Asia Pacific Basmati Rice Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, Category, Distribution Channel, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Basmati Rice Market Size

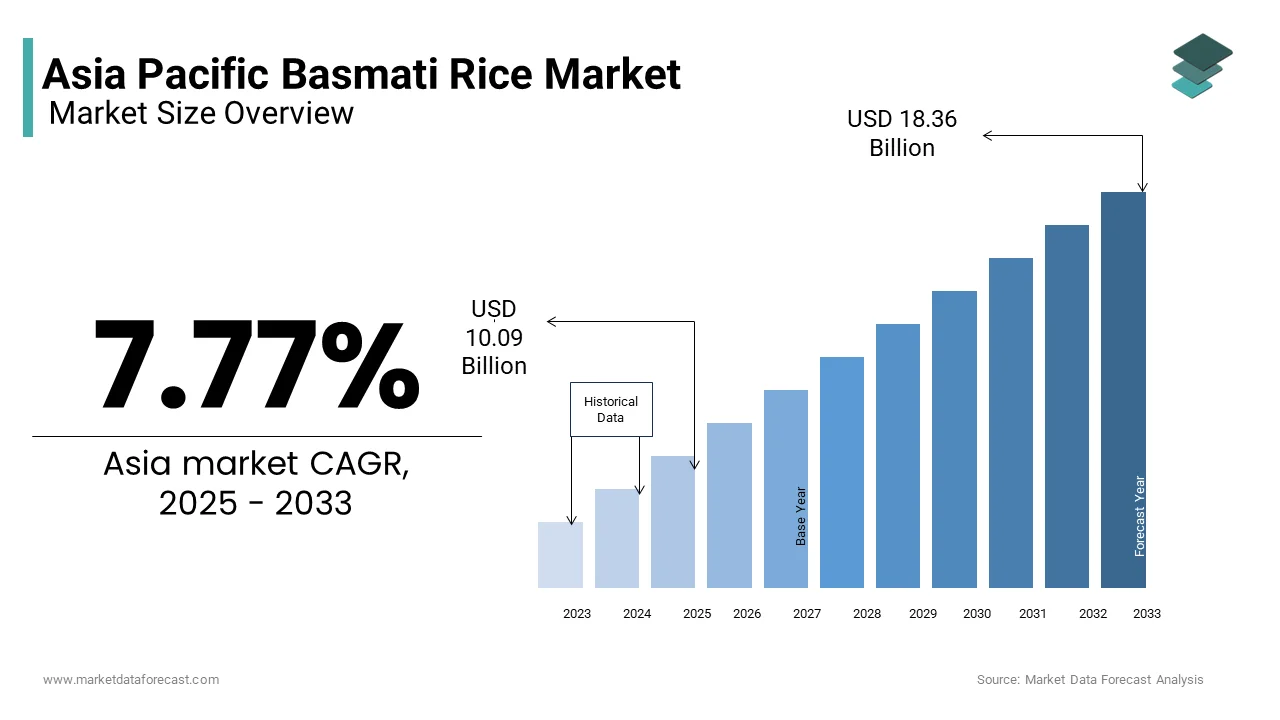

The Asia Pacific basmati rice market size was valued at USD 9.36 billion in 2024 and is anticipated to reach USD 10.09 billion in 2025 from USD 18.36 billion by 2033, growing at a CAGR of 7.77% during the forecast period from 2025 to 2033.

The Asia Pacific basmati rice market refers to the production, distribution, and consumption of long-grain aromatic rice that is indigenous to the Indian subcontinent and known for its distinct fragrance, elongation upon cooking, and delicate texture. This market includes both domestic consumption and international trade, with India and Pakistan being the largest exporters globally. The region's growing middle class, increasing disposable incomes, and rising global demand for ethnic foods have contributed to the sustained growth of this sector.

MARKET DRIVERS

Rising Disposable Incomes and Changing Lifestyle Preferences

One of the key drivers of the Asia Pacific basmati rice market is the increase in disposable incomes and shifting lifestyle trends, particularly in emerging economies such as India, China, and Indonesia. As more consumers move into the middle and upper-income brackets, they are increasingly opting for premium food products, including high-quality grains like basmati rice. According to the Asian Development Bank, real household income in APAC countries grew significantly between 2020 and 2023, enabling consumers to prioritize better quality food choices over basic staples. In urban centers across India and Thailand, young professionals and health-conscious individuals are showing a strong preference for basmati due to its perceived health benefits and culinary versatility.

Growth in Global Exports and Trade Agreements

The expansion of international trade agreements and export corridors has significantly boosted the Asia Pacific basmati rice market, particularly for major producers like India and Pakistan. These countries account for a major share of global basmati exports, supplying to regions such as the Gulf Cooperation Council (GCC) countries, the United Kingdom, and the United States. As per the Food and Agriculture Organization (FAO), basmati rice exports from the Asia Pacific region reached a record high in recent years, driven by favorable trade policies and enhanced logistics infrastructure. For instance, the Indo-UAE Comprehensive Economic Partnership Agreement (CEPA), signed in 2022, facilitated smoother access for Indian basmati rice into West Asian markets, leading to a notable spike in shipments.

MARKET RESTRAINTS

Volatility in Climatic Conditions Affecting Crop Yield

Climate variability poses a significant challenge to the Asia Pacific basmati rice market, as prolonged droughts, erratic monsoons, and unseasonal rains disrupt cultivation cycles and reduce yield consistency. Basmati rice is highly sensitive to weather fluctuations, requiring specific temperature and rainfall conditions during its growing phase.

According to the Indian Council of Agricultural Research, several north Indian states, where most basmati is grown, experienced delayed monsoons and heatwaves in 2023, resulting in a drop in expected output compared to the previous year. Similarly, in Pakistan, the 2022 floods severely impacted arable land, causing widespread losses in the basmati crop and reducing export volumes.

High Production Costs and Labor Shortages

The rising cost of agricultural inputs, such as seeds, fertilizers, water, and labor, is another major restraint affecting the Asia Pacific basmati rice market. Unlike regular rice varieties, basmati requires longer growing periods, specialized irrigation techniques, and careful harvesting, all of which contribute to elevated production expenses. Also, rural-to-urban migration has led to acute labor shortages in farming communities, forcing growers to invest in mechanized alternatives or leave portions of their fields fallow.

MARKET OPPORTUNITIES

Increasing Demand for Organic and Specialty Basmati Varieties

A growing consumer inclination toward organic and specialty basmati rice varieties is creating substantial opportunities within the Asia Pacific market. Health-conscious consumers, particularly in urban areas, are prioritizing food safety, sustainability, and nutritional value, thereby driving demand for pesticide-free and non-GMO rice options. Furthermore, in India, the number of farmers adopting organic practices for basmati cultivation increased in the past two years, supported by government incentives and private sector partnerships. This shift indicates a promising avenue for market differentiation and premium pricing strategies, positioning organic basmati rice as a lucrative segment within the broader industry.

Expansion of E-commerce Platforms and Direct-to-Consumer Distribution Channels

The proliferation of e-commerce platforms and digital retail channels has opened new avenues for basmati rice distribution across the Asia Pacific region. Online grocery services, subscription-based models, and direct-to-consumer (DTC) marketing strategies are enabling brands to reach a wider audience while enhancing customer engagement and brand loyalty. Companies like Amazon Fresh, Alibaba’s Freshippo, and local startups such as BigBasket in India have integrated advanced sorting, packaging, and delivery systems to ensure product freshness and traceability.ty.

MARKET CHALLENGES

Stringent Quality Standards and Certification Requirements in Export Markets

Export-oriented basmati rice producers in the Asia Pacific region face mounting challenges due to increasingly stringent quality standards imposed by importing countries. Regulatory bodies in the EU, GCC nations, and the United States enforce strict guidelines regarding pesticide residues, heavy metals, and genetically modified organisms (GMOs, necessitating rigorous testing and certification processes. According to the European Union Rapid Alert System for Food and Feed (RASFF), Indian basmati rice consignments faced multiple rejections in 2023 due to exceeding permissible limits for certain agrochemical residues. Such incidents not only result in financial losses but also damage brand reputation and delay market entry. Moreover, many small-scale exporters struggle to meet these requirements, limiting their ability to compete in premium export destinations and thereby constraining overall market expansion.

Intellectual Property Disputes and Geographical Indication Issues

Geographical indication (GI) conflicts and intellectual property disputes pose a significant challenge to the Asia Pacific basmati rice market, particularly between India and Pakistan, the two largest producers. While both nations claim heritage rights over specific basmati variants, international GI registrations have become a battleground for legal and commercial dominance. These disputes impact branding strategies and export negotiations, especially in Western markets where GI tagging influences consumer perception and premium pricing. Without a clear resolution, confusion persists among global buyers, potentially affecting market confidence and trade dynamics in the long run.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

% |

|

Segments Covered |

By Type, Category, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country-Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Adani Wilmar Ltd (India), ITC Limited (India), KRBL Limited (India), LT Foods (India), Kohinoor Foods (India), Shri Lal Mahal Group (India), Amira Nature Foods (India), Amar Singh Chawal Wala (India), Riviana Foods Pty Ltd. (U.S.), Matco Foods (Pakistan). |

SEGMENTAL ANALYSIS

By Type Insights

The white basmati rice held the dominant position in the Asia Pacific basmati rice market by accounting for a major portion of the total revenue share in 2024. This dominance is due to its widespread acceptance across both domestic and international markets due to its refined appearance, longer shelf life, and culinary versatility. In countries like Saudi Arabia and the UAE, white basmati is a staple ingredient in traditional dishes such as biryani and pilaf, making it an essential component of daily consumption. Supermarkets and wholesale chains also favor stocking white basmati due to higher consumer turnover and fewer storage concerns compared to brown rice.

Brown basmati rice is emerging as the fastest-growing segment in the Asia Pacific basmati rice market, registering a CAGR of 9.7%. The rising awareness around health benefits, including high fiber content, low glycemic index, and rich micronutrient profile, is driving consumer preference toward whole grain options. As outlined by the International Food Policy Research Institute, sales of brown basmati rice in Japan, Australia, and South Korea saw a notable increase following the growing popularity of gluten-free and plant-based diets. In addition, as reported by the National Nutrition Monitoring Bureau of India, there has been a significant shift among urban middle-class households toward incorporating whole grains into daily meals.

By Category Insights

Raw basmati rice constituted the largest category within the Asia Pacific basmati rice market by capturing a 64.6% of total revenue share in 2024. This segment includes unprocessed, long-grain basmati that retains its natural aroma and texture when cooked, making it highly preferred among consumers who value traditional preparation methods. Also, raw basmati faces minimal processing costs compared to parboiled types, allowing traders and retailers to maintain competitive pricing. These attributes make raw basmati the most widely consumed and traded form across both commercial and home settings in the APAC region.

Parboiled basmati rice is gaining momentum at a faster pace than other segments, expanding at a CAGR of 8.3% during the forecast period. This growth is attributed to increased consumer awareness regarding its enhanced nutritional value, improved cooking yield, and better moisture resistance during storage. In Bangladesh and Indonesia, government food distribution programs have started prioritizing parboiled rice due to its superior nutrient preservation, contributing to rising institutional demand. Retailers in the Philippines and Vietnam are also introducing fortified parboiled variants under premium private-label brands, catering to health-focused customers.

By Distribution Channel Insights

Supermarkets and hypermarkets dominated the Asia Pacific basmati rice distribution landscape by capturing 48.7% of the market in 2024. These large-format retail outlets serve as primary purchase points for packaged and branded basmati rice, offering convenience, variety, and standardized quality assurance. Also, the popular stores stock a wide array of local and imported basmati brands, often featuring promotions and loyalty schemes that encourage repeat purchases.

Online retail is emerging as the fastest-growing distribution channel in the Asia Pacific basmati rice market, expanding at a CAGR of 12.6%. The proliferation of e-commerce platforms and digital grocery services has transformed how consumers access specialty rice products, particularly premium and organic basmati variants. Platforms like BigBasket and Instamart are integrating real-time inventory tracking and cold-chain logistics to ensure freshness and traceability. These innovations are fueling the rapid expansion of the online retail segment in the APAC basmati rice market.

COUNTRY-LEVEL ANALYSIS

India had the top position in the Asia Pacific basmati rice market by commanding 57.7% of total revenue in 2024. As the world’s largest producer and exporter of basmati rice, India plays a defining role in shaping global supply chains and influencing price dynamics. Key markets include the UAE, Saudi Arabia, Iraq, Iran, and the United Kingdom, where Indian basmati is preferred for its aroma, elongation, and consistency. The Indian government has supported the sector through initiatives such as the "eNAM" platform for price transparency and the "Paramparagat Krishi Vikas Yojana" program promoting organic farming.

Pakistan contributes majorly to the Asia Pacific basmati rice market, maintaining a strong presence as the second-largest producer and exporter in the region. Despite facing logistical and climatic challenges, Pakistan continues to be a major supplier to Gulf nations, Africa, and parts of Europe. The Punjab province remains the heartland of basmati cultivation, with new hybrid cultivars improving yield and pest resistance. The Government of Pakistan has encouraged exports through subsidies and streamlined customs procedures, while industry bodies like the Rice Exporters Association of Pakistan (REAP) have worked to enhance branding and market access.

China emerging importer and a niche consumer market. It is primarily a consumer of imported basmati rather than a producer. While domestic rice consumption is dominated by indica and japonica varieties, there is a growing demand for aromatic rice among affluent urban populations and expatriate communities. High-end restaurants specializing in Indian and Middle Eastern cuisine frequently source premium basmati to meet customer expectations. Though still smaller compared to traditional staples, basmati’s appeal in upscale dining and specialty retail is steadily expanding in the Chinese food market.

Australia is serving as a key import destination due to its multicultural population and rising interest in healthy eating. With no significant domestic production, the country relies heavily on imports from India and Pakistan to meet consumer demand. Major supermarket chains like Woolworths and Coles have expanded their basmati offerings, including organic and brown rice variants. With greater emphasis on food diversity and wellness trends, Australia's basmati rice market is positioned for steady expansion.

Indonesia accounts for a notable share of the Asia Pacific basmati rice market, experiencing gradual but noticeable growth due to changing dietary preferences and increasing exposure to global cuisines. While the country remains one of the world’s largest consumers of non-basmati rice, demand for premium aromatic rice is rising, particularly in urban centers. Jakarta, Bandung, and Surabaya have seen a surge in fine-dining establishments offering Middle Eastern and Indian-inspired dishes, boosting basmati usage.

KEY MARKET PLAYERS

Adani Wilmar Ltd (India), ITC Limited (India), KRBL Limited (India), LT Foods (India), Kohinoor Foods (India), Shri Lal Mahal Group (India), Amira Nature Foods (India), Amar Singh Chawal Wala (India), Riviana Foods Pty Ltd. (U.S.), Matco Foods (Pakistan). Are the market players that are dominating the Asia Pacific basmati rice market?

Top Players in the Market

LT Foods Limited (India)

LT Foods is a leading player in the global basmati rice market and one of India's largest exporters. Known for its flagship brand 'Daawat,' the company has built a strong international presence across the Middle East, Europe, North America, and Australia. LT Foods is recognized for its commitment to quality, innovation, and sustainable sourcing practices. The company invests significantly in modern processing facilities, traceability systems, and branding initiatives that enhance consumer trust and elevate the perception of Indian basmati globally.

KRBL Limited (India)

KRBL is one of the largest integrated basmati rice processors and exporters in India, with a well-established reputation in over 70 countries. The company’s flagship brand, India Gate, is synonymous with premium basmati rice, ensuring consistent quality and authenticity. KRBL plays a pivotal role in promoting Indian basmati as a premium product through strategic marketing, supply chain optimization, and export diversification. Its vertically integrated business model ensures control from farm to fork, reinforcing its position as a trusted leader in the global basmati ecosystem.

Pakistan Rice Exporters Association Members (Pakistan)

A consortium of prominent Pakistani rice exporters, including companies like E & J Gallo Rice Mills and Hafeezullah Malik & Sons, represents Pakistan’s strength in the global basmati trade. These firms have been instrumental in promoting Pakistani basmati—known for its distinct texture and flavor—in key markets such as Saudi Arabia, Iran, and African nations. Their contributions include advocating for fair trade policies, improving seed development, and enhancing export logistics to ensure competitiveness in the global arena.

Top Strategies Used by Key Market Participants

One of the most effective strategies employed by leading players in the Asia Pacific basmati rice market is brand differentiation through traceability and certification. Companies are increasingly implementing farm-to-fork tracking systems, organic certifications, and geographical indication (GI) tagging to establish authenticity and build consumer trust in both domestic and international markets.

Another crucial approach involves expanding into premium value-added segments such as ready-to-cook basmati rice, parboiled variants, and organic options. By catering to health-conscious consumers and convenience-driven lifestyles, market leaders can capture higher margins and differentiate themselves from commodity-based competitors.

Additionally, strengthening digital distribution networks and e-commerce partnerships has become a priority for top players. Brands are leveraging online platforms to reach a broader consumer base, especially in urban centers and expatriate communities, while also utilizing data analytics to better understand purchasing behaviors and tailor promotional campaigns accordingly.

COMPETITION OVERVIEW

The competition in the Asia Pacific basmati rice market is shaped by a combination of traditional producers, emerging private-label brands, and multinational food conglomerates vying for dominance in a high-demand global commodity space. While India and Pakistan remain the primary exporters, the competitive landscape is evolving due to shifting consumer preferences, technological advancements in processing, and increasing emphasis on sustainability and brand positioning.

Key players compete not only on price but also on quality assurance, traceability, and adherence to international food safety standards. In developed markets such as Australia and Japan, the focus is on premium branding, packaging innovation, and storytelling around heritage and nutrition. Meanwhile, in Southeast Asia, competition is intensifying among domestic importers and distributors who are expanding their portfolio of branded basmati products.

Moreover, the rise of e-commerce and direct-to-consumer models has introduced new entrants that leverage digital tools to build brand loyalty and streamline supply chains. As the demand for specialty rice grows, the market continues to witness consolidation, strategic alliances, and investment in R&D to maintain a competitive edge in this aromatic and culturally significant grain category.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, LT Foods launched a new line of certified organic basmati rice under its Daawat brand, targeting health-conscious consumers in the U.S., Europe, and Gulf markets. This move aimed to strengthen the company’s foothold in premium retail channels and capitalize on the rising demand for clean-label food products.

- In March 2024, KRBL Limited expanded its overseas distribution network by entering into a strategic partnership with a leading UAE-based food distributor to enhance shelf presence in major supermarket chains across the GCC region, reinforcing its leadership position in West Asian markets.

- In July 2024, India Gate collaborated with a Singaporean grocery-tech startup to launch a subscription-based delivery service for premium basmati rice, aiming to tap into the growing urban consumer segment seeking convenience and quality assurance.

- In September 2024, Hafeezullah Malik & Sons invested in a state-of-the-art rice processing facility in Punjab province, Pakistan, to improve grading, milling precision, and export readiness, thereby strengthening its competitiveness in the global basmati trade.

- In November 2024, E & J Gallo Rice Mills introduced a blockchain-enabled traceability system to track the origin and journey of its basmati rice, enhancing transparency and building consumer confidence—an initiative expected to set a benchmark for industry-wide adoption in the APAC region.

MARKET SEGMENTATION

This research report on the Asia Pacific basmati rice market is segmented and sub-segmented into the following categories.

By Type

- White

- Brown

By Category

- Raw

- Parboiled

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of Basmati rice demand in the Asia-Pacific region?

Rising incomes, shifting consumer preferences toward aromatic and premium rice varieties, and increasing adoption of Indian and Pakistani cuisines are fueling regional demand.

Which countries in APAC are the key importers of Basmati rice?

Singapore, Australia, and Malaysia lead imports due to large South Asian diaspora populations and growing consumer awareness of Basmati's quality and health benefits.

How do regional trade policies impact Basmati rice distribution in APAC?

Import tariffs, phytosanitary requirements, and origin certifications (like GI tags from India) influence trade flow and pricing in countries like Indonesia, Thailand, and Vietnam.

What role does e-commerce play in the Basmati rice market’s expansion?

Online grocery platforms in APAC cities are boosting Basmati sales by offering easy access to premium varieties, niche brands, and bulk buying options for urban consumers.

How is sustainability influencing the future of Basmati rice in APAC?

Demand is rising for sustainably grown, pesticide-free, and organic Basmati as eco-conscious consumers and retailers push for traceability and clean-label sourcing.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com