Asia Pacific Digital Diabetes Management Market Research Report – Segmented By Product Type (Device – CGM, Smart Glucometer, Insulin Patch Pump), Component, Digital Type , End-Use, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Digital Diabetes Management Market Size

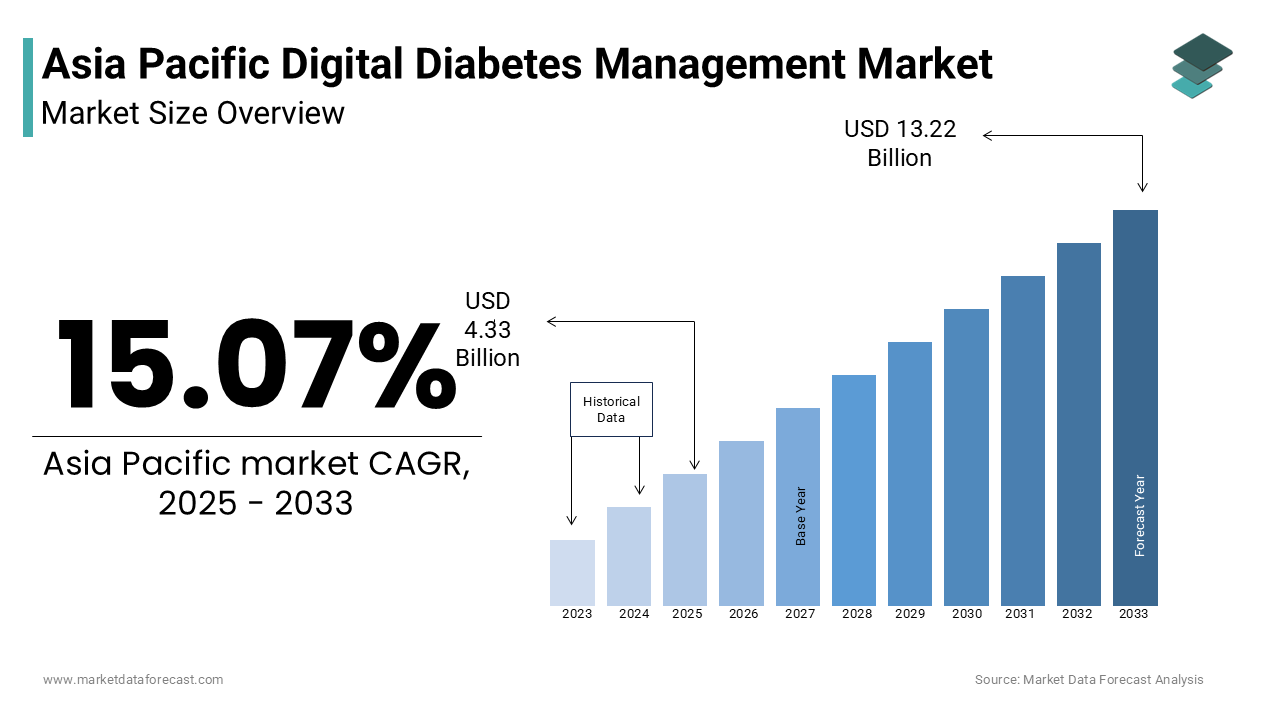

The Asia Pacific digital diabetes management market was worth USD 3.76 billion in 2024. The Asia Pacific market is expected to reach USD 13.32 billion by 2033 from USD 4.33 billion in 2025, rising at a CAGR of 15.07% from 2025 to 2033.

The Asia Pacific digital diabetes management market growth is driven by the growing demand for technology-driven solutions aimed at monitoring, managing and improving the health outcomes of individuals diagnosed with diabetes. These solutions include mobile health applications, cloud-based platforms, wearable glucose monitors, insulin delivery systems integrated with digital interfaces and telemedicine-enabled tools that facilitate remote patient care. The growing adoption of connected devices and artificial intelligence in healthcare has significantly transformed how diabetes is managed across hospitals, clinics and home settings in the region. The Asia Pacific region accounts for nearly half of the global diabetes burden with countries like China, India and Indonesia experiencing rapid increases in both type 1 and type 2 diabetes prevalence. This rise in cases has spurred demand for advanced digital tools that enable real-time tracking, predictive analytics and personalized interventions. Non-communicable diseases such as diabetes are becoming leading causes of morbidity and mortality in low and middle-income Asia Pacific nations thus further reinforcing the need for scalable and efficient digital health ecosystems.

MARKET DRIVERS

The rising prevalence of diabetes due to changing lifestyle patterns is one of the major drivers of the Asia Pacific digital diabetes management market especially in urbanized areas. Rapid industrialization, sedentary habits, increased consumption of processed foods and reduced physical activity have led to a surge in diabetes incidence across several countries in the region. More than 300 million people in the Asia Pacific were living with diabetes in 2023 with countries such as China, India and Malaysia reporting some of the highest rates globally. In India alone, the number of diabetes patients has tripled over the past two decades thereby reaching 74 million cases in 2023. This alarming increase has created an urgent need for effective disease management strategies beyond traditional clinical intervention. Digital diabetes management tools including continuous glucose monitoring systems, AI-powered apps and cloud-based data sharing platforms are being increasingly adopted to offer real-time monitoring and personalized treatment adjustments. Governments and private healthcare providers in countries like Japan and Australia have also begun integrating these tools into national health programs to improve early diagnosis and long-term patient care thereby boosting market growth.

Another significant driver of the Asia Pacific digital diabetes management market is the expanding integration of digital health policies and e-health initiatives by regional governments and healthcare organizations. Several Asia Pacific nations have introduced national digital health missions and frameworks to digitize medical records, streamline chronic disease management and enhance access to remote diagnostics. For example, the Ministry of Health and Family Welfare in India launched the Ayushman Bharat Digital Mission to establish a unified health ecosystem that enables seamless flow of patient data across healthcare stakeholders. Similarly, Australia’s National Digital Health Strategy aims to foster investment in digital tools that support chronic disease management which includes diabetes. The increasing penetration of smartphones and internet connectivity across Southeast Asia and the Pacific Islands has further accelerated the adoption of mobile health applications designed for glucose tracking and medication adherence. These developments have created a conducive regulatory and technological environment that supports the widespread implementation of digital diabetes management solutions across the region.

MARKET RESTRAINTS

Limited awareness and adoption of digital health tools among rural and aging populations is a key restraints affecting the Asia Pacific digital diabetes management market. A substantial portion of the population resides in rural or semi-urban areas where access to digital infrastructure, healthcare education and smartphone penetration remains low. Less than 40.82% of rural populations in countries like Indonesia, Bangladesh and the Philippines regularly use digital health services. Additionally, older adults who form a significant proportion of diabetes patients often struggle with adapting to digital tools due to a lack of technical literacy and confidence in using smart devices. In Japan, where nearly 30.74% of the population is aged above 65 the Ministry of Health, Labour and Welfare found that only 28.09% of elderly individuals used digital health applications consistently for disease monitoring. These gaps hinder the large-scale deployment of digital diabetes management platforms especially in regions where the burden of diabetes is rapidly rising but awareness and accessibility remain limited.

The high cost of advanced digital health technologies and inadequate reimbursement structures are another critical constraint on the Asia Pacific digital diabetes management market. Many cutting-edge diabetes management solutions such as continuous glucose monitoring (CGM) systems, insulin pumps with digital connectivity and AI-integrated platforms which require significant upfront investment from both patients and healthcare providers. Wealthier economies like Australia and Singapore have started incorporating select digital tools into their insurance coverage while most countries in the region still lack standardized reimbursement models for digital therapeutics and monitoring devices. Moreover, small and mid-sized clinics in emerging markets often cannot afford to integrate digital platforms due to budget constraints and insufficient government subsidies. The absence of clear regulatory guidelines regarding device approval and pricing further complicates affordability. The expansion of digital diabetes management solutions remains constrained across large parts of the Asia Pacific region without adequate cost-reduction strategies and policy support.

MARKET OPPORTUNITIES

Growing investment in AI and machine learning for preventive and personalized diabetes care is a major opportunity driving the Asia Pacific digital diabetes management market. Healthcare providers and tech firms are increasingly leveraging artificial intelligence to develop predictive analytics tools that can assess diabetes risk, forecast blood sugar fluctuations and recommend tailored lifestyle interventions. For instance, companies in South Korea and Singapore are deploying AI-based chatbots that interact with patients, provide dietary advice and remind them to take medications based on historical health data. AI-enabled diabetes management platforms could reduce hospital readmissions by up to 30.8% through proactive monitoring and early detection of complications. Furthermore, in China, the government-backed initiative “AI+Healthcare” has funded multiple startups developing algorithms that integrate genetic data with real-time glucose readings to enhance diabetes control. These innovations are attracting considerable venture capital investment with over $500 million raised by digital diabetes startups in the Asia Pacific in 2023 alone. As AI becomes more sophisticated and accessible its application in diabetes care is expected to fuel significant market expansion across the region.

Another compelling opportunity within the Asia Pacific digital diabetes management market is the rising interest in telehealth and remote monitoring solutions following the pandemic-induced acceleration of virtual care. The shift toward decentralized healthcare delivery has prompted governments and private players to invest heavily in digital platforms that allow physicians to monitor diabetic patients from a distance. Teleconsultation platforms equipped with integrated glucose tracking features have gained traction especially in rural areas where access to endocrinologists and specialists is limited. In Australia, the introduction of the Medicare Benefits Schedule (MBS) for telehealth services has enabled more patients to receive digital diabetes care without visiting clinics. Meanwhile, in India, digital health startups such as Apollo Telehealth and Practo have expanded their diabetes management modules to reach millions of patients across tier-2 and tier-3 cities. These developments indicate a robust potential for further integration of remote monitoring and digital consultation tools within the broader diabetes care continuum in the Asia Pacific.

MARKET CHALLENGES

Lack of interoperability among digital health platforms and inconsistent regulatory standards across countries a major challenge facing the Asia Pacific digital diabetes management market. The proliferation of different software systems, data formats, and device protocols hampers seamless information exchange between healthcare providers, patients and digital monitoring tools. For example, while Singapore has established a national health data interchange framework called the "National Electronic Health Record" (NEHR), similar systems in other countries operate on disparate models,s thereby limiting cross-border data compatibility. The absence of a unified digital health architecture across the region results in fragmented patient records and inefficient disease monitoring. Additionally, varying regulatory requirements for digital therapeutics, medical devices and AI-based diagnostics create compliance complexities for multinational companies seeking to scale their offerings. In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) has stringent approval pathways for digital health products which contrasts with the relatively nascent regulatory environments in countries like Vietnam and the Philippines. These inconsistencies slow down product development cycles and limit the seamless deployment of digital diabetes management solutions across the region.

Weak cybersecurity infrastructure and growing concerns around patient data privacy are another pressing challenge confronting the Asia Pacific digital diabetes management market. The risk of data breaches and unauthorized access has escalated as more diabetes management tools become connected to cloud-based platforms and mobile applications. The Asia Pacific region experienced a 45.72% increase in cyberattacks targeting healthcare organizations compared to the previous year with many incidents involving patient health data stored on digital diabetes management systems. In countries like Malaysia and Indonesia, where cybersecurity regulations are still evolving many healthcare providers face difficulties in safeguarding sensitive patient information from malicious actors. Moreover, consumer hesitancy persists due to a lack of awareness about data encryption mechanisms and informed consent practices. Addressing these concerns requires stronger legal frameworks, improved encryption standards and greater transparency in how digital health companies handle user data challenges that must be overcome to ensure sustainable market growth.

SEGMENTAL ANALYSIS

By Product Insights

Continuous Glucose Monitoring (CGM) systems segment held the leading share of 48.1% of the Asia Pacific Digital Diabetes Management Market share in 2024 with the rising adoption of real-time glucose tracking systems that reduce the need for frequent finger-prick tests and enable more accurate diabetes control. Nearly 65.92% of endocrinologists in Japan and Australia prefer CGMs over traditional glucometers for managing type 1 diabetes patients. Additionally, government initiatives such as Australia’s inclusion of certain CGM devices under the National Diabetes Services Scheme (NDSS) have amplified patient access. In China, increasing health awareness and higher disposable incomes are contributing to a surge in private purchases of CGM kits especially among urban populations. Furthermore, companies like Dexcom and Abbott have aggressively expanded their distribution networks across Southeast Asia by aligning with local healthcare platforms to integrate CGM data into broader digital health ecosystems.

The Insulin Patch Pump segment is projected to witness the fastest CAGR of 19.7% from 2025 to 2033 due to the increasing preference for discreet, needle-free and user-friendly insulin delivery mechanisms among younger diabetic populations. Insulin patch pumps are compact, wearable and programmable devices that offer significant advantages in dosing accuracy and lifestyle convenience unlike conventional insulin pumps that require external tubing. Insulin patch pump adoption grew in South Korea and Singapore and is driven by growing integration with mobile apps for dose calculation and remote monitoring. The Japanese Ministry of Health, Labour and Welfare has also initiated pilot programs to evaluate the long-term benefits of patch pumps in pediatric diabetes care. Moreover, industry players such as Medtronic and Tandem Diabetes Care have launched region-specific models tailored to the APAC healthcare infrastructure which further accelerate penetration in both hospital and homecare settings.

By Component Insights

The diabetes management software & platforms segment was the largest segment of the Asia Pacific digital diabetes management market by capturing 42.8% of the share in 2024. These platforms serve as centralized systems integrating data from wearable sensors, glucometers and clinical records to provide personalized insights and treatment recommendations. The uptake is largely driven by hospitals and specialty clinics adopting cloud-based electronic medical record (EMR) systems that allow seamless data exchange between physicians and patients. For instance, Apollo Hospitals in India integrated AI-driven diabetes analytics into its EMR system in early 2023 thereby enhancing risk stratification and early complication detection. Similarly, in Australia, partnerships between digital health startups and public health agencies have enabled population-level data aggregation through platforms like myHealthRecord which now supports over 24 million users. Digital disease management pilots in the Asia Pacific involve some form of integrated platform thus indicating strong institutional backing for software-led diabetes interventions.

The mobile applications segment is anticipated to witness the fastest CAGR of 23.8% from 2025 to 2033. The segment’s robust growth is primarily driven by widespread smartphone penetration and increasing consumer reliance on self-monitoring tools for chronic disease management. Over 750 million smartphones were actively used in India alone thus providing a vast base for diabetes app adoption. In response, major tech firms like Google and Apple have introduced health-oriented platforms such as Google Fit and Apple HealthKit that support third-party diabetes apps thereby enabling automatic syncing with wearable sensors. Startups such as MySugr (acquired by Roche) and WellDoc's BlueLoop have localized versions targeting APAC markets which incorporate multilingual interfaces and dietary customization based on regional food habits. Moreover, in Malaysia and Indonesia primary healthcare accessibility remains a challenge whereas telemedicine-linked diabetes apps have seen a 180.73% increase in downloads between 2021 and 2023 thus reflecting the shift towards mobile-first diabetes care.

By Device Type Insights

The handheld digital diabetes management devices segment was the largest segment and held 55.09% of the Asia Pacific market share in 2024 due to the continued reliance on portable, cost-effective blood glucose meters and smart glucometers that do not require extensive technical setup. In many low and middle-income countries such as India, Thailand and the Philippines handheld devices remain the primary mode of glucose monitoring because of their affordability and ease of use. Over 60 million patients in India depend on handheld glucometers for daily glucose checks which is supported by a wide retail distribution network and subsidized pricing strategies from domestic manufacturers. Additionally, in rural areas of Vietnam and Indonesia stable internet connectivity remains a concern, so which health workers prefer handheld devices over connected wearables due to minimal dependency on online infrastructure. Companies like AgaMatrix and i-SENS have capitalized on this trend by introducing ruggedized and battery-efficient glucometers compatible with budget-conscious consumers thereby reinforcing the stronghold of handheld devices in the APAC landscape.

The wearable diabetes management device segment is likely to experience a fastest CAGR of 21.82% from 2025 to 2033. This growth is propelled by increasing demand for non-invasive and continuous monitoring solutions that integrate seamlessly into the daily lives of diabetic individuals. The popularity of wearables such as smartwatches and patch-style CGMs has surged due to their ability to provide real-time data and sync with mobile applications for trend analysis and alerts. Driven by aging demographics and heightened awareness of diabetes complications. Samsung and Sony have introduced diabetes-compatible wearables tailored for APAC markets thereby incorporating features like voice-guided readings and language localization. In Australia nearly 30.18% of new diabetes patients opted for wearable monitors in 2023 citing comfort and data accuracy as key decision factors. These developments indicate a strong shift toward connected wearables among tech-savvy and urban diabetic populations.

By End Use Insights

The hospitals and clinic-based segments dominated the Asia Pacific Digital Diabetes Management Market by capturing 58.09% of the total market share in 2024. The growth of the segment growth is driven due to the increasing integration of digital diabetes management tools into inpatient and outpatient care protocols. Hospitals in developed APAC nations such as Australia and Singapore have deployed AI-enabled glucose monitoring dashboards to manage critical care patients suffering from diabetes-related complications. More than 40.21% of all hospital admissions related to diabetes involved digital monitoring systems during treatment in 2023. In India, leading hospital chains including Fortis and Apollo have incorporated digital glycemic management software to standardize diabetes care across departments. The Chinese Ministry of Health has also mandated the inclusion of digital tools in tier-1 hospitals to enhance patient outcomes and reduce readmission rates. The hospital segment continues to drive large-scale procurement of digital diabetes infrastructure with governments promoting the digitization of healthcare services.

The self/home healthcare segment is predicted to witness the highest CAGR of 24.93% from 2025 to 2033 with a paradigm shift toward decentralized diabetes care especially in densely populated and geographically vast countries like India, Indonesia and the Philippines. Households in these countries now have access to basic internet services thereby facilitating remote monitoring and teleconsultations. Diabetes patients are increasingly opting for smart glucometers, wearable sensors and mobile health apps that enable self-tracking and doctor consultations via virtual platforms. In Malaysia, the Ministry of Health launched a national initiative called e-Diabetes@Home which provides subsidies for home-use CGMs and digital coaching tools. Urban diabetes patients in India preferred home-based digital monitoring over regular hospital visits thereby citing convenience and reduced exposure to infectious diseases as key motivators.

REGIONAL ANALYSIS

China outperformed other regions in the Asia Pacific digital diabetes management market and accounted for 22.17% of the regional market share in 2024. Over 140 million adults in China suffer from diabetes while making it one of the most affected nations globally. The government has responded by launching national digital health initiatives including the National Health Big Data Platform which are designed to collect and analyze chronic disease trends. Domestic companies like Sinocare and Bionime have gained prominence by producing affordable and smart glucometers with Bluetooth connectivity. The National Healthcare Security Administration (NHSA) has also started reimbursing selected digital therapeutics thus encouraging wider acceptance.

India was positioned second in holding the dominant share of the Asia Pacific digital diabetes management market in 2024. The country faces a severe diabetes burden with the International Diabetes Federation (IDF) reporting over 74 million diagnosed cases. The rise in undiagnosed cases and late-stage complications has prompted both public and private stakeholders to invest heavily in digital health solutions. The Ayushman Bharat Digital Mission (ABDM) launched in 2021 aims to unify health records and improve interoperability across digital platforms. Indian digital health startups raised over $600 million in 2023 with diabetes-focused ventures. India's expanding smartphone penetration and policy push for digital health integration are fueling sustainable market expansion despite challenges related to rural connectivity and affordability.

Japan’s digital diabetes management market is likely to grow with healthy CAGR in the next coming years. The country’s high diabetes prevalence among the elderly which combined with its advanced healthcare infrastructure makes it a crucial hub for digital diabetes innovation. Nearly 10 million people in Japan live with diabetes with a significant portion utilizing digital tools for glucose monitoring and insulin therapy. The Ministry of Health, Labour and Welfare has implemented policies supporting the integration of remote monitoring systems and AI-assisted diagnostics in public healthcare facilities. Japan remains a vital growth engine for digital diabetes technologies in the region with a strong regulatory framework, high geriatric population density and proactive adoption of telehealth.

Australia’s digital diabetes management market is likely to have significant growth opportunities during the forecast period. The nation’s well-developed healthcare system and high healthcare expenditure per capita facilitate the rapid adoption of digital diabetes solutions. More than 1.3 million Australians have been diagnosed with diabetes thereby prompting the government to allocate significant resources for digital intervention programs. The Australian e-Health Strategy promotes the integration of electronic prescribing, telemonitoring and AI-driven analytics into mainstream diabetes care. The Medicare Benefits Schedule (MBS) now covers many telehealth-based diabetes consultations while increasing access to digital care models.

South Korea’s digital diabetes management market growth is likely to have the fastest growth opportunities in the next coming years. The country’s advanced technological infrastructure coupled with a rising incidence of diabetes has created a conducive environment for digital health innovation. Over 5 million citizens suffer from diabetes with the condition ranking among the top causes of mortality nationwide. The Ministry of Health and Welfare has prioritized digital diabetes management through initiatives such as “Digital Healthcare New Deal” aimed at fostering AI-driven diagnostics and remote monitoring.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Medtronic plc, F. Hoffmann-La Roche Ltd, Abbott Laboratories, Dexcom, Inc., Ascensia Diabetes Care Holdings AG, Tandem Diabetes Care, Inc., Insulet Corporation, Ypsomed Holding AG, B. Braun Melsungen AG, and Glooko, Inc. are some of the key market players.

The Asia Pacific digital diabetes management market is marked by intense competition among global leaders and emerging regional players striving to capture a larger share of the expanding digital health landscape. Established multinational corporations leverage their technological expertise, extensive distribution networks and brand recognition to maintain dominance in high-income countries such as Japan, Australia and South Korea. However, local firms are gaining momentum by offering affordable and region-specific solutions tailored to the unique healthcare infrastructures and patient behaviors across Southeast Asia and the Pacific islands. The competitive environment is further shaped by rapid product innovation thereby increasing collaborations between technology and healthcare companies and growing investment in AI-enabled diabetes management tools. Additionally, regulatory developments and reimbursement policies vary significantly across countries which influence market accessibility and adoption rates. Prevalence of diabetes continues to rise because of which market participants are under pressure to deliver more accessible, interoperable and clinically effective digital solutions to remain competitive and meet evolving consumer expectations.

Top Players in the Asia Pacific Digital Diabetes Management Market

Roche Diabetes Care

Roche Diabetes Care is a global leader in diabetes management solutions and has a strong presence in the Asia Pacific region. The company offers a range of integrated digital tools including smart glucometers, insulin delivery systems and mobile applications designed to support personalized care. In APAC, Roche actively collaborates with local healthcare providers and governments to promote digital health integration for diabetes care. Its focus on user-friendly platforms and data-driven insights has significantly influenced patient engagement and treatment adherence across diverse populations.

Dexcom, Inc.

Dexcom is renowned for its continuous glucose monitoring (CGM) systems which have become essential in modern diabetes management. Dexcom has expanded its reach by establishing partnerships with regional distributors and integrating its devices with widely used health apps like Apple Health and Google Fit. The company’s emphasis on real-time glucose tracking and remote monitoring capabilities has contributed to better disease control and improved patient outcomes thereby reinforcing its reputation as a pioneer in digital diabetes innovation.

Medtronic plc

Medtronic plays a crucial role in the Asia Pacific digital diabetes management landscape through its advanced insulin delivery systems and connected care platforms. The company integrates its diabetes devices with cloud-based analytics and decision-support tools that enhance clinical efficiency and patient self-management. Medtronic has been actively involved in conducting educational programs and collaborating with healthcare institutions across the region to raise awareness about digital diabetes solutions.

Top Strategies Used by Key Market Participants

Product Innovation and Integration with Ecosystems

Leading players continuously invest in research and development to introduce technologically superior products that offer seamless integration with existing digital health ecosystems. Companies are designing devices and software capable of syncing with smartphones, telehealth platforms and electronic health records to enable holistic diabetes care. This strategy allows them to cater to an increasingly tech-savvy patient base and clinical professionals seeking data-driven decision-making tools.

Strategic Collaborations and Local Partnerships

Companies engage in strategic alliances with local distributors, startups, academic institutions and government bodies to strengthen their foothold in the Asia Pacific region. These collaborations help in tailoring products to regional needs, navigating regulatory landscapes and accelerating market penetration. By aligning with domestic entities firms can provide culturally relevant and cost-effective digital diabetes management solutions.

Expansion of Telehealth-Connected Solutions

Major players are enhancing their offerings with telehealth compatibility and rise in remote healthcare demand. They are developing platforms that allow physicians to monitor patients in real time and make timely interventions. This approach not only improves chronic disease management but also supports healthcare systems in reaching underserved populations across the region.

REGIONAL ANALYSIS

- In February 2023, Roche Diabetes Care partnered with a leading Indian telemedicine startup to integrate its blood glucose monitoring app into a national digital health platform.

- In July 2023, Dexcom announced a distribution agreement with a Japanese medical device distributor thereby facilitating broader access to its Continuous Glucose Monitoring (CGM) systems across hospitals and homecare settings in Japan.

- In November 2023, Medtronic launched a localized version of its diabetes management software in China which was tailored to support a Mandarin language interface and compatible with major Chinese smartphone operating systems.

- In March 2024, a major South Korean biotech firm acquired a Singapore-based digital therapeutics startup thereby aiming to expand its portfolio of AI-powered diabetes coaching tools across Southeast Asia.

- Also in March 2024, Abbott Diabetes Care collaborated with an Australian health tech incubator to co-develop predictive analytics tools for diabetes progression using real-world data collected from wearable glucose monitors.

MARKET SEGMENTATION

This research report on the Asia Pacific digital diabetes management market 1is segmented and sub-segmented into the following categories.

By Product

- Device – CGM

- Smart Glucometer

- Insulin Patch Pump

By Component

- Diabetes Apps

- Services

- Software & Platforms

By Device Type

- Handheld

- Wearables

By End Use

- Hospitals

- Self/Home Healthcare

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What factors are driving the growth of this market in the Asia Pacific region?

Key drivers include the rising incidence of diabetes, technological advancements in digital health, increasing smartphone penetration, government initiatives promoting digital healthcare, and growing demand for remote patient monitoring.

What is the future outlook of the Asia Pacific digital diabetes management market?

The market is expected to witness strong growth, driven by continued innovation, government support, increased healthcare digitization, and rising investment in healthcare technology.

What challenges does the market face?

Challenges include data privacy concerns, high device costs, limited digital infrastructure in some areas, and regulatory hurdles.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com