Asia Pacific Broadcasting Equipment Market Size, Share, Trends & Growth Forecast Report By Technology (Analog Broadcast, Digital Broadcast), Application, Equipment, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Broadcasting Equipment Market Size

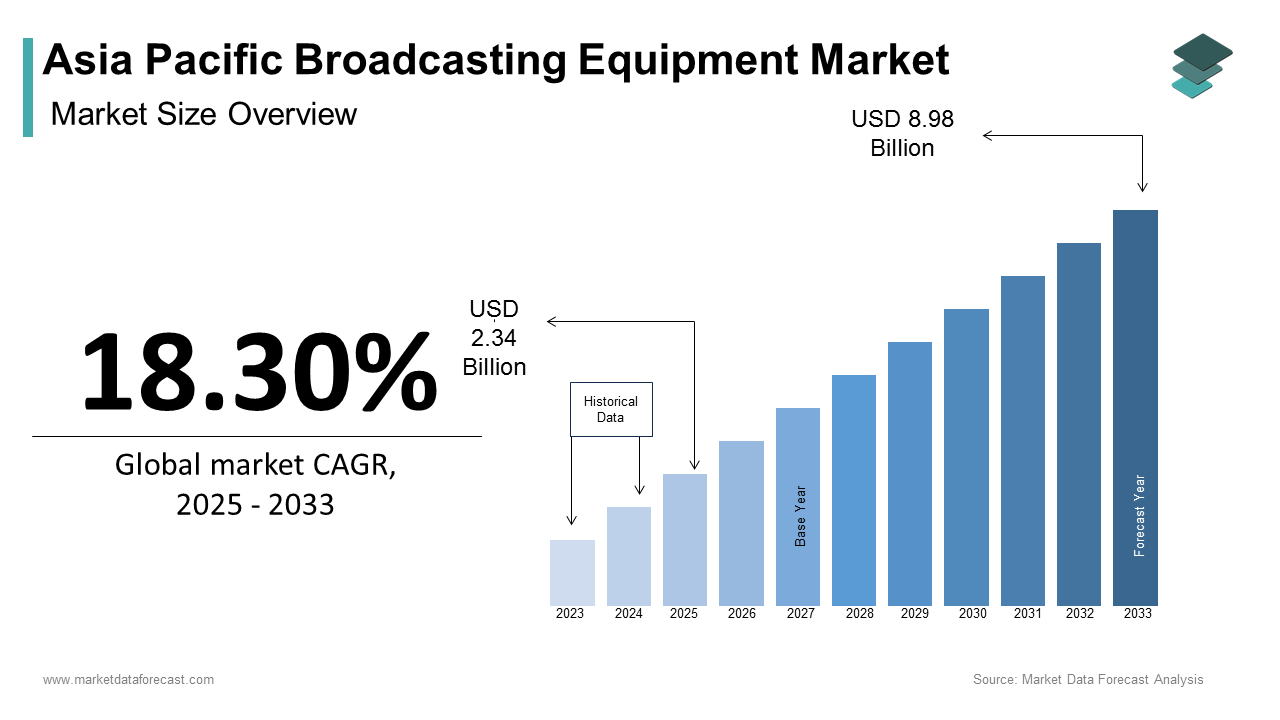

The Asia Pacific broadcasting equipment market size was calculated to be USD 1.98 billion in 2024 and is anticipated to be worth USD 8.98 billion by 2033, from USD 2.34 billion in 2025, growing at a CAGR of 18.30% during the forecast period.

Broadcasting equipment encompasses a wide range of tools including cameras, transmitters, encoders, mixers, and satellite systems all of which are essential for content creation, transmission, and distribution. The region’s diverse cultural landscape and increasing consumer appetite for real-time news, sports, and entertainment have positioned it as a hub for innovation and adoption of cutting-edge broadcasting technologies. Governments in the region are also prioritizing digital transformation. For instance, India’s Ministry of Information and Broadcasting launched the “Digital India” initiative to modernize its broadcasting ecosystem which ensures wider accessibility and higher-quality content delivery. The Asia Pacific region is poised to lead the global transition toward immersive and interactive media experiences with the convergence of traditional broadcasting and digital media.

MARKET DRIVERS

Rising Demand for High-Quality Content

Rising demand for high-definition (HD) and ultra-high-definition (UHD) content is one of the primary drivers of the Asia Pacific broadcasting equipment market. Over 70% of households in Japan now own UHD televisions which drive broadcasters to upgrade their equipment to meet consumer expectations. South Korea is leading the charge in producing 4K and 8K broadcasts for major events like the Olympics and eSports tournaments. The rise of premium content platforms has further fueled this demand. Subscription-based OTT services have grown annually which necessitates investments in advanced cameras, audio systems, and editing tools. Local broadcasters are adopting state-of-the-art encoding and transmission equipment to deliver uninterrupted streaming services. This focus on enhancing content quality ensures sustained growth in the broadcasting equipment market.

Expansion of Sports and Live Event Broadcasting

The expansion of sports leagues and live events being broadcast across the region is another driver of the Asia Pacific broadcasting equipment market. Over 200 million viewers tuned into live sports broadcasts in 2022 alone emphasizing the need for reliable broadcasting equipment. Major events like the Asian Games and cricket tournaments in India have prompted broadcasters to invest in portable cameras, drones, and satellite systems to capture every moment. Live sports account for over 40% of total television viewership making it a lucrative segment for broadcasters. The integration of augmented reality (AR) and virtual reality (VR) technologies into live broadcasts has further driven demand for specialized equipment.

MARKET RESTRAINTS

High Costs of Advanced Equipment

The high cost associated with cutting-edge technologies is a significant barrier to the widespread adoption of advanced broadcasting equipment in the Asia Pacific. Upgrading to 4K or 8K broadcasting equipment can require investments exceeding $1 million per station depending on the scale of operations. This financial burden is particularly challenging for smaller broadcasters operating in emerging economies like Indonesia and Vietnam. Moreover, the ongoing expenses related to maintenance and software updates add to the overall cost. Annual maintenance costs for broadcasting equipment can range from 10-15% of the initial investment deterring many operators from adopting advanced systems.

Limited Skilled Workforce

Shortage of skilled professionals capable of operating and maintaining advanced broadcasting equipment is another critical restraint in the Asia Pacific broadcasting equipment market. Additionally, the absence of standardized training programs exacerbates the issue. Fewer local technicians receive formal training in modern broadcasting technologies creating a bottleneck in service delivery. Addressing this challenge requires targeted educational initiatives and partnerships with industry stakeholders to enhance workforce capabilities.

MARKET OPPORTUNITIES

Integration of AI and Automation

The integration of artificial intelligence (AI) and automation into broadcasting equipment presents a significant opportunity for the Asia Pacific market. AI-driven tools can reduce production costs by up to 25% while enhancing content quality through automated editing and real-time analytics. These innovations are particularly relevant for live broadcasts where efficiency and precision are paramount. Furthermore, AI-powered systems enable personalized content delivery catering to the preferences of diverse audiences across the region. AI algorithms have improved audience engagement which allows broadcasters to optimize their programming strategies.

Growth of Regional OTT Platforms

The exponential growth of regional OTT platforms offers another promising opportunity for the broadcasting equipment market. Over 50% of consumers in Southeast Asia now prefer streaming services over traditional television creating a robust demand for advanced broadcasting tools. These platforms rely heavily on high-quality cameras, encoders, and transmission systems to deliver seamless viewing experiences. Local OTT providers are investing in next-generation broadcasting infrastructure to support 4K streaming and interactive features. Regional platforms are adopting cloud-based broadcasting solutions to enhance scalability and flexibility. This shift toward digital-first content positions the broadcasting equipment market for sustained growth.

MARKET CHALLENGES

Regulatory Fragmentation Across Countries

Regulatory fragmentation across countries is a pressing challenge for the Asia Pacific broadcasting equipment market which complicates compliance and standardization efforts. Each country in the region has its own set of broadcasting standards ranging from frequency allocations to content restrictions. This inconsistency creates operational hurdles for multinational broadcasters seeking to expand their reach.

For instance, the Vietnamese Ministry of Information and Communications enforces strict localization requirements mandating that foreign broadcasters partner with local entities to operate in the country. Similarly, Australia’s ACMA states that regulatory changes often delay the deployment of new technologies such as 5G-enabled broadcasting systems.

Cybersecurity Threats in Digital Broadcasting

The rising threat of cybersecurity breaches in digital broadcasting systems is another significant challenge for the Asia Pacific broadcasting equipment market. Over 40% of cyberattacks in the media sector target broadcasting infrastructure along with compromising data integrity and disrupting transmissions. This vulnerability is particularly concerning in countries like Thailand and Indonesia where cybersecurity measures are still in their infancy. Hackers exploit weaknesses in satellite systems and cloud-based platforms to steal content or disrupt live broadcasts. To address this issue, broadcasters must invest in robust encryption and monitoring systems adding to their operational costs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

18.30% |

|

Segments Covered |

By Technology, Application, Equipment, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

Sony Corporation, Panasonic Corporation, Hitachi Kokusai Electric, NEC Corporation, Huawei Technologies, Samsung Electronics, Fujitsu, Harmonic Inc., Grass Valley, Belden Inc., Imagine Communications, MediaKind, Cisco Systems, EVS Broadcast Equipment |

SEGMENTAL ANALYSIS

By Technology Insights

The digital broadcast segment was the largest in the Asia Pacific broadcasting equipment market with a significant share in 2024. A key factor behind digital broadcast’s dominance is the widespread adoption of digital television (DTV) standards across the region. Over 80% of households in urban areas have shifted to digital TV platforms necessitating investments in advanced broadcasting equipment. Countries like India and Vietnam have implemented phased analog shutdowns which accelerate the transition to digital infrastructure. Another contributing factor is the proliferation of internet protocol television (IPTV) and over-the-top (OTT) platforms. IPTV subscriptions have grown by 50% annually, driving broadcasters to adopt digital encoders and transmitters to deliver seamless streaming services.

The digital broadcast segment is projected to witness a CAGR of 14.2% during the forecast period. This growth is fueled by advancements in digital technologies such as 5G-enabled broadcasting and cloud-based solutions which enhance content delivery and audience engagement. One major driver is the integration of artificial intelligence (AI) and automation into digital broadcasting systems. These innovations are particularly relevant for live sports and events, where precision and scalability are critical. Additionally, the expansion of regional OTT platforms has further accelerated demand for digital broadcasting equipment. Local providers are investing heavily in next-generation infrastructure to support 4K streaming and interactive features.

By Application Insights

The television segment accounted for holding a prominent share of the Asia Pacific broadcasting equipment market in 2024 with the growing popularity of high-definition (HD) and ultra-high-definition (UHD) content which requires advanced broadcasting equipment to meet consumer expectations. Television viewership in Southeast Asia is driven by live broadcasts of sports leagues and cultural events. Another factor is the rise of smart TVs and connected devices. Over 50% of households in metropolitan cities own smart TVs creating a robust demand for advanced broadcasting solutions. These devices enable seamless access to streaming services further boosting the need for high-quality transmission equipment.

The radio segment is projected to witness a CAGR of 9.8% in the future period. This growth is driven by the resurgence of digital radio platforms and the integration of podcasting and on-demand audio content into traditional broadcasting models. A key factor propelling this growth is the increasing adoption of digital audio broadcasting (DAB) systems. DAB listenership has grown by 40% over the past five years encouraging broadcasters to upgrade their equipment to support higher-quality audio streams. Additionally, the rise of smart speakers and voice-activated devices has expanded the audience base for radio content. Over 30% of households now use smart speakers, creating new opportunities for broadcasters to leverage advanced audio equipment and technologies.

By Equipment Insights

The encoders segment dominated the Asia Pacific broadcasting equipment market by capturing 30.4% of the share in 2024. A key factor behind encoders’ vision is their compatibility with emerging technologies like 4K and 8K broadcasting. Another contributing factor is the growing demand for live-streaming services. Encoders are essential for real-time content delivery, particularly in sectors like sports and news. Their ability to integrate with cloud-based platforms further enhances scalability making them indispensable for modern broadcasting operations.

The transmitters and repeaters segment is projected to witness a CAGR of 12.5% during the forecast period with the expansion of 5G networks and the increasing number of regional broadcasters seeking to enhance signal coverage. One major driver is the deployment of 5G-enabled broadcasting systems. 5G networks have reduced latency by 50% enabling broadcasters to deliver real-time content with minimal disruptions. This technological advancement has increased demand for advanced transmitters and repeaters capable of supporting high-frequency transmissions. Additionally, rural electrification initiatives have expanded the reach of broadcasting infrastructure. Over 40% of rural areas now have access to digital broadcasting services, thanks to investments in transmitters and repeaters.

REGIONAL ANALYSIS

China was the top performer of the Asia Pacific broadcasting equipment market with 30.4% of share in 2024. The country’s dominance is rooted in its massive media industry and government-led digital transformation initiatives. Beijing’s “Digital Silk Road” program has spurred investments in next-generation broadcasting technologies ensuring widespread adoption of 4K and 8K systems. Additionally, the proliferation of OTT platforms has created a robust demand for advanced equipment and strengthened China’s position as a market leader.

Japan was positioned second in holding the dominant share of the Asia Pacific broadcasting equipment market and driven by its reputation for technological innovation and high consumer standards. Tokyo and Osaka are hubs for media production where broadcasters prioritize cutting-edge equipment to deliver UHD content. The government’s push for 5G-enabled broadcasting systems has further accelerated demand. India's broadcasting equipment market growth is lucratively to register the fastest CAGR by the end of the forecast period. The country’s transition from analog to digital broadcasting coupled with the rise of regional OTT platforms has created a surge in demand for advanced equipment. Initiatives like the “Digital India” campaign have ensured wider accessibility to high-quality content that ensures sustained growth in the broadcasting equipment sector.

South Korea’s supervision of 5G technology and eSports broadcasting has driven demand for state-of-the-art equipment. Seoul’s focus on exporting broadcasting solutions to neighboring countries further strengthens its position in the regional market.

Australia’s emphasis on digital radio and IPTV platforms has increased investments in broadcasting infrastructure is eventually to propel the growth of the Asia pacific broadcasting equipment market. Initiatives like the National Broadband Network have enhanced connectivity and ensured sustained demand for advanced broadcasting equipment.

LEADING PLAYERS IN THE ASIA PACIFIC BROADCASTING EQUIPMENT MARKET

Sony Corporation

Sony Corporation is a global leader in the Asia Pacific broadcasting equipment market renowned for its cutting-edge cameras, encoders, and transmission systems. The company’s focus on innovation has enabled it to deliver high-definition (HD) and ultra-high-definition (UHD) solutions that cater to the growing demand for premium content. Sony’s commitment to sustainability is evident in its development of energy-efficient broadcasting equipment aligning with regional environmental goals.

Panasonic Corporation

Panasonic Corporation is another key player leveraging its expertise in video production and audio technologies to dominate the market. The company’s advanced video servers and switchers are widely adopted by broadcasters across the region particularly for live sports and entertainment events. Panasonic’s emphasis on integrating artificial intelligence (AI) into its equipment enhances operational efficiency and content quality. Its strong distribution network and after-sales support further strengthen its reputation as a trusted provider of broadcasting solutions.

Cisco Systems, Inc.

Cisco Systems, Inc. is a prominent name in the market known for its cloud-based broadcasting solutions and robust networking infrastructure. The company’s transmitters, encoders, and repeaters enable seamless content delivery across multiple platforms including IPTV and OTT services. Cisco’s focus on cybersecurity ensures the protection of sensitive broadcasting data addressing a critical concern for modern broadcasters. Cisco continues to innovate and expand its footprint in the Asia Pacific broadcasting equipment market.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Partnerships with Local Stakeholders

Strategic partnerships with local stakeholders including broadcasters, governments, and technology providers have been a key priority for major players in the Asia Pacific broadcasting equipment market. These collaborations enable companies to tailor their offerings to regional needs such as supporting digital transformation initiatives or enhancing rural broadcasting infrastructure. For instance, partnerships with telecom operators ensure the integration of 5G-enabled broadcasting systems by enhancing connectivity and content delivery.

Focus on Innovation and Customization

Innovation remains a cornerstone strategy for maintaining a competitive edge. Leading companies invest heavily in R&D to develop next-generation technologies such as AI-driven tools and cloud-based platforms that address evolving customer demands. Customization is another critical aspect with firms offering solutions tailored to specific applications such as live sports or regional OTT platforms.

Expansion of After-Sales Services and Training Programs

Expansion of after-sales services including maintenance, repair and technical support is emphasized by key players to build long-term relationships with customers.These services ensure optimal performance of broadcasting equipment throughout its lifecycle reducing downtime and operational costs for users. Additionally, companies offer training programs to educate customers on the benefits and operation of advanced systems.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific broadcasting equipment market include Sony Corporation, Panasonic Corporation, Hitachi Kokusai Electric, NEC Corporation, Huawei Technologies, Samsung Electronics, Fujitsu, Harmonic Inc., Grass Valley, Belden Inc., Imagine Communications, MediaKind, Cisco Systems, EVS Broadcast Equipment.

The Asia Pacific broadcasting equipment market is characterized by intense competition driven by the region’s rapid technological advancements and increasing demand for high-quality content. Key players like Sony Corporation, Panasonic CCorporationn, and Cisco Systems dominate the landscape leveraging their technological expertise and extensive service networks to market Sony focuses on delivering UHD solutions and Panasonic emphasizes AI integration creating a dynamic rivalry. Smaller regional players also contribute to the competitive environment by offering cost-effective alternatives. Regulatory fragmentation across countries further intensifies competition as companies strive to adapt their offerings to meet diverse requirements. Innovation serves as a key battleground with firms investing in R&D to develop next-generation broadcasting technologies.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Sony Corporation launched a collaboration with India’s Ministry of Information and Broadcasting to provide advanced cameras and encoders for regional news channels.

- In June 2023, Panasonic Corporation signed a partnership agreement with a leading sports broadcaster in Australia to supply AI-enabled video servers for live event coverage.

- In September 2023, Cisco Systems announced the establishment of a dedicated training center in Singapore.

- In November 2023, Samsung Electronics introduced a new line of 8K broadcasting equipment specifically designed for South Korea’s eSports industry.

- In January 2024, Huawei Technologies partnered with a major OTT platform in Thailand to equip its infrastructure with 5G-enabled transmitters and repeaters.

MARKET SEGMENTATION

This research report on the Asia Pacific broadcasting equipment market has been segmented and sub-segmented based on technology, application, equipment, and region.

By Technology

- Analog Broadcast

- Digital Broadcast

By Application

- Television

- Radio

By Equipment

- Dish Antennas

- Switches

- Video Servers

- Encoders

- Transmitters and Repeaters

- Others

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What is driving the growth of the broadcasting equipment market in Asia Pacific?

Growth is driven by increasing demand for high-definition content, expansion of digital and OTT platforms, government investments in digital broadcasting, and the transition from analog to digital broadcasting.

2. Which countries are leading in the Asia Pacific broadcasting equipment market?

China, Japan, South Korea, and India are the key contributors due to advanced media infrastructures, rising media consumption, and government support for broadcasting upgrades.

3. Who are the key players in the Asia Pacific Broadcasting Equipment Market?

Major players include Sony Corporation, Panasonic Corporation, Hitachi Kokusai Electric, NEC Corporation, Huawei Technologies, Samsung Electronics, Fujitsu, Grass Valley, and Harmonic Inc.

4. How does digital transition affect equipment demand?

The shift to digital broadcasting is creating a strong demand for modern, efficient, and scalable equipment that supports higher quality and more flexible content delivery.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]