Asia Pacific Body Temperature Monitoring Market Research Report – Segmented By Product (Contact, Non-Contact), Application, End User, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of APAC) - Industry Analysis On Size, Share, Trends, & Growth Forecast (2025 To 2033)

Asia Pacific Body Temperature Monitoring Market Size

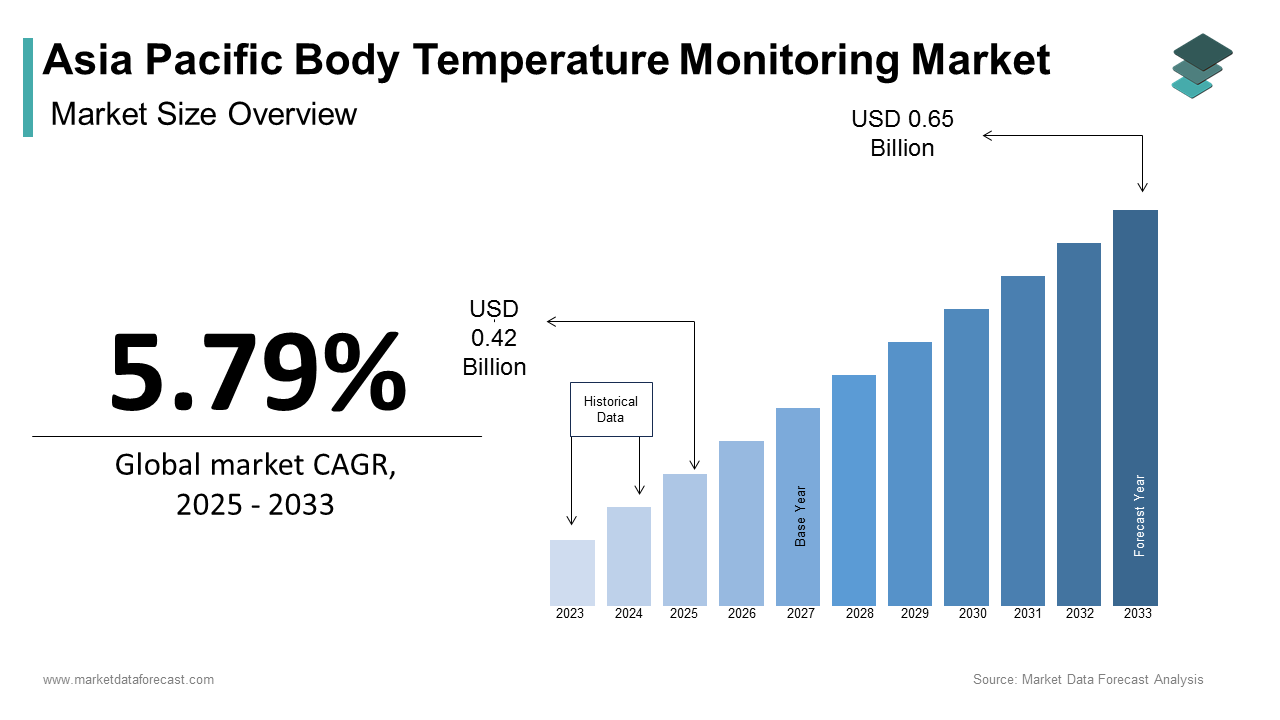

The Asia Pacific Body Temperature Monitoring Market size was calculated to be USD 0.39 billion in 2024 and is anticipated to be worth USD 0.65 billion by 2033, from USD 0.42 billion in 2025, growing at a CAGR of 5.79% during the forecast period.

The Asia Pacific body temperature monitoring market growth is driven by the wide range of devices and technologies used to measure body heat in both clinical and homecare environments. These tools are critical for early detection of febrile conditions, post-operative monitoring, and managing infectious diseases in light of recent global health challenges. Fever remains one of the most common symptoms prompting medical consultations across Southeast Asia and the Pacific islands. Additionally, the surge in chronic illnesses requiring long-term patient surveillance has further intensified the demand for accurate and real-time temperature tracking. Healthcare spending in emerging economies such as India, Indonesia, and Vietnam has risen consistently thereby fostering better access to diagnostic equipment including temperature monitors. In Japan, continuous monitoring systems integrated with telehealth platforms have become essential components of elderly care.

MARKET DRIVERS

Increasing Prevalence of Infectious Diseases and Fever-Related Conditions

The increasing prevalence of infectious diseases and fever-related conditions is one of the primary drivers of the Asia Pacific body temperature monitoring market. Countries in South and Southeast Asia continue to face recurring outbreaks of dengue, malaria, tuberculosis, and viral infections such as influenza and hand-foot-mouth disease. Over 3 million cases of dengue were reported across the ASEAN region in Thailand, the Philippines, and Malaysia. In India, the National Vector Borne Disease Control Program documented more than 100,000 confirmed malaria cases annually thereby reinforcing the need for rapid and accurate temperature screening at both public and private healthcare facilities. Additionally, in Bangladesh and Nepal childhood fevers due to bacterial infections remain a key cause of hospitalization thus necessitating consistent use of temperature monitoring tools. The integration of thermal scanning systems in airport health screenings and community clinics across Australia, China, and Singapore has also expanded the scope of temperature diagnostics beyond hospitals. Elevated body temperature serves as a vital early indicator of many communicable diseases while making temperature monitoring an essential frontline tool in public health management.

Expansion of Telemedicine and Remote Patient Monitoring Frameworks

The rapid expansion of telemedicine and remote patient monitoring frameworks is another significant driver fueling growth in the Asia Pacific body temperature monitoring market. Governments and private healthcare providers are integrating temperature monitoring into virtual care models with advancements in digital health infrastructure and increased smartphone penetration. In Japan, the Ministry of Health, Labour and Welfare has incentivized the use of connected medical devices as part of its universal health coverage reforms thereby encouraging elderly patients to monitor vital signs at home. Similarly, in Australia, the Department of Health’s expansion of Medicare-funded telehealth services has enabled physicians to remotely track patients recovering from respiratory illnesses using wireless thermometers linked to mobile applications. In India, startups such as Portea Medical and Apollo Home Healthcare have incorporated temperature-sensing wearables into their home nursing packages while catering to post-surgical and chronically ill patients. Moreover, the rise of preventive health programs and AI-driven symptom checkers has further boosted the adoption of smart thermometry in urban households. Body temperature monitoring devices are becoming integral to the evolving digital health ecosystem across the Asia Pacific as healthcare systems increasingly prioritize decentralized care delivery.

MARKET RESTRAINTS

Limited Awareness and Low Adoption Rates in Rural Areas

Limited awareness and low adoption rates in rural and underserved regions are other significant restraints inhibiting the widespread growth of the Asia Pacific body temperature monitoring market. Many communities continue to rely on subjective assessments or outdated mercury thermometers despite the growing burden of febrile illnesses which are less reliable and pose environmental hazards. In countries like Laos, Cambodia, and parts of rural India and Indonesia over 60.16% of the population does not have regular access to basic health education or modern diagnostic tools. Only 12.74% of rural households owned a digital thermometer with most preferring tactile methods to assess fever. In Papua New Guinea and the Solomon Islands, early diagnosis of febrile conditions is often delayed due to a lack of proper monitoring equipment where healthcare access remains constrained. Furthermore, cultural barriers and mistrust in new technologies among older populations hinder the uptake of electronic and wearable thermometers.

Regulatory Hurdles and Lack of Standardization Across National Markets

Regulatory complexity and the absence of standardized calibration protocols across national markets is another major obstacle affecting the Asia Pacific body temperature monitoring market. The Asia Pacific region presents a fragmented landscape with varying compliance requirements unlike Europe and North America where unified regulatory bodies streamline approvals. For instance, in China, the National Medical Products Administration mandates stringent testing procedures for medical-grade thermometers which can delay product launches. Meanwhile, in India, the Central Drugs Standard Control Organization has recently strengthened quality control measures for imported temperature monitoring devices thereby increasing operational costs for foreign manufacturers. Navigating these disparate regulations can extend the time-to-market by up to 18 months in certain jurisdictions which discourages smaller players from entering regional markets. In smaller ASEAN nations, the absence of centralized certification authorities further complicates compliance thereby forcing manufacturers to adopt localized strategies that may not be scalable. These regulatory hurdles pose a fundamental challenge to the harmonized growth and commercial scalability of body temperature monitoring solutions across the Asia Pacific.

MARKET OPPORTUNITIES

Integration of IoT and Smart Thermometry in Wearable Devices

Integration of Internet of Things (IoT) technology into wearable thermometry solutions is another promising opportunity shaping the future of the Asia Pacific body temperature monitoring market. Manufacturers are embedding precise temperature sensors into smartwatches, fitness bands,s and patches for continuous physiological monitoring as consumer demand for health-tracking wearables grows. In South Korea, companies like Samsung and LG have introduced smart wristbands capable of detecting subtle body temperature fluctuations which are appealing to both fitness enthusiasts and health-conscious consumers. In Japan, wearable temperature patches linked to cloud-based dashboards are being deployed in assisted living centers to monitor frail patients in real time where elderly care is a pressing concern. Startups in India and Australia are also developing low-cost Bluetooth-enabled thermometers compatible with mobile apps thereby enabling users to track trends and share readings with healthcare providers. Government-backed e-health initiatives are accelerating the integration of IoMT (Internet of Medical Things) in routine diagnostics. These developments open new commercial pathways for medical device firms seeking to expand within the rapidly digitizing healthcare space of the Asia Pacific.

Rise of Preventive Healthcare and Personal Wellness Trends

The growing emphasis on preventive healthcare and personal wellness is creating a lucrative opportunity for the Asia Pacific body temperature monitoring market. There is an increasing inclination toward self-monitoring of vital parameters including body temperature as individuals become more proactive about health management. Urban centers across China, Singapore,e, and Australia are seeing increased adoption of smart thermometers as part of daily health routines, especially during seasonal flu outbreaks and post-vaccination periods. Over 60.81% of respondents in the Asia Pacific region indicated a willingness to invest in personal health monitoring tools. In China, e-commerce platforms like Alibaba Health and JD.com have reported surging sales of digital thermometers, which are driven by heightened health consciousness following the pandemic. Similarly, in India, online health retailers such as 1mg and PharmEasy have seen a doubling of thermometer purchases over the past two years thus indicating a behavioral shift toward home-based monitoring. Additionally, corporate wellness programs in multinational enterprises based in Tokyo, Sydney, and Mumbai now include thermal screening as part of employee health assessments. The demand for user-friendly and accessible temperature monitoring devices is expected to grow significantly across the Asia Pacific region as governments and private organizations continue to promote wellness initiatives.

MARKET CHALLENGES

Technological Limitations and Variability in Accuracy Among Non-Invasive Devices

One of the foremost challenges confronting the Asia Pacific body temperature monitoring market is the variability in the accuracy and reliability of non-invasive temperature measurement devices. Infrared thermometers, wearable patches, and smart rings offer convenience and ease of use while they often produce inconsistent readings compared to traditional core temperature methods like oral or rectal measurements. Some widely used infrared thermometers demonstrated deviations of up to 0.8°C under different ambient conditions thus raising concerns about their clinical validity. In Japan, the Japanese Society of Anesthesiologists reiterated its preference for invasive or tympanic thermometers in surgical environments due to reliability issues with forehead scanners. In India and Indonesia, lower-end infrared thermometers often fail to meet international calibration standards where affordability drives purchasing decisions which leads to misdiagnoses and reduced trust in digital alternatives. Additionally, fluctuating humidity and skin surface temperatures in tropical climates further affect sensor performance thereby limiting the efficacy of contactless monitoring in outdoor or emergency settings.

Supply Chain Disruptions and Manufacturing Constraints in Key Producing Nations

Supply chain disruptions and manufacturing constraints in key producing nations remain a persistent challenge impacting the Asia Pacific body temperature monitoring market in countries that are responsible for producing semiconductor components and sensor modules. Many high-tech thermometers rely on microchips and electronic components sourced from global suppliers and disruptions in logistics due to geopolitical tensions or natural disasters can severely affect production timelines. Semiconductor shortages in 2022 disrupted the manufacturing of medical electronics including digital thermometers and wearable sensors thereby delaying product availability in key markets such as South Korea and Taiwan. In China, factory shutdowns due to pandemic-related restrictions created bottlenecks in the distribution of temperature monitoring products where a significant portion of the region’s medical device exports originate. In India, local manufacturers faced challenges in sourcing high-precision thermistors and infrared sensors thereby leading to price increases and reduced margins. Additionally, import duties and regulatory delays in countries like Thailand and the Philippines have further complicated procurement processes for international brands aiming to scale operations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.79% |

|

Segments Covered |

By Product, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of APAC |

|

Market Leaders Profiled |

Omron Healthcare, 3M Company, Braun GmbH, Hill-Rom Holdings Inc., Koninklijke Philips N.V., Easywell Biomedicals, Exergen Corporation, Terumo Corporation, Microlife Corporation, American Diagnostic Corporation |

SEGMENTAL ANALYSIS

By Product Insights

The Contact Thermometers segment held the leading share of the Asia Pacific body temperature monitoring market by capturing 58.6% of the total market share in 2024 due to their widespread use in clinical environments such as hospitals, clinics, and home care settings where accuracy is critical. Contact thermometers including digital oral and rectal models are preferred for their reliability in measuring core body temperature, especially in pediatric and elderly patients. In India, the National Health Mission continues to recommend digital contact thermometers for primary health centers due to their cost-effectiveness and ease of use. Similarly, in China, frontline healthcare workers rely heavily on contact thermometry during mass screenings and hospital admissions where infectious disease control remains a priority. Contact thermometers remain the most commonly used devices in low-resource settings across Southeast Asia because of their durability and minimal training requirements. Additionally, government procurement programs in countries like Thailand and Vietnam have consistently favored contact-based systems for public health initiatives thereby reinforcing their entrenched position in the regional marketplace.

The Non-Contact Thermometers segment is projected to witness the fastest CAGR of 16.82% during the forecast period with the increasing demand for hygiene-focused and quick-response thermal measurement tools, particularly in high-footfall environments such as airports, schools, and commercial hubs. In Japan, non-contact infrared thermometers are widely deployed in nursing homes, daycare centers, and workplaces as part of routine health screening measures. In Australia, government-backed health guidelines have promoted the use of non-contact thermometers in school health assessments and aged care facilities. Moreover, in South Korea, companies like Berrcom and Omron have introduced compact and high-accuracy infrared thermometers tailored for home use thus contributing to rising consumer adoption. The non-contact segment is poised for sustained expansion as the region prioritizes infection prevention and contactless diagnostics.

By Application Insights

The Ear (Tympanic) Thermometers segment was the largest segment and held 32.94% of the Asia Pacific body temperature monitoring market share in 2024 with the growing preference for rapid and minimally invasive temperature readings especially in pediatric and geriatric populations. Tympanic thermometers provide quicker results compared to oral or rectal methods thereby making them ideal for emergency departments, outpatient clinicsics home home care settings. In China, hospitals frequently use tympanic thermometers to screen large volumes of patients efficiently, ly particularly during seasonal flu outbreaks. Ear thermometers were extensively deployed during recent respiratory disease surges due to their ability to deliver reliable readings with minimal patient discomfort. In India, leading diagnostic chains such as Dr. Lal PathLabs and Apollo Diagnostics have integrated tympanic thermometers into standard check-up protocols thus further boosting adoption. Clinical studies conducted by Singapore General Hospital confirmed that modern tympanic devices offer a high degree of correlation with core body temperature when used correctly.

The Forehead (Temporal Artery) Thermometer segment is estimated to register a CAGR of 18.16% from 2025 to 2033. This surge is largely driven by a heightened emphasis on hygiene, ease of use, e, and suitability for multi-user environments. Temporal artery thermometers allow contactless scanning of the forehead thereby reducing the risk of cross-contamination which is a crucial factor in schools, childcare centers, and healthcare institutions. In Japan, temporal thermometers have been adopted nationwide in pharmacies, train stations, and corporate offices. In South Korea, manufacturers like Exergen and Microlife have launched AI-integrated temporal scanners designed for real-time fever detection in crowded spaces. Additionally, in Australia, the Department of Health has endorsed forehead thermometry in certain community health programs aimed at remote Indigenous communities.

By End User Insights

The hospital segment dominated the Asia Pacific body temperature monitoring market by capturing 45.27% of the total market share in 2024 due to the critical role temperature tracking plays in patient diagnosis, treatment monitoring, and infection control within hospital settings. Hospitals across the region rely on both contact and non-contact thermometers for triaging patients, managing febrile illness, and ensuring post-operative recovery progress. In China, hospitals have integrated advanced thermography systems alongside traditional handheld devices where national health authorities emphasize early detection of infectious diseases. Over 90.62% of tertiary care hospitals in major cities conduct mandatory temperature screenings upon patient admission. In India, the Indian Council of Medical Research mandates temperature monitoring as part of standardized hospital protocols for intensive care units and emergency departments. Additionally, in Australia, public hospitals have adopted digital thermometers with electronic health record integration to streamline patient data management. The increasing burden of communicable diseases and the rise in hospital-acquired infections have further reinforced the need for consistent and precise temperature monitoring thereby sustaining the hospital segment’s dominance in the market.

The Clinics segment is predicted to witness a CAGR of 13.74% from 2025 to 2033 with the expansion of primary care networks, increasing outpatient visits, and the proliferation of telehealth-enabled monitoring. In countries like Indonesia and Vietnam, clinics serve as the first point of contact for millions of patients seeking fever-related consultations where government-led primary healthcare strengthening initiatives are underway. General practitioner clinics have seen a 35.07% increase in temperature monitoring device installations since 2020. In South Korea, private clinics specializing in chronic disease management have adopted smart thermometers that sync with cloud-based patient records thereby enhancing continuity of care. Additionally, in Japan, the Ministry of Health, Labour and Welfare supports clinic-based preventive health check-ups that include routine temperature assessments for elderly patients. Clinics are increasingly investing in portable and reusable thermometers to meet the demands of frequent patient interactions as ambulatory care gains prominence across the region.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific body temperature monitoring market and accounted for 30.72% of the share in 2024. The country’s dominant position is supported by its vast population along with the rising prevalence of infectious and chronic diseases and government-driven public health initiatives. Fever remains one of the top five reasons for hospital visits nationwide thereby prompting widespread deployment of both contact and non-contact thermometers in clinical and community settings. China has enhanced its national surveillance systems while integrating digital thermometry into quarantine and isolation protocols.

India was positioned second in holding the dominant share of the Asia Pacific body temperature monitoring market in 2024. The country is witnessing a surge in demand for temperature monitoring devices due to rising awareness of infectious diseases, increasing hospital admissions, and expanding primary healthcare networks. The launch of the Ayushman Bharat Program has bolstered access to basic diagnostic equipment including thermometers in newly established health and wellness centers. Additionally, the growing presence of e-commerce health retailers such as Flipkart Healthcare and PharmEasy has made personal-use thermometers more accessible to urban consumers.

Japan’s body temperature monitoring market is likely to grow with a healthy CAGR in the coming years. The country’s mature healthcare system, coupled with an aging population thereby drives substantial demand for precision thermometry. Over 28.26% of Japan’s population is aged 65 or older thus making temperature monitoring a critical component of geriatric care. The country has embraced digital thermometers and wearable sensors in assisted living facilities and telemedicine consultations. Moreover, Japan’s regulatory environment promotes rapid adoption of innovative products thereby ensuring that new technologies reach the market quickly.

Australia’s body temperature monitoring sector market growth is driven by its well-developed healthcare infrastructure and proactive disease prevention policies. The Australian Institute of Health and Welfare reports that abnormal body temperature is among the most frequently recorded vital signs in emergency departments and general practice clinics. Public health authorities have incorporated infrared thermometry into national screening programs, particularly in remote and Indigenous communities where access to conventional healthcare is limited.

South Korea’s body temperature monitoring market is likely to have significant growth opportunities during the forecast period and is characterized by rapid technological innovation and strong governmental support for digital health solutions. The Korean Centers for Disease Control and Prevention emphasizes early detection of febrile illnesses as part of its national disease prevention strategy. The country’s healthcare providers are increasingly adopting smart thermometers linked to AI-driven analytics platforms. The government’s push for medical device localization has fostered a conducive environment for domestic firms to thrive.

LEADING PLAYERS IN THE MARKET

Omron Healthcare

Omron is a leading innovator in the Asia Pacific body temperature monitoring market which is known for its precision-engineered digital thermometers and infrared-based solutions. The company has played a pivotal role in advancing non-contact temperature measurement technologies p, particularly in Japan and other developed markets in the region. Omron's focus on user-friendly design, accuracy, and integration with home healthcare systems has made its products widely accepted across clinical and consumer segments. Omron contributes significantly to shaping global standards in thermal diagnostics while addressing diverse environmental and patient-specific conditions in the Asia Pacific region.

Braun Melsungen AG

B. Braun is a major participant in the Asia Pacific body temperature monitoring market and offers a broad range of clinical-grade thermometry devices tailored for hospital and intensive care settings. B. Braun provides advanced temperature monitoring solutions that integrate seamlessly into critical care workflows. The company’s strong presence in key markets such as China, India, and Australia allows it to influence both institutional purchasing trends and clinical best practices. B. Braun continues to enhance the accessibility and reliability of temperature monitoring tools across the Asia Pacific region through strategic collaborations with healthcare providers and governments.

Exergen Corporation (a subsidiary of Welleal Medical)

Exergen, now operating under Welleal Medical, is renowned for pioneering temporal artery thermometry which is a breakthrough in non-invasive and highly accurate temperature measurement. Exergen’s technology is increasingly adopted in hospitals, clinics, and homecare environments with a strong foothold in Japan and expanding reach across Southeast Asia. The company emphasizes ease of use, hygiene, and rapid results are crucial factors in high-demand clinical environments and public health initiatives. Its innovations have significantly influenced the evolution of modern thermometry thereby reinforcing its stature as a leader in the Asia Pacific body temperature monitoring landscape.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Product innovation and technological differentiation is one major strategy employed by leading players in the Asia Pacific body temperature monitoring market. Companies are continuously developing next-generation thermometers with enhanced accuracy, faster response times and smart connectivity features to meet evolving consumer and clinical needs. These advancements help firms establish brand loyalty and maintain a competitive edge in diverse regional landscapes.

Another key approach is strategic partnerships and localized distribution networks. To overcome regulatory complexities and expand market penetration companies frequently collaborate with local distributors, healthcare institutions, and government bodies. These alliances enable them to tailor products to regional preferences and streamline access in both urban and rural settings.

A third impactful strategy is integration with digital health ecosystems. Major players are embedding their temperature monitoring devices into broader telehealth and electronic health record platforms. This not only enhances data interoperability but also supports remote patient monitoring thereby making solutions more valuable in integrated healthcare delivery models across the Asia Pacific region.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major players in the Asia Pacific Body Temperature monitoring market include Omron Healthcare, 3M Company, Braun GmbH, Hill-Rom Holdings Inc., Koninklijke Philips N.V., Easywell Biomedicals, Exergen Corporation, Terumo Corporation, Microlife Corporation, American Diagnostic Corporation.

The competition in the Asia Pacific body temperature monitoring market is marked by a blend of established multinational corporations and emerging domestic manufacturers vying for market share through innovation, pricing strategies, and expanded distribution. Multinational firms leverage their brand reputation, technological superiority, and extensive sales networks to dominate institutional procurement and premium retail segments, particularly in Japan, South Korea, ea, and Australia. At the same time, regional players in China, India, and Southeast Asia are gaining traction by offering cost-effective alternatives that cater to price-sensitive populations without compromising basic functionality. The market is witnessing heightened innovation with companies introducing smart thermometers, wearable sensors, and AI-powered analytics to capture new customer segments. Additionally, the growing emphasis on infection control and preventive healthcare has intensified product differentiation efforts.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Omron launched a new line of infrared forehead thermometers equipped with AI-assisted fever detection specifically tailored for homecare use in Southeast Asia.

- In March 2024, B. Braun signed a strategic partnership agreement with a leading Indian medical equipment distributor to enhance its presence in tier-2 and tier-3 cities.

- In May 2024, Exergen introduced an updated version of its temporal artery thermometer compatible with cloud-based patient monitoring systems in Japanese hospitals.

- In August 2024, Microlife expanded its manufacturing facility in Vietnam to increase production capacity for both contact and non-contact thermometers.

- In November 2024, Yuwell Medical entered into a joint venture with a Singaporean digital health startup to develop a mobile-connected ear thermometer designed for elderly patients.

MARKET SEGMENTATION

This research report on the Asia Pacific Body Temperature Monitoring Market has been segmented and sub-segmented based on product, application and d user region.

By Product Insights

- Contact

- Non-Contact

By Application Insights

- Oral Cavity

- Rectum

- Ear

- Other Applications

By End User Insights

- Hospitals

- Clinics

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What is the Asia Pacific Body Temperature Monitoring market?

It refers to the regional market for devices and solutions used to measure and monitor body temperature, including thermometers, wearable sensors, and thermal scanners.

2. Which countries are the major contributors to this market in Asia Pacific?

China, Japan, India, South Korea, and Australia are key contributors due to their large populations, healthcare infrastructure, and technological adoption.

3. What are the key drivers of market growth?

Rising prevalence of infectious diseases, increasing health awareness, growing elderly population, and advancements in wearable health tech.

4. What types of devices are included in this market?

Digital thermometers, infrared thermometers, wearable temperature sensors, mercury thermometers, and thermal scanners.

5. Who are the leading players in this market?

Omron Healthcare, 3M Company, Braun GmbH, Hill-Rom Holdings Inc., Koninklijke Philips N.V., Easywell Biomedicals, Exergen Corporation, Terumo Corporation, Microlife Corporation, and American Diagnostic Corporation.

6. How did COVID-19 impact the market?

The pandemic significantly boosted demand for non-contact and digital temperature monitoring devices across healthcare and public places.

7. What are the key challenges in this market?

Price sensitivity, regulatory hurdles, competition from low-cost manufacturers, and accuracy concerns with some non-contact devices.

8. What are the major application areas?

Hospitals, clinics, home care, ambulatory settings, and public screening points like airports and offices.

9. What trends are shaping the market?

Integration of IoT and AI in temperature monitoring, miniaturization of sensors, and growing use of smart wearables.

10. What is the market outlook over the next five years?

The market is expected to grow steadily, driven by ongoing public health initiatives, technology adoption, and increasing healthcare expenditure.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com