Asia Pacific Biometrics Market Size, Share, Trends & Growth Forecast Report By Technology (Face Recognition, Hand Geometry, Voice Recognition, Signature Recognition, Iris Recognition, AFIS, Non-AFIS, Others), Functionality, Component, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Biometrics Market Size

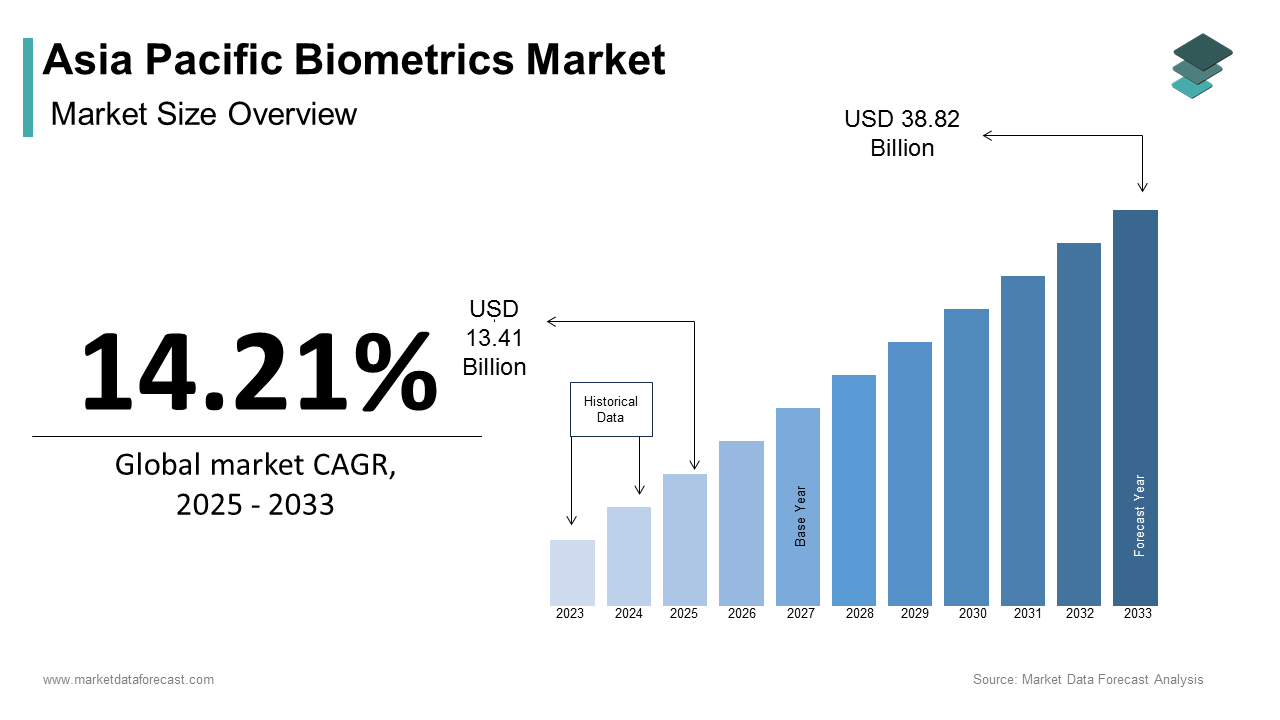

The Asia Pacific biometrics market size was calculated to be USD 11.74 billion in 2024 and is anticipated to be worth USD 38.82 billion by 2033, from USD 13.41 billion in 2025, growing at a CAGR of 14.21% during the forecast period.

Biometric systems rely on unique physiological or behavioral characteristics such as fingerprints, facial recognition, iris scans, and voice patterns. The region’s rapid urbanization and digital transformation have fuelled the demand for secure and efficient identification solutions. For instance, over 200 million people are expected to migrate to urban areas by 2030 creating a pressing need for scalable biometric systems to manage population growth and enhance public safety. Additionally, advancements in artificial intelligence (AI) and machine learning have significantly improved the accuracy and affordability of biometric technologies. Government agencies across the Asia Pacific region are emphasizing the use of facial recognition technologies at airports to streamline passenger processing and enhance border security.

MARKET DRIVERS

Government Initiatives and National ID Programs

Government-led initiatives and national ID programs are key drivers of the Asia Pacific biometrics market as they necessitate scalable and secure identification systems. India’s Aadhaar program managed by the Unique Identification Authority of India has enrolled over 1.3 billion citizens which creates one of the largest biometric databases globally. This initiative not only enhances social welfare delivery but also strengthens national security by enabling accurate identity verification.. These systems are integral to managing the country’s vast population and ensuring compliance with regulatory frameworks.

Rising Demand for Mobile Biometrics

The increasing integration of biometric systems in smartphones is another significant driver. Over 70% of smartphones sold in the Asia Pacific region in 2022 featured fingerprint or facial recognition capabilities. Mobile biometrics are essential for secure mobile banking and e-commerce transactions, particularly in countries like Japan and Singapore where cashless payments are prevalent. Moreover, the growing emphasis on cybersecurity has further propelled the adoption of mobile biometrics. Biometric authentication reduces the risk of unauthorized access compared to traditional passwords by aligning with consumer preferences for convenience and security.

MARKET RESTRAINTS

Privacy Concerns and Ethical Challenges

Privacy concerns and ethical challenges pose significant restraints to the biometrics market particularly regarding data misuse and surveillance. Unauthorized access to biometric databases can lead to identity theft and breaches of personal privacy. The lack of standardized privacy laws across the region exacerbates this issue while forcing companies to navigate complex regulatory environments. These ethical and legal challenges hinder the seamless adoption of biometric systems particularly in sensitive applications like healthcare and finance.

High Implementation Costs

The high costs associated with implementing biometric systems also act as a restraint. The Federation of Indian Chambers of Commerce and Industry notes that small and medium enterprises (SMEs) often struggle to afford advanced biometric solutions despite their potential benefits. For example, installing biometric access control systems in workplaces can cost several thousand dollars deterring smaller players from entering the market. Moreover, the lack of skilled personnel to operate and maintain biometric systems complicates adoption. Only 20.45% of businesses have access to trained professionals capable of deploying biometric technologies.

MARKET OPPORTUNITIES

Integration with AI and IoT

The integration of artificial intelligence (AI) and the Internet of Things (IoT) presents a transformative opportunity for the biometrics market. AI-driven analytics can process vast amounts of biometric data to generate actionable insights and enhance decision-making across industries. Use of AI in facial recognition systems for crowd management during large events which ensure public safety. Similarly, China’s National Development and Reform Commission emphasizes the role of IoT-enabled biometric systems in smart cities where sensors capture data to optimize resource allocation and reduce congestion.

Expansion into Emerging Economies

Emerging economies in the Asia Pacific offer untapped potential for biometrics driven by industrialization and infrastructure development. Biometric systems are used to monitor workforce attendance and ensure transparency in construction projects.Similarly, Vietnam’s growing manufacturing sector relies on biometrics for factory access control and supply chain optimization. These trends emphasize the vast opportunities for biometric companies to expand their footprint in high-growth markets.

MARKET CHALLENGES

Data Security Vulnerabilities

Data security vulnerabilities pose a significant challenge particularly in sensitive applications like banking and defense. The Australian Cyber Security Centre warns that cyberattacks targeting biometric databases can compromise national security and undermine public trust in these technologies. Similarly, India’s Ministry of Defence emphasizes the need for robust encryption protocols to protect classified biometric information. The lack of standardized cybersecurity measures across the region exacerbates this issue while forcing companies to invest heavily in securing their systems.

Regulatory Hurdles and Compliance Issues

Regulatory hurdles and compliance issues also present significant challenges to the biometrics market. The International Civil Aviation Organization states that many countries in the region have stringent regulations governing the use of biometric systems while limiting their adoption for commercial purposes. The absence of unified standards across the region creates operational inefficiencies. The importance of establishing unified regulatory frameworks to enable seamless cross-border biometric data sharing while safeguarding data privacy and security.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.21% |

|

Segments Covered |

By Technology, Functionality, Component and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

NEC Corporation, Fujitsu, Hitachi, Panasonic Corporation, Aware Inc., Thales Group, IDEMIA, Suprema Inc., Hanwang Technology, ZKTeco, Daon Inc., Crossmatch, HID Global, BioEnable Technologies, Dermalog Identification Systems |

SEGMENTAL ANALYSIS

By Technology Insights

The face recognition segment dominates the Asia Pacific biometrics market by capturing 35.09% of the total share. This dominance is driven by its versatility along with cost-effectiveness and ease of integration into existing systems. One major factor is its widespread adoption in public safety and border control. Facial recognition systems are deployed at airports to streamline passenger processing and enhance security. Over 100 cities have implemented facial recognition for law enforcement while reducing crime rates by up to 20.56%. Another factor is the growing demand for mobile biometrics. Over 70.43% of smartphones sold in the region feature facial recognition capabilities, particularly in countries like South Korea and Japan where cashless payments are prevalent.

Iris recognition is projected to witness a CAGR of 18.5% during the forecast period. This growth is fueled by its high accuracy and resistance to spoofing making it ideal for sensitive applications such as banking and healthcare. A key factor is the expansion of financial services. Iris recognition is mainly used for secure transactions, particularly in rural areas where traditional banking infrastructure is limited. Similarly, Japan’s Financial Services Agency emphasizes the adoption of iris scanning in ATMs to prevent fraud and enhance user convenience. Another factor is the focus on healthcare security. Hospitals in Southeast Asia increasingly use iris recognition to protect patient data and prevent unauthorized access.

By Functionality Insights

The non-contact systems segment was the largest of the Asia Pacific biometrics market by capturing 40.4% of share in 2024 owing to their hygienic nature and user-friendly design which aligns with post-pandemic preferences. One key factor is the growing emphasis on public health and safety. Singapore’s Ministry of Health states that non-contact biometric systems such as facial recognition and voice authentication which are widely adopted in healthcare facilities to minimize physical contact and reduce infection risks. Similarly, Australia’s Department of Health reports that hospitals increasingly rely on non-contact systems for patient identification and access control. Another factor is the rise of smart city initiatives. The integration of non-contact biometrics in public transportation systems ensures seamless and secure travel experiences.

The combined systems segment is projected to witness a CAGR of 20.3% during the forecast period. This growth is fueled by their ability to integrate multiple biometric modalities as well as enhancing accuracy and reliability. A significant factor is the increasing complexity of security requirements. Combined systems such as fingerprint and facial recognition are used in Aadhaar-enabled services to ensure robust identity verification. Another factor is the focus on fraud prevention. Combined biometric systems reduce the risk of unauthorized access compared to single-modality solutions and align with the growing demand for secure authentication methods.

By Component Insights

The hardware segment was the largest in the Asia Pacific biometrics market by occupying 60.23% of the share in 2024. This dominance is driven by the critical role of hardware components such as sensors, scanners and cameras in biometric systems. One major factor is the widespread deployment of biometric devices in government programs. India’s Aadhaar initiative, managed by the Unique Identification Authority of India relies on fingerprint scanners and cameras to enroll over 1.3 billion citizens. Another factor is the growing demand for mobile biometrics. Smartphone manufacturers are integrating advanced hardware components such as 3D facial recognition sensors to enhance user experience and security.

The software is projected to witness a CAGR of 22.7% during the forecast period. This growth is fueled by advancements in AI and machine learning which enhance the accuracy and efficiency of biometric systems. A key factor is the integration of AI-driven analytics. AI-powered software can process vast amounts of biometric data to generate actionable insights and improve decision-making across industries. Another factor is the focus on cybersecurity. Australia’s Cyber Security Centre emphasizes the role of software in protecting biometric databases from cyberattacks ensuring compliance with regulatory frameworks.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific biometrics market and accounted for 30.4% of the regional share in 2024. Its dominance is driven by its status as a global leader in technology innovation and large-scale biometric deployments. The Chinese Academy of Sciences reports that over 100 cities have implemented facial recognition systems for law enforcement and citizen registration. Additionally, China’s Belt and Road Initiative promotes cross-border biometric data sharing while creating demand for advanced solutions.

India was positioned second in holding the dominant share of the Asia Pacific biometrics market. The country’s rapid adoption of biometrics is driven by government-led initiatives such as Aadhaar which has enrolled over 1.3 billion citizens. The Unique Identification Authority of India emphasizes the scalability and reliability of biometric systems in enhancing social welfare delivery and national security. Furthermore, India’s growing fintech sector increasingly relies on biometrics for secure transactions while ensuring steady growth in demand.

Japan’s market is driven by its advanced technological expertise and focus on smart city development. The Ministry of Economy, Trade and Industry emphasizes the use of biometrics in public transportation systems to ensure seamless travel experiences. Additionally, Japan’s aging population necessitates secure healthcare solutions with biometric systems playing a critical role in patient identification and data protection.

South Korea’s biometric market is driven by its robust electronics and defense industries. The Ministry of Science and ICT emphasizes the adoption of biometric systems in military installations to strengthen national security. Additionally, South Korea’s cashless economy increasingly relies on mobile biometrics for secure payments which further boost demand.

Australia biometric market growth is driven with its focus on public safety and border control driving biometric adoption. The Department of Home Affairs emphasizes the use of facial recognition at airports to streamline passenger processing and enhance security. Additionally, Australia’s healthcare sector increasingly adopts biometric systems to protect patient data and prevent unauthorized access.

LEADING PLAYERS IN THE ASIA PACIFIC BIOMETRICS MARKET

NEC Corporation

NEC Corporation is a global leader in biometric technologies with a significant presence in the Asia Pacific market. The company’s contribution to the global market lies in its advanced facial recognition and fingerprint identification systems which are widely used for applications ranging from border control to financial services. NEC’s focus on accuracy along with scalability and integration capabilities has positioned it as a preferred partner for governments and enterprises seeking secure identity solutions. Its cutting-edge technologies include AI-driven analytics which enable seamless adoption across diverse industries while ensuring long-term value for customers.

Fujitsu Limited

Fujitsu Limited plays a pivotal role in advancing biometric innovations in the Asia Pacific region. Known for its expertise in palm vein recognition and multimodal biometric systems. Fujitsu provides solutions that enhance security and convenience in sectors such as banking, healthcare, and public services. The company’s focus on integrating IoT and cloud-based platforms enhances operational efficiency and real-time monitoring capabilities. Fujitsu continues to expand its footprint while contributing significantly to global advancements in biometric technology.

IDEMIA

IDEMIA is renowned for its commitment to secure identity solutions making it as a key player in the Asia Pacific biometrics market. The company’s advanced biometric platforms enable intelligent data capture and analysis empowering businesses to optimize resource management and reduce fraud. IDEMIA’s dedication to innovation and customer-centric solutions has strengthened its global reputation. IDEMIA ensures sustainable growth while driving technological transformation in industries such as law enforcement and digital payments.

TOP STRATEGIES USED BY KEY PLAYERS IN THE ASIA PACIFIC BIOMETRICS MARKET

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations with local governments along with research institutions and industry stakeholders are common among key market players.These collaborations help companies address specific regional challenges such as enhancing public safety and streamlining border control.

Product Innovation and Customization

Product innovation and customization are key focus areas for companies driving significant investment in R&D to meet the dynamic and evolving needs of end-users. For instance, manufacturers are developing multimodal biometric systems equipped with AI and machine learning capabilities to support predictive analytics and real-time decision-making. This focus on innovation not only differentiates brands but also aligns with the growing demand for secure and efficient solutions in the region.

Expansion into Emerging Markets

Expansion into emerging economies within the Asia Pacific region such as Vietnam, Indonesia and Thailand is increasingly being pursued by market players where rapid industrialization and infrastructure development are driving strong demand. This strategy allows them to capture untapped opportunities and strengthen their presence in high-growth markets.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific Biometrics market include NEC Corporation, Fujitsu, Hitachi, Panasonic Corporation, Aware Inc., Thales Group, IDEMIA, Suprema Inc., Hanwang Technology, ZKTeco, Daon Inc., Crossmatch, HID Global, BioEnable Technologies, Dermalog Identification Systems

The Asia Pacific biometrics market is characterized by intense competition with both global giants and regional players vying for dominance. Global leaders like NEC, Fujitsu and IDEMIA leverage their technological expertise and extensive distribution networks to maintain their stronghold. Meanwhile, regional players focus on cost-effective solutions and localized services to cater to price-sensitive markets. The competitive landscape is further shaped by rapid technological advancements with companies striving to integrate AI as well as IoT and cloud-based platforms into their offerings. Additionally, stringent regulatory frameworks governing data privacy have compelled manufacturers to innovate continuously. Supply chain disruptions and raw material price volatility add complexity while forcing players to adopt agile strategies. As a result, the market fosters an environment of constant evolution where differentiation through innovation along with customer-centric approaches and strategic expansion becomes critical for sustained success.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, NEC Corporation launched a new facial recognition system specifically designed for airports in Australia.

- In June 2023, Fujitsu Limited partnered with a leading Indian bank to deploy palm vein recognition systems for secure transactions.

- In September 2023, IDEMIA acquired a local biometric technology firm in Singapore to expand its production capabilities for cost-effective identity solutions.

- In January 2024, Suprema, a South Korean biometric solutions provider, introduced a line of multimodal biometric systems tailored for government applications in Japan.

- In November 2023, BioEnable Technologies signed an agreement with a Philippine defense agency to develop specialized biometric systems for military installations.

MARKET SEGMENTATION

This research report on the Asia Pacific biometrics market has been segmented and sub-segmented based on technology, functionality, component and region.

By Technology

- Face Recognition

- Hand Geometry

- Voice Recognition

- Signature Recognition

- Iris Recognition

- AFIS

- Non-AFIS

- Others

By Functionality

- Contact

- Non-contact

- Combined

By Component

- Hardware

- Software

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What is driving the growth of the biometrics market in Asia Pacific?

Key drivers include rising security concerns, government initiatives for national ID programs, increasing adoption of biometric systems in smartphones and banking, and advancements in AI-powered biometric technologies.

2. Which countries are leading in biometric adoption in Asia Pacific?

China, India, Japan, and South Korea are the leading adopters, driven by large-scale government programs, smart city projects, and widespread use in consumer electronics.

3. Who are the key players in the Asia Pacific Biometrics Market?

Major companies include NEC Corporation, Fujitsu, Hitachi, Panasonic Corporation, Aware Inc., IDEMIA, Thales Group, Suprema Inc., ZKTeco, and HID Global.

4. How is AI impacting the biometrics market?

AI is enhancing the accuracy, speed, and real-time identification capabilities of biometric systems, especially in facial and behavioral recognition.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com