Asia Pacific Biocides Market Research Report – Segmented By Type (Non-Oxidizing Biocides, Oxidizing Biocides), Application, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Biocides Market Size

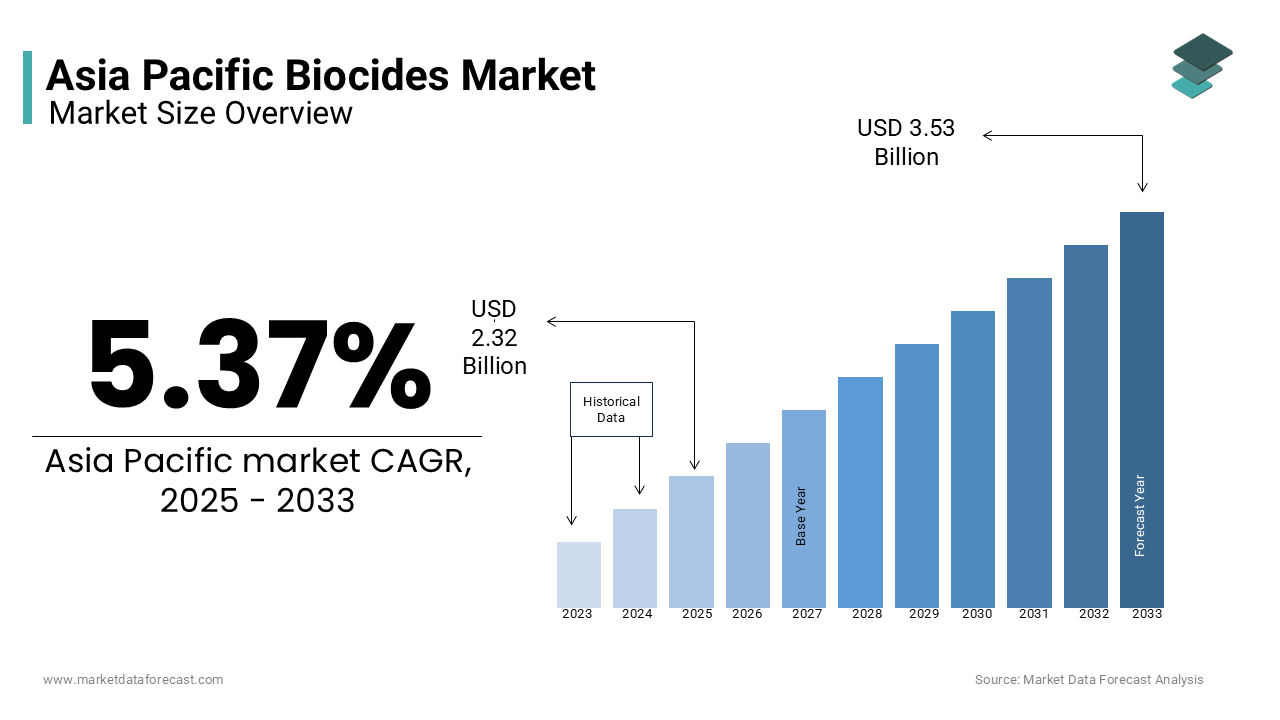

The Asia Pacific Biocides Market was worth USD 2.21 billion in 2024. The Asia Pacific market is expected to reach USD 3.53 billion by 2033 from USD 2.32 billion in 2025, rising at a CAGR of 5.37% from 2025 to 2033.

The Asia Pacific biocides market has emerged as a critical segment within the global chemical industry and is driven by its indispensable role in safeguarding materials and products from microbial degradation. Meanwhile, stringent regulatory frameworks in Japan and South Korea have mandated the use of biocides in the healthcare and food processing industries to ensure hygiene and safety. The region also benefits from favorable government policies promoting clean water initiatives, which rely heavily on biocides for disinfection.

MARKET DRIVERS

Rising Demand in Water Treatment Applications

One of the primary drivers of the Asia Pacific biocides market is the escalating demand for clean and safe water, fueled by rapid urbanization and industrialization. As per the Asian Development Bank, over 300 million people in the region lack access to safe drinking water, prompting governments to invest heavily in water treatment infrastructure. Biocides play a crucial role in this domain by preventing microbial contamination in water systems. Additionally, industries such as textiles and pharmaceuticals require treated water for their operations, further amplifying demand. The rise of smart cities in India, with integrated water management systems, has also contributed to this trend. These factors collectively underscore the pivotal role of water treatment applications in driving the biocides market forward.

Growth of Paints, Coatings, and Construction Industries

The burgeoning paints, coatings, and construction industries serve as another significant driver for the biocides market in the Asia Pacific region. Biocides are also essential in marine coatings to combat biofouling, a major concern for countries like Singapore and South Korea with extensive coastlines. Like, the adoption of biocidal coatings has reduced maintenance costs for ships.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

Stringent regulatory frameworks pose a significant restraint to the Asia Pacific biocides market, as governments increasingly impose restrictions on the use of certain biocidal chemicals due to environmental and health concerns. For instance, Japan’s Chemical Substances Control Law mandates rigorous testing and approval processes for biocides, delaying product launches and increasing compliance costs. According to the United Nations Environment Programme, the ban on chlorinated paraffins, a widely used biocide, has impacted industries such as leather and textiles, forcing them to seek costlier alternatives. In Australia, the National Industrial Chemicals Notification and Assessment Scheme has introduced labeling requirements that add administrative burdens for manufacturers. These regulations, while essential for safeguarding public health and ecosystems, create barriers for smaller players who lack the resources to adapt quickly, thereby slowing market growth.

Environmental Concerns and Public Perception

Environmental concerns and negative public perception regarding the use of biocides also hinder market expansion. Many biocides, while effective, can have adverse effects on non-target organisms and ecosystems if not used responsibly. For example, as per the World Wildlife Fund, the discharge of inadequately treated biocides into water bodies has led to the contamination of aquatic habitats in Southeast Asia, raising alarms among environmentalists. Additionally, consumer awareness campaigns highlighting the potential risks of biocides have influenced purchasing decisions, particularly in urban areas. In South Korea, a significant number of consumers now prefer eco-friendly alternatives, pressuring companies to innovate sustainably.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets in the Asia Pacific region offer untapped potential for the biocides market, driven by industrial growth and infrastructure development. Countries like Vietnam, Indonesia, and Bangladesh are witnessing rapid urbanization, creating demand for biocides in sectors such as water treatment, agriculture, and construction. For instance, Vietnam’s agricultural exports rely heavily on biocides to protect crops from microbial damage, as stated by the Food and Agriculture Organization. Similarly, Bangladesh’s growing textile industry, which contributes majorly to its GDP, requires biocides for fabric protection and dyeing processes. Investing in localized production facilities and distribution networks can help companies cater to these regions effectively. Moreover, partnerships with local governments and NGOs can facilitate the adoption of biocides in rural areas, where microbial contamination remains a persistent issue.

Development of Green Biocides

The development of green biocides presents a lucrative opportunity for the Asia Pacific biocides market, aligning with the global push toward sustainability. Consumers and industries are increasingly seeking eco-friendly alternatives that minimize environmental impact while maintaining efficacy. For example, South Korea’s investments in bio-based biocides have grown notably since 2020, driven by government incentives and consumer demand. Innovations in enzymatic biocides, derived from natural sources, have gained traction in sectors such as healthcare and food processing.

MARKET CHALLENGES

Fluctuating Raw Material Prices

Fluctuating raw material prices represent a significant challenge for the Asia Pacific biocides market, impacting production costs and profitability. Many biocides are synthesized from petrochemical derivatives, whose prices are subject to volatility due to geopolitical tensions and supply chain disruptions. This unpredictability creates financial strain, particularly for small and medium-sized enterprises that lack the resources to hedge against price fluctuations. Additionally, the reliance on imported raw materials exacerbates the issue, especially for countries like Thailand and Malaysia, which depend on global suppliers. Like, rising input costs have led to a decline in profit margins for biocide manufacturers in Vietnam.

Intense Competition from Substitute Products

Intense competition from substitute products poses another challenge for the Asia Pacific biocides market, as industries explore alternative solutions to address microbial contamination. For example, ultraviolet (UV) disinfection systems are gaining popularity in water treatment applications, particularly in urban centers like Singapore and Hong Kong. These systems offer a chemical-free approach, reducing dependency on traditional biocides. Similarly, natural antimicrobial agents, such as essential oils and plant extracts, are being adopted in food processing and cosmetics industries. According to the Food Safety and Standards Authority of India, the use of natural preservatives has increased in recent years, driven by consumer demand for organic products. While these substitutes provide viable options, they threaten the dominance of conventional biocides, compelling manufacturers to innovate and differentiate their offerings to retain market share.

SEGMENTAL ANALYSIS

By Type Insights

The on-oxidizing biocides segment dominated the Asia Pacific biocides market by holding a 65.5% share in 2024. Their widespread adoption is driven by their versatility and effectiveness across diverse applications, including water treatment, paints, and coatings. One key factor is their compatibility with sensitive materials, such as plastics and textiles, which oxidizing biocides can degrade. Additionally, non-oxidizing biocides are preferred for their residual effects, ensuring prolonged protection. In Japan, industries using non-oxidizing biocides have reduced maintenance costs, as they require less frequent reapplication. The rise of smart cities in India has further fueled demand, particularly in water treatment systems where non-oxidizing biocides prevent biofilm formation. These factors ensure non-oxidizing biocides remain the backbone of the regional market.

The oxidizing biocides segment is accelerating in the market and is projected to grow at a CAGR of 7.8% through 2033. This progress is fueled by their cost-effectiveness and broad-spectrum efficacy, making them ideal for high-volume applications like industrial water treatment. For example, Australia’s National Water Commission highlights that oxidizing biocides, such as chlorine dioxide, are now used in a significant portion of municipal water treatment plants due to their ability to eliminate pathogens quickly. Additionally, advancements in formulation technologies have addressed concerns about corrosion, enhancing usability. South Korea’s investments in stabilized oxidizing biocides have reduced equipment damage. Another factor is the growing emphasis on hygiene in institutional settings.

By Application Insights

The water treatment segment was the top performer by accounting for 40.4% of the Asia Pacific biocides market in 2024. This dominance is driven by the region’s increasing focus on clean water initiatives amid rapid urbanization and industrialization. For instance, China’s “Water Pollution Prevention and Control Action Plan” mandates the use of biocides in municipal water systems, increasing biocide consumption since 2020. Apart from these, industries such as pharmaceuticals and textiles rely heavily on treated water for their operations, amplifying demand. In India, the adoption of biocides in wastewater treatment plants has grown, driven by government incentives. The rise of smart cities, equipped with advanced water management systems, has further propelled this trend.

The paints and coatings segment is the fastest-growing application, with a projected CAGR of 8.5%. This expansion is fueled by the booming construction and real estate sectors, particularly in urban areas. For example, China’s real estate market relies extensively on biocides to enhance the durability of paints and coatings, preventing microbial degradation. Similarly, India’s Smart Cities Mission has spurred demand for biocidal coatings in infrastructure projects. Marine coatings also play a critical role, with biocides reducing biofouling and maintenance costs. Innovations in eco-friendly biocides have further bolstered adoption, aligning with sustainability goals.

REGIONAL ANALYSIS

China prevailed in the Asia Pacific biocides market by commanding a 50.4% share in 2024. This prominence is because of its status as a global manufacturing hub, with industries ranging from textiles to electronics relying heavily on biocides. Urbanization has further amplified demand, with a large portion of the population residing in cities, as stated by the United Nations Population Division. Rising disposable incomes have also fueled the adoption of biocides in household cleaning products.

India is an impressive market in the region. The nation is supported by its rapid industrialization and growing middle class. The country’s paints and coatings sector has been a major driver, necessitating biocides to enhance product durability. Besides, government initiatives promoting clean water, such as the Jal Jeevan Mission, have boosted biocide usage in rural and urban areas. Like, the adoption of biocides in food processing has grown, showing their critical role.

Japan is projected to experience steady growth and is driven by its advanced technological capabilities and stringent environmental regulations. The country’s emphasis on hygiene has fostered innovation in biocides, with a considerable share of hospitals using them for disinfection. Additionally, the aging population has increased demand for healthcare products, which rely heavily on biocides. Urban consumers’ preference for eco-friendly solutions further amplifies demand, particularly in cities like Tokyo and Osaka.

Australia is projected to see significant growth. It is driven by its robust regulatory framework and high consumer awareness about hygiene. Additionally, the country’s thriving agricultural sector relies on biocides for crop protection, with the authorities reporting a notable growth in usage. Urban consumers’ preference for eco-friendly products further amplifies demand, particularly in cities like Sydney and Melbourne.

Top Players in the Asia Pacific Biocides Market

BASF SE

BASF SE is a global leader in the biocides market, with a strong presence in the Asia Pacific region. Also, its strategic partnerships with local industries, such as water treatment and paints, have strengthened its market position. By offering customized solutions for diverse applications, BASF has established itself as a trusted provider of high-quality biocides globally, contributing significantly to advancements in hygiene and material protection.

Dow Inc.

Dow Inc. is a key player in the Asia Pacific biocides market, renowned for its expertise in developing advanced microbial control technologies. The company’s commitment to innovation has enabled it to address complex challenges faced by industries such as agriculture, healthcare, and construction. Dow’s emphasis on collaboration with regional stakeholders ensures its products align with local regulatory frameworks and consumer preferences. Through its proactive approach to sustainability and efficiency, Dow continues to shape the global biocides landscape while maintaining a competitive edge in the Asia Pacific market.

Lonza Group

Lonza Group stands out for its specialization in high-performance biocides designed for critical applications such as water treatment and healthcare. Lonza’s dedication to quality and safety has earned it recognition among leading manufacturers and regulatory bodies. By investing in state-of-the-art production facilities and fostering partnerships with local governments, Lonza has reinforced its reputation as a pioneer in microbial control.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Lonza Group Ltd, Solvay S.A., LANXESS AG, Clariant AG, BASF SE, Ecolab Inc., The Dow Chemical Company, Akzo Nobel N.V., Troy Corporation, and Thor Group Limited are some of the key market players in the Asia Pacific biocides market.

The Asia Pacific biocides market is characterized by intense competition, driven by the presence of both global giants and regional players striving to gain a larger share of the rapidly growing sector. The market’s competitive landscape is shaped by the increasing demand for sustainable and effective microbial control solutions, which has prompted companies to innovate and differentiate their offerings. Global players leverage their technological expertise and economies of scale to maintain dominance, while regional players focus on customization and localized strategies to carve out niches. Sustainability remains a central theme, with companies competing to offer the most eco-friendly and cost-effective solutions. Additionally, the rise of industrialization and urbanization has intensified competition, as companies vie to secure contracts with major industries and municipalities.

RECENT MARKET DEVELOPMENTS

- In April 2024, BASF SE launched a new line of bio-based biocides specifically designed for the agricultural sector in Southeast Asia. This move was aimed at addressing the growing demand for sustainable crop protection solutions in rural areas.

- In June 2023, Dow Inc. partnered with a leading South Korean water treatment facility to co-develop advanced oxidizing biocides tailored for municipal water systems. This collaboration enhanced Dow’s visibility in the rapidly expanding water treatment segment.

- In February 2023, Lonza Group announced the acquisition of a small-scale biocide manufacturing plant in Vietnam to bolster its supply chain resilience and reduce dependency on imported raw materials.

- In September 2022, BASF SE signed a memorandum of understanding with the Indian government to promote sustainable biocide practices under the “Clean India Mission.” This initiative strengthened its reputation as a sustainability leader in the region.

- In November 2021, Dow Inc. opened a state-of-the-art R&D center in Thailand to cater to the rising demand for innovative biocides in paints and coatings applications. This expansion strengthened its presence in Southeast Asia.

MARKET SEGMENTATION

This research report on the Asia Pacific biocides market is segmented and sub-segmented into the following categories.

By Type

- Non-Oxidizing Biocides

- Oxidizing Biocides

By Application

- Water Treatment

- Paints & Coatings

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]