Asia Pacific Courier, Express and Parcel Market Research Report - Segmented By Service (Standard Delivery, Express Delivery, Same-Day Delivery, and Last-Mile Delivery), Business Model, Destination, Mode of Transport, End-Use, and Region (India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis, Size, Share, Growth, Trends, And Forecasts 2025 to 2033

Asia Pacific Courier, Express and Parcel Market Size

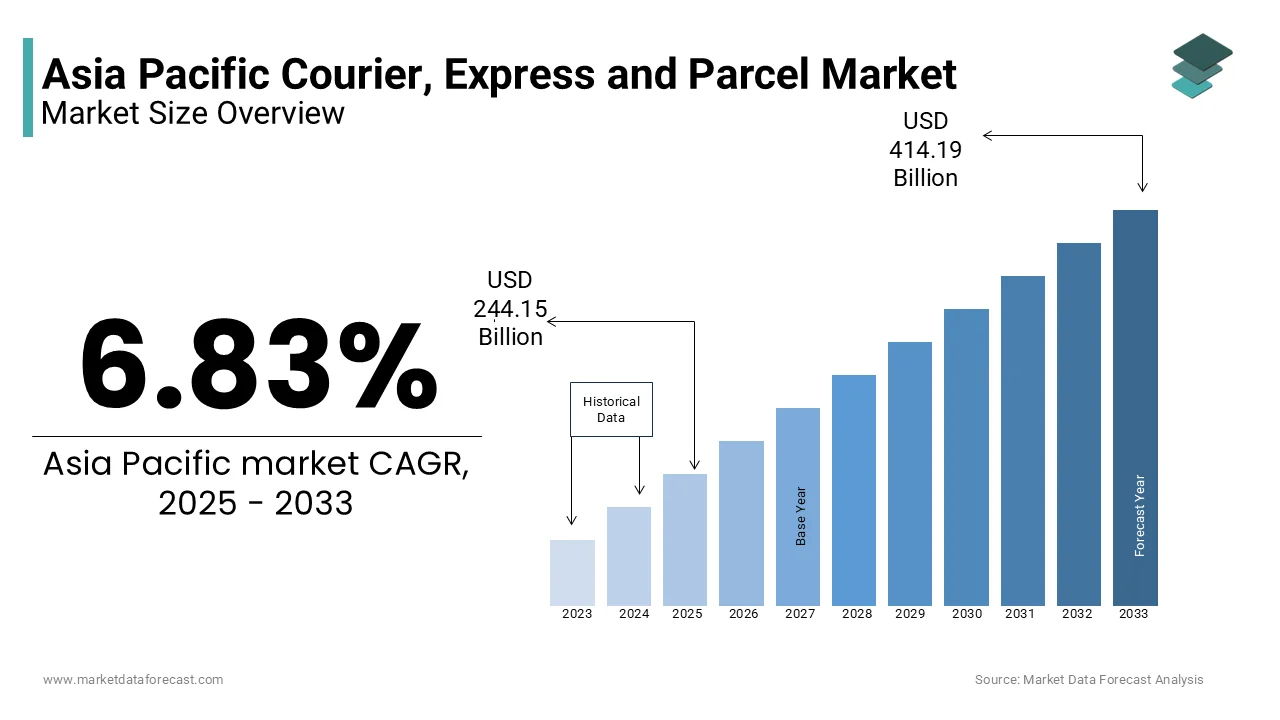

Asia Pacific Courier, Express and Parcel market size was valued at USD 228.54 billion in 2024, and the market size is expected to reach USD 414.19 billion by 2033 from USD 244.15 billion in 2025. The market's promising CAGR for the predicted period is 6.83%.

MARKET DRIVERS

Surge in E-commerce Activities

A major driver of the Asia Pacific Courier, Express and Parcel market is the exponential growth of e-commerce, which has redefined consumer expectations for swift and reliable deliveries. Platforms like Alibaba, Flipkart, and Shopee have fueled demand for courier services, with same-day and next-day delivery options becoming standard. For example, during the 2022 Singles' Day sale in China, courier companies handled over 675 million parcels in just 24 hours, as reported by the State Post Bureau of China. This factor will promote couriers to play major role in sustaining the digital economy. Additionally, small and medium enterprises (SMEs) are increasingly leveraging courier networks to expand their customer base that further boosts the growth of the market.

Urbanization and Smart City Initiatives

Another key driver is rapid urbanization coupled with smart city developments, which enhance logistics efficiency. The United Nations projects that by 2030, 60% of Asia Pacific’s population will reside in urban areas, creating dense markets for courier services. Cities like Seoul and Sydney are adopting smart technologies such as automated sorting systems and AI-driven route optimization by reducing delivery times. Furthermore, governments are investing in infrastructure to support last-mile delivery. For instance, Singapore’s Smart Nation initiative includes the deployment of parcel lockers and autonomous delivery vehicles by streamlining operations for courier firms.

MARKET RESTRAINTS

Rising Operational Costs Due to Fuel Prices

One significant restraint in the Asia Pacific Courier, Express and Parcel market is the volatility of fuel prices, which directly impacts operational costs. This financial burden is exacerbated by the need for frequent vehicle maintenance and compliance with emission regulations. While some companies pass these costs onto consumers through surcharges, this approach risks alienating price-sensitive customers. As a result, profit margins are squeezed, for smaller players who lack economies of scale. Addressing this challenge requires strategic investments in fuel-efficient vehicles or alternative energy solutions, though adoption remains slow due to high upfront costs.

Regulatory Hurdles Across Borders

Another pressing issue is the complexity of cross-border regulations, which hinder seamless operations in the Asia Pacific region. The inconsistent customs policies and documentation requirements lead to delays and increased compliance costs. For instance, shipments between Southeast Asian nations often face bottlenecks due to differing tariff structures and inspection protocols. In Australia, stringent biosecurity regulations require extensive checks on imported goods, causing delays of up to 48 hours, as per the Department of Agriculture. These inefficiencies not only disrupt supply chains but also increase operational burdens for courier firms. Navigating this fragmented regulatory landscape demands significant resources by limiting the ability of companies to scale operations efficiently and serve international markets effectively.

MARKET OPPORTUNITIES

Integration of Advanced Technologies

A promising opportunity lies in the integration of advanced technologies like artificial intelligence (AI), blockchain, and the Internet of Things (IoT) to optimize logistics operations. For example, DHL Express implemented IoT sensors in its fleet to monitor vehicle performance and predict maintenance needs by enhancing operational efficiency. Similarly, blockchain technology is being used to create transparent and tamper-proof tracking systems, which is boosting customer trust. A report by Accenture states that blockchain adoption could save the logistics industry USD 45 billion annually by improving supply chain visibility. The courier firms can streamline processes, reduce costs, and offer superior customer experiences by positioning themselves as leaders in a tech-driven market.

Expansion into Rural and Tier-2 Markets

Another significant opportunity is the untapped potential of rural and tier-2 markets, which are witnessing increased internet penetration and consumer spending. For instance, in Indonesia, platforms like Tokopedia are enabling rural artisans to sell handmade goods nationwide by creating new demand for courier services. Additionally, government initiatives like India’s Digital India campaign are bridging the urban-rural divide, which is fostering economic activity in underserved areas. Courier companies that establish robust last-mile delivery networks in these regions can capture early-mover advantages.

MARKET CHALLENGES

Intense Competition and Price Wars

A major challenge in the Asia Pacific Courier, Express and Parcel market is the intense competition among players, leading to unsustainable price wars. The entry of new players and the expansion of existing giants like FedEx and DHL have saturated the market in urban areas. In response, many companies resort to aggressive pricing strategies to retain market share, often at the expense of profitability. For instance, local courier firms in Thailand have slashed delivery charges by up to 25% to compete with regional e-commerce platforms offering subsidized shipping. While this benefits consumers in the short term, it erodes margins and stifers innovation by making it difficult for smaller players to survive.

Infrastructure Gaps in Developing Regions

Another critical challenge is the inadequate infrastructure in developing regions, which hampers the efficiency of courier operations. The poor road conditions and limited warehousing facilities in countries like Vietnam and the Philippines result in delivery delays and damaged goods. For example, 40% of parcels in rural Indonesia experience delays exceeding 48 hours due to insufficient transport networks, as per the Indonesian Logistics Association. Moreover, the lack of standardized addresses in remote areas complicates last-mile delivery by requiring additional resources for manual navigation. These infrastructure gaps not only increase operational costs but also limit the scalability of courier services. Bridging these deficiencies requires collaboration between governments and private players to invest in road networks, warehousing hubs, and digital mapping technologies by ensuring smoother logistics operations in underserved regions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.83% |

|

Segments Covered |

By Service, Business Model, Destination, Mode of Transport, End-Use, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of Asia-Pacific |

|

Market Leaders Profiled |

Blue Dart Express, China Post, CJ Logistics Corporation, DHL Group, DTDC Express Limited, FedEx, JWD Group, SF Express (KEX-SF), SG Holdings Co., Ltd., Toll Group, Yamato Holdings., and others |

SEGMENTAL ANALYSIS

By Service Insights

The standard delivery segment was the largest and held 45.3% of the Asia Pacific Courier, Express and Parcel market share in 2024. The growth of the segment is driven by its affordability and reliability by making it the preferred choice for non-urgent shipments. For instance, in India, over 60% of parcels shipped annually are via standard delivery, according to the Federation of Indian Chambers of Commerce and Industry (FICCI). One key factor fueling this dominance is the widespread adoption of e-commerce platforms like Flipkart and Lazada, which rely on cost-effective logistics solutions to serve price-sensitive consumers.

Another driving factor is the robust infrastructure supporting road-based transportation. Additionally, government initiatives like India’s Bharatmala project have improved connectivity by reducing transit times and operational costs.

The Same-day delivery segment is likely to register a CAGR of 18.3% throughout the forecast period. This rapid growth is fueled by evolving consumer expectations for instant gratification in urban centers. Technological advancements also play a pivotal role. AI-driven route optimization and real-time tracking systems have reduced delivery times significantly. A study by Accenture reveals that companies adopting such technologies have improved delivery efficiency by 25%. Furthermore, the rise of on-demand services like food delivery and grocery apps has created a spillover effect, with customers expecting similar speed for other goods.

By Business Model Insights

The B2B segment held 50.4% of the Asia Pacific Courier, Express and Parcel market share in 2024 owing to the thriving manufacturing and export industries, which rely heavily on logistics for supply chain management. Companies like Alibaba Logistics enable seamless coordination between suppliers and manufacturers. Additionally, the rise of just-in-time inventory systems has increased demand for reliable courier services.

The B2C segment is expected to witness a CAGR of 15.7% during the forecast period with the explosive expansion of e-commerce. Platforms like Shopee and Amazon India have transformed consumer behavior, with 80% of online shoppers expecting fast and reliable deliveries. Urbanization further accelerates this growth. Cities like Tokyo and Bangkok are witnessing a surge in middle-class consumers who prioritize convenience. Over 65% of urban households in Asia Pacific prefer online shopping by creating steady demand for B2C courier services.

By Destination Insights

The domestic courier services segment was the largest by capturing 60.3% of the Asia Pacific Courier, Express and Parcel market share in 2024 with the dense population and extensive intra-country trade. In India, domestic parcels exceed 2 billion annually, driven by e-commerce platforms like Flipkart. Additionally, cultural preferences for local products fuel demand.

The international courier services segment is likely to exhibit a CAGR of 12.5% in the next coming years. Platforms like AliExpress and Rakuten Global Market have opened new avenues for Asian businesses to reach global consumers. Free trade agreements further accelerate this growth. The Regional Comprehensive Economic Partnership (RCEP) has streamlined customs procedures by reducing delivery times by 30%.

By Mode of Transport Insights

The roadways segment was accounted in holding dominant share of the Asia Pacific Courier, Express and Parcel market in 2024. This supremacy is rooted in the region’s extensive road networks, which provide unmatched accessibility to remote areas. Road transport costs are 40% lower than air freight, which is making it ideal for non-urgent shipments. Additionally, innovations like electric vehicles are enhancing sustainability. Over 25% of courier fleets in urban areas are transitioning to electric models, thereby reducing carbon footprints.

The airways segment is likely to register a CAGR of 10.8% in the next coming years with the demand for express and international deliveries. E-commerce globalization further fuels this growth. Cross-border transactions require swift delivery, with air transport being the only viable option.

By End-Use Insights

By End-Use Insights

The E-commerce led the Asia Pacific Courier, Express and Parcel market with an estimated share of 40.1% in 2024 due to its dominance is fueled by the region’s booming online retail sector. Platforms like Alibaba and Tokopedia rely heavily on courier services to fulfill orders, with China alone shipping over 1 billion parcels monthly are prompting the growth of the market to the extent. Consumer behavior also drives this trend. Additionally, mobile commerce has expanded access to e-commerce, with smartphone penetration exceeding 80% in countries like South Korea.

The healthcare segment is thriving to reach a fastest CAGR of 14.2% in the next coming years owing to the rise of telemedicine and pharmaceutical deliveries. During the pandemic, courier services for medical supplies grew by 50%, as per the World Health Organization. For example, Japan’s courier firms delivered over 10 million vaccine doses weekly in 2021. Regulatory support further accelerates growth. Governments are investing in cold chain logistics to ensure safe transportation of vaccines and biologics.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific Courier, Express and Parcel market with 35.4% of the share in 2024. The country’s dominance is driven by its massive e-commerce ecosystem, with platforms like Alibaba generating billions in courier demand. Government investments in infrastructure, such as high-speed rail and automated warehouses, have enhanced logistics efficiency.

India was accounted in holding 20.3% of the Asia Pacific Courier, Express and Parcel market share in 2024, with its rapidly growing e-commerce sector. The courier services in India are growing at higher rate with the platforms like Flipkart and Amazon India. The government’s Digital India initiative has expanded internet access, which is boosting online shopping and courier demand.

Japan courier market growth is driven with its advanced technology and aging population driving demand for efficient courier services. The Japan External Trade Organization reports that robotics and automation have reduced delivery times by 30% by ensuring timely shipments. South Korea courier market growth is driven with its tech-savvy population relying heavily on e-commerce. Australia with its vast geography necessitating robust logistics networks is likely to propel he growth of the courier market in Asia Pacific.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Blue Dart Express, China Post, CJ Logistics Corporation, DHL Group, DTDC Express Limited, FedEx, JWD Group, SF Express (KEX-SF), SG Holdings Co., Ltd., Toll Group, Yamato Holdings are playing dominating role in the Asia Pacific Courier, Express and Parcel market.

The Asia Pacific Courier, Express and Parcel market is highly competitive, characterized by the presence of global giants like DHL and FedEx alongside regional leaders such as SF Express and Blue Dart. These players compete on speed, reliability, and technological innovation, with a strong emphasis on e-commerce logistics. Urban centers witness intense rivalry, particularly in express and same-day delivery segments, where differentiation through AI-driven solutions and sustainable practices is crucial. Smaller firms focus on niche markets by offering specialized services like cold chain logistics for healthcare. Government support for infrastructure development and trade agreements further intensifies competition by lowering barriers.

TOP PLAYERS IN THE MARKET

DHL Express

DHL Express is a global leader in logistics, with a strong presence in the Asia Pacific Courier, Express and Parcel market. The company has expanded its operations in North America by partnering with e-commerce platforms to offer cross-border shipping solutions. In 2023, DHL launched AI-driven route optimization tools by enhancing delivery efficiency and reducing carbon emissions. Additionally, the company invested in electric vehicles for urban deliveries, which is aligning with sustainability goals. These initiatives have strengthened DHL’s reputation as a tech-savvy and eco-conscious player by enabling it to cater to environmentally aware consumers in North America.

FedEx Corporation

FedEx has established itself as a key player in the Asia Pacific Courier, Express and Parcel market through its robust network and focus on express delivery services. To bolster its North American presence, FedEx partnered with Shopify in 2023 by offering seamless integration for small businesses. The company also introduced real-time tracking systems using IoT sensors, improving transparency for customers. Furthermore, FedEx expanded its air freight capacity by acquiring additional cargo planes by ensuring faster international deliveries.

SF Express

SF Express, a leading Chinese courier firm, has made significant strides in the Asia Pacific region by leveraging advanced technologies. In North America, SF Express collaborated with Amazon in 2023 to handle last-mile deliveries for Chinese exports. The company adopted blockchain technology to ensure secure and tamper-proof shipment tracking by gaining trust among global clients. Additionally, SF Express invested in drone delivery systems for remote areas by showcasing innovation in logistics. These strategic moves have positioned SF Express as a forward-thinking player in both regional and international markets.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the Asia Pacific Courier, Express and Parcel market employ diverse strategies to maintain their competitive edge. A primary focus is technological innovation, with companies adopting AI, IoT, and blockchain to enhance operational efficiency and transparency. Strategic partnerships with e-commerce giants like Alibaba and Amazon have also become critical, enabling firms to tap into growing online retail demand. Sustainability is another priority, with investments in electric vehicles and eco-friendly packaging to align with consumer preferences. Expansion into rural and underserved areas through last-mile delivery networks further strengthens market reach. Finally, mergers and acquisitions are used to consolidate resources and expand service portfolios by ensuring long-term growth and resilience in a dynamic market.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, DHL Express implemented AI-driven route optimization tools across Asia Pacific by reducing delivery times by 20% and enhancing customer satisfaction.

- In June 2023, FedEx partnered with Shopify to integrate its logistics services by enabling seamless cross-border shipping for North American small businesses.

- In September 2023, SF Express launched blockchain-based tracking systems by ensuring secure and transparent shipment monitoring for international clients.

- In January 2024, Blue Dart introduced a fleet of electric vehicles for urban deliveries in India by aligning with sustainability goals and reducing operational costs.

- In March 2023, Japan Post acquired a regional courier firm in Southeast Asia by expanding its network and strengthening its position in emerging markets.

MARKET SEGMENTATION

This research report on the Asia Pacific courier, express, and parcel market has been segmented and sub-segmented based on the following categories.

By Service

- Standard Delivery

- Express Delivery

- Same-Day Delivery

- Last-Mile Delivery

By Business Model

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Customer-to-Customer (C2C)

By Destination

- Domestic

- International

By Mode of Transport

- Roadways

- Airways

- Railways

- Waterways

By End-Use

- E-commerce

- Healthcare

- Manufacturing

- Wholesale & Retail

- Other

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What are the key opportunities in the Asia Pacific Courier, Express, and Parcel Market?

Rising e-commerce penetration, cross-border trade growth, and the adoption of last-mile delivery technologies are fueling opportunities for rapid expansion in the Asia Pacific CEP market.

2. What are the major challenges facing the Asia Pacific Courier, Express, and Parcel Market?

Key challenges include complex logistics in remote regions, rising fuel and labor costs, and the need for digital transformation to manage high parcel volumes efficiently.

3. Who are the major players in the Asia Pacific Courier, Express, and Parcel Market?

Leading companies include SF Express, Yamato Holdings, DHL Express, FedEx, and Blue Dart, offering diverse shipping and delivery solutions across domestic and international segments.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]