Asia Pacific Blood Glucose Monitoring Market Research Report – Segmented By Product (Self-Monitoring Continuous, Glucose Monitoring Devices), Testing Site, Patient Care Setting, Application, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Blood Glucose Monitoring Market Size

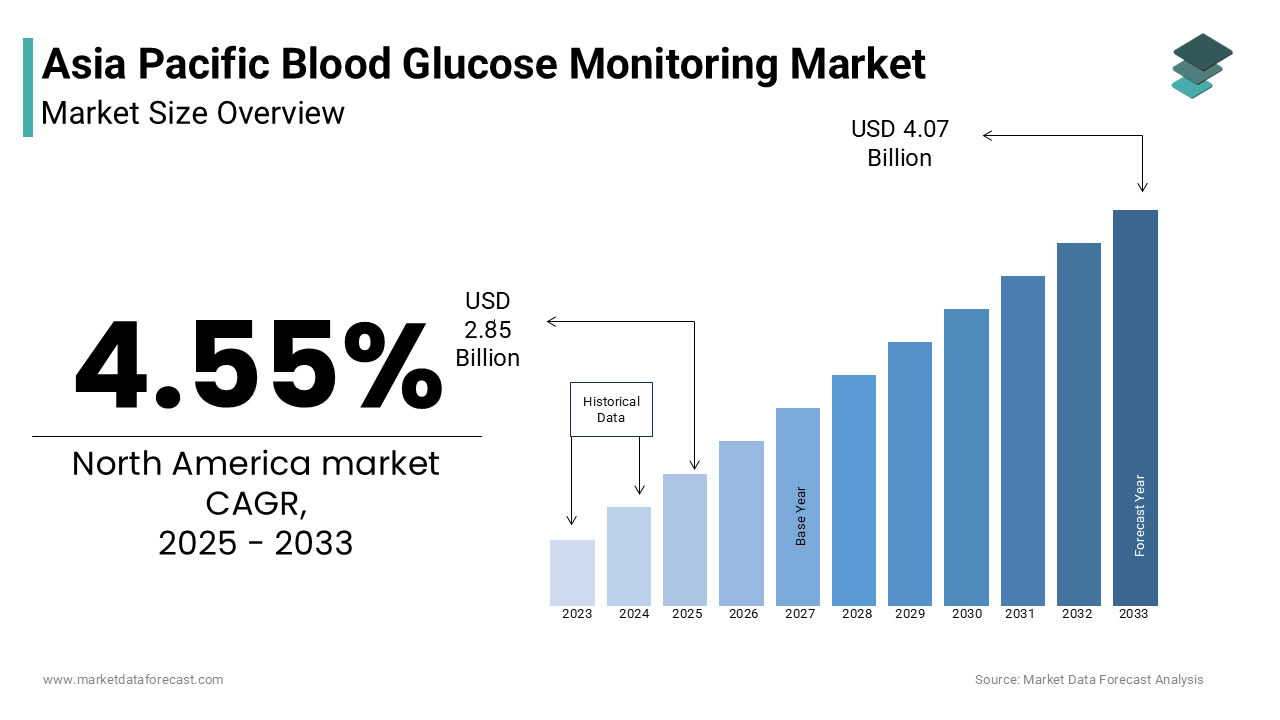

The Asia Pacific blood glucose monitoring market was worth USD 2.73 billion in 2024. The Asia Pacific market is expected to reach USD 4.07 billion by 2033 from USD 2.85 billion in 2025, rising at a CAGR of 4.55% from 2025 to 2033.

The Asia Pacific blood glucose monitoring market is driven by a wide range of diagnostic and therapeutic tools designed for measuring blood sugar levels in diabetic patients. The demand for reliable and efficient glucose monitoring systems has surged significantly with diabetes emerging as a major public health concern across the region. Blood glucose monitoring devices include traditional self-monitoring blood glucose (SMBG) systems such as test strips and glucometers alongside newer continuous glucose monitoring (CGM) technologies that provide real-time data. The increasing adoption of digital health platforms and wearable medical devices is further shaping the landscape of this sector. Over 60.71% of the global adult diabetes population resides in Asia with countries like China, India and Indonesia witnessing rapid increases in prevalence. Non-communicable diseases accounted for nearly 60.93% of total deaths in Southeast Asia in recent years thereby reinforcing the need for effective home-based and clinical monitoring solutions.

MARKET DRIVERS

Rising Prevalence of Diabetes Across Urban and Rural Populations

Escalating prevalence of diabetes mellitus across both urbanized and rural areas is one of the most influential drivers of the Asia Pacific blood glucose monitoring market. Countries like India, China and Thailand are experiencing a dual burden of type 1 and type 2 diabetes which is fueled by lifestyle changes, sedentary habits, poor dietary choices and genetic predispositions. More than 300 million adults in the Asia Pacific region were living with diabetes in 2023 thereby marking it as one of the most affected regions globally. In China alone, over 140 million individuals suffer from diabetes who require regular glucose monitoring to manage their condition effectively. Additionally, in India,diabetes cases have tripled in rural populations over the past two decades thus necessitating affordable and accessible monitoring options. This surge in diabetic patients has directly amplified the demand for easy-to-use, accurate and cost-efficient blood glucose monitoring systems particularly among aging populations and those managing chronic conditions at home.

Expansion of Healthcare Infrastructure and Government Initiatives

Expansion of healthcare infrastructure and supportive government policies are another critical driver fueling the growth of the Asia Pacific blood glucose monitoring market that is steadily aimed at managing chronic diseases. Governments in several Asia Pacific nations have implemented national-level diabetes control programs to curb rising incidence rates and promote early diagnosis. In Japan, the Ministry of Health, Labour and Welfare has integrated diabetes screening into annual health check-ups for working-age citizens thereby encouraging regular blood glucose tracking. Similarly, in Australia, the Department of Health has funded multiple telemedicine projects enabling remote patient monitoring including glucose readings transmitted via mobile apps. Moreover, increased investments in primary healthcare centers in rural parts of India and Indonesia which have improved access to diagnostic services including point-of-care glucose testing. Health expenditure in middle-income countries in the region has risen by an average of 8.9% annually over the past five years thereby reflecting stronger institutional backing for chronic disease management.

MARKET RESTRAINTS

High Cost of Advanced Glucose Monitoring Devices

High cost associated with advanced monitoring technologies is a significant restraint impeding the widespread adoption of blood glucose monitoring systems in the Asia Pacific region. While these systems offer real-time data and improved glycemic control yet their prohibitive pricing limits accessibility especially in low and middle-income countries. In markets such as Indonesia, Vietnam and the Philippines where out-of-pocket healthcare expenses remain substantial and affordability becomes a key barrier to adoption. Even in more developed economies like South Korea and Australia, reimbursement policies for CGM devices are inconsistent or limited to specific patient groups such as those with type 1 diabetes. In China, only a fraction of urban residents can afford long-term use due to high sensor replacement costs despite the availability of CGM technology. The financial burden associated with modern devices hinders consistent usage and slows down market growth across the Asia Pacific region.

Lack of Awareness and Low Health Literacy in Rural Areas

Another major constraint affecting the Asia Pacific blood glucose monitoring market is the inadequate awareness and low health literacy levels regarding diabetes management in rural and underserved communities. Many individuals remain unaware of the importance of regular glucose monitoring in preventing diabetes-related complications despite government efforts to enhance public knowledge. In rural China, over 60.53% of diabetic patients did not monitor their blood sugar levels regularly due to a lack of understanding about its significance. Furthermore, misinformation and reliance on traditional remedies often delay the adoption of scientifically validated monitoring practices. In some Southeast Asian countries, cultural perceptions surrounding illness and treatment also contribute to underutilization of glucose monitoring tools. As a result, low awareness acts as a deterrent to market penetration even when affordable products are available.

MARKET OPPORTUNITIES

Integration of Digital Health Platforms and Mobile Applications

Integration of digital health platforms and smartphone-based applications that facilitate seamless data tracking and remote monitoring is one of the compelling opportunities driving innovation within the Asia Pacific blood glucose monitoring market. Manufacturers are increasingly developing connected glucometers and app-enabled CGM systems that allow patients and healthcare providers to monitor trends in real time with the proliferation of smartphones and internet connectivity across both urban and semi-urban areas. In Singapore and South Korea, digital health ecosystems have matured rapidly which supports the adoption of smart glucose monitors that sync with electronic health records and cloud-based analytics. Companies like Abbott and Roche have introduced mobile-linked glucose monitoring systems that enable users to log readings, set reminders and share data with physicians remotely. In India, startups and multinational firms alike are leveraging artificial intelligence to develop predictive analytics for diabetes management. Government-backed e-health initiatives are accelerating the adoption of mHealth and wearable technologies. These advancements are unlocking new commercial avenues for device manufacturers seeking to expand their footprint in the Asia Pacific market through tech-enabled solutions tailored to evolving consumer needs.

Growth of Telemedicine and Remote Patient Monitoring Services

The expansion of telemedicine and remote patient monitoring services presents a transformative opportunity for the Asia Pacific blood glucose monitoring market especially in light of recent shifts toward decentralized healthcare delivery. Governments and private healthcare providers across the region have been investing heavily in virtual care models and are driven by the necessity to manage chronic conditions without requiring in-person visits. In Japan, the Ministry of Health, Labour and Welfare has actively promoted telehealth consultations which include remote diabetes management through integrated glucose monitoring systems. In Australia, partnerships between digital health companies and pharmaceutical firms have led to the development of end-to-end diabetes management platforms incorporating real-time glucose tracking, personalized alerts and physician coordination. Meanwhile, in India, platforms such as Apollo Sugar Clinics and Practo have incorporated remote monitoring features that connect patients with specialists via video consultations and data-driven insights. The convergence of telemedicine with blood glucose monitoring is poised to redefine patient engagement and drive sustained adoption of next-generation monitoring technologies as healthcare systems continue to embrace digital transformation.

MARKET CHALLENGES

Regulatory Hurdles and Standardization Issues Across Countries

Disparity in regulatory frameworks and product approval processes across different countries is one of the foremost challenges confronting the Asia Pacific blood glucose monitoring market. Asian markets exhibit a fragmented landscape where each country has distinct guidelines for medical device registration, quality assessment and post-market surveillance unlike the more standardized regulatory environments in Europe and North America. For example, China’s National Medical Products Administration (NMPA), Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) and India’s Central Drugs Standard Control Organization (CDSCO) impose varying timelines and documentation requirements for market entry. Navigating these complexities can delay product launches by up to 18 months in certain jurisdictions thereby adding operational costs and limiting timely access to innovative devices. Additionally, differences in calibration standards for glucose meters create inconsistency in accuracy and measurement reliability which impacts user trust and clinician recommendations. In smaller ASEAN nations, the absence of centralized regulatory bodies further complicates compliance which is forcing manufacturers to adopt localized strategies that may not be scalable. These hurdles make it difficult for international players to maintain uniform product performance and commercial viability across the diverse Asia Pacific geography.

Shortage of Skilled Healthcare Professionals and Technical Support

Shortage of skilled healthcare professionals and technical support remains a persistent challenge affecting the Asia Pacific blood glucose monitoring market particularly in guiding patients on the correct usage of advanced monitoring devices. Effective utilization of continuous glucose monitors and smart glucometers requires technical know-how, interpretation skills and ongoing support. The Asia Pacific region faces a significant deficit in trained diabetes educators, nurses and primary care physicians equipped to handle modern diabetes technologies. In countries such as Nepal and Papua New Guinea, there is less than one endocrinologist per million people which severely limits the capacity to support sophisticated monitoring approaches. Even in larger economies like India and Indonesia, the lack of structured training programs for healthcare providers impedes optimal patient outcomes where device availability may be relatively better. Moreover, after-sales service and technical assistance for digital glucose monitoring systems are inconsistently provided thus leading to user frustration and discontinuation of use. This workforce limitation poses a fundamental barrier to the successful deployment and long-term sustainability of innovative blood glucose monitoring solutions in the Asia Pacific region.

SEGMENTAL ANALYSIS

By Product Insights

The Self-Monitoring Blood Glucose (SMBG) segment dominated the Asia Pacific blood glucose monitoring market with significant share in 2024. SMBG devices such as glucometers and test strips remain the most accessible form of glucose monitoring due to their lower cost and ease of use compared to continuous glucose monitoring systems. Nearly 80.75% of diabetic patients in low and middle-income countries rely on traditional finger-prick methods for daily glucose tracking. In China, affordable glucometer kits are widely distributed through government health programs where out-of-pocket healthcare expenditure remains high. Additionally, in Japan, SMBG continues to be a preferred option among elderly patients who are less accustomed to digital technologies despite advanced healthcare infrastructure. The affordability and availability of generic test strips have also contributed significantly to the sustained demand for SMBG products across the region.

The Continuous Glucose Monitoring (CGM) segment is projected to witness a fastest CAGR of 15.27% from 2025 - 2033. The rapid growth of this segment is driven by increasing awareness around real-time glucose tracking and its benefits in managing diabetes more effectively. CGM technology provides users with dynamic data trends thereby enabling proactive adjustments in insulin dosing and dietary habits. In Australia, reimbursement policies have expanded to cover CGM devices for type 1 diabetes patients where public health initiatives support innovative diabetes care thereby boosting adoption rates. Similarly, in South Korea, the Ministry of Food and Drug Safety has streamlined approval processes for new-generation sensors thus encouraging faster product launches. CGM usage improved HbA1c levels by up to 1.2% in patients with poorly controlled diabetes thereby reinforcing its clinical value. Furthermore, major players such as Abbott and Dexcom have introduced cost-effective sensor models tailored for price-sensitive markets like India and the Philippines which makes it increasingly viable for long-term patient management.

By Testing Site Insights

The Fingertip testing site segment was the largest segment in the Asia Pacific blood glucose monitoring market by capturing 65.06% of the regional market in 2024. This method continues to be the preferred choice for both homecare and hospital-based diabetic patients due to its simplicity, familiarity and minimal technical requirements. Fingertip testing offers faster results and higher accuracy, especially during hypoglycemic episodes when timely intervention is crucial unlike alternative testing sites such as forearm or palm. In India, over 90 million people rely on finger-prick tests for regular monitoring where a majority of diabetic individuals manage their condition at home. In Vietnam and the Philippines, fingertip glucometers are the standard prescribed by primary care physicians where access to advanced medical training and digital literacy is limited. Fingertip testing remains the gold standard endorsed by global diabetes management guidelines for self-monitoring purposes. In Thailand, pilot studies conducted by the Ministry of Public Health confirmed that fingertip readings correlated more closely with venous blood measurements than alternate site tests.

The Alternate Site Testing segment is predicted to witness a highest CAGR of 12.51% from 2025 to 2033. This growth is largely driven by increasing user preference for less painful and more convenient testing options. As awareness about diabetes management evolves among younger and tech-savvy populations so there is a rising inclination toward using sites such as the forearm, upper arm and thigh for glucose sampling. In Japan, alternate site testing has gained traction due to reduced discomfort associated with frequent finger pricks where aging demographics are significant. Companies like Roche Diagnostics and Ascensia have introduced glucometers specifically calibrated for alternate site readings thus enhancing reliability and usability. A clinical trial conducted by Osaka University Hospital found that modern alternate site meters provided readings within 10.74% deviation of fingertip results in stable glycemic conditions thus improving confidence in their accuracy. In Australia, an increasing shift toward alternate site testing among type 2 diabetes patients who require routine but non-critical assessments.

By Patient Care Setting Insights

The Homecare setting held the leading share of 60.27% of the Asia Pacific blood glucose monitoring market share in 2024. The dominance of this segment is primarily fueled by the increasing number of diabetic patients opting for self-management solutions rather than frequent hospital visits. Rising disposable incomes and greater access to affordable glucometers leads to a significant portion of the population preferring glucose checks at home. In India, over 75 million people with diabetes perform daily self-monitoring in domestic settings which are often encouraged by family caregivers. Moreover, governments across the region have been promoting home-based chronic disease management to reduce the burden on public hospitals. In Malaysia, the Ministry of Health launched a telemedicine initiative that enables home users to connect monitored data directly with primary care providers. Additionally, advancements in portable and Bluetooth-enabled devices have further enhanced convenience in remote areas of Indonesia and the Philippines where hospital accessibility is limited. Healthcare decentralization efforts in the Asia Pacific region have increased home-based interventions by over 20.48% in the past five years thereby reinforcing the expansion of the homecare segment.

The Hospital-based patient care segment is likely to experience the fastest CAGR of 14.82% between 2025 to 2033. This growth is being propelled by the increasing integration of advanced glucose monitoring systems into critical care units particularly for managing hospitalized diabetic patients and those with acute complications. Hospitals in developed nations like Singapore and South Korea are adopting automated glucose monitoring platforms that interface with electronic medical records thereby ensuring precise and real-time data capture. In China,over 40.7% of hospitalized patients with severe hyperglycemia receive continuous glucose monitoring during their stay which leads to better clinical outcomes. Additionally, the surge in post-COVID metabolic complications has heightened the need for intensive glucose control in hospital settings. In Australia, where diabetes-induced hospitalizations have risen by nearly 29.77% in the last decade. These developments emphasize the expanding role of hospitals in deploying advanced blood glucose monitoring technologies to improve inpatient care and treatment efficiency.

By Application Insights

The Type 2 Diabetes application segment was the largest of the Asia Pacific blood glucose monitoring market share in 2024 with the escalating prevalence of lifestyle-associated diabetes across both urban and semi-urban populations. Countries like China, India and Thailand are witnessing a rapid increase in obesity rates, sedentary behavior and poor diet which are key risk factors for type 2 diabetes. Over 90.2% of all diagnosed diabetes cases in the Asia Pacific region are classified as type 2 thereby necessitating long-term glucose monitoring for effective disease management. In China alone, over 130 million adults suffer from type 2 diabetes, many of whom require regular self-monitoring to prevent complications. Additionally, in India,early detection and consistent glucose tracking can delay disease progression by up to five years. The demand for reliable blood glucose monitoring tools tailored for type 2 diabetes continues to expand significantly as healthcare authorities intensify screening campaigns and encourage home-based monitoring.

The Gestational Diabetes segment is anticipated to witness the fastest CAGR of 18.72% from 2025 to 2033. The rapid expansion of this segment is primarily driven by increasing maternal health awareness and the rising incidence of pregnancy-related metabolic disorders. In several Asian countries, including South Korea, Thailand and Malaysia prenatal care programs now include mandatory glucose tolerance testing for expectant mothers. Gestational diabetes affects nearly one in six pregnancies globally with Asia Pacific reporting some of the highest regional rates due to genetic predisposition and changing maternal lifestyles. In Japan, the Japanese Society of Obstetrics and Gynecology has revised clinical guidelines to recommend structured glucose monitoring for all high-risk pregnancies thereby boosting device uptake. These developments are fostering stronger adoption of blood glucose monitoring solutions tailored for maternal health applications.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific blood glucose monitoring market in 2024 and accounted for 30.71% of total market share in 2024. The country's dominant position is underpinned by a massive diabetic population, rapidly improving healthcare infrastructure and increasing government emphasis on chronic disease prevention. The Chinese government has implemented aggressive screening programs such as the China PEACE Million Persons Project which is aimed at early diagnosis and monitoring. Moreover, the rise of local manufacturers producing cost-effective glucometers and test strips has made self-monitoring more accessible. In addition, multinational companies like Roche and Abbott have intensified their presence through strategic partnerships and digital health integrations thus accelerating the adoption of smart glucose monitoring systems.

India was positioned second in holding the dominant share of the Asia Pacific blood glucose monitoring market in 2024. The country is experiencing a diabetes epidemic with over 100 million diagnosed cases. High prevalence rates coupled with increasing consumer awareness and affordability which drive sustained demand for monitoring devices. The Indian government has launched nationwide initiatives such as the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases and Stroke (NPCDCS) in which it provides free glucose screening in rural centers. Additionally, mobile health startups like Apollo Sugar and BeatO are introducing connected glucometers that sync with AI-powered coaching apps, enhancing patient engagement.

Japan’s blood glucose monitoring market is likely to have significant growth opportunities during the forecast period.The country’s mature healthcare ecosystem and high per capita income facilitate widespread adoption of advanced glucose monitoring technologies. Additionally, Japan has been at the forefront of integrating digital health tools. Major players like Arkray and Terumo continue to innovate in the field of connected glucometers and biosensor-based devices. According to the Japan Diabetes Society, over 4 million people use continuous glucose monitors and are supported by favorable reimbursement policies. The combination of regulatory maturity, technological advancement and strong policy backing ensures Japan’s robust presence in the regional market.

Australia’s blood glucose monitoring market growth is likely to have fastest growth opportunities in the next coming years and is driven by a highly regulated healthcare system and strong emphasis on diabetes education. The country has one of the highest rates of diabetes in the developed world with over 1.3 million registered cases as per the Australian Institute of Health and Welfare. The government supports comprehensive diabetes management through initiatives like the National Diabetes Services Scheme (NDSS) which subsidizes test strips and monitoring equipment for eligible patients. Telehealth services which are accelerated by the pandemic have further enabled remote glucose tracking and physician consultation.

South Korea’s blood glucose monitoring market growth is driven by rapid technological innovation and a strong digital healthcare framework. The Korean Diabetes Association reports that over 5 million adults in the country suffer from diabetes thereby prompting aggressive investment in digital health solutions. The Korean Ministry of Health and Welfare has incorporated glucose monitoring into its national chronic disease management strategy which encourages regular testing and digital record keeping. The integration of AI-driven glucose analytics into patient management systems is transforming diabetes care delivery. Additionally, the government’s push for medical device localization has fostered a conducive environment for domestic companies to thrive.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Abbott Diabetes Care, Roche, Medtronic, Dexcom, Johnson & Johnson (LifeScan), Arkray, Ascensia Diabetes Care, Bionime Corporation, Acon Laboratories, and Medisana. Are some of the key market players.

The competition in the Asia Pacific blood glucose monitoring market is intense and multidimensional which is shaped by the presence of both global giants and rapidly growing regional players. Established multinational corporations leverage their brand strength, advanced technologies and well-established distribution networks to maintain dominance particularly in urban centers and developed healthcare ecosystems. At the same time, local manufacturers are making significant strides by offering cost-effective alternatives that cater to price-sensitive populations in rural and semi-urban areas. Innovation remains a key battleground with companies racing to introduce more accurate, less invasive and digitally integrated monitoring solutions. The increasing demand for real-time data tracking and telemedicine compatibility is pushing firms to invest heavily in smart device development and software integration. Additionally, market participants are focusing on enhancing after-sales support, customer education and strategic collaborations to gain a competitive edge in this evolving landscape.

Top Players in the Market

Abbott Laboratories

Abbott plays a transformative role in the Asia Pacific blood glucose monitoring market with its groundbreaking FreeStyle series of glucose monitoring systems. The company’s introduction of flash glucose monitoring technology has revolutionized patient care by reducing the need for finger-prick tests. Abbott’s commitment to innovation and user-friendly design has positioned it as a global leader particularly in countries like Japan, Australia and India where diabetes prevalence is high. Abbott has been instrumental in expanding access to real-time glucose tracking across both developed and emerging markets.

Roche Diagnostics (a division of F. Hoffmann-La Roche Ltd)

Roche is a long-standing leader in the blood glucose monitoring space and is known for its Accu-Chek brand which remains widely trusted across the Asia Pacific region. The company's extensive product portfolio includes glucometers, test strips and continuous monitoring solutions tailored to varying patient needs. Roche has consistently invested in research and development to enhance accuracy, ease of use and data connectivity. In key markets such as China, South Korea and Singapore, Roche’s strong distribution networks and partnerships with healthcare providers have reinforced its competitive edge and reputation for reliability.

Bayer AG (Healthcare Division)

Bayer has established itself as a major contributor to the Asia Pacific blood glucose monitoring market through its Contour line of products. The company focuses on delivering precise and easy-to-use devices that cater to both home and clinical settings. Bayer has demonstrated a strong commitment to improving diabetes management in developing economies within the region by offering cost-effective solutions without compromising quality. Its emphasis on patient education and digital health integration has helped expand awareness and adoption of self-monitoring practices in rural and underserved areas across Southeast Asia.

Top Strategies Used by Key Market Participants

Product innovation and technological differentiation is the major strategy employed by leading players in the Asia Pacific blood glucose monitoring market. Companies are continuously launching next-generation devices that offer higher accuracy, reduced pain and enhanced connectivity features. These innovations help them cater to evolving consumer expectations and maintain a competitive advantage in diverse regional markets.

Another key approach is strategic partnerships and local collaborations. Companies frequently collaborate with local distributors, government agencies and healthcare institutions to navigate regulatory complexities and improve market penetration. These alliances aid in adapting products to regional needs and streamlining distribution across geographically vast and culturally varied territories.

Expanding digital ecosystems and mobile integration is a growing focus. Major players are embedding their devices into broader digital health platforms thereby enabling seamless data sharing with physicians and cloud-based analytics. This not only enhances patient engagement but also supports long-term customer retention in an increasingly connected healthcare landscape.

RECENT MARKET DEVELOPMENTS

- In February 2024, Abbott launched a new version of its FreeStyle Libre Flash Glucose Monitoring System in Thailand which is specifically designed to withstand tropical humidity and temperature variations.

- In May 2024, Roche partnered with a leading Japanese telehealth provider to integrate Accu-Chek glucose data with virtual consultation platforms.

- In July 2024, Bayer expanded its manufacturing facility in Penang, Malaysia, to increase production capacity for its Contour test strips.

- In October 2024, Medtronic entered into a joint development agreement with a Korean biotech firm to co-create AI-powered glucose trend prediction algorithms.

- In December 2024, Ascensia Diabetes Care introduced a localized training program in rural Indian communities in collaboration with NGOs.

MARKET SEGMENTATION

This research report on the Asia Pacific blood glucose monitoring market is segmented and sub-segmented into the following categories.

By Product

- Self-Monitoring

- Continuous Glucose Monitoring Devices

By Testing Site

- Fingertip Testing

- Alternate Site Testing

By Patient Care Setting

- Hospital

- Homecare

By Application

- Type 1

- Type 2

- Gestational Diabetes

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of the Asia Pacific Blood Glucose Monitoring Market?

The market is driven by the rising incidence of diabetes, aging demographics, urbanization, increasing health awareness, and improved access to medical technology.

What types of products are offered in the Asia Pacific Blood Glucose Monitoring Market?

The market includes Self-Monitoring Blood Glucose (SMBG) devices like glucometers and test strips, as well as Continuous Glucose Monitoring (CGM) systems.

Is there a trend toward Continuous Glucose Monitoring in the Asia Pacific Blood Glucose Monitoring Market?

Yes, CGM systems are increasingly preferred over traditional SMBG devices due to their convenience, real-time data, and lower need for finger pricking.

What are the challenges in the Asia Pacific Blood Glucose Monitoring Market?

Key challenges include high costs of CGM devices, inconsistent reimbursement policies, and lack of awareness in rural or underserved regions.

What is the growth outlook for the Asia Pacific Blood Glucose Monitoring Market?

The market is expected to grow significantly over the coming years, with a strong CAGR driven by technology adoption, increased healthcare investment, and rising chronic disease burden.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com