Asia Pacific Electric Outboard Engines Market Size, Share, Trends & Growth Forecast Report By Power (Below 25 Kw, 25 – 50 Kw, 50 – 150 Kw), Speed, Application, Distribution Channel, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Electric Outboard Engines Market Size

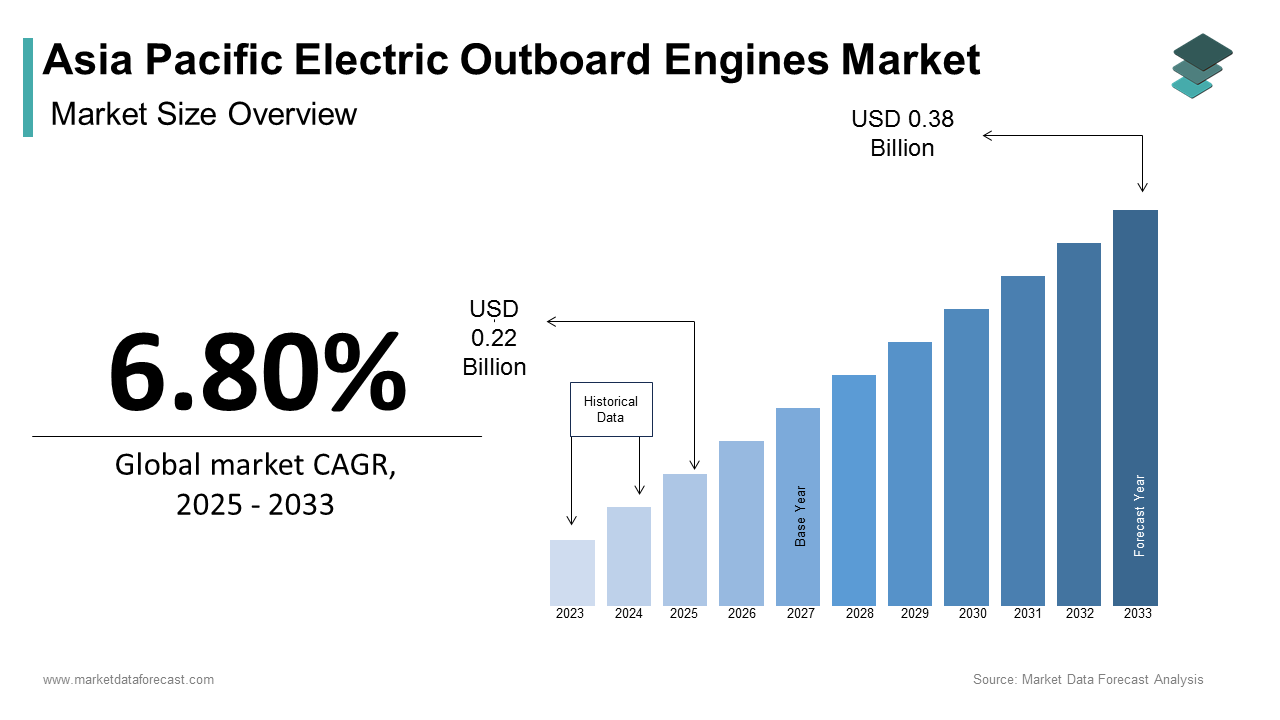

The Asia Pacific electric outboard engines market size was calculated to be USD 0.21 billion in 2024 and is anticipated to be worth USD 0.38 billion by 2033, from USD 0.22 billion in 2025, growing at a CAGR of 6.80% during the forecast period.

Electric outboard engines are compact, battery-powered propulsion systems designed for small to medium-sized vessels, offering a cleaner alternative to traditional gasoline-powered outboards. These engines are particularly suited for recreational boating, fishing, and small-scale commercial operations, aligning with the region’s growing emphasis on reducing carbon emissions and noise pollution in waterways.

According to the Asian Development Bank, over 40% of the global population resides in coastal areas within the Asia Pacific, underscoring the region's reliance on maritime activities. This demographic concentration has spurred demand for environmentally friendly boating solutions. For instance, Australia’s Great Barrier Reef Marine Park Authority enforces strict regulations on fuel emissions to protect sensitive ecosystems, encouraging the adoption of electric outboards. Similarly, China’s Ministry of Ecology and Environment has introduced policies promoting green technologies in its inland waterways, further boosting the market. Technological advancements have also played a crucial role in shaping this market. As per the Japan Electric Outboard Association, innovations in lithium-ion battery technology have extended the operational range of electric outboards by up to 30% in recent years.

MARKET DRIVERS

Stringent Environmental Regulations

One of the primary drivers of the Asia Pacific electric outboard engine market is the implementation of stringent environmental regulations aimed at curbing emissions from marine activities. Countries like Singapore and Malaysia have introduced emission control zones (ECZs) where vessels must adhere to strict limits on greenhouse gas emissions. According to the Maritime and Port Authority of Singapore, these regulations have compelled boat operators to adopt cleaner propulsion technologies, including electric outboards, to avoid penalties and ensure compliance. Electric outboard engines produce zero direct emissions, making them an ideal solution for environmentally sensitive areas such as coral reefs and mangroves. For example, Indonesia’s Ministry of Marine Affairs estimates that over 50% of its coastal tourism operators have transitioned to electric outboards to comply with emission standards while preserving marine biodiversity. Furthermore, the International Union for Conservation of Nature notes that noise pollution from traditional engines disrupts aquatic ecosystems, which is prompting regulators to favor quieter alternatives like electric outboards.

Growing Recreational Boating Culture

The rise of recreational boating culture in the Asia Pacific is another significant driver of the electric outboard engine market. According to the Australian Boating Industry Association, recreational boating participation has increased by 15% annually over the past five years, fueled by rising disposable incomes and urbanization. This trend is particularly evident in countries like Thailand and Vietnam, where leisure activities on waterways are becoming increasingly popular. Electric outboards appeal to recreational users due to their ease of use, low maintenance costs, and quiet operation. Additionally, governments in the region are promoting recreational boating as a sustainable tourism activity. For instance, India’s Ministry of Tourism has launched initiatives to develop eco-friendly boating hubs in Kerala’s backwaters, that will further drive demand for electric propulsion systems.

MARKET RESTRAINTS

High Initial Costs

A significant barrier to the widespread adoption of electric outboard engines in the Asia Pacific is their high initial cost, which often exceeds that of traditional gasoline-powered alternatives. According to the Korean Marine Equipment Research Institute, electric outboards can cost up to 50% more than conventional engines, primarily due to the expense of advanced battery technologies. Moreover, the cost of retrofitting existing vessels with electric outboards adds to the overall expense. The Philippine Coast Guard reports that retrofitting can increase operational costs by 25%, which is deterring many operators from transitioning to electric propulsion. While long-term savings on fuel and maintenance are achievable, the upfront investment remains a significant hurdle for individuals and businesses operating on tight budgets.

Limited Battery Life and Charging Infrastructure

Another critical restraint is the limited battery life and insufficient charging infrastructure for electric outboard engines. According to the Indian Maritime University, the average operational range of electric outboards is approximately 20-30 nautical miles on a single charge, which may not suffice for longer voyages or commercial applications. This limitation restricts their usability in regions with extensive waterways, such as the Mekong Delta in Vietnam or the Ganges River in India. Additionally, the lack of widespread charging stations poses a significant challenge. The Australian Electric Vehicle Association notes that less than 10% of marinas in the Asia Pacific are equipped with charging facilities, creating inconvenience for users. While advancements in battery technology are addressing these issues, the current infrastructure gap remains a deterrent for potential adopters in rural and remote areas where access to reliable electricity is limited.

MARKET OPPORTUNITIES

Advancements in Battery Technology

Rapid advancements in battery technology present a significant opportunity for the Asia Pacific electric outboard engines market. According to the Chinese Academy of Sciences, innovations in lithium-ion and solid-state batteries have improved energy density by up to 40% in recent years, extending the operational range of electric outboards. Furthermore, the integration of smart battery management systems (BMS) enhances efficiency and safety. According to the South Korean Ministry of Trade, Industry, and Energy, BMS-equipped batteries can reduce energy consumption by 15% by lowering operational costs for users. Governments in the region are also investing in research and development to accelerate battery innovation.

Rising Demand for Sustainable Tourism

The growing emphasis on sustainable tourism offers another promising opportunity for the electric outboard engines market. According to the World Tourism Organization, ecotourism accounts for 20% of global tourism revenue, with the Asia Pacific being a key contributor. Countries like Thailand and Malaysia are leveraging their natural waterways to promote eco-friendly boating experiences, driving demand for electric outboards. For instance, Thailand’s Department of Tourism has partnered with local operators to introduce electric-powered tour boats in Phang Nga Bay, attracting environmentally conscious travelers. Similarly, New Zealand’s Ministry for the Environment emphasizes the use of electric propulsion systems in its pristine lakes and fjords to preserve natural habitats. This alignment with sustainable tourism initiatives not only boosts market growth but also enhances the region’s reputation as a leader in green travel practices.

MARKET CHALLENGES

Lack of Awareness and Consumer Education

A significant challenge facing the Asia Pacific electric outboard engines market is the lack of awareness and consumer education about the benefits and capabilities of these systems. According to the Indonesian Marine Recreation Association, over 70% of recreational boaters in Southeast Asia remain unfamiliar with electric outboards, perceiving them as less powerful or unreliable compared to traditional engines. Furthermore, the absence of standardized training programs for electric outboard operation and maintenance exacerbates the issue. Addressing this knowledge gap requires targeted educational campaigns and partnerships with industry stakeholders to demonstrate the advantages of electric outboards by ensuring wider acceptance among consumers.

Competition from Alternative Technologies

Another pressing challenge is the competition from alternative propulsion technologies, such as solar-powered and hydrogen fuel cell systems. According to the Australian Renewable Energy Agency, solar-powered boats are gaining popularity in tropical regions due to abundant sunlight, offering a cost-effective and emission-free alternative to electric outboards. Similarly, hydrogen fuel cells are emerging as a viable option for longer-range applications, with Japan’s Ministry of Economy, Trade, and Industry investing heavily in hydrogen infrastructure.

These technologies pose a threat to the dominance of electric outboards in niche markets where specific operational requirements favor alternative solutions. The rapid pace of innovation in competing technologies emphasizes the need for continuous improvement in electric outboard design and functionality to maintain market relevance. Balancing affordability, efficiency, and adaptability will be crucial to overcoming this challenge.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.80% |

|

Segments Covered |

By Power, Speed, Application, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

Yamaha Motor Co., Torqeedo GmbH, Suzuki Motor Corporation, Pure Watercraft, ePropulsion, Vision Marine Technologies, Minn Kota, Honda Motor Co., Inc., Parsun Power Machine, Evoy AS |

SEGMENTAL ANALYSIS

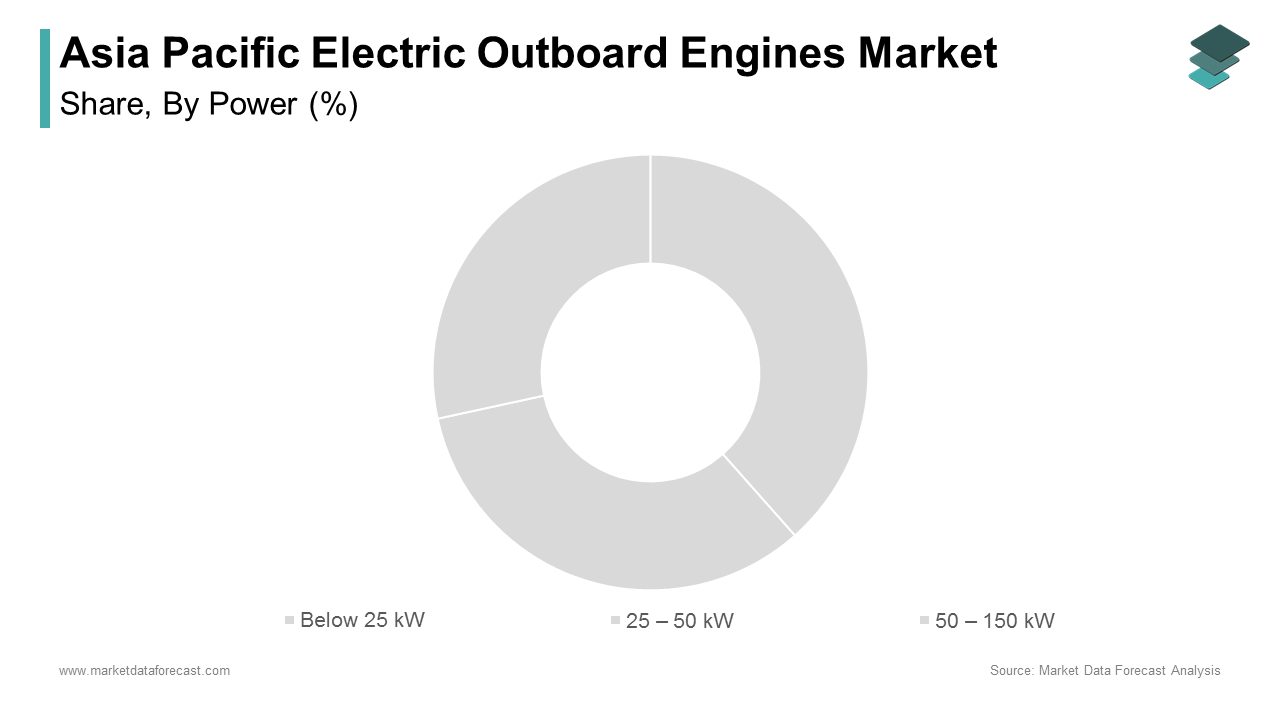

By Power Insights

The "Below 25 kW" segment dominated the Asia Pacific electric outboard engines market with 60.3% of the share in 2024, which is primarily attributed to its suitability for small recreational boats and fishing vessels, which are widely used across the region. A key factor driving this segment's dominance is its affordability compared to higher-powered alternatives. According to the Korean Maritime Equipment Institute, electric outboards below 25 kW cost up to 40% less than those in the 50-150 kW range, which makes them accessible to individual boaters and small-scale operators. This price advantage is significant in emerging economies like India and Vietnam, where budget constraints often dictate purchasing decisions. Another contributing factor is the growing popularity of eco-friendly recreational activities. The Australian Boating Industry Association reports that over 70% of recreational boaters prefer lightweight and low-power engines for calm waterways, such as lakes and coastal areas. These smaller engines align perfectly with the needs of leisure users by ensuring minimal environmental impact while offering sufficient power for short-distance voyages.

The "25 – 50 kW" segment is swiftly growing with a CAGR of 18.5% during the forecast period. This rapid growth is fueled by increasing demand for mid-range electric outboards capable of powering medium-sized vessels used in both commercial and recreational applications. One major driver is the expansion of sustainable tourism initiatives. Electric outboards in this power range are ideal for small tour boats operating in ecologically sensitive areas like Phuket and Krabi. These engines provide a balance between performance and environmental compliance by making them a preferred choice for tourism operators.

By Speed Insights

The "5-10 mph" speed segment led the Asia Pacific electric outboard engines market by accounting for 45.4% of the share in 2024. A primary factor behind its prominence is its alignment with regulatory requirements for noise and emission control in environmentally sensitive zones. According to Australia’s Great Barrier Reef Marine Park Authority, vessels operating at speeds between 5-10 mph produce minimal wake and noise, reducing their ecological footprint. Another factor is the growing adoption of these engines for inland waterway transportation. The Vietnamese Ministry of Transport states that over 60% of small cargo vessels in the Mekong Delta operate within this speed range, ensuring efficient yet eco-friendly logistics. Their moderate speed also ensures energy efficiency, lowering operational costs for users.

The "Above 15 mph" segment is the fastest-growing category, with a CAGR of 20.3%, as per the Japanese Electric Outboard Manufacturers Association. This growth is driven by the increasing demand for high-performance electric outboards among recreational users and emergency response teams. A key factor propelling this growth is the rise of adventure tourism in the region. New Zealand’s Department of Conservation notes that tourists participating in activities like water skiing and jet boating prefer high-speed electric outboards for their thrilling experiences. These engines offer the necessary power while adhering to emission standards, enhancing their appeal. Additionally, governments are investing in high-speed electric propulsion systems for emergency services.

By Application Insights

The "Recreational" segment was the largest and held 55.4% of the Asia Pacific electric outboard engines market by capturing 55.4% of the share in 2024. A key factor is the increasing disposable income among urban populations. According to the Thai Ministry of Tourism, over 75% of recreational boaters in Southeast Asia reside in urban areas, where rising incomes have made leisure boating more accessible. Electric outboards are favored for their quiet operation and zero emissions, aligning with the preferences of environmentally conscious users.

The commercial segment is swiftly emerging with a CAGR of 19.8% in the coming years with the rising adoption of electric outboards for small-scale logistics and fishing operations in inland waterways. One major driver is the push for sustainable commercial practices. Additionally, government incentives are accelerating adoption. The Indonesian Ministry of Marine Affairs states that subsidies for electric outboards have led to a 25% increase in their use among local fishermen.

By Distribution Channel Insights

The "Indirect Sales" channel dominated the Asia Pacific electric outboard engines market with the highest share in 2024. A key factor is the convenience offered by indirect sales channels. According to the Malaysian Marine Federation, over 80% of buyers prefer purchasing through authorized dealerships due to the availability of post-sales services, including maintenance and warranty support. This accessibility is particularly crucial in rural areas where direct manufacturer reach is limited. Another factor is the role of local distributors in promoting awareness.

The direct sales channel segment is likely to register a CAGR of 22.5% in the coming years. This growth is driven by manufacturers leveraging digital platforms to reach end-users directly. A major factor is the rise of e-commerce platforms. Singapore’s Economic Development Board notes that online sales of marine equipment have grown by 30% annually by allowing manufacturers to bypass intermediaries and offer competitive pricing. Additionally, direct sales enable manufacturers to gather valuable customer feedback.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific electric outboard engines market with 35.5% of the share in 2024. The country's dominance is rooted in its robust manufacturing capabilities and emphasis on green technologies. Shanghai and Guangzhou, two of China’s busiest ports, have implemented strict emission controls, driving demand for electric outboards.

Japan was positioned second with 20.4% of the Asia Pacific electric outboard engines market in 2024 owing to its advanced R&D infrastructure and focus on sustainability. Tokyo and Osaka are hubs for recreational boating, with many users preferring electric outboards for their eco-friendliness.

Australia’s vast coastline and stringent environmental regulations, particularly in the Great Barrier Reef region, drive demand for electric outboards. Initiatives like the National Electric Boat Program have incentivized adoption, with Queensland leading the charge in sustainable marine practices.

India electric outboard engines market share owing to its extensive inland waterways and rising eco-tourism activities. States like Kerala and Goa are promoting electric outboards for backwater tourism, supported by subsidies from the Ministry of Tourism.

Thailand is a tourist destination in Phuket and Krabi, which is driving demand for electric outboards in sustainable tourism. Government-backed programs have encouraged operators to adopt eco-friendly propulsion systems by ensuring Thailand’s continued growth in the market.

LEADING PLAYERS IN THE ASIA PACIFIC ELECTRIC OUTBOARD ENGINES MARKET

Torqeedo GmbH

Torqeedo GmbH is a leading innovator in the Asia Pacific electric outboard engines market with renowned for its cutting-edge technology and commitment to sustainability. The company specializes in high-performance electric propulsion systems that cater to both recreational and commercial applications. Torqeedo’s contributions extend beyond the region, as it plays a pivotal role in advancing global marine electrification. Its focus on integrating advanced battery management systems ensures optimal efficiency and reliability.

Yamaha Motor Co., Ltd.

Yamaha Motor Co., Ltd. is another key player by leveraging its expertise in marine engineering to develop innovative electric outboard engines. The company’s products are widely adopted across the Asia Pacific for their durability and ease of use. Yamaha’s commitment to sustainability aligns with the growing demand for green technologies, making its offerings highly relevant in environmentally sensitive regions. Globally, Yamaha has contributed to reducing the carbon footprint of the maritime industry by offering energy-efficient solutions.

Mercury Marine

Mercury Marine is a prominent name in the electric outboard engines market, known for its robust and versatile propulsion systems. The company’s focus on R&D has enabled it to develop next-generation technologies that address the unique challenges faced by users in the Asia Pacific. Mercury’s emphasis on customization ensures that its products meet diverse operational needs, from recreational boating to small-scale commercial activities.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Partnerships with Local Governments and Organizations

Key players in the Asia Pacific electric outboard engines market have prioritized forming strategic partnerships with local governments and environmental organizations. These collaborations enable companies to align their product offerings with regional emission control policies and sustainability goals. For instance, partnerships with port authorities and tourism boards help promote electric outboards as eco-friendly alternatives for recreational and commercial activities.

Focus on Product Customization and Innovation

Innovation remains a cornerstone strategy for enhancing market position. Leading companies invest heavily in R&D to develop advanced electric outboard engines tailored to specific applications, such as fishing, tourism, or emergency services. Customization is another critical aspect, with firms offering solutions designed for diverse water conditions and vessel types. These companies differentiate themselves from competitors and establish themselves as leaders in the market by addressing unique customer needs. This focus on innovation ensures sustained relevance in a rapidly evolving industry.

Expansion of After-Sales Services and Training Programs

To build long-term relationships with customers, key players emphasize comprehensive after-sales services, including maintenance, repair, and technical support. These services ensure optimal performance of electric outboards throughout their lifecycle, reducing downtime and operational costs for users. Additionally, companies offer training programs to educate customers on the benefits and operation of electric propulsion systems.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the Asia Pacific Electric Outboard Engines Market include Yamaha Motor Co., Torqeedo GmbH, Suzuki Motor Corporation, Pure Watercraft, ePropulsion, Vision Marine Technologies, Minn Kota, Honda Motor Co., Inc., Parsun Power Machine, Evoy AS

The Asia Pacific electric outboard engines market is characterized by intense competition, driven by the region’s strategic importance in global maritime trade and recreational boating activities. Key players like Torqeedo GmbH, Yamaha Motor Co., Ltd., and Mercury Marine dominate the landscape, leveraging their technological expertise and extensive service networks to capture market share. While Torqeedo focuses on high-performance systems and digital integration, Yamaha emphasizes durability and ease of use, creating a dynamic rivalry. Smaller regional players also contribute to the competitive environment by offering cost-effective alternatives.

Regulatory fragmentation across countries further intensifies competition, as companies strive to adapt their offerings to meet diverse requirements. Innovation serves as a key battleground, with firms investing in R&D to develop next-generation electric outboard engines. Additionally, partnerships with local stakeholders and expansion of after-sales services play a crucial role in driving the market growth. Despite the dominance of established players, emerging technologies and evolving customer preferences present opportunities for new entrants by ensuring a vibrant and competitive ecosystem.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Torqeedo GmbH launched a collaboration with Australia’s Great Barrier Reef Marine Park Authority to promote the use of electric outboard engines in ecologically sensitive zones. This initiative aimed to position Torqeedo as a leader in sustainable marine solutions while addressing environmental concerns.

- In June 2023, Yamaha Motor Co., Ltd. signed a partnership agreement with a major distributor in Thailand to expand its distribution network. This move focused on increasing accessibility to Yamaha’s electric outboard engines in Southeast Asia’s growing recreational boating market.

- In September 2023, Mercury Marine announced the establishment of a dedicated training center in Indonesia. This facility provides hands-on education for operators and technicians, ensuring proper usage and maintenance of electric propulsion systems.

- In November 2023, ePropulsion, a Chinese manufacturer, introduced a new line of lightweight electric outboards specifically designed for small fishing vessels. This innovation targeted the rising demand for eco-friendly solutions in rural and coastal communities.

- In January 2024, Vision Marine Technologies partnered with a leading eco-tourism operator in New Zealand to equip tour boats with high-speed electric outboard engines. This collaboration aimed to enhance the visitor experience while promoting sustainable tourism practices.

MARKET SEGMENTATION

This research report on the Asia Pacific Electric Outboard Engines Market has been segmented and sub-segmented based on power, speed, application, distribution channel, and region.

By Power

- Below 25 kW

- 25 – 50 kW

- 50 – 150 kW

By Speed

- Below 5 mph

- 5-10 mph

- 10-15 mph

- Above 15 mph

By Application

- Commercial

- Recreational

- Military

By Distribution Channel

- Direct Sales

- Indirect Sales

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What are the key drivers of market growth?

Major drivers include rising environmental concerns, government incentives for electric mobility, increasing marine tourism, and advancements in battery technology.

2. Which types of electric outboard engines are in demand?

Both low-power (below 10 kW) for small boats and high-power (above 10 kW) for commercial applications are gaining popularity, depending on usage.

3. Who are the major players in the market?

Key players include Yamaha Motor Co., Torqeedo GmbH, epropulsion, Pure Watercraft, Suzuki Motor Corporation, Honda Motor Co., and Vision Marine Technologies.

4. How do electric outboard engines compare to traditional ones?

Electric engines are quieter, more efficient, eco-friendly, and require less maintenance than traditional internal combustion engines.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com