Asia-Pacific Controlled Release Fertilizers Market Size, Share, Growth, Trends, And Forecasts Research Report, Segmented By Type, Application, And Non Crop Based, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia-Pacific Controlled Release Fertilizers Market Size

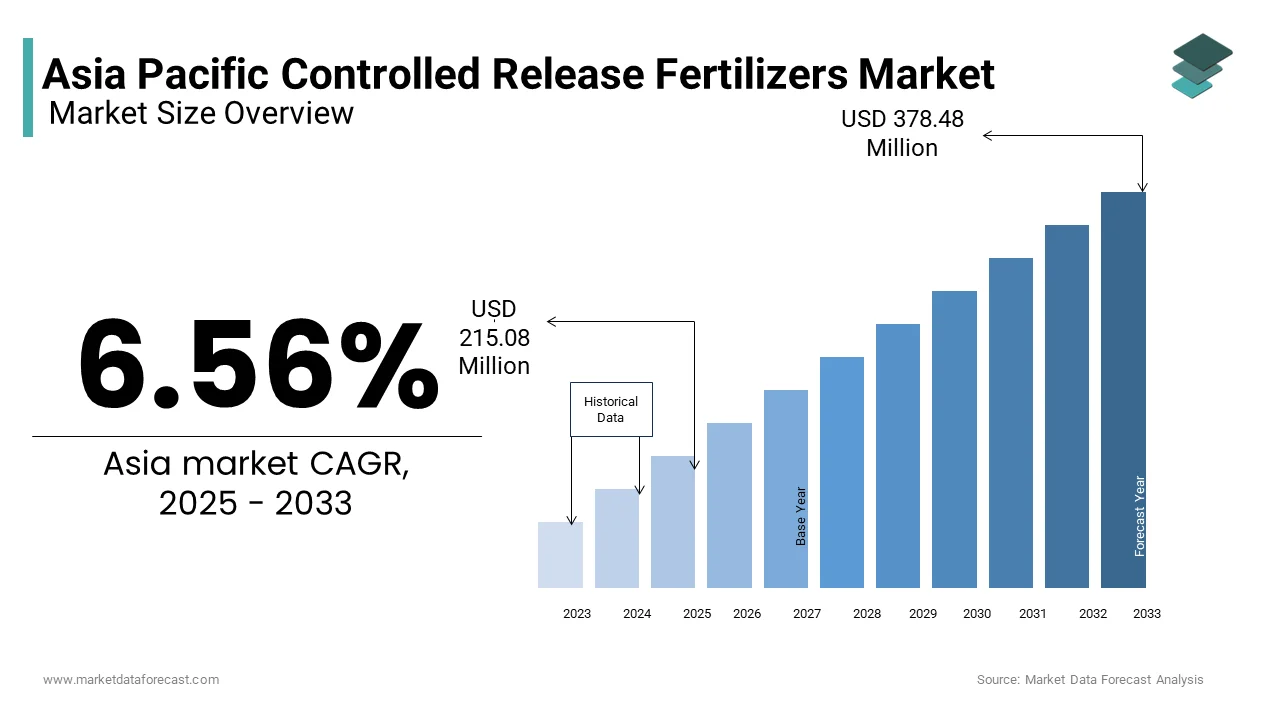

The Asia-Pacific controlled-release fertilizers market was valued at USD 200.41 million in 2024 and is anticipated to reach USD 215.08 million in 2025, from USD 378.48 million by 2033, growing at a CAGR of 6.56% during the forecast period from 2025 to 2033.

The Asia Pacific controlled release fertilizers market encompasses the production, distribution, and application of nutrient-rich agricultural inputs that release nutrients gradually over an extended period. These fertilizers are designed to optimize plant growth by synchronizing nutrient availability with crop demand, thereby improving yield efficiency and reducing environmental impact. They are widely used in high-value crops such as fruits, vegetables, turf, ornamentals, and plantation crops like rubber and oil palm. This market is being driven by rising awareness among farmers about sustainable farming practices and the need for efficient nutrient management. The Asia Pacific controlled release fertilizers market is witnessing strong momentum across both traditional and modern agricultural systems.

MARKET DRIVERS

Increasing Adoption of Precision Agriculture Techniques

One of the primary drivers of the Asia Pacific controlled release fertilizers market is the increasing adoption of precision agriculture techniques, which emphasize optimized input usage and data-driven farm management. Controlled release fertilizers align well with these practices by providing a steady supply of nutrients tailored to specific crop cycles, minimizing waste and enhancing productivity.

According to the International Food Policy Research Institute, precision agriculture adoption in the Asia Pacific region grew by approximately 12% annually between 2020 and 2024 in countries like China, India, and Australia. The Chinese Ministry of Agriculture and Rural Affairs reported that over 30 million hectares of farmland were under precision farming initiatives in 2024, many of which integrated controlled release fertilizers to improve nitrogen use efficiency and reduce leaching.

Similarly, in India, the Indian Council of Agricultural Research launched several pilot programs promoting smart farming technologies, including sensor-based nutrient management and automated irrigation systems. As per the National Academy of Agricultural Sciences, farms using precision techniques recorded up to 20% higher yields when combined with CRF applications.

Growing Demand from High-Value Crops and Horticulture Sector

Another major driver fueling the Asia Pacific controlled release fertilizers market is the expanding cultivation of high-value crops and the rapid growth of the horticulture sector. Unlike staple cereals, fruits, vegetables, and ornamental plants require precise nutrient management to ensure quality and yield consistency, making controlled release fertilizers an ideal choice.

As per the Food and Agriculture Organization, horticultural production in the Asia Pacific region expanded by nearly 8% in 2024 compared to the previous year, with countries like Thailand, Vietnam, and the Philippines leading in fruit and vegetable exports. The Thai Department of Agriculture reported that over 60% of orchard farms cultivating mangoes, durians, and longans have shifted to controlled release fertilizers to enhance fruit size and sugar content while reducing fertilizer application frequency.

In addition, the Japanese Ministry of Agriculture, Forestry and Fisheries highlighted a surge in greenhouse and container-grown ornamental plants, particularly in urban landscaping and export-oriented floriculture. As per the Japan Flower Council, more than 70% of commercial nurseries now use controlled release fertilizers to maintain consistent nutrient levels without frequent reapplication. With rising consumer demand for premium produce and ornamental plants, the horticulture-driven demand for CRFs is set to expand significantly across the Asia Pacific region.

MARKET RESTRAINTS

High Initial Cost Compared to Conventional Fertilizers

A major restraint affecting the Asia Pacific controlled release fertilizers market is the relatively high initial cost of controlled release fertilizers compared to conventional fertilizers such as urea, ammonium phosphate, and potassium chloride. This price differential makes CRFs less accessible to smallholder farmers who operate on tight budgets and rely heavily on subsidized inputs.

According to the International Fertilizer Association, the average price of controlled release fertilizers in the Asia Pacific region is approximately two to three times higher than that of standard compound fertilizers. In India, the Department of Fertilizers reported that despite government incentives, only 15% of small-scale farmers opted for CRFs in 2024 due to affordability concerns. Many continue to prefer traditional fertilizers, even though they contribute to nutrient loss and soil degradation.

Limited Awareness and Technical Knowledge Among Farmers

Another significant restraint on the Asia Pacific controlled release fertilizers market is the limited awareness and technical knowledge among farmers regarding the benefits and proper application methods of controlled release fertilizers. Despite their advantages in nutrient efficiency and labor savings, many growers remain unfamiliar with how to integrate them into existing cropping systems.

According to the Asian Development Bank, only about 30% of farmers in rural parts of Bangladesh, Nepal, and Cambodia had received formal training on modern fertilizer technologies in 2024. In Indonesia, the Center for Agricultural Extension and Social Economics Research found that less than 25% of surveyed farmers understood the concept of slow nutrient release and its implications for yield optimization.

Furthermore, extension services in many developing countries lack the capacity to provide comprehensive guidance on CRF application rates, timing, and compatibility with different crops. As per the Indian Agricultural Research Institute, improper use of controlled release fertilizers can lead to either under-performance or nutrient imbalances, discouraging repeat purchases.

MARKET OPPORTUNITIES

Expansion of Organic Farming and Eco-Friendly Agriculture Practices

An emerging opportunity for the Asia Pacific controlled release fertilizers market lies in the growing trend toward organic farming and eco-friendly agricultural practices. There is a rising demand for fertilizers that minimize environmental impact while maintaining productivity as governments and consumers increasingly prioritize sustainability. According to the Research Institute of Organic Agriculture (FiBL), certified organic agricultural land in the Asia Pacific region expanded by 9% in 2024, with countries like India, China, and Australia leading in organic certification. Moreover, controlled release fertilizers, especially those derived from natural polymers and biodegradable coatings, are gaining traction in organic-certified farms.

Integration with Smart Farming and Digital Agriculture Platforms

Another promising opportunity for the Asia Pacific controlled release fertilizers market is the integration with smart farming and digital agriculture platforms that enable real-time monitoring and precision nutrient management. As IoT-enabled devices, AI analytics, and remote sensing technologies become more accessible, farmers are adopting data-driven approaches to optimize fertilizer use and crop performance.

In addition, in India, startups and agri-tech firms are collaborating with fertilizer manufacturers to develop mobile apps that recommend CRF dosages based on soil tests and weather conditions. As per NITI Aayog’s agricultural transformation report, digital platforms helped reduce fertilizer wastage by up to 25% in pilot projects conducted in Punjab and Haryana.

MARKET CHALLENGES

Regulatory Hurdles and Varying Certification Standards Across Countries

One of the primary challenges facing the Asia Pacific controlled release fertilizers market is the presence of diverse regulatory frameworks and varying certification standards across countries. Unlike in Europe or North America, where harmonized guidelines exist for fertilizer labeling and performance claims, the Asia Pacific region lacks uniformity, complicating product registration and cross-border trade.

According to the International Plant Nutrition Institute, each country in the region has distinct specifications for nutrient content, release duration, and environmental safety testing. For instance, in Japan, the Fertilizer Control Act mandates rigorous laboratory trials before new formulations can be approved, whereas in Indonesia, the Ministry of Agriculture revised its fertilizer classification system in 2024, introducing additional compliance layers for imported products.

Furthermore, multinational fertilizer companies face difficulties in adapting product formulations to meet localized requirements, which increases time-to-market and development costs. As per the Asian Development Bank, inconsistent regulations have discouraged smaller players from entering regional markets, limiting innovation and competition.

Seasonal Variability and Climate Uncertainty Impacting Application Rates

Another significant challenge confronting the Asia Pacific controlled release fertilizers market is the seasonal variability and climate uncertainty that affect crop planning and fertilizer application patterns. Since CRFs are designed for specific growth cycles and temperature ranges, unpredictable weather events such as monsoon delays, droughts, or unseasonal rains can disrupt optimal nutrient release schedules.

According to the World Meteorological Organization, several countries in the region experienced erratic rainfall patterns in 2024, with prolonged dry spells in parts of India and excessive precipitation in Southeast Asia. In the Philippines, the Department of Agriculture reported that typhoon-induced flooding in early 2024 led to premature leaching of nutrients in fields using controlled release fertilizers, which is reducing their effectiveness.

In Australia, extreme heatwaves affected soil moisture levels, altering microbial activity and influencing the breakdown of polymer-coated fertilizers. As per the Commonwealth Scientific and Industrial Research Organisation (CSIRO), CRF performance can vary by up to 20% under abnormal climatic conditions, causing inconsistency in farmer satisfaction and adoption rates.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.56% |

|

Segments Covered |

By Coating Type, Crop Type and Region. |

|

Various Analyses Covered |

Global, Regional, and Country-Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

The Chisso Corporation, Shandong Shikefeng Chemical Industry Co. Ltd., Kingenta Ecological Engineering Group Co. Ltd., Scotts Miracle-Gro Company, Agrium, Yara International, Israel Chemicals Ltd. (Israel), Compo GmbH Co., Sociedad Quimica Y Minera S.A. and Haifa Chemicals Limited. |

SEGMENTAL ANALYSIS

By Coating Type Insights

The polymer-coated controlled release fertilizers segment was the largest by accounting for 52.3% of the Asia Pacific release fertilizers market due to its superior nutrient release efficiency, adaptability to diverse soil conditions, and compatibility with modern agricultural practices.

One major driver behind this dominance is the widespread adoption of polymer-coated fertilizers in high-value crops such as fruits, vegetables, and ornamentals, where precise nutrient management is crucial for yield and quality. According to the Food and Agriculture Organization, horticultural production in the Asia Pacific region expanded by nearly 8% in 2024 compared to the previous year, with countries like Thailand, Vietnam, and the Philippines leading in fruit and vegetable exports. The Thai Department of Agriculture reported that over 60% of orchard farms cultivating mangoes, durians, and longans have shifted to polymer-coated CRFs to enhance fruit size and sugar content while reducing fertilizer application frequency.

The polymer-sulfur coated (PSC) segment is swiftly emerging with a CAGR of 10.3% during the forecast period. This rapid growth is driven by increasing demand from staple crop cultivation, particularly rice, wheat, and corn, which require cost-effective yet efficient nutrient delivery systems.

A key factor fueling this trend is the growing recognition of sulfur as an essential secondary nutrient for plant development, especially in sulfur-deficient soils prevalent across India, China, and Southeast Asia. According to the International Plant Nutrition Institute, sulfur deficiency has been identified in over 40% of arable lands in South and Southeast Asia, which is prompting governments to promote integrated nutrient solutions like PSC fertilizers.

By Crop Type Insights

The horticultural crops segment was the largest and held 45.3% of the Asia Pacific controlled release fertilizers market share in 2024. One primary driver behind this dominance is the expanding area under horticulture in tropical and subtropical regions where nutrient leaching is a persistent challenge. According to the Food and Agriculture Organization, horticultural production in the Asia Pacific region increased by 8% in 2024 compared to the previous year, with Thailand, Vietnam, and the Philippines leading in export-oriented fruit and vegetable cultivation. The Philippine Department of Agriculture noted that over 50% of banana plantations in Mindanao have adopted controlled release fertilizers to improve yield consistency and reduce labor costs associated with frequent top-dressing.

The turf and ornamental crops segment is likely to experience a CAGR of 11.2% in the next coming years. According to the Japan Flower Council, the country's floriculture industry grew by 9% in 2024, with a significant portion of greenhouse-grown ornamentals utilizing controlled release fertilizers for optimal bloom uniformity and color intensity. Moreover, in Australia, the Nursery and Garden Industry Association reported that retail sales of potted plants and decorative foliage surged by 14% in 2024, reflecting a shift toward aesthetic gardening and indoor plant culture. As per the Commonwealth Scientific and Industrial Research Organisation (CSIRO), controlled release fertilizers are preferred in these applications due to their low-maintenance nature and ability to provide balanced nutrition over multiple months.

COUNTRY ANALYSIS

China was the largest contributor of the Asia Pacific controlled release fertilizers market with 38.4% of share in 2024. China’s vast farmland and intensive cultivation practices drive substantial demand for advanced nutrient solutions that improve efficiency and reduce environmental impact.

According to the Ministry of Agriculture and Rural Affairs, the Chinese government has actively promoted the use of controlled release fertilizers through policy incentives such as the National Soil Testing and Formula Fertilization Program. In 2024, over 30 million hectares of cropland were covered under precision agriculture initiatives, many of which incorporated CRFs to enhance nitrogen-use efficiency and curb pollution from nutrient runoff. The China Agricultural University reported that controlled release fertilizer adoption in maize and rice fields rose by 15% in 2024, reflecting a strategic shift toward sustainable nutrient management. With continued investment in smart farming and eco-friendly policies, China remains the central pillar of the Asia Pacific controlled release fertilizers market.

India was positioned second in the Asia Pacific controlled release fertilizers market by capturing 24.4% of share in 2024. As per the Department of Fertilizers, India consumed over 30 million metric tons of conventional fertilizers in FY 2024, yet only about 5% of this was accounted for by controlled release variants. However, the government’s push for neem-coated urea and subsidized pricing for eco-friendly fertilizers has created awareness among progressive farmers. Furthermore, the Indian Institute of Soil Science highlighted a surge in CRF usage among sugarcane, cotton, and vegetable growers in states like Maharashtra, Punjab, and Haryana, where water scarcity and soil degradation have made efficient nutrient management critical.

Japan controlled release fertilizers market growth is lucratively growing with its strong emphasis on precision agriculture and urban horticulture. Moreover, Tokyo and Osaka have implemented extensive rooftop and vertical garden projects, which depend heavily on slow-release nutrient technologies to ensure sustainability in confined spaces.

South Korea controlled release fertilizers market growth is growing with its reliance on high-tech agricultural systems and well-developed horticulture sectors. The country’s focus on resource-efficient farming and landscape beautification drives consistent demand for CRFs tailored for precision environments.

According to the Rural Development Administration, South Korea invested over KRW 1.5 trillion in agricultural technology upgrades in 2024, including automated irrigation and sensor-based nutrient monitoring systems that integrate seamlessly with controlled release fertilizers. The Korea Forest Service also launched several urban greening initiatives, which is requiring CRF-based lawn care solutions for parks and roadside vegetation.

Australia controlled release fertilizers market growth is primarily due to its emphasis on high-value horticulture, turf management, and environmental conservation. According to the Australian Bureau of Agricultural and Resource Economics and Sciences, the country produced over 2 million metric tons of fresh vegetables in 2024, with controlled release fertilizers being widely used in greenhouse and hydroponic farming operations. The Nursery and Garden Industry Association reported that retail sales of ornamental plants rose by 14% in 2024, reflecting a growing preference for low-maintenance nutrient solutions.

KEY MARKET PLAYERS

The market for controlled-release fertilizers is described as strong competition with a large number of big and small players. The Chisso Corporation, Shandong Shikefeng Chemical Industry Co. Ltd., Kingenta Ecological Engineering Group Co. Ltd., Scotts Miracle-Gro Company, Agrium, Yara International, Israel Chemicals Ltd. (Israel), Compo GmbH Co., Sociedad Quimica Y Minera S.A. and Haifa Chemicals Limited are some of the big players in controlled release fertilizer industry.

Top Players in the Market

Yara International ASA

Yara International is a global leader in sustainable crop nutrition and holds a strong presence in the Asia Pacific controlled release fertilizers market. The company offers a wide range of environmentally responsible fertilizer solutions, including coated and stabilized products tailored for diverse cropping systems. In the Asia Pacific region, Yara supports large-scale agricultural operations with customized nutrient programs that enhance productivity while minimizing environmental impact. Its commitment to digital farming tools and sustainability-driven innovation has positioned it as a preferred partner for governments and agribusinesses seeking efficient nutrient management strategies.

The Mosaic Company

The Mosaic Company plays a crucial role in the Asia Pacific controlled release fertilizers market through its extensive portfolio of phosphate- and potash-based nutrient solutions. With a focus on integrated plant nutrition, Mosaic delivers high-efficiency fertilizers that align with modern agronomic practices across rice, corn, fruit, and vegetable cultivation. In the Asia Pacific region, Mosaic collaborates with local distributors and research institutions to promote controlled release technologies that improve nutrient uptake and reduce waste. Its strategic engagement with farmer education programs and supply chain optimization initiatives strengthens its foothold in key markets such as China, India, and Southeast Asia.

Haifa Group

Haifa Group is a key player known for its specialty fertilizers, particularly water-soluble and controlled release formulations designed for precision agriculture and horticulture. In the Asia Pacific region, Haifa supplies premium-grade CRFs to greenhouse operators, turf managers, and export-oriented orchard farms that require consistent nutrient delivery for superior yield quality. The company emphasizes technical support and field trials to demonstrate product efficacy and drive adoption among progressive farmers.

Top Strategies Used by Key Market Participants

One major strategy employed by leading players is product innovation and formulation customization. Companies are continuously developing advanced controlled release fertilizer variants that offer improved nutrient efficiency, compatibility with different soil types, and alignment with specific crop cycles. This helps them differentiate their offerings and cater to evolving industry standards and regulatory expectations.

Another key approach is expanding regional presence through localized production and distribution networks. Several companies have established joint ventures or expanded existing facilities in emerging markets to ensure faster delivery, cost efficiency, and better alignment with local regulatory frameworks. These collaborations also facilitate knowledge exchange and improve access to key agricultural zones across the Asia Pacific region.

COMPETITION OVERVIEW

The competition in the Asia Pacific controlled release fertilizers market is shaped by the presence of well-established multinational corporations and a growing number of regional manufacturers striving to capture market share through differentiation and strategic positioning. Global leaders such as Yara, The Mosaic Company, and Haifa leverage their technological expertise, extensive distribution networks, and strong brand recognition to maintain dominance in premium segments. At the same time, domestic producers in countries like China, India, and South Korea are gaining traction by offering competitively priced alternatives and localized service support. The market is witnessing intensified rivalry not only in pricing but also in product performance, formulation flexibility, and after-sales technical assistance. As demand from commercial farming, horticulture, and urban landscaping sectors continues to evolve, companies are focusing on expanding production capabilities by enhancing product portfolios, and strengthening supply chain efficiencies. Regulatory changes, shifting consumer preferences, and sustainability concerns are further influencing competitive dynamics by prompting firms to adopt agile strategies that align with regional trends and industry standards.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Yara International launched a new line of climate-smart controlled release fertilizers specifically designed for rice cultivation in Southeast Asia.

- In June 2024, The Mosaic Company announced a strategic partnership with a leading Indian agri-tech startup to develop AI-powered fertilizer recommendation tools for smallholder farmers. The collaboration was intended to enhance farmer accessibility to controlled release fertilizers by providing data-driven insights tailored to local soil conditions.

- In September 2024, Haifa Group expanded its technical service team in Japan to provide direct on-site support to greenhouse growers and ornamental plant nurseries. This move was part of a broader effort to strengthen customer engagement and promote best practices in controlled release fertilizer application in high-value crops.

- In November 2024, Coromandel International , a major Indian fertilizer manufacturer, commissioned a new controlled release fertilizer blending unit in Andhra Pradesh to increase domestic supply capacity. The expansion was designed to meet rising demand from horticultural and plantation crops in South India.

- In February 2025, ICL Specialty Fertilizers opened a regional innovation center in Thailand to conduct localized research on controlled release fertilizer applications in tropical fruits and oil palm cultivation. This initiative was aimed at supporting the development of next-generation nutrient solutions tailored to Asia Pacific market needs.

MARKET SEGMENTATION

This research report on the Asia-Pacific controlled release fertilizers market is segmented and sub-segmented into the following categories.

By Coating Type

- Polymer Coated

- Polymer-Sulfur Coated

- Others

By Crop Type

- Field Crops

- Horticultural Crops

- Turf & Ornamental

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What’s driving the adoption of controlled release fertilizers in APAC agriculture?

The push for higher crop yields with minimal nutrient loss, especially in countries like China and India, along with government support for sustainable farming, is accelerating CRF adoption.

How do CRFs support sustainability goals in APAC farming?

By releasing nutrients gradually, CRFs reduce runoff and nitrogen leaching, helping meet tightening environmental standards and soil health mandates across regions like Southeast Asia and Australia.

Which crops are the biggest users of CRFs in the region?

High-value crops such as rice, fruits, vegetables, and plantation crops (like oil palm and tea) are primary users due to their sensitivity to nutrient timing and soil conditions.

What challenges limit widespread CRF usage in emerging APAC economies?

Higher upfront costs, lack of farmer awareness, and limited distribution in rural areas slow CRF uptake, though government subsidies and pilot programs are starting to bridge the gap.

What innovations are enhancing CRF performance in tropical APAC climates?

Advanced polymer coatings, sulfur-based encapsulation, and biodegradable release systems are being tailored to withstand the high heat and moisture conditions of tropical regions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com