Asia Pacific Electric Bus Market Size, Share, Trends & Growth Forecast Report By Vehicle Type (Battery Electric Bus, Plug-In Hybrid Electric Bus), Power Source Type, Consumer, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Electric Bus Market Size

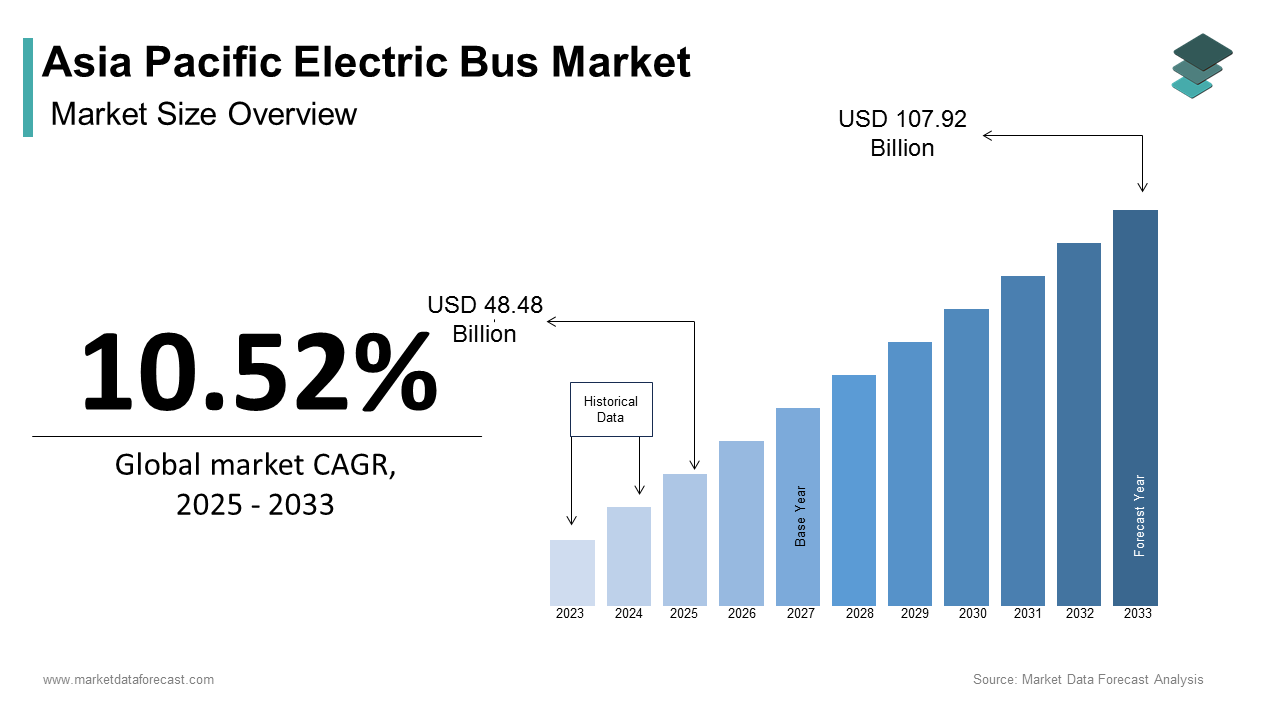

The Asia Pacific electric bus market size was calculated to be USD 43.87 billion in 2024 and is anticipated to be worth USD 107.92 billion by 2033, from USD 48.48 billion in 2025, growing at a CAGR of 10.52% during the forecast period.

Electric buses, powered entirely by electricity stored in onboard batteries, are emerging as a sustainable alternative to traditional fossil fuel-powered vehicles. The region, home to some of the world’s most densely populated cities such as Tokyo, Delhi, and Shanghai, faces significant challenges related to air quality and greenhouse gas emissions.

MARKET DRIVERS

Government Policies and Subsidies

Government initiatives and financial incentives play a pivotal role in driving the adoption of electric buses across the Asia Pacific region. Countries like China and India have implemented aggressive policies to accelerate the transition to electric mobility. This financial support has enabled cities like Shenzhen to become global leaders in electric bus deployment, with its entire fleet of over 16,000 buses now fully electric.

In India, the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme provides direct subsidies for electric buses, encouraging state governments to adopt them. According to the Central Pollution Control Board, Indian cities adopting electric buses under this scheme have reported a 30% reduction in urban air pollution levels. Furthermore, South Korea’s Green New Deal includes provisions for replacing diesel buses with electric models, aiming to cut greenhouse gas emissions by 25% by 2025.

Rising Urbanization and Environmental Concerns

The rapid pace of urbanization in the Asia Pacific region is another critical driver propelling the electric bus market forward. As per the United Nations, the region is expected to add over 1.2 billion urban residents by 2050, intensifying the demand for efficient and sustainable public transport solutions. Cities like Jakarta and Manila, grappling with traffic congestion and poor air quality, are turning to electric buses as a viable solution.

Electric buses offer a cleaner alternative to conventional diesel-powered vehicles, significantly reducing particulate matter and nitrogen oxide emissions. Japan’s Ministry of the Environment reports that cities introducing electric buses have achieved a improvement in local air quality within two years. Moreover, Thailand’s Office of Natural Resources and Environmental Policy highlights that electric buses reduce noise pollution significantly, enhancing the commuting experience for passengers.

MARKET RESTRAINTS

High Initial Costs and Funding Gaps

One of the most significant restraints facing the Asia Pacific electric bus market is the high initial cost of procurement and deployment. Electric buses typically require substantial upfront investment due to expensive battery technology and charging infrastructure. Also, the average cost of an electric bus is nearly three times that of a conventional diesel bus, posing a financial challenge for cash-strapped transit agencies.

In countries like Indonesia and Vietnam, where public transport budgets are limited, funding gaps hinder large-scale adoption. The Indonesian Ministry of Transportation notes that despite government incentives, less than 10% of public buses in Jakarta are electric, primarily due to budgetary constraints. Similarly, Malaysia’s Land Public Transport Agency reports that the lack of long-term financing options discourages operators from transitioning to electric fleets.

Inadequate Charging Infrastructure

Another critical restraint is the lack of robust charging infrastructure, which limits the operational feasibility of electric buses. As per the International Energy Agency, inadequate charging networks remain a bottleneck in several Asia Pacific countries, particularly in rural and semi-urban areas. For instance, in the Philippines, the Department of Energy highlights that only 20% of public transport routes are equipped with charging stations, restricting the range and usability of electric buses.

Australia’s Clean Energy Council reports that the slow rollout of fast-charging facilities has delayed the integration of electric buses into regional transport systems.

MARKET OPPORTUNITIES

Integration with Renewable Energy Sources

The integration of renewable energy sources presents a transformative opportunity for the Asia Pacific electric bus market. By coupling electric buses with solar or wind energy, transit systems can achieve near-zero emissions, aligning with global decarbonization goals. According to the International Renewable Energy Agency, solar-powered charging stations are gaining traction in countries like India and Australia, where abundant sunlight makes solar energy a cost-effective solution.

India’s Ministry of New and Renewable Energy reports that solar-powered depots have reduced energy costs for electric bus operations, making them financially viable for smaller cities. Similarly, Australia’s Smart Energy Council notes that renewable energy integration has improved the sustainability credentials of public transport systems, attracting environmentally conscious investors.

Expansion into Emerging Markets

Emerging markets within the Asia Pacific region offer untapped potential for electric bus adoption. Countries like Bangladesh, Nepal, and Myanmar are witnessing rapid urbanization and an increased focus on sustainable development, creating opportunities for innovative transport solutions. According to the Asian Development Bank, investments in electric buses in these regions could generate up to $50 billion in economic benefits by 2030, driven by reduced healthcare costs and improved air quality.

For instance, Nepal’s Ministry of Urban Development has partnered with international organizations to pilot electric bus projects in Kathmandu, aiming to reduce traffic congestion and pollution.

MARKET CHALLENGES

Limited Battery Life and Technological Constraints

A persistent challenge hindering the Asia Pacific electric bus market is the limited lifespan and performance of batteries, which directly impact operational efficiency. Lithium-ion batteries, the most common type used in electric buses, degrade over time, reducing their capacity to hold charge. According to the Korea Institute of Energy Research, the average battery life of an electric bus is approximately 8-10 years, after which replacement costs can account for a significant portion of the vehicle’s original price.

In tropical regions like Thailand and Indonesia, high temperatures exacerbate battery degradation, leading to shorter lifespans. Furthermore, the lack of standardized battery designs complicates repairs and replacements, creating logistical challenges.

Public Perception and Behavioral Resistance

Public perception and behavioral resistance pose another formidable challenge to the adoption of electric buses. Despite their environmental benefits, many commuters remain skeptical about the reliability and convenience of electric buses. According to a study by the Hong Kong Polytechnic University, over 60% of respondents expressed concerns about the limited range and frequent charging requirements of electric buses, particularly in suburban and rural areas.

In Singapore, the Land Transport Authority notes that misconceptions about longer wait times and reduced seating capacity have slowed passenger acceptance. Similarly, Malaysia’s Ministry of Transport notes that resistance from traditional bus operators, who fear job losses during the transition to automated systems, further complicates adoption efforts.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.52% |

|

Segments Covered |

By Vehicle Type, Power Source Type, Consumer, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

BYD, Tata Motors, Ashok Leyland, Hyundai Motor Company, Zhongtong Bus Holding Co., Ltd., Yutong Bus Co., Ltd., NFI Group Inc., Proterra Inc., King Long United Automotive Industry Co., Ltd., JBM Auto Ltd. |

SEGMENTAL ANALYSIS

By Vehicle Type Insights

The battery electric bus segment dominated the Asia Pacific market by commanding a substantial share in 2024. This dominance is driven by its superior environmental credentials and operational efficiency. A key factor behind this leadership is the growing emphasis on zero-emission public transport. According to China’s Ministry of Ecology and Environment, cities like Shenzhen have achieved a complete transition to battery electric buses, reducing carbon emissions significantly. These buses produce no tailpipe emissions, aligning with stringent air quality regulations in densely populated urban areas.

Another driving factor is the declining cost of lithium-ion batteries. The International Energy Agency reports that battery prices have fallen by 90% over the past decade, making battery electric buses more affordable for transit agencies. Besides, advancements in battery technology have extended range capabilities, addressing range anxiety among operators.

The plug-in hybrid electric bus segment is projected to grow at a robust CAGR of 18% which is fueled by its versatility and transitional appeal. A major driver is its ability to serve as a bridge between conventional diesel buses and fully electric models. Japan’s Ministry of Land, Infrastructure, and Transport shows that plug-in hybrids are particularly suited for suburban routes, where charging infrastructure remains underdeveloped. Their dual power source ensures uninterrupted service, even in areas with limited access to charging stations. Moreover, plug-in hybrids offer significant fuel savings. South Korea’s Ministry of Trade, Industry, and Energy reports that these buses consume less fuel than traditional diesel models, making them an attractive option for fleet operators seeking gradual electrification. Apart from these, Australia’s Clean Energy Council notes that plug-in hybrids reduce maintenance costs, as their regenerative braking systems minimize wear and tear.

By Power Source Type Insights

The e-motor segment held the largest share of the Asia Pacific electric bus market by accounting for a 35.7%. This influence over the market is attributed to its critical role in determining vehicle performance and efficiency. Like, advancements in permanent magnet synchronous motors have improved energy conversion efficiency, enabling electric buses to achieve longer ranges and smoother acceleration.

Another driving factor is the increasing demand for lightweight and compact motors. Japan’s Ministry of Economy, Trade, and Industry states that innovations in motor design have reduced weight by 20%, enhancing payload capacity and overall vehicle performance.

The AC/DC charger segment is poised to expand at a CAGR of 22% and is driven by the rapid development of charging infrastructure. A key factor is the increasing deployment of fast-charging stations. According to Australia’s Smart Energy Council, fast chargers can replenish up to 80% of battery capacity within 30 minutes, significantly reducing downtime for electric buses. Besides, government initiatives are accelerating growth. China’s National Development and Reform Commission reports that investments in charging infrastructure have increased annually, ensuring seamless integration of AC/DC chargers into public transport systems.

By Consumer Insights

The government segment commanded the Asia Pacific electric bus market by capturing a 60.7% share in 2024. This is due to aggressive policy mandates and large-scale procurement programs. For instance, China’s Ministry of Transport has mandated that all new public buses in Tier-1 cities must be electric, driving mass adoption. According to the Asian Development Bank, government-led initiatives have resulted in the deployment of over 600,000 electric buses across the region, significantly reducing urban air pollution. Another driving factor is the availability of subsidies and incentives.

The fleet operators segment is expected to advance at a CAGR of 20% which is propelled by the rising demand for sustainable logistics solutions. A key factor is the push for corporate social responsibility (CSR) initiatives. Moreover, cost savings are a significant motivator. Malaysia’s Land Public Transport Agency reports that fleet operators save notably on fuel costs by switching to electric buses. Also, Singapore’s Land Transport Authority highlights that partnerships with private operators have expanded electric bus networks, improving accessibility.

REGIONAL ANALYSIS

China led the Asia Pacific electric bus market by contributing 50.5% of the total share in 2024 owing to its aggressive electrification policies and massive investments. The country’s dominance is evident in cities like Shenzhen, which operates the world’s largest fully electric bus fleet. Agricultural and industrial hubs benefit from reduced emissions. The Ministry of Ecology and Environment reports that rural areas adopting electric buses have cut air pollutants, improving public health. Furthermore, partnerships with global manufacturers like BYD have positioned China as a leader in exporting electric bus technology to emerging markets.

India is quickly growing ahead in the market. This is propelled by its focus on urban mobility and renewable energy integration. The Ministry of Heavy Industries notes that subsidies under the FAME-II scheme have enabled the procurement of over 3,000 electric buses, primarily in metropolitan cities like Delhi and Mumbai.

Public awareness campaigns have bolstered adoption. Additionally, collaborations with startups like Olectra Greentech have fostered innovation, ensuring affordability and scalability.

Japan contributes notably to the market by leveraging its expertise in advanced technologies and sustainability. The Ministry of Land, Infrastructure, and Transport reports that cities like Tokyo have integrated electric buses into smart city initiatives, reducing traffic congestion. Hydrogen-powered buses are gaining traction. Japan’s Ministry of Economy, Trade, and Industry shows that hydrogen fuel cell buses have been deployed in Osaka, achieving a reduction in greenhouse gas emissions.

South Korea is witnessing a positive trend in the market. It is driven by its Green New Deal and urbanization trends. The Ministry of Trade, Industry, and Energy reports that Seoul’s electric bus fleet has grown annually supported by government subsidies and incentives. Technological advancements play a pivotal role. The Electronics and Telecommunications Research Institute states that AI-powered route optimization has improved operational efficiency, setting a benchmark for other countries.

Australia holds a small share and is focusing on renewable energy integration and regional connectivity. Sustainability goals drive adoption. Australia’s Clean Energy Council highlights that electric buses have reduced carbon emissions along key transit corridors, aligning with national climate targets.

LEADING PLAYERS IN THE ASIA PACIFIC ELECTRIC BUS MARKET

BYD (Build Your Dreams)

BYD, headquartered in Shenzhen, China, is a global leader in electric mobility and plays a pivotal role in shaping the Asia Pacific electric bus market. The company’s cutting-edge battery technology and vertically integrated manufacturing processes have set industry benchmarks. BYD’s electric buses are renowned for their durability, energy efficiency, and suitability for diverse urban environments. BYD’s collaborations with governments and transit agencies have further solidified its position as a trailblazer in green mobility.

Tata Motors

Tata Motors, based in India, is a key player in the Asia Pacific electric bus market, leveraging its expertise in automotive engineering and sustainability. The company’s Starbus Electric range has gained traction for its affordability and adaptability to local conditions. Tata Motors’ focus on integrating renewable energy sources into its electric bus ecosystem aligns with regional decarbonization goals. By partnering with state governments and private operators, Tata Motors has expanded its footprint, offering scalable solutions that address the unique challenges of urban and rural transport networks.

Hyundai Motor Group

Hyundai Motor Group, headquartered in South Korea, is a prominent innovator in the Asia Pacific electric bus market. The company’s Elec City model combines advanced battery systems with smart connectivity features, enhancing operational efficiency. Hyundai’s emphasis on hydrogen fuel cell technology has positioned it as a pioneer in alternative energy solutions. Through strategic alliances with research institutions and government bodies, Hyundai continues to push the boundaries of sustainable transport, contributing significantly to global efforts to reduce carbon emissions.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Partnerships and Collaborations

Key players in the Asia Pacific electric bus market are increasingly forming partnerships with governments, research institutions, and private entities to accelerate adoption. Collaborations with local municipalities enable companies to tailor solutions to regional needs, such as last-mile connectivity and rural electrification.

Investment in R&D and Innovation

Leading companies are prioritizing R&D to develop next-generation technologies, such as AI-driven route optimization and lightweight materials. By integrating smart systems and autonomous capabilities, these innovations improve energy efficiency and operational performance.

Expansion into Emerging Markets

To strengthen their foothold, key players are targeting emerging economies like Vietnam, Indonesia, and the Philippines. By offering affordable and scalable solutions, they aim to tap into untapped potential in sectors such as public transport and logistics. Localization strategies, including training programs and after-sales support, further enhance their market penetration and establish long-term partnerships.

KEY MARKET PLAYERS AND COMPETITOR OVERVIEW

Major Players in the Asia Pacific Electric bus market include BYD, Tata Motors, Ashok Leyland, Hyundai Motor Company, Zhongtong Bus Holding Co., Ltd., Yutong Bus Co., Ltd., NFI Group Inc., Proterra Inc., King Long United Automotive Industry Co., Ltd., JBM Auto Ltd.

The Asia Pacific electric bus market is characterized by intense competition, driven by rapid technological advancements and increasing demand for sustainable urban mobility solutions. Established players like BYD and Tata Motors dominate the landscape, leveraging their expertise in manufacturing and innovation to maintain leadership. However, the market also witnesses the emergence of niche players focusing on specialized applications such as hydrogen fuel cells and autonomous driving. The competitive environment is further intensified by startups entering the fray, bringing disruptive technologies and cost-effective solutions. Regulatory frameworks play a crucial role, as companies navigate varying policies across countries. Additionally, the push for sustainability and energy efficiency has prompted firms to innovate in areas like solar-powered charging and recyclable materials.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, BYD announced a partnership with the Indonesian Ministry of Transportation to deploy 1,000 electric buses in Jakarta. This initiative aimed to enhance urban mobility while reducing air pollution, reinforcing BYD’s leadership in Southeast Asia.

- In June 2023, Tata Motors launched its Starbus Electric Lite model, specifically designed for tier-2 cities in India. This move addressed the growing demand for affordable and efficient electric buses in smaller urban areas, expanding Tata’s market reach.

- In August 2023, Hyundai Motor Group unveiled its Hydrogen Fuel Cell Electric Bus at the Seoul Mobility Show. This innovation positioned Hyundai as a pioneer in alternative energy solutions, attracting global attention and partnerships.

- In October 2023, BYD signed a memorandum of understanding with Australia’s Clean Energy Council to develop solar-powered charging infrastructure. This collaboration aimed to integrate renewable energy into public transport systems, enhancing sustainability.

- In December 2023, Tata Motors partnered with the Malaysian government to introduce electric buses in Kuala Lumpur. This initiative included training programs for local operators, ensuring seamless adoption and strengthening Tata’s presence in ASEAN markets.

MARKET SEGMENTATION

This research report on the Asia Pacific electric bus market has been segmented and sub-segmented based on vehicle type, power source type, consumer, and region.

By Vehicle Type

- Battery Electric Bus

- Plug-in Hybrid Electric Bus

By Power Source Type

- E-Motor

- AC/DC Charger

By Consumer

- Government

- Fleet Operators

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What are the key factors driving the growth of the electric bus market in Asia Pacific?

Government incentives, environmental regulations, technological advancements, and the push for sustainable public transportation are the major growth drivers.

2. How is the infrastructure developing to support electric buses in the region?

Charging infrastructure is rapidly expanding through government investments and public-private partnerships, with a focus on fast-charging and depot-based solutions.

3. Who are the major players operating in the Asia Pacific electric bus market?

Some key players include BYD, Tata Motors, Ashok Leyland, Hyundai Motor Company, and Yutong Bus Co., Ltd.

4. Which segment dominates the Asia Pacific electric bus market—battery-electric or hybrid-electric?

Battery-electric buses currently dominate the market due to zero emissions and lower operational costs.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]