Asia Pacific Dietary Supplement Market Size, Share, Trends & Growth Forecast Report By Ingredient (Vitamins, Minerals, Probiotics), Form, End User, Application, Type, Distribution Channel, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Dietary Supplement Market Size

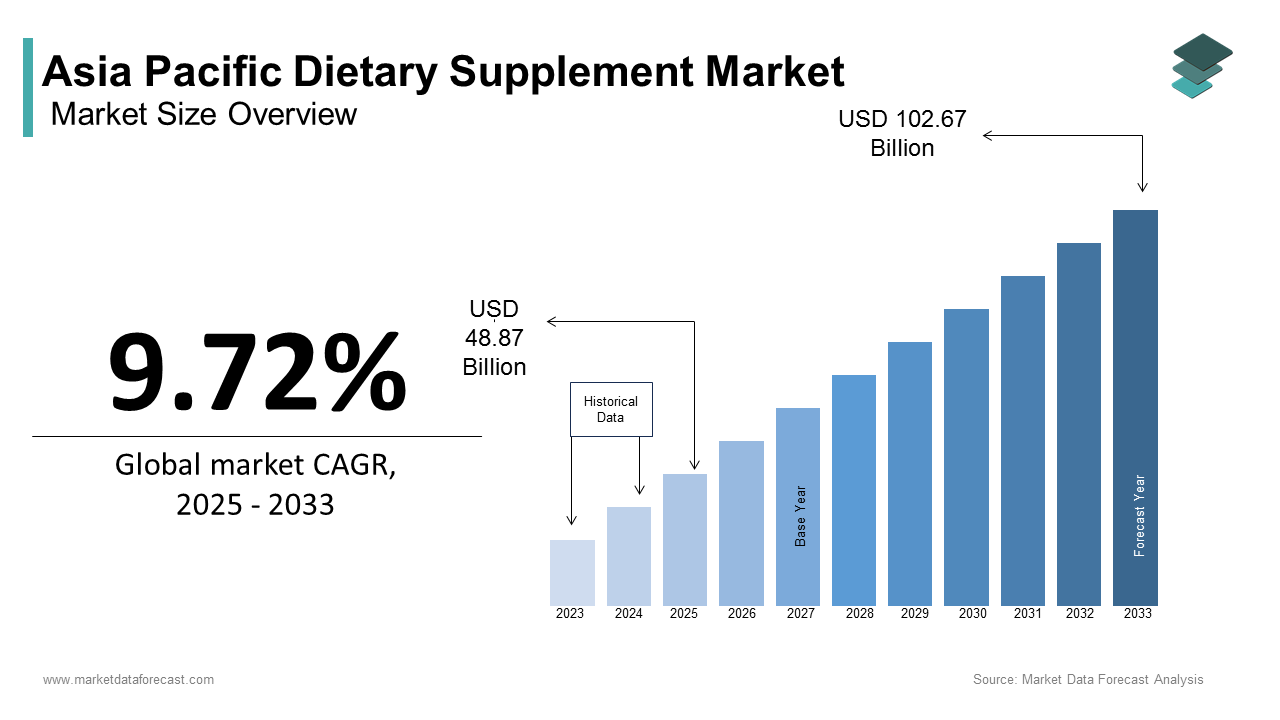

As per our analysis report, the Asia Pacific dietary supplement market was calculated to be worth USD 44.53 billion in 2024 and is anticipated to be worth USD 102.67 billion by 2033 from USD 48.87 billion In 2025, growing at a CAGR of 9.72% during the forecast period.

The Asia Pacific dietary supplement market is a rapidly expanding segment within the broader health and wellness industry. It is driven by an increasingly health-conscious population and rising disposable incomes. Also, regulatory frameworks in the region also play a critical role, with countries like Australia implementing stringent quality standards through the Therapeutic Goods Administration (TGA), ensuring consumer trust. However, challenges such as counterfeit products and inconsistent regulations across borders occasionally hinder progress.

MARKET DRIVERS

Rising Health Awareness Among Consumers

The rising health awareness among consumers is a pivotal driver propelling the Asia Pacific dietary supplement market forward, with individuals increasingly prioritizing preventive healthcare. This trend is particularly pronounced in urban areas, where sedentary lifestyles and processed food consumption have led to a rise in chronic illnesses.

For instance, according to the World Health Organization, non-communicable diseases account for over 60% of deaths in the Asia Pacific region, prompting individuals to adopt healthier habits. Supplements like omega-3 fatty acids, probiotics, and multivitamins have become household staples, especially among millennials and Gen Z consumers. Additionally, the influence of social media platforms has amplified this trend, with fitness influencers and nutritionists advocating the benefits of supplements. Collaborations between brands and wellness experts further reinforce consumer trust, driving demand.

Aging Population and Geriatric Health Needs

The aging population in the Asia Pacific region serves as another major driver for the dietary supplement market, as older adults increasingly turn to supplements to address age-related health concerns. According to the United Nations, the number of people aged 65 and above in the region is projected to arrive at a major mark by the late 2070s, reaching 2.2 billion. This demographic shift has created a robust demand for products targeting bone health, cardiovascular support, and cognitive function.

For example, as per the Japanese Ministry of Health, Labour and Welfare, dietary supplements containing calcium, vitamin D, and collagen are among the fastest-growing categories in Japan, driven by the country’s aging populace. Similarly, in China, where the elderly population exceeds significantly, herbal supplements like ginseng and goji berries remain popular due to their perceived ability to enhance vitality and longevity. Furthermore, government initiatives promoting active aging have bolstered the adoption of supplements among retirees, who view them as essential for maintaining independence.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

Stringent regulatory frameworks pose a significant restraint to the Asia Pacific dietary supplement market, creating barriers for both domestic and international players. While regulations aim to ensure product safety and efficacy, the lack of uniformity across countries complicates compliance for manufacturers. For instance, according to the Food Safety and Standards Authority of India (FSSAI), dietary supplements must undergo rigorous testing and labeling requirements, which can delay product launches by several months. Similarly, in China, the National Medical Products Administration mandates pre-market approvals, adding to operational costs and timelines. These inconsistencies often deter smaller companies from entering the market. Moreover, as per the Asian Development Bank, frequent updates to regulatory guidelines create uncertainty, forcing manufacturers to constantly adapt their formulations and packaging. In some cases, overly restrictive policies have led to the withdrawal of certain products from shelves, impacting revenue streams. These regulatory challenges not only increase the cost of doing business but also limit innovation, making it difficult for the market to achieve its full potential amidst evolving consumer demands.

Proliferation of Counterfeit Products

The proliferation of counterfeit dietary supplements represents another critical restraint hindering the growth of the Asia Pacific market. These counterfeit products often contain substandard or harmful ingredients, leading to adverse effects that tarnish the reputation of legitimate brands. For instance, a significant portion of the dietary supplements sold in informal markets in Southeast Asia fail to meet quality standards, with some even containing banned substances. This issue is exacerbated by the rise of unregulated e-commerce platforms, where counterfeiters exploit lax oversight to sell fraudulent products at lower prices. Furthermore, counterfeit products erode brand equity and discourage investments in research and development, stifling innovation. The lack of effective enforcement mechanisms and consumer awareness campaigns further compounds the problem, making it imperative for stakeholders to address this challenge to safeguard the market’s integrity and ensure sustainable growth.

MARKET OPPORTUNITIES

Expansion into Rural and Emerging Markets

The expansion into rural and emerging markets presents a lucrative opportunity for the Asia Pacific dietary supplement market, driven by untapped consumer bases and improving economic conditions. According to the World Bank, rural populations in countries like India, Indonesia, and Vietnam account for a significant portion of the total population, yet their access to branded dietary supplements remains limited. This gap creates a vast potential for growth, particularly as disposable incomes rise and awareness of preventive healthcare increases. Manufacturers can leverage this shift by introducing affordable and culturally relevant formulations, such as herbal supplements derived from traditional remedies like ashwagandha and turmeric. For instance, as per the Confederation of Indian Industry, companies partnering with local distributors and cooperatives have successfully penetrated rural markets, achieving a 25% increase in sales within two years. Further, government initiatives promoting rural healthcare infrastructure have enhanced accessibility, enabling brands to establish a foothold.

Innovation in Personalized Nutrition

Innovation in personalized nutrition offers a transformative opportunity for the Asia Pacific dietary supplement market, enabling brands to cater to individual health needs and preferences. Advances in genetic testing and wearable technology allow companies to develop customized supplements tailored to specific dietary deficiencies, metabolic profiles, and lifestyle factors. For example, personalized supplements targeting micronutrient deficiencies have gained popularity among urban professionals, with a considerable percentage willing to pay a premium for bespoke formulations. Brands leveraging AI-driven platforms to analyze consumer data can offer highly targeted recommendations, enhancing customer engagement and loyalty. Moreover, collaborations with telemedicine providers and wellness apps further amplify this trend, as highlighted by a report from McKinsey. This focus on personalization not only diversifies product portfolios but also positions the region as a leader in next-generation health solutions.

MARKET CHALLENGES

Consumer Skepticism and Misinformation

Consumer skepticism and misinformation represent a significant challenge for the Asia Pacific dietary supplement market, undermining trust and adoption rates. A notable share of consumers in the region harbor doubts about the efficacy and safety of dietary supplements, often influenced by conflicting information on social media and unverified sources. This skepticism is particularly pronounced in countries like China and India, where historical reliance on traditional remedies creates resistance to modern formulations.

For instance, a significant share of respondents expressed concerns about exaggerated health claims made by supplement manufacturers, leading to hesitancy in purchasing decisions. Furthermore, as per the Indian Council of Medical Research, misinformation about the side effects of certain ingredients, such as synthetic vitamins, has fueled negative perceptions, deterring first-time users. The absence of large-scale awareness campaigns exacerbates the issue, leaving consumers ill-equipped to make informed choices.

Intense Market Competition

Intense market competition poses a formidable challenge to the Asia Pacific dietary supplement market, as an influx of new entrants and established players vie for dominance in a crowded landscape. Like, the number of dietary supplement brands operating in the region has increased notably since 2019, creating heightened pressure on pricing and profit margins. This saturation forces companies to engage in aggressive marketing tactics, often at the expense of long-term brand equity. For example, as per a study by PwC, private-label supplements offered by major retailers now account for 20% of total sales in key markets like Australia and South Korea, further intensifying competition for branded manufacturers. Price wars and promotional discounts have become commonplace, eroding profitability and discouraging investments in innovation. In addition, counterfeit products and unauthorized imports exacerbate the issue, flooding the market with low-cost alternatives that undermine premium brands.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.72% |

|

Segments Covered |

By Ingredient, Form, End User, Application, Type, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

Kirin Holdings, Ajinomoto Co. Inc., Blackmores, Swisse, Sun Pharmaceutical Industries Ltd., Dabur India Ltd., Unilab Inc., Kalbe Farma, Amway Corporation, Herbalife International of America Inc. |

SEGMENTAL ANALYSIS

By Ingredient Insights

The vitamins segment was the largest in the Asia Pacific Dietary Supplement Market by occupying 35.5% of the share with the rising awareness about preventive healthcare and immunity boosting, especially post-pandemic. Countries like China, Japan, and India have witnessed a surge in demand for Vitamin D, C, and B-complex supplements due to changing lifestyles and increasing health concerns. Government initiatives promoting vitamin supplementation, along with the growing prevalence of lifestyle diseases, further support this growth.

The botanicals segment is lucrative to grow with a CAGR of 9.8% from 2025 to 2033. This rapid expansion is driven by increasing consumer preference for natural and herbal ingredients, supported by traditional medicine systems such as Ayurveda and Traditional Chinese Medicine (TCM). Ingredients like ashwagandha, turmeric, and tulsi are gaining scientific validation and global demand for their therapeutic benefits, including stress reduction and immune support. Clinical research from institutions like the Central Council for Research in Ayurvedic Sciences (CCRAS) has further enhanced credibility.

By Form Insights

The tablets segment held 34.3% of the Asia Pacific Dietary Supplement Market share in 2024. Tablets have maintained their dominance due to factors such as longer shelf life, ease of formulation with high nutrient content, and cost-effective manufacturing processes.

The gummies segment is projected to grow at a CAGR of 9.8% between 2025- 2033. The growth of the segment is fueled by changing consumer preferences toward tasty, easy-to-consume formats among children and young adults. The rise of e-commerce platforms and aggressive marketing by global brands like Vitafusion and MyProtein have also played a significant role in expanding the reach and popularity of gummies across urban centers in the Asia Pacific region.

By Application Insights

The General Health segment accounted in holding 28.5% of the Asia Pacific Dietary Supplement Market share in 2024 owing to the growing consumer emphasis on preventive healthcare, rising disposable incomes, and increasing awareness about wellness across countries like China, India, and Japan. The segment encompasses essential nutrients such as vitamins, minerals, and multivitamins, which are widely consumed to bridge nutritional gaps and support immunity and energy levels. Government-backed health promotion programs across Asia Pacific nations have further boosted public trust and adoption of general health supplements, which is making it the cornerstone of the regional market.

The Brain/Mental Health segment is anticipated to witness a CAGR of 9.1% from 2025 to 2033. The growth of the segment is fueled by rising mental health concerns, including stress, anxiety, depression, and cognitive decline in urban populations. According to the World Health Organization, over 150 million people in India suffer from mental health disorders, while China has seen a 12% year-on-year growth in sales of cognitive health supplements. Rapid urbanization, work-related stress, and an aging population are key drivers. Additionally, the National Institute of Mental Health report has shown increased post-pandemic awareness around brain health by encouraging supplement use. Ingredients like omega-3s, adaptogens, and nootropics are gaining traction by positioning this segment as a critical growth engine in the evolving supplement landscape.

By End-User Insights

The Adults segment dominated the Asia Pacific Dietary Supplement Market with 55.6% of the share in 2024 with the rising health consciousness, increasing disposable incomes, and a surge in lifestyle-related diseases such as diabetes and obesity. In China alone, dietary supplement sales reached $36 billion in 2022, primarily driven by adult consumers seeking immunity support and preventive healthcare solutions. The post-pandemic focus on wellness and nutrition has further accelerated demand across both urban and rural regions.

The Geriatric segment is likely to expand with an estimated CAGR of 9.1% in the coming years. This rapid growth is fueled by the region’s aging population by 2050, one in four people in Asia will be aged 60 or above. Countries like Japan, where 30% of the population is over 65 years old are witnessing increased consumption of supplements to manage age-related conditions such as osteoporosis, cardiovascular diseases, and cognitive decline. The geriatric segment is playing a pivotal role in driving market expansion across the Asia Pacific with rising life expectancy and growing awareness about healthy aging.

By Type Insights

The OTC segment was accounted in holding a dominant share of the the Asia Pacific dietary supplement market in 2024 owing to the increasing consumer awareness about preventive healthcare, rising disposable incomes, and a shift toward self-care practices in countries like China, India, Japan, and South Korea. The convenience of access through both physical and online retail channels has further accelerated its adoption.

The Prescribed Supplements segment is anticipated to register a CAGR of 9.7% in the coming years. This growth is largely fueled by the integration of dietary supplements into mainstream medical treatments, especially for chronic diseases such as osteoporosis, anemia, cardiovascular diseases, and vitamin D deficiency. This trend is also being supported by government initiatives. For instance, the Indian Council of Medical Research (ICMR) launched national programs promoting iron and folic acid supplementation for pregnant women and adolescents, which significantly boosted the prescribed supplements category.

By Distribution Channel Insights

The pharmacy segment held 48.2% of the total Asia Pacific dietary supplement market share in 2024 with high consumer trust in pharmacists as credible health advisors, especially in countries like Japan, Australia, China, and India, where supplements are often purchased alongside prescription medications. The presence of certified professionals, assurance of product quality, and regulatory frameworks all contribute to the continued prominence of pharmacies in the region’s dietary supplement market.

The online distribution channel segment is likely to grow with a CAGR of 12.7% from 2025 to 2033. The growth of the segment is fueled by increasing internet penetration, smartphone usage, urbanization, and shifting consumer behavior among younger demographics. Additionally, initiatives like India’s Digital India program and Malaysia’s MyDigital blueprint are accelerating digital infrastructure development, further supporting online market expansion. The online channel is set to reshape how consumers across the Asia Pacific access dietary supplements with advantages such as convenience, competitive pricing, product variety, and doorstep delivery.

REGIONAL ANALYSIS

China was the largest contributor to the Asia Pacific Dietary Supplement Market is China by accounting for 32.1% of the share in 2024. China’s dominance is driven by its large population, rising disposable incomes, and growing health awareness, especially among the aging demographic and urban middle class. The National Medical Products Administration (NMPA) has strengthened regulations to ensure product quality, boosting consumer confidence. Additionally, e-commerce growth is led by platforms like Alibaba and JD.com.

India is projected to register the highest CAGR of 14.3% from 2025 to 2033. The growth of the segment is fueled by increasing health consciousness, urbanization, and rising disposable income, particularly among the young and middle-aged population. Furthermore, online retail expansion under Digital India and increasing participation from organized pharmacy chains are accelerating market penetration across urban and rural areas.

Japan, South Korea, and Australia are expected to maintain steady growth due to aging populations, strong regulatory frameworks, and high health awareness.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players in the Asia Pacific dietary supplement market include Kirin Holdings, Ajinomoto Co. Inc., Blackmores, Swisse, Sun Pharmaceutical Industries Ltd., Dabur India Ltd., Unilab Inc., Kalbe Farma, Amway Corporation, Herbalife International of America Inc

The Asia Pacific dietary supplement market is highly competitive, with a mix of global giants and strong regional players vying for market share. Key companies such as Kirin Holdings, Ajinomoto Co. Inc., Blackmores, Swisse, Sun Pharmaceutical Industries Ltd., Dabur India Ltd., Unilab Inc., Kalbe Farma, Amway Corporation, and Herbalife International of America Inc. play a dominant role in shaping the industry landscape. These companies focus on product innovation, strategic partnerships, mergers and acquisitions, and expansion into emerging markets to strengthen their foothold.

In Japan, Kirin Holdings and Ajinomoto Co. Inc. lead the market with science-backed functional foods and amino acid-based supplements. In Australia, Blackmores and Swisse dominate with premium herbal and wellness products. Swisse, now owned by China’s Shanghai Pharma, has significantly expanded its presence across Asia. In India, Dabur and Sun Pharma leverage Ayurvedic traditions to capture health-conscious consumers. Meanwhile, Amway and Herbalife maintain strong direct-selling networks across Southeast Asia.

Competition is further intensified by rising local brands offering cost-effective alternatives, pushing established players to invest in digital marketing, e-commerce platforms, and regulatory compliance. As per the U.S. Department of Commerce's International Trade Administration, increasing consumer awareness, preventive healthcare trends, and government support for nutraceuticals are expected to sustain competitive dynamics in the region.

LEADING PLAYERS IN THE MARKET

Blackmores, an Australian leader, is renowned for its commitment to natural health solutions. The company has significantly influenced consumer awareness and demand for vitamins, minerals, and herbal supplements. With a deep-rooted presence in Australia and expanding reach across Asia in China and Southeast Asia, Blackmores has set benchmarks in quality and sustainability within the nutraceutical industry.

Swisse, another prominent Australian brand, has gained international recognition for its premium wellness and lifestyle-focused supplements. Known for its strong marketing strategies and celebrity endorsements, Swisse has successfully expanded into multiple Asia Pacific markets. Its acquisition by Shanghai Pharma has further enhanced its supply chain and distribution capabilities across the region.

Kirin Holdings, a Japanese conglomerate, contributes significantly through its health science division, focusing on functional foods, amino acids, and probiotics. Leveraging Japan’s advanced biotechnology and rigorous quality standards, Kirin has established a strong presence both locally and internationally in health-focused and clinical nutrition segments.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Diversification

One of the primary strategies employed by key players in the Asia Pacific Dietary Supplement Market is product innovation and diversification. Companies continuously invest in research and development to introduce new formulations tailored to regional health needs and consumer preferences. This includes launching supplements that cater to specific demographics such as women, seniors, athletes, and individuals with chronic conditions. Additionally, there is a strong emphasis on functional ingredients like probiotics, plant-based nutrients, and adaptogens.

Strategic Collaborations and Mergers & Acquisitions

To consolidate their market presence and access new distribution networks, leading players frequently engage in strategic collaborations, mergers, and acquisitions. These partnerships allow companies to combine expertise, expand their geographical reach, and integrate complementary product lines. For instance, international brands often collaborate with local manufacturers or acquire domestic firms to navigate regulatory landscapes and gain consumer trust in new markets. Such strategic moves also facilitate entry into emerging economies within the Asia Pacific region by enabling faster growth and enhanced competitiveness.

Expansion into E-commerce and Digital Marketing

With the rapid digital transformation across the Asia Pacific, key market players are increasingly focusing on expanding their presence on e-commerce platforms and leveraging digital marketing. Online sales channels provide broader accessibility and convenience for consumers, especially among younger, tech-savvy populations. Companies are investing in robust digital campaigns, influencer partnerships, and direct-to-consumer models to strengthen brand visibility and engagement. This shift not only supports wider market penetration but also allows for data-driven insights into consumer behavior, helping firms refine their offerings and marketing strategies.

RECENT HAPPENINGS IN THE MARKET

- In February 2023, Kirin Holdings launched a new line of functional beverages infused with peptides and probiotics through its subsidiary Kirin Healthcare by enhancing its portfolio in the Japanese and South Korean markets.

- In April 2023, Ajinomoto Co. Inc. expanded its amino acid-based dietary supplement offerings in Southeast Asia by introducing targeted nutrition products for elderly care in collaboration with healthcare providers in Thailand.

- In June 2023, Blackmores partnered with Alibaba Health to strengthen its online distribution in China, leveraging Tmall and Cainiao platforms to expand market reach.

- In August 2023, Swiss opened an R&D center in Shanghai aimed at developing localized formulations tailored to Chinese consumer preferences and regulatory standards.

- In September 2023, Sun Pharmaceutical Industries Ltd. acquired a majority stake in an Ayurvedic nutraceutical startup to enhance its herbal supplement portfolio and boost regional exports.

- In October 2023, Dabur India Ltd. introduced a digital wellness platform offering personalized supplement recommendations to improve customer engagement and direct-to-consumer sales in India.

- In November 2023, Unilab Inc. launched a new range of immunity-boosting supplements in the Philippines, supported by a nationwide health awareness campaign.

- In January 2024, Kalbe Farma partnered with GrabHealth to distribute vitamins and supplements via the app’s pharmacy delivery service, capitalizing on the e-pharmacy trend in Indonesia.

- In March 2024, Amway Corporation upgraded its manufacturing facility in China to increase production capacity for premium health supplements while maintaining international quality compliance.

- In May 2024, Herbalife International of America Inc. launched a mobile nutrition coaching app in South Korea and Japan by featuring AI-driven dietary assessments to support personalized health goals.

MARKET SEGMENTATION

This research report on the Asia Pacific dietary supplement market has been segmented and sub-segmented based on ingredient, form, application, end-user, type, distribution channel, and region.

By Ingredient

- Vitamins

- Botanicals

- Minerals

- Proteins & Amino acids

- Fibers & Specialty Carbohydrates

- Omega Fatty Acids

- Others

By Form

- Tablets

- Capsules

- Soft Gels

- Powders

- Gummies

- Liquids

- Others

By Application

- Energy & Weight Management

- General Health

- Bone & Joint Health

- Gastrointestinal Health

- Immunity

- Cardiac Health

- Diabetes

- Anti-cancer

- Lungs Detox/Cleanse

- Skin/Hair/Nails

- Sexual health

- Brain/Mental Health

- Insomnia

- Menopause

- Anti-aging

- Prenatal Health

- Others

By End-User

- Adults

- Geriatric

- Pregnant Women

- Children

- Infants

By Type

- OTC

- Prescribed

By Distribution Channel

- Offline

- Supermarkets/ Hypermarkets

- Pharmacies

- Specialty Stores

- Practitioners

- Others

- Online

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What factors are driving the growth of the dietary supplement market in Asia Pacific?

Key growth drivers include rising health awareness, a growing aging population, increasing disposable incomes, and a shift toward preventive healthcare.

2. Which countries are leading the Asia Pacific dietary supplement market?

Japan, China, India, and Australia are the top-performing countries in the region due to large populations, urbanization, and evolving consumer preferences.

3. Who are the key players in the Asia Pacific dietary supplement market?

Major companies include Kirin Holdings, Blackmores, Ajinomoto Co. Inc., Swisse, Sun Pharma, Dabur, Amway, Herbalife, Kalbe Farma, and Unilab.

4. How is e-commerce influencing the dietary supplement market in Asia Pacific?

Online retail is significantly boosting market accessibility and consumer reach, especially in emerging economies with growing digital penetration.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com