Asia Pacific Enterprise Networking Market Size, Share, Trends & Growth Forecast Report By Networking Devices (Routers, Switches, Firewalls, Access Points), Technology, Network Type, Connection Type, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Enterprise Networking Market Size

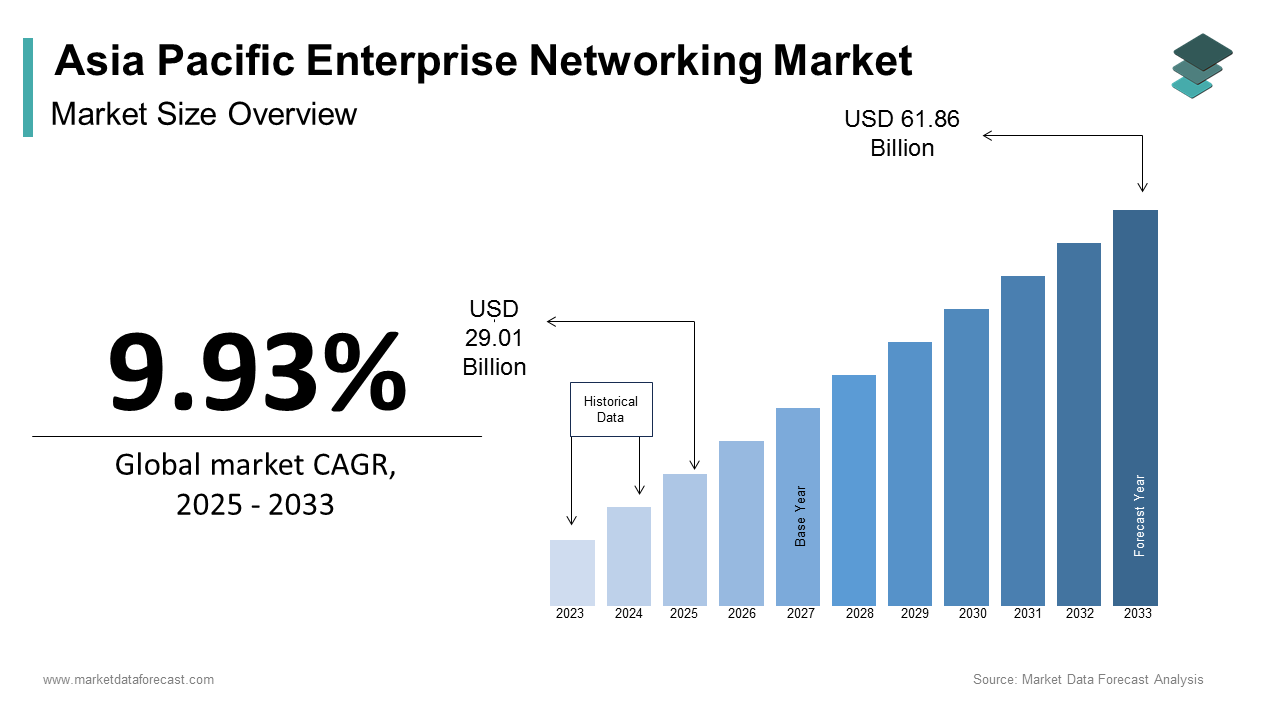

The Asia Pacific Enterprise Networking Market size was calculated to be USD 26.39 billion in 2024 and is anticipated to be worth USD 61.86 billion by 2033, from USD 29.01 billion in 2025, growing at a CAGR of 9.93% during the forecast period.

The Asia Pacific enterprise networking market encompasses deploying and managing advanced communication systems across corporate environments, including wired and wireless infrastructure, data centers, and cloud-based networking solutions. According to a recent assessment by IDC, Asia Pacific (excluding Japan) is witnessing rapid adoption of software-defined networking (SDN), 5G integration, and hybrid cloud architectures, driven largely by evolving business models in China, India, and Southeast Asia. The proliferation of IoT-enabled devices and edge computing platforms has further intensified reliance on high-performance networking systems within enterprises. Additionally, as per the latest findings from Gartner, increased investment in network automation tools has enabled organizations to reduce operational complexities and enhance agility. Digital government initiatives in countries like Singapore and South Korea are also contributing to the expansion of enterprise-grade networking deployments.

MARKET DRIVERS

Growth of Smart Cities and Urban Digitization

One of the most significant drivers of the Asia Pacific enterprise networking market is the rapid development of smart cities and digitally integrated urban ecosystems. Governments across the region are investing heavily in transforming traditional city infrastructures into intelligent, interconnected systems using IoT, AI, and cloud technologies. For example, according to McKinsey Global Institute, over 70 smart city projects have been launched across Asia Pacific since 2020, with China alone accounting for more than half of these developments. These initiatives require extensive enterprise-level networking to support real-time data collection, traffic monitoring, public safety surveillance, and utility management. In India, the Smart Cities Mission has allocated over USD 30 billion to develop 100 smart cities, integrating enterprise networking solutions for municipal governance and citizen services. Similarly, Singapore’s "Smart Nation" initiative leverages high-speed private networks for the healthcare, transport, and education sectors.

Rise of Remote Work and Hybrid Business Models

The widespread adoption of remote work and hybrid business models has become a permanent fixture post-pandemic, which is boosting demand for enterprise networking solutions across the Asia Pacific region. Companies are increasingly relying on secure, cloud-managed networks to facilitate seamless collaboration among geographically dispersed teams. This shift necessitates robust virtual private networks (VPNs), cloud-based unified communications, and SD-WAN solutions to ensure secure and uninterrupted connectivity. In Australia, for instance, the government reported that enterprise internet usage spiked by over 45% during peak remote working periods in 2022. Similarly, Japanese firms such as SoftBank and NEC have accelerated their investments in secure enterprise platforms to support telecommuting infrastructure. Moreover, small and medium-sized enterprises (SMEs) in countries like Indonesia and Vietnam are increasingly adopting managed networking services to support flexible workforce arrangements. With employee expectations shifting toward digital-first workplaces, the enterprise networking market continues to expand as organizations invest in infrastructure that supports productivity without compromising security or scalability.

MARKET RESTRAINTS

High Implementation Costs and Infrastructure Limitations

A key restraint impeding the growth of the Asia Pacific enterprise networking market is the high cost of deploying advanced networking infrastructure in developing economies. While large corporations in countries like South Korea, Singapore, and Australia can afford state-of-the-art networking solutions, many SMEs in regions such as Cambodia, Laos, and parts of rural India face financial constraints. According to the World Bank, approximately 60% of SMEs in Southeast Asia lack the capital required to invest in next-generation enterprise networking technologies such as SD-WAN, 5G-enabled routers, and AI-driven network management systems.

Additionally, existing telecommunications infrastructure in certain areas remains underdeveloped, limiting the reach and effectiveness of enterprise-grade networking solutions. A 2023 study by the Asian Development Bank revealed that only 42% of rural populations in the Philippines had access to reliable broadband connectivity, significantly hindering enterprise digitalization efforts. Even in urban settings, legacy systems often require costly upgrades before they can support modern networking frameworks. These financial and infrastructural barriers prevent widespread adoption, particularly among smaller enterprises, which constitute a substantial portion of the region’s economic landscape.

Cybersecurity Threats and Regulatory Fragmentation

Another significant constraint affecting the Asia Pacific enterprise networking market is the rising frequency of cyber threats coupled with inconsistent cybersecurity regulations across different jurisdictions. Enterprises across the region are increasingly targeted by sophisticated cyberattacks, including ransomware, phishing, and distributed denial-of-service (DDoS) attacks. According to Kaspersky, in 2023, APAC accounted for 34% of all global DDoS attacks, with India and Indonesia experiencing the highest attack volumes. For example, while Australia has implemented the Security of Critical Infrastructure Act, mandating strict cybersecurity compliance for key enterprises, countries like Thailand and Vietnam are still in the process of finalizing comprehensive digital protection laws. This regulatory fragmentation makes it challenging for multinational corporations to standardize their enterprise networking strategies across the region. Moreover, data localization requirements in countries like China and Russia force enterprises to maintain separate networking infrastructures, increasing costs and operational inefficiencies.

MARKET OPPORTUNITIES

Expansion of Industrial Internet of Things (IIoT) in Manufacturing

One of the most promising opportunities in the Asia Pacific enterprise networking market is the rapid expansion of the Industrial Internet of Things (IIoT) in the manufacturing sector. As industries move toward Industry 4.0, there is a growing reliance on interconnected sensors, machines, and automation systems that require high-speed, low-latency enterprise networks to function efficiently. Countries such as South Korea and Japan are implementing smart factory initiatives that integrate real-time data analytics, predictive maintenance, and AI-driven production scheduling. These facilities depend heavily on enterprise networking infrastructure for machine-to-machine communication, supply chain visibility, and quality control automation. India’s Make in India initiative is also driving the integration of IIoT in manufacturing clusters across Tamil Nadu and Gujarat, where enterprises are increasingly adopting Ethernet-based and 5G-enabled networking systems.

Surge in Cloud-Based Networking Services Adoption

The increasing adoption of cloud-based networking services represents a significant growth opportunity for the Asia Pacific enterprise networking market. Enterprises are shifting away from traditional on-premises networking models in favor of cloud-native solutions that offer scalability, flexibility, and lower operational overhead.

Public and hybrid cloud platforms are being widely deployed to support enterprise mobility, remote collaboration, and data-driven decision-making. In China, hyperscale cloud providers such as Alibaba Cloud and Tencent Cloud have expanded their networking-as-a-service offerings to cater to a growing base of businesses seeking cloud-first strategies. Meanwhile, in Australia, the government’s Digital Economy Strategy has spurred increased use of cloud-based enterprise networking in the healthcare and financial services sectors.

MARKET CHALLENGES

Talent Shortage and Skills Gap in Network Management

One of the most pressing challenges facing the Asia Pacific enterprise networking market is the acute shortage of skilled professionals capable of deploying and managing advanced networking technologies. As enterprises adopt complex solutions such as software-defined networking (SDN), intent-based networking (IBN), and zero-trust security models, the demand for highly trained IT personnel has grown exponentially. However, educational institutions and training programs across much of the region have struggled to keep pace with evolving technological requirements.

Furthermore, experienced network engineers are increasingly migrating to developed markets such as Australia and Singapore, exacerbating talent shortages in less developed economies. This labor crunch not only delays project rollouts but also increases recruitment and training costs for enterprises. Unless addressed through industry-academia partnerships and upskilling initiatives, the talent deficit will continue to constrain the market’s growth potential.

Interoperability Issues Across Multi-Vendor Networking Environments

Interoperability issues present a formidable challenge in the Asia Pacific enterprise networking market as businesses deploy multi-vendor networking equipment to meet diverse operational needs. Enterprises often combine products from vendors such as Cisco, Huawei, Juniper, and HPE, each offering proprietary hardware and software ecosystems that do not seamlessly integrate. This heterogeneity complicates network management, hampers automation implementation, and increases the risk of performance bottlenecks. As per a 2023 survey conducted by EMA (Enterprise Management Associates), 62% of enterprises in the Asia Pacific reported difficulties in managing multi-vendor network environments, citing compatibility concerns and inconsistent management interfaces as primary obstacles. In India, where enterprises frequently procure networking gear from multiple suppliers to optimize costs, integration complexities have led to extended deployment cycles and higher operational expenditures.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.93% |

|

Segments Covered |

By Networking Devices, Technology, Network Type, Connection Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

Cisco Systems (US), Broadcom (US), Hewlett Packard Enterprise (US), Juniper Networks (US), Extreme Networks, Inc. (US), Huawei (China), Fortinet (US), Cloudflare, Inc. (US), Alcatel-Lucent Enterprise (France), Arista Networks (US), Riverbed Technology (US), Check Point Software Technologies Ltd. (Israel), SolarWinds Corporation (US), F5 Networks (US), Palo Alto Networks (US), Pica8 (US), Versa Networks (US), Aryaka Networks Inc. (US), A10 Networks, Inc. (US), Cato Networks Ltd. (Israel), Cambium Networks (US), Megaport (Australia), flexiWAN (Israel), Peplink (US), Lavelle Networks (India), Arrcus (US), Celona (US), TBL Networks (US), Open Systems (Switzerland), and Bigleaf Networks (US). |

SEGMENTAL ANALYSIS

By Networking Devices Insights

The switches segment was the largest in the Asia Pacific enterprise networking market with 32.2% of the share in 2024 owing to the growing need for high-speed, scalable, and secure internal network connectivity across enterprises. In data centers and campus networks alike, switches serve as the backbone that enables efficient traffic flow between servers, endpoints, and cloud infrastructures. A key driver is the rapid digitalization of industries such as banking, healthcare, and manufacturing, where low-latency switching solutions are critical. Additionally, the increasing adoption of Power over Ethernet (PoE) switches in smart building automation and surveillance systems has further boosted demand. Moreover, hyperscale data centers in Singapore and Australia are investing heavily in next-generation Layer 3 and managed switches to support AI and big data analytics workloads. The integration of AI-driven network management tools into enterprise switches is also enhancing operational efficiency in modern enterprise infrastructure.

The access points segment is swiftly emerging with a CAGR of 14.6% from 2025 to 2033. The proliferation of mobile devices, IoT-enabled sensors, and real-time collaboration applications has significantly increased reliance on Wi-Fi-based enterprise networks. Enterprises are increasingly adopting cloud-managed access points to enable remote monitoring and dynamic bandwidth allocation. Additionally, government initiatives promoting smart city development in India and Indonesia are fueling investments in outdoor and industrial-grade access points for public transport hubs, surveillance systems, and municipal services.

By Technology Insights

The Software-Defined Wide Area Networking (SD-WAN) held 39.8% of the Asia Pacific enterprise networking market share in 2024. SD-WAN's appeal lies in its capacity to reduce dependency on expensive Multiprotocol Label Switching (MPLS) circuits by leveraging broadband and 4G/5G links intelligently. Enterprises in Australia, South Korea, and Japan have rapidly adopted SD-WAN solutions to optimize branch connectivity and support cloud application performance. Another significant factor driving SD-WAN's dominance is its integration with zero-trust security frameworks. In response to rising cyber threats, vendors like Fortinet and Cisco have embedded advanced threat detection capabilities into SD-WAN architectures, which is making them ideal for financial institutions and healthcare providers. Furthermore, increasing regulatory emphasis on data privacy in countries like India and Singapore has spurred the adoption of secure SD-WAN deployments.

The Secure Access Service Edge (SASE) segment will likely grow with a CAGR of 28.1% during the forecast period. SASE integrates capabilities such as SD-WAN, secure web gateways, cloud access security brokers (CASB), and Zero Trust Network Access (ZTNA) into a single framework, which enables enterprises to securely connect users, devices, and applications regardless of location. With the rise of remote and hybrid working models post-pandemic, organizations are seeking scalable, cloud-delivered security solutions, particularly in economies like India and China. Furthermore, stringent data protection laws across the region—such as Australia’s Privacy Act and Singapore’s PDPA—are pushing firms to adopt SASE for compliance-ready network security.

By Network Type Insights

The campus networks segment accounted for 35.4% of the Asia Pacific enterprise networking market share in 2024. One major driver of campus network growth is the widespread implementation of smart campuses in higher education institutions. Universities in countries like South Korea and Australia have been integrating IoT, AI, and real-time analytics into campus operations, requiring robust wired and wireless networking infrastructure. In addition, large-scale enterprises with multiple departments located within a single geographic location are increasingly investing in converged campus infrastructures. According to HPE, enterprise campus networking spending in China grew by 11.3% in 2023, driven by verticals like finance and healthcare. Industrial parks in India and Vietnam are also adopting unified campus networks to support interconnected production lines and administrative workflows. With increasing digitization and the need for seamless communication across departments and stakeholders, campus networks are expected to maintain their leading position while evolving with next-generation technologies such as AI-powered network management and hyper-converged infrastructure.

The remote networks segment is lucrative to grow with a CAGR of 19.3% from 2025 to 2033. Organizations across the region have adopted virtual private networks (VPNs), SD-WAN, and cloud-managed routers to extend enterprise-grade networking capabilities to remote workers. Governments have also played a role in accelerating this trend. In India, the Digital India initiative has enabled rural entrepreneurs and freelancers to access enterprise-level networking tools, fostering remote employment opportunities. As enterprises continue to prioritize flexibility and resilience, the demand for secure and scalable remote networking infrastructure is expected to sustain double-digit growth across the Asia Pacific region.

By Connection Type Insights

The wired connections segment was the largest with a dominant share of the Asia Pacific enterprise networking market in 2024. Enterprise data centers, which form the backbone of digital transformation efforts in countries like Japan and Singapore, rely heavily on fiber-optic and Ethernet-based wired networks to ensure uninterrupted data transmission and minimal latency. In addition, wired connectivity remains indispensable for industrial automation, where deterministic performance and immunity to interference are paramount. In China, the government’s push for smart factories under Industry 4.0 has led to extensive deployment of Gigabit Ethernet and fiber-linked control systems in production units. Wireless connections are expected to register a CAGR of 16.4% in the coming years. This rapid expansion is being propelled by the increasing adoption of mobility-centric applications, BYOD policies, and the rollout of next-generation Wi-Fi and 5G standards. Wi-Fi 6 deployments are gaining momentum across urban enterprises in India, Thailand, and Malaysia, where businesses are aiming to support high-density device environments in retail stores, hotels, and office spaces. The proliferation of 5G-enabled private networks in manufacturing and logistics is boosting enterprise wireless investments. In Japan, automotive manufacturers like Toyota and Honda are deploying 5G standalone (SA) networks for real-time machine coordination and quality inspection systems.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific enterprise networking market by accounting for 28.4% of the share in 2024. Under the Made in China 2025 and Digital China initiatives, the country has prioritized the integration of enterprise networking in industrial transformation, smart city development, and public administration. In 2023, the Ministry of Industry and Information Technology (MIIT) reported that over 2,000 smart factories were deployed nationwide, all requiring high-speed networking, cloud connectivity, and edge computing.

India ranks second with 14.3% of the Asia Pacific enterprise networking market share in 2024. The Indian government’s focus on expanding broadband penetration has resulted in a surge in enterprise-grade networking demand, particularly in Tier 2 and Tier 3 cities. According to the Telecom Regulatory Authority of India (TRAI), enterprise internet subscriptions grew by 22% in FY 2023, with BFSI, healthcare, and education sectors leading adoption. Additionally, the rise of startup ecosystems and co-working spaces has intensified the demand for flexible and secure networking solutions.

Japan's enterprise networking market growth is growing with its mature digital ecosystem and deep integration of enterprise networking in critical sectors. Japanese enterprises, especially in automotive, electronics, and pharmaceuticals, are early adopters of advanced networking technologies such as intent-based networking and private 5G. The Ministry of Economy, Trade and Industry (METI) reported that over 150 private 5G trials were underway in industrial settings in 2023, that aimed at improving factory-floor connectivity and reducing downtime.

Australia's enterprise networking market growth is with a strong focus on cybersecurity and cloud integration. According to the Australian Bureau of Statistics, enterprise IT expenditure rose by 10.4% in fiscal 2023, with networking forming a substantial component of that investment.

Additionally, the mining, healthcare, and education sectors have been investing heavily in high-capacity wired and wireless infrastructure to support remote operations. Telstra and Optus have launched several enterprise-grade 5G private networks tailored for industrial use cases.

Singapore's enterprise networking market growth is likely to steady growth with serving as a regional innovation hub for networking technologies due to its advanced digital infrastructure and forward-looking policies. Furthermore, Singapore hosts numerous hyperscale data centers operated by Amazon Web Services, Google Cloud, and Microsoft Azure, which continuously drive demand for high-performance enterprise networking equipment.

LEADING PLAYERS IN THE ASIA PACIFIC ENTERPRISE NETWORKING MARKET

Cisco Systems

Cisco remains a dominant force in the Asia Pacific enterprise networking market, offering a comprehensive portfolio of routers, switches, security solutions, and cloud-managed services. The company’s focus on innovation, including intent-based networking and secure access frameworks, has positioned it as a trusted partner for enterprises across sectors such as finance, healthcare, and government. Cisco’s localized R&D initiatives and strong channel partnerships have enabled tailored deployments that meet the diverse needs of businesses in emerging and developed markets within the region.

Huawei Technologies

Huawei plays a vital role in shaping the Asia Pacific enterprise networking landscape by delivering cost-effective, high-performance networking infrastructure across multiple industries. The company has built a strong presence through its integrated digital transformation strategy, which includes SD-WAN, campus networks, and data center solutions. Huawei’s emphasis on indigenous innovation and strategic collaborations with local governments and enterprises has allowed it to capture significant market share, particularly in China and Southeast Asia.

Juniper Networks

Juniper Networks contributes to the global enterprise networking ecosystem by offering high-speed routing, switching, and AI-driven network management solutions. In the Asia Pacific, Juniper is known for its scalable and secure architectures tailored for service providers, hyperscale data centers, and large enterprises. With a strong commitment to open standards and automation, the company has been instrumental in enabling agile and intelligent networking environments in key regional markets.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Localized Innovation and Product Customization

Key players in the Asia Pacific enterprise networking market are prioritizing localized product development to cater to the specific requirements of different economies. Strategic Partnerships and Ecosystem Collaborations

To strengthen their regional foothold, leading vendors are forming alliances with local telecom operators, system integrators, and cloud service providers. These collaborative ecosystems enable more efficient deployment, better after-sales support, and deeper market penetration across both urban and rural areas. Investment in Cloud-Managed and Secure Networking Solutions

With the rise in remote work and increasing cyber threats, vendors are focusing on delivering cloud-native, secure networking platforms. Emphasizing SASE, SD-WAN security, and zero-trust architectures allows companies to align with evolving enterprise priorities while ensuring performance and compliance.

KEY MARKET PLAYERS AND COMPETITIVE OVERVIEW

Major Players of the Asia Pacific Enterprise Networking Market include Cisco Systems (US), Broadcom (US), Hewlett Packard Enterprise (US), Juniper Networks (US), Extreme Networks, Inc. (US), Huawei (China), Fortinet (US), Cloudflare, Inc. (US), Alcatel-Lucent Enterprise (France), Arista Networks (US), Riverbed Technology (US), Check Point Software Technologies Ltd. (Israel), SolarWinds Corporation (US), F5 Networks (US), Palo Alto Networks (US), Pica8 (US), Versa Networks (US), Aryaka Networks Inc. (US), A10 Networks, Inc. (US), Cato Networks Ltd. (Israel), Cambium Networks (US), Megaport (Australia), flexiWAN (Israel), Peplink (US), Lavelle Networks (India), Arrcus (US), Celona (US), TBL Networks (US), Open Systems (Switzerland), and Bigleaf Networks (US).

The competitive environment in the Asia Pacific enterprise networking market is characterized by intense rivalry among global and regional vendors striving to meet the evolving connectivity demands of enterprises. Multinational corporations leverage technological innovation and strategic positioning, while domestic players capitalize on localized expertise and cost advantages. The market is witnessing a shift from traditional hardware-centric models to software-defined and cloud-integrated networking solutions, prompting vendors to continuously realign their portfolios. Companies are also expanding their distribution networks and investing in advanced R&D to develop next-generation networking technologies tailored for diverse industry verticals. Additionally, mergers and acquisitions have become a common strategy to consolidate market positions and gain access to new capabilities or customer bases.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Cisco launched an AI-powered network analytics platform tailored for APAC enterprises, aiming to improve operational efficiency and automate troubleshooting processes within complex network infrastructures.

- In May 2024, Huawei expanded its enterprise networking business by opening a new regional innovation hub in Singapore, designed to accelerate the adoption of SDN, campus networks, and smart campus solutions across ASEAN countries.

- In July 2024, Juniper Networks partnered with a major Australian telecom provider to deploy secure SD-WAN solutions for government agencies, reinforcing its position in the public sector's digital transformation efforts.

- In September 2024, Aruba, a Hewlett-Packard Enterprise company, introduced a new cloud-native networking suite optimized for SMEs in India, targeting the growing demand for scalable and affordable enterprise connectivity solutions.

- In November 2024, Fortinet strengthened its cybersecurity integration capabilities by acquiring a Singapore-based network visibility startup, enhancing its ability to deliver end-to-end secure networking solutions for distributed enterprises.

MARKET SEGMENTATION

This research report on the Asia Pacific Enterprise Networking Market has been segmented and sub-segmented based on networking devices, technology, network type, connection type, and region.

By Networking Devices

- Routers

- Switches

- Firewalls

- Access Points

By Technology

- SDN

- SD-WAN

- SASE

- Intent-Based Networking

By Network Type

- Branch

- Remote

- Campus

- Datacenter

By Connection Type

- Wired

- Wireless

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What are the key factors driving the growth of this market?

The market is primarily driven by the growing adoption of cloud computing, increasing demand for secure and scalable network infrastructure, rapid digital transformation across industries, and the expansion of data centers and 5G networks.

2. Which countries in Asia Pacific are the major contributors to this market?

Major contributors include China, Japan, India, South Korea, and Australia, driven by large-scale IT investments, growing enterprises, and government-led digital initiatives.

3. Who are the leading market players in the region?

Key players include Cisco Systems, Juniper Networks, Hewlett Packard Enterprise, Arista Networks, Nokia, Accton Technology Corporation, and Tejas Networks.

4. How is the rise of remote work and hybrid models impacting the market?

The shift to remote and hybrid work environments has significantly increased the demand for secure, flexible, and scalable networking solutions, accelerating market growth.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]