them indispensable for navigation and parking assistance. Also, the growing emphasis on autonomous driving has intensified demand for multi-camera systems, which enable real-time imaging and decision-making capabilities. Governments across the region are incentivizing the adoption of these technologies through subsidies and research grants, providing additional impetus for their adoption.

REGIONAL ANALYSIS

China stood as the cornerstone of the Asia Pacific automotive camera market, commanding a market share of 40% in 2024. The country’s dominance is underpinned by its status as the world’s largest automotive producer, with a large number of vehicles manufactured annually. The proliferation of electric vehicles (EVs) has further intensified demand for advanced camera systems, with government subsidies driving the adoption of ADAS technologies. Additionally, the integration of AI-based image processing aligns with the transition to autonomous mobility, creating a robust demand-supply ecosystem.

Japan is a key market. The country’s strong focus on safety and innovation has positioned it as a leader in advanced camera technologies. Initiatives like the mandatory inclusion of rearview cameras in all new vehicles have accelerated the adoption of automotive cameras, addressing consumer concerns about road safety. In addition, the shift toward autonomous driving has intensified demand for AI-enabled cameras, which enhance object detection and decision-making capabilities.

South Korea commands a notable share and is propelled by its strong focus on innovation and premium manufacturing. The country is home to leading automakers like Hyundai and Kia, which prioritize advanced safety systems to enhance driver convenience and safety. Further, the growing emphasis on autonomous taxis and shared mobility has intensified demand for multi-camera systems, which enable real-time imaging and decision-making capabilities. Like, automakers adopting these innovations achieve a reduction in operational costs over their lifespan, reinforcing their competitive edge.

India is a lucrative market that is driven by its rapid urbanization and population growth, as per the Federation of Indian Chambers of Commerce and Industry. The country’s burgeoning automotive industry has intensified demand for affordable yet reliable camera systems, particularly in passenger cars and light commercial vehicles. Initiatives like the “Make in India” campaign have accelerated the transition to advanced manufacturing practices, necessitating the adoption of ADAS technologies. Further, the integration of AI-based image processing aligns with the transition to autonomous mobility, creating a robust demand-supply ecosystem.

Australia and New Zealand collectively account for a smaller share, propelled by their strong focus on sustainability and climate-resilient automotive solutions. The region’s stringent environmental regulations have incentivized the adoption of eco-friendly camera systems, such as those integrated with AI and thermal imaging technologies. Also, the growing emphasis on smart cities has propelled the use of cameras in public transportation systems, where they monitor passenger safety and optimize route planning. Governments across the region are incentivizing the adoption of these technologies through subsidies and infrastructure investments, further amplifying demand.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE4

Autoliv Inc., Continental AG, Delphi Automotive PLC, Denso Corporation, Panasonic Corporation, Sony Electronics, Robert Bosch GmbH, Valeo S.A., GWR Safety Systems, Magna International Inc., Mobileye, Stonkam Co. Ltd., OmniVision Technologies Inc., Aptiv PLC, and GENTEX Corporation are some of the key market players.

The Asia Pacific automotive camera market is characterized by intense competition, driven by the presence of both multinational corporations and regional players striving to capture market share. Leading companies leverage their technological expertise and R&D capabilities to introduce innovative solutions that cater to evolving automotive demands. The market landscape is shaped by regulatory dynamics, with stringent safety standards promoting the adoption of advanced camera systems. Regional players often focus on cost-effective solutions tailored to local needs, challenging the dominance of global giants. Strategic initiatives such as mergers, acquisitions, and partnerships are prevalent, enabling companies to consolidate their positions and expand their geographic reach. Additionally, the growing emphasis on sustainability and digital transformation has intensified rivalry, as firms strive to differentiate themselves through eco-friendly offerings and advanced application techniques.

Top Players in the Asia Pacific Automotive Camera Market

Bosch Group

Bosch is a global leader in the automotive camera market, with a significant presence in the Asia Pacific region. The company’s advanced camera systems are integral to advanced driver assistance systems (ADAS), enabling functionalities like lane departure warnings and adaptive cruise control. Bosch’s contributions to the global market are underscored by its focus on innovation, particularly in AI-enabled cameras that enhance object detection and decision-making capabilities.

Continental AG

Continental AG is a key player in the Asia Pacific automotive camera market, offering high-performance systems tailored for safety and convenience applications. The company emphasizes research and development, introducing innovations such as surround-view and thermal imaging cameras. Continental’s global influence is bolstered by collaborations with OEMs to develop customized solutions for electric vehicles (EVs) and autonomous mobility.

Aptiv PLC

The Asia Pacific Smart Lighting Market was worth USD 5.58 billion in 2024. The Asia Pacific market is expected to reach USD 38.95 billion by 2033 from USD 6.92 billion in 2025, rising at a CAGR of 24.10% from 2025 to 2033. Aptiv PLC is renowned for its specialty camera systems, catering to niche applications in autonomous driving and fleet management. The company’s expertise lies in developing high-grade products that offer superior accuracy, real-time imaging, and integration with AI-based platforms. Aptiv’s contributions to the global market extend beyond product innovation; it actively engages in knowledge-sharing initiatives to educate stakeholders about modern camera technologies.

Top Strategies Used by Key Players in the Asia Pacific Automotive Camera Market

Focus on Innovation and AI Integration

Key players in the Asia Pacific market have increasingly prioritized innovation by integrating artificial intelligence (AI) into their camera systems. This strategy enhances object detection, decision-making, and real-time imaging capabilities, addressing critical safety concerns in both passenger and commercial vehicles. Companies actively collaborate with universities and research institutions to develop cutting-edge technologies like deep learning algorithms and thermal imaging. For instance, partnerships with AI startups facilitate the creation of advanced image processing systems, improving system accuracy and reliability.

Strategic Collaborations and Joint Ventures

Strategic collaborations with automakers, suppliers, and technology firms are pivotal for strengthening market positions. These partnerships enable companies to gain insights into regional requirements, co-develop customized solutions, and streamline distribution networks. For example, alliances with EV manufacturers facilitate the use of high-resolution cameras in autonomous driving features. Additionally, joint ventures with logistics firms ensure timely project execution and consistent product availability.

Expansion of Production Facilities and Localization

To meet escalating demand, companies are expanding their production capacities and localizing manufacturing units across the Asia Pacific region. Establishing localized facilities reduces logistical challenges and ensures compliance with regional standards. Furthermore, enhancing distribution channels enables companies to reach small-scale contractors who form a significant portion of the market. Investments in digital tools for supply chain management improve operational efficiency, reducing lead times and costs.

RECENT MARKET DEVELOPMENTS

- In March 2023, Bosch Group launched a new line of AI-enabled cameras in China, aimed at enhancing object detection and decision-making capabilities. This initiative reinforced its commitment to innovation and positioned it as a leader in autonomous mobility solutions.

- In May 2023, Continental AG partnered with a leading EV manufacturer in South Korea to develop high-resolution cameras for autonomous driving features. This collaboration enhanced its product portfolio and addressed regional demands for advanced safety systems.

- In July 2023, Aptiv PLC expanded its production facility in India to increase the output of surround-view camera systems. This move was designed to meet the growing demand for advanced safety and convenience applications in passenger cars.

- In September 2023, Panasonic acquired a regional distributor in Thailand to strengthen its distribution network and improve accessibility to rural automotive projects. This acquisition bolstered its market presence in Southeast Asia.

- In November 2023, Sony introduced a digital platform in Japan to provide real-time insights into camera performance and application techniques. This innovation positioned the company as a pioneer in integrating technology with traditional manufacturing practices.

MARKET SEGMENTATION

This research report on the Asia Pacific Automotive Camera Market is segmented and sub-segmented into the following categories.

By Technology

- Digital Cameras

- Infrared Cameras

By ICE and EV Application

- Adaptive Cruise Control (ACC)

- Driver Monitoring Systems (DMS)

By Vehicle Type

- Largest Segment: Passenger Cars (PC)

- Light Commercial Vehicles (LCV)

By View

- Rear View Cameras

- Surround View Cameras

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of the automotive camera market in Asia Pacific?

The market is primarily driven by the rising adoption of Advanced Driver Assistance Systems (ADAS), increasing vehicle safety regulations, growing demand for autonomous and semi-autonomous vehicles, and technological advancements in imaging and sensor technologies.

What are the challenges facing the automotive camera market in Asia Pacific?

Key challenges include high costs of advanced camera systems, integration complexity with other sensors and systems, and regulatory hurdles related to autonomous driving technologies.

What is the future outlook for the market in Asia Pacific?

The market is expected to continue growing rapidly due to increased investment in automotive safety technologies, regulatory push for safer vehicles, and innovation in AI-powered vision systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]