Asia Pacific Digital Banking Market Size, Share, Trends & Growth Forecast Report By Services (Non-Transactional Activities, Transactional), Deployment, Technology, Industries, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Digital Banking Market Size

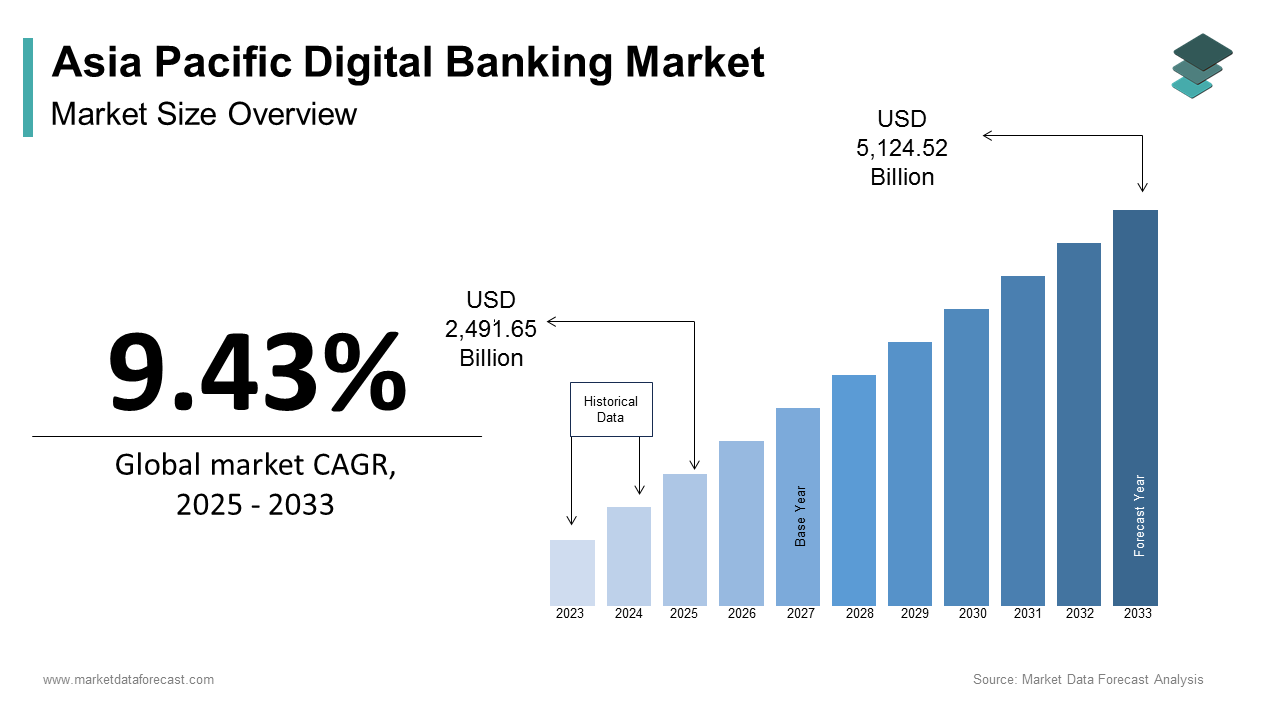

The Asia Pacific digital banking market size was calculated to be USD 2,276.37 billion in 2024 and is anticipated to be worth USD 5,124.52 billion by 2033, from USD 2,491.65 billion in 2025, growing at a CAGR of 9.43% during the forecast period.

Digital banking refers to the delivery of banking services through online platforms, mobile applications, and other digital channels enabling customers to perform transactions along with access to financial products and manage accounts without physical branch visits. The region’s rapid urbanization and increasing internet penetration have further fueled the demand for seamless and secure digital banking experiences. Internet penetration in the region reached 55% in 2022 with countries like South Korea and Singapore leading the way. Similarly, Australia’s Digital Transformation Agency emphasizes the role of digital banking in enhancing financial inclusion in rural areas where traditional banking infrastructure is limited.

MARKET DRIVERS

Rising Internet and Smartphone Penetration

The exponential rise in internet and smartphone penetration is a primary driver of the Asia Pacific digital banking market. Internet penetration in the region grew from 48% in 2018 to 55% in 2022 with over 2 billion active smartphone users. Over 70% of the population uses smartphones for online banking which creates a surge in demand for mobile banking apps and digital wallets. This widespread adoption is fueled by the affordability and accessibility of smartphones which enable even rural populations to participate in the digital economy.

Government Initiatives for Financial Inclusion

Government-led initiatives aimed at promoting financial inclusion are another significant driver of the Asia Pacific digital banking market. Philippines’ Bangko Sentral ng Pilipinas reports that over 50% of adults in rural areas now use digital banking platforms because of initiatives like the National Retail Payment System (NRPS). Moreover, regulatory frameworks supporting open banking and fintech innovation have further accelerated adoption. Australia’s Treasury Department states that policies enabling seamless integration between banks and third-party service providers have empowered consumers to access personalized financial solutions.

MARKET RESTRAINTS

Cybersecurity Threats and Data Privacy Concerns

Cybersecurity threats and data privacy concerns pose significant restraints to the digital banking market particularly regarding the protection of sensitive financial information. The Australian Cyber Security Centre warns that cyberattacks targeting digital banking platforms have increased by over 30% annually undermining public trust in these technologies. Additionally, the lack of standardized cybersecurity measures across the region exacerbates this issue. Only 40% of banks have implemented robust encryption protocols leaving customer data vulnerable to breaches.

Limited Digital Literacy in Rural Areas

Limited digital literacy in rural areas also acts as a restraint, particularly among older populations and low-income groups. Only 20% of adults in remote areas are familiar with using mobile banking apps deterring widespread adoption. Moreover, cultural resistance to change further complicates this issue. The Philippines’ Department of Trade and Industry reports that many rural communities prefer traditional banking methods due to perceived risks and uncertainties.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) presents transformative opportunities for the digital banking market. AI-driven analytics can process vast amounts of customer data to deliver personalized financial solutions that enhance user experience and operational efficiency. Use of AI chatbots to provide 24/7 customer support reducing operational costs and improving satisfaction. China’s National Development and Reform Commission emphasizes the role of ML in fraud detection systems ensuring secure transactions and compliance with regulatory standards.

Expansion into Emerging Economies

Emerging economies in the Asia Pacific offer untapped potential for digital banking driven by industrialization and infrastructure development. Indonesia’s Ministry of Finance states that the use of digital banking platforms to streamline tax collection and improve transparency in rural areas. Similarly, Vietnam’s growing e-commerce sector relies on digital banking for seamless payment processing and customer engagement. These trends emphasize the vast opportunities for digital banking providers to expand their footprint in high-growth markets.

MARKET CHALLENGES

Regulatory Fragmentation Across Countries

Regulatory fragmentation across countries represents a pressing challenge for the digital banking market, particularly regarding cross-border transactions and data sharing. The International Monetary Fund states that many countries in the region have stringent regulations governing data localization that limit the adoption of unified digital banking platforms. South Korea’s Personal Information Protection Commission mandates strict guidelines for data storage and complicates implementation for multinational banks. Additionally, the absence of harmonized standards across the region creates operational inefficiencies. Japan’s Ministry of Justice focuses on the need for regional collaboration to facilitate seamless cross-border transactions and enhance regulatory compliance.

Limited Accessibility in Remote Areas

Limited accessibility in remote areas also poses a significant challenge, particularly regarding internet connectivity and infrastructure. India’s Ministry of Rural Development states that only 25% of villages have access to stable electricity which further complicates the deployment of digital banking platforms. These infrastructural gaps force companies to invest heavily in offline solutions such as USSD-based banking to cater to underserved populations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.43% |

|

Segments Covered |

By Services, Deployment, Technology, Industries, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

HSBC, Standard Chartered, DBS Bank, Bank of China, ICICI Bank, Commonwealth Bank of Australia, Mitsubishi UFJ Financial Group, ANZ Banking Group, HDFC Bank, Citibank |

SEGMENTAL ANALYSIS

By Services Insights

The transactional activities segment dominated the Asia Pacific digital banking market by capturing 60.3% of the share in 2024 with the widespread adoption of online and mobile banking platforms for everyday financial transactions such as fund transfers, bill payments, and account management. Over 400 million users actively use UPI for seamless transactions which reflects the growing preference for digital banking services. Another factor is the rise of e-commerce. Online shoppers prefer digital banking for secure and instant payments which further drive demand for transactional services.

The non-transactional activities segment is projected to witness a CAGR of 12.5% during the forecast period. This growth is fueled by the increasing adoption of advisory and wealth management services offered through digital platforms. Banks are investing in interactive tools like chatbots and virtual assistants to provide real-time support and enhance user experience. A key factor is the growing emphasis on personalized financial solutions. Use of digital platforms for credit scoring and risk assessment which enhance operational efficiency and customer satisfaction. Another factor is the focus on customer engagement.

By Deployment Type Insights

The On-premises deployment segment was the largest and held 55.4% of the Asia Pacific market by capturing 55% of the global market share. This dominance is driven by its reliability, security, and ability to meet regulatory compliance requirements, particularly in industries like banking and finance. The growing emphasis on data sovereignty is likely to fuel the growth of the segment. Over 80% of financial institutions prefer on-premises solutions to ensure compliance with strict data localization laws. On-premises deployment enables banks to maintain full control over sensitive customer data and reduce the risk of breaches. Another factor is the focus on customization. On-premises solutions allow banks to tailor their systems to meet specific operational needs that ensure seamless integration with legacy infrastructure.

The on-cloud deployment is projected to witness a CAGR of 15.3% during the forecast period. This growth is fueled by its scalability, cost efficiency, and ability to support real-time operations. A significant factor is the rise of fintech startups. Fintech companies rely on cloud-based platforms to deliver innovative financial solutions such as peer-to-peer lending and digital wallets. The role of cloud computing in enabling cross-border banking services aligning with global trade initiatives. Another factor is the focus on accessibility. Cloud-based solutions enable rural populations to access digital banking services without requiring robust local infrastructure.

By Technology Insights

The mobile banking segment was the largest occupying 45.6% of the Asia Pacific digital banking market share in 2024 owing to the widespread adoption of smartphones and mobile applications for financial transactions. Over 70% of the population uses smartphones for mobile banking creating a surge in demand for user-friendly apps. Mobile banking platforms enable rural populations to access financial services without physical branch visits and enhance financial inclusion. Another factor is the rise of e-wallets. Urban residents rely on e-wallets for everyday transactions which further boosts demand for mobile banking technologies.

The digital payments segment is projected to witness a CAGR of 18.2% in the forecast period. This growth is fueled by the increasing adoption of contactless payment methods and QR code-based systems. A key factor is the rise of cashless economies. Digital payments in streamlining government disbursements such as social welfare and tax refunds. Another factor is the focus on convenience. Over 60% of consumers prefer digital payments for their speed and ease of use, which further accelerates adoption.

By Industries Insights

The banking segment dominated the Asia Pacific digital banking market by capturing 40% of the total market share. This dominance is driven by the critical role of digital banking in transforming traditional banking operations and enhancing customer experiences. One key factor is the growing demand for seamless transactions. Urban banks have adopted digital platforms to streamline processes such as loan approvals and account management. Another factor is the focus on financial inclusion. Digital banking has enabled over 430 million previously unbanked individuals to access financial services further strengthening its position as the largest segment.

The retail segment is projected to witness a CAGR of 16.8% during the forecast period. This growth is fueled by the increasing adoption of digital payment systems and loyalty programs in the retail sector. Digital banking enhances customer engagement through personalized offers and rewards. A significant factor is the rise of e-commerce and the focus on security. Over 70% of retailers prioritize secure payment systems to build trust and loyalty among customers. These trends position retail as the fastest-growing industry segment.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific digital banking market and accounted for 30% of the regional share in 2024. Its dominance is driven by its status as a global leader in fintech innovation and mobile payment adoption. Over 85% of urban residents rely on mobile banking and digital wallets for everyday transactions. Additionally, China’s Belt and Road Initiative promotes cross-border digital banking services along with creating demand for scalable and secure platforms tailored to diverse markets.

India was positioned second in the Asia Pacific digital banking market in 2024. The country’s rapid adoption of digital banking is driven by government-led initiatives like Jan Dhan Yojana and UPI which have enabled over 430 million previously unbanked individuals to access financial services. Over 400 million users actively use digital payment systems that ensure steady growth in demand.

Japan's digital banking market growth is likely to have steady growth opportunities in the coming years because of its advanced technological expertise and aging population. The Ministry of Economy, Trade and Industry emphasizes the adoption of AI-driven advisory services to cater to elderly customers managing finances independently. Additionally, Japan’s focus on cybersecurity ensures secure and reliable digital banking platforms while aligning with global standards.

South Korea is esteemed to have a steady growth rate throughout the forecast period. Adoption of blockchain technology in digital banking to enhance transparency and reduce fraud. Additionally, South Korea’s emphasis on cashless economies has fueled the transition to contactless payment systems further boosting demand.

Australia's digital banking market growth is driven by its focus on financial inclusion and environmental sustainability driving digital banking adoption. The Digital Transformation Agency focuses on the use of cloud-based platforms to streamline government disbursements such as social welfare and tax refunds. Additionally, Australia’s vast rural population necessitates scalable solutions to ensure safe and efficient banking services in remote areas.

LEADING PLAYERS IN THE ASIA PACIFIC DIGITAL BANKING MARKET

Ant Group

Ant Group, a subsidiary of Alibaba is a global leader in digital financial services with a significant presence in the Asia Pacific digital banking market. The company’s contribution to the global market lies in its innovative platforms like Alipay which enable seamless transactions in wealth management and credit services. Ant Group’s focus on AI-driven analytics and blockchain technology ensures secure and personalized financial solutions for users. Its commitment to fostering financial inclusion has positioned it as a trusted partner for businesses and consumers, who are seeking scalable digital banking services.

DBS Bank

DBS Bank plays a pivotal role in advancing digital banking through its comprehensive suite of online and mobile banking solutions and is known for its robust digital infrastructure and customer-centric approach. DBS empowers users in the Asia Pacific region to access services such as real-time payments as well as investment advisory and loan management. The company’s emphasis on sustainability and innovation aligns with global trends and enables it to expand its footprint while driving technological transformation in the banking sector.

Tencent Holdings

Tencent Holdings is renowned for its innovative approach to digital banking making it a key player in the Asia Pacific market. Tencent offers a wide range of financial services including peer-to-peer payments along with insurance and wealth management through its WeChat platform. The company’s dedication to enhancing user experience and security has strengthened its global reputation. Tencent ensures sustainable growth while driving the adoption of digital banking technologies.

TOP STRATEGIES USED BY KEY PLAYERS IN THE ASIA PACIFIC DIGITAL BANKING MARKET

Strategic Partnerships and Collaborations

Key players in the market frequently engage in partnerships with fintech startups along with governments and industry stakeholders to co-develop tailored solutions. These collaborations help companies address specific regional challenges such as financial inclusion and regulatory compliance. By leveraging local expertise and resources these firms can enhance their product offerings strengthen their market position and ensure alignment with regional priorities.

Investment in AI and Blockchain Technologies

To meet the dynamic needs of end-users companies are investing heavily in integrating artificial intelligence (AI) and blockchain into their platforms. For instance, manufacturers are developing AI-driven chatbots for customer support and blockchain-based systems for secure transactions. This focus on innovation not only differentiates brands but also aligns with the growing demand for secure and efficient solutions in the region.

Expansion into Emerging Markets

Players are increasingly targeting emerging economies within the Asia Pacific region such as Vietnam, Indonesia, and Thailand where industrialization and urbanization are driving demand. This strategy allows them to capture untapped opportunities and strengthen their presence in high-growth markets.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific Digital Banking Market include HSBC, Standard Chartered, DBS Bank, Bank of China, ICICI Bank, Commonwealth Bank of Australia, Mitsubishi UFJ Financial Group, ANZ Banking Group, HDFC Bank, and Citibank.

The Asia Pacific digital banking market is characterized by intense competition with both global giants and regional players vying for dominance. Global leaders like Ant Group, DBS Bank, and Tencent leverage their technological expertise and extensive distribution networks to maintain their stronghold. Meanwhile, regional players focus on cost-effective solutions and localized services to cater to price-sensitive markets. The competitive landscape is further shaped by rapid technological advancements with companies striving to integrate AI, blockchain, and cloud computing into their offerings. Additionally, stringent regulatory frameworks governing data privacy have compelled manufacturers to innovate continuously. Supply chain disruptions and cyber threats add complexity forcing players to adopt agile strategies.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Ant Group launched a new AI-driven wealth management platform specifically designed for small and medium enterprises (SMEs) in India.

- In June 2023, DBS Bank partnered with a leading Australian fintech startup to develop blockchain-based payment systems for cross-border transactions.

- In September 2023, Tencent Holdings acquired a local digital payment provider in Singapore to expand its production capabilities for cost-effective and secure banking solutions.

- In January 2024, Paytm an Indian digital banking provider introduced a suite of AI-driven fraud detection tools tailored for rural banking.

- In November 2023, Standard Chartered Bank signed an agreement with a Philippine retail chain to develop specialized digital payment systems for loyalty programs.

MARKET SEGMENTATION

This research report on the Asia Pacific digital banking market has been segmented and sub-segmented based on services, deployment, technology, industries, and region.

By Services

- Non-Transactional Activities

- Transactional

By Deployment

- On-Premises

- On Cloud

By Technology

- Internet Banking

- Digital Payments

- Mobile Banking

By Industries

- Media & Entertainment

- Manufacturing

- Retail

- Banking

- Healthcare

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What are the key drivers of growth in this market?

Key drivers include increasing smartphone and internet penetration, a growing young tech-savvy population, favorable government policies promoting digital financial inclusion, and rising demand for convenient and secure banking services.

2. Which countries are major contributors to this market?

India, China, Japan, South Korea, and Australia are the leading contributors due to their large populations, rapid digitalization, and significant investments in financial technologies.

3. Who are the key players in the Asia Pacific Digital Banking Market?

Major players include DBS Bank, Mitsubishi UFJ Financial Group, ICICI Bank, Commonwealth Bank of Australia, Standard Chartered, and Ant Group

4. How is the competitive landscape shaping up in the Asia Pacific digital banking market?

The market is becoming increasingly competitive with the rise of digital-only banks, fintech firms, and tech giants entering the space. Traditional banks are also investing heavily in digital transformation to stay relevant and retain market share.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]