Asia Pacific Automotive ECU Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By ECU Capacity, Propulsion, Vehicle Type, Application, Level of Autonomous And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Automotive ECU Market Size

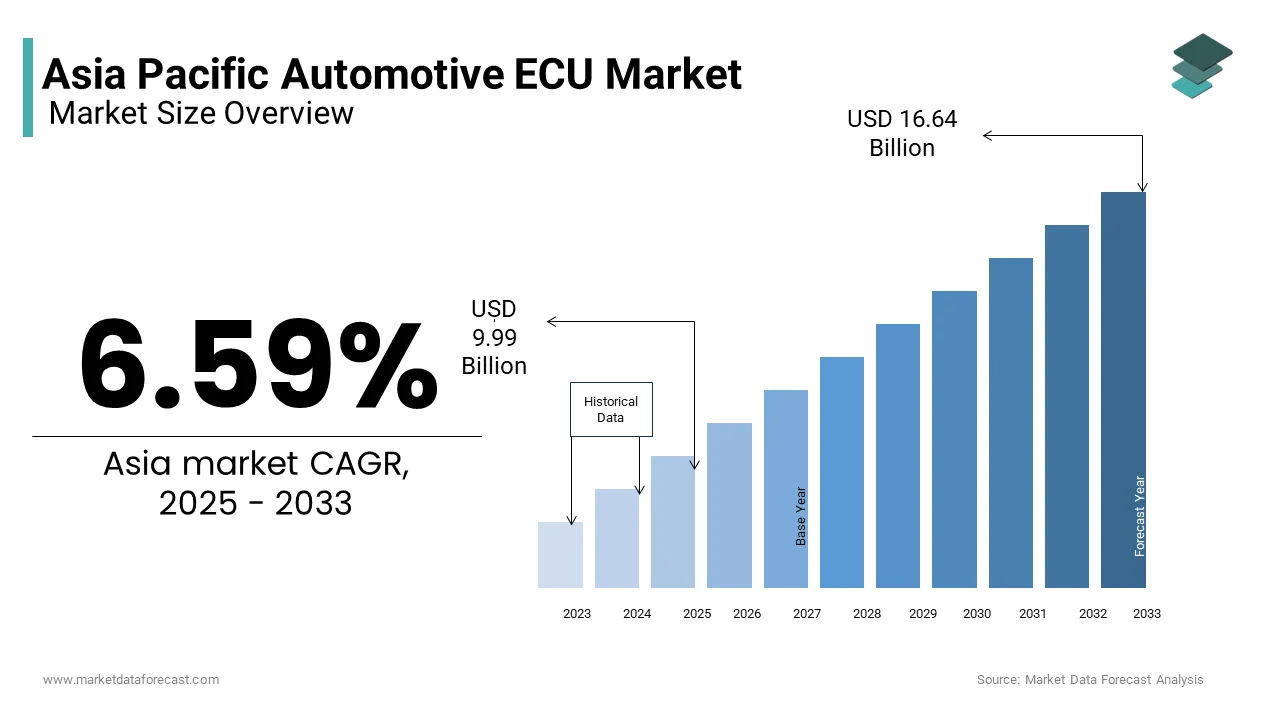

The Asia Pacific automotive electronic control unit (ECU) market was valued at USD 9.37 billion in 2024 and is anticipated to reach USD 9.99 billion in 2025 from USD 16.64 billion by 2033, growing at a CAGR of 6.59% during the forecast period from 2025 to 2033.

The Asia Pacific automotive electronic control unit (ECU) market represents a critical segment within the broader automotive electronics industry, driven by rapid technological advancements and increasing demand for vehicle electrification. Countries such as China, Japan, South Korea, and India are at the forefront of this transformation, owing to their robust automotive manufacturing bases and government initiatives aimed at boosting EV adoption. For instance, China accounted for over 60% of global EV sales in 2023, significantly amplifying the requirement for high-performance ECUs tailored for next-generation vehicles. In addition, rising consumer awareness regarding fuel efficiency, emissions reduction, and vehicle connectivity is prompting automakers to integrate more intelligent electronic architectures, further pushing ECU demand.

MARKET DRIVERS

Surge in Electric Vehicle Production and Sales

One of the primary drivers of the Asia Pacific automotive ECU market is the exponential increase in electric vehicle (EV) production and sales. Unlike traditional internal combustion engine (ICE) vehicles, EVs require a significantly higher number of ECUs to manage complex functions such as battery management, motor control, regenerative braking, and thermal regulation. According to the International Energy Agency, Asia Pacific accounted for nearly 70% of global EV sales in 2023, with China alone contributing over 9 million units sold during the year. This massive shift toward electrification necessitates highly integrated and intelligent ECU architectures capable of real-time data processing and energy optimization.

Furthermore, governments in the region have introduced aggressive policy frameworks to promote EV adoption. For example, China’s Ministry of Industry and Information Technology set an ambitious target of achieving 25% new energy vehicle penetration by 2025. Japan and South Korea have also committed to phasing out ICE vehicles by 2035 and 2035 respectively, thereby accelerating the deployment of advanced electronic systems within automobiles. The growing integration of domain-based and zonal E/E (electrical/electronic) architectures in EV platforms further magnifies ECU demand, making this sector a key growth lever for semiconductor and automotive electronics suppliers across the Asia Pacific region.

Expansion of Connected and Autonomous Vehicle Technologies

Another significant factor propelling the Asia Pacific automotive ECU market is the rapid advancement and integration of connected and autonomous vehicle technologies. These innovations heavily rely on a multitude of ECUs to process real-time data from sensors, cameras, lidar, and radar systems. As the region moves toward semi-autonomous and fully autonomous driving capabilities, the complexity and number of onboard ECUs have increased substantially.

Japan and South Korea have been pioneers in developing smart mobility ecosystems. Companies like Toyota and Hyundai have actively invested in autonomous driving R&D centers, integrating AI-powered ECUs to support decision-making capabilities in self-driving systems. In India, the government-backed Mobility 4.0 initiative aims to fast-track the adoption of connected mobility solutions, leading to increased demand for advanced ECUs that facilitate V2X (vehicle-to-everything) communication.

MARKET RESTRAINTS

Semiconductor Supply Chain Disruptions

A major restraint affecting the Asia Pacific automotive ECU market is the ongoing instability in the global semiconductor supply chain. Modern ECUs depend heavily on microcontrollers, memory chips, and power semiconductors, all of which have faced shortages due to geopolitical tensions, pandemic-induced factory shutdowns, and logistical bottlenecks. According to IHS Markit, in 2022 alone, the global automotive industry experienced a production loss of over 4.5 million vehicles due to semiconductor shortages, with several assembly plants in Thailand, Malaysia, and Japan being particularly affected. Moreover, trade restrictions between the United States and China have led to uncertainty in sourcing essential electronic components. Many automotive manufacturers in the region have had to delay product launches or reduce output due to unavailability of specific chipsets needed for ECU operations. For example, companies like Suzuki and Honda were forced to temporarily halt production lines in Southeast Asia in early 2023 due to component shortages from key suppliers in China and Taiwan. According to McKinsey & Company, full recovery and stabilization of the semiconductor supply chain may not occur until 2025, which is meaning that the automotive ECU market in Asia Pacific will continue to face procurement challenges in the near term.

Rising Complexity and Integration Challenges

The complexity of integrating multiple ECUs into a cohesive and reliable network has become a significant challenge for automotive manufacturers, as vehicle architectures evolve toward centralized computing and zonal E/E systems. Traditional ECU designs were largely independent, but modern architectures require seamless communication between various control units, often resulting in compatibility issues and software inefficiencies. According to SAE International, the average vehicle now runs on more than 100 million lines of code, much of it embedded within different ECUs, which is leading to prolonged validation cycles and higher development costs.

In countries like China and South Korea, where automakers are aggressively pursuing software-defined vehicle strategies, the burden on ECU integration has intensified. Companies are encountering difficulties in ensuring interoperability between hardware and software components sourced from multiple vendors. Furthermore, OEMs are facing delays in certification and compliance testing due to stringent cybersecurity and functional safety requirements under ISO 26262 standards. A report by Roland Berger indicated that up to 30% of automotive recalls in 2023 were related to ECU software failures or integration flaws. These technical hurdles not only slow down time-to-market but also increase financial risk, especially for smaller regional players who lack the infrastructure to handle large-scale ECU reprogramming and maintenance.

MARKET OPPORTUNITIES

Growth of Aftermarket and Retrofitting Solutions

A compelling opportunity emerging within the Asia Pacific automotive ECU market is the expanding aftermarket and retrofitting segment, particularly in response to increasingly stringent emission norms and fleet modernization demands. Governments in several APAC nations including India, Indonesia, and Vietnam are enforcing tighter environmental regulations, compelling commercial fleet operators and individual consumers to upgrade older vehicles rather than replace them entirely. This trend has spurred demand for retrofit ECU solutions designed to enhance fuel efficiency, reduce carbon emissions, and improve engine performance without necessitating full vehicle replacement.

For example, India’s Bharat Stage VI (BS-VI) emission norms, implemented in 2020, which created a surge in demand for retrofit devices compatible with pre-existing BS-IV engines. Companies like Bosch and Continental have launched programmable ECU tuning kits tailored for diesel and petrol engines, enabling compliance with updated emissions benchmarks. According to NITI Aayog, over 5 million commercial vehicles in India are eligible for retrofitment, presenting a significant business opportunity for ECU solution providers. Similarly, in Australia, the Department of Infrastructure, Transport, Regional Development, and Communications reported a 15% year-over-year increase in ECU-based emission control installations in heavy-duty transport fleets.

Additionally, the availability of cost-effective, plug-and-play ECU modules that enables quicker deployment, reducing downtime for fleet owners. With urbanization and last-mile logistics booming across the region, the need for efficient and compliant vehicle operations will continue to drive aftermarket ECU adoption, offering manufacturers a lucrative avenue for revenue diversification beyond OE (original equipment) segments.

Localization of ECU Manufacturing and Software Development

Another strategic opportunity shaping the Asia Pacific automotive ECU market is the localization of both hardware manufacturing and software development for automotive electronics. Historically, ECU design and production were concentrated in Western markets, but recent shifts in trade policies, supply chain resilience strategies, and regional technology incentives have prompted a transition toward localized production hubs across Asia. Countries like India, Vietnam, and Thailand are witnessing increased foreign direct investment (FDI) in semiconductor fabrication and automotive software engineering, supported by government-led programs aimed at building domestic industrial capacity.

India’s PLI scheme for the automobile sector, for instance, has attracted substantial investment from global Tier-1 suppliers keen on setting up regional R&D and manufacturing facilities. According to Invest India, the country's automotive PLI program allocated over USD 6 billion in incentives to companies investing in indigenous auto-component production, including ECUs and associated software stacks. Similarly, Vietnam has emerged as a preferred alternative to China for ECU manufacturing, with firms like Denso and ZF opening new facilities to cater to regional demand while mitigating geopolitical risks.

Beyond hardware, there is a growing emphasis on native software development tailored for local driving conditions and regulatory environments. Chinese tech firms, including Horizon Robotics and Black Sesame Technologies, are partnering with automakers to develop AI-driven ECU software optimized for domestic EV and AV platforms. This localization trend not only reduces dependency on imported components but also accelerates customization and innovation cycles, positioning Asia Pacific as a future leader in automotive ECU development and deployment

MARKET CHALLENGES

Cybersecurity Vulnerabilities in ECU Systems

A pressing challenge confronting the Asia Pacific automotive ECU market is the growing concern around cybersecurity vulnerabilities in embedded control units. As vehicles become increasingly connected and reliant on software-defined functionalities, ECUs serve as potential entry points for cyber threats. Hackers exploiting weaknesses in ECU firmware can gain unauthorized access to critical vehicle systems such as braking, steering, and throttle control. In Asia Pacific, where mass-market EV and connected car adoption is surging, automakers are struggling to implement robust security protocols across distributed ECU networks. Many legacy ECU architectures were not originally designed with cybersecurity in mind, making retroactive protection difficult.

To address these concerns, regulatory bodies are tightening cybersecurity mandates. South Korea’s National Police Agency has mandated OEMs to conduct mandatory ECU-level penetration testing before vehicle registration. Meanwhile, ASEAN members are exploring standardized cybersecurity certification for automotive ECUs.

Rapid Technological Obsolescence and Shorter Product Lifecycles

The pace of technological innovation in the automotive sector is creating a significant challenge for ECU manufacturers in the Asia Pacific region due to rapid obsolescence and compressed product lifecycles. Traditionally, automotive components were designed to remain in use for five to ten years, but today’s ECUs must keep up with evolving software updates, changing vehicle architectures, and faster iteration cycles akin to consumer electronics. The lifecycle of an automotive ECU has decreased from seven years to as little as three years due to constant improvements in processing power, connectivity features, and AI integration. This accelerated development cycle poses operational and financial strain on manufacturers, particularly mid-sized suppliers who struggle to invest in continuous R&D and frequent redesigns. For example, in China, where EV startups like BYD, XPeng, and NIO frequently update their vehicle software every few months, ECU vendors must deliver compatible hardware revisions within extremely tight timelines.

Additionally, the transition from domain-specific ECUs to centralized computing platforms presents another layer of complexity. OEMs are moving toward fewer, more powerful ECUs capable of handling multiple functions through software-defined methods, leaving many traditional ECU suppliers at risk of marginalization. According to Frost & Sullivan, nearly 35% of Tier-2 ECU suppliers in India and Southeast Asia are unable to meet the technical demands of next-generation ECU architectures. This technological turbulence not only disrupts supply chains but also forces companies to rethink their long-term product strategies, making adaptability a critical survival factor in the evolving Asia Pacific automotive ECU market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.59% |

|

Segments Covered |

By ECU Capacity, propulsion, Vehicle Type, Application, Level of Autonomous, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

Aptiv PLC, Continental AG, Denso Corporation, Hitachi, Ltd., Mitsubishi Electric Corporation, Pektron, Robert Bosch GmbH, TRANSTRON Inc., Veoneer Inc, ZF Friedrichshafen AG. |

SEGMENT ANALYSIS

By ECU Capacity Insights

The 32-bit ECU segment held 58.6% of the Asia Pacific automotive ECU market share in 2024. Unlike 16-bit units, which are increasingly being phased out due to limited processing capabilities, 32-bit ECUs offer an optimal balance between performance and cost-effectiveness, making them ideal for mass-market vehicles.

According to McKinsey & Company, over 75% of new internal combustion engine (ICE) vehicles produced in China and India during 2023 were equipped with at least five 32-bit ECUs to manage critical subsystems such as fuel injection and anti-lock braking systems. Additionally, Japanese automakers like Toyota have standardized 32-bit microcontrollers for use in hybrid electric vehicles (HEVs), where mid-range computational power is sufficient yet necessary for managing dual powertrains efficiently. Frost & Sullivan notes that 32-bit ECUs remain the preferred choice for tier-2 and tier-3 suppliers due to their compatibility with legacy platforms and lower software development overhead compared to higher-bit variants.

The 64-bit ECU segment is projected to grow with a CAGR of approximately 14.3% in the next coming years. This rapid expansion is primarily fueled by the increasing adoption of high-performance computing (HPC) platforms in next-generation electric and autonomous vehicles, which demand superior data processing capabilities beyond what 32-bit architectures can provide.

China led this shift, with companies like BYD and NIO deploying 64-bit processors in their latest EV platforms to support advanced real-time analytics, AI-based driver monitoring, and OTA (over-the-air) software updates. According to BloombergNEF, China alone accounted for nearly 60% of global battery electric vehicle (BEV) sales in 2023, significantly boosting demand for powerful ECUs capable of handling complex electrical architectures. Additionally, South Korea’s push for smart mobility infrastructure, supported by government-backed R&D grants, has spurred investment in domain-based ECU systems requiring faster data throughput. Roland Berger reports that leading semiconductor manufacturers such as Renesas and Samsung are expanding their 64-bit MCU production capacities in the APAC region to meet surging demand.

By Propulsion Insights

The Internal combustion engine (ICE) vehicles segment was accounted in holding a prominent share of the Asia Pacific automotive ECU market in 2024. India serves as a prime example, with over 90% of passenger vehicles sold in 2023 still powered by internal combustion technology. According to SIAM (Society of Indian Automobile Manufacturers), domestic ICE vehicle sales exceeded 3.5 million units in 2023, each integrating an average of 8 to 12 ECUs for functions ranging from engine management to climate control. Similarly, in Southeast Asian countries like Indonesia and Thailand, where electrification policies are still in early stages, ICE vehicles account for more than 95% of total auto sales, driving consistent demand for mid-tier ECU modules.

Japanese automakers such as Mazda and Subaru continue to refine traditional ICE platforms with enhanced efficiency and emissions control systems, many of which rely on sophisticated ECU integration. As governments across the region gradually phase in electrification mandates, ICE will continue to be a dominant propulsion type for the near future, ensuring ongoing relevance for associated ECU ecosystems.

The Battery electric vehicles (BEVs) segment is experiencing a significant CAGR of 21.4% from 2025 to 2033. This surge is driven by aggressive government incentives, falling battery costs, and growing consumer acceptance of electric mobility, particularly in leading markets like China, South Korea, and Australia.

China continues to spearhead this transformation, having recorded over 9 million BEV sales in 2023 alone. The Ministry of Industry and Information Technology reported that BEVs now constitute more than 35% of total passenger vehicle sales in the country, up from just 5% in 2020. South Korea is also accelerating its BEV strategy, with Hyundai and Kia committing to introduce 14 new electric models by 2030. The Korean government’s Green New Deal policy includes subsidies and charging infrastructure investments aimed at boosting BEV adoption. Simultaneously, Australia saw a 60% year-over-year increase in BEV registrations in 2023, prompting local dealerships to enhance digital service offerings tied to ECU diagnostics and updates.

By Vehicle Type Insights

The light-duty vehicle (LDV) segment led the Asia Pacific automotive ECU market with 54.3% of the share in 2024. This dominance is largely attributed to the sheer volume of LDVs manufactured and sold across the region in China, India, and Southeast Asia, where urbanization, rising disposable incomes, and improved road infrastructure have fueled passenger car and small commercial truck demand. A significant portion of these vehicles, both ICE and BEV, utilize multiple ECUs for engine control, infotainment, telematics, and safety systems.

Moreover, Japanese automakers like Toyota and Suzuki, who maintain large manufacturing footprints across ASEAN countries, have been progressively enhancing ECU functionalities in their compact and mid-sized vehicle lines. Frost & Sullivan notes that modern LDVs now feature over 30 ECUs on average, covering everything from adaptive lighting to remote diagnostics.

The construction and mining equipment segment is emerging with a projected CAGR of 12.6% from 2025 to 2033. This growth is largely propelled by the increasing automation, digitization, and emission control requirements in off-highway machinery used across major infrastructure projects.

Countries such as India, China, and Indonesia are investing heavily in infrastructure development to support economic growth and urban expansion. According to India’s Ministry of Road Transport and Highways, capital expenditure on road and highway projects reached INR 2.2 trillion (~USD 27 billion) in FY2023, spurring demand for technologically enhanced construction equipment. Modern excavators, loaders, and haulers now come fitted with multiple ECUs to regulate engine performance, monitor emissions, enable telematics, and support predictive maintenance.

COUNTRY-LEVEL ANALYSIS

China was the largest performer in the Asia Pacific automotive ECU market with 38.4% of share in 2024. The country's strong presence in both traditional and electric vehicle manufacturing, backed by extensive domestic supply chains and government policy support, positions it as a dominant force in the regional ECU ecosystem. With over 26 million vehicles produced in 2023, according to the China Association of Automobile Manufacturers, the nation maintains its position as the world’s largest automobile manufacturer. The rapid growth of battery electric vehicles (BEVs) is particularly notable, with over 9 million units sold in 2023 alone. The Chinese government has also played a pivotal role through initiatives such as the "Made in China 2025" plan, which focuses on strengthening indigenous semiconductor and automotive electronics capabilities. Local semiconductor firms, including Canaan and Black Sesame Technologies, are partnering with OEMs to develop homegrown ECU solutions tailored for domestic applications.

Japan automotive ECU market held 14.3% of share in 2024.Japanese automakers such as Toyota, Honda, and Mazda have historically been pioneers in hybrid electric vehicles (HEVs). In 2023, HEVs constituted over 20% of total vehicle sales in Japan, according to the Japan Automobile Manufacturers Association. These vehicles incorporate advanced ECUs to manage dual powertrain systems, energy distribution, and regenerative braking, necessitating high levels of integration and optimization. Furthermore, Japanese Tier-1 suppliers like Denso and Hitachi Astemo play a critical role in designing and supplying next-generation ECUs for both domestic and international markets.

India is lucratively to showcase huge growth opportunities in the Asia Pacific automotive ECU market. India’s automotive industry produced over 28 million vehicles in 2023, including passenger cars, two-wheelers, and commercial vehicles, as reported by the Society of Indian Automobile Manufacturers (SIAM). While ICE vehicles continue to dominate, the introduction of Bharat Stage VI (BS-VI) emission norms in 2020 has significantly increased ECU complexity in new models. Automakers like Tata Motors and Mahindra & Mahindra have ramped up the integration of multi-functional ECUs to optimize fuel efficiency and emissions compliance.

Simultaneously, the Indian government’s Production-Linked Incentive (PLI) scheme for automobiles has attracted foreign and domestic investments into ECU and semiconductor manufacturing. According to Invest India, the PLI program has already drawn commitments exceeding USD 2 billion from global suppliers aiming to establish regional production facilities. Furthermore, startups in Bengaluru and Pune are developing indigenous ECU software stacks, enabling customization for Indian road conditions and driving behaviors.

South Korea automotive ECU market growth is leveraging its reputation as a center for automotive innovation and electronics excellence. Hyundai Motor Group announced a USD 84 billion investment plan through 2030 to develop 17 new electric vehicle (EV) models, significantly boosting ECU demand across its product lineup. According to the Korea Automobile Manufacturers Association, BEV sales in South Korea grew by over 40% in 2023 compared to the previous year, reflecting the heightened need for intelligent control systems. Companies like LG Electronics and Samsung SDI are collaborating with OEMs to develop next-generation ECU hardware and software tailored for EV applications.

Beyond passenger vehicles, South Korea is also advancing in automotive cybersecurity and functional safety domains. The National Police Agency has mandated OEMs to implement secure ECU protocols to mitigate remote hacking risks. Additionally, the Ministry of Trade, Industry & Energy is supporting the development of domestically engineered automotive MCUs to reduce dependency on foreign suppliers.

Australia and New Zealand are significantly to showcase healthy CAGR in the Asia Pacific automotive ECU market during the forecast period, representing a niche but steadily evolving segment. While not among the top manufacturing hubs, these markets are gaining traction due to increasing adoption of electric and connected vehicles, regulatory pushes for emissions reduction, and a growing focus on after-sales service and diagnostics.

According to the Federal Chamber of Automotive Industries, Australia recorded over 1.1 million vehicle sales in 2023, with electric vehicle (EV) penetration reaching 3.7%. Although modest compared to larger markets, this figure marks a doubling of EV uptake from 2022. The Australian government’s Clean Energy Finance Corporation has allocated AUD 2 billion to support transport decarbonization, indirectly boosting demand for advanced ECUs that manage battery performance and driving dynamics.

KEY MARKET PLAYERS

Aptiv PLC, Continental AG, Denso Corporation, Hitachi, Ltd., Mitsubishi Electric Corporation, Pektron, Robert Bosch GmbH, TRANSTRON Inc., Veoneer Inc, ZF Friedrichshafen AG. Are the market drivers that are dominating the Asia pacific automotive ECU market.

Top Players in the Market

Bosch (Germany-based, strong APAC presence)

Bosch stands as a leading global supplier of automotive electronics and plays a crucial role in the Asia Pacific automotive ECU market. The company offers a wide range of ECUs for engine management, transmission control, body electronics, and advanced driver assistance systems. Bosch’s focus on innovation, partnerships with regional automakers, and localized manufacturing facilities have enabled it to maintain a strong foothold in countries like China, India, and Japan.

Denso Corporation (Japan)

Denso is one of Japan’s most influential automotive technology providers and a key player in the ECU ecosystem across the Asia Pacific region. The company develops high-performance ECUs for hybrid and electric vehicles, telematics, and ADAS applications. Denso emphasizes system integration and software-defined functionalities, making its ECUs essential components in next-generation mobility platforms.

Hitachi Astemo, Ltd. (Japan)

Hitachi Astemo is a major contributor to the Asia Pacific automotive ECU market, particularly in the development of intelligent control systems for electrified and connected vehicles. The company delivers ECUs that support powertrain efficiency, safety features, and vehicle networking. Leveraging its strong engineering base in Japan and manufacturing operations across Thailand, China, and India, Hitachi Astemo has become integral to the region’s automotive transformation. Its emphasis on scalable and modular ECU architectures supports diverse regional automotive demands, from compact cars to commercial electric transport, positioning it as a vital player in the competitive ECU landscape.

Top Strategies Used by Key Market Participants in The Market

Localization of Production and R&D Centers

A primary strategy among leading ECU manufacturers involves establishing or expanding local production and research facilities within key Asia Pacific markets. This approach enables companies to reduce logistical complexities, comply with regional regulations, and respond more effectively to local OEM requirements.

Strategic Collaborations and Joint Ventures

To accelerate innovation and strengthen market position, key players are increasingly forming strategic alliances with semiconductor suppliers, software developers, and regional automakers. These collaborations aim to integrate hardware-software ecosystems and develop customized ECU solutions compatible with emerging vehicle technologies such as battery electric platforms and autonomous driving systems. Such partnerships also help in achieving faster time-to-market and enhancing product functionality through shared expertise.

Investment in Software-Defined and Centralized ECU Architectures

As automotive electronics evolve toward centralized computing and domain-based control units, major ECU suppliers are investing heavily in developing next-generation software-defined platforms. These modern ECUs offer greater scalability, over-the-air update capabilities, and improved cybersecurity measures. Companies are focusing on building flexible and future-ready control systems that align with the increasing demand for smart and connected mobility solutions across the Asia Pacific region.

COMPETITION OVERVIEW

The competition in the Asia Pacific automotive ECU market is marked by intense rivalry among established global Tier-1 suppliers and rising regional players aiming to capture growing demand driven by vehicle electrification and digitalization. As automakers transition toward software-defined vehicles and domain-based architectures, ECU vendors are under pressure to innovate rapidly while maintaining cost-efficiency and regulatory compliance. Major international firms such as Bosch, Denso, and Continental compete closely with locally rooted suppliers in countries like China and India, where government policies encourage indigenous production and technological self-reliance. Additionally, the convergence of automotive and semiconductor industries has intensified collaboration and competition, with semiconductor firms entering the ECU space to provide integrated chip-to-system solutions. This dynamic environment fosters continuous product evolution and strategic realignments, shaping a highly adaptive and competitive market structure. The entry of new tech-driven startups further disrupts traditional supplier hierarchies, adding another layer of complexity to the competitive landscape in the Asia Pacific region.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Bosch expanded its ECU manufacturing facility in Suzhou, China, to increase production capacity and meet the rising demand from domestic EV manufacturers. This move reinforced Bosch’s commitment to the Chinese market and supported its long-term growth strategy in the Asia Pacific region.

- In May 2024, Denso announced a partnership with a South Korean semiconductor firm to co-develop next-generation 64-bit microcontrollers tailored for high-performance automotive ECUs. This collaboration was aimed at accelerating the deployment of advanced control units optimized for electric and autonomous vehicles in the Asia Pacific market.

- In July 2024, Hitachi Astemo opened a new R&D center in Pune, India, focused on creating region-specific ECU solutions for two-wheelers and compact passenger vehicles. The initiative responded to India's tightening emission norms and growing demand for fuel-efficient and connected vehicles.

- In October 2024, Continental launched an updated ECU software suite designed for retrofitting older diesel fleets in Southeast Asia. This solution targeted the region’s aging commercial vehicle base and aligned with stricter emissions regulations introduced in several ASEAN countries.

- In December 2024, ZF Friedrichshafen acquired a Singapore-based startup specializing in AI-driven ECU diagnostics to enhance predictive maintenance capabilities for commercial vehicles operating in urban logistics across Asia Pacific cities.

MARKET SEGMENTATION

This research report on the Asia Pacific Automotive ECU Market is segmented and sub-segmented into the following categories.

By Application

- ADAS & Safety System

- Body Control & Comfort System

- Infotainment & Communication System

- Powertrain System

By ECU Capacity

- 16-bit ECU

- 32-bit ECU

- 64-bit ECU

By Propulsion Type

- BEVs

- Hybrid Vehicles

- ICE Vehicles

By Level of Autonomous Driving

- Autonomous Vehicles

- Conventional Vehicles

- Semi-Autonomous Vehicles

By Vehicle Type

- Light-Duty Vehicles

- Heavy Commercial Vehicles

- Construction & Mining Equipment

- Agricultural Tractors

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What’s driving rapid growth in the automotive ECU market across APAC?

Strong demand for electric vehicles (EVs), ADAS-equipped cars, and connected mobility solutions—especially in China, Japan, and South Korea—is accelerating ECU adoption for powertrain, safety, and infotainment systems.

How are regional regulations shaping ECU development and deployment?

Emission and safety standards like China VI, Bharat Stage VI (India), and Japan’s NCAP are pushing automakers to integrate advanced ECUs for engine control, crash response, and driver assistance.

Which ECU types are seeing the fastest adoption in APAC?

Body control modules and ADAS ECUs are growing rapidly due to demand for smart features like lane-keeping assist, blind-spot detection, and automated lighting in mid-range vehicles.

How is the shift toward EVs affecting ECU architecture in the region?

EVs require up to 70% more ECUs than traditional ICE vehicles, including battery management systems (BMS), thermal control units, and regenerative braking controllers, driving demand in China and South Korea’s EV sectors.

What technological trends are influencing ECU design in APAC manufacturing hubs?

OEMs in countries like Thailand, Vietnam, and India are adopting domain-based ECU architecture and integrating over-the-air (OTA) update capabilities to reduce wiring complexity and enhance vehicle software flexibility.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]