Asia pacific Drill Pipe Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Grade, Application, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Drill Pipe Market Size

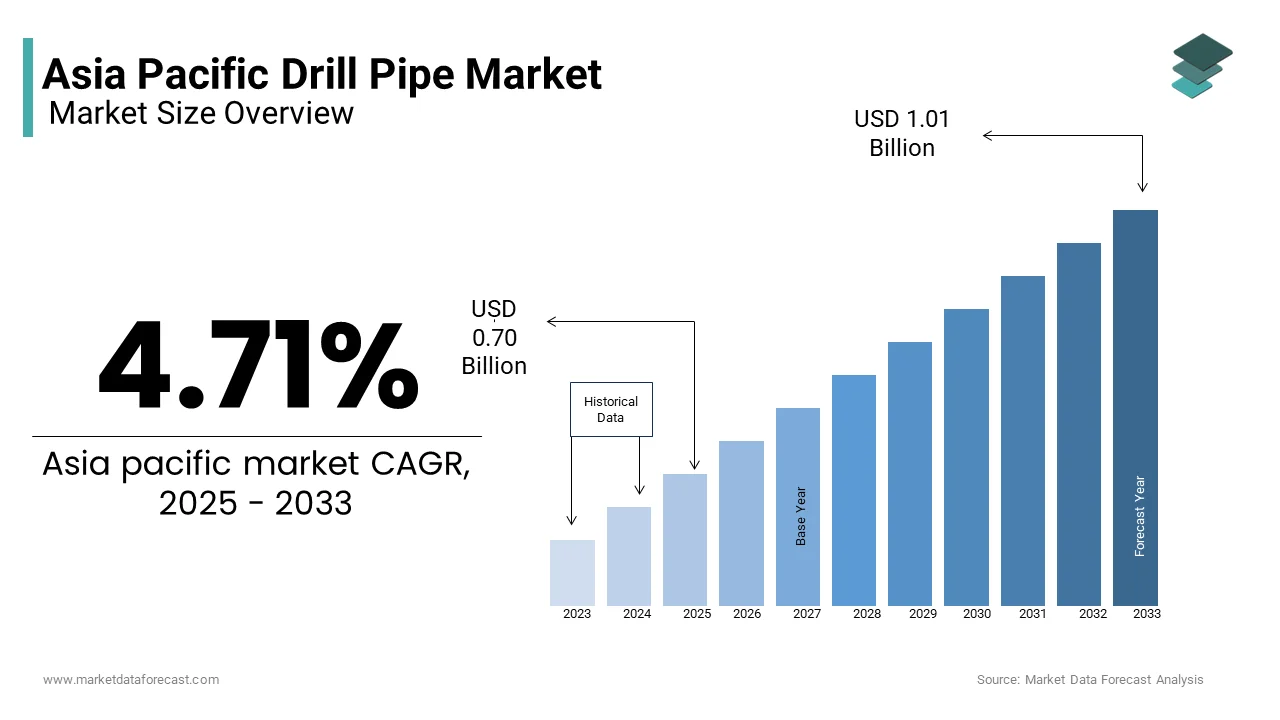

The Asia Pacific drill pipe market was valued at USD 0.66 billion in 2024 and is anticipated to reach USD 0.70 billion in 2025 from USD 1.01 billion by 2033, growing at a CAGR of 4.71% during the forecast period from 2025 to 2033.

Current Scenario of the Asia Pacific Drill Pipe Market

The drill pipes are serving as conduits for drilling fluids and providing structural support during exploration and extraction operations. These hollow steel tubes are engineered to withstand extreme pressures, temperatures, and mechanical stresses encountered in both onshore and offshore drilling environments. According to the International Energy Agency, the Asia Pacific accounts for over 40% of global energy consumption, driving investments in upstream exploration activities. For instance, countries like China and India are intensifying their efforts to reduce reliance on energy imports by tapping into domestic reserves, necessitating advanced drilling technologies.

Moreover, the region’s strategic focus on offshore drilling has further amplified the importance of drill pipes. Additionally, advancements in directional drilling and extended-reach technologies have increased the demand for high-strength drill pipes capable of operating in challenging geological formations. These innovations underscore the pivotal role of drill pipes in enabling efficient and cost-effective drilling operations across the region.

MARKET DRIVERS

Rising Energy Consumption and Exploration Activities

The Asia Pacific region is witnessing an unprecedented surge in energy consumption due to rapid industrialization and urbanization. According to the International Energy Agency, the region’s energy demand is projected to grow by 35% by 2040, with the increased exploration and production activities. Countries like China and India are investing heavily in upstream oil and gas projects to reduce dependence on energy imports. Additionally, the push for energy security has led to renewed interest in domestic hydrocarbon reserves. As per the U.S. Energy Information Administration, China holds the largest technically recoverable shale gas reserves globally, estimated at 1,115 trillion cubic feet. Extracting these resources requires advanced drill pipes designed for horizontal and directional drilling. Furthermore, the growing adoption of enhanced oil recovery (EOR) techniques, which involve injecting fluids or gases into reservoirs to improve extraction rates, has increased the demand for durable drill pipes.

Expansion Of Offshore Drilling Projects

The expansion of offshore drilling projects in the Asia Pacific is another key driver of the drill pipe market. According to the World Offshore Drilling Report, offshore oil production in the region grew by 6% in 2022, with significant projects underway in the South China Sea and the Timor Sea. Drill pipes are indispensable for offshore drilling operations, where they must endure harsh marine conditions, including high salinity and corrosive environments. For instance, Malaysia’s national oil company, Petronas, has invested in deepwater drilling projects that rely on high-strength drill pipes to access reserves located thousands of meters below the seabed.

Another factor contributing to the prominence of offshore drilling is the discovery of new hydrocarbon reserves. As per the International Association of Oil & Gas Producers, over 20 new offshore fields were identified in the Asia Pacific in 2022, which is creating a surge in demand for drill pipes. Additionally, advancements in offshore drilling technologies, such as floating production systems and subsea processing, have expanded the scope of operations, necessitating specialized drill pipes capable of operating in ultra-deepwater environments.

MARKET RESTRAINTS

High Costs of Advanced Drill Pipes

One of the most significant barriers to the widespread adoption of advanced drill pipes in the Asia Pacific is their high cost. High-strength drill pipes, particularly those designed for offshore and unconventional drilling, involve complex manufacturing processes and premium materials, contributing to elevated prices. According to the Asian Development Bank, developing nations in the region allocate less than 3% of their GDP to energy infrastructure, limiting their capacity to invest in costly drilling equipment. For instance, small-scale operators in Southeast Asia often face financial constraints when attempting to procure advanced drill pipes, despite the region’s growing energy demands. Additionally, maintenance and replacement costs further strain budgets. As per the International Association of Oil & Gas Producers, the lifecycle cost of premium drill pipes can be up to 40% higher than standard variants, which is deterring potential adopters with limited financial resources. While these pipes offer superior performance and durability, the upfront capital requirements remain a deterrent, particularly for organizations seeking immediate returns on investment.

Environmental Regulations and Sustainability Concerns

Another critical restraint impacting the Asia Pacific drill pipe market is the increasing stringency of environmental regulations and sustainability concerns. According to the United Nations Environment Programme, governments in the region are implementing stricter policies to mitigate the environmental impact of oil and gas operations. For example, Australia’s Offshore Petroleum and Greenhouse Gas Storage Act mandates stringent controls on emissions and waste management by requiring drill pipe manufacturers to develop eco-friendly solutions.

Furthermore, public opposition to fossil fuel projects has intensified, which is leading to delays and cancellations of drilling initiatives. As per the International Energy Agency, over 20% of planned oil and gas projects in the Asia Pacific faced delays in 2022 due to environmental protests and regulatory hurdles. The growing emphasis on renewable energy alternatives further compounds these issues, creating uncertainty about the long-term viability of traditional drilling technologies.

MARKET OPPORTUNITIES

Growing Adoption of Unconventional Resources

The Asia Pacific region is at the forefront of unconventional resource exploration, presenting a lucrative opportunity for the drill pipe market. According to the U.S. Energy Information Administration, China holds the largest technically recoverable shale gas reserves globally, estimated at 1,115 trillion cubic feet. Extracting these resources requires advanced drill pipes capable of handling horizontal and directional drilling, which is creating new avenues for manufacturers to innovate and expand their offerings.

Additionally, the rise of coal-bed methane (CBM) projects in Australia has increased the demand for durable drill pipes. These projects necessitate specialized drill pipes designed to operate in low-pressure environments, further propelling market growth. Moreover, government incentives, such as tax breaks and subsidies for unconventional resource development, have accelerated adoption, positioning the drill pipe market as a key enabler of regional energy diversification.

Advancements in Deepwater Drilling Technologies

The burgeoning deepwater drilling initiatives in the Asia Pacific present another significant opportunity for the drill pipe market. Countries like Malaysia and Vietnam are investing heavily in offshore projects, which are leveraging advanced technologies to access reserves located thousands of meters below the seabed. For example, Malaysia’s national oil company, Petronas, has launched several deepwater drilling initiatives that rely on high-strength drill pipes to ensure operational efficiency.

Additionally, advancements in subsea processing and floating production systems have expanded the scope of operations, necessitating drill pipes capable of operating in ultra-deepwater environments. These innovations position deepwater drilling as a key growth driver for the drill pipe market is offering untapped potential for manufacturers to capitalize on emerging opportunities.

MARKET CHALLENGES

Stringent Regulatory Frameworks

The deployment of drill pipes in the Asia Pacific is often hindered by stringent regulatory frameworks, which vary significantly across countries. According to the International Association of Oil & Gas Producers, compliance with safety protocols for drilling operations involves navigating complex bureaucratic processes, often delaying project timelines. For instance, in densely populated areas of Indonesia and Thailand, which is obtaining clearance for offshore drilling projects requires multiple approvals from local authorities, environmental agencies, and industry regulators.

These regulations are designed to mitigate risks associated with drilling operations, such as oil spills and gas leaks, but they also increase compliance costs and create operational bottlenecks. Additionally, as per the Centre for Maritime Energy and Sustainable Development, overlapping jurisdictions between maritime authorities and environmental agencies complicate the integration of drill pipes in offshore projects. Such regulatory hurdles not only raise barriers to entry but also limit the flexibility of drill pipe manufacturers in addressing urgent industrial needs.

Vulnerability to Supply Chain Disruptions

Another pressing challenge for the Asia Pacific drill pipe market is its vulnerability to supply chain disruptions, exacerbated by geopolitical tensions and logistical complexities. According to the World Trade Organization, the region’s reliance on imported raw materials and components for drill pipes has made it susceptible to fluctuations in global trade dynamics. For example, the ongoing semiconductor shortage has impacted the production of advanced sensors used in smart drill pipes.

Additionally, geopolitical conflicts, such as those in the South China Sea, have disrupted shipping routes critical for transporting drill pipes and related equipment. As per the United Nations Conference on Trade and Development, maritime trade in the Asia Pacific accounts for over 40% of global shipments, making supply chains highly vulnerable to external shocks. These disruptions not only increase lead times but also drive up costs, which are undermining the reliability and scalability of drilling solutions in the region.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.71% |

|

Segments Covered |

By Grade, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

Hilong Group, NOV Inc., Tenaris S.A., Vallourec S.A., TMK Group, Oil Country Tubular Limited, Tejas Tubular Grades Inc., Texas Steel Conversion Inc., DP Master, Jiangyin Long Bright Drill Pipe Manufacture Co. Ltd., Drill Pipe International LLC, Superior Drill Pipe Manufacturing, Inc. |

SEGMENTAL ANALYSIS

By Grade Insights

The API grade segment dominated the Asia Pacific drill pipe market with 60.1% of share in 2024, owing to the widespread adoption of API-grade drill pipes in conventional onshore and shallow offshore drilling operations, which remain prevalent across the region. According to the International Association of Oil & Gas Producers, over 70% of active drilling projects in the Asia Pacific utilize API-grade equipment due to its cost-effectiveness and compliance with standardized industry requirements. For instance, countries like India and Indonesia rely heavily on API-grade drill pipes for their extensive onshore oil and gas fields, where operational conditions are less demanding compared to deepwater environments. Another factor contributing to the prominence of API-grade drill pipes is their compatibility with existing infrastructure. Additionally, advancements in material science have improved the durability and performance of API-grade drill pipes, making them suitable for a broader range of applications.

The premium-grade drill pipe segment is projected to grow at a CAGR of 8.5% during the forecast period, owing to its application in challenging drilling environments such as deepwater and unconventional resource extraction. Another key driver of the premium-grade segment’s rapid growth is the increasing focus on efficiency and longevity. As per the International Energy Agency, investments in directional drilling and extended-reach technologies have surged by 15% annually in the region is creating demand for high-strength drill pipes that can operate in complex geological formations. Furthermore, government incentives for unconventional resource development have accelerated adoption, which is positioning premium-grade drill pipes as the fastest-growing segment in the market.

By Application Insights

The onshore application segment held a dominant share of the Asia Pacific drill pipe market in 2024. The growth of the segment is fueled by the region’s extensive onshore oil and gas reserves, particularly in countries like China, India, and Indonesia. According to the U.S. Energy Information Administration, China holds the largest technically recoverable shale gas reserves globally, estimated at 1,115 trillion cubic feet, necessitating robust drill pipes for horizontal and directional drilling. For instance, China National Petroleum Corporation (CNPC) has launched several onshore drilling initiatives in the Sichuan Basin, which rely on durable drill pipes to access these resources.

The offshore segment is likely to grow with a CAGR of 9.2% in the coming years, with the expansion of deepwater drilling projects in the Asia Pacific. For example, Vietnam’s recent discovery of hydrocarbon reserves in the South China Sea has led to significant investments in offshore drilling, necessitating high-strength drill pipes capable of operating in ultra-deepwater environments.

Another key driver of offshore growth is the push for energy security. As per the International Energy Agency, countries like Malaysia and Australia are investing heavily in offshore projects to reduce reliance on energy imports, further propelling the demand for advanced drill pipes. Additionally, advancements in subsea processing and floating production systems have expanded the scope of offshore operations.

COUNTRY ANALYSIS

Top Leading Countries in the Market

China was the top performer in the Asia Pacific drill pipe market with a share of 30.4% in 2024. The country’s vast untapped hydrocarbon reserves, particularly in shale gas and coal-bed methane, have driven significant investments in upstream exploration activities. According to the U.S. Energy Information Administration, China holds the largest technically recoverable shale gas reserves globally, estimated at 1,115 trillion cubic feet, with advanced drill pipes for horizontal and directional drilling. Additionally, the Chinese government’s push for energy independence has intensified domestic exploration efforts will further boost the demand for drill pipes.

India was positioned second by holding 20.4% of the Asia Pacific drill pipe market share with its extensive onshore oil and gas fields and growing offshore initiatives. According to the Ministry of Petroleum and Natural Gas, India aims to reduce energy imports by 10% by 2030, which is prompting investments in both conventional and unconventional resources. For instance, the Krishna-Godavari Basin has emerged as a key area for natural gas exploration, which requires robust drill pipes to access deep reserves.

Australia is showcasing huge growth opportunities for the Asia Pacific drill pipe market with a strong focus on offshore drilling and coal-bed methane projects. According to the Australian Petroleum Production & Exploration Association, coal-bed methane production accounted for over 10% of the country’s natural gas output in 2022 by creating demand for specialized drill pipes. Additionally, offshore projects in the Timor Sea have further propelled market growth.

Malaysia's drill pipe market is likely to grow steadily in the coming years. The country’s national oil company, Petronas, has invested heavily in offshore projects is necessitating high-strength drill pipes for ultra-deepwater operations.

Indonesia focuses on onshore oil and gas exploration is exponentially to leverage the growth opportunities for the Asia Pacific drill pipe market.

KEY MARKET PLAYERS

Hilong Group, NOV Inc., Tenaris S.A., Vallourec S.A., TMK Group, Oil Country Tubular Limited, Tejas Tubular Grades Inc., Texas Steel Conversion Inc., DP Master, Jiangyin Long Bright Drill Pipe Manufacture Co. Ltd., Drill Pipe International LLC, Superior Drill Pipe Manufacturing, Inc. are the market players that are dominating the Asia pacific drill pipe market.

Top Players in the Market

Tenaris S.A.

Tenaris is a global leader in the production of premium drill pipes, renowned for its advanced metallurgical expertise and innovative solutions tailored to the oil and gas industry. The company’s contribution to the global market lies in its ability to provide high-strength drill pipes designed for challenging environments, such as deepwater and unconventional drilling. In the Asia Pacific, Tenaris has established strategic partnerships with national oil companies to support their upstream exploration activities. Their focus on sustainability and technological innovation ensures compliance with stringent environmental regulations will escalate the growth of the market.

Vallourec S.A.

Vallourec specializes in manufacturing high-performance drill pipes, leveraging its expertise in tubular solutions to meet the demands of the Asia Pacific market. The company plays a pivotal role in supporting offshore and onshore drilling projects by offering durable and corrosion-resistant products. Vallourec’s commitment to research and development has enabled it to introduce advanced coatings and materials that enhance the lifespan of drill pipes. By collaborating with regional players, Vallourec continues to address the growing need for specialized equipment in unconventional resource extraction, which is reinforcing its global reputation.

TMK Group

TMK Group is a key player in the drill pipe market, known for its comprehensive range of API-grade and premium-grade products. The company’s strong presence in the Asia Pacific is driven by its ability to cater to both conventional and complex drilling operations. TMK’s focus on customization and customer-centric solutions has allowed it to meet the diverse needs of regional operators. TMK has positioned itself as a reliable partner for oil and gas exploration projects across the region.

Top Strategies Used by Key Market Participants

Strategic Partnerships and Collaborations

Key players in the Asia Pacific drill pipe market have prioritized forming strategic partnerships with national oil companies and regional operators to expand their reach. These collaborations enable firms to tailor their solutions to local requirements while leveraging existing networks. For instance, partnerships with governments and private entities allow manufacturers to integrate their products into large-scale exploration projects, ensuring long-term adoption and scalability.

Investment in Research and Development

Investing in R&D remains a cornerstone strategy for market leaders aiming to enhance the capabilities of drill pipes. The companies are improving the durability and performance of their products by incorporating advanced materials and coatings. This focus on innovation not only addresses current challenges but also positions these firms as pioneers in the evolving drill pipe landscape, which is offering scalable and versatile solutions.

Expansion of Product Portfolios

To strengthen their market presence, key players are diversifying their product offerings to include both API-grade and premium-grade drill pipes. Offering a wide range of solutions ensures that companies can cater to varying operational needs, from conventional onshore drilling to complex offshore projects. This approach enables firms to address the entire lifecycle of drilling operations by creating a competitive edge in the market.

COMPETITION OVERVIEW

The Asia Pacific drill pipe market is characterized by intense competition, driven by the presence of established global players and emerging regional firms. Leading companies such as Tenaris, Vallourec, and TMK Group dominate the market through their advanced technologies and extensive experience in energy exploration. However, smaller players are gaining traction by offering cost-effective and customized solutions tailored to local needs. The competitive landscape is further shaped by increasing government investments in energy security and resource diversification, which create lucrative opportunities for all participants. To differentiate themselves, companies are focusing on innovation, strategic collaborations, and expanding their service offerings. Additionally, the growing emphasis on sustainability and technological advancements has intensified competition, as firms strive to develop versatile systems capable of addressing both industrial and environmental challenges.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Tenaris S.A. partnered with China National Petroleum Corporation (CNPC) to supply premium-grade drill pipes for shale gas projects in the Sichuan Basin. This collaboration aimed to enhance China’s domestic energy production while expanding Tenaris’s regional footprint.

- In June 2023, Vallourec S.A. launched a new line of corrosion-resistant drill pipes in Malaysia, designed for offshore drilling in the South China Sea. This initiative aligned with Malaysia’s push for deepwater exploration by reinforcing Vallourec’s prominence in the offshore segment.

- In September 2023, TMK Group signed a Memorandum of Understanding with Indonesia’s state-owned oil company, Pertamina, to support onshore drilling projects in Sumatra. This agreement marked a significant step in strengthening TMK’s presence in Southeast Asia.

- In November 2023, U.S.-based NOV (National Oilwell Varco) opened a manufacturing facility in Vietnam to produce API-grade drill pipes.

- In February 2024, Japan Petroleum Exploration Co., Ltd. (JAPEX) introduced smart drill pipe technology in collaboration with local manufacturers. This innovation positioned JAPEX as a leader in integrating IoT-enabled solutions for real-time monitoring and efficiency improvements.

MARKET SEGMENTATION

This research report on the Asia Pacific drill pipe market is segmented and sub-segmented into the following categories.

By Grade

- API Grade

- Premium Grade

By Application

- Onshore

- Offshore

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

How are deepwater and unconventional drilling projects driving the demand for advanced drill pipe technologies in Asia Pacific?

This examines how exploration shifts, especially in regions like Australia, Malaysia, and China, are creating demand for higher-specification pipes.

What material innovations are influencing drill pipe durability and performance in the challenging geological conditions across Asia Pacific?

Focuses on how regional geology impacts pipe wear, and how developments in steel grades, coatings, and composite technologies are responding

How are government regulations, local content policies, and trade dynamics shaping drill pipe manufacturing and sourcing in the region?

Addresses the impact of localization rules, anti-dumping laws, and tariffs on procurement strategies and regional supply chains.

What role does rig modernization and automation play in influencing drill pipe specifications and compatibility across Asia Pacific markets?

Explores how the transition to automated rigs and smart drilling systems affects the choice, length, and joint designs of drill pipes.

How are fluctuating oil prices and regional energy strategies impacting long-term investments in drill pipe infrastructure in Asia Pacific?

Looks at how macroeconomic factors and national energy policies affect project planning, inventory cycles, and investment in premium-grade drill pipe.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]