Asia-Pacific Biopolymers Market Research Report – Segmentation By Type (Non-biodegradable, Biodegradable), End-User, and Region (India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis, Size, Share, Growth, Trends, And Forecasts 2025 to 2033

Asia Pacific Biopolymers Market Size

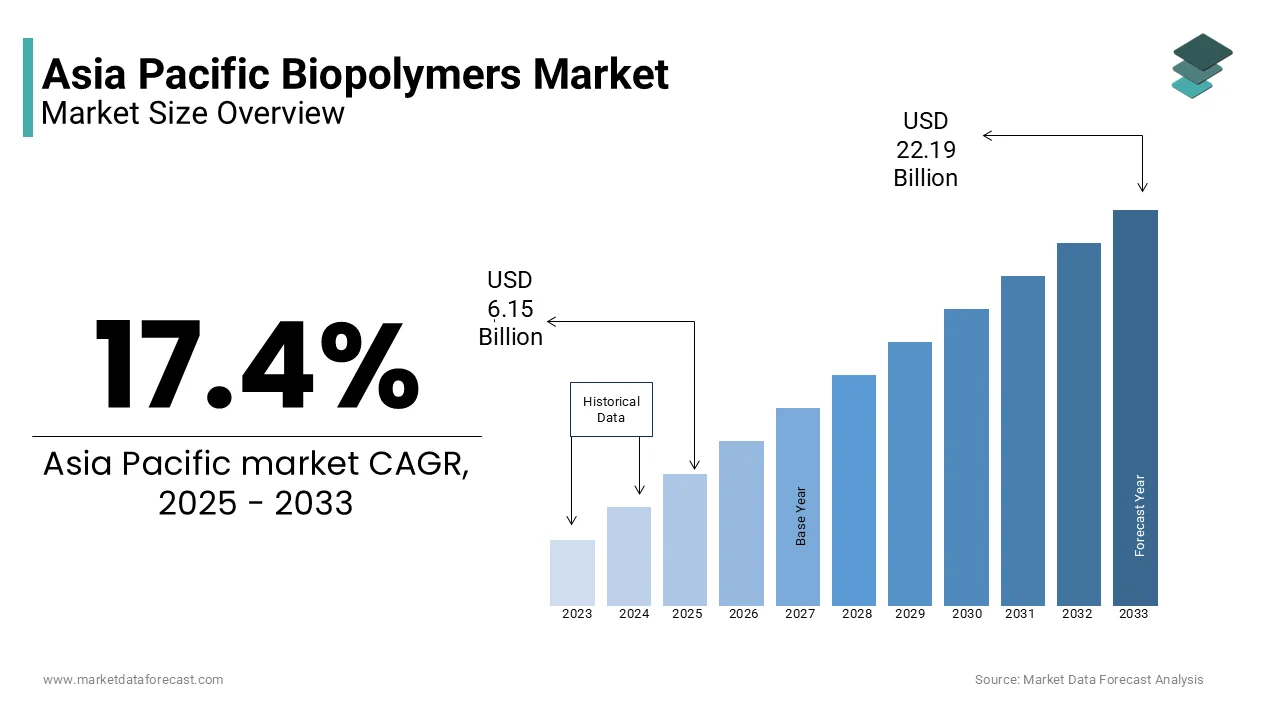

The Asia Pacific Biopolymers Market size was valued at USD 5.24 billion in 2024, and the market size is expected to reach USD 22.19 billion by 2033 from USD 6.15 billion in 2025. The market is growing at a CAGR of 17.4%.

Asia Pacific biopolymers are eco-friendly polymers sourced from renewable materials like plants or microorganisms. These biodegradable alternatives, including PLA, PHA, and starch-based polymers, offer sustainable substitutes for traditional plastics. Widely used in packaging, textiles, and medical fields, they aim to reduce environmental impact by naturally breaking down and curbing plastic pollution. Across the Asia Pacific region, there's a concerted effort towards research and production of these biopolymers, fostering innovation for more sustainable materials in diverse industries.

MARKET DRIVERS

The heightened awareness of environmental issues is one of the drivers that helps in the hyping up of market growth by rising concerns over plastic pollution and the imperative for sustainable alternatives which have fuelled the demand for biopolymers in the region. Biopolymers, derived from renewable resources, are increasingly favoured for their environmentally friendly attributes. Their inherent biodegradability and composability address the ecological challenges posed by conventional plastics. Governments across the Asia-Pacific are enforcing stringent regulations, endorsing sustainable practices, further propelling the adoption of biopolymers. Research and development investments, coupled with collaborative initiatives, are expanding the application areas and positioning them as pivotal contributors in the Asia-Pacific region. Also, in the dynamic landscape of the Asia-Pacific biopolymers market, collaborations and partnerships emerge as catalysts for technological advancement and market growth. Strategic alliances between companies, research institutions, and governmental bodies are instrumental in overcoming challenges and expediting the adoption of biopolymer technologies. These partnerships facilitate the pooling of resources, expertise, and research capabilities, leading to the development of innovative products with enhanced properties. Through a collaborative ecosystem, stakeholders in the Asia-Pacific biopolymers sector can address critical issues such as scalability, cost-effectiveness, and performance optimization. Through cooperative efforts, the Asia-Pacific biopolymers market is poised to realize accelerated advancements, delivering impactful solutions to meet the region's evolving environmental and industrial needs.

MARKET RESTRAINTS

Technological challenges stand as a formidable hurdle to widespread market adoption. The quest for biopolymers with optimal properties balancing performance, cost-effectiveness, and sustainability presents an ongoing struggle for researchers and manufacturers alike. Achieving the desired material characteristics, such as strength, flexibility, and durability, without compromising on eco-friendliness, remains a complex task. The intricate interplay between these factors requires continuous innovation and research investments to overcome inherent technological limitations. Striking the right balance is crucial to offer biopolymers as viable alternatives to traditional plastics. As the industry endeavours to address these technological challenges, advancements will not only propel the growth of the Asia-Pacific biopolymers market but also contribute substantially to the broader global sustainability agenda. However, the Asia-Pacific biopolymers market demand also grapples with inherent challenges related to supply chain dynamics, primarily rooted in the dependence on specific agricultural feedstocks like corn or sugarcane. The vulnerability of this supply chain to fluctuations in agricultural production, influenced by factors such as weather conditions and commodity price volatility, poses a significant constraint. Any disruptions in the production of these key feedstocks can directly impact the availability and cost of biopolymers. This sensitivity to agricultural variables underscores the need for diversification and resilient supply chain strategies. Industry stakeholders must navigate these challenges through strategic planning, alternative feedstock exploration, and collaboration to ensure a stable and sustainable supply chain.

SEGMENTAL ANALYSIS

By Type Insights

Based on non-biodegradable biopolymers, often known for their durability and longevity, may have a more dominant presence in the market growth. As, it possesses properties similar to traditional plastics, making them versatile and easy to integrate into existing manufacturing processes. These biopolymers even find applications in industries where durability and long product life are essential, such as in automotive components and durable goods packaging. Biodegradable biopolymers, including PLA (polylactic acid) and PHA (polyhydroxyalkanoates), are gaining second traction in the Asia-Pacific Biopolymers Market growth due to their eco-friendly characteristics. Biodegradable biopolymers, are mostly suitable for packaging, are witnessing increased demand as the Asia-Pacific region addresses plastic pollution concerns.

By End-User Insights

Packaging remains a dominant end-user segment and holds the largest CAGR in the Asia-Pacific biopolymers market due to the demand for eco-friendly and sustainable packaging solutions has propelled the adoption of biopolymers, especially in single-use applications. Increased consumer awareness of environmental issues and the harmful impact of traditional plastics has led to a surge in demand for biodegradable and compostable packaging. As consumers seek sustainable and environmentally friendly products, the consumer goods segment is witnessing another growing interest in biopolymers. Companies are increasingly adopting biopolymers in the production of consumer goods to align with sustainability goals and enhance brand reputation.

REGIONAL ANALYSIS

China stands out as the most attractive and leading country in the Asia-Pacific biopolymers market growth, both in terms of production and consumption. The country's robust industrial infrastructure, coupled with a massive population and growing environmental concerns, has propelled the adoption of biopolymers. The Chinese government's initiatives promoting sustainability and environmental protection further boost the market. India acts as a second emerging as key player in the market, showcasing substantial growth potential. The country's focus on sustainable development, coupled with a burgeoning population, is driving the demand for environmentally friendly alternatives. Government initiatives promoting green technologies and waste reduction contribute to the growth of biopolymers, particularly in packaging and agriculture. Japan, with its advanced technology and strong commitment to environmental sustainability, plays a pivotal role in the Asia Pacific biopolymers market. South Korea is making significant strides in the Asia-Pacific biopolymers market, driven by a commitment to sustainability and innovation. Also, the companies are actively investing in eco-friendly packaging solutions, catering to the increasing demand for sustainable alternatives.

KEY MARKET PLAYERS

NatureWorks LLC, Braskem S.A., Novamont S.p.A., BASF SE, Mitsubishi Chemical Corporation, TotalEnergies SE, Corbion N.V., PTT Global Chemical Public Company Limited, Danimer Scientific, Inc., Tianan Biologic Materials Co., Ltd, Kingfa Sci. & Tech. Co., Ltd., Zhejiang Hisun Biomaterials Co., Ltd., Plantic Technologies Limited, Lotte Chemical Corporation, Arkema S.A., Toray Industries, Inc., Green Dot Bioplastics, Synbra Technology BV, and Earth Renewable Technologies (ERT) are playing a dominating role in the Asia Pacific biopolymers market.

MARKET SEGMENTATION

This research report on the Asia Pacific biopolymers market has been segmented and sub-segmented based on the following categories.

By Type

- Non-biodegradable

- Biodegradable

By End-User

- Packaging

- Consumer goods

- Automotive

- Textiles

- Agriculture

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What is the Asia-Pacific Biopolymers Market growth rate during the projection period?

The Asia-Pacific Biopolymers Market is expected to grow with a CAGR of 17.4% between 2024-2029.

2. What can be the total Asia-Pacific Biopolymers Market value?

The Asia-Pacific Biopolymers Market size is expected to reach a revised size of US$ 11.68 billion by 2029.

3. Name any three Asia-Pacific Biopolymers Market key players?

Novamont S.p.A., BASF SE, and Mitsubishi Chemical Corporation are the three Asia-Pacific Biopolymers Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com