Asia Pacific Chillers Market Research Report – Segmented By Type ( Centrifugal Chillers, Scroll Chillers ) Medium, End-Use Industry and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis on Size, Share, Trends& Growth Forecast from 2025 to 2033

Asia Pacific Chillers Market Size

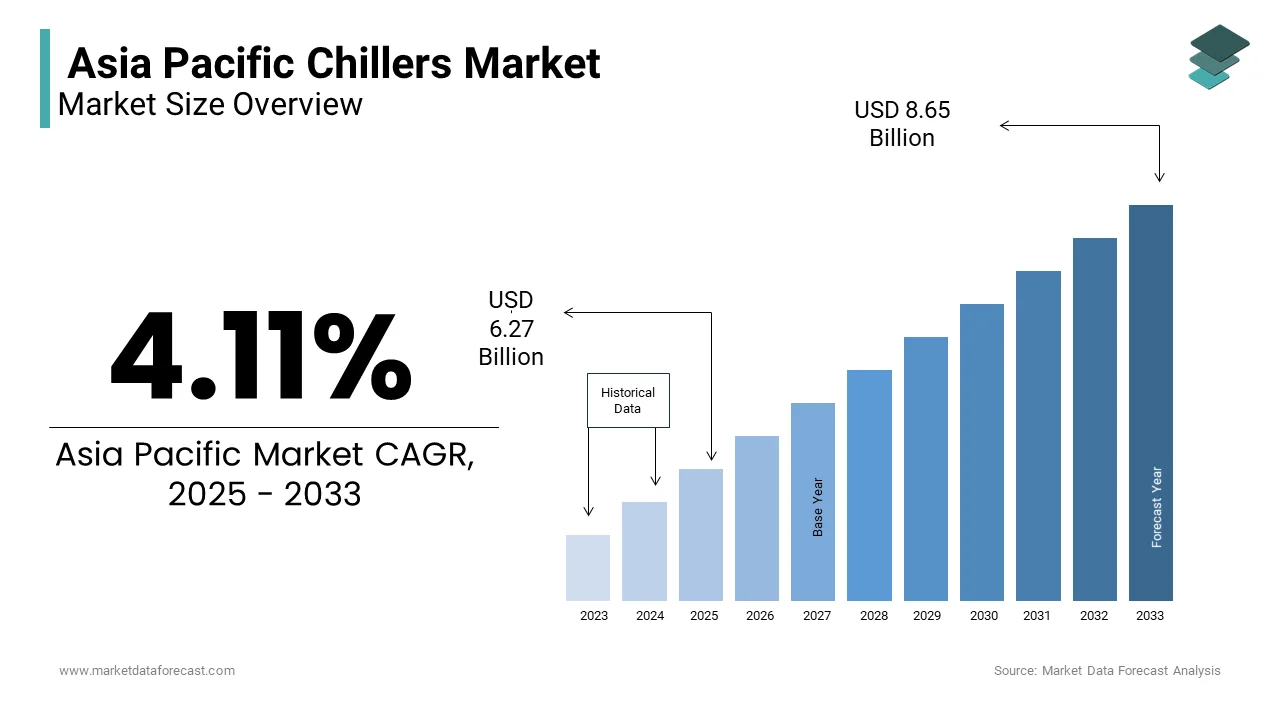

The Asia Pacific Chillers Market Size was valued at USD 6.02 billion in 2024. The Asia Pacific Chillers Market size is expected to have 4.11 % CAGR from 2025 to 2033 and be worth USD 8.65 billion by 2033 from USD 6.27 billion in 2025.

MARKET DRIVERS

Urbanization and Infrastructure Development

Urbanization remains a cornerstone of the Asia Pacific chillers market, with cities expanding rapidly to accommodate burgeoning populations. According to the United Nations, urban areas in Asia are expected to house over 55% of the population by 2030, creating immense demand for commercial buildings, hospitals, and shopping malls. These structures rely heavily on chillers for air conditioning and refrigeration. For instance, the Indian government's Smart Cities Mission aims to develop 100 smart cities, each requiring state-of-the-art HVAC systems, including chillers. Additionally, the rise of mixed-use developments, which combine residential, commercial, and retail spaces, is amplifying the need for centralized cooling solutions. This trend underscores how urbanization not only drives demand but also shapes the technological evolution of chillers, favoring energy-efficient and modular designs.

Industrial Growth and Process Cooling Needs

Industrial sectors such as pharmaceuticals, food processing, and chemicals are major consumers of chillers for process cooling. For example, India’s pharmaceutical industry requires precise temperature control for drug manufacturing, boosting the adoption of industrial chillers. Similarly, the food and beverage sector in Thailand and Vietnam is expanding. This necessitates advanced chilling systems to maintain product quality. Such industrial growth ensures sustained demand for chillers, making it a key driver of the market.

MARKET RESTRAINTS

High Initial Costs and Budget Constraints

One of the primary restraints hindering the Asia Pacific Chillers Market is the high upfront cost associated with advanced chiller systems. This financial barrier is particularly pronounced in developing economies like Bangladesh and Indonesia, where small and medium enterprises (SMEs) dominate the industrial landscape. SMEs often lack the capital to invest in high-efficiency chillers, opting instead for cheaper, less sustainable alternatives. Moreover, public sector projects, which constitute a significant portion of the demand, face budgetary limitations. The Asian Development Bank notes that municipal budgets for infrastructure upgrades are often constrained, delaying the adoption of modern chillers in public facilities such as schools and hospitals. Even in wealthier nations like Japan, economic uncertainties have led businesses to prioritize short-term cost savings over long-term energy efficiency gains.

Stringent Environmental Regulations

While environmental regulations aim to promote sustainability, they inadvertently act as a restraint by increasing compliance costs for manufacturers. As per the United Nations Environment Programme, the phase-out of hydrofluorocarbon (HFC) refrigerants under the Kigali Amendment has forced chiller manufacturers to adopt low-global-warming-potential (GWP) alternatives. However, these substitutes, such as natural refrigerants, often require significant R&D investments and redesign efforts. For instance, a study by the Climate and Clean Air Coalition highlights that retrofitting existing chillers to comply with new standards can increase operational costs. This is particularly challenging for smaller players who lack the resources to adapt quickly. Additionally, regulatory fragmentation across the region complicates compliance, as countries like Australia enforce stricter norms compared to others.

MARKET OPPORTUNITIES

Adoption of IoT-Enabled Smart Chillers

The integration of Internet of Things (IoT) technology into chillers presents a transformative opportunity for the Asia Pacific market. Smart chillers equipped with sensors and predictive maintenance capabilities can optimize energy consumption and reduce operational downtime. In countries like South Korea and Singapore, where smart city initiatives are gaining traction, IoT-based chillers are becoming integral to sustainable urban planning.

For instance, Singapore’s Building and Construction Authority mandates that all new commercial buildings achieve Green Mark certification, encouraging the use of smart HVAC systems. Furthermore, the proliferation of data centers in the region, which require precise thermal management, is driving demand for IoT-integrated chillers. By leveraging IoT, manufacturers can differentiate their offerings and tap into the growing appetite for intelligent building solutions.

Expansion into Tier-II and Tier-III Cities

Another promising opportunity lies in expanding chiller distribution networks to Tier-II and Tier-III cities, where urbanization is accelerating. In India, for example, cities like Ahmedabad and Pune are witnessing rapid industrial and commercial development, creating a fertile ground for chiller adoption. Smaller cities often lack access to advanced cooling technologies, presenting an untapped market for manufacturers. A study by the Confederation of Indian Industry reveals that Tier-II cities account for a notable share of the country’s industrial output, yet their adoption of energy-efficient chillers remains low. By establishing local service centers and offering affordable financing options, companies can penetrate these markets effectively.

MARKET CHALLENGES

Intense Price Competition and Margins Pressure

The Asia Pacific Chillers Market faces significant challenges due to intense price competition, which erodes profit margins and stifles innovation. This dynamic forces companies to compete on pricing rather than technological differentiation, undermining investments in R&D. For example, a report by the Federation of Indian Chambers of Commerce and Industry highlights that domestic chiller manufacturers in India have seen their profit margins shrink by 15% over the past five years due to import pressures. Additionally, buyers in the region often prioritize upfront costs over lifecycle savings, discouraging the adoption of premium products. The resulting margin squeeze limits manufacturers' ability to innovate and offer cutting-edge solutions, posing a significant challenge to long-term growth.

Supply Chain Disruptions and Raw Material Volatility

Supply chain disruptions and volatility in raw material prices represent another critical challenge for the Asia Pacific chillers market. According to the World Economic Forum, the ongoing semiconductor shortage has impacted the production of electronic components essential for modern chillers, delaying deliveries and increasing costs. Similarly, fluctuations in copper and aluminum prices, key materials for chiller manufacturing, have created uncertainty. Also, copper prices surged between 2020 and 2022, significantly affecting production expenses. These challenges are compounded by geopolitical tensions and trade restrictions, which disrupt supply chains further. For instance, the U.S.-China trade war has led to tariff impositions on critical components, forcing manufacturers to seek alternative suppliers at higher costs. Such disruptions not only inflate production expenses but also hinder timely project execution, straining customer relationships and eroding trust in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.11 % |

|

Segments Covered |

By Type, Medium, End-Use Industry and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

China, India, Japan, South Korea, Australia, New Zealand, Thailand, Indonesia, Philippines, Vietnam, Singapore, Rest of APAC. |

|

Market Leader Profiled |

Johnson Controls International (Cork, Ireland), Trane (Dublin, Ireland), Carrier (Florida, United States) |

SEGMENTAL ANALYSIS

By Type Insights

The segment of centrifugal chillers dominate the Asia Pacific Chillers Market by capturing a 35.7% of the market share in 2024. This dominance is primarily driven by their superior energy efficiency and scalability, making them ideal for large-scale commercial and industrial applications. For instance, centrifugal chillers are widely used in data centers, which require precise cooling solutions to maintain optimal operating temperatures. Another key factor driving this segment's leadership is the increasing adoption of green building practices. As per the World Green Building Council, a significant portion of new constructions in the region are designed to meet sustainability standards, favoring energy-efficient technologies like centrifugal chillers. Additionally, government incentives play a pivotal role. In Japan, subsidies for energy-efficient HVAC systems have led to a annual increase in centrifugal chiller installations.

The scroll chillers segment the fastest-growing segment in the Asia Pacific chillers market, with a projected CAGR of 9.5% from 2025 to 2033. Their growth is attributed to their compact design, low noise levels, and suitability for small-to-medium applications, making them ideal for emerging urban centers. Moreover, a significant driver of this growth is the proliferation of Tier-II and Tier-III cities. Ernst & Young notes that these cities account for a significant share of the region’s urban expansion, creating demand for affordable yet efficient cooling solutions. Scroll chillers, with their lower upfront costs compared to centrifugal models, are gaining traction in these areas. Furthermore, advancements in scroll technology, such as variable-speed compressors, are enhancing their performance. According to the American Society of Heating, Refrigerating and Air-Conditioning Engineers, scroll chillers with variable-speed capabilities can reduce energy consumption, making them attractive for energy-conscious buyers.

By Medium Insights

The water-cooled chillers segment led the Asia Pacific Chillers Market by holding a 45.2% market share in 2024. Also, the growth of this segment is due to their exceptional energy efficiency and ability to handle large cooling loads, making them indispensable for industries like chemicals and petrochemicals. The rise of green buildings further amplifies demand for water-cooled systems. Additionally, the growing emphasis on district cooling systems in urban hubs like Singapore and Hong Kong is propelling adoption.

The segment of air-cooled chillers is the quickest expanding, with a CAGR of 8.2%. Their growth is driven by their ease of installation and lower maintenance requirements, appealing to smaller businesses and residential complexes. One major factor is the rapid urbanization in Southeast Asia, where space constraints make air-cooled chillers a practical solution. The United Nations projects that urban populations in countries like Vietnam and Thailand will grow notably each year, boosting demand for compact cooling systems. Moreover, technological advancements, such as improved heat exchangers, are enhancing their efficiency. According to the International Institute of Refrigeration, modern air-cooled chillers now achieve energy savings, narrowing the gap with water-cooled systems. These developments ensure sustained growth for the air-cooled segment.

By End-Use Industry Insights

The chemical and petrochemical industry was the largest end-user segment with 28.7% of the Asia Pacific Chillers Market in 2024. This dominance is fueled by the region’s robust industrial base, with China and India being global leaders in chemical production. For instance, the Indian Chemical Council reports that the country’s chemical sector grew notably in the last few years, necessitating advanced chilling solutions for process cooling. Energy efficiency regulations also play a critical role. A significant share of chemical plants in the region have adopted energy-efficient chillers to comply with environmental norms. Additionally, the expansion of petrochemical hubs, such as those in Saudi Aramco’s joint ventures in Southeast Asia, is driving demand.

The medical and pharmaceuticals segment is the swiftest expanding, with a CAGR of 10.5%. This growth is driven by the increasing demand for precise temperature control in drug manufacturing and storage. A key factor is the expansion of biopharmaceutical facilities. Additionally, vaccine production during the pandemic has accelerated chiller adoption. Like, cold chain infrastructure in the region grew notably in recent years, with chillers playing a crucial role.

COUNTRY LEVEL ANALYSIS

China led the Asia Pacific Chillers Market by commanding a 35% share in 2024. The country’s dominance is driven by its massive industrial base and rapid urbanization. Additionally, the Belt and Road Initiative has spurred infrastructure development across Asia, indirectly boosting chiller demand. Also, Chinese manufacturers are also investing in IoT-enabled chillers, achieving an annual increase in smart system adoption.

India is contributing majorly to the regional market. The Smart Cities Mission and rising industrial output are key drivers. Moreover, government incentives for energy-efficient systems have led to an increase in chiller installations in Tier-II cities, according to Deloitte.

Japan holds a notable portion of the market share and is driven by its focus on sustainability. A notable share of Japanese buildings use energy-efficient chillers, supported by stringent environmental laws. Additionally, the country’s aging population has increased demand for medical-grade chillers.

South Korea contributes small but important share to the market, propelled by its semiconductor industry. Also, the country’s semiconductor exports grew significantly in recent years, requiring advanced chillers for precision cooling.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Asia Pacific Chillers Market are Johnson Controls International (Cork, Ireland), Trane (Dublin, Ireland), Carrier (Florida, United States), Mitsubishi Electric Corporation (Tokyo, Japan), Daikin Airconditioning India Pvt. Ltd. (Osaka, Japan), Smardt Chiller Group (Quebec, Canada), Multistack LLC (Wisconsin, United States), Thermax Limited (Maharashtra, India), Thermal Care Inc. (Illinois, United States), Midea Group (Foshan, China).

The Asia Pacific Chillers Market is characterized by intense competition, driven by technological advancements and increasing demand for sustainable solutions. Established players like Carrier, Daikin, and Trane dominate through continuous innovation, while regional manufacturers offer cost-effective alternatives. The market is witnessing a surge in IoT-enabled chillers, creating opportunities for differentiation. Regulatory mandates promoting energy efficiency further intensify rivalry, pushing companies to invest in R&D. Additionally, emerging markets like India and Vietnam are attracting investments, fostering a dynamic competitive landscape.

Top Players in the Market

Carrier Global Corporation

Carrier Global Corporation is a leading player in the Asia Pacific chillers market, renowned for its innovative HVAC solutions. The company has been instrumental in driving energy-efficient technologies, particularly through its AquaEdge and AquaForce chiller series. By collaborating with regional governments, Carrier has expanded its footprint in green building projects across India and Southeast Asia. Its focus on R&D ensures compliance with evolving environmental regulations, reinforcing its leadership in the region.

Daikin Industries Ltd.

Daikin Industries Ltd. has established itself as a pioneer in the Asia Pacific market with its advanced air-cooled and water-cooled chillers. The company’s emphasis on smart cooling technologies has positioned it as a key innovator. Through partnerships with local distributors, Daikin has strengthened its presence in Tier-II cities, addressing the growing demand for affordable yet efficient cooling solutions.

Trane Technologies

Trane Technologies is a prominent contributor to the Asia Pacific chillers market, offering cutting-edge centrifugal and absorption chillers. The company’s EcoWise portfolio focuses on low-GWP refrigerants, aligning with regional sustainability goals. By investing in training programs for technicians, Trane has improved service delivery, ensuring customer satisfaction and long-term loyalty in markets like China and Australia.

Top Strategies Used by Key Market Participants

Key players in the Asia Pacific Chillers Market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives. Product innovation is central, with companies launching IoT-enabled chillers to meet smart city demands. Strategic collaborations with local governments and industries have also been pivotal, enabling tailored solutions for diverse applications. Additionally, sustainability remains a core focus, with manufacturers adopting eco-friendly refrigerants and energy-efficient designs. These strategies collectively enhance market penetration and customer engagement.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Carrier Global Corporation launched its Abound platform, integrating IoT to optimize chiller performance and support sustainability goals.

- In June 2023, Daikin Industries partnered with Indian distributors to expand its reach in Tier-II cities, focusing on affordable cooling solutions.

- In January 2024, Trane Technologies introduced its Nexia Building Automation System, enhancing chiller integration with smart infrastructure.

- In March 2024, Mitsubishi Electric unveiled its P-Series chillers, featuring low-GWP refrigerants to comply with environmental regulations.

- In May 2024, Johnson Controls acquired a regional AI startup, strengthening its predictive maintenance capabilities for chillers in Asia Pacific.

MARKET SEGMENTATION

This research report on the asia pacific chillers market has been segmented and sub-segmented into the following.

By Type

- Centrifugal Chillers

- Scroll Chillers

By Medium

- Water-Cooled Chillers

- Air-Cooled Chillers

By End-Use Industry

- Chemical & Petrochemical

- Medical and Pharmaceuticals

By Country

- China

- India

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Indonesia

- Philippines

- Vietnam

- Singapore

- Rest of APAC

Frequently Asked Questions

What are chillers, and why are they important in the Asia Pacific region?

Chillers are cooling systems used to remove heat from a liquid, widely used in HVAC systems for buildings, manufacturing processes, and data centers—especially critical in tropical climates like Southeast Asia.

Which countries in Asia Pacific have the highest demand for chillers?

China, India, Japan, South Korea, and Southeast Asian countries like Indonesia and Vietnam are major markets due to rapid urbanization, industrial growth, and infrastructure development.

What are the challenges faced by the Asia Pacific chillers market?

Challenges include are High initial investment costs Fluctuating energy prices Complex installation and maintenance processes Need for skilled labor.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com