Asia Pacific Dental Practice Management Software Market Research Report – Segmented By Delivery Mode (Cloud-Based Delivery Mode, Hybrid Delivery Mode, On-Premise Delivery Mode), Component, Deployment, Interface type, End-User, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Dental Practice Management Software Market Size

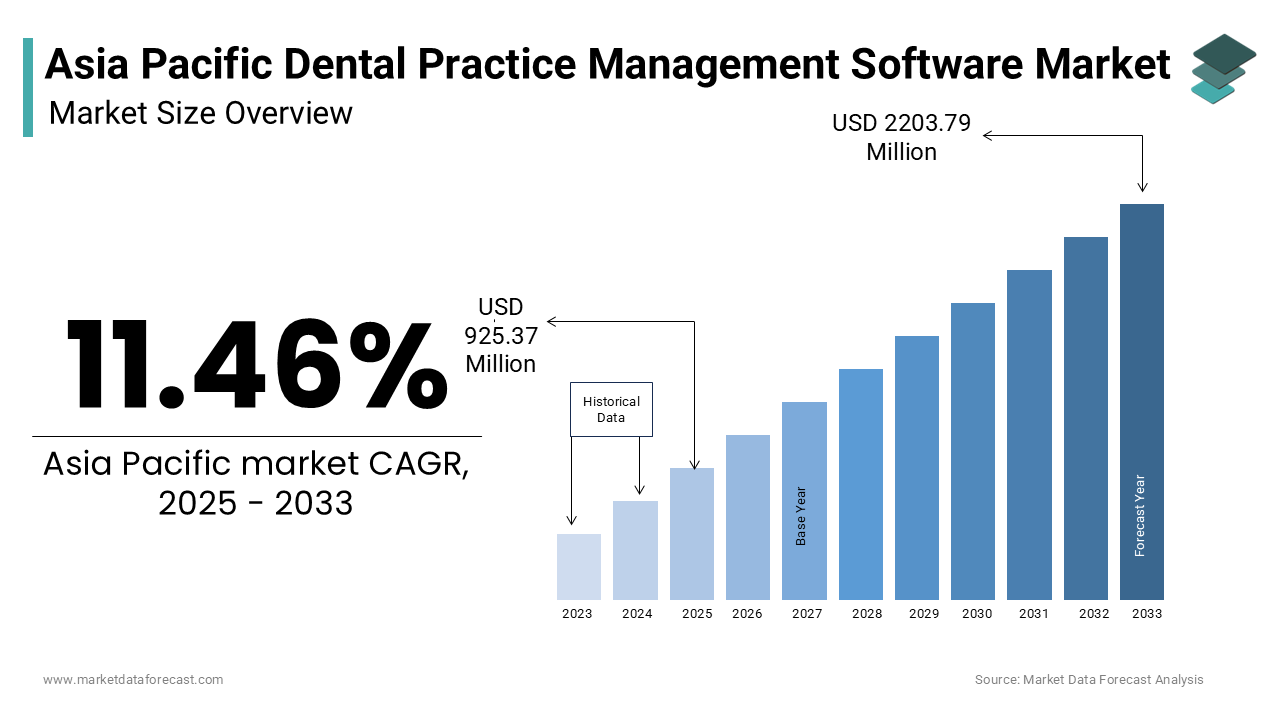

The Asia Pacific Dental Practice Management Software Market was worth USD 830.07 million in 2024. The Asia Pacific market is expected to reach USD 2203.79 million by 2033 from USD 925.37 billion in 2025, rising at a CAGR of 11.46% from 2025 to 2033.

The Asia Pacific dental practice management software market is driven by the growing need for digital tools to streamline administrative and clinical operations in dental practices. These software solutions enable dentists and administrative staff to manage patient records, appointment scheduling, billing and treatment planning efficiently. Dental clinics in urban areas of the region have adopted some form of practice management software emphasizing its critical role in modernizing healthcare delivery. For instance, countries like Japan and Australia are leveraging cloud-based platforms to enhance accessibility and interoperability across dental networks. Additionally, the rise of tele-dentistry and preventive care initiatives has amplified the demand for integrated systems that support remote consultations and patient engagement. The integration of artificial intelligence (AI) and machine learning into these platforms has further expanded their capabilities thereby enabling predictive analytics and personalized treatment recommendations.

MARKET DRIVERS

Increasing Adoption of Digital Health Technologies

The rapid adoption of digital health technologies is a significant driver of the dental practice management software market in the Asia Pacific. Governments and healthcare providers are increasingly investing in digital tools to improve operational efficiency and patient outcomes. Dental clinics in South Korea and Singapore are leveraging AI-driven software to analyze patient data and recommend optimal treatment plans thereby enhancing diagnostic accuracy and treatment effectiveness. Additionally, the growing emphasis on preventive care has amplified the need for software that can track patient histories and predict potential dental issues. Clinics using AI-powered software reported a 30.6% reduction in administrative errors which ensured timely interventions and improved overall patient satisfaction.

Rising Demand for Streamlined Administrative Processes

streamline administrative processes in dental practices is another major driver is the increasing demand particularly in urban areas where patient volumes are high. Over 50.93% of dental clinics in the Asia Pacific face challenges related to manual record-keeping and inefficient appointment scheduling thereby leading to operational bottlenecks. Dental practice management software addresses these pain points by automating tasks such as billing, insurance claims processing and inventory management. For instance, companies like Henry Schein and Dentsply Sirona offer platforms that integrate seamlessly with existing systems which reduce overhead costs and improve workflow efficiency. Additionally, the integration of cloud-based solutions enables real-time access to patient data. Clinics adopting such software have reported significant improvements in operational efficiency thereby leading to increased investment in scalable and cost-effective solutions.

MARKET RESTRAINTS

High Implementation Costs

High implementation costs are one of the primary restraints facing the Asia Pacific dental practice management software market especially for small and medium-sized dental practices. Deploying enterprise-grade systems require significant investments in hardware, software and skilled personnel. The average upfront cost of setting up a comprehensive dental practice management system exceeds $10,000 for medium-sized clinics making it prohibitive for smaller players with limited budgets. Additionally, the shortage of professionals proficient in IT and software implementation further compounds the issue. These financial and resource constraints hinder widespread adoption in developing economies where healthcare budgets are already strained.

Resistance to Change Among Traditional Practitioners

Resistance to change among traditional dental practitioners is another significant restraint on the market and particularly in rural and semi-urban areas. Many dentists underestimate the importance of adopting advanced software tools viewing them as unnecessary or overly complex rather than as enablers of competitive advantage. Over half of dental practices in the region do not integrate practice management software into their operations. This complacency stems from a limited understanding of potential risks and the perceived complexity of implementation. The absence of dedicated IT departments in smaller practices exacerbates the problem as staff often lack the technical knowledge to identify and mitigate gaps.

MARKET OPPORTUNITIES

Integration with Emerging Technologies

The integration of emerging technologies such as artificial intelligence (AI), machine learning (ML) and blockchain presents a transformative opportunity for the Asia Pacific dental practice management software market. AI-driven platforms can analyze vast amounts of patient data to provide personalized treatment recommendations thereby enabling dentists to deliver precision care. AI-powered software can reduce diagnostic errors by up to 40.7% making it highly attractive to clinics seeking to improve patient outcomes. For instance, dental practices in Japan and Australia are using AI algorithms to predict cavity progression and recommend preventive measures thereby ensuring timely interventions. Additionally, blockchain technology offers unparalleled transparency and security by creating immutable records of patient interactions which is particularly valuable for managing sensitive health data.

Expansion into Rural and Underserved Areas

Expanding dental practice management software solutions is another promising opportunity for the Asia Pacific dental practice management software market in rural and underserved areas. Countries like Vietnam, Indonesia and the Philippines face significant disparities in healthcare access, thereby creating a robust demand for innovative tools that address inefficiencies. Over 40.2% of rural populations in Southeast Asia lack access to quality dental care which further amplifies the need for scalable solutions. For instance, startups in India are leveraging mobile-based platforms to provide affordable and accessible software solutions for small clinics thereby ensuring continuity of care for underserved communities. Additionally, government-led initiatives promoting rural healthcare development have further bolstered the market which encourages investments in cost-effective and sustainable technologies. Companies can tap into new revenue streams while contributing to equitable healthcare access across the region.

MARKET CHALLENGES

Shortage of Skilled Workforce

The scarcity of skilled professionals proficient in dental practice management software and IT systems poses a significant challenge to the market’s growth. Despite the rising demand for expertise in areas such as software implementation, data analytics and cybersecurity the talent pool remains insufficient. The global shortage of IT professionals is expected to reach 3.5 million unfilled positions by 2025 with the Asia Pacific accounting for nearly 40.54% of this deficit. In countries like Malaysia and Thailand universities produce fewer than 500 IT specialists annually far below industry requirements. This shortage forces dental practices to either outsource critical functions or operate with understaffed teams thereby increasing the risk of inefficiencies and suboptimal outcomes. Additionally, the rapid evolution of software technologies necessitates continuous upskilling which many professionals struggle to achieve due to limited access to advanced training programs.

Data Privacy and Security Concerns

Another pressing challenge is the growing concern over data privacy and security particularly as dental practice management software relies heavily on sensitive patient information. Cyberattacks targeting healthcare networks have become increasingly sophisticated thereby posing a threat to the integrity and confidentiality of data. The healthcare sector experienced a 45.65% increase in cyberattacks in 2022 with ransomware being the most prevalent threat. For instance, dental clinics in Thailand and Malaysia reported breaches that exposed patient records which undermined trust in digital tools. Additionally, fragmented regulatory frameworks across the region exacerbate the issue as countries like India and Indonesia lack comprehensive data protection laws.

SEGMENTAL ANALYSIS

By Solution Insights

The manufacturing segment was the largest in the Asia Pacific dental practice management software market by capturing 55.63% of the total share in 2024 and is driven by the critical role software plays in optimizing production processes for dental equipment and materials such as crowns, implants and orthodontic devices. Companies in Japan and South Korea leverage predictive analytics to anticipate demand fluctuations and optimize just-in-time (JIT) production systems thereby reducing costs and minimizing waste. Another driving factor is the increasing emphasis on compliance with stringent healthcare regulations. Over 70.7% of dental manufacturers in the region prioritize software solutions to ensure adherence to quality standards and regulatory frameworks. Companies can ensure compliance while enhancing productivity thereby reinforcing the dominance of the manufacturing segment in the market.

Logistics analytics is projected to witness a CAGR of 22.3% during the forecast period. This rapid expansion is fueled by the growing complexity of supply chains and the need for real-time visibility into logistics operations. For example, dental clinics and suppliers in countries like India and Australia are using AI-driven analytics to optimize inventory management, transportation and last-mile delivery of dental products. Another contributing factor is the integration of IoT-enabled devices into logistics operations which enable real-time tracking and monitoring of shipments. IoT-based analytics can reduce logistics costs by up to 30.5%, making it highly attractive to businesses seeking cost-effective and scalable solutions. Logistics analytics is poised to experience significant growth thereby positioning it as the fastest-growing segment in the market.

By Deployment Insights

The on-premise deployment was the largest in the Asia Pacific dental practice management software market by capturing 60.3% of the total share in 2024. This growth is driven by the widespread adoption of on-premise solutions among large dental practices and hospitals particularly in industries where data security and control are paramount. Many large organizations in the region prefer on-premise systems to manage sensitive patient data thereby aiming to ensure compliance with strict regulatory requirements. Dental hospitals in Japan and South Korea rely on on-premise software platforms to maintain complete control over their data while mitigating risks associated with cyberattacks and data breaches. Another driving factor is the growing complexity of IT infrastructures. As organizations expand their digital footprints they require adaptable solutions that can integrate seamlessly with existing systems. On-premise deployment modes reduce operational costs by 25.3% compared to fully cloud-based systems which makes them highly attractive to businesses seeking cost-effective yet secure solutions.

The cloud deployment is likely to experience a CAGR of 24.5% from 2025 to 2033. This rapid expansion is fueled by the increasing affordability and scalability of cloud-based platforms which enable dental practices to access real-time analytics without significant upfront investments. For instance, small and medium-sized clinics in India and Southeast Asia are adopting cloud-based solutions to enhance patient record management and streamline administrative tasks. The adoption of cloud technologies in the Asia Pacific region grew by 30.9% in 2022, thereby reflecting its growing popularity among diverse stakeholders. Another contributing factor is the integration of AI and machine learning into cloud platforms which enable predictive and prescriptive analytics.

REGIONAL ANALYSIS

China was the top performer of the Asia Pacific dental practice management software market by occupying 35.86% of the share in 2024. The country’s massive population and rapidly aging demographic have created a fertile ground for digital health solutions to address growing dental care demands. Enterprises and dental clinics in China are increasingly adopting software platforms to manage electronic health records (EHRs) along with optimizing resource allocation and predicting patient needs. Government initiatives promoting digital health technologies have further accelerated investments to strengthen China’s position as the market leader.

Japan was positioned second in holding a dominant share of the Asia Pacific dental practice management software market. The country’s advanced technological infrastructure and emphasis on precision medicine have positioned it as a leader in adopting AI-driven dental practice management software. Japanese dental providers prioritize efficiency and innovation particularly in areas like preventive care and patient engagement. The

Indian dental practice management software market is esteemed to grow with prominent growth opportunities in the next coming years. The country’s booming IT sector and rapidly evolving startup ecosystem are major drivers of dental practice management software adoption. Indian enterprises are increasingly leveraging software platforms to address challenges such as chronic disease management and rural healthcare access. Government-led initiatives promoting telemedicine and digital health have further bolstered the market thereby ensuring steady growth.

Australia dental practice management software market growth is driven by its strong emphasis on regulatory compliance and public health surveillance has fueled demand for dental practice management software solutions. Australian dental providers spend significant resources on managing EHRs, clinical trials and population health trends. Healthcare organizations use predictive models to monitor infectious disease outbreaks, thereby improving preparedness and response times.

South Korea dental practice management software market is driven by its focus on innovation and digital transformation and the adoption of advanced dental practice management software platforms. South Korean dental providers in urban centers rely on software tools to manage chronic diseases and enhance patient care. Large hospitals have implemented AI-driven systems to analyze imaging data for early disease detection thereby ensuring timely interventions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Carestream Dental, Dentsply Sirona, Henry Schein, Inc., Gaargle Solutions, Dentalz, Open Dental Software, ACE Dental Software, Cloud Dentistry, iDentalSoft, Medent, Exan Software, and Zoft Dental.

The Asia Pacific dental practice management software market is characterized by intense competition and is driven by a mix of global giants and regional innovators striving to capture market share. Established players like Henry Schein, Dentsply Sirona and Carestream Dental bring extensive resources and technological expertise thereby enabling them to dominate key segments such as AI-driven analytics and cloud-based platforms. At the same time, regional companies leverage their deep understanding of local cultures and regulatory frameworks to carve out niche positions. The market’s dynamic nature is further amplified by rapid technological advancements which compel vendors to continuously innovate and adapt. Strategic collaborations with governments and industry bodies play a crucial role in shaping competitive strategies particularly in emerging markets. Additionally, the rise of digital transformation initiatives has created new opportunities for differentiation as companies strive to offer seamless and scalable solutions.

Top Players in the Asia Pacific Dental Practice Management Software Market

Henry Schein, Inc.

Henry Schein is a global leader in the dental practice management software market offering comprehensive solutions that cater to both administrative and clinical needs of dental practices. Its platforms integrate seamlessly with existing systems thereby enabling efficient appointment scheduling, billing and patient record management. Henry Schein’s emphasis on innovation and scalability has positioned it as a trusted partner for clinics seeking to modernize their operations. The company has expanded its footprint in the Asia Pacific addressing unique challenges such as fragmented regulations and cross-border healthcare compliance.

Dentsply Sirona

Dentsply Sirona specializes in advanced dental practice management software that emphasizes real-time data analytics and interoperability. Its solutions empower dental practices to streamline workflows and enhance patient engagement as well as improve treatment outcomes. Dentsply Sirona has strengthened its presence in the Asia Pacific by investing in AI-driven tools and fostering partnerships with startups and academic institutions. The company continues to shape the future of dental technologies worldwide while ensuring precision care and operational efficiency.

Carestream Dental

Carestream Dental offers cloud-based dental practice management platforms that provide end-to-end visibility across operations and ensure alignment with global and regional standards. Its tools enable clinics to manage patient records, treatment planning and inventory efficiently. Carestream Dental has deepened its engagement in the Asia Pacific by tailoring its offerings to meet local needs such as data privacy laws in Japan and Australia.

Top Strategies Used by Key Players in the Asia Pacific Dental Practice Management Software Market

Integration of Artificial Intelligence and Machine Learning

Integration of artificial intelligence (AI) and machine learning (ML) into dental practice management software is becoming more common among leading players aiming to enhance functionality and adaptability. These technologies enable predictive analytics along with real-time decision-making and automation while addressing complex challenges in areas such as treatment planning and patient engagement. For instance, AI-driven systems can analyze patient data to recommend optimal interventions thereby ensuring timely and personalized care.

Expansion Through Strategic Partnerships

Strategic partnerships with local enterprises, governments and industry bodies have become a cornerstone of success in the Asia Pacific dental practice management software market. Collaborations with public sector organizations help promote awareness campaigns and regulatory compliance initiatives thereby fostering trust among stakeholders. Additionally, partnerships with technology firms facilitate the integration of advanced tools which ensure scalability and reliability. Focus on Localization and Customization

The focus on localization and customization is a priority for key players aiming to address the unique needs of businesses in the Asia Pacific region. This approach not only enhances user experience but also fosters brand loyalty. Additionally, customization allows companies to adapt their solutions to specific industries such as rural healthcare and telemedicine while ensuring relevance and applicability in diverse operational contexts.

RECENT MARKET DEVELOPMENTS

- In April 2024, Henry Schein launched a new AI-powered module tailored to address the growing complexity of patient data management in Southeast Asia.

- In June 2023, Dentsply Sirona partnered with a leading dental chain in Australia to integrate its practice management software with the firm’s existing clinical systems.

- In September 2023, Carestream Dental introduced a blockchain-enabled feature to ensure tamper-proof records for patient interactions in India.

- In February 2024, Henry Schein acquired a regional startup specializing in AI-driven predictive analytics for dental diagnostics.

- In November 2023, Dentsply Sirona collaborated with a government agency in Singapore to promote the adoption of dental practice management tools among small and medium-sized clinics.

MARKET SEGMENTATION

This research report on the Asia Pacific dental practice management software market is segmented and sub-segmented into the following categories.

By Delivery Mode

- Cloud-Based Delivery Mode

- Hybrid Delivery Mode

- On-Premise Delivery Mode

By Component

- Patient Management

- Records Managements

- Finance & Accounting

- Analytical and Dashboards

- Others

By Deployment

- Window

- macOS

- iOS

- Android

- Others

By Interface Type

- Biometric Device Interface

- QR Code Scanner Interface

- Barcode Scanner Interface

- RFID Interface

By End-User

- Hospitals

- Dental Clinics

- Others

By Distribution Channel

- Direct Tender

- Third Party Distributors

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What factors are driving the Asia Pacific Dental Practice Management Software Market?

The Asia Pacific Dental Practice Management Software Market is driven by increasing digitization in healthcare, the growth of dental clinics, rising demand for automation in practice management, and supportive government initiatives for healthcare IT.

What challenges does the Asia Pacific Dental Practice Management Software Market face?

Challenges in the Asia Pacific Dental Practice Management Software Market include high implementation costs for small clinics, lack of digital infrastructure in rural areas, cybersecurity concerns, and resistance to replacing manual systems.

What is the future outlook for the Asia Pacific Dental Practice Management Software Market?

The Asia Pacific Dental Practice Management Software Market is expected to grow at a CAGR of around 9–12% over the next few years, driven by digital health initiatives, rising dental service needs, and technological advancements.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com