Asia Pacific Biomedical Refrigerators and Freezers Market Research Report – Segmented By Product( Ultra Low Temperature (ULT) Freezers, Plasma Freezers ) End Use( hospitals, Research Laboratories ) and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis on Size, Share, Trends& Growth Forecast from 2025 to 2033

Asia Pacific Biomedical Refrigerators and Freezers Market Size

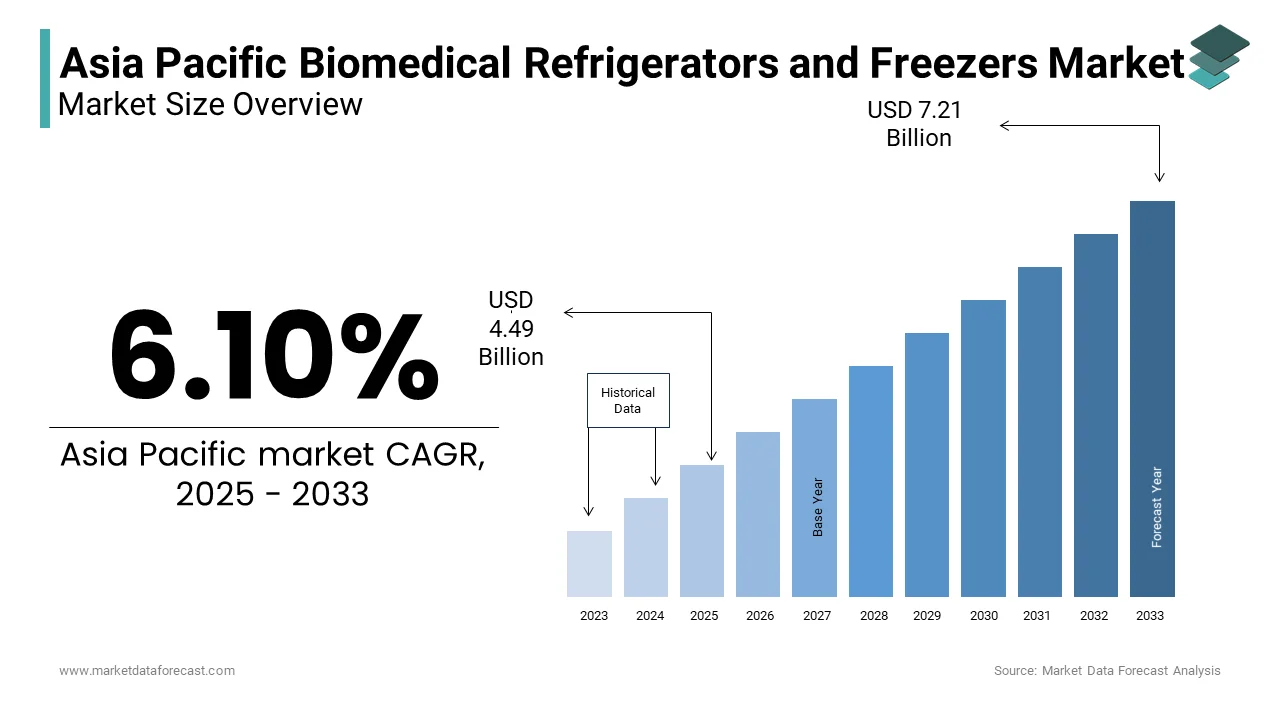

The Asia Pacific Biomedical Refrigerators and Freezers Market Size was valued at USD 4.23 billion in 2024. The Asia Pacific Biomedical Refrigerators and Freezers Market Size is expected to have 6.10 % CAGR from 2025 to 2033 and be worth USD 7.21 billion by 2033 from USD 4.49 billion in 2025.

Asia Pacific has emerged as a focal point for growth in this sector due to rapid advancements in healthcare infrastructure and increasing investments in life sciences research. Additionally, government initiatives aimed at modernizing healthcare facilities and enhancing disease surveillance programs are further boosting deployment rates of biomedical refrigeration systems. In Australia, for instance, the National Vaccine Storage Facility established by the Department of Health relies heavily on advanced biomedical freezers to manage nationwide immunization supply chains. Similarly, in South Korea, the Korea Centers for Disease Control and Prevention (KCDC) has mandated strict cold storage protocols for clinical labs handling infectious agents, which is contributing to the increased adoption of compliant refrigerator-freezer units.

MARKET DRIVERS

Expansion of Biopharmaceutical Manufacturing in Asia Pacific

One of the primary drivers fueling the Asia Pacific biomedical refrigerators and freezers market is the rapid expansion of biopharmaceutical manufacturing across key economies such as China, India, and South Korea. The region has witnessed a substantial influx of foreign direct investment into drug development and biologics production over the past decade. This industrial boom necessitates robust cold storage infrastructure to preserve sensitive biological materials including monoclonal antibodies, cell therapies, and mRNA-based drugs. For example, in 2022, Shanghai-based WuXi Biologics commissioned new large-scale fermentation and purification facilities requiring hundreds of high-capacity biomedical freezers operating at ultra-low temperatures (-70°C or lower). Such infrastructure developments are mirrored across India’s Hyderabad and Bengaluru regions, where biotech parks have expanded their capacities under the Government's Make in India initiative.

Moreover, the rise in domestic R&D efforts by local pharmaceutical companies is leading to greater demand for validated, temperature-monitored refrigeration systems. In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) mandates that all clinical trial materials be stored under controlled conditions, which is amplifying the need for certified biomedical refrigeration units.

Surge in Healthcare Infrastructure Investments

Another significant driver of the Asia Pacific biomedical refrigerators and freezers market is the substantial increase in public and private investments aimed at upgrading healthcare infrastructure across both urban and rural areas. Governments in countries such as Indonesia, Vietnam, Thailand, and the Philippines have launched multi-billion-dollar health system modernization programs, particularly post-pandemic, to enhance diagnostic capabilities and emergency response mechanisms.

This has led to an increased requirement for reliable cold storage systems in blood banks, pathology labs, and vaccine distribution hubs. For instance, in 2023, the Indian government announced an allocation of USD 25 billion under its Ayushman Bharat Digital Mission to strengthen healthcare IT and infrastructure, including the installation of biomedical refrigeration units in newly built rural health centers. Additionally, Australia’s National Critical Care and Trauma Response Centre has been expanding its network of mobile vaccine storage units equipped with biomedical freezers to support remote communities. As per Deloitte’s 2023 Asia Pacific Healthcare Outlook report, more than 60% of surveyed hospitals in the region plan to upgrade or replace existing refrigeration systems within the next two years to meet WHO-recommended standards for vaccine and specimen storage. This infrastructural push is not only improving patient care but also creating a steady demand trajectory for biomedical refrigeration equipment across the Asia Pacific.

MARKET RESTRAINTS

High Initial Investment and Maintenance Costs

One of the principal restraints impeding the growth of the Asia Pacific biomedical refrigerators and freezers market is the elevated cost associated with purchasing, installing, and maintaining these specialized systems. Unlike standard refrigeration units, biomedical refrigerators and freezers must comply with stringent international standards such as ISO 9001, IEC 60068-3, and UL 412, which significantly inflate their acquisition costs. For smaller hospitals, rural clinics, and independent diagnostic laboratories in developing economies like Cambodia, Laos, and parts of India, this represents a considerable financial burden. A 2023 survey conducted by the Asian Development Bank revealed that nearly 40% of small-to-medium-sized healthcare providers in Southeast Asia cited equipment affordability as a critical barrier to upgrading cold storage infrastructure. Moreover, in emerging markets, there is often a lack of trained service technicians who can handle complex repairs, leading to extended downtime and increased maintenance costs. These economic and logistical challenges collectively act as a drag on widespread adoption, limiting market penetration primarily to well-funded private hospitals and government-run tertiary care centers, thereby constraining overall growth in the Asia Pacific biomedical refrigeration sector.

Regulatory Complexity and Compliance Burden

A significant restraint in the Asia Pacific biomedical refrigerators and freezers market is the evolving nature of regulatory requirements governing the storage and handling of medical specimens and pharmaceuticals. Each country in the region has developed its own set of guidelines and certification processes, making it difficult for manufacturers to achieve uniform compliance. For instance, in Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) enforces rigorous Good Manufacturing Practice (GMP) and Good Storage Practice (GSP) standards that require biomedical refrigeration units to undergo extensive validation before deployment.

In China, the National Medical Products Administration (NMPA) has tightened its oversight on imported medical equipment, which is introducing mandatory inspections and cybersecurity evaluations for digital-enabled refrigeration units. This has resulted in slower market entry for international players and increased reliance on domestic manufacturers who are already familiar with the approval process.

MARKET OPPORTUNITIES

Rise in Organ Transplantation and Regenerative Medicine Initiatives

A promising opportunity for the Asia Pacific biomedical refrigerators and freezers market lies in the expanding field of organ transplantation and regenerative medicine. Over the past few years, several countries in the region have intensified their focus on advancing transplant programs and stem cell therapy applications, both of which rely heavily on ultra-cold preservation technologies. According to the Asia-Pacific Transplant Registry maintained by the Japan Organ Transplant Network, the number of organ transplants performed across the region increased by approximately 18% from 2020 to 2023, with China, South Korea, and India witnessing the most pronounced growth.

In China, the Chinese Red Cross Society reported in 2023 that the country performed over 20,000 organ transplants in the previous year, which is marking a record high. This trend has spurred investments in cryopreservation units capable of maintaining tissues and organs at sub-zero temperatures prior to transplantation. Companies such as Thermo Fisher Scientific and Panasonic Healthcare have responded by deploying custom-engineered freezers with temperature stabilization features tailored for biomedical transport and long-term organ storage.

India has also seen a surge in stem cell banking and regenerative therapy clinics, particularly in metropolitan cities like Mumbai and Delhi. According to the Indian Council of Medical Research (ICMR), the number of registered stem cell banks in the country has doubled since 2019, each requiring multiple biomedical freezers to store cord blood units and tissue samples.

Increasing Government Funding for Public Health Programs

Government funding for public health initiatives has emerged as a key opportunity for the Asia Pacific biomedical refrigerators and freezers market. Across the region, national governments have significantly ramped up financial allocations for immunization campaigns, disease prevention programs, and pandemic preparedness frameworks, all of which depend on robust cold chain logistics. A striking example is India’s Universal Immunization Program, which is among the largest in the world. Part of this funding was directed toward replacing outdated refrigeration units with solar-powered and energy-efficient biomedical cold storage systems, particularly in off-grid rural areas. This initiative has created consistent demand for new-generation refrigerators that conform to WHO PQS (Performance, Quality, and Safety) specifications. Australia has also reinforced its National Vaccine Strategy through a AUD 350 million investment in 2023, focusing on strengthening storage infrastructure for future pandemic responses. With other nations like Vietnam and the Philippines following suit, government-backed spending on healthcare cold chain systems is expected to sustain strong demand for biomedical refrigeration equipment throughout the region.

MARKET CHALLENGES

Energy Access and Power Supply Reliability in Rural Areas

One of the foremost challenges confronting the Asia Pacific biomedical refrigerators and freezers market is the inconsistency of power supply, particularly in rural and remote regions. Reliable electricity is a fundamental prerequisite for the continuous operation of temperature-sensitive storage equipment. However, in many parts of Southeast Asia and South Asia, frequent power outages and grid instability severely impact the functionality of biomedical refrigeration systems.

According to the International Energy Agency, as of 2023, approximately 100 million people in the Asia Pacific region still lack regular access to electricity, with rural Bangladesh, Myanmar, and Papua New Guinea being among the most affected. Even in countries like India and the Philippines, where electrification levels are relatively higher, intermittent blackouts persist, especially in peripheral health centers. A study conducted by the World Health Organization in 2022 found that nearly 20% of health facilities in low-income districts of India experienced daily power cuts lasting more than four hours, which is posing a serious risk to vaccine and sample preservation.

To mitigate this challenge, some healthcare providers have adopted solar-powered refrigeration systems. However, these alternatives come with their own limitations, including high upfront costs and dependency on weather conditions. Moreover, retrofitting existing biomedical cold storage units with backup power solutions adds another layer of complexity and expense.

Limited Availability of Skilled Technicians for Installation and Repair

A critical challenge affecting the growth of the Asia Pacific biomedical refrigerators and freezers market is the scarcity of trained professionals capable of installing, calibrating, and repairing these highly specialized units. Unlike standard refrigeration appliances, biomedical refrigerators and freezers require precision engineering and adherence to strict regulatory standards by necessitating skilled intervention at every stage of the equipment lifecycle. According to a 2023 report by the International Labour Organization, fewer than 30% of technical training institutions across Southeast Asia offer formal courses in medical device maintenance, which is resulting in a significant skills gap. In countries like Indonesia and Vietnam, where the healthcare infrastructure is rapidly expanding, the shortage of qualified biomedical technicians has led to prolonged equipment downtime. For example, in Indonesia’s East Nusa Tenggara province, nearly half of the installed biomedical freezers remained non-operational for extended periods due to the absence of certified repair services. In response, some universities in South Korea and Australia have introduced specialized biomedical engineering tracks to address the workforce deficit.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.10 % |

|

Segments Covered |

By Product, End Use and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

China, India, Japan, South Korea, Australia, New Zealand, Thailand, Indonesia, Philippines, Vietnam, Singapore, Rest of APAC. |

|

Market Leader Profiled |

Panasonic Healthcare Corporation, Haier Biomedical, Eppendorf AG, Power Scientific |

SEGMENTAL ANALYSIS

By Product Insights

The Ultra Low Temperature (ULT) Freezers segment was accounted in holding 38.5% of the Asia Pacific biomedical refrigerators and freezers market share in 2024 owing to its widespread use in biopharmaceutical research, vaccine storage, and cryogenic applications that require extreme temperature control below -70°C. The surge in mRNA vaccine production across the region, particularly in China and India is also to fuel the growth of the market. These vaccines must be stored at ultra-low temperatures to maintain stability, a requirement amplified by the rapid deployment of Pfizer-BioNTech and Moderna COVID-19 vaccines. According to the Serum Institute of India, one of the world’s leading vaccine manufacturers, over 60% of its cold chain infrastructure expansion in 2022 involved ULT freezer installations to support global vaccine distribution. Another key driver is the expansion of genomics and cell-based research facilities , especially in Japan and South Korea.

The Plasma Freezers segment is projected to register a CAGR of 8.7% from 2025 to 2033 owing to a sharp rise in plasma-derived therapies and the strengthening of blood banking networks across the region. According to the Indian Society of Blood Transfusion and Immunohaematology, plasma collection centers in India saw a 40% year-over-year increase in operations during 2022, which is necessitating additional plasma freezing units to ensure proper storage and separation of immunoglobulins and clotting factors. Additionally, growing awareness about rare diseases treated through plasma-derived medicinal products (PDMPs) has led to increased fractionation activities. CSL Behring’s Singapore facility, one of the largest PDMP manufacturing hubs in Asia, expanded its plasma freezer capacity by 30% in 2023, aligning with rising export commitments to the Middle East and Africa. These interconnected developments are rapidly accelerating the adoption of plasma freezers in the region.

By End Use Insights

The hospitals segment was the largest and held 36.5% of the Asia Pacific biomedical refrigerators and freezers market share in 2024. Hospitals serve as critical nodes in healthcare delivery, requiring extensive cold storage systems to manage vaccines, blood components, tissue samples, and pharmaceutical inventories.

One key reason behind the hospital segment’s dominance is the expansion of tertiary care facilities and government-funded super-specialty hospitals in India and China. In India, the Ayushman Bharat Health Infrastructure Mission allocated over USD 15 billion in 2023 to establish 200 new multi-specialty hospitals, each equipped with advanced biomedical refrigeration units for pathology labs and transfusion medicine departments. According to the Federation of Indian Chambers of Commerce and Industry (FICCI), this initiative contributed to a 22% increase in hospital refrigerator procurements in fiscal year 2023–2024.

Another driving force is the enhanced focus on infection control and vaccine storage compliance in public health institutions. For instance, in Australia, the Therapeutic Goods Administration mandated all public hospitals to upgrade their vaccine storage equipment to WHO PQS-certified models by mid-2023. Additionally, rising surgical volumes and organ transplant procedures have intensified the need for reliable cold storage infrastructure. These cumulative trends reinforce hospitals as the leading end-use segment in the Asia Pacific biomedical refrigeration landscape.

The Research Laboratories segment is likely to register a CAGR of 9.4% during the forecast period 2025 and 2033 due to the escalating investment in life sciences research and the establishment of high-end laboratory infrastructure across the region. In parallel, collaborations between academic institutions and global pharma firms have accelerated lab setup projects across the region.

Moreover, the proliferation of incubators and innovation hubs in countries like Singapore and Malaysia has created a favorable ecosystem for startups engaged in drug discovery and personalized medicine. Enterprise Singapore reported that biotech startup registrations grew by 33% in 2023, with each entity requiring scalable refrigeration solutions for preclinical studies. These dynamics collectively position research laboratories as the fastest-growing end-use segment in the Asia Pacific biomedical refrigeration market.

COUNTRY LEVEL ANALYSIS

China was the top performer in the Asia Pacific biomedical refrigerators and freezers market with 28.4% of the share in 2024 due to its aggressive push in biopharmaceutical manufacturing, government-backed healthcare modernization, and advancements in medical research infrastructure. Another significant driver is the National Medical Equipment Upgrade Program , launched by the National Development and Reform Commission in 2022. As per the China Medical Equipment Industry Association, over 100,000 units were procured nationwide under this initiative in the past two years. Additionally, the growth in clinical research centers and biosafety level-3 (BSL-3) laboratories has spurred demand for shock-freezers and plasma storage units. The Chinese Center for Disease Control and Prevention reported that the number of BSL-3 labs exceeded 80 in 2023, each requiring specialized cold storage to handle infectious specimens safely.

India positioned second in holding Asia Pacific biomedical refrigerators and freezers market with 19.4% of share in 2024. The country's growth is being propelled by expanding healthcare access programs, by increasing private healthcare spending, and a booming diagnostics industry. A primary driver is the universal immunization drive supported by the Government of India, which has significantly boosted vaccine storage needs. Under the National Cold Chain Management Programme, over 70,000 solar-powered and conventional biomedical refrigerators have been installed across Primary Health Centers and sub-centers since 2020. According to the Ministry of Health and Family Welfare, this initiative is expected to cover 95% of rural areas by 2025. Simultaneously, India’s diagnostics sector is undergoing rapid digitization and expansion , with standalone pathology labs multiplying across Tier I and Tier II cities.

Another notable trend is the rise in contract research organizations (CROs) and bio-banking initiatives in Hyderabad and Bengaluru. According to BioAsia, the biotech policy forum, India now hosts over 250 CROs engaged in clinical trials, many of which depend on plasma and ultra-low temperature freezers for sample preservation. These combined factors make India one of the fastest-developing markets for biomedical refrigeration equipment in the region.

Japan was accounted in holding 12.3% of the Asia Pacific biomedical refrigerators and freezers market share in 2024. The expansion of regenerative medicine and cellular therapy clinics, in Osaka and Tokyo is leveraging the growth of the market. The Japanese government has actively promoted iPS cell-based treatments, with Kyoto University’s Center for iPS Cell Research and Application leading numerous clinical trials. Furthermore, Japan’s aging population and associated chronic disease burden have elevated the demand for long-term medication storage and biobanking. The National Cancer Center Japan reported a 12% rise in personalized oncology treatments in 2023, many of which require ultra-low temperature storage. These structural healthcare needs continue to sustain a high demand for sophisticated biomedical refrigeration technologies in Japan.

South Korea biomedical refrigerators and freezers market growth is propelled with the well-integrated healthcare system, coupled with its emphasis on digital transformation in clinical environments, supports a steady uptake of high-performance refrigeration units.

Also, the expansion of smart hospital initiatives , where IoT-enabled medical equipment including connected refrigerators with remote temperature monitoring is becoming standard. The Korean Ministry of Health and Welfare reported that over 50% of tertiary hospitals upgraded to smart cold storage systems between 2021 and 2023, which is improving real-time tracking and reducing human error in vaccine management. Additionally, Korea’s proactive pandemic response strategies have reinforced the need for resilient cold storage networks. During the peak of the Omicron wave in early 2022, the Korea Disease Control and Prevention Agency (KDCA) deployed over 1,000 mobile ultra-low temperature freezers for vaccine distribution.

Australia’s well-established healthcare infrastructure, stringent quality controls, and substantial public funding for immunization programs support consistent demand for high-standard refrigeration systems. Australia’s commitment to maintaining global biosafety standards has resulted in greater adoption of certified refrigeration units. The Therapeutic Goods Administration (TGA) mandates strict adherence to AS/NZS 3820 standards for temperature-controlled medical devices.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Asia Pacific biomedical refrigerators and freezers market are Panasonic Healthcare Corporation, Haier Biomedical, Eppendorf AG, Power Scientific, Inc., Aegis Scientific, Inc., Haier Biomedical, Follett LLC, Helmer Scientific, Thermo Fisher Scientific, Azbil Corporation

The competition in the Asia Pacific biomedical refrigerators and freezers market is characterized by a blend of global leaders and regional manufacturers striving to capture a larger share of a rapidly expanding sector. As demand surges due to advancements in life sciences, vaccine distribution programs, and hospital modernization efforts, companies are intensifying efforts in innovation, localization, and strategic positioning. While multinational corporations leverage brand strength, technical expertise, and broad product portfolios to maintain dominance, regional players are gaining traction by offering cost-effective alternatives tailored to local regulatory and operational needs. The market landscape is also shaped by heightened collaboration between industry stakeholders and public health organizations, fostering the development of more efficient and compliant cold storage solutions. Moreover, the growing emphasis on sustainability and energy efficiency is driving differentiation strategies, with several companies focusing on eco-friendly refrigerants and power-saving technologies.

Top Players in the Market

One of the leading players in the Asia Pacific biomedical refrigerators and freezers market is Thermo Fisher Scientific , a global leader in serving science. The company offers a wide range of temperature-controlled storage solutions, including ultra-low temperature freezers, plasma freezers, and medical refrigerators that cater to hospitals, research institutions, and pharmaceutical firms across the region. Thermo Fisher’s commitment to innovation and its ability to provide compliant, energy-efficient cold chain systems have made it a preferred supplier in key markets like China, Japan, and South Korea. Its extensive distribution network and strong partnerships with regional healthcare providers further strengthen its presence.

Another dominant player is Panasonic Healthcare , known for its high-performance biomedical refrigeration products tailored for clinical and laboratory environments. With a focus on Japanese and Southeast Asian markets, Panasonic has built a reputation for reliability and precision engineering. The company emphasizes digital integration, offering smart refrigeration units equipped with remote monitoring capabilities. This technological edge, combined with deep-rooted relationships in the domestic healthcare sector, that allows Panasonic to maintain a competitive stance in the Asia Pacific market.

Eppendorf AG is another major contributor, particularly in specialized segments such as sample preservation and biobanking. While headquartered in Germany, Eppendorf has significantly expanded its footprint in the Asia Pacific by collaborating with academic and research institutions in countries like Australia, India, and Singapore. The company’s emphasis on product customization, quality assurance, and after-sales support has helped solidify its position among high-end users requiring precision storage solutions.

Top Strategies Used by Key Market Participants

Key players in the Asia Pacific biomedical refrigerators and freezers market are leveraging product innovation and digital integration to enhance equipment functionality and user experience. Companies are increasingly introducing smart refrigeration units equipped with IoT-enabled sensors and cloud-based monitoring systems that allow real-time data tracking and alerts, improving reliability and compliance in critical applications.

Another major strategy is strategic partnerships and collaborations with local distributors, government bodies, and research institutions to expand their regional reach. These alliances help companies better understand regulatory landscapes and tailor their offerings accordingly, ensuring faster market access and greater customer retention across diverse healthcare settings.

Lastly, localized manufacturing and service centers are being established to reduce costs, ensure quicker response times for maintenance, and comply with country-specific regulations. By setting up production hubs within the region, companies can streamline supply chains, offer customized models, and provide enhanced after-sales support, thereby strengthening their market positions.

RECENT HAPPENINGS IN THE MARKET

In July 2023, Thermo Fisher Scientific launched a new line of energy-efficient ultra-low temperature freezers specifically designed for tropical climates, addressing challenges related to heat and humidity prevalent in Southeast Asia. This move was aimed at enhancing reliability and reducing maintenance costs in regions where ambient conditions pose risks to cold chain integrity.

In September 2023, Panasonic Healthcare entered into a strategic partnership with a leading Indian diagnostics chain to supply smart-connected biomedical refrigerators for over 100 lab locations. The initiative was designed to improve temperature monitoring and compliance with national and international standards for sample storage.

In January 2024, Eppendorf AG expanded its regional service network in Australia by opening a dedicated technical support and calibration center in Sydney, aiming to provide faster response times and improved after-sales service for academic and research clients.

In March 2024, B Medical Systems, based in Luxembourg but active in the Asia Pacific region, announced a joint venture with a Chinese state-backed enterprise to localize production of vaccine storage refrigerators in Guangzhou, aligning with national immunization infrastructure goals.

In May 2024, Haier Biomedical inaugurated a new R&D facility in Singapore focused on developing intelligent cold chain solutions for hospitals and blood banks across Asia. The center is intended to accelerate product innovation tailored to regional healthcare requirements.

MARKET SEGMENTATION

This research report on the asia pacific biomedical refrigerators and freezers market has been segmented and sub-segmented into the following.

By Product

- Ultra Low Temperature (ULT) Freezers

- Plasma Freezers

By End Use

- hospitals

- Research Laboratories

By Country

- China

- India

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Indonesia

- Philippines

- Vietnam

- Singapore

- Rest of APAC

Frequently Asked Questions

What is the Asia Pacific biomedical refrigerators and freezers market?

The Asia Pacific biomedical refrigerators and freezers market comprises medical-grade refrigeration equipment used to store biological samples, vaccines, blood, and other sensitive products in hospitals, research labs, and pharmaceutical companies across countries in the Asia Pacific region.

Who are the key players in the Asia Pacific biomedical refrigeration market?

Some major companies include are Panasonic Healthcare Co. Haier Biomedical Thermo Fisher Scientific Eppendorf AG PHC Holdings Corporation.

What are the main application areas for biomedical refrigerators and freezers?

Primary application sectors are Hospitals and clinics Blood banks Research and academic institutes Pharmaceutical companies Biotechnology labs

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com