Asia Pacific Egg Powder Market Research Report – Segmented By Product (Whole Egg Powder, Egg Yolk Powder) Application , Distribution Channel and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis on Size, Share, Trends& Growth Forecast from 2025 to 2033

Asia Pacific Egg Powder Market Size

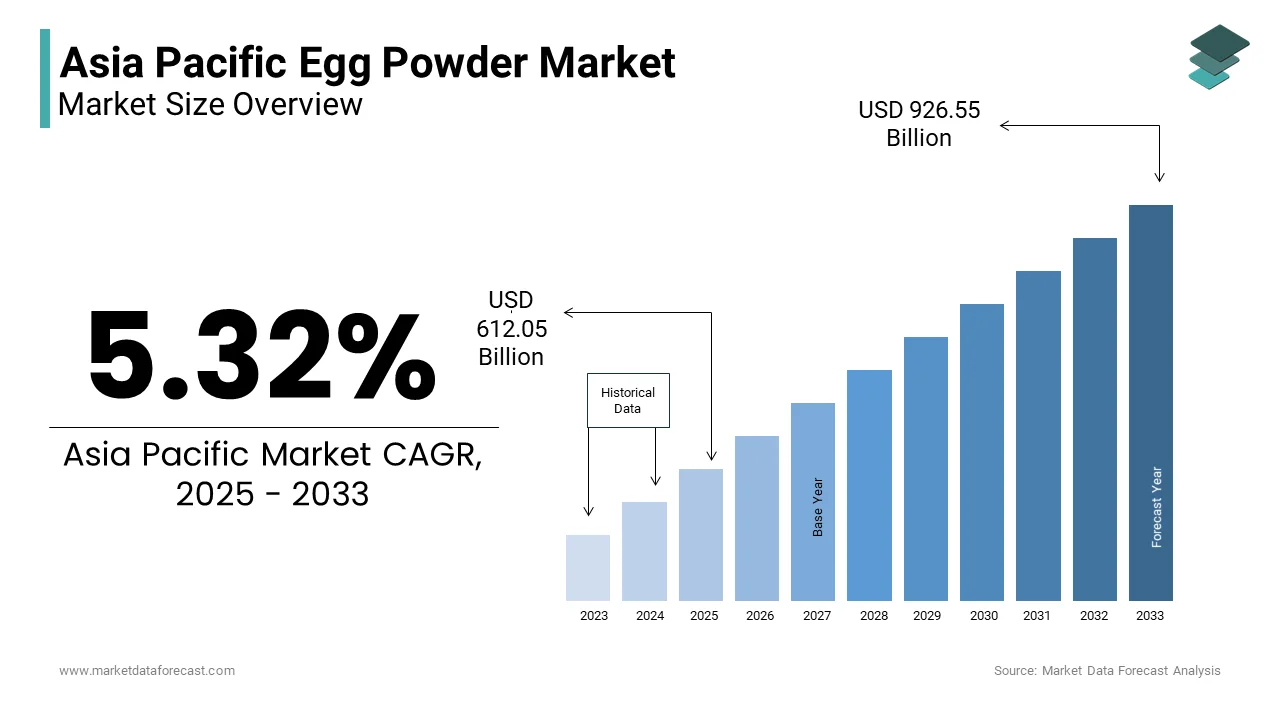

The Asia Pacific egg powder market Size was valued at USD 581.13 billion in 2024. The Asia Pacific egg powder market Size is expected to have 5.32 % CAGR from 2025 to 2033 and be worth USD 926.55 billion by 2033 from USD 612.05 billion in 2025.

The Asia Pacific egg powder market is gaining momentum as a critical segment within the food processing industry, driven by its versatility and extended shelf life. Countries like China, India, Japan, and Australia are leading contributors, with urbanization and industrial food production acting as primary catalysts.

Additionally, according to the Food and Agriculture Organization (FAO), investments in sustainable egg farming practices have led to a 12% annual increase in organic egg powder production in India and Vietnam. The rising disposable incomes and the growing popularity of plant-based alternatives are escalating the growth of the market.

MARKET DRIVERS

Rising Demand in the Food Processing Industry

The rising demand for egg powder in the food processing industry serves as a major driver for the Asia Pacific market, fueled by its functional properties and convenience. In countries like China and India, urbanization has spurred consumption of convenience foods such as bakery items, pasta, and instant noodles, which is prompting the growth of the market. For instance, according to the Confederation of Indian Industry, egg powder accounts for nearly 30% of all egg-based ingredients used in the domestic food processing industry. Its ability to enhance texture, flavor, and shelf life makes it indispensable in commercial kitchens and large-scale manufacturing units. Additionally, as per a study by Frost & Sullivan, the rise of e-commerce platforms has amplified the reach of processed foods, with online sales of bakery and confectionery products growing by 40% in 2022. This surge directly benefits egg powder manufacturers, who cater to both domestic and export markets.

Increasing Adoption in Animal Feed

The increasing adoption of egg powder in animal feed formulations represents another significant driver for the Asia Pacific market, driven by its nutritional benefits and cost-effectiveness. The egg powder emerging as a preferred ingredient for enhancing livestock health and productivity. Rich in proteins, vitamins, and essential amino acids, egg powder is widely used in poultry and aquaculture feed to improve growth rates and immune function. Similarly, in Vietnam, where aquaculture is a cornerstone of the agricultural economy, egg powder is increasingly used to fortify fish feed, which is driving the growth of the market. Moreover, as per a report by McKinsey, the shift toward sustainable and nutrient-dense animal feed has further bolstered the adoption of egg powder, particularly in countries like Thailand and Indonesia.

MARKET RESTRAINTS

Fluctuating Raw Material Costs

Fluctuating raw material costs pose a significant restraint to the Asia Pacific egg powder market, impacting production timelines and profitability. The reliance on fresh eggs makes the industry vulnerable to price volatility, especially in regions prone to extreme weather events and disease outbreaks. These disruptions are exacerbated by inadequate infrastructure in rural farming areas, where transportation networks often struggle to meet the demands of large-scale production.

Compounding the issue, as per the International Trade Centre, export restrictions and trade barriers further complicate cross-border movement of egg-based products. For instance, stringent quality certifications required by countries like Japan and South Korea delay shipments, which is resulting in financial losses for exporters. Such inefficiencies not only inflate operational expenses but also limit market penetration in high-demand areas.

Limited Consumer Awareness

Limited consumer awareness about the benefits of egg powder presents another critical restraint hampering the Asia Pacific market in rural and underdeveloped areas. While urban consumers are increasingly adopting egg powder for its convenience and nutritional value, many rural populations remain unfamiliar with its applications beyond traditional fresh eggs. These inconsistencies directly translate into lower retail penetration rates. Additionally, cultural perceptions also play a role. For instance, a study by the Indian Council of Agricultural Research, traditional beliefs associating fresh eggs with superior nutrition deter regular consumption of egg powder. Compounding these challenges, inadequate retail infrastructure in remote areas restricts product availability, further stifling demand. Bridging this awareness gap is essential to unlocking the full potential of the Asia Pacific egg powder market and fostering inclusive growth across all consumer strata.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The expansion into emerging markets offers a lucrative opportunity for the Asia Pacific egg powder market, driven by untapped consumer bases and evolving purchasing power. Countries like Vietnam, Cambodia, and Myanmar present fertile ground for growth, with their expanding middle-class populations increasingly gravitating toward convenient and nutritious food options. Companies investing in localized distribution networks stand to capture significant market share, particularly through partnerships with small retailers and cooperatives. Moreover, as per the International Finance Corporation, government initiatives promoting agribusiness in Southeast Asia have facilitated the establishment of new egg farms by ensuring a steady supply of raw materials.

Innovation in Product Offerings

Innovation in product offerings represents a transformative opportunity for the Asia Pacific egg powder market by enabling brands to differentiate themselves and attract diverse consumer segments. There is a growing appetite for value-added variants such as organic, fortified, and specialty egg powders tailored to specific dietary needs. Consumers in the region express interest in food products that combine nutrition with additional health benefits, such as probiotics or omega-3 enrichment. This trend has spurred companies to experiment with formulations like vitamin-fortified egg powder by catering to niche markets seeking specialized nutrition. Innovations in processing techniques, such as cold-pressed extraction, have also enhanced product quality, preserving natural nutrients while extending shelf life. The companies can carve out a competitive edge, driving both market penetration and premiumization.

MARKET CHALLENGES

Intense Market Competition

Intense market competition poses a significant challenge to the Asia Pacific egg powder market, as numerous players vie for dominance in an increasingly saturated landscape. The entry of multinational corporations alongside local brands has fragmented the market, which is leading to aggressive pricing wars and eroding profit margins. This proliferation forces smaller players to either consolidate or exit the market, as they struggle to match the marketing budgets and distribution networks of larger conglomerates. Brand differentiation has become increasingly difficult, with consumers often prioritizing cost over loyalty. For instance, a survey conducted by Nielsen reveals that 60% of shoppers in urban areas switch brands based on discounts or promotions, undermining efforts to build long-term customer relationships.

Supply Chain Disruptions

Supply chain disruptions pose a significant challenge to the Asia Pacific egg powder market by impacting production timelines and distribution efficiency. The reliance on fresh eggs makes the industry vulnerable to logistical bottlenecks in regions prone to extreme weather events. According to the Asian Development Bank, typhoons and monsoon floods caused a 15% reduction in egg harvests in Southeast Asia during 2021, leading to shortages and increased raw material costs. These disruptions are exacerbated by inadequate infrastructure in rural farming areas, where transportation networks often struggle to meet the demands of large-scale production.

Compounding the issue, as per the International Trade Centre, export restrictions and trade barriers further complicate cross-border movement of egg powder. For instance, stringent quality certifications required by countries like Japan and South Korea delay shipments, resulting in financial losses for exporters. Such inefficiencies not only inflate operational expenses but also limit market penetration in high-demand areas. While investments in cold chain logistics and warehousing are underway, progress remains uneven in less-developed economies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.32 % |

|

Segments Covered |

By Product ,Application, Distribution Channel and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

China, India, Japan, South Korea, Australia, New Zealand, Thailand, Indonesia, Philippines, Vietnam, Singapore, Rest of APAC. |

|

Market Leader Profiled |

Rose Acre Farms, Ovostar Union, Rembrandt Foods, Sanovo Technology Group |

SEGMENTAL ANALYSIS

By Product Insights

The whole egg powder segment was accounted in holding dominant share of the Asia Pacific egg powder market in 2024 due to its versatility and widespread application across various industries, including food processing and animal feed. A key factor fueling this dominance is the growing demand for functional ingredients in processed foods. Its ability to enhance texture, flavor, and shelf life makes it indispensable in commercial kitchens and large-scale manufacturing units. This surge directly benefits whole egg powder manufacturers, who cater to both domestic and export markets. The food processing industry continues to fuel the dominance of whole egg powder in the region by addressing the needs of a rapidly urbanizing population.

The egg yolk powder segment is projected to witness a CAGR of 8.5% in the next coming years. This rapid expansion is fueled by increasing adoption in high-value applications such as infant nutrition and pharmaceuticals. One of the primary drivers of this growth is the rising awareness of the nutritional benefits of egg yolk powder due to its rich content of essential fatty acids, vitamins, and lecithin. As per the International Food Information Council, egg yolk powder is increasingly being incorporated into infant formula and dietary supplements, which is driving a 30% annual increase in demand in urban centers like Singapore and Sydney. Moreover, as per a report by the Australian Institute of Food Science and Technology, innovations in extraction techniques have enhanced the purity and functionality of egg yolk powder by making it suitable for use in premium products like cosmetics and nutraceuticals. Another significant factor is the influence of health-conscious consumers, who are willing to pay a premium for fortified and nutrient-dense products.

By Application Insights

The food and beverage sector dominated the Asia Pacific egg powder market with prominent share in 2024 with the versatility of egg powder in enhancing the quality and shelf life of processed foods, making it a staple ingredient in the industry. A critical factor driving this dominance is the growing urbanization and demand for convenience foods. Additionally, the rise of e-commerce platforms has further amplified the reach of processed foods, with online sales growing by 35% in 2022.

Animal feed segment is attributed to register a CAGR of 9.2% in the next coming years with the increasing adoption of egg powder in poultry and aquaculture feed formulations to enhance livestock health and productivity. One of the primary drivers of this expansion is the rising demand for sustainable and nutrient-dense animal feed. Another significant factor is the shift toward precision nutrition in livestock farming, which has bolstered the adoption of egg powder in countries like Thailand and Indonesia.

By Distribution Channel Insights

The supermarkets and hypermarkets segment dominated the Asia Pacific egg powder market with 50.4% of share in 2024 due to their extensive reach and ability to cater to diverse consumer demographics, from urban professionals to rural households. A critical factor driving this dominance is the strategic placement of egg powder products in prominent aisles, which is enhancing visibility and impulse purchases. Additionally, the integration of private-label egg powder brands by major retailers like Woolworths in Australia and Big Bazaar in India has further solidified this segment's position. As per the International Trade Centre, private-label products now account for 30% of supermarket sales in the region by offering affordable alternatives to branded offerings. Another contributing factor is the growing trend of one-stop shopping in urban areas. A study by Euromonitor reveals that 65% of consumers in cities like Tokyo and Mumbai prefer purchasing food ingredients alongside groceries by making supermarkets and hypermarkets the go-to destination.

The online distribution channel segment is lucratively to witness a CAGR of 12.8 in the next coming years. This growth is fueled by the rapid digitalization of retail and the increasing penetration of e-commerce platforms across the region. One of the primary drivers of this surge is the convenience offered by online shopping in densely populated urban areas. According to a report by McKinsey, 75% of consumers in Singapore and South Korea now prefer ordering food ingredients online due to time constraints and the availability of home delivery services. Moreover, the rise of subscription-based models has further boosted online sales. As per a study by EY, subscription programs for egg powder have grown by 50% in the past two years, with consumers valuing the regularity and discounts offered.

COUNTRY LEVEL ANALYSIS

China was the largest contributor in the Asia Pacific egg powder market by accounting for 28.3% of the share in 2024 with the vast population and rising disposable incomes make it a natural hub for consumption. A key driving factor is the government's push for preventive healthcare, with initiatives like the "Healthy China 2030" plan encouraging the use of egg powder in food processing and animal feed. Urbanization has also spurred demand in cities like Shanghai and Beijing, where health-conscious consumers prioritize wellness.

India held 20.9% of the Asia Pacific egg powder market share in 2024. The country's large agricultural base and growing health awareness drive demand for egg powder in both food processing and livestock nutrition. According to the Indian Ministry of Agriculture, investments in sustainable egg farming practices have led to a 15% annual increase in egg powder production. Urban centers like Mumbai and Delhi benefit from a strong distribution network, with the increasing sales especially in supermarkets.

Japan egg powder market growth is with its aging population's reliance on convenience foods. Government initiatives promoting sustainable agriculture techniques is ascribed to boost the growth of the market in this country.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Asia Pacific egg powder market are Rose Acre Farms, Ovostar Union, Rembrandt Foods, Sanovo Technology Group, Kewpie Corp, Building house Enthoven, Interovo Egg Group B.V., Afrigrow Agriholdings, Adriaan van Erk, Oskaloosa Food Products, Farm Pride Foods, WEKO Group.

The Asia Pacific egg powder market is characterized by intense competition, with numerous players vying for dominance in an increasingly saturated landscape. Established global brands like Sanovo Technology Group and Rembrandt Enterprises compete alongside regional leaders such as Kewpie Corporation, each striving to differentiate themselves through unique value propositions. While multinational corporations leverage their extensive distribution networks and marketing budgets to capture urban markets, local players focus on affordability and cultural relevance to appeal to broader demographics. The entry of private-label products from major retailers further intensifies the rivalry, pressuring branded manufacturers to innovate continuously. Sustainability and health consciousness have emerged as key battlegrounds, with companies investing in eco-friendly packaging and clean-label formulations to gain a competitive edge. Additionally, the rise of e-commerce has leveled the playing field, enabling smaller brands to challenge incumbents by reaching consumers directly. Despite these challenges, the market remains dynamic, with opportunities for growth driven by untapped rural areas and emerging markets. Strategic collaborations, aggressive marketing, and a focus on product innovation are essential for navigating this fiercely competitive environment.

Top Players in the Market

Sanovo Technology Group

Sanovo Technology Group is a dominant player in the Asia Pacific egg powder market, known for its advanced processing technologies and global supply chain capabilities. The company has significantly contributed to the global market by introducing innovative solutions that enhance product quality and shelf life. Its commitment to sustainability and ethical sourcing practices has strengthened its reputation, making it a preferred choice among environmentally aware buyers. Sanovo’s strategic partnerships with food processors and animal feed manufacturers have further solidified its presence in urban markets across the region.

Rembrandt Enterprises

Rembrandt Enterprises has carved a niche in the Asia Pacific market through its focus on premium-quality egg powder products. The company’s emphasis on transparency in sourcing and production processes resonates with consumers seeking clean-label ingredients. Its contributions to the global market include pioneering cold-pressed technology, which has set new standards for freshness and nutritional value in the industry.

Kewpie Corporation

Kewpie Corporation is a regional leader that leverages its deep understanding of local consumer preferences to tailor its product offerings. The company’s strong distribution network and collaborations with major retailers have enabled it to penetrate both urban and rural markets effectively. Kewpie’s efforts to promote egg powder as a versatile ingredient have expanded its appeal beyond industrial applications to household consumers. Globally, the brand is recognized for its affordability and accessibility, which is contributing to the democratization of egg powder consumption.

Top Strategies Used by Key Market Participants

Product Diversification

Key players in the Asia Pacific egg powder market are increasingly focusing on product diversification to cater to evolving consumer preferences. By introducing organic, fortified, and specialty variants, companies are able to target niche segments like health-conscious consumers and premium buyers. This strategy not only enhances brand visibility but also strengthens their competitive edge in a crowded marketplace. Collaborations with nutritionists and fitness influencers further amplify the appeal of these specialized offerings, which is driving consumer engagement and loyalty.

Sustainability Initiatives

Sustainability has become a cornerstone of market strategies, with companies emphasizing eco-friendly practices to resonate with environmentally conscious buyers. From adopting biodegradable packaging to promoting sustainable farming techniques, key players are investing in initiatives that reduce their carbon footprint. These efforts not only align with global trends toward green consumption but also position brands as responsible corporate citizens. Partnerships with environmental organizations further reinforce their commitment to sustainability by enhancing brand equity and fostering long-term relationships with consumers.

Digital Marketing and E-commerce Expansion

To strengthen their position, leading companies are leveraging digital marketing and expanding their e-commerce presence. Social media campaigns, influencer collaborations, and targeted advertisements are being used to reach tech-savvy consumers, particularly in urban areas. Simultaneously, investments in online platforms and subscription models ensure seamless accessibility and convenience.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Sanovo Technology Group launched a series of organic egg powder variants certified by international sustainability bodies. This move was aimed at appealing to environmentally conscious consumers and expanding its product portfolio in urban markets.

- In June 2023, Rembrandt Enterprises partnered with local organic farms in Thailand to source eggs sustainably. This initiative reinforced the company’s commitment to ethical sourcing and enhanced its reputation among eco-conscious buyers.

- In August 2023, Kewpie Corporation introduced recyclable packaging for its entire product range. This shift toward sustainable packaging aligned with global environmental trends and strengthened its market positioning.

- In October 2023, Sanovo Technology Group collaborated with fitness influencers across Australia and New Zealand to promote its egg powder as a high-protein ingredient for health enthusiasts. This campaign boosted brand visibility and engagement among health-conscious consumers.

- In February 2024, Rembrandt Enterprises expanded its e-commerce operations by partnering with major online retailers in India and Indonesia. This strategic move increased accessibility and tapped into the growing demand for online purchases of processed food ingredients in these regions.

MARKET SEGMENTATION

This research report on the asia pacific software market has been segmented and sub-segmented into the following.

By Product

- Whole Egg Powder

- Egg Yolk Powder

By Application

- Food & Beverage

- Animal Feed

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online

By Country

- China

- India

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Indonesia

- Philippines

- Vietnam

- Singapore

- Rest of APAC

Frequently Asked Questions

What are the major drivers of the egg powder market in the Asia Pacific region?

Key drivers include rising demand for convenience foods, longer shelf life of egg powder compared to fresh eggs, growing bakery and processed food industries, and increased health awareness.

Which countries in Asia Pacific are the largest consumers or producers of egg powder?

China, India, Japan, and Australia are among the top producers and consumers in the region.

What are the main applications of egg powder in the Asia Pacific market?

Egg powder is widely used in bakery products, confectionery, instant food, mayonnaise, noodles, and dietary supplements.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]