Asia Pacific Bitumen Market Report – Segmented By Product Type (Paving Grade Bitumen, Polymer-Modified Bitumen (PMB)), Application, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

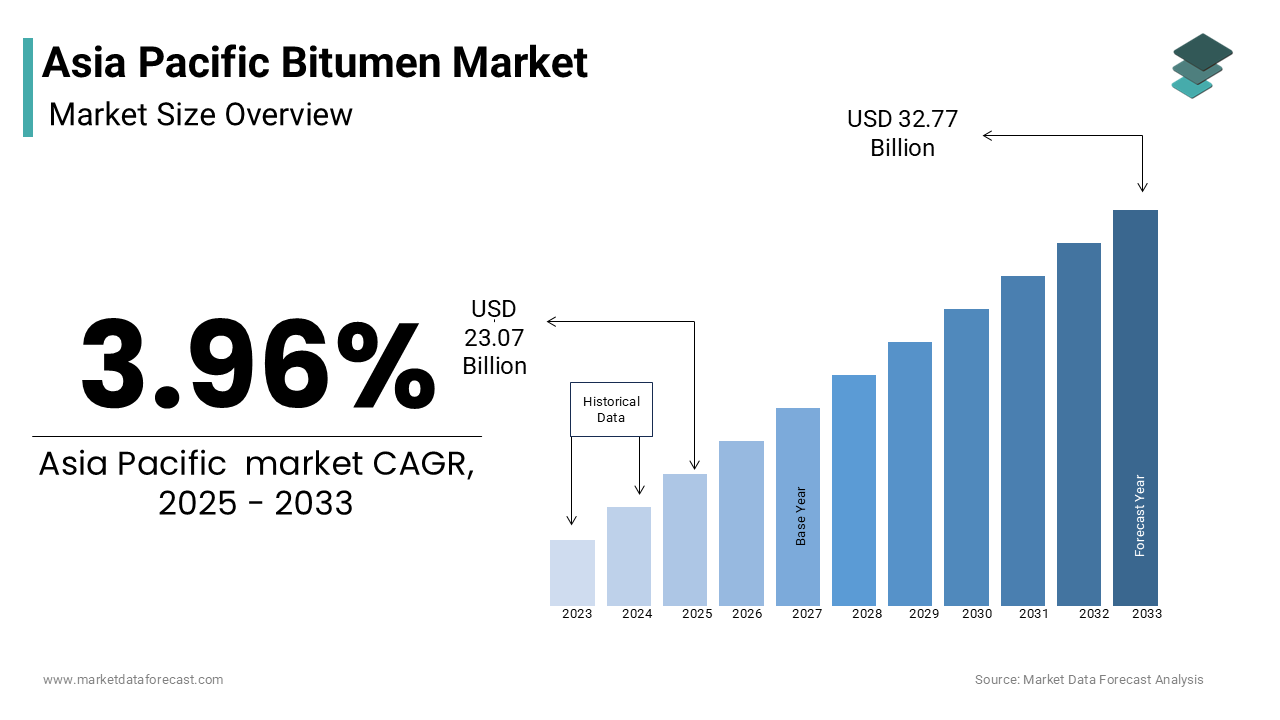

Asia Pacific Bitumen Market Size

The Asia Pacific Bitumen Market was worth USD 22.19 billion in 2024. The Asia Pacific market is expected to reach USD 32.77 billion by 2033 from USD 23.07 billion in 2025, rising at a CAGR of 3.96% from 2025 to 2033.

Bitumen, a viscous byproduct of crude oil refining, is primarily used in asphalt for road paving due to its adhesive and waterproofing properties.

MARKET DRIVERS

Expansion of Road Networks Across the Region

The unprecedented expansion of road networks in the Asia Pacific serves as a primary driver for the bitumen market. As per the International Road Federation, the total road length in the region is projected to increase significantly by 2030, driven by government initiatives aimed at enhancing connectivity and economic growth. Similarly, Southeast Asian nations like Vietnam and Indonesia are prioritizing rural road development to improve accessibility and reduce poverty. A study by the United Nations Economic and Social Commission for Asia and the Pacific indicates that improved road infrastructure can boost regional GDP. The use of bitumen in these projects is further amplified by its cost-effectiveness and durability, making it the preferred choice for large-scale construction. Also, the adoption of advanced bitumen technologies, such as crumb rubber-modified bitumen, aligns with sustainability goals by recycling waste tires and reducing environmental impact.

Rising Urbanization and Smart City Initiatives

Another significant driver is the rapid urbanization and proliferation of smart city projects across the Asia Pacific. Smart city initiatives, such as those in Singapore and South Korea, emphasize sustainable urban planning, including the development of eco-friendly roads and energy-efficient buildings. Bitumen plays a crucial role in these endeavors, particularly through innovations like porous asphalt, which aids in stormwater management and reduces urban flooding risks. A report by the Global Infrastructure Hub notes that substantial amount is being invested annually in urban infrastructure across the region, with a significant portion allocated to road surfacing and maintenance. Furthermore, the integration of smart technologies in road construction, such as temperature-sensitive bitumen, enhances durability and reduces lifecycle costs.

MARKET RESTRAINTS

Environmental Concerns and Regulatory Pressures

One of the most pressing restraints in the Asia Pacific bitumen market is the mounting scrutiny over its environmental impact. The release of volatile organic compounds (VOCs) during bitumen laying exacerbates air pollution, prompting regulatory bodies to impose stricter emission standards. For example, Australia’s Environment Protection Authority mandates the use of low-emission bitumen in urban areas, limiting the flexibility of manufacturers. Besides, the extraction of crude oil, the primary raw material for bitumen, faces opposition from environmental groups advocating for renewable alternatives. A significant portion of consumers in the region prioritize eco-friendly products, pressuring companies to adopt greener practices.

Fluctuating Crude Oil Prices

Another critical restraint is the volatility of crude oil prices, which directly impacts the cost of bitumen production. Since bitumen is derived from crude oil refining, these price swings create uncertainty for manufacturers and end-users alike. This instability is particularly challenging for small-scale contractors in developing countries like Bangladesh and Myanmar, where financial resources are limited. Moreover, the lack of long-term hedging mechanisms leaves stakeholders vulnerable to sudden price spikes, undermining project feasibility and timelines.

MARKET OPPORTUNITIES

Adoption of Polymer-Modified Bitumen (PMB)

A burgeoning opportunity in the Asia Pacific bitumen market lies in the increasing adoption of polymer-modified bitumen (PMB), which offers superior performance characteristics compared to conventional bitumen. Similarly, PMB enhances pavement durability, reducing maintenance costs and extending road lifespans. This makes it particularly appealing for regions prone to extreme weather conditions, such as monsoons in Southeast Asia or freezing temperatures in northern China. Governments across the region are incentivizing the use of PMB through subsidies and mandates. Apart from these, the integration of recycled plastics into PMB formulations presents a dual benefit: addressing plastic waste while improving road resilience.

Growth of Green and Sustainable Bitumen Solutions

Another significant opportunity stems from the growing demand for green and sustainable bitumen solutions, driven by the global push toward decarbonization. Innovations such as bio-bitumen, derived from renewable sources like vegetable oils and sugarcane residues, are gaining traction in countries like Thailand and Malaysia, where agricultural waste is abundant. Furthermore, the adoption of warm-mix asphalt technologies, which lower application temperatures by 20-50°C, is accelerating in Australia and New Zealand, reducing energy consumption and VOC emissions. Government policies promoting circular economy principles, such as India’s Swachh Bharat Mission, provide additional impetus for sustainable bitumen adoption.

MARKET CHALLENGES

Limited Awareness Among Small-Scale Contractors

A significant challenge facing the Asia Pacific bitumen market is the limited awareness and technical expertise among small-scale contractors, who play a vital role in regional infrastructure development. Many of these contractors rely on outdated practices, using conventional bitumen without exploring modern alternatives like polymer-modified or bio-bitumen. This gap is exacerbated by inadequate training programs and extension services, leaving them ill-equipped to evaluate the benefits of innovative solutions. For instance, a survey revealed that limited number of local contractors were familiar with the advantages of warm-mix asphalt in reducing environmental impact. The absence of targeted educational campaigns and financial incentives further impedes adoption, creating a disconnect between technological advancements and grassroots implementation.

Aging Infrastructure and Maintenance Backlogs

Another pressing challenge is the extensive backlog of aging infrastructure requiring maintenance and rehabilitation, which strains the capacity of the bitumen market. A notable portion of the existing road network in the Asia Pacific is over 20 years old, with many sections deteriorating due to heavy traffic loads and harsh environmental conditions. The repair and resurfacing of these roads demand substantial quantities of bitumen, often exceeding available resources. Also, the lack of proactive maintenance strategies in countries like the Philippines and Cambodia results in premature road failures, amplifying the demand for emergency repairs. A study by the Asian Infrastructure Investment Bank highlights that reactive maintenance costs higher than preventive measures, placing additional financial pressure on governments.

SEGMENTAL ANALYSIS

By Product Type Insights

The segment of paving grade bitumen dominated the Asia Pacific bitumen market by commanding a market share of 65.1% in 2024. This dominance is primarily driven by its widespread use in road construction and maintenance. The insatiable demand for durable road infrastructure, particularly in emerging economies like India and Indonesia, has fueled the adoption of paving grade bitumen. Governments across the region are investing heavily in connectivity initiatives; for instance, China’s Belt and Road Initiative alone involves the construction of over 150,000 kilometers of new roads. In addition, the cost-effectiveness and versatility of paving grade bitumen make it indispensable for large-scale infrastructure projects

The polymer-modified bitumen (PMB) segment is projected to grow at a CAGR of 8.5%. This rapid expansion is fueled by the increasing demand for high-performance pavements capable of withstanding extreme weather conditions and heavy traffic loads. PMB enhances road durability, reducing maintenance costs and extending service life. Countries like Japan and South Korea are leading this transformation, mandating the use of PMB for highways and expressways undergoing rehabilitation. Besides, the integration of recycled materials, such as crumb rubber, into PMB formulations aligns with sustainability goals, further propelling its growth.

By Application Insights

The road construction segment represented the largest application segment in the Asia Pacific bitumen market. This prominence is driven by the region’s aggressive infrastructure development agenda, with governments prioritizing road networks to enhance connectivity and economic growth. For instance, India’s Bharatmala Pariyojana aims to construct 34,800 kilometers of highways by 2025, necessitating substantial quantities of bitumen. Additionally, the adoption of advanced technologies, such as warm-mix asphalt, has improved the efficiency and sustainability of road construction, further boosting demand. A study by the University of Queensland highlights that roads constructed using modern bitumen technologies can reduce lifecycle costs, making them economically viable for both urban and rural areas.

The waterproofing segment is emerging as a rapidly expanding application, with a projected CAGR of 9.2%. This rise is propelled by the increasing emphasis on sustainable building practices and the need for durable waterproofing solutions in residential, commercial, and industrial structures. The growing prevalence of high-rise buildings in urban centers like Singapore and Hong Kong has further amplified demand, as these structures require robust waterproofing systems to withstand monsoons and humidity. Also, innovations such as self-adhesive bitumen sheets have simplified application processes, making them accessible for small-scale contractors.

REGIONAL ANALYSIS

China stood as the cornerstone of the Asia Pacific bitumen market by commanding a market share of 40.87% in 2024. The country’s dominance is underpinned by its unparalleled infrastructure development agenda. The Belt and Road Initiative has further intensified demand, requiring massive quantities of bitumen for both domestic and international projects. In addition, the adoption of advanced technologies, such as polymer-modified bitumen, has enhanced road durability and reduced maintenance costs.

India is a key player in the market. The country’s rapid urbanization and population growth have spurred unprecedented demand for road infrastructure, with the government allocating a substantial amount annually for road projects. Initiatives like the Bharatmala Pariyojana. According to the Ministry of Road Transport and Highways, the adoption of warm-mix asphalt has reduced carbon emissions during road construction, aligning with sustainability goals. Furthermore, the integration of recycled plastics into bitumen formulations has gained traction, with pilot projects demonstrating a reduction in road repair frequency.

Japan holds a significant share and is driven by its focus on high-performance infrastructure and sustainability. The country’s aging road network, with a significant portion of highways exceeding 20 years, necessitates extensive rehabilitation projects using advanced bitumen solutions like polymer-modified bitumen. Additionally, Japan’s emphasis on eco-friendly construction practices has accelerated the adoption of bio-bitumen and warm-mix technologies. The alignment of regulatory frameworks, technological expertise, and sustainability goals reinforces Japan’s position as a leader in premium bitumen applications.

Australia and New Zealand collectively account for a smaller share, driven by their strong focus on sustainable and climate-resilient infrastructure. The region’s stringent environmental regulations have incentivized the use of eco-friendly bitumen solutions, such as warm-mix asphalt and bio-bitumen. Also, the prevalence of extreme weather conditions, such as floods and heat waves, has heightened demand for durable bitumen formulations. A study by the University of Melbourne reveals that polymer-modified bitumen used in Australia’s highways can withstand temperature fluctuations of up to 50°C, ensuring longevity and performance.

The Indonesian market is propelled by its rapid urbanization and infrastructure development agenda. The country’s ambitious plans to construct 25,000 kilometers of new roads by 2025 have created a robust demand for bitumen. Besides, the adoption of bitumen emulsions for rural road construction has gained traction, with studies showing a reduction in material costs compared to traditional methods.

Top Players in the Asia Pacific Bitumen Market

Shell plc

Shell is a global leader in the bitumen market, with a significant presence in the Asia Pacific region. The company’s extensive portfolio includes high-performance bitumen solutions tailored for road construction, waterproofing, and industrial applications. Shell’s contributions to the global market are underscored by its focus on innovation, particularly in polymer-modified bitumen (PMB) and eco-friendly formulations. Through partnerships with governments and contractors, Shell has facilitated large-scale infrastructure projects across the region. Its commitment to sustainability is evident in initiatives promoting warm-mix asphalt and bio-bitumen, aligning with regional decarbonization goals. Shell’s robust supply chain and technical expertise further reinforce its leadership position.

TotalEnergies SE

TotalEnergies SE is a key player in the Asia Pacific bitumen market, offering a diverse range of products designed to meet the evolving needs of the construction industry. The company emphasizes research and development, introducing advanced solutions such as crumb rubber-modified bitumen and low-emission formulations. TotalEnergies’ global influence is bolstered by its collaborations with local stakeholders to promote sustainable infrastructure practices. By focusing on climate-resilient materials, the company addresses challenges posed by extreme weather conditions, ensuring durability and performance. TotalEnergies’ proactive approach to environmental responsibility and customer-centric innovations strengthens its competitive edge.

Nynas AB

Nynas AB is renowned for its specialty bitumen products, catering to niche applications in the Asia Pacific market. The company’s expertise lies in developing high-performance binders for road surfacing, waterproofing, and industrial coatings. Nynas’ contributions to the global market extend beyond product innovation; it actively engages in knowledge-sharing initiatives to educate stakeholders about modern bitumen technologies. Through strategic partnerships and localized manufacturing, Nynas continues to enhance its market presence while fostering innovation in sustainable solutions.

Top Strategies Used by Key Players in the Asia Pacific Bitumen Market

Focus on Sustainability and Eco-Friendly Solutions

Key players in the Asia Pacific market have increasingly prioritized sustainability by developing eco-friendly bitumen solutions. Innovations such as bio-bitumen, warm-mix asphalt, and recycled material integration align with regional regulatory mandates and consumer expectations. Companies actively collaborate with environmental organizations and government bodies to promote green infrastructure practices. For instance, partnerships with universities facilitate research into renewable raw materials, enhancing product viability.

Strategic Collaborations and Partnerships

Strategic collaborations with local governments, contractors, and research institutions are pivotal for strengthening market positions. These partnerships enable companies to gain insights into regional requirements, co-develop customized solutions, and streamline distribution networks. For example, alliances with agricultural sectors facilitate the use of waste materials like sugarcane residues in bio-bitumen production. Additionally, joint ventures with construction firms ensure timely project execution and consistent product availability.

Expansion of Production Facilities and Distribution Networks

To meet escalating demand, companies are expanding their production capacities and distribution networks across the Asia Pacific region. Establishing localized manufacturing units reduces logistical challenges and ensures compliance with regional standards. Furthermore, enhancing distribution channels, particularly in rural areas, enables companies to reach small-scale contractors who form a significant portion of the market. Investments in digital tools for supply chain management improve operational efficiency, reducing lead times and costs.

RECENT MARKET DEVELOPMENTS

- In March 2023, Shell plc launched a new line of bio-bitumen products in Australia, aimed at reducing carbon emissions during road construction. This initiative reinforced its commitment to sustainability and positioned it as a leader in eco-friendly solutions.

- In May 2023, TotalEnergies SE partnered with a leading university in India to develop crumb rubber-modified bitumen formulations. This collaboration enhanced its product portfolio and addressed regional demands for durable road surfacing materials.

- In July 2023, Nynas AB expanded its production facility in Malaysia to increase the output of specialty bitumen binders. This move was designed to meet the growing demand for high-performance waterproofing solutions in Southeast Asia.

- In September 2023, BP plc acquired a regional distributor in Indonesia to strengthen its distribution network and improve accessibility to rural infrastructure projects. This acquisition bolstered its market presence in Southeast Asia.

- In November 2023, ExxonMobil introduced a digital platform in Japan to provide real-time insights into bitumen application and performance. This innovation positioned the company as a pioneer in integrating technology with traditional construction practice.

MARKET SEGMENTATION

This research report on the Asia Pacific bitumen market is segmented and sub-segmented into the following categories.

By Product Type

- Paving Grade Bitumen

- Polymer-Modified Bitumen (PMB)

By Application Insights

- Road Construction

- Waterproofing

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of the Asia Pacific Bitumen Market?

The market is driven by rapid infrastructure development, increased road construction activities, urbanization, and government investments in transportation infrastructure. The rising demand for high-quality bitumen for use in road surfacing and industrial applications is also a key factor.

What are the challenges faced by the Asia Pacific Bitumen Market?

Key challenges include fluctuating raw material prices (crude oil), environmental concerns related to the use of bitumen, and competition from alternative materials. The need for innovations in sustainable bitumen production is also an ongoing challenge.

What is the future outlook for the Asia Pacific Bitumen Market?

The market is expected to continue growing due to ongoing infrastructure development, especially in emerging economies like India and China. The adoption of eco-friendly and sustainable alternatives, as well as innovations in high-performance bitumen, will shape the future growth of the market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]