Asia Pacific Elevator and Escalator Market Report – Segmented By Product (Elevators Escalators Moving Walkway), Material, Application, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Elevator and Escalator Market Size

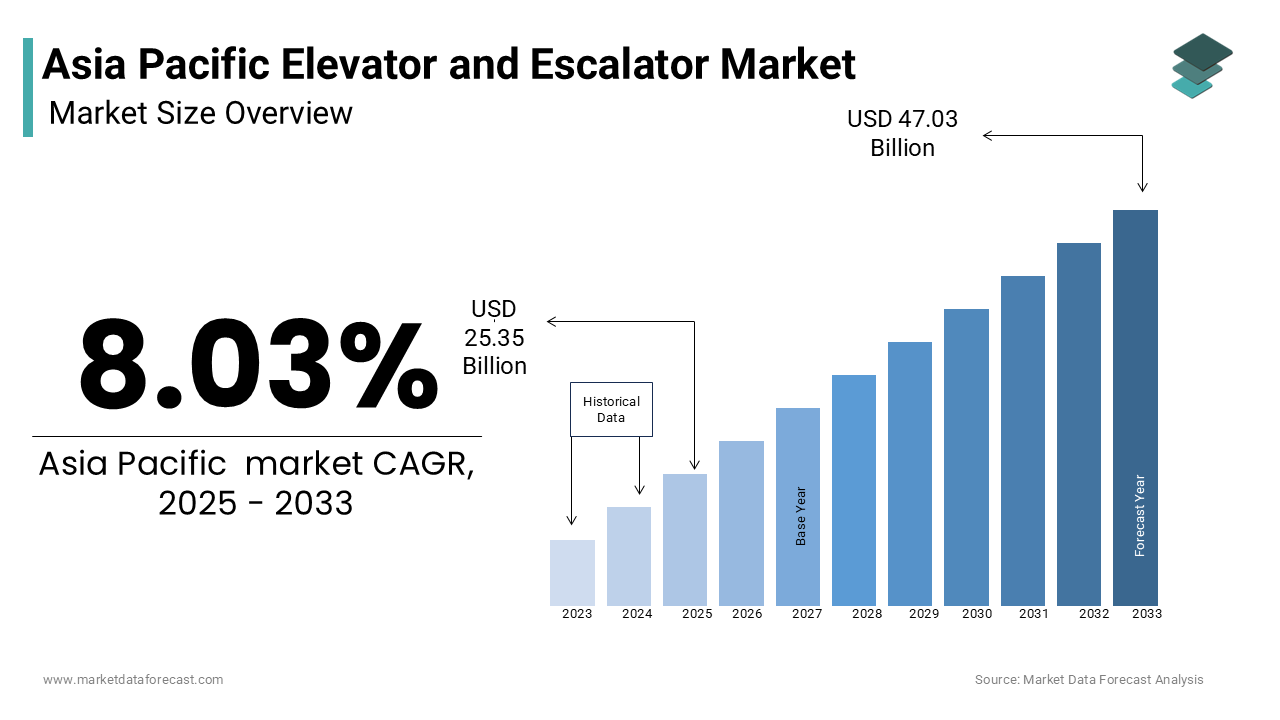

The Asia Pacific Elevator and Escalator Market was worth USD 23.46 billion in 2024. The Asia Pacific market is expected to reach USD 47.03 billion by 2033 from USD 25.35 billion in 2025, rising at a CAGR of 8.03% from 2025 to 2033.

Elevators and escalators are integral to modern architecture, enabling seamless movement within high-rise buildings, shopping malls, airports, and metro stations. According to the United Nations Department of Economic and Social Affairs, urbanization in the Asia Pacific region is projected to reach 58% by 2030, driving unprecedented demand for vertical transportation systems. This growth is further amplified by the proliferation of smart cities, with countries like China and India investing heavily in urban infrastructure. For instance, as per the Ministry of Housing and Urban-Rural Development of China, over 300 smart city pilot projects have been launched, creating a robust ecosystem for advanced elevator and escalator technologies.

Beyond urbanization, the region’s aging population necessitates accessible and user-friendly mobility solutions. Japan, with over 28% of its population aged 65 or above as per the World Health Organization, has become a hub for innovations in barrier-free access systems. These trends collectively position the Asia Pacific market at the forefront of innovation and adoption, driven by an intricate interplay of demographic shifts, technological advancements, and urban planning priorities.

MARKET DRIVERS

Rapid Urbanization and High-Rise Construction

The rapid urbanization across the Asia Pacific region serves as a significant driver for the elevator and escalator market. As cities expand vertically to accommodate growing populations, the demand for efficient vertical transportation systems has surged. According to the World Bank, the urban population in the region is expected to grow by 500 million by 2035, which is intensifying the need for residential, commercial, and mixed-use high-rise buildings. For example, cities like Mumbai and Bangkok are witnessing a boom in skyscraper construction, with numerous projects exceeding 40 floors, as noted by the Council on Tall Buildings and Urban Habitat (CTBUH). These developments rely heavily on advanced elevator systems capable of handling high traffic volumes while ensuring safety and reliability. Additionally, government initiatives promoting urban renewal and infrastructure development further amplify demand. For instance, India’s Smart Cities Mission aims to develop 100 smart cities, each requiring integrated public transit systems equipped with elevators and escalators. The convergence of urbanization and policy-driven infrastructure projects ensures sustained growth for the market.

Adoption of Energy-Efficient Systems

Another key driver is the increasing adoption of energy-efficient elevators and escalators, fueled by global sustainability goals and regional regulations. According to the International Energy Agency (IEA), buildings account for nearly 40% of global energy consumption, prompting governments to mandate energy-saving technologies. For example, Japan’s Top Runner Program requires elevators to meet stringent energy efficiency standards, encouraging manufacturers to innovate in this space. Regenerative drives, which convert kinetic energy into electricity, have gained traction, reducing operational costs by up to 30%, as per the Japan Elevator Association.

Moreover, the integration of IoT-enabled features, such as predictive maintenance and real-time monitoring, enhances energy efficiency while minimizing downtime. These advancements align with green building certifications like LEED, making energy-efficient systems a preferred choice for developers.

MARKET RESTRAINTS

High Installation and Maintenance Costs

One of the primary restraints in the Asia Pacific elevator and escalator market is the high cost associated with installation and maintenance for advanced systems. Modern elevators equipped with regenerative drives, IoT sensors, and destination control systems require significant upfront investment. According to the Federation of Indian Chambers of Commerce & Industry (FICCI), the installation cost of premium elevators can exceed $100,000 per unit, making them unaffordable for smaller developers and retrofitting projects. Additionally, maintenance expenses, including periodic inspections and component replacements, which is added to the overall financial burden. According to the Australian Building Codes Board, annual maintenance costs for escalators in commercial spaces can range from $5,000 to $10,000 per unit, depending on usage and complexity. These costs deter widespread adoption, particularly in emerging economies where budget constraints limit infrastructure spending.

Stringent Safety Regulations and Compliance Challenges

The stringent safety regulations governing elevator and escalator installations are ascribed to hindering the growth of the Asia Pacific elevator and escalator market. Compliance with international standards, such as EN 81 (European Norm) and ASME A17.1 (American Society of Mechanical Engineers), imposes additional costs and operational complexities. According to the Korean Elevator Safety Agency, non-compliance with safety regulations can result in penalties exceeding $50,000, deterring smaller players from entering the market. Moreover, regional variations in standards, such as Japan’s JIS certifications and India’s Bureau of Indian Standards (BIS) norms, create fragmented requirements that increase administrative burdens. A study by the Asian Productivity Organization reveals that compliance costs can account for up to 15% of total project expenses for small and medium enterprises.

MARKET OPPORTUNITIES

Integration of Smart Technologies

The integration of smart technologies presents a significant opportunity for the Asia Pacific elevator and escalator market. IoT-enabled systems, AI-driven analytics, and cloud-based platforms are transforming traditional vertical transportation solutions into intelligent systems capable of enhancing user experience and operational efficiency.

Additionally, destination control systems, which optimize passenger flow by grouping individuals heading to the same floor, are gaining popularity in commercial buildings. These innovations not only improve energy efficiency but also cater to the growing demand for seamless connectivity and automation. The convergence of smart technologies and vertical mobility solutions creates untapped potential for manufacturers to differentiate themselves in a competitive market.

Growing Demand for Accessibility Solutions

Another promising opportunity lies in the growing demand for accessibility solutions tailored to aging populations and individuals with disabilities. According to the World Health Organization, over 20% of the Asia Pacific population will be aged 60 or above by 2050, which is necessitating barrier-free access systems in public and private spaces. For instance, Japan’s Act on Promotion of Removal of Architectural Barriers mandates the installation of elevators with tactile buttons and voice guidance in all new public buildings, as per the Japanese Ministry of Land, Infrastructure, Transport and Tourism.

Similarly, Australia’s Disability Discrimination Act requires commercial properties to incorporate accessible escalators and elevators, fostering demand for specialized designs. Innovations such as vacuum elevators, which occupy minimal space, and inclined platform lifts, which cater to wheelchair users, are gaining traction. These solutions not only address social inclusivity but also create lucrative opportunities for manufacturers to tap into niche markets.

MARKET CHALLENGES

Intense Price Competition

The Asia Pacific elevator and escalator market faces significant challenges due to intense price competition, exacerbated by the presence of numerous local and regional manufacturers. The reliance on low-cost production capabilities creates vulnerabilities, particularly in countries like China and India. This trend is particularly pronounced in residential projects, where cost competitiveness often takes precedence over quality and innovation.

While affordability benefits end-users, it squeezes profit margins for manufacturers, especially smaller firms with limited resources to invest in R&D or automation. A survey conducted by the Confederation of Indian Industry reveals that nearly 40% of small-scale elevator manufacturers operate on single-digit profit margins by making it challenging to sustain long-term growth.

Technological Obsolescence Risks

Rapid technological advancements pose another challenge, as manufacturers risk falling behind due to obsolescence. The pace of innovation in sectors like IoT, AI, and predictive maintenance demands constant upgrades to meet evolving specifications. For instance, as per McKinsey & Company, the lifecycle of elevator control systems has shortened by 30% over the past decade, leaving manufacturers with little time to adapt. Legacy systems often become incompatible with newer technologies by forcing companies to invest heavily in redesigning and retooling.

As per a report by the International Association of Elevator Engineers, over 20% of elevator designs introduced in 2018 were rendered obsolete by 2022 due to shifts in industry standards. This challenge is compounded by the high R&D costs associated with developing next-generation systems, which can deter smaller players from participating in cutting-edge segments. Failure to keep pace with technological trends not only erodes market share but also diminishes the ability to capitalize on emerging opportunities, which poses a significant threat to sustained growth.

SEGMENTAL ANALYSIS

By Product Insights

The elevators segment was the largest by holding a significant share of the Asia Pacific elevator and escalator market in 2024. According to the United Nations Department of Economic and Social Affairs, urbanization in the region is projected to reach 58% by 2030, which is driving unprecedented demand for high-rise structures that rely heavily on elevators. For instance, cities like Shanghai and Mumbai are witnessing a surge in skyscraper construction, with numerous projects exceeding 40 floors, as noted by the Council on Tall Buildings and Urban Habitat (CTBUH).

Another key factor is the increasing adoption of energy-efficient elevator systems. The International Energy Agency (IEA) highlights that elevators account for nearly 10% of a building’s total energy consumption, prompting governments to mandate advanced technologies such as regenerative drives and IoT-enabled systems. These innovations not only enhance operational efficiency but also align with green building certifications like LEED, which is amplifying demand.

The escalators segment is likely to grow with a CAGR of 8.4% in the next coming years. This growth is fueled by the expansion of public infrastructure, including shopping malls, airports, and metro stations. According to the Asian Development Bank, investments in public transit infrastructure in the region exceeded $200 billion in 2022, which is creating significant opportunities for escalator installations. For example, India’s Metro Rail projects have integrated over 500 escalators across major cities, as per the Ministry of Housing and Urban Affairs. Another driving factor is the growing emphasis on accessibility solutions. Countries like Japan and Australia have implemented stringent regulations mandating barrier-free access in public spaces, which is fostering demand for escalators equipped with safety features such as tactile indicators and emergency stop buttons.

By Business Insights

The new equipment segment held the Asia Pacific elevator and escalator market by accounting for 60.4% of the share in 2024 due to the region’s booming construction industry, fueled by urbanization and infrastructure development. According to the World Bank, the urban population in the Asia Pacific region is expected to grow by 500 million by 2035, which is intensifying the need for residential and commercial buildings equipped with modern vertical transportation systems. For instance, China’s Belt and Road Initiative has spurred the construction of high-rise buildings across Southeast Asia, as noted by the Asian Infrastructure Investment Bank. Another key factor is the adoption of smart technologies in new equipment. The integration of IoT, AI, and predictive maintenance systems enhances operational efficiency and user experience, making these systems highly sought after.

By Application Insights

The commercial segment dominated the Asia Pacific elevator and escalator market by holding 45.4% of the share in 2024 with the proliferation of shopping malls, office buildings, and hospitality facilities across the region. For instance, Singapore’s Marina Bay Sands complex integrates over 100 elevators and escalators to cater to its massive footfall, as per the Urban Redevelopment Authority. Another key factor is the rise of mixed-use developments, which combine residential, office, and retail spaces under one roof. These projects require advanced elevator systems capable of handling high traffic volumes while ensuring seamless connectivity.

The residential segment is lucratively growing with a CAGR of 7.5% in the next coming years owing to the increasing demand for high-rise apartments in urban areas. For example, India’s Smart Cities Mission has prioritized affordable housing projects, many of which incorporate elevators to enhance accessibility, as highlighted by the Ministry of Housing and Urban Affairs. Additionally, aging populations in countries like Japan and South Korea amplify demand for residential elevators tailored to accessibility needs.

REGIONAL ANALYSIS

China was the largest contributor in the Asia Pacific elevator and escalator market with 45.4% of share in 2024 with the country’s status as the world’s largest producer and consumer of vertical transportation systems. According to the Ministry of Housing and Urban-Rural Development, China accounts for over 60% of global elevator production, with companies like KONE and Otis maintaining significant manufacturing hubs in the region.

Another factor is the rapid urbanization and infrastructure development. Projects like the Belt and Road Initiative have spurred the construction of high-rise buildings and metro systems, creating immense demand for elevators and escalators. These dynamics position China as a key driver of innovation and adoption in the market.

India ranked second with a 15.4% share of the Asia Pacific elevator and escalator market in 2024. The country’s booming real estate sector and urbanization trends have amplified demand for vertical transportation systems. Additionally, government initiatives like the Smart Cities Mission and Pradhan Mantri Awas Yojana (PMAY) promote affordable housing and urban infrastructure, which is fostering demand for elevators and escalators.

Japan’s aging population and stringent safety regulations drive demand for advanced elevator systems. According to the Japanese Elevator Association, over 30% of elevators in Japan are more than 20 years old, necessitating modernization efforts. Another factor is the focus on energy efficiency. Japan’s Top Runner Program mandates elevators to meet stringent energy-saving standards, encouraging manufacturers to innovate in this space.

South Korea's elevator and escalator market share is driven by its emphasis on smart cities and sustainable infrastructure. According to the Korean Ministry of Land, Infrastructure, and Transport, over 50% of new buildings in Seoul are equipped with IoT-enabled elevators, which reflects the country’s commitment to technological advancement. Another key factor is the adoption of accessibility solutions, mandated by regulations like the Act on Welfare of Disabled Persons.

Australia and New Zealand’s market growth can be attributed to be driven by their focus on accessibility and energy efficiency. According to the Australian Building Codes Board, all new public buildings must incorporate elevators with tactile buttons and voice guidance, which is fostering demand for specialized designs. Another factor is the emphasis on sustainability. New Zealand’s Zero Carbon Act mandates industries to adopt cleaner technologies, which is creating opportunities for energy-efficient elevators and escalators.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Otis Elevator Company, KONE Corporation, Schindler Group, Hitachi Ltd., Mitsubishi Electric Corporation, Thyssenkrupp Elevator (TK Elevator), Hyundai Elevator Co. Ltd., Fujitec Co. Ltd., Johnson Lifts Pvt. Ltd., and Toshiba Elevator and Building Systems Corporation are some of the key market players in the Asia Pacific elevator and escalator market.

The Asia Pacific elevator and escalator market is characterized by intense competition, driven by the presence of both global giants and regional players vying for dominance. Global leaders like KONE, Otis, and Mitsubishi Electric leverage their extensive experience, advanced technologies, and strong distribution networks to maintain prominent positions. Meanwhile, regional players focus on niche markets, offering cost-effective solutions tailored to local regulatory frameworks and industrial needs.

The competitive landscape is further shaped by rapid technological advancements and shifting urban mobility priorities. Players must continuously innovate to keep pace with trends such as IoT integration, AI-driven analytics, and sustainable practices. Additionally, stringent safety regulations compel companies to adopt robust compliance measures while ensuring reliability. While global firms benefit from economies of scale and expertise, regional players often excel in understanding local dynamics. This interplay fosters a dynamic ecosystem where collaboration, differentiation, and adaptability are critical for success.

Top Players in the Asia Pacific Elevator and Escalator Market

KONE Corporation

KONE Corporation is a global leader in the elevator and escalator industry, with a significant presence in the Asia Pacific region. The company is renowned for its innovative solutions, including energy-efficient systems and IoT-enabled predictive maintenance platforms. KONE’s contribution to the global market lies in its ability to deliver tailored solutions that cater to diverse applications, from high-rise buildings to public infrastructure. Its focus on sustainability aligns with global green building standards, making it a preferred partner for developers. Additionally, KONE’s emphasis on user-centric designs enhances accessibility and safety by positioning it as a pioneer in smart mobility solutions.

Otis Worldwide Corporation

Otis Worldwide Corporation is a key player in the Asia Pacific elevator and escalator market, known for its advanced technologies and reliable service offerings. The company specializes in modernization, new installations, and maintenance services, addressing the needs of both developed and emerging markets. Otis’s commitment to innovation is evident in its Gen360™ elevators, which integrate AI-driven analytics to optimize performance. Globally, Otis plays a pivotal role in shaping urban mobility by providing scalable solutions for commercial, residential, and industrial applications. Its strong brand reputation and extensive network ensure consistent growth in the region.

Mitsubishi Electric Corporation

Mitsubishi Electric Corporation is a leading manufacturer of elevators and escalators, with a strong foothold in the Asia Pacific market. The company leverages cutting-edge technologies such as regenerative drives and destination control systems to enhance energy efficiency and operational reliability. Mitsubishi Electric’s focus on customization allows it to meet the unique requirements of regional projects, from luxury skyscrapers to public transit systems. Its contributions to the global market include pioneering innovations in barrier-free access and smart building integration, reinforcing its dominance in the industry.

Top Strategies Used by Key Players in the Asia Pacific Elevator and Escalator Market

Strategic Partnerships and Collaborations

Key players in the Asia Pacific elevator and escalator market have prioritized forming strategic partnerships to enhance their technological capabilities and expand their customer base. By collaborating with real estate developers, governments, and technology providers, companies aim to co-develop innovative solutions tailored to local market needs. These alliances enable firms to access new markets, share resources, and accelerate product development cycles. For instance, partnerships with smart city initiatives allow companies to integrate IoT and AI-driven systems into their offerings, ensuring alignment with urbanization trends.

Focus on Sustainability and Energy Efficiency

Sustainability remains a cornerstone of competitive strategies adopted by leading players. Companies are investing heavily in R&D to design energy-efficient systems that reduce carbon footprints and operational costs. Innovations such as regenerative drives, solar-powered elevators, and predictive maintenance platforms address environmental concerns while enhancing user experience. This strategy not only strengthens brand image but also ensures compliance with stringent regulatory standards. Additionally, manufacturers are aligning their products with green building certifications like LEED and BREEAM to cater to eco-conscious customers.

Expansion of Service Networks and Modernization Offerings

To cater to the growing demand in the Asia Pacific region, key players are expanding their service networks and focusing on modernization. Establishing localized service hubs allows companies to provide timely maintenance and technical support, enhancing customer satisfaction. Additionally, modernization services target aging equipment in developed markets, offering upgrades to meet current safety and energy efficiency standards. This approach not only extends the lifecycle of existing systems but also creates recurring revenue streams by ensuring long-term market presence.

RECENT MARKET DEVELOPMENTS

- In March 2023, KONE partnered with a leading Indian real estate developer to supply IoT-enabled elevators for a luxury residential project in Mumbai. This initiative aimed to enhance user experience through predictive maintenance and real-time monitoring by aligning with smart city goals.

- In June 2023, Otis launched a new line of energy-efficient escalators designed specifically for shopping malls in Southeast Asia. These systems were developed to support regional sustainability initiatives while reducing operational costs for property owners.

- In August 2023, Mitsubishi Electric acquired a Chinese startup specializing in AI-driven elevator control systems. This acquisition allowed the company to integrate advanced analytics into its product portfolio by catering to the growing demand for smart mobility solutions.

- In November 2023, Schindler expanded its manufacturing facility in Vietnam to produce escalators tailored for the hospitality sector. This move aimed to address the rising demand for vertical transportation systems in luxury hotels and resorts across the region.

- In January 2024, Hitachi signed a memorandum of understanding with the Indonesian government to modernize outdated elevator systems in Jakarta’s public transit infrastructure. This collaboration focused on enhancing safety and energy efficiency while supporting urban mobility challenges.

MARKET SEGMENTATION

This research report on the Asia Pacific Elevator and Escalator Market is segmented and sub-segmented into the following categories

By Product

- Elevators

- Escalators

- Moving Walkway

By Business

- New Equipment

- Maintenance

- Modernization

By Application

- Residential

- Commercial

- Industrial

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What factors are driving the growth of the Asia Pacific elevator and escalator market?

The growth of the Asia Pacific elevator and escalator market is driven by rapid urbanization, increasing government investment in infrastructure, rising demand for vertical transportation in residential and commercial buildings, and the adoption of smart and energy-efficient technologies.

What challenges does the Asia Pacific elevator and escalator market face?

The Asia Pacific elevator and escalator market faces challenges such as high costs for maintenance and modernization, compliance with strict safety regulations, supply chain disruptions, and intense price competition, especially in developing economies.

What is the future outlook for the Asia Pacific elevator and escalator market?

The future outlook for the Asia Pacific elevator and escalator market is positive, with a projected CAGR of around 6–8% from 2024 to 2030, supported by continued urban development, real estate expansion, and adoption of smart building technologies.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com