Asia Pacific Blast Chillers Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, Application, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Blast Chillers Market Size

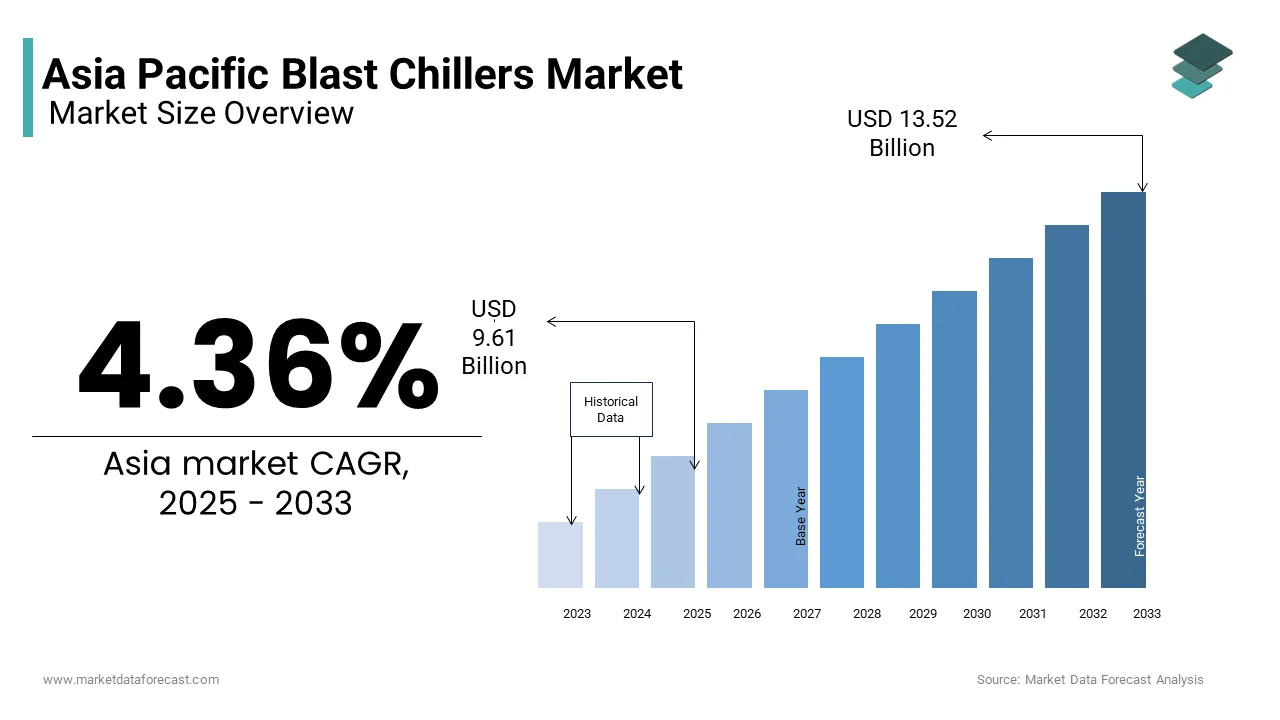

The Asia Pacific blast chillers market size was valued at USD 9.21 billion in 2024 and is anticipated to reach USD 9.61 billion in 2025 from USD 13.52 billion by 2033, growing at a CAGR of 4.36% during the forecast period from 2025 to 2033.

The Asia Pacific blast chillers market is a critical part of the broader food processing and cold chain industry, designed to rapidly cool food products while maintaining their quality and safety. Also, blast chillers are specialized refrigeration systems that bring down the temperature of cooked or perishable items swiftly to inhibit bacterial growth and preserve freshness. This technology is indispensable in commercial kitchens, catering services, pharmaceuticals, and food processing units across the region.

MARKET DRIVERS

Rising Demand for Processed Foods

The escalating consumption of processed and convenience foods is one of the primary drivers propelling the Asia Pacific blast chillers market. Urbanization and changing lifestyles have led to a significant increase in dual-income households, reducing the time available for meal preparation. This trend necessitates advanced food preservation technologies, such as blast chillers, to ensure product safety and shelf life. For instance, in countries like China and India, the demand for frozen and ready-to-eat meals has surged significantly. Blast chillers play a crucial role in this context by enabling manufacturers to meet stringent food safety standards while maintaining product quality. Furthermore, the growing presence of quick-service restaurants (QSRs) and cloud kitchens across the region amplifies the need for rapid cooling solutions. These establishments rely heavily on blast chillers to prepare large quantities of food efficiently while adhering to hygiene protocols.

Stringent Food Safety Regulations

Another significant driver of the blast chillers market in the Asia Pacific is the implementation of stringent food safety regulations by regional governments. Regulatory bodies such as the Ministry of Health in Australia and the Food Safety Commission of Japan have mandated specific temperature control measures during food production and storage to prevent contamination and ensure public health. Blast chillers address this challenge by rapidly reducing food temperatures to safe levels, thereby minimizing bacterial proliferation. For example, in South Korea, the Hazard Analysis and Critical Control Points (HACCP) system requires food businesses to adopt rapid cooling methods, creating a robust demand for blast chillers. Similarly, in India, the FSSAI has introduced guidelines emphasizing the importance of chilling cooked food within two hours of preparation. These regulatory frameworks not only enhance food safety but also encourage businesses to invest in advanced cooling technologies.

MARKET RESTRAINTS

High Initial Investment Costs

One of the primary restraints hindering the growth of the Asia Pacific blast chillers market is the high initial investment required for procurement and installation. Blast chillers are sophisticated equipment that incorporates advanced cooling technologies, making them significantly more expensive than conventional refrigeration systems. Also, small and medium-sized enterprises (SMEs) in the food processing sector often face financial constraints, limiting their ability to adopt such capital-intensive solutions. This financial barrier is particularly pronounced in developing economies like Vietnam and Indonesia, where access to credit remains limited. Apart from these, the operational costs associated with energy consumption further exacerbate the financial burden. While modern blast chillers are designed to be energy-efficient, their power requirements are still higher compared to traditional cooling systems. This factor deters many businesses, especially smaller players, from investing in blast chillers despite their long-term benefits.

Lack of Awareness and Technical Expertise

Another major restraint is the lack of awareness and technical expertise regarding the optimal use of blast chillers among end-users. Many businesses, particularly in rural and semi-urban areas, remain unfamiliar with the advantages of rapid cooling technologies and their role in enhancing food safety. According to the Food and Agriculture Organization, a substantial portion of food losses in developing countries occur due to inadequate post-harvest handling and storage practices, highlighting the need for better education on advanced cooling solutions. In countries like Bangladesh and Myanmar, where traditional methods of food preservation are still prevalent, the adoption of blast chillers is hindered by a lack of understanding about their functionality and benefits. Moreover, the absence of skilled personnel trained in operating and maintaining these systems further complicates the issue. This knowledge deficit not only limits the effective utilization of blast chillers but also increases the risk of operational inefficiencies.

MARKET OPPORTUNITIES

Expansion of Cloud Kitchens and Food Delivery Services

The rapid proliferation of cloud kitchens and online food delivery platforms presents a lucrative opportunity for the Asia Pacific blast chillers market. The food delivery industry has witnessed exponential growth, driven by the increasing penetration of smartphones and internet connectivity. Cloud kitchens, which operate exclusively for delivery purposes, require efficient cooling solutions to manage bulk food preparation while ensuring compliance with food safety standards. Blast chillers enable these establishments to prepare large quantities of food in advance, store them safely, and reheat them without compromising quality. For instance, in India, companies like Rebel Foods and Swiggy have scaled their operations significantly, relying on advanced kitchen equipment to streamline processes. Similarly, in Southeast Asia, GrabFood and Gojek have expanded their reach, creating a surge in demand for rapid cooling technologies. As the cloud kitchen model gains traction, the need for blast chillers is expected to rise, offering manufacturers an opportunity to tap into this burgeoning segment.

Government Initiatives for Cold Chain Infrastructure

Another promising opportunity lies in government-led initiatives aimed at strengthening cold chain infrastructure across the Asia Pacific region. Governments are increasingly recognizing the importance of robust cold storage facilities to reduce food wastage and enhance supply chain efficiency. These initiatives not only create a favorable environment for market growth but also foster collaboration between public and private stakeholders. By leveraging government support, blast chiller manufacturers can position themselves as key contributors to the region’s cold chain ecosystem, unlocking new avenues for expansion and innovation.

MARKET CHALLENGES

Energy Consumption Concerns

A significant challenge facing the Asia Pacific blast chillers market is the concern over energy consumption and its environmental impact. Blast chillers are known to consume substantial amounts of electricity due to their rapid cooling capabilities, which can strain power grids, especially in regions with limited energy resources. In countries like Indonesia and the Philippines, where energy costs are relatively high, businesses are often reluctant to adopt energy-intensive technologies. Moreover, the environmental implications of high energy usage cannot be overlooked. As per the United Nations Environment Programme, the carbon footprint of industrial cooling systems is a growing concern, prompting calls for more sustainable alternatives. While manufacturers are working to develop energy-efficient models, the current generation of blast chillers still poses a challenge in terms of balancing performance with environmental responsibility.

Logistical Barriers in Remote Areas

Another pressing challenge is the logistical difficulty of deploying blast chillers in remote and underdeveloped areas. The Asia Pacific region is characterized by diverse geographical landscapes, ranging from densely populated urban centers to vast rural expanses with limited infrastructure. This disparity creates significant barriers to the widespread adoption of blast chillers, particularly in agricultural communities that could benefit from their use. For example, in Papua New Guinea, where road connectivity is limited, transporting and installing heavy equipment like blast chillers becomes a daunting task. Even when blast chillers are successfully deployed, maintaining them in such environments poses additional challenges. As per the Asian Infrastructure Investment Bank, the cost of servicing and repairing equipment in remote locations can be up to three times higher than in urban areas, further deterring businesses from investing in these technologies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.36% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

Johnson Controls International (Cork, Ireland), Trane (Dublin, Ireland), Carrier (Florida, United States), Mitsubishi Electric Corporation (Tokyo, Japan), Daikin Airconditioning India Pvt. Ltd. (Osaka, Japan), Smardt Chiller Group (Quebec, Canada), Multistack LLC (Wisconsin, United States), Thermax Limited (Maharashtra, India), Thermal Care Inc. (Illinois, United States), Midea Group (Foshan, China). |

SEGMENTAL ANALYSIS

By Type Insights

The scroll compressors segment dominated the Asia Pacific blast chillers market by capturing 40.5% of the total market share in 2024. This dominance is attributed to their superior efficiency and reliability in handling medium-capacity cooling applications. Scroll compressors are widely preferred in industries such as food processing and pharmaceuticals due to their ability to maintain consistent cooling performance with minimal noise and vibration. According to the International Institute of Refrigeration, scroll compressors account for over 60% of all compressors used in commercial refrigeration systems globally, underscoring their popularity. A key driving factor behind their prominence is their energy efficiency. For instance, scroll compressors consume less energy compared to reciprocating compressors. This energy-saving advantage makes them particularly appealing in energy-conscious markets like Japan and South Korea, where businesses prioritize sustainability. In addition, scroll compressors require less maintenance due to their fewer moving parts, reducing operational costs over time. The growing demand for energy-efficient solutions in the food and beverage sector has also contributed to the widespread adoption of scroll compressors.

Another contributing element is the increasing urbanization and industrialization across the Asia Pacific region, which has spurred the need for advanced cooling technologies. According to the United Nations, urban populations in the region are expected to grow notably by 2050, creating a surge in demand for processed foods and pharmaceuticals. Scroll compressors, with their ability to handle diverse cooling requirements, are ideally positioned to meet this rising demand.

The centrifugal compressors segment is emerging as the rapidly advancing segment in the Asia Pacific blast chillers market, with a projected CAGR of 8.5% during the forecast period. This rapid surge is driven by their ability to cater to large-scale industrial applications, particularly in sectors like chemicals and petrochemicals. These compressors are highly efficient in managing high-capacity cooling needs, making them indispensable for large-scale operations such as oil refineries and chemical plants. For instance, in China, the world’s largest chemical producer, the adoption of centrifugal compressors has surged over the past five years. Another significant factor propelling the growth of centrifugal compressors is their compatibility with renewable energy sources. As per the International Renewable Energy Agency, the Asia Pacific region is investing heavily in solar and wind energy, with renewable energy capacity expected to double by 2030. Centrifugal compressors, which can be integrated with renewable energy systems, offer a sustainable solution for industries aiming to reduce their carbon footprint. This trend is particularly evident in countries like Australia and India, where government policies are encouraging the adoption of green technologies. Apart from these, advancements in compressor design have improved their efficiency and reduced operational costs.

By Application Market

The food and beverage industry represented the largest application segment in the Asia Pacific blast chillers market by accounting for 35.6% of the total market share in 2024. This influence is propelled by the exponential growth of the processed food sector, which relies heavily on advanced cooling technologies to ensure product safety and quality. The rise of convenience foods, frozen meals, and ready-to-eat products has created a strong demand for blast chillers, which enable rapid cooling to prevent microbial contamination. For example, in Japan, where the consumption of frozen foods has increased over the past decade, blast chillers are integral to maintaining product integrity and extending shelf life. Further main factor contributing to the segment’s leadership is the stringent regulatory environment governing food safety. As per the World Health Organization, foodborne illnesses affect an estimated 125 million people annually in the Asia Pacific region, noting the critical need for effective cooling solutions. Blast chillers play a pivotal role in meeting these regulatory standards by ensuring that cooked food is cooled to safe temperatures within two hours, as mandated by bodies like the Food Safety and Standards Authority of India (FSSAI). Furthermore, the expansion of organized retail and e-commerce platforms has amplified the demand for blast chillers. The food and beverage industry’s reliance on blast chillers to support these trends underscores its position as the largest application segment.

The medical sector is a quickly expanding application segment in the Asia Pacific blast chillers market, with a CAGR of 9.2%. This development is caused by the increasing demand for temperature-sensitive storage solutions in healthcare facilities, particularly for vaccines, blood plasma, and biologics. The Asia Pacific region accounts for a significant share due to its large population and expanding healthcare infrastructure. For instance, in India, the government’s Universal Immunization Program requires advanced cooling systems to store and transport vaccines, driving the adoption of blast chilling . Additionally contributing element is the rising prevalence of chronic diseases has increased the demand for diagnostic and therapeutic products that require precise temperature control. According to the Global Burden of Disease Study, non-communicable diseases account for a large share of all deaths in the Asia Pacific region, necessitating robust cold chain solutions. Blast chillers are essential in maintaining the efficacy of medical products, particularly in countries like China and South Korea, where healthcare spending is growing at an annual rate. Apart from these, the ongoing advancements in biotechnology and pharmaceutical research have created new opportunities for blast chillers. For example, in Singapore, the Biopolis research hub is leveraging advanced cooling technologies to support innovations in regenerative medicine.

COUNTRY ANALYSIS

Top Leading Countries in the Market

China stood as the largest contributor to the Asia Pacific blast chillers market by commanding a 25.7% market share in 2024. The country’s control is underpinned by its status as a global manufacturing hub, particularly in the food processing, pharmaceutical, and electronics industries. According to the National Bureau of Statistics of China, the country’s food processing industry grew notably in 2022, creating a robust demand for advanced cooling technologies. Blast chillers are extensively used in this sector to preserve the quality of perishable goods, especially in light of China’s strict food safety regulations. For instance, the Hazard Analysis and Critical Control Points (HACCP) system mandates the use of rapid cooling methods, driving the adoption of blast chillers. Besides, China’s Belt and Road Initiative has facilitated the expansion of cold chain infrastructure, further boosting market growth.

A different and significant aspect is the country’s focus on sustainability and energy efficiency. Like, China is the largest investor in renewable energy, with h substantial amount allocated to clean technologies in 2022. This emphasis on sustainability has encouraged businesses to adopt energy-efficient blast chillers, which consume up to 30% less energy than traditional cooling systems.

India is witnessing positive growth in the market. The country’s position is bolstered by its rapidly expanding food processing and pharmaceutical industries, which are among the largest in the world. Blast chillers play a crucial role in this growth by enabling efficient cooling and preserving product quality. For example, in states like Maharashtra and Gujarat, the adoption of blast chillers has surged due to their ability to meet FSSAI guidelines for food safety. Another key factor is the government’s push for modernizing cold chain infrastructure. Also, the rise of e-commerce platforms like BigBasket and Grofers has amplified the need for advanced cooling solutions, further driving market growth. India’s strategic focus on enhancing food safety and supply chain efficiency positions it as a key player in the regional market.

Japan holds a significant market share in the Asia Pacific blast chillers market. It is driven by its advanced healthcare and pharmaceutical sectors. Blast chillers are widely used in hospitals and research facilities to store temperature-sensitive products such as vaccines and biologics. For instance, the introduction of mRNA-based vaccines during the pandemic highlighted the critical need for precise cooling solutions, accelerating the adoption of blast chillers. A main factor is Japan’s commitment to sustainability. Blast chillers, with their ability to minimize energy consumption, align with this goal. The convergence of healthcare advancements and environmental initiatives ensures Japan’s steady growth in the regional market.

South Korea accounts for r considerable portion of the Asia Pacific blast chillers market and is supported by its robust electronics and food processing industries. Blast chillers are essential in this context, enabling manufacturers to meet international food safety standards while maintaining product quality. A further key point is the government’s investment in smart factories and automation. South Korea’s focus on innovation and export-oriented growth positions it as a significant contributor to the regional market.

Australia and New Zealand together make an important player, which is driven by their thriving agricultural and dairy industries. Blast chillers are widely used in dairy farms and processing units to ensure compliance with food safety regulations. One more factor is the region’s emphasis on sustainability. Australia and New Zealand’s commitment to environmental responsibility and agricultural excellence ensures their steady presence in the regional market.

KEY MARKET PLAYERS

Johnson Controls International (Cork, Ireland), Trane (Dublin, Ireland), Carrier (Florida, United States), Mitsubishi Electric Corporation (Tokyo, Japan), Daikin Airconditioning India Pvt. Ltd. (Osaka, Japan), Smardt Chiller Group (Quebec, Canada), Multistack LLC (Wisconsin, United States), Thermax Limited (Maharashtra, India), Thermal Care Inc. (Illinois, United States), Midea Group (Foshan, China). Are the market players that are dominating the Asia Pacific blast chillers market?t.

Top Players in the Market

Carrier Global Corporation

Carrier Global Corporation is a leading player in the Asia Pacific blast chillers market, renowned for its innovative refrigeration solutions. The company has established itself as a global leader by focusing on energy-efficient and sustainable cooling technologies. Its advanced blast chiller systems cater to diverse industries, including food processing, pharmaceuticals, and healthcare. Carrier’s commitment to research and development has enabled it to introduce cutting-edge products that meet stringent regulatory standards.

Daikin Industries Ltd.

Daikin Industries Ltd. is another prominent player in the Asia Pacific blast chillers market, known for its high-performance cooling systems. The company leverages its expertise in air conditioning and refrigeration to deliver reliable and efficient blast chillers. Daikin’s focus on sustainability and technological innovation has positioned it as a preferred choice for businesses seeking eco-friendly solutions.

Panasonic Corporation

Panasonic Corporation has emerged as a key contributor to the Asia Pacific blast chillers market, offering advanced cooling technologies tailored to industrial applications. The company’s emphasis on integrating smart features into its blast chillers has set it apart from competitors. Panasonic’s ability to adapt to evolving market needs, coupled with its reputation for durability and performance, has solidified its position as a global market leader.

Top Strategies Used By Key Market Participants

Product Innovation and Customization

Key players in the Asia Pacific blast chillers market have prioritized product innovation and customization to meet the unique demands of various industries. Companies are investing heavily in R&D to develop advanced features such as IoT-enabled monitoring, energy-efficient designs, and modular configurations. These innovations allow businesses to optimize their operations while adhering to stringent regulatory standards.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations have become a cornerstone for strengthening market presence. Leading companies are teaming up with local distributors, technology providers, and government bodies to expand their reach and improve service delivery. These alliances enable players to leverage complementary strengths, access new markets, and address logistical challenges.

Sustainability Initiatives

Sustainability has emerged as a key differentiator in the blast chillers market. Companies are adopting eco-friendly practices, such as using renewable energy sources and designing energy-efficient systems, to align with global environmental goals. By promoting green technologies, manufacturers not only reduce their carbon footprint but also appeal to environmentally conscious consumers.

COMPETITION OVERVIEW

The Asia Pacific blast chillers market is characterized by intense competition, driven by the presence of established multinational corporations and emerging regional players. Companies are vying for market leadership by leveraging their technological expertise, extensive distribution networks, and customer-centric strategies. The competitive landscape is shaped by rapid advancements in cooling technologies, increasing demand for energy-efficient solutions, and stringent regulatory frameworks. To maintain their edge, key players are continuously innovating and expanding their product portfolios to cater to diverse applications across industries like food processing, pharmaceuticals, and healthcare. Additionally, the growing emphasis on sustainability and digital transformation has prompted companies to adopt smart features and eco-friendly designs.

RECENT HAPPENINGS IN THE MARKET

- In January 2023, Carrier Global Corporation launched a new line of IoT-enabled blast chillers in the Asia Pacific market. This move aimed to enhance operational efficiency and provide real-time monitoring capabilities to customers, reinforcing Carrier’s leadership in smart cooling solutions.

- In June 2023, Daikin Industries Ltd. announced a partnership with a leading cold chain logistics provider in India. This collaboration focused on developing integrated cooling systems tailored to the country’s growing food processing sector, strengthening Daikin’s regional presence.

- In September 2023, Panasonic Corporation expanded its manufacturing facility in Thailand to meet the rising demand for blast chillers in Southeast Asia. This expansion underscored Panasonic’s commitment to supporting regional industrial growth and improving supply chain resilience.

- In November 2023, Midea Group acquired a mid-sized refrigeration equipment manufacturer in Australia. This acquisition enabled Midea to diversify its product offerings and enhance its distribution network across the Oceania region.

- In February 2024, LG Electronics introduced a modular blast chiller system designed for small and medium enterprises in Vietnam. This initiative addressed the growing need for cost-effective and scalable cooling solutions, bolstering LG’s market share in emerging economies.

MARKET SEGMENTATION

This research report on the Asia Pacific blast chillers market is segmented and sub-segmented into the following categories.

By Type

- Screw

- Scroll

- Centrifugal

- Others (Reciprocating, etc.)

By Application

- Chemicals & Petrochemicals

- Food & Beverage

- Medical

- Plastic

- Rubber

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

Why is demand for blast chillers increasing in APAC's foodservice and hospitality sectors?

Rising food safety regulations, rapid urbanization, and the growth of QSRs (Quick Service Restaurants) are driving the adoption to preserve freshness and comply with HACCP standards.

How do APAC energy efficiency standards impact blast chiller design and sales?

Markets like Japan, South Korea, and Australia require compliance with localized energy labeling systems, pushing manufacturers to innovate with inverter compressors and eco-friendly refrigerants.

What role do blast chillers play in cold chain expansion in emerging Asian economies?

They ensure safe temperature transitions for perishable goods, crucial for expanding retail, pharmaceutical, and cloud kitchen infrastructures in countries like India, Vietnam, and Indonesia.

Are small-format or modular blast chillers gaining traction in APAC?

Yes, due to the rise of space-constrained commercial kitchens and bakery chains, demand for under-counter and customizable units has grown significantly across urban centers.

How is smart technology transforming blast chiller usage in the Asia-Pacific region?

IoT-enabled chillers with touch controls and remote monitoring are gaining favor, especially in premium segments and smart commercial kitchens aiming for better automation and food traceability.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com