Asia Pacific Duty Free Retailing Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, Sales Channel, And By Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia Pacific Duty Free Retailing Market Size

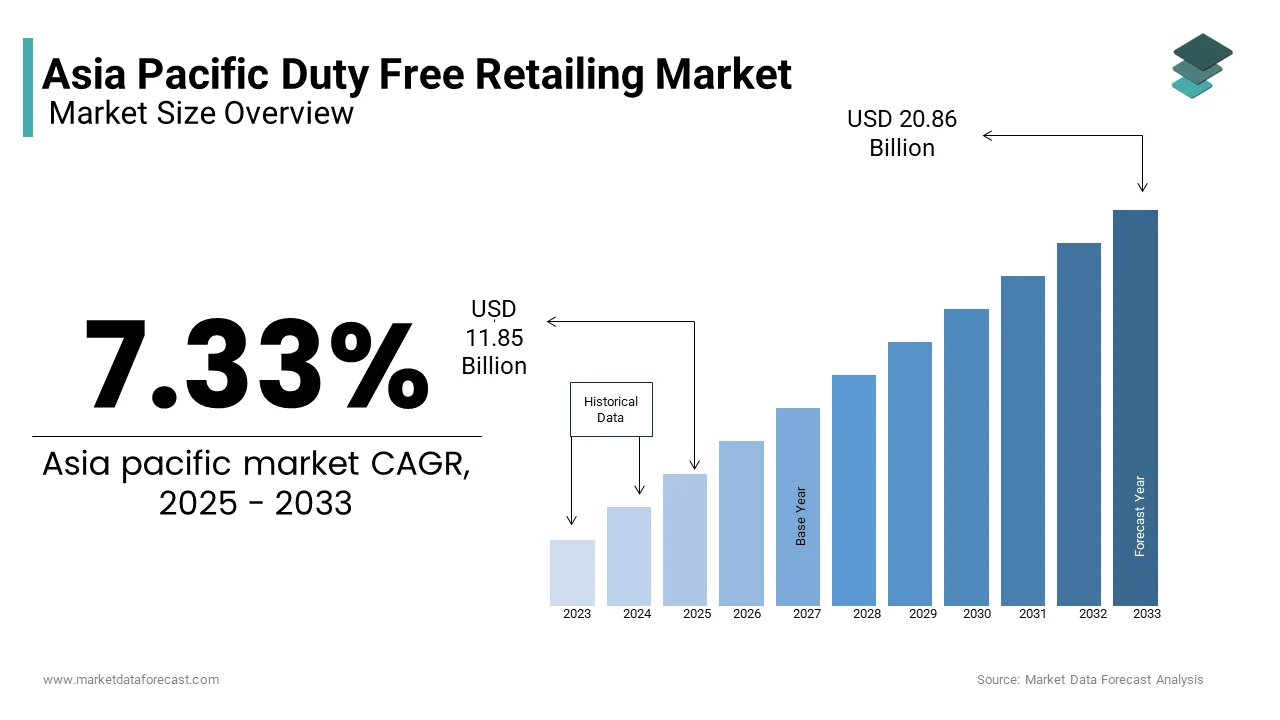

The Asia Pacific duty-free retailing market size was valued at USD 11.04 billion in 2024 and is anticipated to reach USD 11.85 billion in 2025 from USD 20.86 billion by 2033, growing at a CAGR of 7.33% during the forecast period from 2025 to 2033.

Current Scenario Of The Asia Pacific Duty Free Retailing Market

Duty-free retailing provides travelers with access to premium products such as cosmetics, fragrances, alcohol, tobacco, and luxury goods at competitive prices, making it an integral part of the travel ecosystem. According to the World Tourism Organization, international tourist arrivals in the Asia Pacific region are projected to reach 1.6 billion by 203,0, with the growing significance of duty-free retailing in enhancing traveler satisfaction.

The region’s rapid urbanization, rising disposable incomes, and increasing air travel accessibility have further fueled demand for duty-free retailing. As per the International Air Transport Association (IATA), passenger traffic in the Asia Pacific is expected to grow by 4.5% annually through 2030 by creating opportunities for retailers to expand their offerings. Additionally, Australia’s Department of Infrastructure, Transport, Regional Development and Communications emphasizes the role of duty-free retailing in supporting regional economies and promoting local products, aligning with global trade initiatives.

MARKET DRIVERS

Rising International Travel and Tourism

The exponential rise in international travel and tourism is a primary driver of the Asia Pacific duty-free retailing market. For example, Japan’s Ministry of Land, Infrastructure, Transport and Tourism reports that over 60% of visitors to Japan purchased duty-free goods, particularly high-end electronics and cosmetics, contributing significantly to retailer revenues. Thailand’s Ministry of Tourism and Sports, duty-free shopping accounts for over 30% of total tourist spending in the country, by enhancing traveler satisfaction.

Increasing Affluence and Consumer Preferences

Another significant driver is the increasing affluence and changing consumer preferences among travelers. According to China’s National Bureau of Statistics, over 40% of outbound Chinese travelers prioritize duty-free shopping during their trips by reflecting their preference for luxury goods and exclusive deals. Similarly, India’s Ministry of Civil Aviation notes that middle-class travelers are increasingly seeking affordable yet premium products, which is driving demand for tax-free offerings. Moreover, the rise of experiential shopping has further fueled demand for innovative retail formats. Singapore’s Economic Development Board emphasizes that interactive displays and personalized promotions enhance customer engagement by ensuring steady growth in the duty-free retailing market.

MARKET RESTRAINTS

Regulatory Challenges and Tax Policies

The regulatory challenges and fluctuating tax policies pose significant restraints to the duty-free retailing market, particularly regarding cross-border operations and product availability. The International Trade Administration states that many countries in the region impose stringent regulations on imports and exports, limiting the range of products available for duty-free sales. For instance, South Korea’s Ministry of Finance mandates strict guidelines for alcohol and tobacco sales, complicating implementation for retailers. Additionally, the absence of harmonized tax policies across the region creates operational inefficiencies. As per Japan’s Ministry of Finance, need for regional collaboration to facilitate seamless cross-border transactions and enhance regulatory compliance.

Impact of Geopolitical Tensions and Travel Restrictions

Geopolitical tensions and travel restrictions also act as restraints regarding fluctuations in tourist arrivals and consumer confidence. Malaysia’s Ministry of Foreign Affairs reports that over 50% of retailers experienced a decline in sales due to geopolitical uncertainties affecting travel patterns. According to Australia’s Department of Home Affairs, stringent visa requirements and border controls deter potential travelers, further reducing demand for duty-free goods.

MARKET OPPORTUNITIES

Expansion of E-Commerce and Digital Platforms

The expansion of e-commerce and digital platforms presents transformative opportunities for the duty-free retailing market. Online duty-free shopping enables travelers to pre-order products before their journeys, enhancing convenience and customer satisfaction. According to McKinsey & Company, online duty-free sales are expected to generate USD 500 billion annually in the Asia Pacific region by 2030.

South Korea’s Ministry of Science and ICT studies have shown that the use of mobile apps and virtual catalogs to streamline purchasing processes and improve accessibility. Similarly, Hong Kong’s Airport Authority emphasizes the role of digital platforms in expanding product ranges and catering to diverse consumer preferences. These advancements position e-commerce as a key enabler of innovation in the duty-free retailing market.

Integration of Sustainable and Local Products

The integration of sustainable and locally sourced products offers vast growth opportunities, driven by the increasing demand for eco-friendly and culturally authentic offerings. New Zealand’s Ministry for the Environment notes that over 60% of travelers prefer environmentally responsible products, which is creating a niche for sustainable duty-free retailing. According to Indonesia’s Ministry of Tourism and Creative Economy, the use of local handicrafts and organic goods promotes cultural heritage and supports regional economies.

MARKET CHALLENGES

Intense Competition Among Retailers

Intense competition among retailers represents a pressing challenge for the duty-free retailing market regarding pricing strategies and brand differentiation. The Confederation of Indian Industry states that over 70% of retailers struggle to maintain profitability due to price wars and limited product exclusivity. Smaller operators often face difficulties competing with global giants, which is forcing them to adopt cost-cutting measures that compromise quality. Additionally, the lack of economies of scale in emerging economies exacerbates this issue, thereby limiting the ability of smaller players to compete effectively. These financial barriers hinder the sustainability of duty-free retailing businesses in low-income countries.

Limited Accessibility in Remote Areas

Limited accessibility in remote areas also poses a significant challenge, particularly regarding infrastructure and logistics. As per India’s Ministry of Rural Development, only 25% of border crossings have modernized retail spaces, further complicating the deployment of duty-free services.

These infrastructural gaps force companies to invest heavily in offline solutions, such as pop-up stores, to cater to underserved populations. These factors collectively limit the ability of retailers to achieve universal coverage and inclusivity.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.33% |

|

Segments Covered |

By Type, Sales Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of APAC |

|

Market Leaders Profiled |

Avolta (Dufry AG) (Switzerland), DFS Group (China), Gebr. Heinemann SE & Co. KG (Germany), Lagardère Group (France), Dubai Duty Free (UAE), China Duty Free Group (China), Lotte Duty Free (South Korea), The Shilla Duty Free (South Korea), Shinsegae Duty Free Inc. (South Korea), King Power International Group (Thailand). |

SEGMENTAL ANALYSIS

By Type Insights

The cosmetics segment was the largest and held 35.4% of the Asia Pacific duty-free retailing market share in 202,4, owing to the growing demand for premium skincare, makeup, and beauty products among travelers from affluent demographics. One major factor is the increasing affluence and changing consumer preferences among travelers. According to China’s National Bureau of Statistics, over 60% of outbound Chinese travelers prioritize purchasing cosmetics during their trips by reflecting their preference for luxury brands and exclusive deals. Similarly, South Korea’s Ministry of Culture, Sports and Tourism reports that K-beauty products account for over 40% of duty-free sales in the country, with the critical role of cosmetics in driving revenue growth.

The alcohol is projected to grow with a CAGR of 8.2% during the forecast period. The growth of the segment can be driven by the increasing popularity of premium spirits and wines among travelers in emerging countries. A key factor is the growing affluence and cultural preferences of travelers. Similarly, Australia’s Department of Agriculture, Water, and the Environment emphasizes the role of wine exports in boosting duty-free sales, which aligns with global trade initiatives. Another factor is the focus on exclusivity. Thailand’s Ministry of Commerce reports that limited-edition alcohol products attract high-net-worth travelers, which is further accelerating adoption.

By Sales Channel Insights

The airports accounted in holding 50.4% of the Asia Pacific duty-free retailing market share in 2024, owing to the critical role of airports as primary hubs for international travel and tourism. One key factor is the exponential rise in air travel accessibility. As per India’s Ministry of Civil Aviation, over 70% of international travelers engage in duty-free shopping at airports, reflecting its integral role in enhancing traveler satisfaction. Similarly, South Korea’s Ministry of Land, Infrastructure, and Transport reports that Incheon International Airport generates over 40% of its revenue from duty-free retailing due to its significance in supporting regional economies. Another factor is the focus on convenience. Australia’s Department of Infrastructure, Transport, Regional Development and Communications notes that the strategic placement of duty-free stores within airports ensures seamless access for travelers.

The onboard aircraft is anticipated to grow lucratively with a CAGR of 9.5% in the foreseeable future, with the increasing adoption of onboard retailing solutions to cater to long-haul travelers and enhance customer experience. A significant factor is the rise of experiential shopping. As per Japan’s Ministry of Economy, Trade and Industry, over 60% of airlines are integrating digital catalogs and mobile payment systems to streamline onboard purchases, thereby reducing operational costs and improving satisfaction. Similarly, Singapore’s Civil Aviation Authority emphasizes the role of onboard duty-free in promoting local products by aligning with regional trade initiatives. Another factor is the focus on exclusivity. Malaysia’s Ministry of Tourism, Arts and Culture reports that limited-edition onboard offerings attract high-net-worth travelers, which will boost the growth of the segment.

COUNTRY ANALYSIS

Top Leading Countries in the Market

China led the Asia Pacific duty-free retailing market by accounting for 30.2% of the share in 2024, owing to its status as a global leader in outbound tourism and luxury consumption. The Chinese Academy of Social Sciences reports that over 70% of outbound Chinese travelers prioritized duty-free shopping, reflecting their preference for premium goods and exclusive deals. Additionally, China’s Hainan province has emerged as a major duty-free hub, offering tax-free shopping experiences to domestic and international travelers that will further promote the growth opportunities for the market.

South Korea was positioned second by holding 20.2% of the Asia Pacific duty-free retailing market share in 2024. The country’s rapid adoption of duty-free retailing is driven by its robust tourism sector and the global popularity of K-beauty products. Over 60% of inbound tourists actively engage in duty-free shopping for cosmetics and skincare products. Furthermore, Seoul’s Incheon International Airport serves as a major gateway for international travelers by ensuring steady growth in demand for duty-free offerings.

Japan, with its advanced infrastructure and cultural appeal, is solely to grow with the fastest CAGR in the coming years. The Ministry of Land, Infrastructure, Transport, and Tourism emphasizes the role of duty-free retailing in promoting Japanese whiskey, sake, and electronics as must-buy items for international travelers. Additionally, Japan’s focus on customer-centric services ensures widespread adoption of innovative retail formats by aligning with global standards.

Thailand duty duty-free retailing market growth is driven by its robust tourism industry and strategic location as a regional travel hub. According to the Ministry of Tourism and Sports, integration of duty-free retailing into the country’s hospitality ecosystem offers travelers access to affordable yet premium products. Additionally, Thailand’s focus on promoting local handicrafts and organic goods enhances its appeal as a duty-free destination, which will promote the growth of the market in this country.

Australia duty duty-free retailing market growth is likely to be propelled by the increasing focus on promoting local wines and indigenous products, driving duty-free retailing adoption. The use of duty-free channels to support regional economies and promote Australian brands globally. Additionally, Australia’s vast network of airports and seaports necessitates scalable solutions to ensure safe and efficient operations in remote areas.

KEY MARKET PLAYERS

Avolta (Dufry AG) (Switzerland), DFS Group (China), Gebr. Heinemann SE & Co. KG (Germany), Lagardère Group (France), Dubai Duty Free (UAE), China Duty Free Group (China), Lotte Duty Free (South Korea), The Shilla Duty Free (South Korea), Shinsegae Duty Free Inc. (South Korea), King Power International Group (Thailand). Are the market players that are dominating the Asia Pacific duty-free retailing market?

Top Players in the Market

Lotte Duty Free

Lotte Duty Free is a global leader in duty-free retailing, with a significant presence in the Asia Pacific market. The company’s contribution to the global market lies in its extensive network of stores and innovative shopping experiences in South Korea and other regional hubs. Lotte’s focus on premium brands, such as cosmetics, luxury goods, and alcohol, ensures it caters to affluent travelers seeking exclusive deals. Its commitment to digital transformation, including mobile apps and virtual catalogs, enhances customer convenience and engagement, which is positioning it as a trusted partner for travelers.

DFS Group

DFS Group plays a pivotal role in advancing duty-free retailing through its world-class shopping destinations at airports and downtown locations. DFS empowers travelers in the Asia Pacific region to access high-end brands at competitive prices and is known for its robust portfolio of luxury products. The company’s emphasis on experiential retail, including interactive displays and personalized promotions, aligns with evolving consumer preferences.

Dufry AG

Dufry AG is renowned for its innovative approach to duty-free retailing, which is making it a key player in the Asia Pacific market. Through its diverse product offerings and strategic partnerships with airports, Dufry provides travelers with seamless access to tax-free goods, ranging from cosmetics to spirits. The company’s dedication to sustainability and customer-centric solutions has strengthened its global reputation.

Top Strategies Used By Key Players In The Market

Focus on Digital Transformation

Key players in the market increasingly prioritize digital transformation by integrating e-commerce platforms, mobile apps, and contactless payment systems into their operations. These efforts enhance customer convenience and streamline purchasing processes, ensuring alignment with modern traveler expectations. For instance, retailers are adopting AI-driven personalization tools to recommend products based on individual preferences, which is enhancing engagement and satisfaction.

Strategic Partnerships with Airlines and Airports

To strengthen their market position, companies are forming strategic partnerships with airlines and airports to expand their reach and improve accessibility. Collaborations with aviation stakeholders enable retailers to offer pre-order services and onboard shopping options by catering to long-haul travelers and enhancing revenue opportunities.

Expansion into Emerging Markets

Players are increasingly targeting emerging economies within the Asia Pacific region, such as Vietnam, Indonesia, and Thailand, where rising disposable incomes and tourism growth are driving demand.

COMPETITION OVERVIEW

The Asia Pacific duty-free retailing market is characterized by intense competition, with both global giants and regional players vying for dominance. Global leaders like Lotte Duty Free, DFS Group, and Dufry leverage their technological expertise and extensive distribution networks to maintain their stronghold. Meanwhile, regional players focus on cost-effective solutions and localized services to cater to price-sensitive markets. The competitive landscape is further shaped by rapid technological advancements, with companies striving to integrate AI, IoT, and e-commerce into their offerings. Additionally, stringent regulatory frameworks governing cross-border trade have compelled manufacturers to innovate continuously. Supply chain disruptions and geopolitical tensions add complexity, forcing players to adopt agile strategies. As a result, the market fosters an environment of constant evolution, where differentiation through innovation, customer-centric approaches, and strategic expansion becomes critical for sustained success.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Lotte Duty Free launched a new mobile app specifically designed for international travelers, enabling them to pre-order duty-free products before their flights. This move aimed to capitalize on the growing demand for convenience and enhance Lotte’s market presence in the region.

- In June 2023, DFS Group partnered with Singapore Changi Airport to open a flagship duty-free store offering exclusive luxury brands. This collaboration strengthened DFS’s visibility in the region’s aviation sector and expanded its customer base.

- In September 2023, Dufry AG acquired a local retail operator in Thailand to expand its production capabilities for affordable yet premium products. This acquisition enabled the company to better serve Southeast Asia’s burgeoning tourism market and increase its regional footprint.

- In January 2024, Shilla Duty Free, a South Korean retailer, introduced a suite of AI-driven personalization tools tailored for Chinese travelers. This initiative aligned with the country’s push toward experiential shopping, allowing Shilla to position itself as a leader in innovative retail technologies.

- In November 2023, Heinemann Asia Pacific signed an agreement with a Philippine airline to develop specialized onboard duty-free catalogs. This partnership reinforced Heinemann’s dominance in precision retailing technology and expanded its application portfolio.

MARKET SEGMENTATION

This research report on the Asia Pacific duty-free retailing market is segmented and sub-segmented into the following categories.

By Type

- Perfumes

- Cosmetics

- Alcohol

- Cigarettes

- Others

By Sales Channel

- Airports

- Onboard Aircraft

- Seaports

- Train Stations

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

How are evolving international travel patterns and tourism flows shaping the future of duty-free retail across Asia Pacific airports and borders?

Explores how post-pandemic recovery, regional travel corridors, and growing intra-Asia tourism are redefining consumer footfall and sales opportunities.

What cultural and demographic shifts are influencing product preferences among duty-free shoppers in different Asia Pacific countries?

Looks into how younger travelers, rising middle-class consumers, and luxury-seeking tourists from markets like China, South Korea, and India are driving category trends.

How is the rise of digitalization and omnichannel retailing transforming the traditional duty-free shopping experience in Asia Pacific?

Covers pre-order platforms, mobile apps, and hybrid models blending online discovery with in-terminal or in-flight pickup, as well as personalized marketing.

What are the key regulatory and taxation differences across Asia Pacific markets that impact pricing strategies and inventory management in duty-free stores?

Focuses on how local customs laws, duty thresholds, and inbound allowances vary, affecting product selection, pricing transparency, and retailer margins.

How are sustainability concerns and changing consumer values influencing the product mix and sourcing practices in Asia Pacific duty-free retail?

Addresses how brands and retailers are responding to growing demand for eco-conscious packaging, local artisanal products, and ethical supply chains.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]