Asia Pacific Choline Chloride Market Size, Share, Trends & Growth Forecast Report By Application (Poultry Feed, Swine Feed, Pet Feed, Human Nutrition, Oil and Gas), and Country (India, China, Japan, South Korea, Australia, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific Choline Chloride Market Size

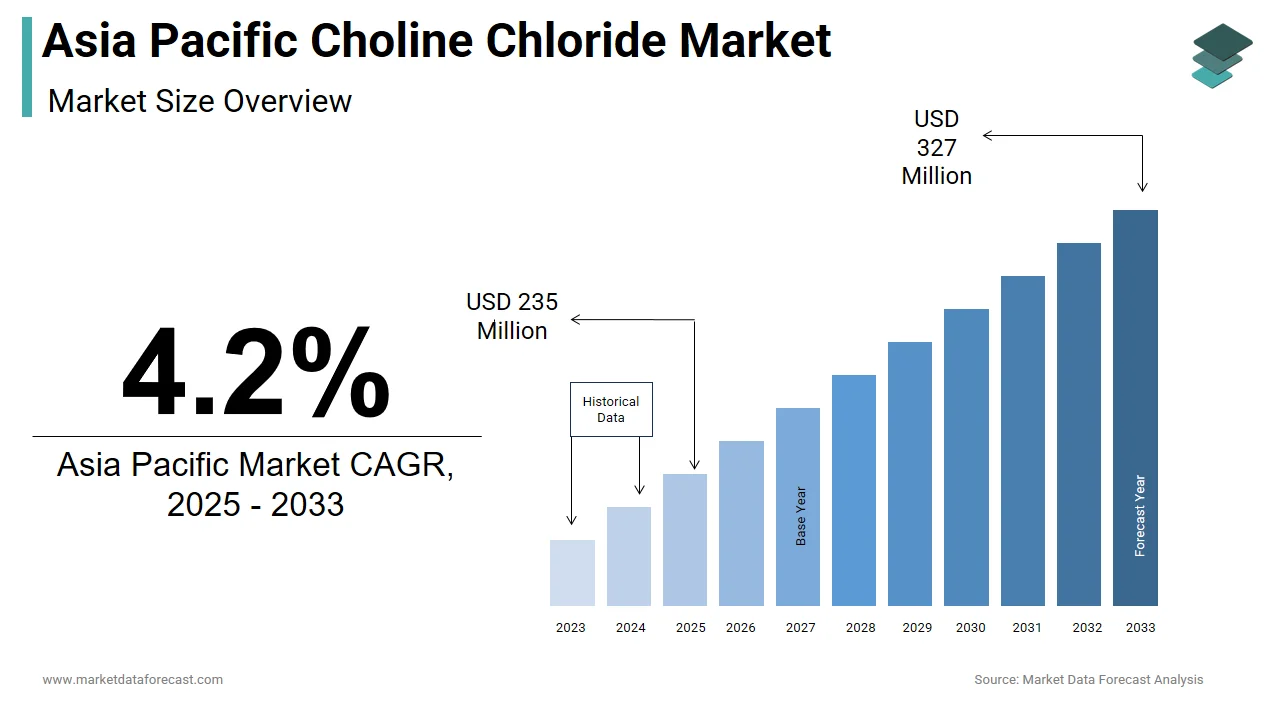

The size of the Asia Pacific choline chloride market was worth USD 226 million in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 4.2% from 2025 to 2033 and be worth USD 327 million by 2033 from USD 235 million in 2025.

Choline chloride is a water-soluble quaternary ammonium salt widely used as an essential nutrient in animal feed, functioning as a source of choline, a vital component for fat metabolism, liver function, and nervous system development. In the Asia Pacific region, it plays a critical role in supporting intensive livestock production systems in poultry and swine farming. The Asia Pacific choline chloride market encompasses its production, supply chain dynamics, and application across the agricultural and industrial sectors.

MARKET DRIVERS

Expansion of Poultry and Livestock Farming

One of the primary drivers of the Asia Pacific choline chloride market is the rapid expansion of poultry and livestock farming in countries such as China, India, Thailand, and Vietnam. Choline chloride serves as a crucial feed additive that supports efficient nutrient absorption, improves weight gain, and prevents fatty liver syndrome in broilers and layers. As per the Food and Agriculture Organization, Asia accounts for over 60% of global poultry meat production, with China and India being the top two producers after the United States.

In China, the National Bureau of Statistics reported that poultry meat output reached 23 million metric tons in 2024, with a steady increase from previous years. This growth is attributed to rising consumer demand for affordable protein sources and government-backed initiatives promoting modernized farming techniques.

Furthermore, large-scale poultry integrators such as CP Group in Thailand and Godrej Agrovet in India have adopted standardized feed formulations that include choline chloride to enhance productivity and disease resistance.

Regulatory Emphasis on Reducing Antibiotic Use in Animal Feed

Another major driver fueling the Asia Pacific choline chloride market is the increasing regulatory focus on reducing antibiotic use in animal feed, which has prompted the adoption of alternative nutritional supplements to maintain livestock health and productivity. Governments across the region are implementing stricter guidelines to curb antimicrobial resistance by encouraging the use of functional feed additives like choline chloride. According to the World Organisation for Animal Health, several Asian countries have introduced policies to phase out non-therapeutic antibiotic growth promoters (AGPs) in livestock production. In China, the Ministry of Agriculture and Rural Affairs issued a directive in 2020 banning the use of certain antibiotics in animal feed, leading to a surge in demand for natural and supportive feed ingredients.

Similarly, in South Korea, the Ministry of Food and Drug Safety implemented new regulations in 2023 mandating reduced antibiotic levels in poultry and swine feed, which is prompting feed manufacturers to reformulate their products. Indian state governments have also launched awareness campaigns promoting antibiotic-free poultry farming, supported by research from institutions like the Indian Council of Agricultural Research.

MARKET RESTRAINTS

Volatility in Raw Material Prices Affects Production Costs

A major restraint affecting the Asia Pacific choline chloride market is the volatility in raw material prices for ethylene oxide and trimethylamine, which are key inputs in its synthesis. Fluctuations in these chemical prices are influenced by factors such as crude oil prices, geopolitical tensions, and supply chain disruptions, all of which impact the cost structure of choline chloride manufacturers.

According to the International Energy Agency, crude oil prices experienced significant fluctuations in 2024 due to shifting global demand patterns and OPEC+ production cuts. Since ethylene oxide is derived from petroleum refining, any change in crude oil pricing directly affects its availability and cost. The Chemical Business Association of Japan reported that ethylene oxide prices in the Asia Pacific region increased by approximately 12% in early 2024 compared to the previous year, putting pressure on choline chloride producers to either absorb higher costs or pass them on to end users.

Moreover, logistics challenges caused by port congestion and container shortages have further inflated transportation expenses. As per the World Bank, freight rates for bulk chemicals rose by around 10% in 2024, adding to the financial burden on manufacturers. These cost pressures limit profit margins and reduce the ability of smaller players to compete effectively, thereby restraining overall market expansion in the Asia Pacific region.

Stringent Environmental Regulations Impacting Manufacturing Practices

Stringent environmental regulations pose another significant restraint on the Asia Pacific choline chloride market, as manufacturing facilities face increasing scrutiny over emissions, waste disposal, and chemical handling practices. Governments across the region are tightening norms to align with global sustainability goals by requiring companies to invest heavily in compliance measures.

In China, the Ministry of Ecology and Environment has enforced stricter emission limits for chemical plants under its revised Pollution Prevention and Control Law implemented in 2024. Compliance with these standards necessitates upgrades to wastewater treatment systems and air filtration units.

MARKET OPPORTUNITIES

Rising Demand for Organic and Natural Animal Feed Ingredients

An emerging opportunity for the Asia Pacific choline chloride market lies in the increasing consumer preference for organic and natural animal feed ingredients, driven by heightened awareness about food safety and animal welfare. Choline chloride, being a naturally occurring nutrient, is gaining traction as a safe and effective supplement in clean-label feed formulations.

According to the Organic Trade Association, the demand for certified organic meat and dairy products has been rising steadily in Asia, particularly in Japan, South Korea, and Australia. These markets emphasize stringent quality standards, encouraging livestock producers to adopt feed additives that align with organic certification criteria. Moreover, in Southeast Asia, countries such as Thailand and Malaysia are witnessing a surge in premium poultry brands that promote antibiotic-free and hormone-free meat. As per the Malaysian Livestock Association, over 30% of commercial poultry producers have transitioned to organic feed formulations since 2022, incorporating essential nutrients like choline chloride to ensure optimal growth and health.

Growth in Aquaculture and Alternative Protein Sources

Another promising opportunity for the Asia Pacific choline chloride market is the rapid expansion of aquaculture and alternative protein production, both of which require specialized feed formulations to support high-yield and sustainable operations. Choline chloride plays a crucial role in fish and shrimp diets by aiding lipid metabolism and preventing liver disorders, making it an essential additive in aquafeed.

According to the Food and Agriculture Organization, aquaculture now accounts for more than 50% of global seafood consumption, with Asia producing over 90% of the world’s farmed fish. In China, the Ministry of Agriculture and Rural Affairs reported that aquaculture output exceeded 50 million metric tons in 2024, driven by strong domestic and export demand. As part of its strategy to enhance aquaculture productivity, the government has encouraged the use of fortified feed, including choline-enriched variants.

MARKET CHALLENGES

Intense Competition from Substitute Nutritional Additives

One of the primary challenges facing the Asia Pacific choline chloride market is the intense competition from alternative nutritional additives that serve similar physiological functions in animal feed. Compounds such as betaine, methionine, and synthetic choline analogs are increasingly being explored as potential replacements or complements to choline chloride, depending on formulation economics and performance outcomes.

Additionally, synthetic alternatives such as choline bitartrate and choline citrate are being promoted for their enhanced stability and bioavailability in specific livestock applications. While choline chloride remains a standard in many feed programs, the increasing presence of substitutes poses a challenge to its market dominance, which is compelling manufacturers to differentiate through product innovation and value-added services.

Fluctuating Demand from Traditional Feed Formulations

Another significant challenge confronting the Asia Pacific choline chloride market is the fluctuating demand from traditional feed formulations, largely influenced by economic conditions, livestock disease outbreaks, and changes in dietary preferences. The market is highly sensitive to shifts in animal protein consumption patterns and feed conversion efficiencies, which can alter the volume of choline chloride required in feed premixes.

In 2024, several Asian countries faced outbreaks of avian influenza, particularly in China, Japan, and South Korea, leading to temporary declines in poultry production. According to the World Organisation for Animal Health, over 5 million birds were culled in East Asia during the first half of 2024 due to bird flu containment measures. This disruption resulted in reduced demand for poultry feed additives, including choline chloride.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Application and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

BASF SE, Eastman Chemical Company, Jubilant Life Sciences Limited, NB Group Co. Ltd., and Kemin Industries, Inc. |

SEGMENTAL ANALYSIS

By Application Insights

The poultry feed application segment was the largest and held 45.3% of the Asia Pacific choline chloride market share in 2024. One major driver behind this dominance is the rapid expansion of commercial poultry farming across countries like China, India, Thailand, and Vietnam. According to the Food and Agriculture Organization, Asia accounts for over 60% of global poultry meat output, with China producing around 23 million metric tons of poultry meat in 2024 alone. As per the Chinese Ministry of Agriculture and Rural Affairs, the country’s broiler chicken population exceeded 6 billion in 2024, requiring substantial volumes of fortified feed additives, including choline chloride.

The human nutrition segment is emerging with a CAGR of 8.4% during the forecast period. This rapid growth is driven by increasing awareness of choline’s essential role in cognitive development, liver function, and maternal health, particularly among urban populations. A key factor fueling this trend is the rising adoption of dietary supplements and fortified food products in countries such as Japan, South Korea, and Australia. According to the Japanese Health and Nutrition Survey, over 30% of pregnant women in Japan were found to have insufficient choline intake, prompting increased inclusion of choline chloride in prenatal vitamins and functional foods. The Ministry of Health, Labour and Welfare further encouraged the fortification of infant formulas with choline by aligning with WHO recommendations.

In South Korea, the Korean Society of Clinical Nutrition reported a 15% rise in sales of brain-health supplements containing choline derivatives in 2024, reflecting growing consumer interest in cognitive wellness. Similarly, in Australia, the Australian Institute of Health and Welfare noted an uptick in functional beverage and energy drink consumption, many of which now include choline chloride as a nutrient booster.

COUNTRY LEVEL ANALYSIS

China was the largest contributor with 35.4% of the Asia Pacific choline chloride market share in 2024. According to the National Bureau of Statistics of China, the country produced over 23 million metric tons of poultry meat and nearly 55 million metric tons of pork in 2024. The Ministry of Agriculture and Rural Affairs also implemented policies to phase out antibiotic growth promoters, encouraging greater use of nutritional supplements like choline chloride. Moreover, domestic manufacturers such as Sichuan Tongjiang Hongda and Shandong Lvhua have expanded their choline chloride production capacities to meet both internal and export demand.

India was positioned second with 20.3% of the Asia Pacific choline chloride market share in 2024. The country’s rapidly expanding livestock and poultry sectors are the primary drivers behind this growth, supported by government initiatives aimed at boosting agricultural productivity. As per the Department of Animal Husbandry and Dairying, India’s poultry production grew by 6% annually between 2020 and 2024, with egg output reaching 120 billion units in FY 2024. Swine production, though smaller compared to poultry, is also gaining traction, especially in states like Uttar Pradesh and West Bengal.

Japan choline chloride market is likely to grow with prominent growth opportunities, with its strong emphasis on human nutrition and premium feed applications. Unlike other markets where choline chloride is primarily used in livestock feed, Japan sees significant utilization in dietary supplements, infant formula, and fortified food products.

According to the Japanese Ministry of Health, Labour and Welfare, choline was officially recognized as a conditionally essential nutrient in 2022, which is leading to stricter fortification guidelines for baby food and maternal supplements. The National Institute of Health and Nutrition reported that over 40% of Japanese adults showed suboptimal choline levels, prompting increased incorporation of choline chloride into functional beverages and health supplements.

South Korea's choline chloride market is growing with its advanced agricultural practices and growing focus on human nutrition. The country’s well-developed livestock sector in poultry and swine supports consistent demand for fortified feed ingredients.

Australia's choline chloride market is likely to grow steadily in the coming years, with the emphasis on high-quality feed and human nutrition products. While not the largest volume consumer, Australia’s market is notable for its adherence to strict safety and sustainability standards.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC choline chloride market profiled in this report are BASF SE, Eastman Chemical Company, Jubilant Life Sciences Limited, NB Group Co., Ltd., and Kemin Industries, Inc.

TOP LEADING PLAYERS IN THE MARKET

BASF SE

BASF is a global leader in the choline chloride market and holds a strong presence in the Asia Pacific region. The company offers high-quality feed additives under its Animal Nutrition division, catering to poultry, swine, and aquaculture sectors. With advanced production technologies and a well-established distribution network, BASF supports large-scale livestock producers across China, India, and Southeast Asia. Its commitment to innovation and sustainability has made it a trusted supplier in both conventional and emerging feed markets.

Cargill, Incorporated

Cargill plays a crucial role in the Asia Pacific choline chloride market through its integrated animal nutrition business. The company supplies customized feed solutions that include essential nutrients like choline chloride to enhance productivity and animal health. With a focus on agricultural supply chain optimization, Cargill serves major poultry and swine producers in China, Thailand, and Vietnam. Its strategic partnerships with local feed manufacturers help strengthen regional market penetration and ensure consistent product availability.

Evonik Industries AG

Evonik is a key player known for its specialty additives in animal nutrition, including high-purity choline chloride products. The company emphasizes research-driven formulations tailored for efficient nutrient absorption and metabolic support in livestock. In the Asia Pacific region, Evonik collaborates with integrators and feed mills to promote sustainable feeding practices. Its technical expertise and customer-centric approach position it as a preferred partner in supporting the growth of modern livestock farming systems.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by leading players is product innovation and formulation customization. Companies are developing enhanced choline chloride variants that offer improved stability, bioavailability, and ease of handling to meet specific requirements across different livestock species and production systems. This helps them cater to diverse customer needs while maintaining product differentiation in a competitive landscape.

Another key approach is expanding regional presence through partnerships and localized manufacturing. Several companies have established joint ventures or distribution alliances with regional feed producers to ensure reliable supply chains and faster response to market demands. These collaborations also facilitate knowledge exchange and allow for better alignment with local regulatory frameworks and consumer preferences.

COMPETITION OVERVIEW

The competition in the Asia Pacific choline chloride market is shaped by a mix of multinational corporations and regional chemical producers striving to capture market share through differentiation, innovation, and strategic positioning. Global leaders such as BASF, Cargill, and Evonik leverage their technological expertise, extensive distribution networks, and strong brand recognition to maintain dominance in premium segments. At the same time, domestic manufacturers in countries like China and India are gaining traction by offering cost-effective alternatives and localized service support. The market is witnessing increased rivalry not only in pricing but also in product quality, formulation flexibility, and after-sales technical assistance. As demand from the livestock and human nutrition sectors continues to evolve, companies are focusing on expanding production capabilities, enhancing product portfolios, and strengthening supply chain efficiencies. Regulatory changes, shifting consumer preferences, and sustainability concerns are further influencing competitive dynamics by prompting firms to adopt agile strategies that align with regional trends and industry standards.

RECENT MARKET DEVELOPMENTS

- In January 2024, BASF launched a new line of stabilized choline chloride products designed specifically for tropical climates across Southeast Asia. This initiative was aimed at improving feed efficiency in high-temperature environments and reinforcing the company’s position in the region's growing livestock sector.

- In June 2024, Cargill announced a collaboration with a leading Indian poultry integrator to develop customized feed premixes incorporating optimized levels of choline chloride. The partnership was intended to enhance broiler performance and support antibiotic-free poultry production in alignment with evolving consumer preferences.

- In September 2024, Evonik expanded its technical service team in China to provide direct on-site support to feed manufacturers and livestock producers. This move was part of a broader effort to strengthen customer engagement and promote best practices in choline supplementation across intensive farming operations.

- In November 2024, Sichuan Tongjiang Hongda, a major Chinese choline chloride producer, commissioned a new production facility in Sichuan province to increase domestic supply capacity. The expansion was designed to meet rising demand from the country’s rapidly growing swine and aquaculture industries.

- In March 2025, Adisseo, a global leader in animal nutrition, opened a regional innovation center in Singapore to conduct localized research on choline chloride applications in aquafeed and alternative protein diets. This initiative was aimed at supporting the development of next-generation feed solutions tailored to the Asia Pacific market needs.

MARKET SEGMENTATION

This Asia Pacific choline chloride market research report is segmented and sub-segmented into the following categories.

By Application

- Poultry Feed

- Swine Feed

- Pet Feed

- Human Nutrition

- Oil and Gas

- Other Applications (Aquaculture Feed and Catalyst Application)

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific choline chloride market?

The Asia Pacific choline chloride market is driven by rising demand in animal feed, especially poultry and aquaculture, expanding livestock production, and increasing use in human nutrition and agriculture

2. What challenges affect the Asia Pacific choline chloride market?

The Asia Pacific choline chloride market faces challenges from raw material price fluctuations, fragmented regulations across countries, high freight costs, and skilled workforce shortages impacting production

3. What opportunities exist in the Asia Pacific choline chloride market?

The Asia Pacific choline chloride market offers opportunities in sustainable production methods, local manufacturing expansion, novel applications in agriculture and health, and strategic regional partnerships

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com