Asia Pacific Endpoint Security Market Size, Share, Trends & Growth Forecast Report By End User (BFSI, Government, Manufacturing, Healthcare, Energy and Power, Retail, Other Businesses), And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Endpoint Security Market Size

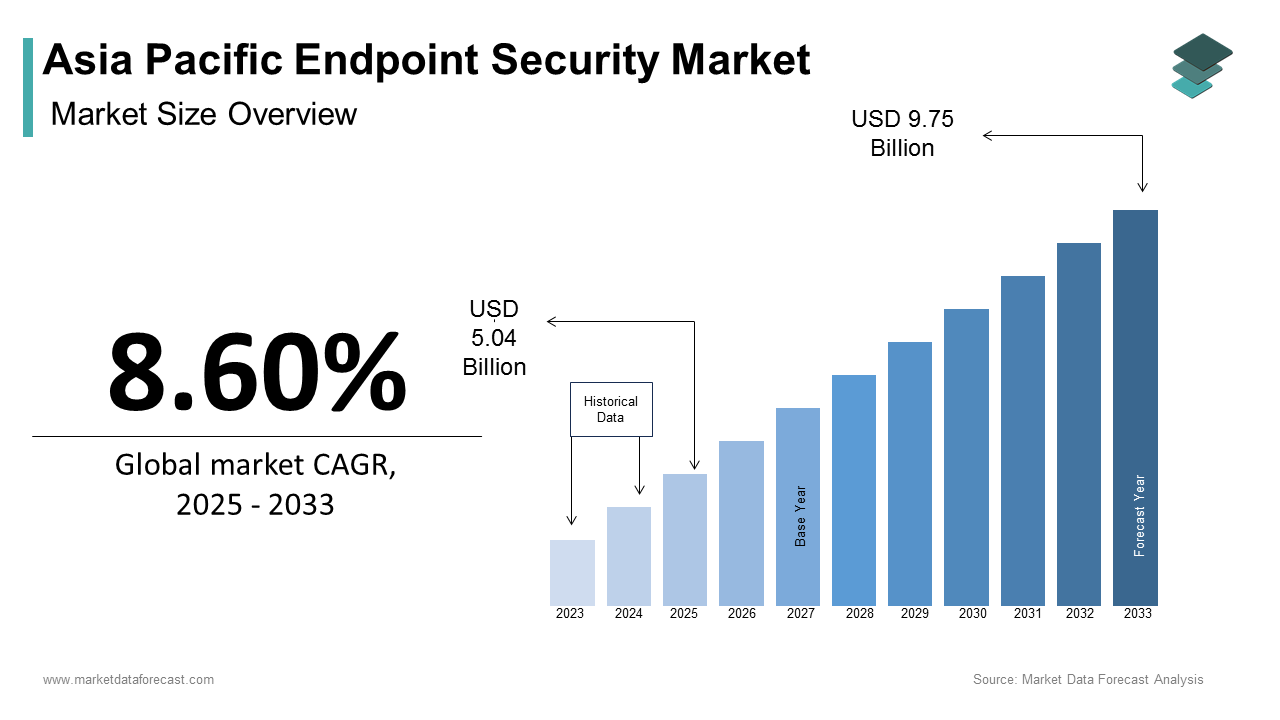

The Asia Pacific endpoint security market size was calculated to be USD 4.64 billion in 2024 and is anticipated to be worth USD 9.75 billion by 2033, from USD 5.04 billion in 2025, growing at a CAGR of 8.60% during the forecast period.

Endpoint security is an important segment in the overall cybersecurity ecosystem and addresses the growing need to protect endpoints such as laptops, smartphones, servers, and IoT devices from evolving cyber threats. Endpoint security solutions encompass technologies like antivirus software, firewalls, encryption, and advanced threat detection systems, which safeguard sensitive data and ensure operational continuity. According to the International Data Corporation (IDC), over 70% of organizations in the region experienced a cyberattack in 2022, underscoring the urgency for robust endpoint protection measures. The region’s rapid digital transformation, driven by increased internet penetration and the proliferation of smart devices, has created a fertile ground for cybercriminals. As per the World Bank, internet penetration in the Asia Pacific region exceeded 60% in 2022, amplifying the attack surface for malicious actors.

Moreover, government initiatives aimed at enhancing cybersecurity infrastructure further amplify the importance of endpoint security. For instance, Australia’s Cyber Security Strategy 2023 allocates $1.6 billion to strengthen national cybersecurity capabilities, highlighting the role of endpoint security in safeguarding critical assets. Similarly, India’s National Cyber Security Policy mandates stringent endpoint protection measures for enterprises, creating a fertile environment for innovation and adoption. Collectively, these factors position the Asia Pacific region as a focal point for advancements in endpoint security solutions.

MARKET DRIVERS

Rising Incidence of Cyberattacks

The increasing frequency and sophistication of cyberattacks is majorly driving the growth of the Asia Pacific endpoint security market. For instance, ransomware attacks in the region surged by 150% in 2022, targeting industries like healthcare, finance, and manufacturing. These attacks exploit vulnerabilities in endpoints, causing financial losses and reputational damage. For instance, a single ransomware attack on an Australian healthcare provider resulted in losses exceeding $10 million, as noted by the Australian Cyber Security Centre. Such incidents have heightened awareness among organizations about the importance of robust endpoint security solutions. Additionally, the rise of remote work due to the COVID-19 pandemic has expanded the attack surface, with employees accessing corporate networks through unsecured devices. For instance, more than 60% of organizations in the region reported an increase in endpoint-related breaches during the pandemic. This trend underscores the critical need for advanced endpoint protection tools capable of detecting and mitigating threats in real-time.

Growing Adoption of IoT Devices

The widespread adoption of IoT devices across industries that amplifies the demand for endpoint security solutions is further boosting the endpoint security market in Asia-Pacific. For instance, the number of IoT devices in the Asia Pacific region is projected to exceed 20 billion by 2025, creating numerous entry points for cybercriminals. For example, smart factories in China utilize thousands of connected sensors and devices, each requiring robust security protocols to prevent unauthorized access, as highlighted by the Ministry of Industry and Information Technology. Additionally, the integration of IoT in sectors like healthcare and transportation necessitates specialized endpoint security measures. More than 40% of healthcare providers in the region have adopted IoT-enabled medical devices, making them vulnerable to cyber threats. These dynamics ensure sustained growth for the endpoint security market as organizations prioritize safeguarding their interconnected ecosystems.

MARKET RESTRAINTS

High Implementation Costs

One of the primary restraints in the adoption of endpoint security solutions is the high cost associated with implementation and maintenance. Advanced tools like endpoint detection and response (EDR) systems require significant investments in hardware, software, and skilled personnel to deploy and manage effectively. According to the Asian Development Bank, small and medium-sized enterprises (SMEs) in the region allocate less than 5% of their annual revenue to cybersecurity initiatives, limiting their ability to adopt comprehensive endpoint security measures. For instance, integrating AI-driven EDR systems can cost up to $100,000 annually for mid-sized organizations, as highlighted by the Confederation of Indian Industry. Additionally, ongoing expenses related to software updates, threat intelligence subscriptions, and employee training add to the financial burden. These costs deter widespread adoption, particularly among smaller players operating on thin profit margins.

Lack of Skilled Cybersecurity Professionals

The shortage of skilled cybersecurity professionals capable of managing endpoint security systems is further boosting the expansion of the endpoint security market in Asia-Pacific. According to the International Information System Security Certification Consortium (ISC)², the Asia Pacific region faces a cybersecurity skills gap of over 2 million professionals, hindering organizations’ ability to fully leverage these solutions. For example, a survey by the Vietnam Chamber of Commerce and Industry revealed that 70% of local businesses struggle to find talent with expertise in advanced threat detection and response. Moreover, the rapid evolution of cyber threats requires continuous upskilling, which many organizations cannot afford. This skills gap leaves companies vulnerable to attacks, undermining confidence in endpoint security solutions and slowing market growth.

MARKET OPPORTUNITIES

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) is a significant opportunity for the Asia Pacific endpoint security market. These technologies enable predictive analytics and real-time threat detection, addressing the limitations of traditional signature-based systems. According to McKinsey & Company, AI-driven security solutions can reduce incident response times by up to 50%, as highlighted by case studies in Japan and South Korea. For instance, Singapore’s Cyber Security Agency leverages AI-powered tools to monitor and mitigate threats across government networks, ensuring proactive defense mechanisms. Additionally, ML algorithms analyze vast datasets to identify anomalous behavior, enabling organizations to detect zero-day exploits and advanced persistent threats (APTs). These innovations align with the region’s focus on digital transformation, creating lucrative opportunities for vendors to offer scalable and intelligent endpoint security solutions.

Expansion of Cloud-Based Endpoint Security

The growing adoption of cloud-based endpoint security solutions is another promising opportunity in the Asia-Pacific endpoint security market, which is driven by the shift toward remote work and hybrid IT environments. For instance, over 60% of organizations in the region are transitioning to cloud platforms, necessitating cloud-native security tools that integrate seamlessly with existing infrastructure. For example, Australia’s National Broadband Network uses cloud-based endpoint protection to secure its distributed workforce, reducing operational costs by 30%, as noted by the company’s IT department. Moreover, cloud-based solutions offer scalability, flexibility, and centralized management, making them ideal for SMEs and large enterprises alike. These benefits position cloud-based endpoint security as a transformative solution for modern cybersecurity strategies.

MARKET CHALLENGES

Resistance to Change Among Traditional Organizations

The resistance to change among traditional organizations, particularly in rural and semi-urban areas is a major challenge to the Asia-Pacific endpoint security market. According to the International Labour Organization, over 80% of businesses in the region are family-owned or operated, relying on outdated cybersecurity practices that fail to address modern threats. These organizations often perceive advanced endpoint security solutions as unnecessary expenses that disrupt established workflows. For instance, only 30% of small retailers have adopted any form of endpoint protection, let alone AI-driven tools. Additionally, cultural and generational factors contribute to this resistance, with older business owners preferring manual oversight over automated systems. This reluctance to embrace innovation slows down the pace of adoption, limiting the potential impact of endpoint security solutions.

Fragmented Regulatory Landscape

The fragmented regulatory landscape governing cybersecurity across the Asia Pacific region is another major challenge to the regional market growth. According to the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), cybersecurity standards vary significantly between countries, with some imposing strict mandates while others maintain lenient policies. For example, Australia’s Privacy Act requires organizations to notify affected individuals of data breaches within 30 days, whereas similar incidents in Indonesia may go unreported due to weaker enforcement, as highlighted by the Indonesian Ministry of Communication and Informatics. This inconsistency creates operational inefficiencies for companies operating across multiple jurisdictions, requiring them to adapt their systems to meet varying standards. Additionally, the absence of harmonized testing and certification protocols increases costs and delays implementation. Addressing these disparities is crucial to fostering a cohesive and efficient market ecosystem.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.60% |

|

Segments Covered |

By End User, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

Trend Micro, Symantec, McAfee, Kaspersky, Sophos, Microsoft, Cisco Systems, Palo Alto Networks, Check Point Software Technologies, Fortinet |

SEGMENTAL ANALYSIS

By End User Insights

The business segment dominated the Asia Pacific endpoint security market by commanding 66.1% of the Asia-Pacific market share in 2024. The promising position of business segment in the regional market is driven by the increasing reliance on digital infrastructure across industries such as banking, financial services, and insurance (BFSI), healthcare, and manufacturing. According to the International Data Corporation (IDC), over 70% of cyberattacks in the region target businesses, particularly those in critical sectors like BFSI and healthcare, which handle sensitive customer data. For instance, a cyberattack on a major Indian bank in 2022 exposed the personal information of over 3 million customers, highlighting the need for robust endpoint security solutions, as noted by the Reserve Bank of India. The growing adoption of remote work and cloud-based systems that have expanded the attack surface for businesses is further boosting the expansion of the business segment in the Asia-Pacific market. A study by PwC reveals that over 60% of organizations in the region reported an increase in endpoint-related breaches during the pandemic, necessitating advanced tools like endpoint detection and response (EDR) systems. Additionally, stringent regulatory mandates, such as Australia’s Privacy Act and Japan’s Cybersecurity Basic Act, compel businesses to adopt comprehensive security measures, further amplifying demand.

The consumer segment is anticipated to grow at a CAGR of 18.8% over the forecast period owing to the rising adoption of smartphones, IoT devices, and smart home technologies among households. For instance, the number of connected devices in the region is projected to exceed 20 billion by 2025, creating numerous entry points for cybercriminals. For example, South Korea’s Ministry of Science and ICT highlights that over 40% of households use smart home devices, making them vulnerable to attacks like phishing and malware. Additionally, increased awareness about cybersecurity threats has driven consumers to invest in endpoint protection solutions. For instance, a survey by Norton LifeLock notes that over 70% of smartphone users in the region now use antivirus software to safeguard their devices. These trends position the consumer segment as a high-growth area, driven by the convergence of technology adoption and security concerns.

REGIONAL ANALYSIS

China held the major share of 36.1% of the Asia Pacific endpoint security market in 2024. The dominance of China in the Asia-Pacific market is primarily attributed to the country’s status as the world’s largest manufacturing hub and a leader in digital transformation. According to the Ministry of Industry and Information Technology, over 50% of enterprises in China have adopted advanced cybersecurity measures, including endpoint protection, to safeguard their operations. The push of the Chinese government for self-reliance in cybersecurity technologies such as the "Made in China 2025" initiative is further fuelling the growth of the Chinese market growth. Investments in AI-driven endpoint security solutions have enabled organizations to detect and mitigate threats in real time. These dynamics position China as a leader in both innovation and adoption of endpoint security technologies.

India is a promising market for endpoint security in the Asia-Pacific region. The rapid digitalization and rising internet penetration in India drive demand for endpoint security solutions. According to the Telecom Regulatory Authority of India, internet users in the country exceeded 800 million in 2022, fostering e-commerce and remote work trends. Additionally, government initiatives like "Digital India" promote cybersecurity adoption across industries. For instance, the Reserve Bank of India mandates stringent endpoint protection measures for financial institutions, ensuring compliance. These efforts underscore India’s growing significance in the market.

Japan is predicted to account for a substantial share of the Asia-Pacific endpoint security market over the forecast period. The advanced technological infrastructure and aging population of Japan drive demand for endpoint security solutions. According to the Japanese Ministry of Economy, Trade and Industry, over 60% of organizations have adopted AI-driven tools to address labor shortages and improve operational efficiency. The focus on sustainability in Japan is also boosting the Japanese endpoint security market. AI-driven systems help retailers optimize energy consumption and reduce waste, aligning with Japan’s carbon neutrality goals.

South Korea is expected to hold a notable share of the Asia-Pacific market over the forecast period owing to its emphasis on smart retail and technological innovation. According to the Korea Internet & Security Agency, over 70% of retailers in Seoul use AI-powered tools like visual search and virtual assistants. Additionally, government policies promoting AI adoption further amplify demand. These initiatives highlight South Korea’s proactive approach to integrating AI in retail.

Australia and New Zealand are estimated to hold a considerable share of the Asia-Pacific market over the forecast period owing to their focus on customer-centric solutions. According to the Australian Retailers Association, AI-powered personalization tools have increased customer retention rates by 25%. The emphasis on data privacy, and ensuring ethical AI adoption is also fuelling the market expansion in these countries.

LEADING PLAYERS IN THE ASIA PACIFIC ENDPOINT SECURITY MARKET

CrowdStrike

CrowdStrike is a global leader in cloud-native endpoint security solutions, with a significant presence in the Asia Pacific region. The company’s Falcon platform leverages artificial intelligence and machine learning to provide real-time threat detection, prevention, and response capabilities. CrowdStrike’s contribution to the global market lies in its ability to address advanced persistent threats (APTs) and zero-day exploits, ensuring robust protection for enterprises across diverse industries. Its focus on innovation and scalability has positioned it as a preferred partner for organizations undergoing digital transformation. Additionally, CrowdStrike’s emphasis on proactive threat intelligence strengthens its reputation as a pioneer in endpoint security.

McAfee

McAfee is a key player in the Asia Pacific endpoint security market, renowned for its comprehensive suite of solutions designed to protect endpoints across devices, networks, and cloud environments. The company’s offerings cater to both consumer and enterprise segments, addressing the growing demand for integrated cybersecurity tools. McAfee’s commitment to innovation is evident in its AI-driven threat detection systems, which enhance accuracy and reduce false positives. Globally, McAfee plays a pivotal role in shaping endpoint security strategies by introducing scalable and user-friendly solutions. Its strong brand recognition and extensive distribution network ensure consistent growth in the region.

Trend Micro

Trend Micro is a leading provider of endpoint security solutions, with a strong foothold in the Asia Pacific market. The company specializes in protecting hybrid IT environments, including cloud, on-premises, and IoT ecosystems. Trend Micro’s XDR (Extended Detection and Response) platform integrates multiple layers of security, offering holistic visibility and faster incident response. Its contributions to the global market include pioneering innovations in AI-powered threat analytics and automated response mechanisms. Trend Micro’s focus on localized solutions tailored to regional regulatory frameworks further amplifies its impact on the cybersecurity landscape.

TOP STRATEGIES USED BY KEY PLAYERS IN THE ASIA PACIFIC ENDPOINT SECURITY MARKET

Strategic Partnerships and Collaborations

Key players in the Asia Pacific endpoint security market have increasingly relied on strategic partnerships to expand their technological capabilities and market reach. By collaborating with local governments, technology providers, and research institutions, companies gain access to innovative solutions and regional expertise. These alliances enable them to address specific market needs while enhancing their product portfolios. For instance, partnerships with cloud service providers allow companies to integrate endpoint security tools seamlessly into hybrid IT environments, ensuring alignment with digital transformation trends.

Focus on AI-Driven Threat Detection

Artificial intelligence and machine learning remain cornerstones of competitive strategies adopted by leading players. Companies invest heavily in developing AI-driven solutions capable of detecting and mitigating advanced threats in real-time. This approach not only enhances accuracy but also reduces response times, ensuring proactive defense against cyberattacks. By leveraging predictive analytics and behavioral analysis, vendors can identify anomalous activities and neutralize threats before they escalate.

Expansion of Cloud-Based Solutions

To cater to the growing demand for flexible and scalable security tools, key players are expanding their cloud-based endpoint security offerings. Implementing cloud-native platforms allows organizations to centralize management, reduce operational costs, and improve accessibility. This strategy aligns with the region’s shift toward remote work and hybrid IT environments, ensuring seamless integration with existing infrastructure.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the Asia Pacific Endpoint security market include Trend Micro, Symantec, McAfee, Kaspersky, Sophos, Microsoft, Cisco Systems, Palo Alto Networks, Check Point Software Technologies, Fortinet

The Asia Pacific endpoint security market is characterized by intense competition, driven by the presence of both global giants and regional innovators vying for dominance. Global leaders like CrowdStrike, McAfee, and Trend Micro leverage their extensive experience, advanced technologies, and strong distribution networks to maintain leadership positions. Meanwhile, regional players focus on niche markets, offering cost-effective solutions tailored to local regulatory frameworks and industry needs.

The competitive landscape is further shaped by rapid advancements in AI, machine learning, and cloud computing, which redefine the capabilities of endpoint security solutions. Players must continuously innovate to keep pace with evolving cyber threats and shifting customer expectations. Additionally, stringent data privacy regulations compel companies to adopt ethical practices while ensuring compliance. While global firms benefit from economies of scale and R&D investments, regional players often excel in understanding local dynamics. This interplay fosters a dynamic ecosystem where collaboration, differentiation, and adaptability are critical for success.

RECENT HAPPENINGS IN THE MARKET

- In February 2023, CrowdStrike partnered with a leading Australian financial institution to deploy its AI-driven Falcon platform across all endpoints. This initiative aimed to enhance real-time threat detection and response capabilities, ensuring compliance with the country’s stringent cybersecurity mandates.

- In June 2023, McAfee launched a cloud-native endpoint security solution tailored for small and medium-sized enterprises (SMEs) in India. This move aimed to democratize access to advanced cybersecurity tools, fostering inclusivity in the market.

- In August 2023, Trend Micro collaborated with a Japanese manufacturing firm to integrate its XDR platform into the company’s hybrid IT environment. This initiative focused on providing end-to-end visibility and faster incident response, reducing operational risks.

- In November 2023, Palo Alto Networks expanded its endpoint security services to rural areas in Indonesia. This initiative aimed to enhance cybersecurity awareness and accessibility, particularly for first-time internet users.

- In January 2024, Symantec acquired a Singapore-based AI startup specializing in behavioral analytics for endpoint security. This acquisition allowed the company to integrate advanced tools into its product portfolio, strengthening its position in the market.

MARKET SEGMENTATION

This research report on the Asia Pacific endpoint security market has been segmented and sub-segmented based on end-user and region.

By End User

- BFSI

- Government

- Manufacturing

- Healthcare

- Energy and Power

- Retail

- Other Businesses

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What factors are driving the growth of this market?

Key drivers include the rise in remote work, increasing cyberattacks, growing adoption of mobile devices, regulatory compliance requirements, and expanding digital transformation initiatives across industries.

2. Which countries are major contributors to the Asia Pacific Endpoint Security Market?

Due to their strong IT infrastructure and growing focus on cybersecurity, major contributors include China, India, Japan, South Korea, Australia, and Singapore.

3. Who are the key players in the Asia Pacific Endpoint Security Market?

Major companies include Trend Micro, Symantec, McAfee, Kaspersky, Sophos, Microsoft, Cisco Systems, Palo Alto Networks, Check Point Software Technologies, and Fortinet.

4. How do organizations choose the right endpoint security solution?

Organizations consider factors such as threat detection capabilities, ease of deployment, scalability, integration with existing systems, vendor reputation, and compliance with local regulations.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]