Asia Pacific Cold Insulation Market Report – Segmented By Material (Glass Fibre, Cellular Glass, Glass Mineral, Wool Phenolic Foam, Polystyrene Foam, Polyurethane Foam, Poly-isocyanurate Foam, Polyethylene Foam, Synthetic Rubber, Others),Application, End-Use, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

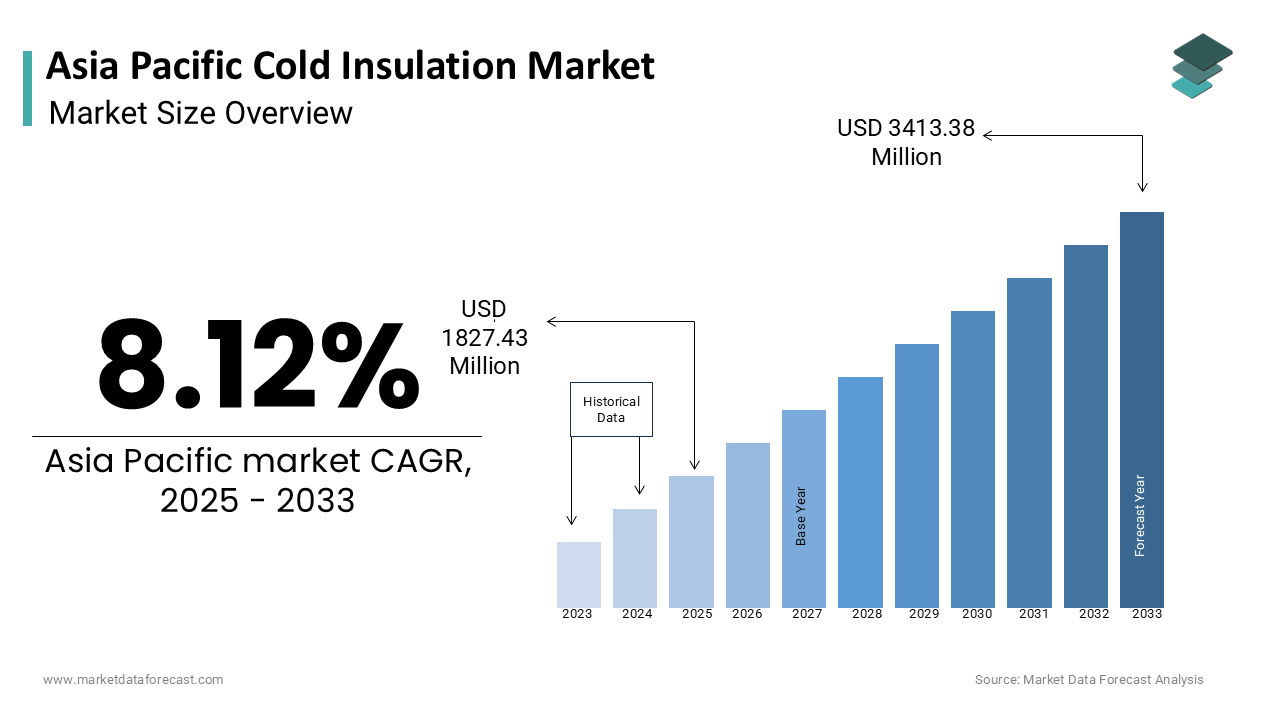

Asia Pacific Cold Insulation Market Size

The Asia Pacific Cold Insulation Market was worth USD 1689.75 million in 2024. The Asia Pacific market is expected to reach USD 3413.38 million by 2033 from USD 1827.43 million in 2025, rising at a CAGR of 8.12% from 2025 to 2033.

Cold insulation plays an indispensable role in reducing energy consumption preventing thermal bridging and ensuring compliance with environmental regulations. The rise of urbanization and the expansion of cold chain logistics have amplified the demand for scalable and energy-efficient insulation solutions. Advancements in material science such as the development of aerogels and vacuum-insulated panels have further enhanced the performance and applicability of cold insulation systems.

MARKET DRIVERS

Expansion of the Cold Chain Logistics Network

Expansion of the cold chain logistics network is a significant driver of the Asia Pacific cold insulation market with over 50% of the global population residing in urban areas by 2030. This demographic shift necessitates robust cold storage infrastructure to ensure product quality and safety during transportation. For example, cities like Shanghai and Bangkok are investing heavily in cold storage facilities equipped with advanced insulation systems to meet the growing demand for temperature-controlled environments. Effective cold insulation can reduce energy losses by up to 40%, which is making it a critical component of sustainable logistics.

Increasing Emphasis on Energy Efficiency

Growing emphasis on energy efficiency is another major driver of the Asia Pacific cold insulation market. Governments across the Asia Pacific region are implementing stringent regulations to curb carbon emissions and promote green building practices. Energy consumption in industrial refrigeration accounts for 15% of total electricity usage in the region amplifying the need for energy-saving technologies. For instance, companies in India and South Korea are adopting polyurethane foam-based insulation systems to enhance thermal resistance and reduce power consumption. The integration of IoT-enabled monitoring systems allows for real-time adjustments ensuring optimal performance and minimizing waste. Enterprises using advanced cold insulation materials reported a 25% reduction in energy costs emphasizing their widespread adoption and contribution to sustainable industrial practices.

MARKET RESTRAINTS

High Initial Costs of Installation

High initial costs of installation for advanced insulation systems for small and medium-sized enterprises (SMEs) remain one of the primary restraints facing the Asia Pacific cold insulation market. Deploying high-performance materials such as vacuum-insulated panels or aerogels requires significant upfront investments in specialized labor, equipment and raw materials. Additionally, the shortage of skilled professionals proficient in installing and maintaining cold insulation systems further compounds the issue. A survey by KPMG revealed that over 60% of SMEs in Southeast Asia struggle to recruit qualified technicians, forcing them to rely on external consultants or managed service providers. These financial and resource constraints hinder widespread adoption particularly in developing economies where infrastructure budgets are already strained.

Regulatory and Compliance Challenges

Regulatory and compliance complexities across the Asia Pacific region serve as another significant restraint for the cold insulation market making it challenging for companies to navigate varying standards and requirements. The misuse of substandard materials or improper installation techniques poses a threat to both operational efficiency and environmental sustainability which leads to stricter enforcement of compliance standards. Countries like Indonesia and Thailand lack standardized guidelines for cold insulation materials complicating project execution. Additionally, fragmented regulatory frameworks exacerbate the issue as businesses must navigate varying local and national laws. This inconsistency complicates compliance efforts and discourages organizations from adopting cold insulation technologies due to potential legal and reputational risks.

MARKET OPPORTUNITIES

Integration of Smart Technologies

The integration of smart technologies such as IoT sensors and AI-driven analytics presents a transformative opportunity for the Asia Pacific cold insulation market. These innovations enable real-time monitoring and predictive maintenance which ensure optimal performance and minimizes downtime. IoT-enabled insulation systems can improve energy efficiency by up to 30%, which is making them highly attractive to industries like food processing and pharmaceuticals. For example, shopping malls in Singapore and South Korea are leveraging smart cold storage solutions to track temperature fluctuations and prevent spoilage which ensures higher customer satisfaction and reduced waste. Additionally, AI-powered analytics allow businesses to optimize energy consumption by dynamically adjusting parameters based on variables such as weather and occupancy.

Expansion into Rural and Tier-II Cities

Expansion into rural and tier-II cities within the Asia Pacific region presents another promising opportunity for the growth of cold insulation solutions. Countries like Vietnam, Indonesia and the Philippines face significant disparities in access to advanced cold storage infrastructure creating a robust demand for innovative tools that address inefficiencies. Over 40% of rural populations in Southeast Asia lack access to reliable cold chain networks by amplifying the need for scalable solutions. For instance, startups in India are using cost-effective and localized insulation materials to deliver affordable cold storage solutions and ensure continuity of supply chains for underserved communities. Additionally, government-led initiatives promoting rural development have further bolstered the market which encourages investments in sustainable and energy-efficient technologies.

MARKET CHALLENGES

Shortage of Skilled Workforce

The shortage of skilled professionals proficient in cold insulation installation and maintenance poses a significant challenge to the market’s growth. Despite the rising demand for expertise in areas such as material science, thermal dynamics, and energy auditing the talent pool remains insufficient. The global shortage of skilled technicians in the industrial sector is expected to reach 3 million unfilled positions by 2025 with the Asia Pacific accounting for nearly 40% of this deficit. In countries like Malaysia and Thailand universities produce fewer than 500 graduates annually with specialized training in insulation technologies which is far below industry requirements. Additionally, the rapid evolution of insulation materials necessitates continuous upskilling which many professionals struggle to achieve due to limited access to advanced training programs. Only 25% of enterprises in the region receive regular training updates. This skills gap undermines efforts to implement effective cold insulation solutions leaving businesses vulnerable to missed opportunities.

Resistance to Adoption Among Traditional Enterprises

Resistance to adopting advanced cold insulation technologies is another pressing challenge among traditional enterprises particularly in rural and semi-urban areas. Over 60% of SMEs in the region do not integrate advanced cold insulation solutions into their operations. This complacency stems from limited understanding of potential benefits and the perceived complexity of implementation. For example, 70% of family-owned businesses in India were unaware of basic energy-saving insulation materials making them easy targets for inefficiencies and outdated practices. Furthermore, the absence of dedicated technical departments in smaller organizations exacerbates the problem as employees often lack the knowledge to identify and mitigate gaps. This lack of awareness not only hampers innovation but also undermines broader efforts to create a technologically advanced ecosystem.

SEGMENTAL ANALYSIS

By Material Type Insights

The polyurethane foam segment dominated the Asia Pacific cold insulation market by capturing 35.4% of global share in 2024 with its exceptional thermal resistance and versatility making it indispensable for applications such as refrigeration and HVAC systems. Over 60% of industrial facilities in the region rely on polyurethane foam to achieve energy efficiency targets which reduce power consumption by up to 25%. For example, food processing plants in Japan and South Korea use polyurethane-based insulation to maintain consistent temperatures during storage and transportation that ensure product quality and compliance with international standards. Another driving factor is the increasing complexity of industrial operations. Enterprises adopting polyurethane foam report a 30% improvement in operational efficiency highlighting its widespread adoption across diverse sectors.

The phenolic foam segment is projected to grow with a CAGR of 22.3% in the coming years due to its superior fire-resistant properties and low thermal conductivity making it ideal for high-risk environments like chemical plants and power stations. For instance, companies in India and Australia are integrating phenolic foam into their cold storage infrastructure to enhance safety and reduce energy losses. Another contributing factor is the integration of IoT-enabled sensors into phenolic foam systems enabling real-time monitoring and predictive maintenance.

By Application Insights

The refrigeration segment dominated the Asia Pacific cold insulation market by holding 40.4% of the share in 2024, with the growing demand for temperature-controlled environments in industries such as food processing in addition to pharmaceuticals and logistics. Over 50% of perishable goods in the region require cold chain infrastructure amplifying the need for advanced insulation solutions. Another driving factor is the rise of urbanization and consumer preferences for fresh produce. Enterprises adopting cold insulation technologies in refrigeration systems report a 35% reduction in energy costs due to their widespread adoption.

The HVAC systems segment is projected to grow with an anticipated CAGR of 24.5% during the forecast period. This rapid expansion is fueled by the increasing emphasis on energy efficiency and sustainability in commercial and residential buildings. For instance, hospitals and office complexes in Australia and South Korea are integrating advanced insulation materials into their HVAC systems to reduce energy consumption and comply with green building standards. The adoption of energy-efficient HVAC systems in the Asia Pacific grew by 30% in 2022 reflecting their growing popularity among diverse stakeholders. Another contributing factor is the integration of AI-driven analytics into HVAC systems enabling dynamic adjustments based on occupancy and weather conditions.

By End-Use Industry Insights

The industrial sector was the largest segment by occupying 55.4% of the Asia Pacific cold insulation market share in 2024 with its critical role in industries such as manufacturing, food processing and petrochemicals where maintaining low temperatures is essential for operational efficiency and product quality. Over 70% of industrial facilities in the region prioritize cold insulation to meet stringent regulatory requirements and reduce energy losses. For example, chemical plants in China and Malaysia use advanced insulation materials to ensure safety and compliance with environmental standards minimizing risks associated with thermal bridging. Another driving factor is the growing complexity of supply chains. Enterprises adopting cold insulation solutions in industrial settings report a 25% improvement in operational efficiency and are focusing on their widespread adoption.

The commercial sector is likely to register a CAGR of 23.5% in the coming years. This rapid expansion is fueled by the increasing demand for energy-efficient buildings and sustainable infrastructure in urban areas. For instance, hospitals and shopping malls in Japan and Indonesia are integrating advanced insulation materials into their designs to reduce energy consumption and enhance occupant comfort. The adoption of green building practices in the Asia Pacific is projected to grow by 25% annually which creates a robust demand for scalable and innovative solutions. Another contributing factor is the integration of IoT-enabled monitoring systems into commercial buildings that enable real-time adjustments and predictive maintenance. Enterprises using smart insulation platforms experience a 20% reduction in operational costs and reinforcing its position as the fastest-growing end-use industry.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific cold insulation market and accounted for 35% of the share in 2024. Enterprises and government agencies in China are increasingly adopting advanced materials like polyurethane foam and phenolic foam to address rising energy costs and stringent sustainability mandates. Over 60% of large organizations have integrated cold insulation into their operations with its widespread adoption. Government initiatives promoting energy efficiency have further accelerated investments in scalable and innovative solutions boosting China’s position as the market leader.

Japan was positioned second with 18.7% of the Asia Pacific cold insulation market share in 2024, with the advanced technological infrastructure and emphasis on precision positioned it as a leader in adopting AI-driven cold insulation solutions. Japanese corporations prioritize efficiency and innovation particularly in industries like food processing and pharmaceuticals. Over 70% of large enterprises use cold insulation platforms to enhance operational efficiency and compliance. Additionally, the integration of robotics and automation into business processes has gained traction, which enables seamless and scalable solutions.

India is a key player in holding the dominant share in the Asia Pacific cold insulation market. The country’s booming construction sector and rapidly evolving startup ecosystem are major drivers of cold insulation adoption. Indian enterprises are increasingly leveraging advanced materials to address challenges such as energy efficiency and rural access. Over 50% of tech startups in India have integrated AI-driven analytics into their offerings which reflects its growing importance. Additionally, government-led initiatives promoting sustainable infrastructure have further bolstered the market and ensured steady growth.

Australia is driven by a strong emphasis on regulatory compliance and environmental sustainability which has fueled demand for cold insulation solutions across various industries. Australian enterprises spend significant resources on managing EHRs, clinical trials and population health trends. Over 40% of healthcare organizations use predictive models to monitor infectious disease outbreaks along with improving preparedness and response times.

South Korea's focus on innovation and digital transformation has driven the adoption of advanced cold insulation platforms will propel the growth of the Asia Pacific cold insulation market. South Korean enterprises that operate particularly in urban centers rely on analytics tools to manage chronic diseases and enhance patient care. Over 50% of large hospitals have implemented AI-driven systems to analyze imaging data for early disease detection and ensure timely interventions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Armacell International S.A., Huntsman Corporation, Owens Corning, BASF SE, The Dow Chemical Company, Kingspan Group, L'ISOLANTE K-FLEX S.p.A., ROCKWOOL International A/S, Aspen Aerogels Inc., and Johns Manville are some of the players in the Asia Pacific cold insulation market

The Asia Pacific cold insulation market is characterized by intense competition driven by a mix of global giants and regional innovators striving to capture market share. Established players like Knauf Insulation, Owens Corning and Rockwool Group bring extensive resources and technological expertise enabling them to dominate key segments such as AI-driven analytics and eco-friendly materials. Regional companies leverage their deep understanding of local cultures and regulatory frameworks to carve out niche positions. The market’s dynamic nature is further amplified by rapid technological advancements which compel vendors to continuously innovate and adapt. Strategic collaborations with governments and industry bodies play a crucial role in shaping competitive strategies particularly in emerging markets. Additionally, the rise of digital transformation initiatives has created new opportunities for differentiation as companies strive to offer seamless and scalable solutions.

Top Players in the Asia Pacific Cold Insulation Market

Knauf Insulation

Knauf Insulation is a global leader in the cold insulation market which is renowned for its innovative and sustainable solutions tailored to industrial and commercial applications. The company specializes in high-performance materials such as glass mineral wool and phenolic foam which are designed to enhance energy efficiency while minimizing environmental impact. Knauf’s focus on sustainability aligns with global green building initiatives as it integrates eco-friendly manufacturing processes into its operations. By fostering partnerships with local governments and enterprises Knauf has expanded its footprint in the Asia Pacific and addressed unique challenges such as stringent regulatory frameworks and diverse climatic conditions. Its commitment to innovation and scalability positions it as a trusted partner for businesses seeking to reduce energy consumption.

Owens Corning

Owens Corning specializes in advanced cold insulation solutions that emphasize thermal resistance and durability catering to industries like HVAC systems as well as refrigeration and pipeline insulation. Its products are widely adopted in urban areas where energy efficiency and compliance with environmental standards are critical. Owens Corning has strengthened its presence in the Asia Pacific by investing in R&D and fostering collaborations with startups and academic institutions. By prioritizing localization and innovation the company continues to shape the future of cold insulation technologies that enable precision engineering and enhanced operational efficiency.

Rockwool Group

Rockwool Group offers robust cold insulation platforms that provide end-to-end visibility across applications ensuring alignment with both regional and global standards. Enterprises leverage Rockwool’s tools to streamline processes such as energy audits, as well as material selection and performance optimization. Rockwool has deepened its engagement in the Asia Pacific by tailoring its offerings to meet local needs such as fire-resistant materials in Japan and Australia. Its emphasis on ethical governance and cutting-edge research reinforces its vision in the global cold insulation ecosystem.

Top Strategies Used by Key Players in the Asia Pacific Cold Insulation Market

Integration of Smart Technologies

Integration of smart technologies such as IoT sensors and AI-driven analytics into cold insulation solutions is increasingly being adopted by leading players to enhance functionality and adaptability. These innovations enable real-time monitoring as well as predictive maintenance and dynamic adjustments based on variables such as weather and occupancy. For instance, IoT-enabled platforms can track temperature fluctuations and energy consumption ensuring optimal performance and minimizing waste.

Expansion Through Strategic Partnerships

Strategic partnerships with local enterprises along with governments and industry bodies have become a cornerstone of success in the Asia Pacific cold insulation market. Collaborations with public sector organizations help promote awareness campaigns and regulatory compliance initiatives fostering trust among stakeholders. Additionally, partnerships with technology firms facilitate the integration of advanced tools which ensure scalability and reliability.

Focus on Localization and Customization

Localization and customization are being prioritized by key players to address the unique needs of businesses in the Asia Pacific region. Additionally, customization allows companies to adapt their solutions to specific industries such as rural healthcare and telemedicine which ensures relevance and applicability in diverse operational contexts.

RECENT MARKET DEVELOPMENTS

- In April 2024, Knauf Insulation launched a new line of eco-friendly phenolic foam tailored to address the growing demand for sustainable insulation solutions in Southeast Asia.

- In June 2023, Owens Corning partnered with a leading construction firm in Australia to integrate its cold insulation materials into the firm’s green building projects.

- In September 2023, Rockwool Group introduced a fire-resistant insulation variant to ensure safety in high-risk environments like chemical plants in India.

- In February 2024, Knauf Insulation acquired a regional startup specializing in AI-driven energy optimization for cold storage facilities.

- In November 2023, Owens Corning collaborated with a government agency in Singapore to promote the adoption of cold insulation technologies among small and medium-sized enterprises (SMEs).

MARKET SEGMENTATION

This research report on the Asia Pacific cold insulation market is segmented and sub-segmented into the following categories.

By Material Type

- Glass Fibre

- Cellular Glass

- Glass Mineral Wool

- Phenolic Foam

- Polystyrene Foam

- Polyurethane Foam

- Poly-isocyanurate Foam

- Polyethylene Foam

- Synthetic Rubber

- Others

By Application

- HVAC systems

- Refrigeration

- Pipeline Insulation

- Vessels Insulation

- Others

By End-use

- Commercial

- Industrial

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of cold insulation demand in Asia Pacific?

Key growth drivers include the rise of LNG infrastructure, expanding cold storage facilities for food and pharmaceuticals, increasing energy efficiency regulations, and urban development driving HVAC installations.

What are the major challenges in the cold insulation market?

The market faces challenges such as high costs for advanced insulation systems, limited availability of green alternatives in some regions, strict environmental regulations, and a shortage of skilled installation professionals.

What is the future outlook for the cold insulation market in Asia Pacific?

The future outlook is strong, with steady growth expected due to industrial expansion, rising cold chain investments, stricter energy regulations, and innovation in insulation materials and sustainability solutions.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com