Asia Pacific Blood Glucose Test Strip Packaging Market Report – Segmented By Material (Plastic, Aluminum, Others), Product Type, End-User, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Blood Glucose Test Strip Packaging Market Size

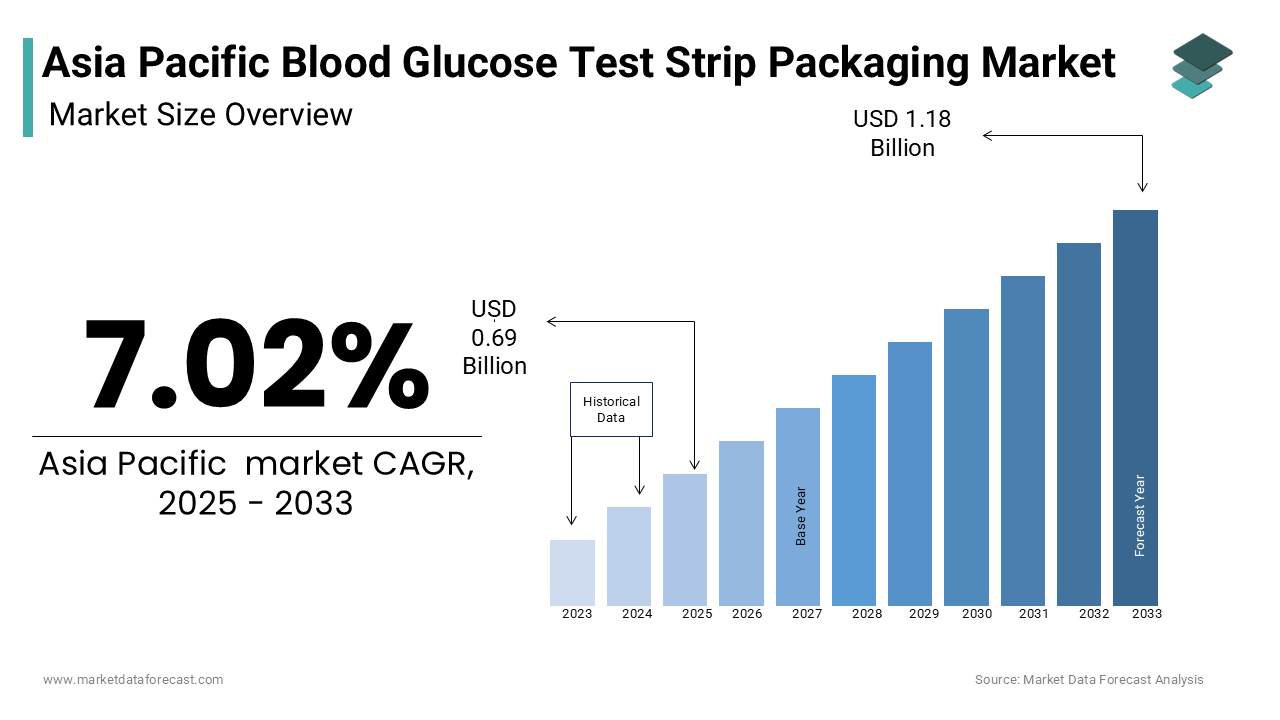

The Asia Pacific Blood Glucose Test Strip Packaging Market was worth USD 0.64 billion in 2024. The Asia Pacific market is expected to reach USD 1.18 billion by 2033 from USD 0.69 billion in 2025, rising at a CAGR of 7.02% from 2025 to 2033.

Blood glucose test strips are indispensable tools for individuals managing diabetes which enable them to monitor their blood sugar levels with precision. The packaging of these strips plays a pivotal role in maintaining their sterility, usability and shelf life making it an integral part of the supply chain. The region’s aging population and rising prevalence of lifestyle diseases have further fueled the need for effective diabetes management tools. The number of adults aged 65 and above in the Asia Pacific is projected to double by 2050 increasing the burden of chronic diseases like diabetes. Improper storage or exposure to moisture can compromise the accuracy of test strips, emphasizing the importance of high-quality packaging.

MARKET DRIVERS

Rising Prevalence of Diabetes

The escalating prevalence of diabetes is a primary driver of the blood glucose test strip packaging market in the Asia Pacific region. Over 230 million people in the region were living with diabetes in 2021 a figure expected to rise significantly due to urbanization and sedentary lifestyles. India alone accounts for over 77 million diabetics making it one of the largest markets for diabetes management tools. China’s National Health Commission emphasizes the need for tamper-proof and moisture-resistant packaging to ensure the accuracy of test strips. These trends show how the growing burden of diabetes is propelling the demand for advanced packaging technologies tailored to meet the needs of patients and healthcare providers.

Increasing Focus on Patient Convenience

Growing emphasis on patient convenience and user-friendly designs is another key driver in the Asia Pacific Blood Glucose Test Strip Packaging Market. Japan’s Ministry of Health, Labour and Welfare states that elderly patients often struggle with complex packaging leading manufacturers to develop easy-to-open yet secure solutions. Compact and portable packaging designs are gaining popularity among younger patients aligning with their active lifestyles. Moreover, the rise of e-commerce has created a demand for durable packaging that can withstand transportation and storage conditions.

MARKET RESTRAINTS

High Costs of Advanced Packaging Solutions

The high cost associated with advanced packaging is one of the primary restraints of the market. Small and medium enterprises (SMEs) often struggle to afford cutting-edge packaging solutions despite their potential benefits. For example, incorporating moisture-resistant and tamper-proof features can increase production costs significantly deterring smaller players from adopting these innovations. Additionally, the lack of economies of scale in emerging economies exacerbates this issue. Vietnam’s Ministry of Health reports that only 30% of local manufacturers have access to advanced packaging technologies limiting their ability to compete in the global market.

Stringent Regulatory Requirements

Stringent regulatory frameworks governing medical device packaging also pose a significant challenge in the market. The Australian Therapeutic Goods Administration emphasizes the need for compliance with strict hygiene and safety standards which can be costly and time-consuming for manufacturers. Similarly, India’s Central Drugs Standard Control Organization mandates rigorous testing and certification processes which increase operational burdens. Non-compliance can lead to penalties or market exclusion further straining smaller players. Achieving compliance often involves redesigning packaging which can take up to two years and cost millions in research and development expenses.

MARKET OPPORTUNITIES

Integration of Smart Packaging Technologies

The integration of smart packaging technologies presents a transformative opportunity for the blood glucose test strip packaging market. Smart packaging solutions, such as QR codes and NFC tags enable patients to access real-time information about product authenticity, expiration dates and usage instructions. Smart packaging could generate economic value of up to $1 trillion annually in the Asia Pacific region by 2030. Adoption of NFC-enabled packaging in hospitals to streamline inventory management and reduce waste. These advancements position smart packaging as a key enabler of innovation in the market.

Expansion into Rural and Underserved Areas

Expansion into rural and underserved areas is unlocking untapped potential for blood glucose test strip packaging in emerging Asia Pacific economies driven by the growing need to improve healthcare access and chronic disease management. Over 60% of the region’s population resides in rural areas where access to diabetes care remains limited. Deployment of durable and cost-effective packaging solutions to ensure the safe delivery of test strips to remote communities. Similarly, India’s Ayushman Bharat initiative emphasizes the need for affordable packaging to support universal healthcare coverage.

MARKET CHALLENGES

Environmental Sustainability Concerns

Environmental sustainability concerns pose a significant challenge to the market particularly regarding the use of single-use plastics in packaging. The United Nations Environment Programme warns that plastic waste generated by medical packaging contributes to environmental degradation prompting calls for eco-friendly alternatives. There is an increasing need for biodegradable materials to minimize the environmental impact and reduce the carbon footprint of healthcare products. However, transitioning to sustainable materials often increases production costs and complicates manufacturing processes. These challenges hinder the adoption of environmentally friendly packaging solutions.

Supply Chain Disruptions

Supply chain vulnerabilities represent another pressing challenge caused by geopolitical tensions and natural disasters have delayed the production and distribution of blood glucose test strip packaging. For instance, typhoons in Southeast Asia frequently disrupt logistics and cause delays in packaging deliveries. These uncertainties complicate planning and execution ultimately impeding market growth and stability. China’s Ministry of Commerce emphasizes that port closures and shipping bottlenecks have further exacerbated these issues forcing manufacturers to seek alternative suppliers or absorb additional expenses.

SEGMENTAL ANALYSIS

By Material Insights

The plastic segment was the largest and held 60.4% of the Asia Pacific blood glucose test strip packaging market share in 2024 with its versatility, cost-effectiveness and ability to provide a sterile environment for test strips. One major factor is the widespread adoption of plastic in single-use packaging solutions. Over 70% of blood glucose test strips in India are packaged using plastic due to its lightweight and moisture-resistant properties. Plastic packaging ensures the sterility of test strips during transportation and storage while reducing contamination risks. Plastic packaging is easier to open and use compared to alternatives like aluminum making it ideal for elderly patients.

The aluminum segment is projected to witness a CAGR of 8.5% during the forecast period owing to its superior barrier properties which protect test strips from moisture and light exposure. A key factor is the increasing demand for eco-friendly packaging solutions. South Korea’s Ministry of Environment reports that over 40% of healthcare companies are transitioning to aluminum-based packaging to reduce their carbon footprint. Another factor is the focus on premium products. Aluminum packaging is increasingly used for high-end test strips enhancing product shelf life and appeal.

By Product Type Insights

The vials and tubes segment was the largest with 45.3% of the Asia Pacific blood glucose test strip packaging market share in 2024 due to their ability to house multiple test strips securely while maintaining sterility. One key factor is the widespread use of vials in hospital settings. Vials are preferred in clinical environments due to their durability and ease of access. Another factor is the growing emphasis on cost efficiency. Vials reduce packaging waste compared to individual packaging options aligning with healthcare providers’ sustainability goals.

The film is projected to witness a CAGR of 9.2% during the forecast period. This growth is fueled by its lightweight and flexible design making it ideal for portable and compact packaging solutions. A significant factor is the rise of e-commerce. Film-based packaging is gaining popularity among online retailers due to its ability to withstand transportation conditions without compromising sterility. Film packaging reduces production costs which enables manufacturers to offer affordable diabetes care products. Another factor is the focus on patient convenience. Use of film packaging for single-use test strips ensures ease of use for elderly patients.

By End-User Insights

The hospitals segment led the Asia Pacific blood glucose test strip packaging market with 35.4% of the share in 2024 with the critical role hospitals play in managing chronic diseases like diabetes. One major factor is the rising prevalence of diabetes. China’s National Health Commission states that hospitals account for over 50% of test strip usage, ensuring consistent demand for secure packaging solutions.Another factor is the growing emphasis on centralized care. Japan’s Ministry of Health, Labour and Welfare notes that hospitals increasingly adopt bulk packaging solutions like vials to streamline inventory management and reduce costs.

The households segment is projected to witness a CAGR of 10.3% during the forecast period. This growth is fueled by the increasing adoption of self-monitoring practices among diabetic patients. A key factor is the aging population. The number of adults aged 65 and above is projected to double by 2050 driving demand for at-home diabetes care solutions. Another factor is the rise of e-commerce. Online sales of household diabetes care products have surged by 25% in recent years further boosting demand for compact and durable packaging solutions.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific blood glucose test strip packaging market and accounted for 30% of global market share. Its dominance is driven by its status as a global leader in manufacturing and technology innovation. China’s Belt and Road Initiative promotes cross-border trade by creating demand for durable packaging solutions tailored to diverse climates and transportation conditions.

India was positioned second in holding the dominant share of the Asia Pacific blood glucose test strip packaging market. The country’s rapid adoption of diabetes management tools is driven by the rising prevalence of diabetes with over 77 million cases. The Ayushman Bharat initiative emphasizes the need for affordable and accessible packaging solutions to support universal healthcare coverage. Furthermore, India’s growing pharmaceutical sector increasingly relies on innovative packaging to meet regulatory standards which ensures steady growth in demand.

Japan blood glucose test strip packaging market is driven by its advanced technological expertise and aging population. The adoption of eco-friendly and user-friendly packaging solutions to support elderly patients managing diabetes independently. Additionally, Japan’s focus on sustainability has led to increased use of recyclable materials aligning with global environmental goals.

South Korea glucose test strip packaging market is driven by its robust healthcare and electronics industries. The Ministry of Food and Drug Safety emphasizes the adoption of smart packaging solutions such as NFC-enabled vials to enhance patient safety and convenience. Additionally, South Korea’s emphasis on reducing plastic waste has fueled the transition to sustainable materials like aluminum which further boost demand.

The Australian market is driven by its focus on environmental sustainability and remote healthcare driving packaging adoption. The Department of Agriculture, Water and the Environment emphasizes the use of biodegradable materials to reduce the carbon footprint of diabetes care products. Additionally, Australia’s vast rural population necessitates durable packaging solutions to ensure safe delivery of test strips to remote areas.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Abbott Laboratories, LifeScan Inc., Ascensia Diabetes Care, i-SENS Inc., Trividia Health, AgaMatrix Inc., TaiDoc Technology Corporation, Universal Biosensors, ARKRAY Inc., B. Braun Melsungen AG, ACON Laboratories Inc., and All Medicus Co. Ltd. Packaging specialists such as Aptar CSP Technologies, Sanner GmbH, Huhtamaki Oyj, Amcor plc, and Airnov Healthcare Packaging are some of the key market players.

The Asia Pacific blood glucose test strip packaging market is characterized by intense competition with both global giants and regional players vying for dominance. Global leaders like Amcor, WestRock and Sealed Air leverage their technological expertise and extensive distribution networks to maintain their stronghold. Meanwhile, regional players focus on cost-effective solutions and localized services to cater to price-sensitive markets. The competitive landscape is further shaped by rapid technological advancements with companies striving to integrate smart features and sustainable materials into their offerings. Additionally, stringent regulatory frameworks governing medical packaging have compelled manufacturers to innovate continuously. Supply chain disruptions and raw material price volatility add complexity forcing players to adopt agile strategies.

Top Players in the Asia Pacific Blood Glucose Test Strip Packaging Market

Amcor plc

Amcor plc is a global leader in packaging solutions with a significant presence in the Asia Pacific blood glucose test strip packaging market. The company’s contribution to the global market lies in its innovative and sustainable packaging designs which cater to the healthcare industry's stringent requirements. Amcor’s ability to provide tamper-proof and moisture-resistant packaging ensures the safety and usability of blood glucose test strips making it a trusted partner for healthcare providers and manufacturers worldwide.

WestRock Company

WestRock Company plays a pivotal role in advancing packaging technologies tailored for medical applications and known for its expertise in creating durable and user-friendly packaging. WestRock provides solutions that enhance patient convenience while meeting regulatory standards. The company’s emphasis on integrating advanced materials and smart packaging features has positioned it as a key player in the region.

Sealed Air Corporation

Sealed Air Corporation is renowned for its commitment to precision and hygiene in packaging making it a key player in the Asia Pacific blood glucose test strip packaging market. The company’s advanced packaging platforms ensure the sterility and integrity of test strips empowering healthcare providers to deliver reliable diabetes management tools. Sealed Air’s dedication to innovation and customer-centric solutions has strengthened its global reputation. Sealed Air ensures sustainable growth while driving technological transformation in the healthcare packaging industry.

Top Strategies Used by Key Players in the Asia Pacific Blood Glucose Test Strip Packaging Market

Focus on Sustainability and Eco-Friendly Solutions

Focus on sustainability and eco-friendly solutions is driving key players in the market to develop recyclable and biodegradable materials aligning with growing consumer demand and environmental regulations. For instance, manufacturers are transitioning to plant-based plastics and aluminum-based solutions to reduce their carbon footprint. This strategy not only enhances brand reputation but also caters to the growing demand for environmentally responsible products particularly in developed economies like Japan and Australia.

Investment in Smart Packaging Technologies

Investing in smart packaging technologies such as QR codes, NFC tags and tamper-evident features has become a key strategy for companies aiming to meet the evolving needs of end-users and enhance product security and consumer engagement. These innovations enable patients to access real-time information about product authenticity and usage instructions that enhance transparency and trust. Additionally, smart packaging streamlines inventory management for healthcare providers reducing waste and ensuring timely replenishment.

Expansion into Emerging Markets

Expansion into emerging markets like India, Indonesia and Vietnam is becoming a strategic priority for players in the Asia Pacific region driven by the rapidly increasing prevalence of diabetes in these countries. This strategy allows them to capture untapped opportunities and strengthen their presence in high-growth markets.

RECENT MARKET DEVELOPMENTS

- In April 2024, Amcor plc launched a new line of recyclable packaging specifically designed for blood glucose test strips in India.

- In June 2023, WestRock Company partnered with a leading Japanese hospital chain to develop tamper-proof and moisture-resistant packaging solutions.

- In September 2023, Sealed Air Corporation acquired a local packaging technology firm in South Korea to expand its production capabilities for cost-effective and eco-friendly packaging.

- In January 2024, Huhtamaki Group, a Finnish packaging provider introduced a line of NFC-enabled packaging tailored for premium diabetes care products in China.

- In November 2023, Berry Global signed an agreement with a Philippine pharmaceutical company to develop specialized packaging for rural healthcare initiatives.

MARKET SEGMENTATION

This research report on the Asia Pacific Blood Glucose Test Strip Packaging Market is segmented and sub-segmented into the following categories.

By Material

- Plastic

- Aluminum

- Others

By Product Type

- Bottle

- Vial & Tubes

- Film

- Others

By End-user

- Hospital

- Diagnostic Clinics

- Household

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of the Asia Pacific market?

The market is driven by the rising prevalence of diabetes, increased awareness of self-monitoring, growing demand for point-of-care diagnostics, and the need for improved medical packaging standards across the region.

What challenges does the market face?

Key challenges include high regulatory standards, cost pressures, and the need for compatibility with automated manufacturing and filling processes.

What is the market outlook for the next decade?

The Asia Pacific market is expected to grow steadily due to the increasing diabetic population, expanding healthcare access, and continuous innovations in medical packaging technologies.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]